Professional Documents

Culture Documents

Business Valuation

Uploaded by

Mohiuddin AshrafiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Valuation

Uploaded by

Mohiuddin AshrafiCopyright:

Available Formats

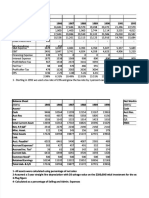

The Free Cash Flow Business Valuation Model

Instructions: Change any of the forecasting variables shown in red below and observe the effect on the model's

outputs in the section below. To what variable is the business value conclusion most sensitive? To what variable

is it least sensitive?

The Discounted Free Cash Flow Model for a Complete Business

Pie In the Sky Company

Forecasting Variables:

2002 2003 2004 2005 2006

Revenue growth factor

Expected gross profit margin

S, G, & A expense % of revenue

Depr. & Amort. % of revenue

Capital expenditure growth factor

Net working capital to sales ratio

Income tax rate

Assumed long-term sustainable growth rate

Discount rate

2007

2008

2009

2010

2011

60%

54%

28%

10%

20%

15%

50%

55%

27%

10%

-10%

14%

40%

56%

26%

10%

-15%

13%

30%

57%

25%

10%

-20%

12%

20%

58%

24%

10%

-25%

11%

10%

59%

23%

10%

-30%

10%

2002 2003 2004 2005 2006

2007

2008

2009

2010

2011

50% 51% 52% 53% 54% 55% 56% 57% 58%

#REF! ##### ##### ##### ##### #REF! #REF! #REF! #REF!

#REF! ##### ##### ##### ##### #REF! #REF! #REF! #REF!

59%

#REF!

#REF!

#REF!

20%

50%

50%

10%

40%

19%

30%

51%

40%

10%

35%

18%

40%

5% per year after 2011

20%

40%

52%

30%

10%

30%

17%

50%

53%

29%

10%

25%

16%

40%

5%

20%

Valuation Model Outputs:

Gross profit margin

Net operating profit margin

Free cash flow ($ mil)

Terminal value ($ mil)

PV of Company Operations ($ mil)

#REF!

Market Value of Company Assets ($ mil)

#REF!

The Discounted Free Cash Flow Model for a Complete Business

Pie In the Sky Company

Actual

1996

1997

1998 1999Q1

1,460

1,610

1,717

1999Q2

499

510

1999

2016.8

Total revenue

$2,400,000

$3,120,000

$4,368,000

652.8

1364

1,200,000

800,000

1,200,000

1,200,000

1,528,800

1,591,200

2,096,640

2,271,360

3,079,440

3,472,560

4,822,272

5,660,928

7,076,160

8,648,640

9,686,477

12,328,243

12,306,228

16,312,908

14,424,045

19,918,918

15,488,676

22,288,584

595.2

768.8

1,200,000

(400,000)

1,200,000

0

1,248,000

343,200

1,310,400

960,960

1,900,080

1,572,480

2,935,296

2,725,632

4,245,696

4,402,944

5,723,827

6,604,416

7,154,784

9,158,124

8,242,311

11,676,607

8,688,770

13,599,814

200,000

240,000

312,000

436,800

655,200

1,048,320

1,572,480

2,201,472

2,861,914

3,434,296

3,777,726

(600,000)

(240,000)

31,200

524,160

917,280

1,677,312

2,830,464

4,402,944

6,296,210

8,242,311

9,822,088

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

240,000

(1,400,000)

76,000

#REF!

312,000

(1,890,000)

129,600

#REF!

436,800

(2,457,000)

212,160

#REF!

655,200

(3,071,250)

349,440

#REF!

468

496

540

168

159

992.5

1114.9

1177.3

330.6

351.4

Selling, general and administrative expenses

Earnings before interest, taxes, depr. & amort. (EBITDA)

436

505

518

142

156

556.9

609.8

659.1

188.5

195.9

335

(104)

405

(193)

458

2,115

123

384

159

890

565.2

2548.2

2751.8

Non-operating income

Earnings before Interest and taxes (EBIT)

Interest expense

Income Taxes

Net Operating Profit After-Tax (NOPAT)

Add back depreciation and amortization

Subtract Capital Expenditures

Subtract New Net Working Capital

Free Cash Flow

117.5

12.2

2316.8

449.2

926.7

Years Ending December 31

|------------------------------------------------------------------------------------------ Forecast ----------------------------------------------------------------------------------------|

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

$2,000,000

Cost of Goods Sold

Gross profit

Depreciation and amortization

2001

146

23

202

(54)

223

883

54

144

69

352

245.4

-51.6

-136.4

1210.7

251.1

505.9

2506.4

200,000

(1,000,000)

#REF!

$6,552,000 $10,483,200 $15,724,800 $22,014,720 $28,619,136 $34,342,963

#REF!

#REF!

1,048,320

(3,685,500)

589,680

#REF!

#REF!

#REF!

1,572,480

(3,316,950)

733,824

#REF!

#REF!

#REF!

2,201,472

(2,819,408)

817,690

#REF!

#REF!

#REF!

2,861,914

(2,255,526)

792,530

#REF!

#REF!

#REF!

3,434,296

(1,691,645)

629,621

#REF!

Terminal value, 2011

$37,777,260

#REF!

#REF!

3,777,726

(1,184,151)

343,430

#REF!

#REF!

Present Value of Free Cash Flows @ 20%

#REF!

Total Present Value of Company Operations

Plus Current Assets

#REF!

500,000

Total Market Value of Great Expectations' Assets

#REF!

#REF!

#REF!

#REF!

from Pie in the Skys' December 31, 2001 Balance Sheet

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cummins to Outperform Kirloskar as DG Industry Growth Driven by Infrastructure SpendingDocument28 pagesCummins to Outperform Kirloskar as DG Industry Growth Driven by Infrastructure SpendingPringles JinglesNo ratings yet

- Olam Annual Report Fy19 - 3 in 1 PDFDocument298 pagesOlam Annual Report Fy19 - 3 in 1 PDFMario EscobarNo ratings yet

- Accenture Equity Research ReportDocument10 pagesAccenture Equity Research ReportLee Davie100% (1)

- Chapter 2 Developing Business Idea-1Document58 pagesChapter 2 Developing Business Idea-1Anisul HoqueNo ratings yet

- 2011 Annual Report EngDocument143 pages2011 Annual Report Engsabs1234561080No ratings yet

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument9 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsIrwan AdimasNo ratings yet

- Tying Free Cash Flows To Market Valuation - Robert Howell - Financial ExecutiveDocument4 pagesTying Free Cash Flows To Market Valuation - Robert Howell - Financial Executivetatsrus1No ratings yet

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Goldman Valuation TelemigDocument44 pagesGoldman Valuation Telemigarvindrobin9835100% (1)

- Berk Prob AnswersDocument7 pagesBerk Prob AnswersMarjorie PagsinuhinNo ratings yet

- Chapter Two Problems SolutionsDocument49 pagesChapter Two Problems SolutionsLovan So0% (1)

- Thomson Lear Ning1267Document40 pagesThomson Lear Ning1267Sammy Ben MenahemNo ratings yet

- CHAPTER 5 SolutionDocument29 pagesCHAPTER 5 SolutionAA BB MM100% (1)

- Financial Analysis and Valuation PICAVET ValentinDocument26 pagesFinancial Analysis and Valuation PICAVET ValentinValentin PicavetNo ratings yet

- Chapter 09Document18 pagesChapter 09simeNo ratings yet

- Presentation On Financial ModelingDocument136 pagesPresentation On Financial ModelingMd. Zahedul Ahasan100% (1)

- Financial Statements and Cash Flow: Mcgraw-Hill/IrwinDocument41 pagesFinancial Statements and Cash Flow: Mcgraw-Hill/IrwinQUYÊN PHAN ĐÌNH PHƯƠNGNo ratings yet

- Relative Valuation: Aswath DamodaranDocument130 pagesRelative Valuation: Aswath Damodaranvivek102No ratings yet

- Finance Dictionary PDFDocument248 pagesFinance Dictionary PDFLeonel FrancoNo ratings yet

- Vanita Black Book FINALDocument78 pagesVanita Black Book FINALVikas SinghNo ratings yet

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirNo ratings yet

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- Project 1 - FCF Intel Example - DirectionsDocument27 pagesProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्No ratings yet

- Lbo SumDocument5 pagesLbo SumprachiNo ratings yet

- BF3203: Equity Securities: DCF Valuation IV - Firm Evaluation Models (WACC vs. APV)Document38 pagesBF3203: Equity Securities: DCF Valuation IV - Firm Evaluation Models (WACC vs. APV)Jennifer YoshuaraNo ratings yet

- CaseDocument10 pagesCasejgiujwNo ratings yet

- FM II Assignment 8 W22Document1 pageFM II Assignment 8 W22Farah ImamiNo ratings yet

- Introduction To Global Investment Banking - Merrill LynchDocument28 pagesIntroduction To Global Investment Banking - Merrill LynchAlexander Junior Huayana Espinoza100% (2)

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet