Professional Documents

Culture Documents

Income Analysis Worksheet

Uploaded by

Rajasekhar Reddy AnekalluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Analysis Worksheet

Uploaded by

Rajasekhar Reddy AnekalluCopyright:

Available Formats

INCOME ANALYSIS WORKSHEET

Borrower Name: Co-Borrower Name:

P lease Note: If the amount is negative you MUST preface the number with a minus sign (-) in order for the amount to be deducted from the total.

Income Analysis - Cash Flow Quick Method

Individual Tax Return (1040) Wages, salaries, tips, etc. (line 7) Interest (line 8a) Interest (line 8b) Ordinary dividends (line 9a) Ordinary dividends (line 9b) Alimony received (line 11) Business income (loss) (line 12) Other gain (loss) (line 14) IRA distributions (line 15a) Pensions and annuities (line 16a) Farm income (loss) (line 18) Unemployment compensation (line 19) Social security benefits (line 20a) Other income (line 21) Form 2106 Expenses (line 8a) Form 2106 Expenses (line 8b) Form 2106 Depreciation (line 28) Form 2106 Business Miles (line 13) Depreciation Rate Total Business Miles Schedule C Depletion (line 12) Schedule C Depreciation (line 13) Schedule C Meals/Entertainment exclusion (line 24b) Schedule C Business use of home (line 30) Schedule D Capital gain (loss) Short-term (line 7) Schedule D Capital gain (loss) Long-term (line 15) Schedule E Rents (line 3) Schedule E Royalties (line 4) Insurance (line 9) Mortgage Interest paid to banks, etc (line 12) Taxes (line 16) Amortization/Casualty Loss -if noted (line 18) Schedule E Total Expenses (line 19) Schedule E Net Rental Income (loss) Schedule E 179 Expense (line 28i) Schedule E Part./S-corp. income (loss) (line 32) Schedule F Depreciation (line 16)

Year (YY) Yr. $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

20

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

20

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

20

0.00 Yr. 0.00

$ $ $ $ $ $ $ $ $ $ $ $ $ $

0.00 Yr. 0.00

$ $ $ $ $ $ $ $ $ $ $ $ $ $

0.00 0.00

0.00

$ $ $ $

0.00

$ $ $ $

0.00

Other Income (Expense)* TOTAL TOTAL 1040 INCOME (A)

*Other income/expense includes items such as amortization.

$ $ $

0.00 0.00

0.00

0.00

INCOME ANALYSIS WORKSHEET

P artnership Tax Return (1065) Depreciation (line 16a) Depletion (line 17) Mortgage, Notes, Bonds Payable in Less Than One Year (Schedule L, line 16)2 Other Income (Expense) (line 7) Subtotal Times Ownership Percentage (K-1 line J) Guaranteed Payments (K-1 line 4) TOTAL TOTAL PARTNERSHIP INCOME (B) 0.00%

3

20

$ $ $ $

20

$ $

20

$ $ $ $ $ $ $

$ $

$ $

0.00 0.00

$ $ $

0.00 0.00

$ $ $

0.00 0.00

0.00 0.00

0.00

0.00

S Corp. Tax Return (1120S) Depreciation (line 14) Depletion (line 15) Mortgage, Notes, Bonds Payable in Less Than One Year (Schedule L, line 17)2 Other Income (Expense) (line 5) Subtotal Times Ownership Percentage (K-1 line F) TOTAL TOTAL S CORP. INCOME (C) 0.00%

3

20

$ $ $ $

20

$ $

20

$ $ $ $ $ $

$ $

$ $

0.00 0.00 0.00 0.00

$ $ $

0.00 0.00 0.00

$ $ $

0.00 0.00 0.00

Corporation Tax Return (1120) Depreciation (line 20) Depletion (line 21) Net Operating Loss (line 29a) Taxable income/loss (line 30) (Total tax) (line 31) Mortgage, Notes, Bonds Payable in Less Than One Year (Schedule L, line 17)2 Other Income (Expense)3 (line 10) Subtotal Times Ownership Percentage (Schedule E) TOTAL TOTAL CORPORATION INCOME (D) GRAND TOTAL (A) (B) (C) (D) 0.00%

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

20

$ $ $ $ $

20

$ $ $ $ $

20

$ $

$ $

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1

$ $ $

0.00 0.00 0.00

$ $ $

0.00 0.00 0.00

Total Total divided by # months Total divided by # months

Monthly Income

0.00

T his Income Analysis Worksheet is provided by PMI Mortgage Insurance Co. (PMI) for training and informational purposes only. It is not intended to and should not be relied upon for any other purpose, including mortgage loan underwriting or preparation of tax forms or other documents, and should be reviewed by your own independent legal and compliance advisors. Please direct any questions you may have about this or any other PMI training publication to your PMI representative or call 800.966.4PMI (4764). Please note that the GSE guidelines stated on this worksheet are effective as of February 26, 2010. 2011 PMI Mortgage Insurance Co. 11-0060 (3.11)

Cell: B10 Comment: Income shown here could be generated for a corporation from which the borrower pays himself or herself and/or their spouse. If this is the case, the income can be entered here. If the income is related to a spouse that is employed by another company, the income should be considered separately and not entered on this form. Any income shown here will be reported on a W-2. Cell: B11 Comment: Interest income is earned on assets the borrower owns. It may be added to income if it has been received for the previous two years and it is likely to continue for the next three years. Subtract any assets used for down payment or closing costs from the borrowers total assets before calculating expected future interest income. Cell: B12 Comment: Interest income is earned on assets the borrower owns. It may be added to income if it has been received for the previous two years and it is likely to continue for the next three years. Subtract any assets used for down payment or closing costs from the borrowers total assets before calculating expected future interest income. Cell: B13 Comment: Dividend income is earned on assets the borrower owns. It may be added to income if it has been received for the previous two years and it is likely to continue for the next three years. Subtract any assets used for down payment or closing costs from the borrowers total assets before calculating expected future dividend income. Cell: B14 Comment: Dividend income is earned on assets the borrower owns. It may be added to income if it has been received for the previous two years and it is likely to continue for the next three years. Subtract any assets used for down payment or closing costs from the borrowers total assets before calculating expected future dividend income. Cell: B15 Comment: Typically, alimony income is considered stable if it has been received for at least 12 months. It must continue at least three years after the date of the mortgage application in order to add it in income.

Cell: B16 Comment: Net business income from a sole proprietorship is reported here. The income can be added to income; any losses must be subtracted from income. Detailed income/expenses are reported on Schedule C or C-EZ. Cell: B17 Comment: Other gains/losses are reported if assets used in a trade or business are sold or exchanged. Typically, this is not considered stable or recurring income.

Cell: B18

Comment: IRA Distributions can be added to income if regular and contined receipt of this income can be documented. If retirement income is paid in the form of a monthly distribution from a 401(k), IRA, or Keogh retirement account, determine whether the income is expected to continue for at least three years after the date of the mortgage application.

Cell: B19 Comment: IRA Distributions can be added to income if regular and contined receipt of this income can be documented. If retirement income is paid in the form of a monthly distribution from a 401(k), IRA, or Keogh retirement account, determine whether the income is expected to continue for at least three years after the date of the mortgage application.

Cell: B20 Comment: The net business income from a farm can be added here; detailed income/expenses will be claimed on Schedule F. Cell: B21 Comment: Unemployment benefits may be used in qualifying only if they are verified as a traditional and continuing source of income. A minimum 2-year history is required.

Cell: B22 Comment: Certain portions of income received as Social Security benefits are not taxable; however, the borrower can be given credit for all of this income if the benefits will be ongoing. If the Social Security benefits have a defined expiration date, confirm that the remaining term is at least three years from the date of the mortgage application. Cell: B23 Comment: Income in this category is usually extraordinary and nonrecurring, and should not be considered as income unless you can document that the income is recurring, consistent and stable. Cell: B24 Comment: Form 2106 reports reimbursed and unreimbursed business expenses. Only the unreimbursed business expenses should be subtracted from income. Total expenses in line 8a & 8b and subtract from income.

Cell: B25 Comment: Form 2106 reports reimbursed and unreimbursed business expenses. Only the unreimbursed business expenses should be subtracted from income. Total expenses in line 8a & 8b and subtract from income.

Cell: B26 Comment: Vehicle depreciation may be claimed as part of the borrowers vehicle expense. It is a a noncash expense and can be added to income. Cell: B27

Comment: A mileage expense can be claimed for vehicles used during the tax year for business purposes. A percentage of the deduction can be added to income as this is a non-cash expense. Enter the number of miles. Cell: B28 Comment: The number of miles will be multiplied by the depreciation for the year in which is was claimed to arrive at the amount that can be added to income. Select the year from the drop-down list.

Cell: B29 Comment: Total Business Miles will be automatically calculated based on the year and the number of miles entered above. Cell: B30 Comment: Depletion is a noncash expense reflecting the decrease of a non-renewable resource. If the depletion of this resource will not adversely impact future business operations, the amount of depletion allowance can be added to income. Cell: B31 Comment: Depreciation is a non-cash business expense that is allocated over the useful life of an asset. Depreciation can be added back to income. Cell: B32 Comment: 50% of the borrowers out-of-pocket costs for business-related meals and entertainment are deductible on the tax return. The remaining 50% of costs must be absorbed by the borrower and therefore should be subtracted from the borrowers income.

Cell: B33 Comment: Business use of home is an allowable deduction for business use of the borrowers residence, such as space dedicated to an office or storage of materials and supplies used by the business. This is a non-cash deduction and it can be added back to income. Cell: B34 Comment: Capital Gains/Loss are the profit or loss of the sale of an asset. Income received from a capital gain is generally a one-time transaction; therefore, it should not usually be considered part of the borrowers stable monthly income. If; however, the borrower constantly turns over such assets, capital gains may be added and losses should be subtracted from income. If capital gains are to be considered, develop an average gain (net of capital losses for the period) based on a verified 2-year history. This must be the borrowers primary source of income and none of the assets can be used for closing of the transaction. Cell: B35 Comment: Capital Gains/Loss are the profit or loss of the sale of an asset.

Income received from a capital gain is generally a one-time transaction; therefore, it should not usually be considered part of the borrowers stable monthly income. If; however, the borrower constantly turns over such assets, capital gains may be added and losses should be subtracted from income. If capital gains are to be considered, develop an average gain (net of capital losses for the period) based on a verified 2-year history. This must be the borrowers primary source of income and none of the assets can be used for closing of the transaction. Cell: B36 Comment: Income from rental property may be considered; however, investors vary in how they treat this income. Check your investor guidelines to determine the appropriate calculations. In general, it requires documentation of receipt for the prior 2 years and current lease/rental agreement. Cell: B37 Comment: Royalties can, in some instances, meet the criteria for stable, continuous income. They may be used if there is a history and reasonable expectation of continuance for a minimum of three years. Royalties are generally received from copyrighted material or natural resources. Cell: B38 Comment: Fannie Mae requires that mortgage insurance expenses are added back in the borrowers cash flow analysis. Cell: B39 Comment: Fannie Mae requires that mortgage interest expenses are added back in the borrowers cash flow analysis. Cell: B40 Comment: Fannie Mae requires that mortgage tax expenses are added back in the borrowers cash flow analysis. Cell: B41 Comment: Amortization and Casualty losses can be added back to income. Amortization is a deductible expense allowed as a means of recovering the investment in intangible assets of the business. A Casualty Loss is a type of tax loss that is caused by a sudden, unexpected or unusual event. Cell: B42 Comment: Line 19 on the Schedule E reflects the total amount paid for the maintenance and upkeep of the property. This also includes mortgage interest and taxes. These expenses must be subtracted from income. Cell: B43 Comment: The net rental income/loss will be automatically calculated.

Note: Please refer to Fannie Mae's guidelines on calculating rental income and handle the income/loss and the PITIA on the rental properties accordingly. Cell: B44 Comment: Section 179 property is property that was purchased for the active use by the trade or business. Part or all of the cost of the section 179 property may be expensed in the year in which it was placed in service. The taxpayers share of the section 179 expense may be added back to income. Cell: B45 Comment: The borrowers share of partnership or S corporation income or loss is reported here. This amount should be considered in determining qualified income.

Cell: B46 Comment: Depreciation is a non-cash business expense that is allocated over the useful life of an asset. Depreciation can be added back to income. Cell: B47 Comment: Other income/expenses may added or subtracted to income such as amortization.

Cell: B48 Comment: The total income/loss will be automatically calculated in each column.

Cell: B49 Comment: The total income/loss for each column is totalled automatically and populated in Section A in the Grand Total section on the bottom of page 2.

Cell: B54 Comment: Depreciation is a noncash business expense that is allocated over the useful life of an asset. Financial capacity of the business should be evaluated to ascertain that depreciated assets can be replaced as needed. If the business proves financial capacity, depreciation can be added to income as it is a noncash expense. Cell: B55 Comment: Depletion is a noncash expense reflecting the decrease of a non-renewable resource. If the depletion of this resource will not adversely impact future business operations, the amount of depletion allowance can be added to income. Cell: B56 Comment: Morgage, notes, bonds payable may be a single payment note or have a renewal option. The actual working capital needed daily by the partnership may be affected by these liabilities.

Analysis must be conducted to determine if required repayment of these debts will adversely impact the partnerships cash flow. If there is an adverse impact to the cash flow they must be subtracted from income. Cell: B58 Comment: Analyze other income to determine the probability of continuance and stability.

Cell: B59 Comment: The sub-total of the partnership income is automatically calculated.

Cell: B60 Comment: Enter the partners percent of interest in the business. The sub-total of partnership income is automatically multiplied by the borrowers % of ownership.

Cell: B61 Comment: These payments are made to the partner for services rendered or for the use of capital. Guaranteed payments are made without regard to the partnerships profits and are subject to self-employment tax by the partner. Analysis must be conducted to determine if this income is consistent and recurring. If so, it may be added to income. Cell: B62 Comment: The total income/loss will be automatically calculated in each column. Cell: B63 Comment: The total income/loss in each column is totalled automatically and populated in Section B in the Grand Total section on the bottom of page 2.

Cell: B66 Comment: Depreciation is a noncash business expense that is allocated over the useful life of an asset. Financial capacity of the business should be evaluated to ascertain that depreciated assets can be replaced as needed. If the business proves financial capacity, depreciation can be added to income as it is a noncash expense. Cell: B67 Comment: Depletion is a noncash expense reflecting the decrease of a non-renewable resource. If the depletion of this resource will not adversely impact future business operations, the amount of depletion allowance can be added to income. Cell: B68 Comment: Morgage, notes, bonds payable may be a single payment note or have a renewal option. The actual working capital needed daily by the S Corporation may be affected by these liabilities. Analysis must be conducted to determine if required repayment of these debts will adversely impact the S Corporation's cash flow.

If there is an adverse impact to the cash flow they must be subtracted from income. Cell: B70 Comment: Analyze other income to determine the probability of continuance and stability.

Cell: B71 Comment: The sub-total of the s coporate income is automatically calculated.

Cell: B72 Comment: Enter the shareholders ownership interest in the business. The total shareholder's income is automatically multiplied by the shareholder's % of ownership, which determines the percentage of profit or loss to be distributed by the S Corporation. Cell: B73 Comment: The total income/loss will be automatically calculated in each column.

Cell: B74 Comment: The total income/loss in each column is totalled automatically and populated in Section C in the Grand Total section on the bottom of page 2. Cell: B77 Comment: Depreciation is a noncash business expense that is allocated over the useful life of an asset. Financial capacity of the business should be evaluated to ascertain that depreciated assets can be replaced as needed. If the business proves financial capacity, depreciation can be added to income as it is a noncash expense. Cell: B78 Comment: Depletion is a noncash expense reflecting the decrease of a non-renewable resource. If the depletion of this resource will not adversely impact future business operations, the amount of depletion allowance can be added to income. Cell: B79 Comment: Net operating loss is a loss that was carried forward from previous years generally used to reduce future tax payments. The net operating loss is a non-cash loss for the year it is claimed since the loss was experienced in a prior year. It may be added back to income; however, careful analysis should be conducted as to the nature of the loss and whether is has any negative impact to future profits. Cell: B80 Comment: This is the corporations taxable income and should be added back to corporate income.

Cell: B81 Comment: This is the tax incurred by the corporation. You must subtract from the corporations taxable

income. Cell: B82 Comment: Morgage, notes, bonds payable may be a single payment note or have a renewal option. The actual working capital needed daily by the Corporation may be affected by these liabilities. Analysis must be conducted to determine if required repayment of these debts will adversely impact the Corporation's cash flow. If there is an adverse impact to the cash flow they must be subtracted from income. Cell: B84 Comment: Analyze other income to determine the probability of continuance and stability.

Cell: B85 Comment: The sub-total of the corporate income is automatically calculated.

Cell: B86 Comment: Enter the shareholders ownership interest in the business. The total shareholder's income is automatically multiplied by the shareholder's % of ownership, which determines the percentage of profit or loss to be distributed by the Corporation.

Cell: B87 Comment: The total income/loss will be automatically calculated in each column.

Cell: B88 Comment: The total income/loss in each column is totalled automatically and populated in Section D in the Grand Total section on the bottom of page 2. Cell: E90 Comment: Income/Loss from the 1040s. Cell: E91 Comment: Income/loss generated from the partnership. Cell: E92 Comment: Income/loss generated from the s corporation. Cell: E93 Comment: Income/loss generated from the corporation. Cell: E94 Comment: Grand total of all income for all years calculated. Cell: D95 Comment: Enter the number of months used in qualifying. Cell: E96 Comment: Total monthly qualifying income.

You might also like

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Chapter 3 Financial Model ExcelDocument11 pagesChapter 3 Financial Model Excelzzduble1No ratings yet

- Activity Based Budget Spreadsheet TemplateDocument15 pagesActivity Based Budget Spreadsheet TemplateAnass HamdouneNo ratings yet

- 1 - Blank Financial AppendixDocument57 pages1 - Blank Financial AppendixKingNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Analysis of Beta Corporation's 1991 Cash Flow StatementDocument14 pagesAnalysis of Beta Corporation's 1991 Cash Flow Statementshahin selkarNo ratings yet

- Accounting Excel Reports - Report Generalledger ExcelDocument36 pagesAccounting Excel Reports - Report Generalledger ExcelMark Ceddrick MioleNo ratings yet

- 2019 Tax Advisors Update 11.14.19 PDFDocument326 pages2019 Tax Advisors Update 11.14.19 PDFD100% (1)

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- Projected Profit and Cash FlowDocument27 pagesProjected Profit and Cash FlowAprian ImmanuelNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument9 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manuallemon787100% (5)

- Chart of Accounts 1670433717Document22 pagesChart of Accounts 1670433717Ahmed ElwaseefNo ratings yet

- 2018-Income-Statement Copy-2Document9 pages2018-Income-Statement Copy-2api-464285260No ratings yet

- Chapter 4Document6 pagesChapter 4Ashanti T Swan0% (1)

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- Balance SheetDocument4 pagesBalance SheetSiddharth KaliaNo ratings yet

- Tax Credits for Child Care and Education ExpensesDocument17 pagesTax Credits for Child Care and Education ExpensesKeti AnevskiNo ratings yet

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- Worked Example Financial StatementDocument2 pagesWorked Example Financial StatementNayaz EmamaulleeNo ratings yet

- Former Mayor Bill White's 2009 Tax ReturnDocument43 pagesFormer Mayor Bill White's 2009 Tax ReturnTexas WatchdogNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- ACC 330 Final Project Two Tax Planning Template - 2020Document3 pagesACC 330 Final Project Two Tax Planning Template - 2020BREANNA JOHNSONNo ratings yet

- Income StatementDocument26 pagesIncome StatementRashad MallakNo ratings yet

- The Polks Tax CalculationDocument8 pagesThe Polks Tax CalculationhuytrinhxNo ratings yet

- Dashboard: Profit & Loss StatementDocument3 pagesDashboard: Profit & Loss StatementKhairie RahimNo ratings yet

- Introduction to Federal Taxation in CanadaDocument40 pagesIntroduction to Federal Taxation in CanadaDonna So100% (2)

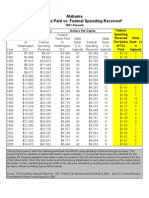

- Federal Taxes Paid Vs Federal Spending Received by States, 1981-2005Document51 pagesFederal Taxes Paid Vs Federal Spending Received by States, 1981-2005Javier Arvelo-Cruz-SantanaNo ratings yet

- Physical properties of HC gas streamDocument2 pagesPhysical properties of HC gas streammahi_kotaNo ratings yet

- Estimated Grade Calculator for Accounting CourseDocument7 pagesEstimated Grade Calculator for Accounting Course037boyNo ratings yet

- ITR AssignmentDocument8 pagesITR AssignmentEkta VermaNo ratings yet

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingDocument13 pagesFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidNo ratings yet

- PL Appropriation AcDocument6 pagesPL Appropriation AcShivangi Aggarwal100% (1)

- Indirect MethodDocument34 pagesIndirect MethodHacker SKNo ratings yet

- f1040x PDFDocument2 pagesf1040x PDFAlexNo ratings yet

- 12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedDocument9 pages12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedSrikiran RajNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- Amended 1040 Tax Form ExplainedDocument2 pagesAmended 1040 Tax Form Explainedgolcha_edu532No ratings yet

- Irs 990-Ez 2007Document3 pagesIrs 990-Ez 2007api-18678301No ratings yet

- Homework ES 2 Solution ACCT 553Document5 pagesHomework ES 2 Solution ACCT 553Mohammad IslamNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNo ratings yet

- Specimen Examen F3 AccaDocument21 pagesSpecimen Examen F3 AccaGNo ratings yet

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestNo ratings yet

- F3 Specimen Exam 2014 PDFDocument21 pagesF3 Specimen Exam 2014 PDFgrrrklNo ratings yet

- Computation of Adjusted Profit For Self EmployedDocument8 pagesComputation of Adjusted Profit For Self EmployedCindyNo ratings yet

- Chapter 11 - Computation of Taxable Income and TaxDocument22 pagesChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Partner's Instructions For Schedule K-1 (Form 1065)Document15 pagesPartner's Instructions For Schedule K-1 (Form 1065)Mario LaflammeNo ratings yet

- Untitled PDFDocument2 pagesUntitled PDFjenny abbottNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- Accounting 4Document8 pagesAccounting 4syopiNo ratings yet

- Tax Audit Issues and ApplicabilityDocument20 pagesTax Audit Issues and ApplicabilityJigar MehtaNo ratings yet

- Financial Statements SummaryDocument53 pagesFinancial Statements Summaryrachealll100% (1)

- 3 Partnership AccountsDocument93 pages3 Partnership AccountsCA K D Purkayastha100% (1)

- 2013 Form IL-1040: Personal InformationDocument2 pages2013 Form IL-1040: Personal Informationvimal_pro222-scribdNo ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- CPA Regulation (Reg) Notes 2013Document7 pagesCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- FTG Irs Form 990-Ez 2008Document12 pagesFTG Irs Form 990-Ez 2008L. A. PatersonNo ratings yet

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- Instructions For Filling The Tax Calculator For Financial Year 2017-18Document2 pagesInstructions For Filling The Tax Calculator For Financial Year 2017-18SubramanyaNo ratings yet

- Premarket OpeningBell ICICI 15.12.16Document8 pagesPremarket OpeningBell ICICI 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 21.12.16Document8 pagesPremarket OpeningBell ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Ashika 16.12.16Document4 pagesPremarket Technical&Derivative Ashika 16.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 15.12.16Document3 pagesPremarket MorningGlance SPA 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 21.12.16Document4 pagesPremarket CurrencyDaily ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 20.12.16Document4 pagesPremarket CurrencyDaily ICICI 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 15.12.16Document4 pagesPremarket CurrencyDaily ICICI 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Angel 15.12.16Document14 pagesPremarket MarketOutlook Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Angel 15.12.16Document5 pagesPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersRajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 20.12.16Document5 pagesPremarket MarketOutlook Motilal 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket WakeUpCall Wallfort 21.12.16Document2 pagesPremarket WakeUpCall Wallfort 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Ashika 15.12.16Document6 pagesPremarket MorningReport Ashika 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket WakeUpCall Wallfort 20.12.16Document2 pagesPremarket WakeUpCall Wallfort 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 20.12.16Document7 pagesPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 20.12.16Document3 pagesPremarket MorningGlance SPA 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Angel 20.12.16Document14 pagesPremarket MarketOutlook Angel 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Technical Derivatives Report SummaryDocument5 pagesTechnical Derivatives Report SummaryRajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 19.12.16Document4 pagesPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 19.12.16Document7 pagesPremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Ashika 21.12.16Document6 pagesPremarket MorningReport Ashika 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 21.12.16Document3 pagesPremarket MorningGlance SPA 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 21.12.16Document7 pagesPremarket MorningReport Dynamic 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Angel 19.12.16Document14 pagesPremarket MarketOutlook Angel 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Angel 9.12.16Document11 pagesPremarket MarketOutlook Angel 9.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 19.12.16Document4 pagesPremarket CurrencyDaily ICICI 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- US$ INR Currency Futures OutlookDocument4 pagesUS$ INR Currency Futures OutlookRajasekhar Reddy AnekalluNo ratings yet

- Techno Funda Pick Techno Funda Pick: R Hal Research AnalystsDocument10 pagesTechno Funda Pick Techno Funda Pick: R Hal Research AnalystsRajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 09.12.16Document8 pagesPremarket OpeningBell ICICI 09.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Monthly Call: Apollo TyresDocument4 pagesMonthly Call: Apollo TyresRajasekhar Reddy AnekalluNo ratings yet

- Godrej Meridien Gurgaon Sector 106 BrochureDocument59 pagesGodrej Meridien Gurgaon Sector 106 BrochureGodrej MeridienNo ratings yet

- Intern Report BBA PUDocument34 pagesIntern Report BBA PUBabita ChhetriNo ratings yet

- 2 0 1 1 C A S E S PropertyDocument36 pages2 0 1 1 C A S E S PropertyIcee GenioNo ratings yet

- Amortization On A Simple Interest MortgageDocument470 pagesAmortization On A Simple Interest Mortgagesaxophonist42No ratings yet

- Preface To The Third Edition: Life Contingencies by C.W. Jordan, Our Text Has Become The Only OneDocument59 pagesPreface To The Third Edition: Life Contingencies by C.W. Jordan, Our Text Has Become The Only OneAelin IsmailovaNo ratings yet

- August 9, 2013 Federal RICO Complaint To Add 2260 Defendant Ryder Ray Sexual Exploitation ChildDocument193 pagesAugust 9, 2013 Federal RICO Complaint To Add 2260 Defendant Ryder Ray Sexual Exploitation Childrealestatelawyer101No ratings yet

- Activity A - Introduction To Engineering EconomyDocument2 pagesActivity A - Introduction To Engineering EconomySofia MonteroNo ratings yet

- Ra 8291 - Gsis LawDocument15 pagesRa 8291 - Gsis LawjoyeduardoNo ratings yet

- Home Loans in India - A Complete GuideDocument84 pagesHome Loans in India - A Complete GuidePrathmesh AmbulkarNo ratings yet

- Phil Savings Bank vs. ManalacDocument13 pagesPhil Savings Bank vs. ManalacSherwin Anoba CabutijaNo ratings yet

- Mortel V KasscoDocument1 pageMortel V KasscoMichelle BernardoNo ratings yet

- Allahabad Bank Was Founded by Group of Europeans On April 24Document34 pagesAllahabad Bank Was Founded by Group of Europeans On April 24Mahendra KushwahaNo ratings yet

- LEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsDocument2 pagesLEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsJims Leñar CezarNo ratings yet

- Owais Zahid - Nov 22Document6 pagesOwais Zahid - Nov 22Owais ZahidNo ratings yet

- Singapore Property Weekly Issue 93 To 126 PDFDocument436 pagesSingapore Property Weekly Issue 93 To 126 PDFPrasanth NairNo ratings yet

- Loan Documentation IobDocument18 pagesLoan Documentation IobVenkatesanSelvarajan0% (1)

- The Savings and Loan Crisis and Its Relationship To BankingDocument22 pagesThe Savings and Loan Crisis and Its Relationship To Bankingmanepalli vamsiNo ratings yet

- PART - 5 - Precalculus Fifth Edition Mathematics For CalculusDocument182 pagesPART - 5 - Precalculus Fifth Edition Mathematics For CalculusJed Lavu0% (1)

- 2017 (GR No 202364, Arturo Calubad V Ricarcen Development Corporation) PDFDocument15 pages2017 (GR No 202364, Arturo Calubad V Ricarcen Development Corporation) PDFFrance SanchezNo ratings yet

- Investigate Three Occupations: Instruction Sheet: Posted On CanvasDocument5 pagesInvestigate Three Occupations: Instruction Sheet: Posted On Canvasapi-521677138No ratings yet

- Upholds validity of consignation of loan payment when creditor is unknownDocument8 pagesUpholds validity of consignation of loan payment when creditor is unknownJm CruzNo ratings yet

- 3 C's of CreditDocument45 pages3 C's of Creditsushant1903No ratings yet

- Chap 014Document67 pagesChap 014Nitesh Agrawal100% (2)

- Bachrach V Talisay SilayDocument1 pageBachrach V Talisay SilayalexNo ratings yet

- Mi Investment Outlook Ce enDocument17 pagesMi Investment Outlook Ce enCrypto JiznNo ratings yet

- ACC 240 CH - 17 - SM - 9eDocument17 pagesACC 240 CH - 17 - SM - 9eashandron4everNo ratings yet

- Chapter 5 Annual Cash Flow AnalysisDocument54 pagesChapter 5 Annual Cash Flow AnalysisShudipto PodderNo ratings yet

- Business Mathematics: For LearnersDocument13 pagesBusiness Mathematics: For LearnersJet Rollorata BacangNo ratings yet

- Financial crises caused by cross-border investment flows not misbehaviorDocument4 pagesFinancial crises caused by cross-border investment flows not misbehavioralpar7377No ratings yet

- Taxation of Federal ObligationsDocument26 pagesTaxation of Federal ObligationsTRISTARUSANo ratings yet