Professional Documents

Culture Documents

Syllabus Ba114.12012syllabus

Uploaded by

Ryan SanitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus Ba114.12012syllabus

Uploaded by

Ryan SanitaCopyright:

Available Formats

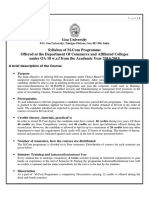

UNIVERSITY OF THE PHILIPPINES VISAYAS TACLOBAN COLLEGE

DIVISION OF MANAGEMENT Course Syllabus *Course number *Course title *Course credit *Class venue, day & time Section BA 114.1 Accounting Theory and Practice I 6 Units DM-21 M T Th F 01:00-2:30 EM *Professor *Consultation hours Prerequisite E-mail Website Phone Local Harold B. Lacaba 3:00-5:00 PM MTThF BA 99.1 and BA 99.2; 3rd year BSA

hlacaba@gmail.com

http://haroldlacaba.webng.com 09228371392

*Course description

This course is designed for accounting major students who have completed the fundamental accounting courses. The course will cover the conceptual framework of accounting and the generally accepted accounting principles applicable to accounting and financial reporting. At the end of the course, the student is expected to be able to: 1. Perform the functions of analyzing, recording, classifying, summarizing and reporting business transactions in accordance with generally accepted accounting principles. 2. Understand, analyze and solve accounting problems and cases. 3. Know and understand the conceptual framework of accounting and the pronouncements of the Accounting Standards Council embodied in the Philippine Accounting Standards (PAS) and Philippine Financial Reporting Standards (PFRS) 4. Recognize, analyze and justify the need for new or revised standards to appropriately address changes in the business environment and in requirements of users of financial information which may involve harmonizing pure theory and economic reality. *Course objective The student should be able to: Enumerate the users of accounting information and their information needs; Enumerate the branches of accounting; Narrate the history of the accounting profession; Identify the recent developments affecting the accounting profession *Topic/Activity The Development of the Accounting Profession/ Framework of Accounting *References and deadline of requirements Chapter 1 Submission on end-of-chapter questions

*Course goals

*Course schedule Session 1-2

Session 3-4

The student should be able to: Identify the different components of the financial statements Know the different elements of the financial statements Prepare the different financial statements Solve problems and cases related to financial statement preparation

Financial Statements: An Introduction

Chapter 2 Submission on end-of-chapter questions

Session 4-5

The student should be able to: Determine how and at what amount cash is presented in the balance sheet; Identify some basic features of internal control to safeguard cash; Know the proper accounting for petty cash fund

Cash and Cash Equivalents Board work on cash problems

Chapter 3 http://cashaccounting.webng.com/ Submission on end-of-chapter questions

Critiquing of answers on the board Cases on Internal Control about Cash Short Quiz

Session 6-7

Prepare bank reconciliation and Formulate adjusting entries to bring cash account to its correct balance; The student should be able to: Identify when and at what amount receivables are initially recognized; Formulate entries for transactions affecting notes and accounts receivables; Determine how and at what amount receivables are presented on the balance sheet

Bank Reconciliation Board work /Critiquing of answers on the board Case Problems Short Quiz Loans and Receivables Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 4 http://bankrecon.webng.com/ Submission on end-of-chapter questions

Session 8-9

Chapter 5 and 6 http://receivables.webng.com/ Submission on end-of-chapter questions

Session

Formulate entries to account for different forms of receivable

Receivable Financing Board work /Critiquing of answers

Chapter 7

10-11

financing;

on the board Case Problems Short Quiz Inventories Board work /Critiquing of answers on the board Case Problems Short Quiz

http://receivables.webng.com/

Submission on end-of-chapter questions Chapter 8

Session 12-13

The student should be able to: Enumerate the items making up the inventories of a manufacturing entity, a merchandising entity and a service entity; Differentiate the perpetual inventory system and periodic inventory system; Compute inventory values using the different inventory costing procedures; Evaluate effects of inventory costing methods for both financial and tax reporting; Identify the effects of inventory errors on current and future financial statements; Measure inventories based on the lower of cost and net realizable value;

http://inventory.webng.com/

Submission on end-of-chapter questions

Session 14-15

Session 16-17

The student should be able to have a working knowledge on the following: a. Measurement of inventory b. FIFO, weighted average, specific identification and LIFO c. Measurement at lower of cost or NRV d. Accounting for inventory writedown and reversal of writedown e. Standard costs f. Relative sales price method g. Purchase commitments h. Disclosure with respect to inventories i Agricultural forest and mineral products j. Commodities of broker-traders The student should have a working knowledge on the following: a. Definition of biological assets, agricultural produce and harvest b. Recognition of biological assets and agricultural produce c. Measurement of biological

Inventory Valuation Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 9 Submission on end-of-chapter questions

Biological Assets Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 10 Submission on end-of-chapter questions

assets and agricultural produce Session 18-19 Estimate cost of inventories using estimating procedures and understand the applicability of each estimating procedures Inventory Estimation Board work /Critiquing of answers on the board Case Problems Short Quiz Financial Asset at Fair Value Board work /Critiquing of answers on the board Case Problems Short Quiz Chapter 11

http://www.freewebs.com/invent oryestimation/

Submission on end-of-chapter questions Chapter 12 Submission on end-of-chapter questions

Session 20-21

The student should be able to: Explain why enterprises acquire investments; Distinguish the different classification of investment securities; Account for investment securities (transactions subsequent to acquisition and disposal); Account for changes in value of investment securities; Determine the proper valuation for investment securities on the balance sheet; Identify the required disclosures for investment securities The student should have a working knowledge on the following: a. Acquisition of equity securities b. Investment categories c. Investment in unquoted equity instruments d. Sale of equity securities e. Cash dividend, property dividend, liquidating dividend, stock dividend f. Shares received in lieu of cash dividend g. Share split, special assessment, redemption of share h. Stock rights accounted for separately and not accounted for separately The student should have a working knowledge on the following: a. Intercorporate share investments b. Equity method c. Upstream and downstream transactions d. Measurement after loss of significant influence

Session 2223

Investment in Equity Securities Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 13

http://investments101.webng.co m/

Submission on end-of-chapter questions

Session 24-25

Investment in Associate Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 14 Submission on end-of-chapter questions

Session 26-27

e. Investment of less than 20% f. Cost Method g. Cash dividend from preacquisition retained earnings h. Change from cost or fair value to equity method I. Investment in associate achieved in stages The student should have a working knowledge on the following: a. Measurement at amortized cost b. Definition of bond c. Classification of bond investment d. Amortization of discount or premium e. Sale of bond prior to maturity f. Callable, convertible, serial and term bonds g. Methods of amortization straightline, bond outstanding, and effective interest method h. Computation of effective interest rate I. Computation of purchase price of bonds The student should have a working knowledge on the following: a. Definition of investment property and owner-occupied property b. Recognition of investment property c. Measurement of investment property d. Derecognition of investment property e. Disclosures related to investment property The student should have a working knowledge on the following: a. Current and noncurrent fund b. Accounting for sinking fund, preference share redemption fund, fund for property acquisition, contigency fund and insurance fund c. Annual contribution at the beginning of each year d. One time contribution e. Cash surrender value The student should have a working knowledge on the following:

Financial Asset at Amortized Cost Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 15 Submission on end-of-chapter questions

Session 28-29

Investment Property Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 16 Submission on end-of-chapter questions

Session 30-31

Fund and Other Investments Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 17 Submission on end-of-chapter questions

Session 3233

Derivatives Board work /Critiquing of answers on the board

Chapter 18 Submission on end-of-chapter questions

a. Purpose of derivatives b. Types of financial risk c. Characteristics of derivatives d. Measurement of derivatives Session 34-35 Determine the proper amount at which items of property, plant and equipment are measured upon recognition; Account for costs incurred subsequent to acquisition of property, plant and equipment; Account for changes in estimated useful life and changes in residual value of property, plant and equipment; Properly measure property, plant and equipment on the balance sheet; Identify the required disclosures on the financial statements related to property, plant and equipment Session 36-37 The student should have a working knowledge on the following: a. Definition of government grant b. Recognition and measurement c. Disclosures related to government grant The student should have a working knowledge on the following: a. Definition of borrowing costs b. Qualifying assets c. Assets excluded from capitalization d. Accounting for borrowing cost e. Disclosures related to borrowing cost The student should have a working knowledge on the following: a. Land statement classification, costs chargeable, land improvements, special assessment, real property taxes b. Building costs chargeable when purchased and when constructed c. Sidewalks, pavements, parking lot, driveways, claim for damages, building fixtures,

Case Problems Short Quiz

Property, Plant and Equipment Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 19

http://equipment.webng.com/

Submission on end-of-chapter questions

Government Grant Board work /Critiquing of answers on the board Case Problems Short Quiz Borrowing Cost Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 20 Submission on end-of-chapter questions

Session 38-39

Chapter 21 Submission on end-of-chapter questions

Session 40-41

Land, Building and Machinery Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 22 Submission on end-of-chapter questions

Session 42-43

ventilating system, lighting system, elevator d. Machinery, tools, patterns and dies, equipment, returnable containers e. Capital expenditures and revenue expenditures f. Additions, improvements or betterments, replacements, repairs, rearrangement cost g. Accounting for major replacement The student should have a working knowledge on the following: a. Concept of depreciation b. Methods of depreciation The student should have a working knowledge on the following: a. Exploration and evaluation of mineral resources b. Wasting asset cost of wasting asset c. Depletion and depletion method d. Revision of depletion rate e. Depreciation of mining property f. Trust fund doctrine and wasting asset doctrine g. Maximum dividend under the wasting asset doctrine The student should have a working knowledge on the following: a. Cost model and revaluation model b. Frequency and basis of revaluation c. Statement of presentation and classification d. Accounting for revaluation proportional and elimination approach e. Revaluation surplus f. Sale of revalued asset g. Disclosures related to revaluation The student should have a working knowledge on the following: a. Definition and measurement of impairment

Depreciation Board work /Critiquing of answers on the board Case Problems Short Quiz Depletion Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 23 Submission on end-of-chapter questions

Session 44-45

Chapter 24 Submission on end-of-chapter questions

Session 46-47

Revaluation Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 25 http://equipment.webng.com/p9.html

http://equipment.webng.com/p10.ht ml

Submission on end-of-chapter questions

Session 4849

Impairment of Assets Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 26 Submission on end-of-chapter questions

Session 50-51

b. Fair value less cost to sell c. Value in use d. Cash generating unit e. Corporate assets f. Reversal of impairment loss The student should be able to: a. Explain the nature of intangible assets; b. Account for acquisition of intangible assets; c. Account for amortization of intangible assets; d. Determine how and at what amount intangible assets are presented on the balance sheet; e. Account for subsequent expenditures on intangible assets; and f. Identify the disclosure requirements for intangible assets Wednesday after the discussion on Inventory Valuation As scheduled (University calendar)

Intangible Assets Board work /Critiquing of answers on the board Case Problems Short Quiz

Chapter 27 and 28 Submission on end-of-chapter questions

Midterms Finals

*Teaching methods & strategies

Power point Presentation. Board work /Critiquing of answers on the board Case Problems Short Quiz

*Grading System

Activity 1. Midterms 2. Finals 3. Quizzes 4. Board work/attendance/assignments /other requirements Total

Points 30% 30% 20% 20% 100%

Class requirements details *Reading List

Answers to end of chapter questions will be written on a notebook.

Financial Accounting Book 2011 or 2012 edition by Valix, Valix and Peralta Intermediate Accounting Books PAS/PFRS

Class-pals

List below names of at least three classmates. Get the best mode of getting in touch with them in case you have concerns regarding the course. Name Phone/Fax/Cell Email Address

You might also like

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Principles of AccountingDocument4 pagesPrinciples of AccountingjtopuNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- ACC203Document7 pagesACC203waheedahmedarainNo ratings yet

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Principles of Financial Accounting 1Document6 pagesPrinciples of Financial Accounting 1Amonie ReidNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- 2MINVESDocument3 pages2MINVESMynn Ü DeLa CruzNo ratings yet

- AC418 Module OutlineDocument5 pagesAC418 Module OutlinetinashekuzangaNo ratings yet

- 2005 - ACCTG 14-02 - Auditing ProblemsDocument5 pages2005 - ACCTG 14-02 - Auditing ProblemscutieaikoNo ratings yet

- Acct 101 SyllabusDocument8 pagesAcct 101 Syllabusapi-267728422No ratings yet

- Course Outline Intermediate and Advanced Accounting1 Revised 2Document5 pagesCourse Outline Intermediate and Advanced Accounting1 Revised 2Amde GetuNo ratings yet

- Principles of Accounting Course Outline Based On Weekly LecturesDocument4 pagesPrinciples of Accounting Course Outline Based On Weekly LecturesShumailNo ratings yet

- MBA (Evening) Program Department of Finance University of Dhaka F-508Managerial Finance Spring 2019 Semester Section: B Course SyllabusDocument2 pagesMBA (Evening) Program Department of Finance University of Dhaka F-508Managerial Finance Spring 2019 Semester Section: B Course SyllabusMohammad NayeemNo ratings yet

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Document10 pagesSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNo ratings yet

- FA - SNU - Course Outline - Monsoon 2023Document6 pagesFA - SNU - Course Outline - Monsoon 2023heycontigo186No ratings yet

- ACCA Advanced Corporate Reporting 2005Document763 pagesACCA Advanced Corporate Reporting 2005Platonic100% (2)

- BSBFIM501A - Manage Budgets and Financial PlansDocument4 pagesBSBFIM501A - Manage Budgets and Financial Plansbluemind200517% (6)

- Fundamentals of Accountancy Business and ManagementDocument86 pagesFundamentals of Accountancy Business and ManagementJosie Ann VelascoNo ratings yet

- B.F. by S.K As at 5 May 2005Document355 pagesB.F. by S.K As at 5 May 2005John Munene Karoki100% (2)

- Dipifrs AccaDocument11 pagesDipifrs AccaDeepak Thakkar100% (1)

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- Level 1 Certificate in Book-Keeping: SyllabusDocument20 pagesLevel 1 Certificate in Book-Keeping: Syllabusvincentho2k100% (1)

- MGMT 2020 Fall 11fDocument7 pagesMGMT 2020 Fall 11fYunasis AesongNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- SyllabusDocument9 pagesSyllabusMichael KirschNo ratings yet

- Applied AuditingDocument2 pagesApplied Auditingctcasiple50% (2)

- 186 Syllabus MCOM-1Document30 pages186 Syllabus MCOM-1Md Sharif HossainNo ratings yet

- 0452 2010 SW 6 PDFDocument8 pages0452 2010 SW 6 PDFAbirHudaNo ratings yet

- Faieza-Intermidiate Act Course Outline - Summer 2016Document12 pagesFaieza-Intermidiate Act Course Outline - Summer 2016Arif BokhtiarNo ratings yet

- Advanced Accounting SyllabusDocument7 pagesAdvanced Accounting Syllabusapi-323483989No ratings yet

- Fin 314 SyllabusDocument5 pagesFin 314 SyllabusDamian VictoriaNo ratings yet

- ACC 203 Main Course (R.B. Jat)Document196 pagesACC 203 Main Course (R.B. Jat)Rolfu Bambido Looken100% (1)

- Acctg 5Document6 pagesAcctg 5justineNo ratings yet

- Acctg 2Document8 pagesAcctg 2justineNo ratings yet

- Subject Guide ADMDocument14 pagesSubject Guide ADMEga Hilmi A.No ratings yet

- Financial Accounting & ReportingDocument4 pagesFinancial Accounting & Reportingkulpreet_20080% (1)

- 7110 Nos SW 2Document4 pages7110 Nos SW 2mstudy123456No ratings yet

- Financial Accounting PDFDocument684 pagesFinancial Accounting PDFImtiaz Rashid91% (11)

- Financial AccountingDocument471 pagesFinancial AccountingJasiz Philipe Ombugu80% (10)

- Principles of Accounting - OutlineDocument4 pagesPrinciples of Accounting - OutlineKHAWAJA MUHAMMAD HUZAIFANo ratings yet

- Level 3 Certificate in Accounting: SyllabusDocument16 pagesLevel 3 Certificate in Accounting: SyllabusCharles MK ChanNo ratings yet

- Eng'g EconomyDocument2 pagesEng'g EconomyErikson MoralesNo ratings yet

- F. L. Vargas College Tuguegarao City Master in Public and Business Management Syllabus in Financial ManagementDocument4 pagesF. L. Vargas College Tuguegarao City Master in Public and Business Management Syllabus in Financial ManagementsantasantitaNo ratings yet

- SBL SD22 Examiner ReportDocument19 pagesSBL SD22 Examiner Reportnur iman qurrataini abdul rahmanNo ratings yet

- Accounts Notes For CsecDocument1 pageAccounts Notes For CsecBoLTYTNo ratings yet

- 1.1 Course Outline Accy206Document3 pages1.1 Course Outline Accy206bsaccyinstructorNo ratings yet

- ACCT5170 Syllabus - 2023Document7 pagesACCT5170 Syllabus - 2023bafsvideo4No ratings yet

- A. Financial Management 13Document5 pagesA. Financial Management 13Honey EditsNo ratings yet

- Fundamentals OF AccounthngDocument4 pagesFundamentals OF AccounthngKarim MohamedNo ratings yet

- Accounting 2Document104 pagesAccounting 2Ayo AleshNo ratings yet

- Sjerris@sfsu - Edu: Intermediate Financial Accounting Accounting 302Document6 pagesSjerris@sfsu - Edu: Intermediate Financial Accounting Accounting 302ArshSinghNo ratings yet

- Examiner's Report: Financial Reporting (FR) June 2019Document10 pagesExaminer's Report: Financial Reporting (FR) June 2019saad aliNo ratings yet

- GBA645 Winter2018Document10 pagesGBA645 Winter2018Mubarrach MatabalaoNo ratings yet

- SITXFIN004 - Student Assessment v2.0Document15 pagesSITXFIN004 - Student Assessment v2.0Heloisa GalesiNo ratings yet

- Advanced Financial Accounting IDocument3 pagesAdvanced Financial Accounting IMaryam umarNo ratings yet

- Advanced Financial Accounting: FTMS College Malaysia (2011)Document6 pagesAdvanced Financial Accounting: FTMS College Malaysia (2011)891511No ratings yet

- Accounting For Equities Course Outline Jan 2012Document4 pagesAccounting For Equities Course Outline Jan 2012mutaikcNo ratings yet

- SBL SD20 Examiner's ReportDocument16 pagesSBL SD20 Examiner's ReportleylaNo ratings yet

- Dependency and Economic DevelopmentDocument12 pagesDependency and Economic DevelopmentRyan SanitaNo ratings yet

- 2.5.E-Prospects of Fusion Energy (Summary)Document2 pages2.5.E-Prospects of Fusion Energy (Summary)Ryan SanitaNo ratings yet

- FA Vol.3 Operating SegmentsDocument7 pagesFA Vol.3 Operating SegmentsRyan SanitaNo ratings yet

- Yield To MaturityDocument8 pagesYield To MaturityRyan SanitaNo ratings yet

- Demand Deposits - : ChequeDocument1 pageDemand Deposits - : ChequeRyan SanitaNo ratings yet

- 1.7.C - 18th and 19th Century Sciences (Summary)Document4 pages1.7.C - 18th and 19th Century Sciences (Summary)Ryan SanitaNo ratings yet

- 4.4.C-Head To Head A New Economic Game (Summary)Document2 pages4.4.C-Head To Head A New Economic Game (Summary)Ryan SanitaNo ratings yet

- How Does The Internet Work?: FromDocument7 pagesHow Does The Internet Work?: FromRyan SanitaNo ratings yet

- Summary Networked Computing in 1990sDocument3 pagesSummary Networked Computing in 1990sRyan SanitaNo ratings yet

- 2.1 Summary Microelectronics and PhotonicsDocument4 pages2.1 Summary Microelectronics and PhotonicsRyan Sanita100% (1)

- 3.6.a - Computer and Literary Arts (Summary)Document2 pages3.6.a - Computer and Literary Arts (Summary)Ryan SanitaNo ratings yet

- 1.5.C-The Industrialization of EuropeDocument26 pages1.5.C-The Industrialization of EuropeRyan SanitaNo ratings yet

- 1.7.C - 18th and 19th Century Sciences (Summary)Document4 pages1.7.C - 18th and 19th Century Sciences (Summary)Ryan SanitaNo ratings yet

- 1.5.C-The Industrialization of EuropeDocument26 pages1.5.C-The Industrialization of EuropeRyan SanitaNo ratings yet

- 1.2.B-The Poverties and TriumphsDocument3 pages1.2.B-The Poverties and TriumphsRyan SanitaNo ratings yet

- 4.7.F - The Solid Waste Disposal Problem of Metro Manila A GeDocument16 pages4.7.F - The Solid Waste Disposal Problem of Metro Manila A GeRyan SanitaNo ratings yet

- 1.1.a-Science and Technology in The Iron AgeDocument16 pages1.1.a-Science and Technology in The Iron Agetwinkledreampoppies100% (1)

- 4.7.F - The Solid Waste Disposal Problem of Metro Manila A GeDocument16 pages4.7.F - The Solid Waste Disposal Problem of Metro Manila A GeRyan SanitaNo ratings yet

- 2.1 Summary Microelectronics and PhotonicsDocument4 pages2.1 Summary Microelectronics and PhotonicsRyan Sanita100% (1)

- Chapter 7Document10 pagesChapter 7NCTNo ratings yet

- Design and Management of Information Systems For Purbasha: Submitted By: Group 10, Section ADocument31 pagesDesign and Management of Information Systems For Purbasha: Submitted By: Group 10, Section ADevesh ShahNo ratings yet

- SMEDA Fruit Juice Processing 2007Document49 pagesSMEDA Fruit Juice Processing 2007Jia Khan100% (1)

- Economic Order QuantityDocument6 pagesEconomic Order QuantityJelay QuilatanNo ratings yet

- Life Values Inventory LVIDocument7 pagesLife Values Inventory LVIAnnie Ofo-obNo ratings yet

- Production Engineering Scheme18-19Document4 pagesProduction Engineering Scheme18-19atulcoldwarNo ratings yet

- Toyota Production SystemDocument2 pagesToyota Production SystemDiwakar BishtNo ratings yet

- Store Management System Literature ReviewDocument7 pagesStore Management System Literature Reviewafmzitaaoxahvp100% (1)

- WWW Winebrenner Inigo ComDocument1 pageWWW Winebrenner Inigo ComJericho PedragosaNo ratings yet

- Chapter Two Cost Concepts and Classification: Value Chain Functions and Examples of Costs R&D Example of Cost DriverDocument13 pagesChapter Two Cost Concepts and Classification: Value Chain Functions and Examples of Costs R&D Example of Cost DriverEnoch HE100% (1)

- An Exercise ProblemDocument5 pagesAn Exercise ProblemAnimesh GuptaNo ratings yet

- Mba April 2012Document146 pagesMba April 2012Vivek MulchandaniNo ratings yet

- Final EXIT 2015Document110 pagesFinal EXIT 2015naolmeseret22No ratings yet

- Logistics, Supply Chain Strategy and PlanningDocument32 pagesLogistics, Supply Chain Strategy and PlanningSajal GargNo ratings yet

- Tcs Eis Brochure Automotive SolutionDocument4 pagesTcs Eis Brochure Automotive SolutionYashwanth NarayananNo ratings yet

- Ratio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able ToDocument21 pagesRatio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able TobanilbNo ratings yet

- CIMA E1 Enterprise Operations Study TextDocument457 pagesCIMA E1 Enterprise Operations Study TextBalaji SanthanakrishnanNo ratings yet

- 00 Lean ManufacturingDocument12 pages00 Lean ManufacturingErnesto Rascon Basaldua0% (1)

- Beginning Work in Process: Units - 800 Direct Materials 100% Complete Conversion Costs 70% CompleteDocument4 pagesBeginning Work in Process: Units - 800 Direct Materials 100% Complete Conversion Costs 70% Completemohitgaba19No ratings yet

- Understanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument33 pagesUnderstanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanySheena HarrienNo ratings yet

- Crack A Case - Sample Case Studies Strategy& PDFDocument30 pagesCrack A Case - Sample Case Studies Strategy& PDFAnkur ShahNo ratings yet

- Verklar Austria - Case StudyDocument4 pagesVerklar Austria - Case StudySHIVAM DUBEYNo ratings yet

- Financial Management Midterm ExamDocument4 pagesFinancial Management Midterm ExamJoody CatacutanNo ratings yet

- DocxDocument10 pagesDocxJohnnoff BagacinaNo ratings yet

- Supply Chain at Coca Cola PakistanDocument32 pagesSupply Chain at Coca Cola PakistanNoshairwaan Khalid71% (21)

- A Posteriori A Priori Ad HocDocument10 pagesA Posteriori A Priori Ad HocAila Jean PascualNo ratings yet

- CF Final Report Group 7 MWG - CompressDocument22 pagesCF Final Report Group 7 MWG - CompressThư NguyễnNo ratings yet

- Fusion Assets Physical Inventory Comparison Process ADFDIDocument4 pagesFusion Assets Physical Inventory Comparison Process ADFDISyed MustafaNo ratings yet

- SCLM Cia 3Document28 pagesSCLM Cia 3Mohd Yousuf MasoodNo ratings yet

- PWP MPDocument13 pagesPWP MPPrathamesh SodageNo ratings yet