Professional Documents

Culture Documents

Guaranty & Suretyship: Chapter 1-Nature & Extent of Guaranty #2047

Uploaded by

Zyra C.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guaranty & Suretyship: Chapter 1-Nature & Extent of Guaranty #2047

Uploaded by

Zyra C.Copyright:

Available Formats

GUARANTY & SURETYSHIP

Chapter 1- Nature & Extent of Guaranty #2047

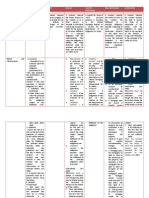

Definition of Guaranty It is a contract between guarantor and creditor. It includes pledge and mortgage because the purpose of guaranty may be accomplished not only by securing the fulfillment of an obligation contracted by the principal debtor thru the personal guaranty of a third person but also by furnishing to the creditor for his security, property with authority to collect the debt from the proceeds of the same in case of default. Characteristics of the contract 1. Accessory - because it is dependent for its existence on the principal obligation guaranteed by it; 2. Subsidiary & Conditional because it takes effect only when the principal debtor fails in his obligation subject to limitation. 3. Unilateral It gives rise only to a duty on the part of the guarantor in relation to the creditor and not vice versa although after its fulfillment, the principal becomes liable to indemnify the guarantor but this is merely an incident of the contract; It may be entered into even without the intervention of the principal debtor; and 4. It is a contract which requires that the guarantor must be a person distinct from the debtor because a person cannot be the personal guarantor of himself This is inconcistent with the purpose of a guarantee which is for the creditor to proceed against a third person if the debtor defaults in his obligation. Classification of Guaranty 1. Guaranty in the broad sense a. Personal- the guarantee is the credit given by the person who guarantees the fulfillment of the principal obligation b. Real- the guaranty is property. If immovable the guranty is in the form of real mortgage or antichresis. If movable, in the form of pledge or chattel mortgage 2. As to its origin a. Conventional- constituted by agreement of the parties b. Legal- imposed by virtue of a provision of law c. Judicial- required by a court to guarantee the eventual right of one of the parties in a case 3. As to its consideration a. Gratuitous- one where the guarantor does not receive any price or renumeration for acting as such. b. Onerous- one where the gurantor receives valuable consideration for his guaranty 4. As to the person guaranteed a. Single- one constituted solely to guarantee or secure performance by the debtor of the principal obligation b. Double or Sub-guaranty- one constituted to secure the fulfillment by the guarantor of a prior guaranty 5. As to its scope and extent a. Definite- one where the guaranty is limited to the principal obligation only, or to a specific portion thereof b. Indefinite or simple- one where the guaranty includes not only the principal obligation but also all its accessories (interests) including judicial costs Law applicable to contract of suretyship Suretyship may be defined as a relation which exists where one person (principal or obligor) has undertaken an obligation and another person (surety) is also under a direct and primary obligation or other duty to a third person (obligee), who is entitled to but

one performance and as between the two who are bound, the one rather than the other should perform. Suretyship is a contractual relation resulting from an agreement where one person, the surety, engages to be answerable to a third personfor the debt, default or miscarriage of another known as the principal. If a person binds himself solidarily with the principal debtor, the contract is called suretyship and the guarantor is called a surety. In a solidary obligation, a solidary debtor is himself a principal debtor. Hence, a solidary debtor cannot be considered a guarantor of his co-debtor. When applicable, the provisions on guaranty also apply to suretyship.

Where the party binds himself solidarily with principal debtor Since guaranty consists in an undertaking to secure the fulfillment of an obligation contracted by another in case the latter should fail to do so, it is quite possible for a guarantor to bind himself solidarily with the principal debtor without affecting the nature of the contract. It all depends on the terms of the contract or the intention of the third person. Thus if his intention is not to convert himself into a principal debtor but merely to constitute himself as a guarantor although binding himself solidarily with him, action may be brought against him outright by reason of the said solidarity but he retains his character as guarantor and all the rights inherent in a guarantor by reason of payment by him. Nature of suretys undertaking 1. Liability is contractual and accessory but direct Suretyship is a contractual relation. The suretys obli is not an original and direct one for the performance of his act, but merely accessory or collateral to the obli contracted by the principal. Nevertheless, his liability to the creditor or the principal is said to be direct. So he is directly, primarily and equally bound with the principal as original promissor although he possesses no direct or personal interest over the latters obligations nor does he receive any benefit therefrom...regardless of WON the principal debtor is financially capable to fulfill his obligations. In law, a surety is considered as being the same party as the debtor and their liabilities are interwoven as to be inseparable. In suretyship, there is but one contract, and the surety is bound by the same agreement which binds the principal. A surety is usually bound with the principal by the same instrument executed at the same time and upon the same consideration. It is for the obligee to see to it that the principal debtor pays the debt or fulfill the contract, but for the surety to see to it that the principal debtor pays or performs. 2. Liability is limited by terms of contract A contract of surety is not presumed; it cannot extend to more than what is stipulated. The extent of the suretys liability is determined only by the clause of the contract of suretyship as well as the conditions stated in the bond. 3. Liability arises only if principal debtor is held liable Their liability to pay the creditor would be solidary but the nature of the suretys undertaking is such that it does not incur liability unless and until the principal debtor is held liable. 4. Surety is not entitled to exhaustion of the properties of the principal debtor The reason is that a surety assumes a solidary liability for the fulfillment of the principal obligation as an original promissor and debtor from the beginning. But when demanded by justice, the principal obligor rather than the surety may be required to pay the

5.

6.

7.

8.

insured obli such as where the former has the necessary amount it got under the bond with which to comply with the terms thereof. Undertaking is to creditor, not debtor Suretys undertaking is that the principal shall fulfill his obli and theat the surety shall be relieved of liability when the obli secured is performed. He makes no agreement with the principal that it will fulfill the obli guaranteed for the benefit of the principal. Surety is not entitled to notice of principals default The surety is bound to take notice of the principals default and to perform the obli. He cannot complain that the creditor has not notified him in the absence of a special agreement to that effect in the contract of suretyship. Prior demand by the creditor upon principal not required A creditors right to proceed against the surety alone exists independently of his right to proceed against the principal where equally bound. As soon as the principal is in default, the surety likewise is in default. The proper remedy of the surety is to pay the debt and pursue the principal reimbursement. Surety is not exonerated by neglect of creditor to sue principal Mere want of diligence does not affect the creditors rights vis a vis the surety, unless the surety requires him by appropriate notice to sue on the obli. The reason for the rule is that there is nothing to prevent the creditor from proceeding against the principal at any time. If dissatisfied, surety may pay the debt himself and be subrogated to creditors rights and remedies.

The essence of the obli of the surety is to pay the creditor without qualification if the principal debtor does not pay. A guarantor on the other hand, does not contract that the principal will pay, but simply that he is able to do so. So the responsibility assumed by the surety is greater or more onerous than that of a guarantor.

Terminology used by parties not controlling The word guarantee is frequently employed in business transactions to describe not the securing of the debt but an intention to be bound by a primary obli. But if from the language used and the circumstances, the intention to be liable as a surety cannot be inferred, the promisor must be deemed to have bound himself only as a guarantor under the rule of reasonable construction applicable to all contracts. Guaranty and Indorsement Indorsement The contract is primarily that of transfer Unless the note is promptly presented for payment at maturity and due notice of dishonor given to the indorser within a reasonable time, he will be discharged absolutely from all liability thereon, whether he has suffered any actual damage or not. distinguished Guaranty The contract is that of security The liability is more extensive than that of an indorsee. The failure in either or both of these particulars does not work an absolute discharge of a guarantors liability, but he is discharged only to the extent of the loss which he may have suffered in consequence thereof Indorser does not warrant, he Guarantor warrants the being answerable on a strict insolvency of the compliance with the law by promisor the holder, whether the promisor is solvent or not An indorser may be sued A guarantor cannot be sued as promisor Guaranty and Warranty Distinguished Each is an undertaking by one party to another to indemnify or make good the assured against some possible default or defect. Guaranty Warranty Is a contract by Is an undertaking that the title, which a person is quality or quantity of the subject bound to another for matter of a contract is what it the fulfillment of a has been represented to be, and promise or relates to some agreement enagement of a third made ordinarily by the party who party makes the warranty #2048 Guaranty generally gratuitous It is onerous only when there is a stipulation to the contrary Cause of contract of guranty 1. Presence of cause which supports principal obligations - The cause of the contract is the same cause which supports the obli as to the principal debtor. The consideration which supports the obligation as to the principal debtor is a sufficient consideration to support the obligation of a guarantor or surety. - A guarantor or surety is bound by the same consideration that makes the contract effective between the principal parties 2. Absence of direct consideration or benefit to guarantor - Valid. A consideration to the principal alone will suffice. #2049 Married as guarantor

Guaranty distinguished from Suretyship They are alike in that each promises to answer for debt, default or miscarriage of another. Surety Guarantor Assumes liability as a regular Depends on an party to the undertaking independent agreement to pay the obli if the primary debtor fails to do so Is charged as an original His engagement is a promisor collateral undertaking Is primarily liable, he undertakes Is secondarily or directly for the payment without subsidiarily liable, he reference to the solvency of the contracts to pay if, principal (regardless of WON the by the use of due principal is financially capable to diligence, the debt fulfill his obli), and he is cannot be paid by responsible at one if the latter the principal makes default, without any demand by the creditor on the principal whatsoever or any notice of default Is ordinarily, held to know every Is not bound to take default of his principal notice of the nonperformance of his principal Will not be discharged either by Is often discharged the mere indulgence of the by the mere creditor of the principal or by indulgence of the want of notice of the default of creditor of the the principal, no matter how principal and is much he may be injured thereby usually not liable unless notified of the default of the principal Guarantor not Insurer of debt guaranteed While a surety undertakes to pay if the principal does not pay, without regard to his ability to do so, the guarantor only binds himself to pay if the principal cannot or unable to pay. One is the insurer of the debt itself, the other, an insurer of the insolvency of the debtor.

A married woman who acts as guarantor ordinarily

binds only her separate property. However, she may also bind the community or conjugal partnership property with her husbands consent, and even without the consent of her husband, in cases provided by law such as when the guaranty has redounded to the benefit of the family. There is no express prohibition against a married woman acting as guarantor for her husband.

Reason: the contract of guaranty is subsidiary 1. To secure the payment of a loan at maturity 2. To secure payment of any debt to be subsequently incurred 3. To secure existing unliquidated debts Guaranty of conditional obligations A guaranty may secure all kinds of obligations, be they pure or subject to a suspensive or resolutory condition. A conditional obligation may also be secured for it is valid and binding just like a pure one. 1. Suspensive condition- the guarantor is liable only after the fulfillment of the condition 2. Resolutory condition- the happening of the condition extinguishes both the principal obligation and the guaranty. #2054 Guarantors liability cannot exceed principal obligation 1. Guaranty is a subsidiary and accessory contract- the guarantor cannot bind himself for more than the principal debtor and even if he does, his liability shall be reduced to the limits of that of the debtor. But a guarantor may bind himself for less than that of the principal. 2. Interest, judicial costs, and attorneys fees as part of damages may be recovered- Creditors suing on a suretyship bond may however, recover from the surety, even without stipulation and even if the surety would thereby become liable to pay more than the total amount stipulated in the bond. a. The surety is made to pay, not by reason of the contract, but by reason of his failure to pay when demanded and for having compelled the creditor to resort to the courts to obtain payment. b. Interest does not run from the time the obligation became due, but from the filing of the complaint or from the time demand was made upon the surety until the principal obligation is fully paid. 3. Penalty may be provided- Similarly, a surety may be held liable for the penalty provided for in a bond for violation of the condition Principals liability may exceed guarantors obligation The measure of the guarantors or suretys obligation is not the measure of the principals obligation. Thus, the amount specified in a surety bind as the suretys obligation does not limit the extent of the damages that may be recovered from the principal, the latters liability being governed by the obli he assumed in contract #2055 Guaranty not presumed As a conrtact, guaranty requires the expression of consent on the part of the guarantor to be bound. It cannot be presumed because of the existence of a contract or principal obligation Reason for the rule He who guarantees does so in the confidence that the debtor can and will pay, but that confidence could be wrong. The law wants, not alone that there be assurance that the guarantor had the true intention to bind himself, but also to make certain that, on making it, he proceeded with consciousness of what he was doing. Guaranty covered by the Statute of Frauds Guaranty must not only be expressed but must also be reduced to witing. It falls under the Statute of Frauds, since it is a special promise to answer for the debt, default or miscarriage of another Art 1403(2), Art 1358, Guaranty strictly construed

#2050 Guaranty undertaken without knowledge of debtor Guaranty is unilateral. It exists for the benefit of the creditor and not for the benefit of the principal debtor who is not a party to the contract of guaranty. The creditor has every right to take all possible measures to secure the payment of his credit. Hence, it can be constituted without the knowledge and even against the will of the principal debtor. Rights of third person who pays The rights of a third person who pays or performs the obligation of the debtor and one who guarantees the obligation of the debtor are similar. Hence, the rules on payment apply. A person who pays without the knowledge or against the will of debtor can recover only insofar as the payment has been beneficial to the debtor, and he cannot compel the creditor to subrogate him in his rights (which the creditor has against debtor), such as in mortagage, guaranty or penalty #2051 Guaranty by reason of origin Guaranty may be conventional, legal or judicial Judicial guaranty, is one constituted by decree of court not by virtue of a provision of law, or by an agreement of the parties Double or sub-guaranty One constituted to guarantee the obli of a guarantor. It should not be confounded with guaranty wherein several guarantors concur. Necessity of a valid principal obligation Guaranty is an accessory contract. It is an indispensable condition for its existence that there must be a principal obligation. So if the principal obligation is void, it is also void. A guaranty may secure the performance of a 1. Voidable contract- inasmuch as the contract is binding, unless it is annulled by a proper action in court 2. Unenforceable contract- becuase such contract is not void 3. Natural obligation- so creditor may proceed against guarantor although he has no right of action against principal debtor since latters obli is not civilly enforceable. When the debtor himself offers a guaranty for his natural obligation, he impliedly recognizes his liability, thereby transforming the obli from natural to civil. #2053 Guaranty of future debts Continuing guaranty or suretyship. This is one which is not limited to a single transaction but which contemplates a future course of dealings, covering a series of transactions for an indefinite time or until revoked. It covers all transactions, including those arising in the future, which are within the description or contemplation of the contract of guaranty, until the expiration or termination thereof. Future debts, even if the amount is not yet known, may be guaranteed but there can be no claim against the guarantor until the amount of the debt is ascertained or fixed and demandable.

It has to be strictly interpreted against the creditor and in favor of the guarantor and is not to be extended beyond its terms or specified limits. If there is any doubt on the terms and conditions of the guaranty or surety agreements, the doubt should be resolved in favor of the gurantor or surety.

Strictissimi juris rule applicable only to accomodation surety Reason: An accomodation surety acts without motive of pecuniary gain and hence should be protected against unjust and pecuniary impoverishment by imposing on the principal, duties akin to those of a fiduciary. The rule will apply only after it has definitely ascertained that the contract is one of suretyship or a guaranty. It cannot be used as an aid in determining whether a partys undertaking is that of a s/g. Rule of strict construction not applicable to compensated sureties The surety bond must be read in its entirety and together with the principal contract. If there is any ambiguity in the surety bond, it should be interpreted against the surety company that prepared it Reason: Compensated sorporate sureties are bsuiness associations organized for the purpose of assuming classified risks in large numbers, for profit and on an impersonal basis. Furthermore, they are secured from all possible loss by adequate conterbonds or indemnity agreements. Although calling themselves sureties, such corporation are in fact, insurers. Extent of guarantors liability 1. Where guaranty definite - The obli of the guarantor under the terms of the contract is limited in whole or in part to the principal debt, to the exclusion of the accessories. Thus, if the amount to be paid or the service to be performed by the person guaranteed is specified in a contract of guaranty, then the obligation of the guarantor extends no further than the sum or services so specified, and extrinsic facts cannot be resorted to for the purpose of enlarging the limit if the guarantor was ignorant of such facts 2. Where guaranty indefinite or simple - The guarantors liability is limited to the principal obligation, in whole or in part, it extends also to all its accessories, they being comprehended within the principal because the guaranty has secured it with all its consequences. - Reason: the guarantor, in entering into the conract, could have fixed the limits of his responsibility to the strict terms of the principal obligation and if he did not do so, it must be presumed that he wanted to be bound to the extent so established. Liability of guarantor for judicial costs The guarantor shall answer for such judicial costs only as have been incurred after he has been judicially required to pay. It is within the power of the guarantor to relieve himself from responsibility of responding for such judicial costs by making payment. From the time he had been judicially required to pay, all of the costs that arise depend on his exclusive will and are therefore, attributed to his fault if he does not do so. Acceptance of guaranty by creditor and notice thereof to guarantor In declaring that guaranty must be express, the law refers to the obligation of the guarantor because it is he alone who binds himself by his acceptance. With respect to the creditor, no such requirement need to be prescribed because he binds himself to nothing. 1. When necessary - Where there is merely an offer of a guaranty or merely a conditional guaranty in the sense that it requires action by the creditor before the obligation

becomes fixed, it does not become a binding obli until it is accepted and (unless there is a waiver of notice) until notice of such acceptance by the creditor is given to, acquired by the guarantor, or until he has notice or knowledge that the creditor has performed the condition and intends to act upon the guaranty. a. The acceptance of the guaranty by the creditor may be implied b. The guarantor is entitled to notice, being secondarily liable, that he may know the anture and extent of his liability and have an opportunity of taking indemnity from the principal obligor or securing himself of the loss, and have reasonable time in which to arrange for payment of guaranty and if the principal defaults... 2. When not necessary - When the transaction is not merely an offer of guaranty, but it amounts to direct or unconditional promise of guranty, but it amounts to direct or unconditional promise of guaranty, unless notice of acceptance is made a condition of the guaranty, all that is necessary to make the promise binding is that creditor should act on it, and notice of acceptance is not necessary, the reason being that the contract of guaranty is unilateral. #2056 & 2057 Qualifications of guarantor (Creditor can waive the requirements) 1. He possesses integrity 2. He has capacity to bind himself 3. He has sufficient property to answer for the obligation which he guarantees Effect of subsequent loss of required qualifications The qualifications need only be present at the time of the perfection of the contract. So the loss of the guarantor would not operate to exonerate the guarantor of the eventual liability he has contracted, and the contract of guaranty continues However, the creditor may demand another guarantor with proper qualifications. But he may waive it if he chooses to hold the guarantor to his bargain. Selection of guarantor 1. Specified person stipulated as guarantor - The substitution of guarantor may not be demanded because in such a case, the selection of the guarantor is a term or condition of the agreement and as a party, the creditor is, therefore, bound thereby 2. Guarantor selected by the principal debtor - The latter answers for the solvency of the former because the guarantor must possess the qualifications prescribed not only at the moment the guarnty is given but also thereafter, until the extinguishment of the debt. 3. Guarantor personally designated by the creditor - It is because he considers him to have the qualifications for the purpose and the responsibility for the selection should, therefore, fall upon him and not on the debtor Section 1- Effects of Guaranty between the Guarantor & the Creditor #2058 Right of guarantor to benefit of excussion or exhaustion 1. Guarantor only secondarily liable 2. All legal remedies against debtor to be first exhausted - To warrant recourse against the guarantor for payment, it may not be a sufficient reason that the debtor appears insolvent. Such insolvency may be simulated.

Chapter 2- Effects of Guaranty

These legal remedies include the bringing of actions for the recission of fraudulent alienations of property made by the debtor. The benefit of excusssion

Right of creditor to secure judgement against guarantor prior to exhaustion An ordinary personal guarantor may demand exhaustion of all the property of the debtor before he can be compelled to pay. - However, that the creditor may prior thereto, secure a judgement against the guarantor, who shall be entitled, however, to a deferment of the execution of said judgement against him, until after properties of the principal debtor shall have been exhausted to satisfy the latters obligation. - There is nothing procedurally objectionable in impleading the guarantor as a co-defendant. The Rules of Court explicitly allows it. This rule is designed to permit the joinder of plaintiffs or defendants whenever there is a common question of law or fact, #2058 Exceptions to benefit of excussion 1. As provided in Article 2059 2. If he does not comply with Article 2060 3. If he is a judicial bondsman and sub-surety 4. Where a pledge or mortgage has been given by him a special security 5. If he fails to interpose it as a defense before judgement is rendered against him Exceptions provided in Article 2059 1. Right waived - The benefit of excussion is a personal right recognized in a guarantor. It waiver is valid. It must be in express terms. 2. Liability assumed that of surety - If the guarantor binds himself solidarily with the principal debtor, he becomes a surety with primary liability as a solidary co-debtor. 3. Insolvency of debtor proven by unsatisfied writ of execution - The insolvency or inability to pay must be actual, and it may be proven by the return of a writ of execution unsatisfied or by other means, but it is not sufficiently established by the mere fact that the debtor has been declared insolvent. 4. Debtor absconds or cannot be locally sued - The creditor is not required to go after a debtor who is hiding or cannot be sued in our courts, and to incur the delays 5. Resort to all legal remedies, a useless formality #2060 & 2061 Duty of creditor to make prior demand for payment from guarantor 1. When demand to be made - The demand for payment by the creditor upon the guarantor under Article 2060 can be made only after judgement on the debt for the exhaustion of the principals property 2. Actual demand to be made - The fact that the guarantor was joined in such suit does not necessarily mean that a demand has already been made upon him. Duty of guarantor to set up benefit of excussion The failure of the guarantor to point out to the creditor the debtors property sufficient to cover his debt forecloses his righ to to set up defense of excussion. Duty of creditor to resort to all legal remedies The exhaustion of the principals debtor property, the benefit of which the guarantor claims-cannot even begin to take place before judgement has obtained against the debtor. The creditor must notify the guarantor of the debtors inability to pay. Joinder of guarantor and principal as parties defendant 1. General

- The guarantor, not being a joint contractor with his principal, cannot be sued with his principal 2. Exception - Yet adherence to this rule is not required where it would serve merely to delay the accounting of the guarantor #2062 Procedure when creditor sues 1. Sent against the principal - The creditor must sue the principal alone. The guarantor cannot be sued with his principal, much less alone, except in the cases in 2059, where the guarantor is not entitled to the benefit of excussion. As a rule, the creditor may hold the guarantor only after judgement has been obtained against the principal debtor and the latter is unable to pay. 2. Notice to guarantor of action - The guarantor however, must be notified so that he may appear, if he so desires, and set up defenses he may want to offer. - If the guarantor appears, he is still given the benefit of exhaustion even if judgement should be rendered against him and the principal debtor. His voluntary appearance does not constitute a renunciation of his right to excussion. - If he does not appear, he cannot set up the defenses which, by appearing, are allowed to him by law, and it may no longer be possible for him to question the validity of the judgement rendered against the debtor. 3. Hearing before execution can be issued against guarantor - A guarantor is entitled to be heard before an excution can be issued against him where he is not a party in the case involving his principal. Notice and hearing constitute the essence of of procedural due process. #2063 Effects of compromise - A compromise is a contract whereby the parties, by making reciprocal concession, avoid a litigation or put an end to one already commenced. 1. Where prejudicial - A contract binds only the parties thereto and not third persons. Hence, a compromise cannot prejudice the guarantor or the debtor, as the case may be, when he is not party to such compromise. Furthermore, a guarantor may not bind himself for more than the principal debtor both as regards the amount the onerous nature of the conditions. 2. Where in the nature of a stipulation in favor of a third person - Even if the guarantor or debtor is not a party to such compromise, the same can benefit him as it is in the nature of stipulation in favor of a third person which the guarantor or debtor may accept unless it has been revoked before his acceptance. #2064 Sub-guarantors right to excussion - A guarantor has the right to demand the exhaustion of the properties of the principal debtor. - A sub-guarantor enjoys the benefit of excussion not only with respect to principal debtor but also with respect to the guarantor for the reason that he stands with respect to the guarantor on the same footing as the latter does w/ respect to the principal debtor #2065 Benefit of division among several guarantors 1. In whose favor applicable - In addition to the benefit of exhaustion granted in 2058m this article entitles the several guarantors of only one debtor and for the same debt to what is known as the benefit of division. - This benefit cannot be availed of if there are two or more debtors of one debt, even if they are bound solidarily, each with different guarantors, or if there

be two or more guarantors of the same debtor but not only for the same debt 2. Extent of liability of several guarantors - Their liability is only joint, that is, the obligation to answer for the debt is divided among all of them. Therefore, the guarantors are not liable to the creditor beyond the shares which they are respectively bound to pay. 3. Exceptions - The exception to this rule is when solidarity has been expressly stipulated. The benefit of division also ceases if any of the circumstances in 2059 should take place as would the benefit of exhaustion of the debtors property. Benefit of excussion among several guarantors - But in order that the guarantor may be entitled to the benefit of division, it is not required that he point out the property of his co-guarantors. The obligation of the guarantor with respect to his co-guarantors is not subsidiary, but direct and does not depend as to its origin on the solvency or insolvency of the latter, although afterwards, if one of them should turn out to be insolvent, his share has to be borne by the others. - Where, however, a creditor claims the share of a guarantor from the others on the ground of insolvency, the latter can set up against the creditor the existence of the property of the supposed insolvent, possessing the same conditions as in 2060 Section 2- Effects of Guaranty Between the Debtor & Guarantor #2066 Guaranty, a contract of indemnity Since the debtor is the one directly and principally liable, it is just that the guarantor who makes payment must be indemnified by said debtor. The indemnity comprises: 1. Total amount of the debt - It is evident that the guarantor has no right to demand reimbursement until he has actually paid the debt, unless by the terms of the contract, he is given the right before making payment. Of course, he cannot collect more than what he has paid Exceptions to right to indemnity or reimbursement The right to indemnity of the guarantor is subject to certain exceptions or qualifications 1. Where the guaranty is constituted without the knowledge or against the will of the principal debtor, the guarantor can recover only insofar as the payment had been beneficial to the debtor. 2. Payment by a third person who does not intend to be reimbursed by the debtor is deemed to be a donation which however, requires the debtors consent. But the payment is in any case valid as to the creditor who has accepted it. 3. The right to demand reimbursement is subject to waiver. #2067 Guarntors right to subrogation 1. Effect of subrogation - Subrogation transfers to the person subrogated, the credit with all the rights thereto appertaining either against the debtor or against third persons, be they guarantors or possessors of mortgages, subject to stipulation in conventional subrogation. Except for the change in the person of the creditor by the guarantor, the obligation subsists in all respects as before payment 2. Accrual, basis & nature of right - This right of subrogation is necessary to enable the guarantor to enforce the indemnity in 2066 - It arises by operation of law upon payment by the guarantor. It is not necessary that the creditor cede to the guarantor the formers rights against the debtor. - It is not a contractual right. THe guarantor is subrogated by virtue of the payment, to the rights of the creditor, not those of the debtor. Thus, a

guarantor who has been obliged to contribute to the satisfaction of a judgement rendered against him and the principal debtor cannot excercise the right of redemption of his principal with respect to real property belonging to the latter which was sold by virtue of a writ of execution issued on said payment. - If the guarantor paid a smaller amount to the creditor of a compromise, he cannot demand more than he actually paid. 3. When right not available - The benefit of subrogation is the means of effectuating the right of the guarantor to indemnity or reimbursement. It cannot, therefore, be invoked in those cases where the guarantor has no right to be reimbursed. #2068 Effect of payment by guarantor without notice to debtor - If the debtor has already paid the creditor, when the guarantor pays, the debtor can set up against the guarantor the defense of previous extinguishment of the obligation by payment. - The guarantor cannot be allowed, through his own fault or negligence, to prejudice the rights or interests of the debtor #2069 Effect of payment by guarantor before/after maturity 1. If the debtors obligation is with a period, it becomes demandable only when the day fixed comes. The guarantor who pays before maturity is not entitled to reimbursement since there is no necessity for accelerating payment. - A contract of guaranty being subsidiary in character, the guarantor is not liable for the debt before it becomes due. - The debtor will be liable if the payment was made with his consent or if the payment was subseuently ratified by him. The ratification may be express or implied. In any case, the guarantor can recover what he has paid upon the expiration of the period. 2. Where demand on the guarantor was made during the term of the guarantee, the fact that payment was actually made after term is not material. - What is controlling is that default and demand on guarantor had taken place while the guarantee was still in force. #2070 Effect of repeat payment by debtor 1. General Rule - Before the guarantor pays the creditor, he must first notify the debtor. If he fails to give such notice and the debtor repeats the payment, the guarantors only remedy is to collect from the creditor, but he has no cause of action against the debtor for the return of the amount paid by him (guarantor) even if the creditor should become insolvent. Being at fault for not advising the debtor, the guarantor must bear the loss. 2. Exception - However, the guarantor may still claim reimbursement from the debtor in spite of lack of notice if the ff conditions are present: a. The creditor becomes insolvent b. The guarantor was prevented by fortuitous event to advise the debtor of the payment c. The guaranty is gratuitous In a gratuitous guaranty, the guarantor receives nothing and it would be unfair to deny him the right to recover from the principal debtor. If the creditor is solvent, the guarantor must still recover from him #2071 Right of guarantor to proceed against debtor before payment - As a rule, the guarantor has no cause of action against the debtor until after the former has paid the obligation.

The article enumerates 7 instances when the guarantor may proceed against the debtor even before payment, and specifies the remedy to which the guarantor is entitled. The purpose is to enable the guarantor to take measures for the protection of his interest in view of the probability that he would be called upon to pay the debt. The provision is applicable to surety

Remedy to which guarantor entitled - The guarantor cannot demand reimbursement for indemnity because he has not paid the obligation. His remedy is to obtain release from the guaranty or to demand a security that shall protect him from any proceedings by the creditor, and against the danger of insolvency of the debtor. - There are certain cases when the guarantor cannot claim the benefit of excussion and in such cases it is but proper that the guarantor be given the right to proceed against the debtor. - The guarantors remedies are alternative. He has the right to choose the action to bring. Suit by guarantor against creditor before payment - The guarantors or suretys action for release can only be excercised against the principal debtor and not against the creditor. The creditor is not compellable to release the guarantor (which is a property right) before payment of his credit against his will. For the release of the guarantor imports an extinction of his obligation to the creditor; it connotes either a remission or a novation by subrogation, and either operation requires the creditors assent for its validity. - Especially should this be the case where the principal debtor has become insolvent, for the purpose of a guaranty is exactly to protect the creditor against such a contingency. - Absent the creditors consent, the principal debtor may only proceed to protect the demanding guarantor by a counterbond or counter-guranty as is authorized by Article 2071 Article 2066 and 2071 distinguished 2066 2071 Provides for the For his protection before enforcement of the rights he has paid but after he of the guarantor against has become liable the debtor after he has paid the debt Gives a right of action after Gives a protective remedy payment before payment Is a substantive right Is in the nature of a preliminary remedy Recovery by surety against indemnitor even before payment 1. Indemnity agreement for benefit of surety - An indemnity agreement is not executed for the benefit of the creditor but rather for the benefit of the surety; and if the indemnitor (principal debtor) voluntarily agrees to its terms and conditions, the obligations arising from the contract have the force of law. 2. Indemnity agreement may be against actual loss as well as liability - An indemnity agreement whereby the indemnitor binds himself to indemnify the surety for any damage or prejudice the latter may sustain under the surety bond, may provide for indemnification not only against actual loss but against liability as well. - In a contract of indemnity against loss, an indemnitor will not be liable until the person to be indemnified makes payment or sustains loss, while in contract of indemnity against liability, the indemnitors liability arises as soon as the liability of the person to be indemnified has arisen without regard to WON he has suffered actual loss. 3. Such agreement valid - A stipulation, therefore in an indemnity agreement providing that the indemnitor shall pay the surety as

soon as the latter becomes liable to make payment to the creditor under the terms of the bond, regardless of whether the surety has made payment actually or not, is valid and enforceable, and in accordance therewith, the surety may demand from the indemnitor even before the creditor has paid. Hence, an action by the surety against the principal debtor and the indemnitor to enforce payment under such an agreement is not premature. And where the principal debtors are simultaneously the same persons who executed the indemnity agreement, the position occupied by them is that of a principal debtor and indemnitor at the same time, and their liability being joint and several with the surety, the creditor may proceed against either, The principle of guarantee in 2071 does not apply, i.e., there is no more need for the surety to exhaust all the properties of the principal debtors before it may proceed against them.

#2072 Guarantor of a third person at request of another The guarantor who guarantees the debt of an absentee at the request of another has a right to claim reimbursement, after satisfying the debt either from (1) the person who requested him to be a guarantor; or (2) the debtor Section 3- Effects of Guaranty as Between coguarantors #2073 Right to contribution of guarantor who pays The obligation of several guarantors of the same debtor and for the same debt is joint. Each is bound to pay only his proportionate share. 1. Restrictions - The article contemplates a situation which arises when one guarantor has paid the debt to the creditor and is seeking reimbursement from each of his coguarantors the share which is proportionately owing him. - It is required however that the payment must have been made (a) In virtue of a judicial demand (b) Because the principal debtor is insolvent - Without the requirement, the guarantor who pays the debt under the circumstances giving him the right to contribution may proceed directly against his cogurantors for their respective shares, with the latter having to incur the trouble and expense of claiming afterwards from the debtor what they have paid. - On the other hand, if the guarantor proceeds first against the debtor who, as a consequence, makes payment, then not only the debtor but the coguarantors as well would be discharged at once from their obligations. - The guarantor is perfectly justified in paying the debt because any delay on his part may increase the liability for interest, expenses 2. Effect of insolvency of any guarantor - If any of the guarantors should be insolvent, his share shall be borne by the others including the paying guarantor in the same joint proportion. This ff the rule in solidary obligations 3. Accrual and basis of right - The right of the guarantor who has paid the debt in either of the cases specified to demand proportionate contribution or reimbursement from his co-guarantors is acquired ipso jure by the guarantor by virtue of said payment without the need of obtaining from the creditor any prior cession of rights to such guarantor #2074 Defenses available to co-guarantors In the action filed by the paying guarantor against his co-guarantors for their proportionate shares in the obligation, the latter may avail themselves of all defenses which the debtor would have interposed against the creditor but not those which cannot be transmitted for being purely personal to the debtor #2075

Liability of sub-guarantor in case of insolvency of guarantor In case of insolvency of the guarantor for whom he bound himself, a sub-guarantor is liable to the coguarantors in the same manner as the guarantor whom he guaranteed.

You might also like

- Guaranty and SuretyshipDocument3 pagesGuaranty and SuretyshipMary Joy Barlisan Calinao100% (3)

- Memoradum of AssociationDocument45 pagesMemoradum of Associationvishalbansal6675No ratings yet

- Guaranty and SuretyshipDocument14 pagesGuaranty and Suretyshiproansalanga100% (1)

- Basic Rules On SuccessionDocument7 pagesBasic Rules On SuccessionsheilafranciaNo ratings yet

- Taxation Law Reviewer - SyllabusDocument15 pagesTaxation Law Reviewer - Syllabusadonismiller03No ratings yet

- LOAN TERMSDocument10 pagesLOAN TERMSAdine DyNo ratings yet

- Real Estate Mortgage LectureDocument7 pagesReal Estate Mortgage LectureJoycee MarasiganNo ratings yet

- Will Sand Succession Memory AidDocument13 pagesWill Sand Succession Memory AidAnonymous wDganZNo ratings yet

- Lecture Notes Maxims of Equity 27 PDFDocument27 pagesLecture Notes Maxims of Equity 27 PDFSumaia Akhter100% (1)

- CREDIT TRANS REVIEWER: NATURE OF GUARANTY AND SURETYSHIPDocument12 pagesCREDIT TRANS REVIEWER: NATURE OF GUARANTY AND SURETYSHIPzal50% (2)

- Guaranty and SuretyshipDocument40 pagesGuaranty and SuretyshipTsuuundereeNo ratings yet

- Consti 1 Notes MidtermDocument28 pagesConsti 1 Notes MidtermdindoNo ratings yet

- CREDIT TRANSACTIONS Q&ADocument19 pagesCREDIT TRANSACTIONS Q&AJued CisnerosNo ratings yet

- GUARANTYDocument16 pagesGUARANTYmcris101100% (1)

- General Contract Clauses: Representations and Warranties (OH)Document19 pagesGeneral Contract Clauses: Representations and Warranties (OH)Filippe OliveiraNo ratings yet

- REVIEWER NOTES ON BAILMENT AND LOAN CONTRACTSDocument61 pagesREVIEWER NOTES ON BAILMENT AND LOAN CONTRACTSDiane Althea Valera Pena91% (11)

- Case Doctrines Credit Transactions PDFDocument24 pagesCase Doctrines Credit Transactions PDFJ Castillo MejicaNo ratings yet

- "Next Friend" and "Guardian Ad Litem" - Difference BetweenDocument1 page"Next Friend" and "Guardian Ad Litem" - Difference BetweenTeh Hong Xhe100% (2)

- 2011 Ust Golden Notes Taxation Law Reviewerpdf PDF FreeDocument339 pages2011 Ust Golden Notes Taxation Law Reviewerpdf PDF FreeMaris Angelica AyuyaoNo ratings yet

- JAVELLANA Vs LIMDocument2 pagesJAVELLANA Vs LIMakimoNo ratings yet

- GUARANTY Surety Mortgages Pledge AntichresisDocument35 pagesGUARANTY Surety Mortgages Pledge AntichresisJennilyn TugelidaNo ratings yet

- CH 2 - Indian Contract Act, 1872Document28 pagesCH 2 - Indian Contract Act, 1872Prosenjit RoyNo ratings yet

- Naguiat v. CA (412 Scra 591)Document1 pageNaguiat v. CA (412 Scra 591)Manuel Rodriguez IINo ratings yet

- Patent and insurance key points under 40 charsDocument3 pagesPatent and insurance key points under 40 charsZyra C.No ratings yet

- Patent and insurance key points under 40 charsDocument3 pagesPatent and insurance key points under 40 charsZyra C.No ratings yet

- Credit Midterm Reviewer - Loan and DepositDocument12 pagesCredit Midterm Reviewer - Loan and Depositviva_33No ratings yet

- San Beda Credit TransactionsDocument33 pagesSan Beda Credit TransactionsLenard Trinidad100% (5)

- Embassy Farms Vs CADocument12 pagesEmbassy Farms Vs CADexter CircaNo ratings yet

- Due Diligence AgreementDocument6 pagesDue Diligence AgreementMahesh Nagaraj100% (1)

- Title Iii: Bureau of Labor Relations Article. 226. Bureau of Labor Relations & Labor Relations Divisions (RO) Original andDocument17 pagesTitle Iii: Bureau of Labor Relations Article. 226. Bureau of Labor Relations & Labor Relations Divisions (RO) Original andSheena ValenzuelaNo ratings yet

- CIVIL LAW PRINCIPLES ON CREDIT TRANSACTIONS AND BAILMENT CONTRACTSDocument38 pagesCIVIL LAW PRINCIPLES ON CREDIT TRANSACTIONS AND BAILMENT CONTRACTSarrrrrrrrr100% (1)

- Recent Juris in Civil Law 2015 PDFDocument49 pagesRecent Juris in Civil Law 2015 PDFJJ Pernitez50% (2)

- Simple Loan or MutuumDocument54 pagesSimple Loan or MutuumNoreenesse SantosNo ratings yet

- Article 1933-1940Document4 pagesArticle 1933-1940Maricon AsidoNo ratings yet

- General Garcia charged with plunderDocument2 pagesGeneral Garcia charged with plunderZyra C.No ratings yet

- The New Central Bank Act PDFDocument8 pagesThe New Central Bank Act PDFitsmenatoyNo ratings yet

- Telephone Directory 010918Document8 pagesTelephone Directory 010918alro100% (1)

- Telephone Directory 010918Document8 pagesTelephone Directory 010918alro100% (1)

- Personal Property Security ActDocument18 pagesPersonal Property Security ActFrancis PunoNo ratings yet

- Credit TransactionsDocument12 pagesCredit TransactionsMark Tano100% (3)

- Property Finals - Gurtiza Reviewer.Document33 pagesProperty Finals - Gurtiza Reviewer.Mary Grace Soriano GurtizaNo ratings yet

- Lambert Vs Heirs of RayDocument3 pagesLambert Vs Heirs of RayKaren Patricio LusticaNo ratings yet

- Succession Notes 1Document10 pagesSuccession Notes 1Andrew GallardoNo ratings yet

- Prof. Roentgen F. Bronce: Credit TransactionsDocument13 pagesProf. Roentgen F. Bronce: Credit TransactionsAnnaNo ratings yet

- Antichresis ReviewerDocument6 pagesAntichresis Reviewersushisupergirl14100% (1)

- What Is The Contract of Guaranty?Document7 pagesWhat Is The Contract of Guaranty?AldrinNo ratings yet

- CREDTRANS 2SR 1st EXAM TSNDocument71 pagesCREDTRANS 2SR 1st EXAM TSNMa Gloria Trinidad ArafolNo ratings yet

- @clawmcq Indian Contract ActDocument76 pages@clawmcq Indian Contract ActRittik PrakashNo ratings yet

- 2 Finals Reviewer Sem 2003: Chapter 1. Nature, Form and Kinds of AgencyDocument20 pages2 Finals Reviewer Sem 2003: Chapter 1. Nature, Form and Kinds of AgencyJerald-Edz Tam AbonNo ratings yet

- Pledge, Mortgage, AntichresisDocument9 pagesPledge, Mortgage, AntichresisAnonymous N9dx4ATEghNo ratings yet

- Cred Trans Case Digests Part3Document13 pagesCred Trans Case Digests Part3Ayeesha PagantianNo ratings yet

- Understanding PossessionDocument19 pagesUnderstanding PossessionArgel Joseph Cosme100% (1)

- Work Experience Sheet for Supervising PositionsDocument2 pagesWork Experience Sheet for Supervising PositionsCes Camello100% (1)

- New Public Administration TheoryDocument11 pagesNew Public Administration TheoryZyra C.No ratings yet

- Intellectual PropertyDocument3 pagesIntellectual PropertyJanelle TabuzoNo ratings yet

- Arts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISDocument5 pagesArts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISSherri BonquinNo ratings yet

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Document3 pagesPajuyo v. CA, G.R. No. 146364, June 3, 2004catrina lobatonNo ratings yet

- Commodatum VsDocument4 pagesCommodatum VsbluephoeNo ratings yet

- Guaranty Basics in 40 CharactersDocument29 pagesGuaranty Basics in 40 CharactersMing100% (1)

- SuccessionDocument12 pagesSuccessionbigbully23No ratings yet

- Redit Ransaction: TranscriptionsDocument75 pagesRedit Ransaction: Transcriptionsjames lebron100% (1)

- Exception: Partnership by EstoppelDocument10 pagesException: Partnership by EstoppelJefNo ratings yet

- Credit Transactions PDFDocument79 pagesCredit Transactions PDFVincent Tan100% (1)

- Concurrence and Preference of Credit: Concurrence of Credits Implies The Possession by Two orDocument6 pagesConcurrence and Preference of Credit: Concurrence of Credits Implies The Possession by Two orLara DelleNo ratings yet

- G.R. No. L-38745 August 6, 1975 Doctrine: No Interest Shall Be Due Unless It Has Been Expressly Stipulated in WritingDocument1 pageG.R. No. L-38745 August 6, 1975 Doctrine: No Interest Shall Be Due Unless It Has Been Expressly Stipulated in WritingKaren Ryl Lozada BritoNo ratings yet

- People vs Tulin conviction piracy Philippine watersDocument2 pagesPeople vs Tulin conviction piracy Philippine watersZyra C.100% (1)

- Republic of Indonesia Vs VinzonDocument3 pagesRepublic of Indonesia Vs Vinzonrodel_odzNo ratings yet

- Contract of Sale VS Contract of AgencyDocument1 pageContract of Sale VS Contract of AgencyjeanneNo ratings yet

- CSC Resolution 01 0940Document17 pagesCSC Resolution 01 0940Nhil Cabillon Quieta100% (1)

- Art 774-782Document6 pagesArt 774-782ferdzky100% (3)

- Credit Transactions, Loans, First Part of Commodatum and MutuumDocument12 pagesCredit Transactions, Loans, First Part of Commodatum and MutuumJohn Lexter Macalber50% (2)

- Credit Transactions Case DoctrinesDocument14 pagesCredit Transactions Case DoctrinesKobe BullmastiffNo ratings yet

- 1b. Motion To Declare Jamero Defendant in DefaultDocument3 pages1b. Motion To Declare Jamero Defendant in Defaultoshin saysonNo ratings yet

- Theories of Governance and New Public Management JapanDocument24 pagesTheories of Governance and New Public Management Japanvison22100% (1)

- Strengthening Philippines Secured Transactions LawDocument10 pagesStrengthening Philippines Secured Transactions LawAl MarvinNo ratings yet

- Nature and Effects of Contract of GuarantyDocument3 pagesNature and Effects of Contract of GuarantyNikki Andrade100% (2)

- Belonio v. NovellaDocument3 pagesBelonio v. NovellaKatherine KatherineNo ratings yet

- Credit Notes GuarantyDocument3 pagesCredit Notes GuarantyRyan Suaverdez100% (1)

- Credit Transactions Finals ReviewerDocument12 pagesCredit Transactions Finals ReviewerChristiane Marie BajadaNo ratings yet

- Credit Transactions Final ReviewerDocument5 pagesCredit Transactions Final ReviewerPJ HongNo ratings yet

- Summary Jurisdiction of The OmbudsmanDocument7 pagesSummary Jurisdiction of The OmbudsmanBelteshazzarL.CabacangNo ratings yet

- Contract of DepositDocument5 pagesContract of DepositSamia CachoNo ratings yet

- SC upholds leasehold rights in land disputeDocument3 pagesSC upholds leasehold rights in land disputeEunice IquinaNo ratings yet

- PAJUYO V CA and GUEVARRADocument2 pagesPAJUYO V CA and GUEVARRAAngela Marie AlmalbisNo ratings yet

- Chapter 1. - Commodatum 1. CharacteristicsDocument2 pagesChapter 1. - Commodatum 1. CharacteristicsLari dela RosaNo ratings yet

- GUARANTYDocument4 pagesGUARANTYJulia San JoseNo ratings yet

- Sanitation Code, EtcDocument3 pagesSanitation Code, EtcZyra C.No ratings yet

- Primer On Phil Mechanisms For Civil Redress & Proprietary Rehab of TIP VictimsDocument8 pagesPrimer On Phil Mechanisms For Civil Redress & Proprietary Rehab of TIP VictimsZyra C.No ratings yet

- PA 203 With AnswersDocument2 pagesPA 203 With AnswersZyra C.No ratings yet

- Handout - Cuevas (PA 201)Document1 pageHandout - Cuevas (PA 201)Zyra C.No ratings yet

- Republic Act 8187 Grants 7-Day Paternity LeaveDocument2 pagesRepublic Act 8187 Grants 7-Day Paternity LeaveZyra C.No ratings yet

- PA 203 PaperDocument1 pagePA 203 PaperZyra C.No ratings yet

- EDITED-Revised Contract 2017Document4 pagesEDITED-Revised Contract 2017Zyra C.No ratings yet

- Part 4 ULP & StrikesDocument9 pagesPart 4 ULP & StrikesZyra C.No ratings yet

- Human Behavior Approach To ManagementDocument2 pagesHuman Behavior Approach To ManagementZyra C.No ratings yet

- NLRC AppealDocument1 pageNLRC AppealZyra C.No ratings yet

- Nego SamplexDocument1 pageNego SamplexZyra C.No ratings yet

- LTD NotesDocument2 pagesLTD NotesZyra C.No ratings yet

- JuratDocument1 pageJuratZyra C.No ratings yet

- ProsecutionDocument6 pagesProsecutionZyra C.No ratings yet

- Samplex CompilationDocument3 pagesSamplex CompilationZyra C.No ratings yet

- Do 40-03Document38 pagesDo 40-03Sonny Morillo100% (1)

- Part 2 Representation, Certification ElectionDocument3 pagesPart 2 Representation, Certification ElectionZyra C.No ratings yet

- Dean Jara - RemRevDocument129 pagesDean Jara - RemRevZyra C.No ratings yet

- Samplex CompilationDocument3 pagesSamplex CompilationZyra C.No ratings yet

- 4 Carbonell V Metrobank PDFDocument15 pages4 Carbonell V Metrobank PDFCla SaguilNo ratings yet

- Mendoza v. ValteDocument23 pagesMendoza v. ValteiptrinidadNo ratings yet

- Types of Partnership DeedsDocument2 pagesTypes of Partnership DeedsChikanma OkoisorNo ratings yet

- Aligarh Muslim University: Faculty of LawDocument11 pagesAligarh Muslim University: Faculty of LawAnas AliNo ratings yet

- S.P Chengalvaraya Naidu v. JagannathDocument3 pagesS.P Chengalvaraya Naidu v. JagannathManoharan ViswanathanNo ratings yet

- Court upholds housing developer's claim against homeowner for exceeding approved building heightDocument30 pagesCourt upholds housing developer's claim against homeowner for exceeding approved building heightZairus Effendi Suhaimi100% (1)

- 3 Comglasco Corp. v. Santos Car Check Center CorpDocument13 pages3 Comglasco Corp. v. Santos Car Check Center CorpGlean Myrrh Almine ValdeNo ratings yet

- The Law of Partnership Is An Extention of Law of AgencyDocument21 pagesThe Law of Partnership Is An Extention of Law of AgencyHaovangDonglien KipgenNo ratings yet

- ABBL3033 Business Law – Chapter 10 PartnershipDocument12 pagesABBL3033 Business Law – Chapter 10 PartnershipZHI CHING ONGNo ratings yet

- Class Notes On Law of Torts - Unit III (1st Sem / 3 Year LL.B)Document9 pagesClass Notes On Law of Torts - Unit III (1st Sem / 3 Year LL.B)Saransh BhardwajNo ratings yet

- Law of Contracts Semester IDocument13 pagesLaw of Contracts Semester IManushree TyagiNo ratings yet

- G.R. No. 110358 RobledoDocument3 pagesG.R. No. 110358 Robledomarkhan18No ratings yet

- Sandiganbayan case reconsideration soughtDocument17 pagesSandiganbayan case reconsideration soughtDavao PropertyNo ratings yet

- Admin PDFDocument14 pagesAdmin PDFHarshit RathoreNo ratings yet

- Memorandum AgreementDocument5 pagesMemorandum AgreementsitiNo ratings yet