Professional Documents

Culture Documents

Black Derman Toy Model

Uploaded by

NITINCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Black Derman Toy Model

Uploaded by

NITINCopyright:

Available Formats

1

Technical Note No. 23

1

Options, Futures, and Other Derivatives, Eighth Edition

J ohn Hull

The Black, Derman, and Toy Model

As explained in Chapter 30 there are two types of models of the short rate: equilibrium and no-arbitrage

models. In an equilibrium model the process followed by the short-term interest rate is specified. This

totally defines the model. Zero-coupon bond prices and the term structure of interest rates are outputs

from the model. Examples of equilibrium models are the Vasicek and Cox, Ingersoll, and Ross models

described in Section 30.2. These models each have three parameters. The parameters can be chosen so

that the models provide an approximate fit to the term structure of interest rates, but the fit is not usually

an exact one.

A no-arbitrage model is constructed so that it is exactly consistent with the term structure of interest rates

that is observed in the market. This means that the term structure of interest rates is an input to the model,

not an output from it. No-arbitrage models can be constructed in many different ways. An early no-

arbitrage model was the Black, Derman, and Toy model published in 1990.

2

This model has the

advantage that it can easily be represented in the form of a binomial tree. To correspond as closely as

possible with the Black-Derman-Toy paper, we assume that interest rates are compounded annually.

The Black-Derman-Toy model is a particular case of the more general Black-Karasinski model. The

short rate follows a mean-reverting lognormal process. However, the way the tree is constructed implies a

relationship between the short rate volatility and the reversion rate.

As in the case of the binomial tree used to value stock options, we consider steps of length At. The tree

models the behavior of the At-period interest rate. The zero-coupon interest rates for all maturities at time

zero are known. We denote the zero-coupon interest rate for a maturity of nAt by R

n

. The volatility of the

At rate between time (n1)At and nAt is denoted by o

n

.

During each time step the At-period interest rate has a 50% probability of moving up and a 50%

probability of moving down. The tree is shown in Figure 1. The initial At period rate, r, is known and

equals R

1

. The value of a zero-coupon bond that pays off $1 at time 2At is

t

R

A

+

2

2

) 1 (

1

The value of this bond at node B on the tree is

1

CopyrightJohnHull.AllRightsReserved.ThisnotemaybereproducedforuseinconjunctionwithOptions,

Futures,andOtherDerivativesbyJohnC.Hull

2

SeeF.Black,E.Derman,andW.Toy,``AonefactormodelofinterestratesanditsapplicationtoTreasurybond

options,FinancialAnalystsJournal,46(1),3339.

2

t

d

r

A

+ ) 1 (

1

The value of the bond at node C is

t

u

r

A

+ ) 1 (

1

It follows that the value of the bond at the initial node A is

(

(

+

+

+ +

A A A t

u

t

d

t

r r r ) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

Hence

t t

u

t

d

t

R r r r

A A A A

+

=

(

(

+

+

+ +

2

2

) 1 (

1

) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

(1)

Figure 1 The Binomial Tree

r

r

u

r

d

r

uu

r

ud

r

dd

r

uuu

r

uud

r

udd

r

ddd

A

B

C

D

E

F

3

This is one equation that must be satisfied by r

u

and r

d

. To match the volatility, the standard deviation of

the logarithm of the interest rate at time At must be t A o

1

(Recall: o

i

is the volatility of interest rates

during the ith time period.) This means that

3

t

r

r

d

u

A o =

1

ln 5 . 0 (2)

Equations (1) and (2) can be solved to determine r

u

and r

d

.

We now move on to determine r

uu

, r

ud

and r

dd

. To match volatility we must have

t

r

r

ud

uu

A o =

2

ln 5 . 0 (3)

t

r

r

dd

ud

A o =

2

ln 5 . 0 (4)

We must also match the price of a zero-coupon bond that pays off $1 at the end of time 3At. Rolling back

through the tree the values of this bond at nodes D, E, and F are

t

uu

t

ud

t

dd

r r r

A A A

+ + + ) 1 (

1

,

) 1 (

1

,

) 1 (

1

and

respectively. The values at nodes B and C are

(

(

+

+

+ +

A A A t

ud

t

dd

t

d

r r r ) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

and

(

(

+

+

+ +

A A A t

uu

t

ud

t

u

r r r ) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

The value at the initial node is therefore

3

To see this note that the variance of the logarithm of the interest rate is

0.5(ln r

u

)

2

+0.5(ln r

d

)

2

[0.5(ln r

u

+ln r

d

)]

2

=[0.5(ln r

u

ln r

d

)]

2

t t

uu

t

ud

t

u

t

t

ud

t

dd

t

d

t

R r r r r

r r r r

A A A A A

A A A A

+

=

|

|

.

|

\

|

(

(

+

+

+ + +

+

|

|

.

|

\

|

(

(

+

+

+ + +

3

3

) 1 (

1

) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

5 . 0

) 1 (

1

(5)

The interest rates r, r

u

and r

d

have already been determined. Equations (3), (4), and (5) therefore provide

three equations for determining r

uu

, r

ud

, and r

dd

.

Continuing in this way a complete tree can be constructed. The calculations are made considerably easier

if as we move forward we keep track of the value of a security that pays $1 if a particular node is reached

and zero elsewhere. It is then only necessary to roll back one step when valuing zero-coupon bonds using

the tree.

Determining the o

i

The determination of the o

i

depends on the data available. Sometimes the historical volatilities of zero-

coupon bond yields are used; sometimes the volatilities of caps or swaptions are used. An iterative search

procedure is always necessary.

When bond yields are being matched, we assume that we have data at time zero on the volatilities of a

bond maturing at time iAt. We will denote this by |

i

. (We approximate |

i

as the volatility of this bond

yield between time zero and time At.) We denote y

un

as the yield on a bond maturing at time nAt at node

C and y

dn

as the yield on a bond maturing at time nAt at node B. Considering a bond that matures at time

2At,

2

2

2

ln 5 . 0

d

u

y

y

t = A |

Because there is only one period left in the bond's life at the nodes at time At, y

u2

= r

u

and y

d2

= r

d

. As a

result

d

u

r

r

t ln 5 . 0

2

= A |

Using equation (2) leads to

o

1

= |

2

The interest rates r

u

and r

d

can then be determined from equations (1) and (2).

Determining the subsequent o

i

requires an iterative search. For example, to determine o

2

3

3

3

ln 5 . 0

d

u

y

y

t = A |

5

This must be solved iteratively with equations (3), (4), and (5) for o

2,

r

uu

, r

ud

, and r

dd

.

In general the procedure to determine o

i

(i > 1) is

1. Choose a trial value of o

i

2. Calculate the interest rates at time iAt

3. Calculate the yield volatility for a bond lasting until iAt from the tree. This involves calculating

the bond yields y

u

and y

d

at nodes B and C. The bond yield volatility is 0.5ln(y

u

/y

d

)

4. Search iteratively for the value of o

i

that matches the bond yield volatility

Once the tree has been constructed it can be used to value a range of interest rate derivatives.

Example

As an example of the application of the model suppose that the term structure of interest rates is as shown

in Table 1, the zero-coupon yield volatilities are as shown in Table 2, and the time step is one year. In this

case r=0.10, At=1, o

1

=0.19 (the two-year yield volatility) and equations (1) and (2) give

19 . 0 ln 5 . 0

11 . 1

1

1

1

5 . 0

1

1

5 . 0

10 . 1

1

2

=

=

(

+

+

+

d

u

u d

r

r

r r

Solving these two equations gives r

u

= 0.1432 and r

d

= 0.0979.

Table 1

Zero-coupon Yield Curve (Annually Compounded)

Maturity (years) Rate

1 10.0

2 11.0

3 12.0

4 12.5

5 13.0

6

Table 2

Yield Volatilities

i |

i

2 19.0%

3 18.0%

4 17.5%

5 16.0%

Equations (3), (4), and (5) give

2

ln 5 . 0 o =

ud

uu

r

r

2

ln 5 . 0 o =

dd

ud

r

r

3

12 . 1

1

1

1

5 . 0

1

1

5 . 0

1432 . 1

1

5 . 0

1 . 1

1

1

1

5 . 0

1

1

5 . 0

0979 . 1

1

5 . 0

1 . 1

1

=

|

|

.

|

\

|

(

+

+

+

+

|

|

.

|

\

|

(

+

+

+

uu ud

ud dd

r r

r r

We do not know o

2

directly. For each trial value of o

2

we solve equations (3), (4), and (5) and then

calculate the price of a three-year bond at nodes B and C. The price of a three-year bond at node B is

(

+

+

+

=

ud dd

d

r r

B

1

1

5 . 0

1

1

5 . 0

0979 . 1

1

and the bond yield at node B is

1

1

=

d

d

B

y

The price of a three-year bond at node C is

(

+

+

+

=

uu ud

u

r r

B

1

1

5 . 0

1

1

5 . 0

1432 . 1

1

The bond yield is

1

1

=

u

u

B

y

7

Carrying out an iterative search we find that o

2

= 0.172 does the trick. With this value of o

2

the solutions

to the three equations are

r

uu

= 0.1942

r

ud

= 0.1377

r

dd

= 0.0976

These in turn give B

u

= 0.7507, B

d

= 0.8152, y

u

= 0.1542, and y

d

= 0.1076. Because 0.5ln(0.1542/0.1076)

= 0.18 the three-year yield volatility is matched.

The complete tree of short rates is shown in Figure 2.

Figure 2 The Short-Rate Tree

25.53

21.79

19.42 19.48

14.32 16.06

10 13.77 14.86

9.79 11.83

9.76 11.34

8.72

8.65

You might also like

- Exam History Transcript 8970940390200880587Document2 pagesExam History Transcript 8970940390200880587NITIN100% (1)

- CFA L3 Exam ResultDocument2 pagesCFA L3 Exam ResultNITINNo ratings yet

- AccaDocument1 pageAccaNITINNo ratings yet

- Coursera Analyzing Global Trends For Business and SocietyDocument1 pageCoursera Analyzing Global Trends For Business and SocietyNITINNo ratings yet

- IMF Debt Sustainability AnalysisDocument1 pageIMF Debt Sustainability AnalysisNITINNo ratings yet

- IMF Financial Programming and PoliciesDocument1 pageIMF Financial Programming and PoliciesNITINNo ratings yet

- Principles of Economics With John TaylorDocument1 pagePrinciples of Economics With John TaylorNITINNo ratings yet

- Merit 4Document1 pageMerit 4NITINNo ratings yet

- BCG Classics Revisited The Growth Share Matrix Jun 2014 Tcm80-162923Document9 pagesBCG Classics Revisited The Growth Share Matrix Jun 2014 Tcm80-162923NITINNo ratings yet

- Merit 1Document1 pageMerit 1NITINNo ratings yet

- Consolidated Mark StatementDocument2 pagesConsolidated Mark StatementNITINNo ratings yet

- LandB MGM Press ReleaseDocument3 pagesLandB MGM Press ReleaseNITINNo ratings yet

- Merit 2Document1 pageMerit 2NITINNo ratings yet

- Merit 3Document1 pageMerit 3NITINNo ratings yet

- BachelorsDocument1 pageBachelorsNITINNo ratings yet

- CAS ALM PresentationDocument22 pagesCAS ALM PresentationNITINNo ratings yet

- Adv of Sherlock PDFDocument162 pagesAdv of Sherlock PDFNITINNo ratings yet

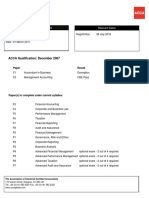

- ACCA WorkoutDocument5 pagesACCA WorkoutNITINNo ratings yet

- Infosys ReportDocument7 pagesInfosys ReportNITINNo ratings yet

- Fma Past Papers 1Document23 pagesFma Past Papers 1Fatuma Coco BuddaflyNo ratings yet

- Optimizing Fixed Income Funds BlackrockDocument16 pagesOptimizing Fixed Income Funds BlackrockNITINNo ratings yet

- Asean - Oecd StatsDocument3 pagesAsean - Oecd StatsNITINNo ratings yet

- Sperandeo, Victor - Trader Vic - Methods of A Wall Street MasterDocument147 pagesSperandeo, Victor - Trader Vic - Methods of A Wall Street Mastervinengch93% (28)

- A Study On Role of Gold Portfolio AllocationDocument6 pagesA Study On Role of Gold Portfolio AllocationNITINNo ratings yet

- Excel Functions Cheat SheetDocument3 pagesExcel Functions Cheat SheetNITINNo ratings yet

- CFA PubDocument3 pagesCFA PubNITINNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CSE 191 Homework Proposition LogicDocument5 pagesCSE 191 Homework Proposition LogicJyothi AnkumNo ratings yet

- Métodos de Reabilitação para Redução Da Subluxação Do Ombro Na Hemiparesia pós-AVC Uma Revisão SistemátDocument15 pagesMétodos de Reabilitação para Redução Da Subluxação Do Ombro Na Hemiparesia pós-AVC Uma Revisão SistemátMatheus AlmeidaNo ratings yet

- Distinguish Opinion From TruthDocument12 pagesDistinguish Opinion From TruthMAR ANTERO R. CENIZA100% (2)

- Hedge Fund Strategies, Mutual Fund Comparison & Fund of FundsDocument46 pagesHedge Fund Strategies, Mutual Fund Comparison & Fund of Fundsbboyvn100% (1)

- Breaking Bad News AssignmentDocument4 pagesBreaking Bad News AssignmentviksursNo ratings yet

- Confidential: Turn in Exam Question PaperDocument20 pagesConfidential: Turn in Exam Question PaperRifat ManzoorNo ratings yet

- Work Industry and Canadian Society 7th Edition Krahn Test BankDocument7 pagesWork Industry and Canadian Society 7th Edition Krahn Test BankSamanthaRamospfozx100% (10)

- 2 10 1 PBDocument4 pages2 10 1 PBHeesung KimNo ratings yet

- 22-Submission File-35-1-10-20190811Document3 pages22-Submission File-35-1-10-20190811DhevNo ratings yet

- Crane's Manual - CV ValuesDocument14 pagesCrane's Manual - CV Valuesnghiemta18No ratings yet

- MERLINDA CIPRIANO MONTAÑES v. LOURDES TAJOLOSA CIPRIANODocument1 pageMERLINDA CIPRIANO MONTAÑES v. LOURDES TAJOLOSA CIPRIANOKaiserNo ratings yet

- Pilar Fradin ResumeDocument3 pagesPilar Fradin Resumeapi-307965130No ratings yet

- Employee Retention Plan QuestionnaireDocument5 pagesEmployee Retention Plan QuestionnaireThayyib MuhammedNo ratings yet

- CPS 101 424424Document3 pagesCPS 101 424424Ayesha RafiqNo ratings yet

- Geppetto's Wish Comes True: Pinocchio Becomes a Real BoyDocument1 pageGeppetto's Wish Comes True: Pinocchio Becomes a Real BoyDonzNo ratings yet

- Allosteric EnzymeDocument22 pagesAllosteric EnzymeAhmed ImranNo ratings yet

- List of Private Schools in Batangas SY 2016-2017Document9 pagesList of Private Schools in Batangas SY 2016-2017Lucky MalihanNo ratings yet

- Exery Analysis of Vapour Compression Refrigeration SystemDocument22 pagesExery Analysis of Vapour Compression Refrigeration Systemthprasads8356No ratings yet

- 15 Tips To Get Fair Skin Naturally PDFDocument2 pages15 Tips To Get Fair Skin Naturally PDFLatha SivakumarNo ratings yet

- Assignment On Diesel Engine OverhaulingDocument19 pagesAssignment On Diesel Engine OverhaulingRuwan Susantha100% (3)

- SPONSORSHIP GUIDE FOR FIJI'S NATIONAL SPORTS FEDERATIONSDocument17 pagesSPONSORSHIP GUIDE FOR FIJI'S NATIONAL SPORTS FEDERATIONSvaidwara100% (1)

- Marketing Management: Amit Pandey +91-7488351996Document15 pagesMarketing Management: Amit Pandey +91-7488351996amit pandeyNo ratings yet

- 1.7 The Lagrangian DerivativeDocument6 pages1.7 The Lagrangian DerivativedaskhagoNo ratings yet

- Paradine V Jane - (1646) 82 ER 897Document2 pagesParadine V Jane - (1646) 82 ER 897TimishaNo ratings yet

- A History Analysis and Performance Guide To Samuel Barber?Document117 pagesA History Analysis and Performance Guide To Samuel Barber?giorgio planesioNo ratings yet

- Fiber006 SorDocument1 pageFiber006 SormbuitragoNo ratings yet

- Making Hand Sanitizer from Carambola FruitDocument5 pagesMaking Hand Sanitizer from Carambola FruitMary grace LlagasNo ratings yet

- Somatic Symptom DisorderDocument26 pagesSomatic Symptom DisorderGAYATHRI NARAYANAN100% (1)

- Assessment: Direction: Read The Story of "Silence - A Fable" by Edgar Allan Poe. Interpret and Analyze The StoryDocument4 pagesAssessment: Direction: Read The Story of "Silence - A Fable" by Edgar Allan Poe. Interpret and Analyze The StoryElsa BorrinagaNo ratings yet

- Berkman Classics: Lawrence Lessig'S Ilaw CourseDocument1 pageBerkman Classics: Lawrence Lessig'S Ilaw CourseJoe LimNo ratings yet