Professional Documents

Culture Documents

Engineering Economics: Modern Design Process

Uploaded by

Benny BasitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economics: Modern Design Process

Uploaded by

Benny BasitCopyright:

Available Formats

Engineering Economics

Introduction: People have been designing objects and processes for thousands of years. From a simple wheel to complex computer systems, design has been a dynamic factor in personal and organizational success throughout history. With early design processes, companies considered technology and markets separately. Often, engineering and marketing departments worked independently, with different and sometimes conflicting goals. One example of the traditional design method is the railway engineers working in the 1800's, who apparently disregarded the influence of track locations upon the prospective costs and revenues of their railways. Arthur M. Wellington, a pioneer in the field of engineering economics, published "The Economic Theory of Railway Location," one of the first books on engineering economics, in 1877. In it, he addressed his disgust with the design process, stating "There is no field of professional labor in which a limited amount of modest incompetence at $150 per month can set so many picks-and-shovels and locomotives at work to no purpose whatsoever." This serious condemnation indicates that the planners didn't really plan-they didn't plan so that operating costs would be minimized and revenues maximized. Such concern finally led Wellington to state a classic definition of engineering as: "The art of doing well for one dollar what any bungler can do for two." In today's competitive world, companies can no longer afford such an ineffective approach. They need innovative product-design processes to give them a competitive advantage in the marketplace. In the modern design process, planning is key, and much of the work takes place early in the process. Note that production does not occur until the very end of a process that involves preliminary, or conceptual, design, and several iterations of optimization (analytical design). Three measurements of success of the design process are product cost, quality and time to market. This module, the second in the series on Engineering Economics, will focus on the cost aspects of good design, specifically during the analytical design process. NOTE: Portions of this module's material were taken from Engineering Economics: Principles and Concepts, a module developed at The Ohio State University under the NSF sponsored Gateway Coalition (grant EEC-9109794). Contributing members include Gary Kinzel, Project Supervisor and Amita Danak, Primary Author. The impact of design The cost of the design process is usually a small part of the overall cost of the product throughout its life; however, product design greatly affects the ability of the product to meet all three factors for success. The graph shows that about 75 percent of the manufacturing cost of a typical product is committed by the end of the conceptual phase. This means that only 25 percent of the product's cost can be influenced by decisions made after this time. Thus, if decisions made during the early design phases are poor, the company stands to lose much of the money that was committed before production even begins. The graph illustrates clearly how cost and time are affected by design decisions. There are many costs to consider when designing a project or process: initial costs; operating costs; maintenance costs; product liability costs; and the cost of borrowing money to finance the project. In order to maximize profits, the engineer must understand and manage all these costs and work cooperatively with other departments such as finance and marketing. Every company has its own design process, but these steps are common to most successful modern design practices: concept development, system-level design, detail design, testing and

Page 1 of 10 Engineering Economics.

refinement and production ramp-up. Here they are depicted visually. In the engineering economics module on conceptual design, you learned that a conceptual designer is interested in a product's overall feasibility, technically as well as economically. Conceptual designers must take a broad economic view of a project, considering factors such as taxes, depreciation, the time value of money, and the investment's rate of return, as they evaluate various approaches for conducting a project or developing a product. Analytical designers, on the other hand, are concerned with optimizing the system after the approach is selected, usually by a manager or a conceptual designer. They select components, materials and processes to yield an optimum system. Consequently, they are concerned first with detail costs, second, with the initial system costs, and third, to some extent, with overall or life cycle costs. Analytical designers can often assume that the project is already funded, and that money for the design and construction of a least one prototype has been allocated. All their decisions involve optimization of initial and operating costs through their choices of: . Materials Manufacturing Methods Purchased Components Finishing Methods

Component of system optimation:

Analytical designers must examine each component within a system to ensure that it is optimized for the duty it must perform. Failure or weakness in any part of the design can jeopardize the success of the product in the marketplace, since design modifications during the later stages of the design process are extremely expensive. In reviewing the design of a component, some general questions to ask are: Will the material specified be the most economical for the part? Can the part be fabricated at an adequate production rate? Will the physical shape lend itself to processing at the minimum cost and an adequate rate or volume of production? Do dimensional tolerances permit selection of the most economical production methods? Is the part design based on consideration of scheduled production volume? Analytical designers incorporate into their systems those components that maximize the ratio of effectiveness to cost, where effectiveness is the ability of a component or system to perform its intended function when it is operating in accordance with the original design concept. For example, assume that a device is required to convert rotary motion to rectilinear motion. The "black box" for the component is represented in the figure, and the following devices are being considered to perform this function:

Page 2 of 10 Engineering Economics.

Cam-and-follower Rack-and-pinion Power screw (or ball screw) Slider-crank The analytical designer must first determine how well each mechanism fulfills the technical design requirements. Such an analysis might eliminate some of the alternates from the list. The final choice, though, would be made by comparing effectiveness-to-cost ratios such as mechanical efficiency to cost, life to cost, or power per pound per dollar. To evaluate a complete system, consider areas such as these listed below for possible cost savings (these are examples appropriate to a manufacturing environment): 1. selection of materials. 2. choice of fits, limits, and tolerances between parts - generally, costs increase rapidly as the degree of precision is increased. 3. selection of plain bearings versus anti-friction bearings - anti-friction bearings are often used for low-volume productions while inexpensive plain bearings are used in high-volume production. 4. the quality of insulation used to reduce noise. 5. the type and amount of thermal insulation, and the associated size of pipe or duct employed. 6. the degree of precision or quality of purchased parts - a common example is the replacement of a low-class (low precision) ball-bearing with an equivalent high-class ball bearing. Here a significant increase in life (effectiveness) can be realized but only with a significant initial cost penalty. We trade off initial cost for performance, and the effectiveness-to-cost ratio may increase or decrease depending on whether the cost factor reflects the total cost. 7. The quality of surface finish employed - this can have a significant effect on cost. If hand finishing is required the added cost is notoriously large, but a high-grade finish can have a significant effect on the fatigue life of a critically loaded part. 8. the type and amount of plating and/or painting which is used to protect a component in an adverse environment. In general, this leads to large, but necessary, additional costs. Economy is also closely associated with production volume and with the manufacturing process. The best choice of manufacturing processes depends on the projected production volume and the desired market life. Production volume is usually divided into three categories: one-of-a-kind low-volume manufacturing (less than 250,000 units per year) high-volume manufacturing (more than 250,000 units per year)

Page 3 of 10 Engineering Economics.

When a one-of-a-kind machine is produced, as little as possible should be spent on tooling, since hand made parts are very expensive. Standard or purchased parts usually represent at least 60 percent of the total costs under these circumstances. In fact, even low-volume products parts should be designed so that they can be manufactured on standard tools. If high-volume production is indicated, only then can expensive tooling be amortized effectively. The effectiveness of forging parts, for example, can be realized because the volume of production can easily produce the necessary money to amortize the high initial cost of the forging dies and forging machine tools.

Design Analysis Tools:

There are a number of design analysis tools available to predict product performance, life, cost and failure modes before the prototype stage. Some of these are: Finite Element Analysis (FEA) Boundary Element Analysis (BEA) Computational Fluid Dynamics (CFD) Design for Manufacturing (DFM) Tools Design for Assembly (DFA) Tools Fault Tree Analysis (FTA) Dynamic Analysis Fluid Flow Network Analysis Finite element analysis, boundary element analysis, fluid flow network analysis and computational fluid dynamics programs model products and systems, and allow the designer to determine how a product will perform. Design for Manufacture and Assembly involves designing products with ease of manufacture in mind. DFM considers the part count; labor, tooling method, and the actual manufacturing capabilities, while DFA considers the part count, attachment time, and model complexity. Fault tree analysis specifies an unwanted event (a fire, for example) and then identifies all the elements in the system that could cause the event to occur. Dynamic analysis is the analysis of the properties of a running program. Cost Comparison: In design situations, the costs which should be compared are not immediate ones, but long-range ones. While as an analytical designer you will be more directly concerned with the initial product costs, you should keep in mind that operating costs, maintenance costs, product liability costs, cost of capital (interest lost), etc., as well as initial costs, will in the long run decide the fiscal success of the product. Consider the following example. The Smith Company has decided to manufacture a new product, and in the conceptual design process has narrowed the number of possible manufacturing methods down to two. You, the analytical engineer, must select between them. The performance characteristics for both machines are similar, so at this point, the cost factor will have the deciding effect on your final choice. A market study has produced estimates of sales volume, prices, etc., and its sale is expected to bring in an average of $200,000 per year, regardless of how the product is made. Fixed costs (associated with sales, distribution, raw materials, etc.) are expected to average

Page 4 of 10 Engineering Economics.

$85,000 per year. Manufacturing method A uses semi-automatic machines. The machines will cost $250,000 to buy and install, and are expected to last 10 years (and be practically worthless after that time.) The additional yearly expenses for labor, maintenance, and power - the out-of-pocket expenses - are $50,000. Manufacturing method B uses automatic machines that are more expensive to buy ($400,000 initial cost and 10 years of life), but cut out-of-pocket expenses to $30,000 per year. Gross income from sale Marketing, distribution, material costs Operating costs Depreciation (machine lasts 10 years) Total annual cost Profit (Income - Cost) $200,000 $ 85,000 $ 50,000 $ 25,000 __________ $160,000 $ 40,000

This includes an annual $25,000 depreciation of the semi-automatic machines, calculated here as the initial cost of the machine divided by its life span of 10 years. Following the same steps, Method B yields a $45,000 annual profit. Thus, it would appear from this analysis that the Smith Company will make $5,000 more per year by adopting method B. this is actually not the case! One very important item has been overlooked: method A requires an initial investment of $250,000, while method B requires an investment of $400,000. Initial investment is a very different kind of expenditure than, for example, wages, which are paid on a weekly basis, usually out of current income. In order to buy machinery, the company must spend money before any products have been made and sold. If Method A is adopted, the $150,000 savings (compared to purchasing the automatic machines) could be invested to earn money. At 8 percent, it can earn approximately $12,000 per year. Adding this to the initial profit of $40,000 gives a more accurate profit of $52,000. This is $7,000 more than Method B. Even at an interest rate of 4%, Method A would be more attractive economically. The important point is that money can earn money. The question to be asked about any investment, then, is not simply 'Will it earn a profit?' but rather 'Will it earn a bigger profit here or somewhere else?' In a problem of this sort, in which it has already been decided that one of a group of alternatives will be used, and in which some items are the same for all alternatives, it is possible to simplify the arithmetic considerably. You can set up a table or a spreadsheet that includes only those costs that differ for the alternatives, and include an interest-on-investment term as if it were a cost. Minimum-cost Analysis: If the cost of an alternative is a function of variables that take on a range of values, it is useful to determine when that cost is minimized. Multiple alternatives that depend on the same variable or variables can be compared on the basis of their minimum-cost points. This is known as minimumcost analysis. Example:

Page 5 of 10 Engineering Economics.

Suppose a mechanical engineering firm is to build a double-walk pedestrian bridge for a 1,200foot crossing and is considering two girder designs. The first will have a superstructure weight per foot of where S is the span between piers. The second will have a superstructure weight per foot of In both cases, the piers will cost $220,000 each and the superstructure will cost 22 cents per pound. The engineering firm wants to know the minimum-cost pier spacing for each design. As the number of piers increases, the amount of superstructure required decreases, and vice versa. This situation involves increasing and decreasing cost components, the sum of which will be a minimum for a certain number of piers. The total cost for the superstructure and piers for design 1 can be described by: Solving this equation yields By taking the derivative of TC with respect to S, setting it to zero and solving for S, we find that S is 213 feet. Using this value in the equation above to solve for TC1, we get: Performing the same steps for design 2 results in S = 224 feet and On the basis of this analysis, the designer would choose design 2 because of its lower cost. Exercise # 1 - Consider that same situation at two other crossing points, but let W1 = 22(S) + X and W2 = 20(S) + Y, where X and Y range in increments of 100, from 500 to 1,500. Build a spreadsheet to allow repeated calculations to determine the minimum cost for each situation. When you are finished, click here for the solution. Overview: According to John H. Batten, former president of Twin Disc Inc., Racine, Wisconsin, profits and jobs are inseparable. He says, "Profits build factories and buy machine tools. Profits support the cost of Research and Development. Profits perpetuate the economic cycle that has given Americans better educations, more leisure time and a higher standard of living than any other country in the history of the world. Profit is the food by which a company lives. Take away that food and everyone suffers." Profits can be increased by reducing costs, raising productivity and permitting companies to establish and charge a price that permits a fair and reasonable return on investment. Only profitable companies are able to grow, increase employment, and pay wages and dividends. Most likely, your job will depend on whether your company is able to make a profit on its goods and services. You can help by providing accurate cost estimates for the projects in which you are involved. Sometimes, selling price is the bottom line, and your job in the analytical design process is to ensure that you can manufacture a product to realize a profit. At other times, your job is to provide your company with an estimate on selling price, given the costs and the acceptable profit margin. In both cases, you must conduct a selling price analysis.

Page 6 of 10 Engineering Economics.

We will describe a basic method of analyzing the selling price for a simple system, defined as one which contains a small number of components. A complex system such as a supersonic transport contains a large number of components, usually arranged into what are called sub-systems. The same principles could be applied to estimate the selling price of a complex system, with a corresponding increase in effort and an uncertainty dependent on how accurately the costs of the various sub-systems can be quantified. Costs: When a company develops a new process or product, there are costs associated. Initial costs are one-time expenses, such as labor for installation, material, amortization and overhead, which must be covered at the start of a project. Operating costs, such as power and maintenance, must be covered as long as the company manufactures the product or runs the process. The analytical designer must optimize both these costs by choosing the most cost-effective materials, for example, and the best manufacturing method. The analytical designer must also consider warranty costs, since original equipment manufacturers increasingly are assuming the burden of unusual repair costs for a specified period. Car manufacturers, for example, usually warranty their parts for a specified time. In some industries, the cost of preventing or settling legal disputes is also a substantial portion of the product cost. Production costs can be divided into the following four categories: 1. Direct material costs (dollars per lb x the number of lbs) and purchased parts 2. Direct labor costs (dollars per hour x the number of hrs) 3. Indirect (overhead) material and purchased parts cost. 4. Indirect (overhead) labor costs

Direct costs are easy to estimate, but indirect costs are intangible and generally difficult to estimate. Usually, a company establishes overhead factors to be used in estimating indirect costs, but the numbers are only valid for that company. As an engineer, you will have to work closely with colleagues in finance to ensure you are using reasonable estimates for both direct and indirect costs. Additional Costs: Miscellaneous and administrative costs, sometimes called GA (general and administration) costs, cover general manufacturing overhead items such as: advertising and market analysis warranty costs taxes equipment insurance lost interest equipment depreciation administrative and legal costs research costs

Page 7 of 10 Engineering Economics.

Depreciation of the physical plant (7 to 10 years) and depreciation of utilities (15 to 20 years) may or may not be included in this list, depending on whether they are taken into account in the overhead on production labor. Likewise, the overhead on engineering and drafting labor may include the necessary physical plant and utilities for the engineering department. Facility costs include the necessary physical plant and utilities. Determining selling price: Selling price is the sum of initial cost and profit, SP = IC + P (Eq. 1) where IC includes labor costs, overhead on labor, material costs, overhead on material costs of purchased parts, amortization costs of all tooling, engineering and development costs, and miscellaneous overhead items. All costs and depreciation are included in the determination of initial cost, because corporation taxes are paid on profits. Initial Cost: Selling price is the sum of initial cost and profit, SP = IC + P (Eq. 1) where IC includes labor costs, overhead on labor, material costs, overhead on material costs of purchased parts, amortization costs of all tooling, engineering and development costs, and miscellaneous overhead items. All costs and depreciation are included in the determination of initial cost, because corporation taxes are paid on profits. Profit: Profit normally varies from 5 percent to 28 percent of IC, depending upon various factors such as risk, competition, safety and product image. Assuming that profit is 28 percent of the total initial cost, the selling price can be found - using Equation 1 - to be 1.28*IC. Example: Estimation of Selling Price Your Company is charged with designing a wheel-less dolly for stockers in warehouses. The vehicle must operate on the air-cushion principle and use at least some of the intake air to sweep the floor. The dolly will carry a payload of up to 1,000 pounds. It will be powered by a regular 220V, 60 cycles, 3-phase line. The cost is to be based upon yearly production of 10,000 units, and your company wishes to attain a profit margin of 20 percent. You have determined that direct material costs are $94.95/unit, the direct cost of purchased components is $71.52/unit, and the overhead factor on labor, materials, and purchased parts is 1.1. The important design criteria are that the dolly be lightweight and affordable - less than $375. Is this feasible? Let's find out.

You can calculate the total production costs as shown above. You know direct costs of materials and purchased components. Assuming that labor costs $4.50 per hour, and that each unit takes 26 hours to make, direct labor costs can be calculated as: DLC = 26 hrs x $4.50/hr = $117 per unit

Page 8 of 10 Engineering Economics.

Then ICT = (DLC +DMC + DPC)*OVH or ICT = ($117+$94.95+$71.52)*1.1 = $311.82 per unit You calculate the selling price for a profit of 20 percent of total initial cost, Using Equation 1. The per-unit selling price is: SP = IC + P = 1.2(IC) = $374.18 per unit You can do it, but only if your assumptions were accurate or conservative. In general, cost information varies with time and location. Usually, manufacturing costs will be lower if items are obtained locally. Exercise #2 $4.50 may strike you as a ridiculously low hourly wage to use in a calculation, and it is, by U.S. standards. It may not be possible to produce this wheel-less dolly in the United States if the selling price needs to be $375. Assuming that you have been given a maximum selling price of $475, what is the highest hourly wage rate that will allow you to achieve that, assuming that material, purchased components, the time required to make each unit, and indirect costs remain constant? In how many countries would it be economically feasible to produce the dolly? For your analysis, use the 2002 costs available in the "Hourly compensation costs in U.S. dollars for production workers in manufacturing, 30 countries or areas and selected economic groups, selected years, 1975-2002," available from the Bureau of Labor Statistics at http://www.bls.gov/news.release/ichcc.t02.htm. Conclusion: Economics is a central concern in any engineering project, so you must understand engineering economics equations and the impact of your design choices on cost as well as performance. While these equations are easy to manipulate and simple to grasp, their complexity increases as the component or machine being analyzed requires special machining processes, treatment for manufacture, etc. Along with the complexities in technical considerations are the uncertainties in making accurate estimates for material, labor, operating, and component costs, especially if you are considering diverse locations across the globe. The implications of engineering economics are vast, and affect many aspects of your work, as more and more manufacturing takes place in countries around the globe, to capitalize on lower wage and material costs. Analytical designers aim to get the best performance for the least number of dollars, but they must also keep in mind that it is in their company's best interest to give value to the customer at a fair price. Their designs should incorporate reasonable safeguards to minimize risks to the consumer, for example, to reduce product liability costs.

As competition increases, overall costs or life cycle costs will be of increasing interest to analytical designers and their managers. Engineers are estimating costs much earlier in the

Page 9 of 10 Engineering Economics.

design process than they once did. It's vitally important to work closely with finance and marketing experts in the cost analysis of projects, to ensure you are using accurate estimates and making reasonable assumptions in your analyses. Many other factors contribute to your ability to cooperate in this manner, e.g. communication and negotiation skills and your ability to present the results of your analysis clearly and concisely. In our free enterprise system, in the long run, your career and salary will depend on whether your company is able to realize a profit. Accurate estimation of costs will help predict whether a profit is possible. Money will always be a constraint, and understanding how to work with it will put you ahead in the game! Website Editor,

R. Benny Wahyuadi, S.T., M.B.A. Part-time Lecturer FT-Unisma, AWM.

Graduated from: Mechanical Engineering, Polytechnic University of Indonesia Industrial Engineering, School of Industrial & Management Engineering The Pitts burg State University, Business School, Kansas, USA.

Page 10 of 10 Engineering Economics.

You might also like

- Project Quality Management A Complete Guide - 2019 EditionFrom EverandProject Quality Management A Complete Guide - 2019 EditionNo ratings yet

- Spork Product Design, Analysis & It's Mould Design Using Cad-Cae TechnologyDocument8 pagesSpork Product Design, Analysis & It's Mould Design Using Cad-Cae TechnologyAMIT SOMWANSHINo ratings yet

- Production and Costs: MP TP Units of LabourDocument11 pagesProduction and Costs: MP TP Units of LabourJoep MinderhoudNo ratings yet

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Chapter 34 - Types of Cost, Revenue and Profit, Short-Run and Long-Run ProductionDocument39 pagesChapter 34 - Types of Cost, Revenue and Profit, Short-Run and Long-Run ProductionPhuong DaoNo ratings yet

- Financial Statement AnalysisDocument61 pagesFinancial Statement Analysisrajesh shekarNo ratings yet

- Critical Book About Operations ManagementDocument40 pagesCritical Book About Operations ManagementEsra Sitanggang0% (1)

- Theory of Production & Cost Analysis: Unit IiDocument67 pagesTheory of Production & Cost Analysis: Unit IiI'll SlydpdydNo ratings yet

- Software Development Project Manager in San Diego or Orange County California ResumeDocument2 pagesSoftware Development Project Manager in San Diego or Orange County California ResumeTerry MillerNo ratings yet

- Split Core Current Transformers - Newtek Eletricals, CTS, PTS, Digital MetersDocument12 pagesSplit Core Current Transformers - Newtek Eletricals, CTS, PTS, Digital MetersNewtek ElectricalsNo ratings yet

- Just in Time Manufacturing System: A Special Topic in Cost Accounting 2Document12 pagesJust in Time Manufacturing System: A Special Topic in Cost Accounting 2Venn Bacus RabadonNo ratings yet

- Schneider Electric - R&D Job Description - 2024 BatchDocument32 pagesSchneider Electric - R&D Job Description - 2024 BatchTejeswini KrishnanNo ratings yet

- CT & Shunt RevalcoDocument75 pagesCT & Shunt RevalcoToàn Vũ Đình0% (1)

- Inventory Management ProjectDocument11 pagesInventory Management ProjectMOHD.ARISH100% (1)

- Compliance Sheet: Key SkillsDocument6 pagesCompliance Sheet: Key SkillsAnoop VANo ratings yet

- Stores and Inventory ManagementDocument18 pagesStores and Inventory ManagementUdit Sharma0% (1)

- Total Solution Services For Advanced Maintenance of Thermal Power-Generation PlantsDocument6 pagesTotal Solution Services For Advanced Maintenance of Thermal Power-Generation PlantsRam MohanNo ratings yet

- Outsourcing Strategies For Capital ProductivityDocument9 pagesOutsourcing Strategies For Capital ProductivitySunnyVermaNo ratings yet

- Supplier Integration, Mass Customization, Issues To Customer ValueDocument43 pagesSupplier Integration, Mass Customization, Issues To Customer Valuebalaji suryaNo ratings yet

- Senior Manufacturing EngineerDocument4 pagesSenior Manufacturing Engineerapi-78878905No ratings yet

- Aluminium Mold BasesDocument20 pagesAluminium Mold BasessferrandNo ratings yet

- Design Mee2008 VusDocument42 pagesDesign Mee2008 VusRajesh RJNo ratings yet

- Read Acknowledgement Based Routing Misbehavior in Mobile Ad-Hoc Networks (RACK)Document7 pagesRead Acknowledgement Based Routing Misbehavior in Mobile Ad-Hoc Networks (RACK)Aravinda GowdaNo ratings yet

- Design For LogisticsDocument22 pagesDesign For LogisticsBarun BhardwajNo ratings yet

- Production Engineer (Junior) : Job DescriptionDocument2 pagesProduction Engineer (Junior) : Job DescriptionManoj KumarNo ratings yet

- Warehouse Audit Checklist: Define Your Inventory Audit ObjectivesDocument3 pagesWarehouse Audit Checklist: Define Your Inventory Audit Objectivesalbert rajNo ratings yet

- Injection Molding AssignmentDocument8 pagesInjection Molding AssignmentaakshusabhNo ratings yet

- Term PaperDocument4 pagesTerm PaperPraneeth Akula SonaNo ratings yet

- DFMADocument17 pagesDFMAvenkat4No ratings yet

- Defining and Measuring ProductivityDocument4 pagesDefining and Measuring ProductivityFadhil HerdiansyahNo ratings yet

- CATIA - Mold Tooling Design 2 (MTD)Document6 pagesCATIA - Mold Tooling Design 2 (MTD)Vignesh SelvarajNo ratings yet

- 3D Rapid Realization of Initial Design For Plastic Injection MoldsDocument16 pages3D Rapid Realization of Initial Design For Plastic Injection MoldsDjuraTheHarpYNo ratings yet

- AMI Co-Injection Molding: Autodesk® Moldflow® Insight 2012Document18 pagesAMI Co-Injection Molding: Autodesk® Moldflow® Insight 2012ansari_poly5264No ratings yet

- Production MGT Design For Manufacture and AssemblyDocument14 pagesProduction MGT Design For Manufacture and AssemblybshariNo ratings yet

- Chapter 14 Products and ProcessesDocument7 pagesChapter 14 Products and ProcessesKamble AbhijitNo ratings yet

- Store ManagementDocument64 pagesStore ManagementshahzanladiwalaNo ratings yet

- (Case Study) Utilization of DFMA To TRIZ MethodologyDocument11 pages(Case Study) Utilization of DFMA To TRIZ MethodologyJosh PeraltaNo ratings yet

- Mechathon Problem Statement-2 PDFDocument3 pagesMechathon Problem Statement-2 PDFFarhan Ahamed HameedNo ratings yet

- Role of ERP in Supply Chain ManagementDocument15 pagesRole of ERP in Supply Chain ManagementRohit GaikwadNo ratings yet

- Introduction To MFG ToolingDocument51 pagesIntroduction To MFG ToolingRamji RaoNo ratings yet

- Lean Six Sigma Mid-Term Ass Final 1.0Document21 pagesLean Six Sigma Mid-Term Ass Final 1.0era nominNo ratings yet

- QA Course TotalDocument32 pagesQA Course Totalafic219473No ratings yet

- Chapter 9 Inventory Management Teaching StudentDocument62 pagesChapter 9 Inventory Management Teaching StudentMUHAMMAD SYAFIQ ABDUL HALIMNo ratings yet

- Design and ManufacturingDocument49 pagesDesign and ManufacturingThulasi Doss100% (2)

- Veritek VIPS 80LDocument2 pagesVeritek VIPS 80LNutty ChaivaratNo ratings yet

- Supply-ChainDocument61 pagesSupply-ChainJackson TeohNo ratings yet

- Seminar Report TQMDocument22 pagesSeminar Report TQMPravin JagtapNo ratings yet

- Injection Moulding Details&Notes 1Document24 pagesInjection Moulding Details&Notes 1Anonymous kkXmM40En2No ratings yet

- The Engineering Design ProcessDocument5 pagesThe Engineering Design ProcessfendytoiliNo ratings yet

- Unit-V Design of Moulds Molding PartsDocument8 pagesUnit-V Design of Moulds Molding Partsyuvaraj4509No ratings yet

- Warehouse Operations: Mumbai Institute of Management & Research (Mimr)Document52 pagesWarehouse Operations: Mumbai Institute of Management & Research (Mimr)Shailesh VarmaNo ratings yet

- BY: Akanksha Arora Sumit Rohiwal Shashank Arora Manish ChauhanDocument20 pagesBY: Akanksha Arora Sumit Rohiwal Shashank Arora Manish ChauhanmoneyshhNo ratings yet

- Manufacturing Process DesignDocument45 pagesManufacturing Process DesignAnuj Chanda0% (1)

- Ai 11Document141 pagesAi 11Juan100% (1)

- The Cost of Production - Chapter 7Document18 pagesThe Cost of Production - Chapter 7rajesh shekarNo ratings yet

- Developing A Project Scope For An Injection MoldDocument3 pagesDeveloping A Project Scope For An Injection MoldnadoNo ratings yet

- QA/QC: Quality Assurance and Quality ControlDocument3 pagesQA/QC: Quality Assurance and Quality Controlcement drNo ratings yet

- VE2Document90 pagesVE2Avinash M. KatkarNo ratings yet

- 508 - Asco 7000 Series - Operator's Manual-381333 - 283bDocument10 pages508 - Asco 7000 Series - Operator's Manual-381333 - 283bGeorge AsuncionNo ratings yet

- ArcelorMittal Cofrastra 40 Brochure enDocument12 pagesArcelorMittal Cofrastra 40 Brochure endinoNo ratings yet

- Compaction Test Report No. / Izvestaj Ispitivanja Zbijenosti BRDocument1 pageCompaction Test Report No. / Izvestaj Ispitivanja Zbijenosti BRveljko2008No ratings yet

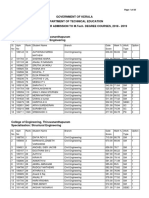

- Kerala MTech SeatDocument63 pagesKerala MTech Seattirursachin0% (1)

- EPLAN Pro Panel PDFDocument8 pagesEPLAN Pro Panel PDFHussain AbouelkhairNo ratings yet

- Slab-On-Grade Reinforcing DesignDocument9 pagesSlab-On-Grade Reinforcing DesignAdam GreenlawNo ratings yet

- Pavement DesignDocument21 pagesPavement DesignAbinash Panda100% (4)

- Microsoft Word - Quality Function DeploymentDocument9 pagesMicrosoft Word - Quality Function DeploymentMuhammad Tahir NawazNo ratings yet

- Chapter 1Document178 pagesChapter 1Hugo GandaraNo ratings yet

- NX9.0 Manual PDFDocument240 pagesNX9.0 Manual PDFToni Pérez100% (3)

- Maintenance Engineering and MnagmntDocument4 pagesMaintenance Engineering and MnagmntbahreabdellaNo ratings yet

- Preliminary Investigation On The Overstrength and Force Reduction Factors For Industrial Rack Clad BuildingsDocument11 pagesPreliminary Investigation On The Overstrength and Force Reduction Factors For Industrial Rack Clad BuildingssaurabhsubhuNo ratings yet

- Seismic Behavior and Design of Composite Steel Plate Shear Walls PDFDocument73 pagesSeismic Behavior and Design of Composite Steel Plate Shear Walls PDFmanpreetkhanujaNo ratings yet

- 2nd Sem ResultDocument82 pages2nd Sem ResultSumiran ManghaniNo ratings yet

- Cbse4103 920713135047 Final Exam AnswerDocument9 pagesCbse4103 920713135047 Final Exam Answerhafizuddin hussinNo ratings yet

- 1.assignment On Terotechnology and Reliability Engineering For BSC Electrical Class Final Year StudentsDocument7 pages1.assignment On Terotechnology and Reliability Engineering For BSC Electrical Class Final Year StudentsCharles OndiekiNo ratings yet

- RCDDocument31 pagesRCDJohn Mark Soliven100% (1)

- Codes and Standards Related To Piping: What Are Rigid Struts?Document1 pageCodes and Standards Related To Piping: What Are Rigid Struts?tibor121774_66173108No ratings yet

- Process Selection and Facility LayoutDocument32 pagesProcess Selection and Facility LayoutPher MorsNo ratings yet

- 2013 SKF Training Handbook: Reliability Maintenance InstituteDocument134 pages2013 SKF Training Handbook: Reliability Maintenance InstituteBalázs HernádiNo ratings yet

- Batch 23 AdvtDocument6 pagesBatch 23 AdvtV. Krishna ThejaNo ratings yet

- NRP5 Organization Review All - Optimization - 220224Document22 pagesNRP5 Organization Review All - Optimization - 220224trirat phonloedNo ratings yet

- Tugas 1Document2 pagesTugas 1Laisa HusrainiNo ratings yet

- Fieldbus Vs 4-20ma: Hart Ethernet GatewayDocument3 pagesFieldbus Vs 4-20ma: Hart Ethernet GatewaysuhailfarhaanNo ratings yet

- ASHRAE 62.1-2007 (Ventilation For Acceptable Indoor Air QualityDocument44 pagesASHRAE 62.1-2007 (Ventilation For Acceptable Indoor Air Qualityhmdhojjat166No ratings yet

- Problem/Project To Report:: Ee Laws and Ethics Final Exam Part 1 MARCH 18, 2020Document4 pagesProblem/Project To Report:: Ee Laws and Ethics Final Exam Part 1 MARCH 18, 2020Elizabeth Jovie ViolaNo ratings yet

- Post Tensioning in Building StructuresDocument50 pagesPost Tensioning in Building StructuresJaime LandinginNo ratings yet

- IEEE 34 Node Test Feede - 2 PDFDocument6 pagesIEEE 34 Node Test Feede - 2 PDFLalex MoretaNo ratings yet

- Daniel Foos: EducationDocument1 pageDaniel Foos: Educationapi-528045580No ratings yet

- Career ObjectiveDocument2 pagesCareer ObjectiveSandeep RedhuNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Building a Second Brain: A Proven Method to Organize Your Digital Life and Unlock Your Creative PotentialFrom EverandBuilding a Second Brain: A Proven Method to Organize Your Digital Life and Unlock Your Creative PotentialRating: 4.5 out of 5 stars4.5/5 (238)

- The PARA Method: Simplify, Organize, and Master Your Digital LifeFrom EverandThe PARA Method: Simplify, Organize, and Master Your Digital LifeRating: 5 out of 5 stars5/5 (36)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Managing Time (HBR 20-Minute Manager Series)From EverandManaging Time (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (47)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionFrom Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNo ratings yet

- The PARA Method: Simplify, Organize, and Master Your Digital LifeFrom EverandThe PARA Method: Simplify, Organize, and Master Your Digital LifeRating: 4.5 out of 5 stars4.5/5 (3)

- High Velocity Innovation: How to Get Your Best Ideas to Market FasterFrom EverandHigh Velocity Innovation: How to Get Your Best Ideas to Market FasterRating: 5 out of 5 stars5/5 (1)

- Agile: The Insights You Need from Harvard Business ReviewFrom EverandAgile: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (34)

- Crossing the Chasm, 3rd Edition: Marketing and Selling Disruptive Products to Mainstream CustomersFrom EverandCrossing the Chasm, 3rd Edition: Marketing and Selling Disruptive Products to Mainstream CustomersRating: 4.5 out of 5 stars4.5/5 (19)

- PMP Exam Prep: Master the Latest Techniques and Trends with this In-depth Project Management Professional Guide: Study Guide | Real-life PMP Questions and Detailed Explanation | 200+ Questions and AnswersFrom EverandPMP Exam Prep: Master the Latest Techniques and Trends with this In-depth Project Management Professional Guide: Study Guide | Real-life PMP Questions and Detailed Explanation | 200+ Questions and AnswersRating: 5 out of 5 stars5/5 (2)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Harvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsFrom EverandHarvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsRating: 4.5 out of 5 stars4.5/5 (15)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Myth of Multitasking: How "Doing It All" Gets Nothing DoneFrom EverandThe Myth of Multitasking: How "Doing It All" Gets Nothing DoneRating: 5 out of 5 stars5/5 (1)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeFrom EverandThe Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeRating: 4.5 out of 5 stars4.5/5 (99)

- The Third Wave: An Entrepreneur's Vision of the FutureFrom EverandThe Third Wave: An Entrepreneur's Vision of the FutureRating: 4 out of 5 stars4/5 (63)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- PMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamFrom EverandPMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamRating: 4.5 out of 5 stars4.5/5 (3)