Professional Documents

Culture Documents

A Poor Little Rich Country

Uploaded by

rajivkhatlawalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Poor Little Rich Country

Uploaded by

rajivkhatlawalaCopyright:

Available Formats

A POOR LITTLE RICH COUNTRY!

Usually the Union Budget is a hyped up event providing some masala and some livelihood to the media, the experts, the professionals and the industry bodies. In fact, getting interviewed for your comments on the budget makes you an overnight celebrity, at least for some days. Our collective experience has been that the Budget seems to have lost its charm in initiating constructive brain storming and probably in a weeks time most would forget about it, and life would continue as usual. Finance Ministers, over the years have followed the same old back thumping, statistics, exaggerated glorification of smaller routine things and of course ending with shayari or poems. Nothing to tickle the mind, one would say! But this time there was one statistic spelled out by the FM which actually stunned me, as if a bolt from out of the blue! The FM, to my utter disbelief and astonishment, stated that there are 42800 income tax assesses who have a taxable income of more than Rs one crore. Initially I thought I heard it wrong. But the FM, as if reading my thoughts, said I repeat 42800....! A thought sprang in my mind. Only 42800 people out of 120 crore people in India earn more than Rs one crore per year? Statistically that is 0.00035%. In fact this would include individuals and HUFs of politicians, industrialists, and celebrities. So the FM and the Income Tax department are suggesting that we have just 42800 crorepatis from out of 28 states and 7 union territories? Thats real bull***t! Utter nonsense! And to top it, the FM was actually taking pride in saying this! India, one of the fastest growing economies of the world, has just 42800 crorepatis ? If this is indeed true, are we not amongst the poor countries? Mr FM, just take a stroll in the posh localities of even Tier 1 and Tier 2 cities and you will be shocked! The figure you mentioned may perhaps pertain to only a couple of metros or Tier 1 cities not the whole of India! For starters, do visit the Diamond city of Gujarat and you will actually feel aghast! While every year the FM gives his logic of widening the tax base, they end up targeting only those who are of the lower or middle class. Mr FM, it would be much cost efficient to widen your tax base by targeting the teaming crorepatis who are not filing their returns nor paying taxes, instead of harassing the ever-gullible middle class tax payer. Ten new crorepatis in your tax net would be equal to one thousand middle class tax payers! Think of the resultant real savings in resources! Hope someone in the inner circle of the finance ministry examines this simple fact and enlightens our decision makers. If in the next few years this super-rich tax-paying 42,800 figure does not become 4,28,000, I would presume our FM and the Tax department may have grossly failed as tax collectors. Surely till such time India will remain a poor little rich country! May God bless, or rather save, India !

CA Rajiv D Khatlawala

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Women Empowerment in India: With Reference To Current PoliciesDocument20 pagesWomen Empowerment in India: With Reference To Current PoliciesArindam Neral100% (2)

- A Case For Commodities - by Rajiv D KhatlawalaDocument2 pagesA Case For Commodities - by Rajiv D KhatlawalarajivkhatlawalaNo ratings yet

- The August of Our LivesDocument1 pageThe August of Our LivesrajivkhatlawalaNo ratings yet

- The Coming Commodities BoomDocument2 pagesThe Coming Commodities BoomrajivkhatlawalaNo ratings yet

- SUN's White ElephantDocument1 pageSUN's White ElephantrajivkhatlawalaNo ratings yet

- The Mother of All Bubbles !Document1 pageThe Mother of All Bubbles !rajivkhatlawalaNo ratings yet

- Entrepreneurship Education - An Oxymoron ?Document1 pageEntrepreneurship Education - An Oxymoron ?rajivkhatlawalaNo ratings yet

- The Hesitant Governor PDFDocument1 pageThe Hesitant Governor PDFrajivkhatlawalaNo ratings yet

- Aa Baile Mujhe Maar - Are We Inviting A Crises?Document1 pageAa Baile Mujhe Maar - Are We Inviting A Crises?rajivkhatlawalaNo ratings yet

- Of Angels and UsDocument3 pagesOf Angels and UsrajivkhatlawalaNo ratings yet

- Crime and PunishmentDocument1 pageCrime and PunishmentrajivkhatlawalaNo ratings yet

- Hallucinations, Lies and Damned LiesDocument1 pageHallucinations, Lies and Damned LiesrajivkhatlawalaNo ratings yet

- Daughters of A LESSER GODDocument2 pagesDaughters of A LESSER GODrajivkhatlawalaNo ratings yet

- Humpty Dumpty ..They All Fall Down - . - .Document1 pageHumpty Dumpty ..They All Fall Down - . - .rajivkhatlawalaNo ratings yet

- Emerging India - A Short Story by Rajiv D KhatlawalaDocument6 pagesEmerging India - A Short Story by Rajiv D KhatlawalarajivkhatlawalaNo ratings yet

- IAS UPSC Current Affairs Magazine AUGUST 2019 IASbabaDocument228 pagesIAS UPSC Current Affairs Magazine AUGUST 2019 IASbabakusum meenaNo ratings yet

- Electoral Politics in The PhilippinesDocument54 pagesElectoral Politics in The PhilippinesJulio Teehankee100% (2)

- Police Patrol Opn SyllabusDocument3 pagesPolice Patrol Opn SyllabusDraque TorresNo ratings yet

- Ed White Bio For CAA VPDocument4 pagesEd White Bio For CAA VPGreg HortonNo ratings yet

- 01 Overview of Accounting PDFDocument18 pages01 Overview of Accounting PDFEdogawa SherlockNo ratings yet

- Francis Clavé - Comparative Study of Lippmann's and Hayek's Liberalisms (Or Neo-Liberalisms)Document22 pagesFrancis Clavé - Comparative Study of Lippmann's and Hayek's Liberalisms (Or Neo-Liberalisms)Sergio LobosNo ratings yet

- CLAT Previous Year Question Papers With AnswersDocument209 pagesCLAT Previous Year Question Papers With AnswersRishabh AgrawalNo ratings yet

- Project Report On GST-2018Document32 pagesProject Report On GST-2018Piyush Chauhan50% (6)

- With Liberty and Dividends For All: How To Save Our Middle Class When Jobs Don't Pay EnoughDocument6 pagesWith Liberty and Dividends For All: How To Save Our Middle Class When Jobs Don't Pay EnoughDwight MurpheyNo ratings yet

- Grade Math TleDocument256 pagesGrade Math TleSunshine GarsonNo ratings yet

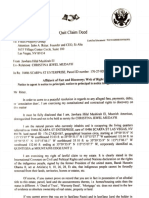

- Quit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020Document4 pagesQuit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020empress_jawhara_hilal_el100% (1)

- CITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCDocument2 pagesCITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCEmil BautistaNo ratings yet

- Machiavelli and Modern BusinessDocument16 pagesMachiavelli and Modern BusinessAlexandra AlNo ratings yet

- 2019-11-14 Email Letter To Shaw & Associates (Signed)Document2 pages2019-11-14 Email Letter To Shaw & Associates (Signed)rohanNo ratings yet

- Saudi Arabia BackgrounderDocument32 pagesSaudi Arabia BackgrounderHalil İbrahimNo ratings yet

- Constitution of PTAFOADocument15 pagesConstitution of PTAFOAS MNo ratings yet

- Handbook For Tactical Operations in The Information EnvironmentDocument17 pagesHandbook For Tactical Operations in The Information EnvironmentVando NunesNo ratings yet

- Compostela Valley ProvinceDocument2 pagesCompostela Valley ProvinceSunStar Philippine NewsNo ratings yet

- Ranjit Singh Administration FeaturesDocument2 pagesRanjit Singh Administration FeaturesshumailaNo ratings yet

- Right To Work IndiaDocument5 pagesRight To Work IndiagambitsaNo ratings yet

- The Imaculate Deception - The Bush Crime Family ExposedDocument45 pagesThe Imaculate Deception - The Bush Crime Family ExposedKifan Radu MariusNo ratings yet

- Bacsin v. WahimanDocument5 pagesBacsin v. WahimanChriscelle Ann PimentelNo ratings yet

- T8 B6 FAA HQ Bart Merkley FDR - Handwritten Interview Notes and Email From Miles Kara Re Interview Merkley and TaafeDocument8 pagesT8 B6 FAA HQ Bart Merkley FDR - Handwritten Interview Notes and Email From Miles Kara Re Interview Merkley and Taafe9/11 Document ArchiveNo ratings yet

- Corruption & Afghanistan's Education SectorDocument6 pagesCorruption & Afghanistan's Education SectorRobin Kirkpatrick BarnettNo ratings yet

- Defences To Defamation (Guyana)Document4 pagesDefences To Defamation (Guyana)Abhimanyu DevNo ratings yet

- CH 31 L1 - Guided ReadingDocument2 pagesCH 31 L1 - Guided ReadingEdward FosterNo ratings yet

- Eb73f2ee 91ae 4de7 81c7 3076718bd250 Xsocw.s5Document2 pagesEb73f2ee 91ae 4de7 81c7 3076718bd250 Xsocw.s5Arvind GoudNo ratings yet

- Christian Laws of Succession and Roys CaseDocument10 pagesChristian Laws of Succession and Roys CaseAnushka PratyushNo ratings yet

- Mikwendaagoziwag - Memorial at Sandy Lake. Mikwendaagoziwag in Ojibwe Means: We Remember Them.Document2 pagesMikwendaagoziwag - Memorial at Sandy Lake. Mikwendaagoziwag in Ojibwe Means: We Remember Them.Sarah LittleRedfeather KalmansonNo ratings yet