Professional Documents

Culture Documents

Dissertation Report

Uploaded by

Geetanshi AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dissertation Report

Uploaded by

Geetanshi AgarwalCopyright:

Available Formats

DISSERTATION REPORT ON SUPPLY CHAIN MANAGEMENT AND DISTRIBUTION SYSTEM OF ASIAN PAINTS

Acknowledgement

I consider my proud privilege to express deep sense of gratitude her admirable and valuable guidance, keen interest,

encouragement and constructive suggestions during the course of the project. I would also like to express my hearty gratitude to my faculty guides, for her valuable guidance.

COMPANY PROFILE

BACKGROUND Champaklal H Choksey, Chimanlal Choksi, SC Dani and A Vakil set up APIL, in 1942 as a partnership firm .In 1945, it was converted into a private limited company, under the name of Asian Oil and Paint Co Pvt. Ltd. In 1965, the name was change to Asian Paints (India) Pvt. Ltd. In 1973, it was converted into a public limited company. APILs first plant came up in Bhandup in 1957 .It has three other plants located at Ankeleshwar (1981), Patancheru (1985) and Kasna (1990) .All the plants have captive resin manufacturing faculties and are capable of producing the entire range of paints. APIL also manufactures a key raw material Phthalic Anhydride, at its Ankleshwar plant, 30 % of which is costively consumed. Earlier APIL used to also manufacture

another raw material, vinyl pyridine latex, which was later hived off onto a separate company, under the name of Apcotex Lattices Ltd. Capacity expansions have come in a phased manner. Productivity at the Bhandup plant has been lackluster. Through a AVS scheme introduced in 1993, APIL was able to cut back workforce. Investment in information technology, especially in the areas of production and distribution logistics has helped APIL improve its operating efficiency .In FY96 APILs ailing subsidiary Pentasia Chemicals Ltd. was merged with APIL.

Locations APIL has 4paints manufacturing plants .The oldest plant is at Bhandup in Mumabi .The other plants are at Ankleshwar in Gujarat , Patancheru in Andhra Pradesh and Kasna in Uttar

Pradesh .The Phthalic anhydride plant is located at Ankleshwar in Gujarat. Penta plant (result of PCL merger) is located at Cuddalore in Tamil Nadu .The installed Capacity of each manufacturing facilities are:

Manufacturing facilities Bhandaup, Mumbai Ankleshwar Patancheru Pradesh Kasna ,Uttar Pradesh Total

Installed (TAP) 20,000 50,000

capacity

Andhra 50,000

42,700 162,700

APIL ,Indias largest Paints Company , is the market leader in decorative paints .It has remained focused on core business and has consistently improved operating efficiencies .The company has registered a net profile of Rs 1064mn in Fy 01 as compared to Rs 973 mn in the previous year. Paints sector can be segmented application wise , as decorative paints and industrial paints . While both are characterized by low capital costs and high working capital intensive, ht latter requires special technology. Capacities are normally set up close to markets, so as to be able to offer multitude of shades and colors to customers. Brand building and dealer network act as effective entry barriers. Demand is seasonal in nature low during monsoon, high during festivals.

Domestic paints sector, dominated by decorative paints (70%) is expected to undergo a structural shift towards industrial paints , as cross border tie-ups in industrial paints are becoming order of the day. Most organized sector players are established with well-entrenched distribution network and established brands. Threat of global competition in is minimal. The underdeveloped industrial paints market hold maximum growth potential, albeit competition, product innovations and a fight for superior distribution network. Focussed on decorative paints segment, APIL is set gain the maximum amongst the peer members from the uptrend in the housing sector .The company is restructuring its operations into three SBUs and has set target to be amongst the top ten

decorative manufactures in the world by 2003. APIL is investing heavily in dealer tinting machine Colour World and IT technologies to keep ahead of competition .APIL has set target

of Gross sales of Rs21bn by 2003and earning growth of above 20% . It also has set a vision to be among the top five paint companies worldwide by 2005.On export front , the company is looking out for alliances/ takeover in the emerging markets of Asia.

ASIAN PAINTS OVERVIEW

Asian Paints Limited (APL) is the market leader in the Indian paint industry, commanding a market share of 38 per cent in decorative paints and 33 per cent overall in the organised sector. Its annual sales turnover exceeds Rs. 1,300 crore, way ahead of all the competitors in the industry. In profits too, Asian Paints is far ahead. Asian paints market leadership in the decorative paints segments can be grasped correctly when we take note of the relative position of the various players in the industry. Whereas Asian Paints has a market share of 38 per cent, its nearest rival, Goodlass Nerolac, commands a share of just 14 per cent. All others have only less than 10 per cent. Such an achievement by a company that is wholly Indian in capital, management and technology and in an industry historically dominated by multinationals is certainly a commendable feat

Asian Paints Limited was established in 1942 as a partnership firm by four friends Champaklal H. Choksey, Chimanlal N. Choksi, Suryakant C. Dani and Arvind R.Vakil to manufacture paints in a garage in Mumbai (Bombay). From its humble beginnings, the company has moved on to become the largest paints company in India with a market share of 30 percent. The company with a turnover of US$ 535 million on standalone basis and US$ 640 million on consolidated basis (including turnover of all its subsidiaries) is one of the top ten decorative paints companies in the world. Its reach and dominance in the Indian market can be gauged from the fact that it is more than twice the size of its neares competitor in India and it has been the market leader in paints industry in India since 1968.The company operates in 22 countries and has 29 paint manufacturing plants in the world which service consumers in

over 65 countries. The company operates around the world on its own and also through its three subsidiaries Berger International Limited,Apco Coatings and SCIB Chemicals.The company aims to become one of the top five decorative paint companies in the world and has embarked on an aggressive strategy of expanding its global operations. The promoters hold the majority stake in the company (46.8 per cent of the equity stake).The next largest shareholders are the foreign institutional investors (19.5 per cent stake), followed by Indian public (16.5 per cent stake). Domestic banks, financial Institutions, mutual funds and insurance companies hold 13.4 per cent stake. Corporate bodies and non-resident Indians hold the remaining stake.

The Indian Paint industry, estimated to be a Rs.21,000 Cr. industry, has been growing at a rate of above 15% for the past few years. The organized players of the industry cater to about 65% of the overall demand, whereas the unorganized players take care of the remaining 35%, in value terms. The unorganised players mainly dominate the distemper segment. The industry consists of two segments, namely

Decorative segment caters to the housing sector and

Industrial segment - consists of powder coatings, floor coatings and other protective coatings catering to the automobile, marine and other industries.

In the domestic market, Decorative segment accounts for 70% of the total demand for paints whereas the industrial segment accounts for the remaining 30%. Globally, the demand for paints is almost equally distributed, where both the segments account for close to 50% of demand.

INDIAN PAINT INDUSTRY

DECORATIVE SEGMENT (70%)

INDUSTRIAL SEGMENT (30%)

PREMIUM RANGE (HIGH END ACRELYC EMULSION)

MEDIUM RANGE (ENAMEL PAINTS)

DISTEMPER RANGE (LOW END PAINTS)

AUTOMOTI VE SECTOR (2/3 rd SHARE)

CONSUMER DURABLES, MARINE PAINTS, OTHER OEMs

METROS AND LARGE CITIES

SMALL CITIES

SUB URBAN AND RURAL AREAS

So, how does the industry work? Here is the analysis. The working of the Paint industry has been explained pictorially below:

Raw Materials: On an average, raw materials constitute ~56% of the total expenditure in paint companies. Titanium dioxide is one of the major raw materials and price fluctuations in its cost have direct and substantial impact on the cost of production. Crude oil derivatives are the other major raw materials and have similar impact. Apart from these a large number of other raw materials are used for adding/giving specific properties to the wide product range offered by the industry. End-User: The decorative paints segment products find use in households and construction whereas the industrial segment products find use in automotive industry, consumer durables

industry and other MANUFACTURER).

OEMs

(ORIGINAL

EQUIPMENT

Asian Paints is the market leader in the Indian Paint Industry and gets the major portion of its revenue from the Decorative segment. Over the years, it has outperformed its peers in every aspect by wide margins. This is mainly due to its strong moat (competitive advantage) which lies in its strong Brand Equity and an extensive Distribution Network. The companys Net sales, Net Profit and Book Value have grown with a 5 year CAGR of 22%, 27% and 28% respectively. Also the companys debt is very low and its ROIC has been 40% on an average over the last six years. Kansai Nerolac holds the second position in the Indian Paint market, and is the market leader in the Industrial Paint Segment, owing to its leadership position in the Automobile Paint segment. It is the subsidiary of Kansai Paints Ltd., the leading Japanese paint company. Berger paints has the third position and derives its major revenue from the Decorative segment. Akzo Nobel (former ICI Paints) is the subsidiary of the worlds largest Paint Company and is at the fourth position. Shalimar Paints is at the fifth position.

Main Concerns Of The Paint Industry

Cost of raw materials: The Cost of Raw materials is an

important factor as the industry is raw material intensive. Fluctuation in the prices of Titanium dioxide and Petroleum directly affect the production cost. This is more of a concern for the Industrial segment as compared to the Decorative Segment, as it is comparatively easier to pass on the costs in case of decorative paints. Also, a large portion of raw materials are imported, leaving the cost factor vulnerable to exchange rate fluctuation. MNCs entering the Indian Paint Market: The entry of

Established foreign players in the Indian market may increase the competition among the players of the industry. This may lead to price competition which may impact the profit margin of the companies. As a result, the increase in volume growth may not equally reflect in the profit growth for the companies.

Top Paint Brands In India Goodlass Nerolac : - This companys paint decors every third car in the country. It is the market leader in the industrial paint segment supplying over 90% of the requirements and has planned to increase its presence in the decorative segment through aggressive new product development and brand building. They are the second largest company in India in the decorative segment with a market share of around 20%. They are the leaders in powder coatings. Goodlass Nerolac Paints Ltd is a subsidiary of Kansai Paint Company Limited, which is the largest paint manufacturing company in Japan and among the top ten coating companies of the world, with a human asset of over 1900 professionals and a sales turnover of Rs. 925 crores. This company started in 1920 as Gahagan Paints and Varnish Co. Ltd. at Lower Parel in Bombay. In 1930, three British companies merged to formulate Lead Industries Group Ltd. In 1933, Lead Industries Group Ltd. acquired entire share capital of Gahagan Paints in 1933 and thus, Goodlass Wall (India) Ltd. was born. Subsequently, by 1946, Goodlass Wall (India) Ltd. was known as Goodlass Wall Pvt. Ltd. In 1957, Goodlass Wall

Pvt. Ltd. grew popular as Goodlass Nerolac Paints (Pvt.) Ltd. Also, it went public in the same year and established itself as Goodlass Nerolac Paints Ltd. In 1976, Goodlass Nerolac Paints Ltd. became a part of the Tata Forbes Group on acquisition of a part of the foreign shareholdings by Forbes Gokak. In 1983, Goodlass Nerolac Paints Ltd. strengthened itself by entering in technical collaboration agreements with Kansai Paints Co. Ltd., Japan and Nihon Tokushu Toryo Co. Ltd., Japan. In 1986, Goodlass Nerolac Paints Ltd. turned into a joint venture of the Tata Forbes and the Kansai Paints with the latter acquiring 36% of its share capital. In 1999, Kansai Paints Company Ltd., Japan took over the entire stake of Tata Forbes group. During this journey, Nerolac has entered into technical collaborations with other industry leaders such as E.I. Du-Pont de Nemours & Company Inc., USA and Oshima Kogya Company Ltd., Japan for different products. Berger Paints:- This company started in 1947 as British Paints when it acquired Hadfield's (India) Limited, a paint company that produced 150 tonnes of ready mixed stiff paints, varnishes and distempers.Sales offices were opened in Delhi and Mumbai

and in 1951 a depot was started in Guwahati. Sales rose to Rs.60 lakhs in 1952. The Company declared its first dividend and shifted the H.O. to 32, Chowringhee Road, Calcutta. By 1959, modernization of the Howrah Factory was completed and the first Resin Plant commissioned. With that, the Company entered the Synthetics Paints market. By 1965 British Paints (Holdings) Limited, UK was acquired by Celanese Corporation, U. S.A. As a result, the controlling interest of British Paints (India) Limited passed on to Cel. Euro N.V., Holland. In 1969 Celanese Corporation sold their interest in the Indian Company to Berger Jenson Nicholson Limited, UK. In 1975, the foreign holding of the Company was reduced from 60% to 45% through a Public issue. A year later the foreign holding was diluted to below 40% by sale of a portion of the shares to the UB Group. In 1983, the name of the Company was changed to Berger Paints India Limited (BPIL) and by this time the Berger's operations were divisionalized into the Retail Business Line (RBL) and the Industrial Business Line (IBL) in order to better cater to the needs of the customers. During this period many new products were launched like "Luxol Silk" the first premium emulsion in

India, Viton Refinish for cars, Bison Acrylic Distemper and Rangoli Acrylic Emulsion. In 1990s, Berger Pro Links, a service aimed at providing paint and application related information to professionals, was introduced marking one of the first steps into painting related services. In 1991, the stake of the UB Group in the Company was purchased, by Mr. K S Dhingra, Mr. G S Dhingra and

their associates. The sales of the company touched 276 crores by 1995-96. The latter half of the nineties saw Berger attain the ISO - 9000 certification (1996) and establishment of Berger's Quality Management System. Color Bank tinting system was also launched through which the consumer can select from a range of over 5000 colors and which are then made available in minutes. As part of its expansion program, a new paint-manufacturing unit at Pondicherry was commissioned in early 1997. Berger Paints Home Decor a complete painting solution service was launched making painting a hassle free activity for consumers. An illusion multichrome finishes was also introduced as "designer finishes for walls" allowing consumers to transform

their walls into fashion statements. This is a first for the Indian paint industry. ICI:- ICI India was the subsidiary of the $15 billion British multinational company ICI Plc. Brunner Mond & Co., one of the four Companies that combined to form ICI in UK in 1926, opened a trading office to sell alkalis and dyes in Calcutta. In 1923, Brunner Mond & Co. (India) was incorporated and the company's name was subsequently changed to Imperial Chemical Industries (India) Ltd., in 1929. During its 70 years in India, ICI had created six subsidiary companies in businesses such as research, chlorine, caustic soda, paints, rubber chemicals, explosives, polyester fiber, urea, agro-chemicals, seeds, pharmaceuticals, specialty chemicals, polyurethane, nitrocellulose, and surfactants. In 1984, all ICI companies consolidated in one of the largest mergers in Indian corporate history. By 1997, as a part of a restructuring exercise ICI had exited or was planning to exit from several non-core businesses. The 1996 sales break up was as follows: Paints 43%, Explosives 28%, Rubber chemicals 17%, Pharmaceuticals 8%, and Other Products 4%. ICI (India) ranked No. 4 in the paint business,

after Asian Paints, Goodlass Nerolac Paints and Berger Paints. Unlike the other paint companies ICI (India) was a diversified unit and paint constituted 43% of its net sales. ICI (India)s turnover in 1996-97 was $180 million and paint amounted to $77.4 million. ICI identified paints as a thrust area and was aggressively moving to improve their position. They invested $11 million in a new decorative paints plant near Bombay and were constructing a $16.7 million plant for industrial paints near Chandigarh in North India. ICI (India) intends to go on an offensive with a target of achieving ten-fold growth in 10 years. The 10X Plan, as it was called, envisaged a strategy based on acquisitions, take-over and alliances.

THE INDIAN PAINT INDUSTRY

The paint industry of India is 100 years old. Its beginning can be traced to the setting up of a factory by Shalimar Paints in Kolkata in 1902. Till the advent of World War II, the industry consisted of just a few foreign companies, and some small,

indigenous producers. The war led to a temporary stoppage of imports leading to many more local entrepreneurs setting up manufacturing facilities. Nevertheless, foreign companies continued to dominate the industry. Even now, they remain active contestants, though their foreign shareholdings stand reduced, with two of them having become totally Indian. Currently, the industry has a sales turnover of about Rs.3, 600 crore. In terms of volume, it corresponds to 5 lakh tonnes. The industry is composed of two sectors, the organised and the unroganised. The organised sector controls 70 per cent of the total market. The remaining 30 per cent is in the hands of the unorganised sector, consisting of 2000 odd small-scale units. The industry is not capital intensive. It is however working capital intensive. The demand for paints is fairly price-elastic and is linked to economic and industrial growth. Demand is somewhat seasonal in nature-low during monsoon months, high during festival seasons. Drivers to the growth of the Paint Industry 1. Increasing level of income and education The increasing proportion of young population along with increasing disposable incomes is leading to a change in consumer habits. The Indian economy is shifting from a savings economy to a spending economy. With more income at their disposal, people are now ready to pay for better products and paint is no exception.

Educated consumers are more brand conscious and seek value in what they consume. Thus, paint companies offering value-added features like non-toxicity, weather protection, texture, ecofriendly production, etc. will attract more demand. These valueadded products enable the manufacturers to earn a better premium as compared to the regular paints, thus offering higher margins. 2. Increasing Urbanization: Urbanization is leading to a shift from temporary houses to permanent houses. Urban houses are well-designed in its interior as well as exterior aspect. This calls for more houses being painted using medium and premium paints. For urban houses, interior design is becoming a fashion statement and a lot of paint is used to decorate the interiors. This will lead to an increase in the per capita consumption of paint which will increase the overall demand of paint. Urbanization also brings more nuclear families. More nuclear families mean more number of houses even for the existing population thus further driving the demand. 3. Increasing share of organized sector: Decrease in taxes on key raw materials will improve the position of the organized players.

The Organized sector is expanding its distribution network and adopting the installation of tinting machines at retail outlets. These tinting machines offer a wide variety of colour shade options to choose from. The unorganized players are not in a position to offer such facility as it is comparatively capital intensive. Shift in use, from distemper segment towards premier segment is also shifting market share from the unorganized sector to the organized sector. 4. Development of the Realty, Automobile and Infrastructure sector: The growth of the paint industry is largely dependent on the development of the realty and housing sector, as decorative segment generates about 70% of the total paint demand from this sector. The Automobile segment generates more than twothird of the demand for Industrial paints, and hence is the growth driver for Industrial Paints. The Infrastructure segment creates direct demand for paints as well as creates indirect demand through supporting the growth of the realty, automobile, FMCG and other industries where paint is used.

The growth potential in the above 3 sectors is immense, the paint industry being dependent on these 3 sectors is expected to grow along with them. 5. Availability of financing options: Easier housing finance and auto finance is expected to favour more people to buy houses and travel in personal vehicles. This will drive the growth of housing and automobile sector, of which the Paint industry will get its share.

6. Increasing Penetration in the Rural Markets: Paint usage in rural areas is generally in the distemper segment, hence dominated by the unorganized players. Demand in rural areas is dependent on agriculture, which is dependent on the monsoons. With the development of irrigation facility, the dependence of

agricultural output on monsoons will be on a decreasing trend. Also, with the modernization of agriculture and accompanying development of rural India, consumer preferences are expected to improve. Paint companies are expanding their distribution network in rural parts of India, which is a relatively untapped market for the organized players. These factors supported by the increasing penetration of the paint companies will help drive the demand for paints.

Distribution Strategy AP bypassed the bulk buyer segment and went to individual consumers of paints. AP went slow on urban areas and concentrated on semiurban and rural areas. AP went retail. AP went in for an open-door dealer policy. AP voted for nationwide marketing / distribution

Market Share of Decorative Paints

Asian Paints (India) Ltd. ICI India (Ltd.) Goodlass Nerolac Paints Ltd. Shalimar Paints Ltd. Berger Paints (India) Ltd. Others

25% 38%

6% 8% 9% 14%

COMPETETIVE ADVANTAGE PROFILE : Marketing Factors Market leader -38% share in organized sector. Asian Paints is more than twice the size of its nearest competitor. >50 yrs -leader Widest product range -product shades, wide colours ,pack sizes 40 different decorative paints -1000 shades, 8 different sizes in packing, no. of brands -all segments Brands -quite powerful high quality MR & MIS , 90% accuracy in forecasting, 100 fastest moving Stock Keeping Units, monitored daily Countrywide distribution (29 plants in 22 countries) .

Physical distribution far superior to competitors strong in inventory control (18 processing centres, 350 raw material and intermediate goods suppliers, 140 packing material vendors, 6 regional distribution centres, 72 depots are integrated)

Manufacturing/Operations factors : Size advantage in relation to competitors. Finesse in production planning ,scheduling ,matching with marketing requirements In-house production outsourcing suppliers superior quality assurance. high reliability

Four production location spread benefits. Human Resources : Asian Paints believes that people are its strongest assets HIGH calibre A talent pool of over 4700 employees employed across 23 countries bring in a unique blend of mindsets and skills

Excellent training is provided to develop leaders and restrengthen competencies from within the organisation Information Technology : Asian Paints is the only company in India to have integrated Supply Chain Management (SCM) Solution from i2 Technologies, and Enterprise Resource Planning (ERP) solution from SAP. Customer Relations Management (CRM) tools are being used in Asian Paints Helpline and Home Solutions initiatives Improve efficiency in the business as well as increase the transparency and accuracy of information across the country. Research & Development :

At Asian Paints, R&D plays an important role in developing new products and innovations, and reducing costs by value re-engineering of formulations. It consists of 140 strong R&D team consisting of 7 doctorates and around 115 qualified scientists, has always backed the company's business plan and demands of the market place.

Asian Paints' R&D team has successfully managed to develop High-end exterior finished and wood finishes inhouse. ENVIRONMENT AND SAETY :

Asian Paints approaches the environment issue from the perspective of waste minimisation and conservation of resources. It attempt is to reuse, recycle and eliminate waste, which results in less and less waste being generated. Accordingly, the material losses in manufacturing have been reduced substantially over the last few years. It has ISO 14001 certification for environment management standards. It has achieved 'zero industrial discharge' capability. This has been achieved by the installation of upgraded effluent treatment facilities and installation of reverse osmosis plants in conjunction with appropriate recycling and reuse schemes. Our emulsion manufacturing facility has also achieved 'zero waste' status. It has adopted the principles of "green productivity". Some of its innovative schemes which enhance green productivity are dealer tinting systems which has resulted in large batch sizes ; bulk storage facility for monomers which reduces wastage; Use of natural gas which is a cleaner fuel ; solvent recovery plants have been set up which has resulted in zero reduction of solvent disposal ; Improved incinerating systems and reverse osmosis.

The "Sword of Honour", instituted by the BSC, is recognized the world over as the pinnacle of achievement in safety management systems.

QUALITY POLICY:

We shall provide products and services that meet stated standards on time, every time. We accept Zero Defect as a quality absolute, and shall design and operate our quality system accordingly. We will organise our work practices to do a job right the first time, every time. We are committed to continuous improvement in quality in all business processes and shall track such improvement through measurable indicators.

Product Distribution & Implementation Strategy

A company formulates and implements a product distribution strategy to make more money and ensure that clients have timely access to goods. The business also draws up the outline to quell or limit rivals' commercial aspirations. A product distribution plan is integral to the marketing strategy an organization sets to manufacture top-quality items that clients relish and can afford.

A product strategy deals with the thinking process corporate management goes through to foster innovation in departments as varied as research and development (R&D), sales, marketing and logistics. In the blueprint, top leadership analyzes market trends and customer needs, defines prototypes that R&D engineers must work on, discusses positioning issues with marketing personnel and asks shipping and logistics professionals to weigh in on item marketability and shipping convenience. Product positioning touches on the way a business wants the public to perceive its items and services, along with the tools the corporation relies on to implement that vision. Distribution Policy Distribution policies cover various conduits and tools an organization uses to convey its products from corporate warehouses to retail centers and wholesale platforms. These include neighborhood plazas, shopping malls and department stores. These policies touch on how a business limits money it pays in product distribution, how it selects the best and quickest intermediaries, whether it uses exclusive or non-selective distribution models, and how it prevents goods decay and equipment obsolescence throughout the distribution spectrum. The whole idea is not to give competitors a free pass and let them get a leg up against the business in terms of logistical superiority and quickness in goods distribution.

To implement product strategies and distribution tactics, corporate personnel heed such factors as nature of goods, client

preferences, geography and regulatory compliance -- all of which figure in the policy book of supply chain management (SCM) specialists. These professionals help a company facilitate the shipping and maintenance of materials to distribution centers or other temporary -- or permanent -- storage facilities. The nature of goods involved in SCM processes is essential. For example, perishable goods mandate that a logistics company deliver them as early as possible or set proper conservation procedures to prevent outright decay or gradual putrefaction. Geography -- in other words, distance -- may bring more shipping costs into the distribution equation. Regulatory compliance often is cardinal in distribution strategy implementation, because a shipping business may need to adopt specific procedures to conform to government directives. For example, the transportation of hazardous materials calls for compliance with U.S. Occupational Safety and Health Administration edicts. Connection

Discussions about product strategy, distribution tactics and implementation considerations generally fall under the broader topics of corporate strategy and marketing management. Although they're distinct terms, top leadership heeds these concepts when formulating plans for sales growth, corporate branding and future profitability.

Product Distribution Strategy

When selling products is your business' main purpose, the first thing you must do is create a demand for those products. The second is getting those products into consumers' hands. It's imperative to know how you will satisfy the demand for your product once you have created desire in the hearts of your consumers. Planning your product distribution strategy should be considered during the product development stage.

The Importance of Product Distribution Strategy A thorough product distribution strategy attempts to define the cost-variables involved in getting your products from creation to consumption. The method of distribution will impact the actual retail price of the product, the profit margin, the marketing budget and the way the product is marketed. Lars Perner, Ph.D., assistant professor of clinical marketing at the University of California teaches that cost is the leading factor in determining distribution. He says, "Cost has to be traded off against speed of delivery and intensity."

Exclusive Distribution Strategy

Exclusivity is a strategy often used to establish a particular image of a product or brand. Using a limited number of distribution channel partners helps to create an image of exclusivity. It's also a measure of quality control by using only distributors who specialize within that industry. Distribution channel partnerships requires both the manufacturer and the distribution partners to take a larger stake in one another's survival.

Creating a Product Distribution Strategy

Keep an open mind on new possibilities in distribution and changes that may impact current distribution structures. Consider parallel distribution opportunities and joint promotion partnerships. Get the opinions of distribution partners. Set up market research opportunities to find out how the customer prefers to receive the product. Examine competitors' strategies and compare them to your own. Adopt the ones that work and discard or improve the ones that don't.

Supply Chain Management (SCM)

Supply Chain Management (SCM) is the management of the inter-connectivity between suppliers, manufacturing and corporate customers. It addresses the movement of all raw inventory, production in progress inventory and the end product from origin to consumption. According to management consulting firm R. Michael Donovan & Co., supply chain management "sees all suppliers and customers as part of one complex supply chain network and understands that transforming that supply chain into a synchronized chain is the primary goal." Lean Supply Chain Management (LSCM)

Lean Supply Change Management (LSCM) is Supply Change Managment coupled with continuous and ongoing process improvement methodology to ensure supply chain management systems always runs at peak efficiency. LSCM touches all aspects of a corporate supply chain from procurement, manufacturing, warehousing and transportation.

Asian Paints Distribution Strategies Asian Paints is a leading company in the paint industry in India. While it has grown from a relatively small, decorative paint company to a large business that has a vast consumer customer base, the company's methods of distribution and marketing have only changed slightly over the years. The basic distribution and marketing strategies are still similar to the initial strategies used when Asian Paints first opened its doors.

Wide Range of Products

Asian Paints used the strategy of offering a wide range of products to push competitors to the side and become the leading Indian company in decorative paint. Companies that have a larger selection available for clients or customers are more likely to retain those clients and customers than companies which are limited and do not have the color choices. By offering a wide range of products, Asian Paints has been able to broaden its customer base. Automated Machines at Distributors Technology is a large part of Asian Paints' distribution success. According to a distribution strategy case study of Asian Paints, the company provided automated machines that mixed paint colors at the distributors to allow customers and consumers more range in color and more options. These machines use technology to produce colors that otherwise are unavailable, resulting in a wider range of selection.

Distribute to Rural Areas

A big problem with paint companies in India was a competitive market in the large cities, where distribution was relatively easy and the risks were low. Asian Paints started by working from the rural areas, where distribution was a challenge and where the other companies had overlooked. Instead of focusing in cities and urban areas, Asian Paints focused on a national level and worked in until reaching the cities.

Focus on Emerging Markets

Expanding from India, Asian Paints started working on distributing decorative paints to emerging economies. It is a similar strategy to the initial strategy used in India, but it is now expanding to countries and locations outside of India. Rather than distribute to economies like the U.S., Asian Paints has turned its focus to customers in places like Singapore and Egypt. Market segmentation :

Asian Paints segment the market based on the usage : BRAND POSITIONING

It is how the Asian paints enabled people to form a mental image for their products in the customers mind. The strategies that they followed where as follows,

Brand

Image

The ways in which Asian Paints attempted to meet the customers psychological and social needs.Indian paint industry is a low involvement industry. Till 1990s people will just tell their budget for painting their house to their contractors. And few customers will also mention the colour they need. During that period Asian Paints analyzed the customer market and found that people where not brand conscious but their concern was only the price of the paint. To meet this needs of the customer Asian paints reduced the cost of the raw materials by backward integration in order to reduce the cost of the paints Established an advertising strategy with created an emotional touch among the customers All these strategies helped them in creating a Brand Image for their products among people and people started realizing the need for brand conscious in this industry. Umbrella Brand

In 2004 the company realized that though they have almost 20 brands only few products like Apex emulsion, Royale interior emulsion, Apcolite and Touch wood had high recall among the customers. Therefore they decided to promote the brand as a whole, to create a corporate image and the various products under their Umbrella Brand Asian Paint, which became their mother brand. This created a Brand Awareness as a whole among the customers.

Brand Portfolio: It was realized that instead of spending on individual brands and in promoting them it was logical to promote their corporate image and allthe brands under their umbrella brands ... Asian Paints has embarked on an umbrella branding policy encompassing all its products and services. The project includes a new visual identity that establishes the company name as the dominant reason for purchase. Tractor, Royale, Utsav and Apcolite names are no longer the focus on the can, rather consumers will be buying "Asian Paints." Some key brand names are being retained for the time being--to signal a position in the market rather than a product or surface. For instance, Tractor will represent the "value for money" brands. The immediate advantage is obvious. Rather than spread resources thinly across brands and sub-brands, a company centric portfolio can synergize communication efforts. To be competitive in a world of fragmentation and rising costs, traditional mass media, such as television, can be prohibitively costly. With the umbrella-branding move, Asian Paints can also afford to move forward from a mere functional platform for each individual product to the high ground of a mood-based emotional dimension.

An Underlying Theme At Asian Paints, the underlying theme is "har ghar kuchh kehta hai," or "every home has something to say." The depth and texture visualized by this line goes into the customer's basic psyche of owning a home, and will carry through various messages emanating from the company, which is the leader in the decorative coatings market in India. Accessibility of Asian paints to the customers : Asian paints have started a 24 hours customer help centre at Hyderabad. It is informationto consumers to answer their needs for any query related, to their products. Through thiscompany is also getting a lot of data related to the customers need & appreciations of the products.In order to provide better consumer service, company has connected all colour world installations with Asian Paints main sys tem through software & providingcomputes to dealers. This is speeding up order execution, electronic banking will speedup recovery & money transfer. Market Share Analysis

The market share clearly shows that Asian paint is the leader in Indian paint industry.The nearest competitors of Asian paints are Nerolac & Barger paints. Asian paints has thelargest sells in Decorative paints Asian paints annually spends on an average Rs325 Cr on its selling & marketingexpenses. It givers us an idea about the effort the

company put on expanding its market inall segments.When customers buy the products of Asian paints As the customers normallyuses the products of Asian paints on certain occasions like. Marriage ceremony, Dewalior any other special occasions, other than normal paint in houses, customers are verychoosy & brand specific. This appreciation by the customers helped Asian paints to become the number one paint company in India. ANSOFF Matrix Asian Paints value for the customers was build through innovative package (size),distribution , and communication .In 1970s they decide to computerize and network their 30 depots round the country ,to provide proper feedback of market needs ,resulting in quick response to meet the needs. They planned a new distribution structure , smaller packages and computerized communication networks. Asian paints differentiation strategy starts from market segment, distribution & packaging . With increasing volumes in chosen segments Asian Paints achieved economies of scale for cost leadership .With their dominant position they diversified in product range as also market and geographic segment. 1. They diversified into manufacturing raw materials for paints. 2. product diversification also included industrial paints .Now with a large market share ,they have strong distribution network even in metros.

Asian paints strategy of quick response translates into supplying 95% of the order supply in 48 hrs which is a positive competitive advantage .Their R&D has developed new products to later to industrial & scientific segments . The paint industry is in growth stage in India as construction activity has a high priority.

With 27% market share, they enjoyed double the market share than their nearest competitor .In order to maintain this leadership position they have drawn up the following strategy.

Asian Paints went to backward vertical integration by getting into manufacturing raw materials for paints. With liberalized economy more international brands are likely to enter the Indian markets as entry barriers are low in the Paint Industry. To keep their dominant position Asian Paints should pursue vigorous R & D for innovative products ,increase the number of depots for covering the entire country advertise separately for each market segment & average continuous market research to enhance their competitive advantage.

DISTRIBUTION Asian paints have an extensive distribution channel through out the country. Itused to maintain unique channel from the manufacturer to the customer. Distributionsystem at Asian paints : 1.Multiplant Distribution setup. Neither geographic nor product specific. Offers flexibility & variable cost advantages 2.Servicing has been key competitive advantage.

3.Around 15000 sales location.40

dealers serviced

from

around

85

4.Role of distribution department is to ensure timely product availability at theselocations at minimum cost.The company ahs 4 manufacturing facilities & more than 2800 stock ke eping units(SKUs) These are supported by 6 regional distribution centers, which cater 55 deposits.Each depot is having branch manager for supervision over more than 15000 dealers inmore than 3500 small & big cities in India.Asian paint implemented & concisely improving its IT systems over the years. Ithas already linked all sites & Depots through V-SAT technology, which helps them tomonitor constantly & has given benefits in streamlining the distribution channel.A s i a n p a i n t s a l s o i m p l e m e n t e d 1 2 s o l u t i o n s t o i n c r e a s e i t s n e t w o r k i n g s & solutions, which is a very good replacement of ERP.

Asian paint is highly accepted in the urban sector a n d n o w t h e company is trying to access the rural market with low price product like Utsavtargeting every customer of all income level. To enhance their marketing in rural sector a huge amount investmentis made in adcampaign and demonstration cum sales technique is going on.

To increase its sales in the urban sector Asian paints today have 30colour world located in different cities of India where any body can have thereal taste of the colour. Online marketing has become an integrated part of the company andcompany is trying install a strong integrated for online marketing. Asian paints international unit, which have a dedicated marketing teamis also targeting for a rapid growth in overseal market. Asian paint is concentrating on the development of technological intheir industrial coating so that to make the product more stronger positon inthe market. And do it they are following the product with huge ad compaign. Asian paint is now targeting to provide paint solution with insurance. Asian paint is following unlque strategy of marketing in the ruralareas by using their official mascot. According to the company it feels that picture are more dominant than name. Asian paint website Asian paints com provides several informationregarding the product and various other information that is being required bycustomer and dealer. Programme Objective

Programme objective is one of the main objective of thecompany. Here the company frames the strategy about the products related issue andvarious other thing relating to the business. Most of the company follows the 4Ps policynamely price, product peace and promotion. Product : Asian paint details with product that is (i) Decorative (ii) Industrial (iii)Automative. In decorative segment company has a wide range of product from low price19 to high price low price product like utsav which is basically targeted to the rural customer and high price product Apex cefirma for exterior and interior emulsion. Asian paintinvesting a huge amount of fun in R & D sector for Quality and the technologicaldevelopment of product so that it compets globally. Price : the price range of Asian paint varies according to the product. Asian paint hadalways a stragegy in domination in the rural sector. The product that is supplied to therural area have low price range. Where as in the urban sector some of the high price product circulates. Place : Asian paint is available to all types of customer and the main advantage of theAsian paint is that it is easily accessible to its customer. At present there are 20,000dealer and a large no. of retailer. Asian paints distribution channel extends to the thirtystate of India. Asian

paints is also exporting to contrites like Caribbean, Africa, Middleeast Asia and south pacific. Promotion : Asian paint follow good promotional strategy regarding their sales of the product. Their promotional strategy are made looking at the different category of the product and price associated with it. In urban areas Asian paint established colour worldwhere the customer can enjoy the taste real colour while in rural sector it follow salesdemonstration programme along with van displaying the product of Asian paint in therural market. It also invest a huge amount of funds in the advertising sector for the promotion of this product.20

MARKETING STRATEGY STRA TEGYALTERNATIVES : The prospect of a paint company has many dependence like weather, occasionslike puja, id etc. when we consider the decorative segments. So there is always a possibility of ups & downs in the business. Besides this there is another very importantfactor i.e. the position of the competitor. Thr ough Asian paints is the largest paintcompany still under circumstances it will have to go for some strategy alternatives.Alternatives available : 1.As Asian paints market is mainly the decorative segment so a downfall in thatmarket will lead

the company in trouble them it immediate focus will turn to theIndustrial segment. 2.Importance on water based paints may recover a poor situation created due to sustain poor weather condition in some region. 3.As there is every possibility that conventional coatings are likely to lose some share ecofriendly coasting is going to be very good alternatives. 4. With all countries in southeast Asia beginning to adhere to the ASEAN free tradeArea (AFTA) that will reduce trade barriers for paints & coatings. A reduce indomestic market share of Asian paints then will not be a constant for growth, became export of paints to the foreign countries will contribute a lot. 5.Increasing the product package & application oriented service will make companydifferent from others. 6.A strong post sales service division will b e a n i m p o r t a n t f a c t o r i n b u i l d i n g customer loyalty. 7. Tie up with automobile sector with strong appearance will be effective. 8.Lastly but not the least price of oil i s i n c r e a s i n g d a y b y d a y , w h i c h r e s u l t s t o increase the price of paints. If this can be controlled by stocking oil

or directlylinking up with foreign cheap refineries so as get oil at least available price.21 AP creates a Marketing Organisation that Matched its Distribution Intensity Effective control of the large number of depots, each having substantial stocks of 2,000 odd distinct items necessitated a matching marketing organisation structure. AP set up a marketing organisation consisting of four regional sales offices, 35 branch sales offices and a large number of sales supervisors and sales representatives spread all over the country. The marketing organisation of the company is presented in Exhibit 4. It can be seen from the chart that a very extensive structure has been created in the consumer division. It is primarily meant for taking care of the massive distribution task involved in this sector. Each branch sales office has its own depots and the various items are stocked in the depots under the control of the concerned branches. The branches service the dealers and customers in their territories.

These are supported by six regional distribution centres, which cater to 55 depots. Each depot has a branch manager for supervision of several salespersons who cater to more than 14,500 dealers in the more than 3,500 big and small cities all

over the country. AP faced many challenges. Of these, the costservice dilemma was no doubt, the most important one. And, that is the aspect in which we are mainly interested in this study.

AP Successfully Resolves the Cost-Service Conflict in Distribution Managing the cost-service conflict was the main challenge that AP faced in the implementation of its distribution strategy. AP met this challenge successfully.

We have seen that AP has over 15,000 dealers in 3,500 towns in India. AP caters to all of them directly. As a result, for AP, the distribution task gets tremendously extended and distribution cost becomes a significant business parameter.

Demand for decorative paints is characterised by seasonality. Demand drops during monsoons and picks up around a mouthand-a-half before the festive season. Major part of the sales take place in the second half of the financial year. Manufacturers have to carry huge inventories during the lean period. As a result, distribution cost becomes all the more significant.

Naturally, distribution cost emerged as a major hurdle that AP had to cross. The strategy adopted by AP necessitated expensive distribution. In addition, AP took another basis decision. It went in for a very high service level in distribution. Service level is measured in terms of the number of stock keeping units (SKUs) available in stock as a percentage of the number of SKUs that should have been in stock. APs service level is more than 85 per cent whereas that of other large paint companies falls between 50 and 60 per cent. This meant a further rise in APs physical distribution costs. AP had to resolve this cost-service conflict.

In the chapter on Physical Distribution and Logistics Management, we had seen that a cost-service dilemma is inherent in any physical distribution situation. A high service level in physical distribution-in transportation, warehousing, order processing and inventories necessarily means a high level of costs. Every firm has to face this cost-service dilemma and work out a compromise. AP voted for a high service level and without compromising this service level, it tried to contain the distribution costs. Interestingly, AP succeeded in this endeavour. When we go in to the details as to how AP actually resolved the cost-service dilemma, four factors stand out:

A strong commitment to distribution cost control, without compromising service level Effective inventory management Effective control of credit outstanding IT initiatives in support of distribution cost control Conclusion The supply chain is very important aspect of the business, basically when you are in the manufacturing industry. The demand of paint is very high in the market because of customer choice become broad and they give more priority to the decorative paints and also the real estate is booming sector. So providing the right product at right time to the right person is very important in today scenario, as these two companies are doing well for their supply chain management to be good for the market so that they dont have any problem in future in inventory management and logistic management. The supply chain system includes supply chain process management or event management capabilities. These

capabilities will enable close to real time, event based escalation of relevant pieces of information through the organization to

appropriate individuals, Resulting strategies, potentially systemrecommended, could involve the following options:

confirmation of the event with the supplier, an examination of the possibility of replacing the material, or an assessment of the impact on downstream value chain coupled with an evaluation of alternate suppliers. As in one of the previous chapters we have seen that the controlling of such a huge bunch of products is very difficult and is not possible to attain a optimal formula to get all the products at the right time, at the right place and also at the right price, which is one of the key areas on which the paint company works. Real-time visibility of the supply chain, combined with a monitoring and an event-management system, will increase the proportion of decisions that are taken preemptively to minimize unintended consequences or exploit unforeseen situations. Increasingly, key decisions will be made by cross-functional teams, chosen explicitly with the right skill set mix, and sometimes assembled just for the purpose of solving the problem at hand.

The demands for supply chain efficiency will emphasize a combination of both centralized and decentralized structures and approachescollaborative and centralized planning with

decentralized executionrequiring real time visibility for monitoring and rapid response mechanisms for event-driven management involving close to real-time problem escalation and remediation. Effective management of supply chains will occur through the deployment of integrated organizational team structures at multiple levelsexecutive through senior and middle managementexecuted through physical and/or virtual facilities such as war rooms. The first area where the industry has to move is that they have to make the customer involved in the process of purchasing the products; in fact the industry should try and make paint as a product that should be a part of a persons life. This should be done as a person is spending most of the time in a day in his office or at his home and he is only able to see the colors of the walls. This has also been proved scientifically also that the colors that are surrounding us have a major effect.

By doing the above they will first be able to create demand in the market, which will finally force the dealers to stock the product in the market. This will improve the reach of a company in the market and will create presence in the market. By creating the presence in the market a company can create fast turnover of the product. i.e. the product will quickly get cleared from the dealers counter which will finally help the company to quicken the whole process and this will lead to an effective supply chain management. A company if have the fast moving of the products from the counter can even plan things in a better manger as on the forecasting front. This company can very well forecast that what the market will be demanding in this particular period. The existing system of paint industry, which mainly runs on the rebates base, will also not affect the player; this is because of the market demand that is been created in the mind of a customer. For getting best results of the promotions a company also needs to educate the customer as to how to use the products. This is needed because of the painter involvement in the final output of the product. If a painter works well on the paint then only the

paint will give the best result. As also been discussed earlier that if a painter uses 3rd grade paint in a proper manner and a 1st grade paint in not a proper manner then he will be able to get a better result from the 3rd grade paint. This is the reason that a company needs to educate the customer also so that the customer will be well equipped to supervise the whole process and will be able to notice about the mistakes made by the painter. In addition to educating the customer a company also needs to educate the painters in a better manner, a big initiative is to be taken as to make a better class of painters in the country. This is needed as that by improving the whole class of painters one is improving the whole paint industry. Painters are the first point of interaction for the paint industry, even to many they are the only level of interaction for getting the work done. To improve this some of the companies have taken the initiative as by introducing Home Dcor by Berger Paints and Home Solutions by Asian Paints. These two services that are been provided by these the companies, provides all the painting services to the customer. This service starts from giving quotation to the

customer to shifting the stuff back to the places where it was before the painting work started. This all will be take n care by a well-educated executive of the company. By providing all these services companies are trying to improve the customer satisfaction by getting the products from a company. This is one of the most important focuses of the supply chain management.

You might also like

- Green Products A Complete Guide - 2020 EditionFrom EverandGreen Products A Complete Guide - 2020 EditionRating: 5 out of 5 stars5/5 (1)

- Asian Paints (Doosra Kadam)Document30 pagesAsian Paints (Doosra Kadam)Deepak ThakurNo ratings yet

- Study of Consumer Buying Behaviour in Reliance FreshDocument61 pagesStudy of Consumer Buying Behaviour in Reliance FreshAkakshi Chandok100% (1)

- CHEMEXIL - Chemical Exports From India (Report)Document37 pagesCHEMEXIL - Chemical Exports From India (Report)Mayank GuptaNo ratings yet

- KumarDocument70 pagesKumarKd GujjarNo ratings yet

- Retail MarketDocument44 pagesRetail Marketvipul5290No ratings yet

- Project Report On Amul Milk Kamlesh JhaDocument94 pagesProject Report On Amul Milk Kamlesh JhaAyush Tiwari100% (1)

- A PROJECT REPORT On Analysis On Customer of Big-BazaarDocument122 pagesA PROJECT REPORT On Analysis On Customer of Big-BazaarVikram RajputNo ratings yet

- Consumer Behaviour Towards Four Wheeler: With Special Reference To Hyundai CarsDocument21 pagesConsumer Behaviour Towards Four Wheeler: With Special Reference To Hyundai CarskumardattNo ratings yet

- ST JohnDocument58 pagesST JohnAashay KulshresthaNo ratings yet

- Tide Surt ExcelDocument75 pagesTide Surt ExcelDeep Tiwari100% (1)

- Palani ProjectDocument75 pagesPalani ProjectVinitha PriyaNo ratings yet

- Manpreet Project NEW INTERDocument107 pagesManpreet Project NEW INTERanand kumar100% (1)

- Swot BCCLDocument3 pagesSwot BCCLavani singhNo ratings yet

- Final ThesisDocument225 pagesFinal ThesisAnonymous VdwBhb4frFNo ratings yet

- BSNL SynopsisDocument72 pagesBSNL SynopsisAtul MauryaNo ratings yet

- Project On Brand Positioning of Birla Cement AMIT GHAWARI Vision School of MGMT ChittorgarhDocument81 pagesProject On Brand Positioning of Birla Cement AMIT GHAWARI Vision School of MGMT ChittorgarhSonalee ParmarNo ratings yet

- Consumers Perception of Private BrandsDocument8 pagesConsumers Perception of Private BrandsmanojrajinmbaNo ratings yet

- Pricing Strategies of Pathanjali ProductsDocument8 pagesPricing Strategies of Pathanjali ProductsaaaaNo ratings yet

- Business Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisDocument12 pagesBusiness Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisAnish GuptaNo ratings yet

- HUL ProjectDocument47 pagesHUL Projectpothupalepu prabhuNo ratings yet

- Consumer's Perception Towards FOUR WHEELER INDUSTRYDocument91 pagesConsumer's Perception Towards FOUR WHEELER INDUSTRYShubhamprataps0% (1)

- Project Report On Totota Kirloskar Motor by Piyush PrasannaDocument64 pagesProject Report On Totota Kirloskar Motor by Piyush PrasannaPiyush Singh Prasanna100% (3)

- Arunkumar ProjectDocument67 pagesArunkumar ProjectanushwaryaNo ratings yet

- Bachelor of Business AdministrationDocument65 pagesBachelor of Business AdministrationmonalNo ratings yet

- Employee's Job Satisfaction at Zuari Cements LTD., YerraguntlaDocument69 pagesEmployee's Job Satisfaction at Zuari Cements LTD., Yerraguntlathella deva prasadNo ratings yet

- Marketing Strategies Adopted by Reliance Mart Vishal Mega MartDocument84 pagesMarketing Strategies Adopted by Reliance Mart Vishal Mega MartAbhinav SinghNo ratings yet

- Bba (Sem-V) Product Project Report GuidelinesDocument5 pagesBba (Sem-V) Product Project Report Guidelinesahmedalyani100% (2)

- Consumer Buying Behavior and Brand Perception in Shopping Malls - A Study of Lulu Mall, CochinDocument2 pagesConsumer Buying Behavior and Brand Perception in Shopping Malls - A Study of Lulu Mall, CochinZara SabriNo ratings yet

- Marketing ProjectDocument155 pagesMarketing Projectepost.sb100% (1)

- Impact of Organized Retailing On The Unorganized SectorDocument60 pagesImpact of Organized Retailing On The Unorganized SectorHriday Prasad0% (1)

- Project HRMDocument47 pagesProject HRMKishoreAgarwalNo ratings yet

- A Study On Brand Awareness With Special Referance To Maruti RitzDocument78 pagesA Study On Brand Awareness With Special Referance To Maruti RitzAnonymous 6TK7S3RxNo ratings yet

- Project Report FormatDocument6 pagesProject Report FormatPramod UgaleNo ratings yet

- Sales & Distribution and Comparative Market Analysis of Pepsi Product in Patna PEPSICO MARKETING GL BAJAJDocument104 pagesSales & Distribution and Comparative Market Analysis of Pepsi Product in Patna PEPSICO MARKETING GL BAJAJtanya gupta50% (2)

- FMCG Meaning Fast Moving Consumer GoodsDocument4 pagesFMCG Meaning Fast Moving Consumer GoodsSustain FitnessNo ratings yet

- Draft ReportDocument54 pagesDraft ReportMandhara KsNo ratings yet

- Airtel Vs BSNL - MarketingDocument98 pagesAirtel Vs BSNL - MarketingSami ZamaNo ratings yet

- Apollo TyresDocument95 pagesApollo TyresSubramanya DgNo ratings yet

- Packed and Unpacked Milk ProductDocument34 pagesPacked and Unpacked Milk ProductRicha TiwariNo ratings yet

- Project Report ON " "Document65 pagesProject Report ON " "sana ganesh0% (1)

- Bisleri: A Comparative Brand Analysis & Marketing Research ofDocument82 pagesBisleri: A Comparative Brand Analysis & Marketing Research ofarvind3041990No ratings yet

- Synopsis Report On Organic Cosmetics by PCTEDocument10 pagesSynopsis Report On Organic Cosmetics by PCTESingh GurpreetNo ratings yet

- Meaning of Capital StructureDocument84 pagesMeaning of Capital StructureShashank KUmar Rai BhadurNo ratings yet

- JK TyresDocument46 pagesJK TyresUdayveerSinghNo ratings yet

- Final Research ProjectDocument84 pagesFinal Research ProjectPrathmesh ShuklaNo ratings yet

- ProjectDocument115 pagesProjectchaluvadiinNo ratings yet

- Project ReportDocument110 pagesProject ReportAlaji Bah CireNo ratings yet

- 1 a Project Report on “Investment Opportunity in Stock Market With Special Focus on Oil Sector” for “Indiainfoline Securities Limited”Lunkad Poonam” Mba Semester III Project Guide _ Ram Priya Kannan - Academia.eduDocument71 pages1 a Project Report on “Investment Opportunity in Stock Market With Special Focus on Oil Sector” for “Indiainfoline Securities Limited”Lunkad Poonam” Mba Semester III Project Guide _ Ram Priya Kannan - Academia.eduHarish0% (1)

- Desk Project On Financial Risk ManagementDocument28 pagesDesk Project On Financial Risk ManagementAamirNo ratings yet

- Minor Project ReportDocument24 pagesMinor Project ReportSanchit JainNo ratings yet

- Internship Project - HimanshuDocument31 pagesInternship Project - Himanshuhimanshu maurya100% (1)

- Dissertation AyushiDocument32 pagesDissertation AyushiTaseen MbNo ratings yet

- Organisation Study at Manjilas Double HorseDocument84 pagesOrganisation Study at Manjilas Double HorseAnanthuNo ratings yet

- A Study On Customer Satisfaction With MahendraDocument119 pagesA Study On Customer Satisfaction With Mahendragalaxy50% (2)

- I. Industry Profile: Part-ADocument40 pagesI. Industry Profile: Part-Amalthu.malthesh6185100% (1)

- Ankit Project- customer Kajaria Ceramics ltd. was incorporated in 1985 and was promoted by Kajaria Exports ltd. And its associates. The plant was set up for manufacturing Ceramic Glazed floor and wall tiles in technical collaboration with M/s Todagres of Spain and imported major equipments from Sacmi Imola and Omis due of Italy.Document54 pagesAnkit Project- customer Kajaria Ceramics ltd. was incorporated in 1985 and was promoted by Kajaria Exports ltd. And its associates. The plant was set up for manufacturing Ceramic Glazed floor and wall tiles in technical collaboration with M/s Todagres of Spain and imported major equipments from Sacmi Imola and Omis due of Italy.Benjamin HillNo ratings yet

- Parth ProjectDocument69 pagesParth ProjectParth TrivediNo ratings yet

- ASIAN Paints DistrbnDocument12 pagesASIAN Paints Distrbnapi-3719687100% (9)

- Asian Paints SCMDocument12 pagesAsian Paints SCMAmit100% (5)

- 6cff1IMC As An Integral Part of Marketing PlanDocument5 pages6cff1IMC As An Integral Part of Marketing PlanGeetanshi AgarwalNo ratings yet

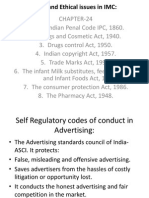

- Legal and Ethical Issues in IMCDocument5 pagesLegal and Ethical Issues in IMCGeetanshi AgarwalNo ratings yet

- IAS Main General Studies Paper-I Syllabus Indian Heritage and Culture, History and Geography of The World and SocietyDocument3 pagesIAS Main General Studies Paper-I Syllabus Indian Heritage and Culture, History and Geography of The World and SocietyGeetanshi AgarwalNo ratings yet

- Unit-2 Emergence of The Discipline - Issues and ThemesDocument13 pagesUnit-2 Emergence of The Discipline - Issues and ThemesGeetanshi AgarwalNo ratings yet

- Village Studies Participant ObservationDocument17 pagesVillage Studies Participant ObservationRajeev GandhiNo ratings yet

- Sales and Distribution Management Case Study 3 HUL: InstructionsDocument1 pageSales and Distribution Management Case Study 3 HUL: InstructionsGeetanshi AgarwalNo ratings yet

- Unit-1 Social Background of The Emergence of Sociology in IndiaDocument16 pagesUnit-1 Social Background of The Emergence of Sociology in IndiaGeetanshi Agarwal100% (2)

- Business Mathematics & Statistics: BBA (M&S and FBM)Document34 pagesBusiness Mathematics & Statistics: BBA (M&S and FBM)Geetanshi AgarwalNo ratings yet

- B9ed0measures of Central TendencyDocument36 pagesB9ed0measures of Central TendencyGeetanshi AgarwalNo ratings yet

- Communalism, Caste and ReservationsDocument9 pagesCommunalism, Caste and ReservationsGeetanshi AgarwalNo ratings yet

- Module-I Basic Concepts Entrepreneurship DevelopmentDocument50 pagesModule-I Basic Concepts Entrepreneurship DevelopmentGeetanshi AgarwalNo ratings yet

- 502d1assignment 4 & 5Document2 pages502d1assignment 4 & 5Geetanshi AgarwalNo ratings yet

- Management Planning Process: Ms. Pallavi Ghanshyala Lecturer, AsbDocument93 pagesManagement Planning Process: Ms. Pallavi Ghanshyala Lecturer, AsbGeetanshi AgarwalNo ratings yet

- Key System Applications For The Digital Age: Amity School of BusinessDocument8 pagesKey System Applications For The Digital Age: Amity School of BusinessGeetanshi AgarwalNo ratings yet

- Asian PaintsDocument24 pagesAsian Paintscsowbhagya81% (16)

- Corporate IdentityDocument64 pagesCorporate IdentityGeetanshi Agarwal100% (1)

- Ethical Issues in Corp. GovernanceDocument18 pagesEthical Issues in Corp. GovernanceGeetanshi Agarwal100% (1)

- Market Opportunities and Challenges For Indian Organic ProductsDocument38 pagesMarket Opportunities and Challenges For Indian Organic ProductsGeetanshi AgarwalNo ratings yet

- 2017 Lecture 3 Metal Carbonyls PDFDocument28 pages2017 Lecture 3 Metal Carbonyls PDFMahnoor FatimaNo ratings yet

- Medicinal Chemistry/ CHEM 458/658 Chapter 8-Receptors and MessengersDocument41 pagesMedicinal Chemistry/ CHEM 458/658 Chapter 8-Receptors and MessengersMehak SarfrazNo ratings yet

- Book Review: Cancy Mcarn Issues in Teacher Education, Spring 2009Document4 pagesBook Review: Cancy Mcarn Issues in Teacher Education, Spring 2009juan_carlos0733No ratings yet

- 3500 Ha027988 7Document384 pages3500 Ha027988 7Gigi ZitoNo ratings yet

- 329 Cryogenic Valves September 2016Document8 pages329 Cryogenic Valves September 2016TututSlengeanTapiSopanNo ratings yet

- Jackson R. Lanning: Profile StatementDocument1 pageJackson R. Lanning: Profile StatementJacksonLanningNo ratings yet

- Restricted Earth Fault RelayDocument5 pagesRestricted Earth Fault Relaysuleman24750% (2)

- DLL English 7-10, Week 1 Q1Document8 pagesDLL English 7-10, Week 1 Q1Nemfa TumacderNo ratings yet

- SOLIDWORKS 2022 Whitepaper UsingDesignAutomationtoReduceCostsIncreaseProfitability FinalDocument10 pagesSOLIDWORKS 2022 Whitepaper UsingDesignAutomationtoReduceCostsIncreaseProfitability FinalAlba R.No ratings yet

- Va797h 15 Q 0019 A00001003Document35 pagesVa797h 15 Q 0019 A00001003Hugo GranadosNo ratings yet

- Improving Radar Echo Lagrangian Extrapolation Nowcasting by Blending Numerical Model Wind Information: Statistical Performance of 16 Typhoon CasesDocument22 pagesImproving Radar Echo Lagrangian Extrapolation Nowcasting by Blending Numerical Model Wind Information: Statistical Performance of 16 Typhoon CasesLinh DinhNo ratings yet

- How To Deliver A Good PresentationDocument9 pagesHow To Deliver A Good PresentationGhozi Fawwaz Imtiyaazi LabiibaNo ratings yet

- Design Report of STOL Transport AircraftDocument64 pagesDesign Report of STOL Transport Aircrafthassan wastiNo ratings yet

- Flexure Hinge Mechanisms Modeled by Nonlinear Euler-Bernoulli-BeamsDocument2 pagesFlexure Hinge Mechanisms Modeled by Nonlinear Euler-Bernoulli-BeamsMobile SunNo ratings yet

- Chain Rule 3LNDocument2 pagesChain Rule 3LNsaad khNo ratings yet

- Introduction To Plant Physiology!!!!Document112 pagesIntroduction To Plant Physiology!!!!Bio SciencesNo ratings yet

- Demand Management in Global Supply Chain - Disertasi S3Document166 pagesDemand Management in Global Supply Chain - Disertasi S3Ahmad BuchoriNo ratings yet

- Shakespeare Ubd Unit PlanDocument16 pagesShakespeare Ubd Unit Planapi-239477809No ratings yet

- Deviation Control MethodsDocument4 pagesDeviation Control MethodsLazuardhy Vozicha FuturNo ratings yet

- LAB - Testing Acids & BasesDocument3 pagesLAB - Testing Acids & BasesRita AnyanwuNo ratings yet

- COLUMNA A. Erosion B. Ecosystem C. Conservation D - .DDocument1 pageCOLUMNA A. Erosion B. Ecosystem C. Conservation D - .DkerinsaNo ratings yet

- Isabela State University: Republic of The Philippines Roxas, IsabelaDocument17 pagesIsabela State University: Republic of The Philippines Roxas, IsabelaMarinette MedranoNo ratings yet

- Police Log September 24, 2016Document14 pagesPolice Log September 24, 2016MansfieldMAPoliceNo ratings yet

- IHRM Midterm ASHUVANI 201903040007Document9 pagesIHRM Midterm ASHUVANI 201903040007ashu vaniNo ratings yet

- Unit One Mathematical EconomicsDocument15 pagesUnit One Mathematical EconomicsSitra AbduNo ratings yet

- ECU MS 4 Sport ManualpdfDocument26 pagesECU MS 4 Sport ManualpdfLucas DuarteNo ratings yet

- Unit 6 - ListeningDocument11 pagesUnit 6 - Listeningtoannv8187No ratings yet

- DNA Structure and Replication: Chapter Nine Khalid HussainDocument49 pagesDNA Structure and Replication: Chapter Nine Khalid HussainKhalid HussainNo ratings yet

- Freedom SW 2000 Owners Guide (975-0528!01!01 - Rev-D)Document48 pagesFreedom SW 2000 Owners Guide (975-0528!01!01 - Rev-D)MatthewNo ratings yet

- LAC BrigadaDocument6 pagesLAC BrigadaRina Mae LopezNo ratings yet