Professional Documents

Culture Documents

G-7 F/X Weekly Report: Highlights

Uploaded by

Aaron UitenbroekOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

G-7 F/X Weekly Report: Highlights

Uploaded by

Aaron UitenbroekCopyright:

Available Formats

Technical Analysis

G-7 F/X Weekly Report

Tuesday, February 5th, 2013

Volume 3 Issue 5

Highlights

USD/CAD has broken back below rotational resistance at 1.0021 which indicates the USD/CAD is not ready to break higher and remains in a rotational state which leaves it vulnerable for a further decline to .9832. Longs are open at 1.0025 with a .9950 stop. EUR/USD remains in an uptrend since making lows at the end of July and has now broken above resistance, now support at 1.3490, which if held, targets a continued move higher to 1.3878 in extension. GBP/USD Shorts remain favored below 1.5825. Below support at 1.5721, look for a further decline into 1.5490 with further support/target at 1.5256-1.5320. Short entries at 1.5890 hit a protective stop at 1.5860.

USD/JPY Continues to act strong. Look for continued longs above the top of the trend channel. Below 90.15 would negate the near-term bullish bias and favor aggressive shorts down to 86.70.

AUD/CAD has broken back into its previous rotational range after a brief break above. The bias is now rotational instead of bullish. Longs at 1.0470 were stopped at 1.0390. AUD/CHF has broken below the bottom of its HVA rotational range between .9630 and .9900 and has reached its support/target at .9410-28. Look for continuation shorts below .9410 or retracement shorts at .9630 targeting .9330. AUD/JPY continues to act strong, breaching 94.70 and is breaking out on the longer term charts. Look for continued longs above 94.70 with little resistance until 105. CAD/CHF Short positions are now open at. 9215 with a stop at 9300 and a target of .8935 CAD/JPY Look for continuation longs above 91.06 with further resistance/target at 92.50/95.00 (March 10 highs). CHF/JPY Look for continued upside action above 100.50 targeting 104.10. EUR/CAD has now broken above the top of its trend channel . Above 1.3475 targets a continued move higher with the next area of key resistance at 1.4125-1.4375.. Pullbacks to 1.3330 may be used to enter new longs. EUR/GBP has breached the top of the trend channel. Pullback longs are favored above .8500. EUR/JPY Continuation longs are favored above 127.15 or pullback longs at 122.90. GBP/AUD Shorts are open at 1.5140 with a stops currently at 1.5265 targeting 1.4715. GBP/JPY Expect continuation longs above 144.65 targeting 147.90. Pullback longs may be considered at l142.65 and 139.50..

This report is copyrighted by i10Research. It is authorized for subscribers ONLY. Do not photocopy, otherwise copy or further distribute this information. i10research strictly prohibits these practices. i10Research employs tracing technologies and, for the protection of all subscribers, will prosecute violators. Jeremy Berkovits, CMT(Compliance) (212) 879-0596 jberkovits@i10research.com David Truffelman(Analyst) (919) 267-3974 dtruffelman@i10research.com Aaron Uitenbroek(Analyst) (646) 535-1012 auitenbroek@i10research.com .

i10 Research LLC | New York, NY

Table of Contents

Page 3: Page 4: Page 5: Page 6: Page 7: Page 8: Page 9: Page 10: Page 11: Page 12: Page 13: Page 14: Page 15: Page 16:

Trade Update Summary AUD/USD, USD/CAD USD/CHF, EUR/USD GBP/USD, USD/JPY AUD/CAD, AUD/CHF AUD/JPY, CAD/CHF CAD/JPY, CHF/JPY EUR/AUD, EUR/CAD EUR/CHF, EUR/GBP EUR/JPY, GBP/AUD GBP/CAD, GBP/CHF GBP/JPY About i10 Research Disclaimer

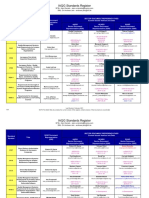

Trade Update Summary

Open Orders Symbol Side Type Entry Stop Target Reward / Risk

Open Positions % Move Points Underlying .0112 1.2% .0105 .7% .0058 .6%

Symbol CAD/CHF GBP/AUD USD/CAD

Side Short Short Long

Entry .9215 1.5140 1.0025

Stop .9300 1.5265 .9950

Target .8935 1.4715 1.0290

Last .9103 1.5035 .9967

Recently Closed Symbol GBP/USD AUD/CAD Side Short Long Entry 1.5890 1.0470 Exit 1.5865 1.0390 Points .0025 .0080 % Move Underlying .15% .54%

AUD/USD is trading in a rotational range between 1.0317 and 1.0620.. Price has been rejected at HVA resistance at 1.0620 forcing price back down to the ascending trend line. Above this trend line favors another test of HVA resistance and a possible break above. Below the trend line would target further declines into 1.0317-37 with further support at the bottom of the larger rotation at 1.0138-64.

AUD/USD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

USD/CAD has broken above, then back below rotational resistance at 1.0021which indicates the USD/CAD is not ready to break higher and remains in a rotational state which leaves it vulnerable for a further decline to .9832. Longs are open at 1.0025 but keep stops tight at .9950. Failure to break back above 1.0021-54 would present a reason to flatten the position.

USD/CAD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

USD/CHF has broken back below the bottom of the High Value Area (HVA) at .9230 which favors shorts on retracements targeting .8920.

USD/CHF

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

EUR/USD remains in an uptrend since making lows at the end of July and has now broken above resistance, now support at 1.3490, which if held, targets a continued move higher to 1.3878 in extension. Below 1.3490 would target a retracement back to the lower ascending trend line where new longs may be considered as well..

EUR/USD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

GBP/USD has broken its uptrend on a break below 1.5990 and has breached support, now resistance at1.5825. Shorts remain favored below 1.5825. Below support at 1.5721, look for a further decline into 1.5490 with further support/target at 1.5256-1.5320. Short entries at 1.5890 hit a protective stop at 1.5860.

GBP/USD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

USD/JPY Continues to act strong. Look for continued longs above the upper trend line. A break back inside the trend line would target a brief retracement back to the lower trend line of the channel.

USD/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

AUD/CAD has broken back into its previous rotational range after a brief break above. The bias is now rotational instead of bullish. Longs at 1.0470 were stopped at 1.0390.

AUD/CAD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

AUD/CHF has broken below the bottom of its HVA rotational range between .9630 and .9900 and has reached its support/target at .9410-28. Look for continuation shorts below .9410 or retracement shorts at .9630 targeting .9330

AUD/CHF

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

AUD/JPY continues to act strong, breaching 94.70 and is breaking out on the longer term charts. Look for continued longs above 94.70 with little resistance until 105.

AUD/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

CAD/CHF has broken below .9140 which favors continued shorts down to .8928-.9003. Retracements back to .9287 may also be used to enter shorts. Short positions are now open at. 9215 with a stop at 9300 and a target of .8935.

CAD/CHF

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

CAD/JPY continues to act strong and trade higher. Look for continuation longs above 91.06 with further resistance/target at 92.50 and then 95.which are the highs back in March 10.

CAD/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

CHF/JPY Look for continued upside action above 100.50 targeting 104.10

CHF/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

EUR/AUD has broken the upper end of its rotational range above 1.2820 and has pulled back after reaching resistance at 1.2991-1.3027. There is too much longer-term resistance to enter new longs at these levels.

EUR/AUD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

EUR/CAD remains in an uptrend since August 2012 and has now broken above the top of its trend channel . Above 1.3475 targets a continued move higher with the next area of key resistance at 1.4125-1.4375.. Pullbacks to 1.3330 may be used to enter new longs.

EUR/CAD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

10

EUR/CHF has broken below its wedge and has reach support at 1.2246 which favors continued shorts down to 1.2147-83..

EUR/CHF

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

EUR/GBP has been modestly trending higher since July 12 and has now breached the top of the trend channel. Pullback longs are favored above .8500.

EUR/GBP

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

11

EUR/JPY continues to trade higher breaking above resistance, now support at 122.90 but has reached long term resistance at 127.15 so expect a pause or a pullback from this level Continuation longs remains favored above 122.90

EUR/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

GBP/AUD broken below the bottom of the HVA. At 1.5255, which favor shorts down to 1.4900/1.4705. Shorts are open at 1.5140 with a stops currently at 1.5265 targeting 1.4715.

GBP/AUD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

12

GBP/CAD is trading in the middle of its rotational range Below the trend line favors a move to the bottom of the rotation..

GBP/CAD

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

GBP/CHF is in a near-term down trend and has breached previous HVA support at 1.4370-1.4610. We expect the GBP/CHF to find near-term support in this area and are looking for a near-term bounce. .

GBP/CHF

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

13

GBP/JPY continues to act strong. Look for continuation longs above 144.65 targeting 147.90. Pullback longs may be considered at l142.65 and 139.50.

GBP/JPY

Spot Currency

Daily Bar Chart

Volume-at-Price overlay

14

Disclaimer & Analyst Certification

The views expressed in this research report accurately reflect the personal views of the research analysts responsible for the content of this report, Jeremy Berkovits, David Truffelman and Aaron Uitenbroek. The research analysts further certifies that he receives no compensation that is directly or indirectly related to the specific recommendations or views contained within this report. This publication does not constitute and should not be construed as an offer or the solicitation of any transaction to buy or sell any securities or any instruments or any derivatives of the securities mentioned herein or to participate in any particular trading strategies. Although the information contained herein has been obtained from recognized services, and sources believed to be reliable, its accuracy or completeness cannot be guaranteed. Opinions, estimates or projections expressed in this report may make assumptions regarding economic, industry and political considerations and constitute current opinions, at the time of issuance, which are subject to change without notice. The products or securities mentioned in this report may not be eligible for sale in some states or countries. Their value and any income which they may produce may fluctuate and / or be adversely affected by interest rates, exchange rates and other factors. This information is being furnished to you for informational purposes only, and on the condition that it will not form a primary basis for any investment decision. Any recommendation contained in this report is not intended to be, nor should it be construed or inferred to be, investment advice, as such investments may not be suitable for all investors. When preparing this report, no consideration to ones investment objectives, risk tolerance or other individual factors was given; as such, as with all investments, purchase or sale of any securities mentioned herein may not be suitable for all investors. By virtue of this publication, neither the Firm nor any of its employees shall be responsible for any investment decisions. Before committing funds to ANY investment, an investor should seek professional advice. Any information relating to the tax status of financial instruments discussed herein is not intended to provide tax advice, or to be used by anyone to provide tax advice. Investors are urged to consult an independent tax professional for advice concerning their particular circumstances. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, either expressed or implied, is made regarding future performance.

The authors of this report may, from time to time, have long or short positions in, and buy or sell the securities or derivatives (including options) of the companies mentioned herein. Additional information relative to securities, other financial products, or issuers discussed in this report is available upon request.

i-10 Research 2013 All Rights Reserved

You might also like

- USD G-7 Foreign Exchange Daily ReportDocument6 pagesUSD G-7 Foreign Exchange Daily ReportAaron UitenbroekNo ratings yet

- US Futures Daily ReportDocument7 pagesUS Futures Daily ReportAaron UitenbroekNo ratings yet

- G-7 FX Weekly ReportDocument15 pagesG-7 FX Weekly ReportAaron UitenbroekNo ratings yet

- Commodity Futures Weekly Report - 20130226Document15 pagesCommodity Futures Weekly Report - 20130226Aaron UitenbroekNo ratings yet

- Commodity Futures Weekly Report: HighlightsDocument15 pagesCommodity Futures Weekly Report: HighlightsAaron UitenbroekNo ratings yet

- G-7 F/X Weekly Report: HighlightsDocument15 pagesG-7 F/X Weekly Report: HighlightsAaron UitenbroekNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case Study GuidelinesDocument4 pagesCase Study GuidelinesKhothi BhosNo ratings yet

- FABTEKDocument11 pagesFABTEKKarthik ArumughamNo ratings yet

- Concise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewDocument659 pagesConcise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewPhương TạNo ratings yet

- BembosBurger PDFDocument34 pagesBembosBurger PDFcreynosocNo ratings yet

- Kalyan Pharma Ltd.Document33 pagesKalyan Pharma Ltd.Parth V. PurohitNo ratings yet

- AIP WFP 2019 Final Drps RegularDocument113 pagesAIP WFP 2019 Final Drps RegularJervilhanahtherese Canonigo Alferez-NamitNo ratings yet

- Mergers and Acquisitions: The Role of Corporate Culture AnalysisDocument16 pagesMergers and Acquisitions: The Role of Corporate Culture AnalysisBellaaaaa100% (1)

- Tally PPT For Counselling1Document11 pagesTally PPT For Counselling1lekhraj sahuNo ratings yet

- E Channel Product FinalDocument100 pagesE Channel Product Finalakranjan888No ratings yet

- Call-for-Paper-AJBE-24Document1 pageCall-for-Paper-AJBE-24istiakamd46No ratings yet

- Financial Performance Evaluation Using RATIO ANALYSISDocument31 pagesFinancial Performance Evaluation Using RATIO ANALYSISGurvinder Arora100% (1)

- Advantages and Disadvantages of Business Entity Types.Document3 pagesAdvantages and Disadvantages of Business Entity Types.Kefayat Sayed AllyNo ratings yet

- Arbitration ClausesDocument14 pagesArbitration Clausesramkannan18No ratings yet

- ResearchDocument10 pagesResearchElijah ColicoNo ratings yet

- Dominos PizzaDocument14 pagesDominos PizzahemantNo ratings yet

- Samsung Care Plus Terms and Conditions PDFDocument10 pagesSamsung Care Plus Terms and Conditions PDFav86No ratings yet

- Project Profile On Automobile WiresDocument8 pagesProject Profile On Automobile WiresGirishNo ratings yet

- MM ZC441-L2Document60 pagesMM ZC441-L2Jayashree MaheshNo ratings yet

- Shareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaDocument3 pagesShareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaCasper MaungaNo ratings yet

- Schneider EnglishDocument134 pagesSchneider EnglishpepitoNo ratings yet

- IAQG Standards Register Tracking Matrix February 01 2021Document4 pagesIAQG Standards Register Tracking Matrix February 01 2021sudar1477No ratings yet

- Value Stream Mapping Process - Supply Chain ManagementDocument21 pagesValue Stream Mapping Process - Supply Chain ManagementMANTECH Publications100% (1)

- Operations Management of Coca ColaDocument3 pagesOperations Management of Coca ColaWahab Javaid58% (12)

- Review MODULE - MATHEMATICS (Algebra-Worded Problems) : Number Problems Age ProblemDocument1 pageReview MODULE - MATHEMATICS (Algebra-Worded Problems) : Number Problems Age ProblemYeddaMIlaganNo ratings yet

- Fundamental Analysis On Stock MarketDocument6 pagesFundamental Analysis On Stock Marketapi-3755813No ratings yet

- 09 Bastida v. Menzi - CoDocument2 pages09 Bastida v. Menzi - CoNica PineNo ratings yet

- Franchising Expansion Benefits Through Franchisee Capital and Motivated ManagementDocument13 pagesFranchising Expansion Benefits Through Franchisee Capital and Motivated ManagementTirsolito SalvadorNo ratings yet

- Microeconomics Midterm Review QuestionsDocument14 pagesMicroeconomics Midterm Review QuestionsRashid AyubiNo ratings yet

- Working Capital Management at BSRM SteelDocument144 pagesWorking Capital Management at BSRM SteelPushpa Barua100% (1)

- 05 - E. Articles 1828 To 1842Document14 pages05 - E. Articles 1828 To 1842Noemi MejiaNo ratings yet