Professional Documents

Culture Documents

Richard Vetstein Quoted in Banker & Tradesman Article On Recent Foreclosure Rulings

Uploaded by

Richard VetsteinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Richard Vetstein Quoted in Banker & Tradesman Article On Recent Foreclosure Rulings

Uploaded by

Richard VetsteinCopyright:

Available Formats

Banker & Tradesman Battle Lines

Cases Could Make Foreclosure Challenges Easier Assignments Validity Could Be Questioned

By Colleen M. Sullivan Banker & Tradesman Staff Writer March 3, 2013 Two new decisions handed down from the federal appeals court this month give borrowers a clear path to challenge the lenders right to foreclose on them -- and may clear the way for foreclosure defense attorneys to upend the mortgage securitization market. The cases, Juarez vs. Select Portfolio and Culhane vs. Aurora, turn on whether a borrower has a right to challenge the validity of the servicers assignment of a mortgage. During the boom, sloppy paperwork often meant that transfers between one servicer and another were not properly recorded. Often, the necessary paperwork to notify registrars of the change in ownership was only filed after the foreclosure itself was completed. In the Eaton case, the Massachusetts Supreme Judicial Court (SJC) ruled that in order to begin a foreclosure the servicer must possess both the mortgage and the note (or be acting as the agent of the note-holder). In the Ibanez case, the SJC had ruled that a servicer could not begin a foreclosure unless a mortgage had been legally transferred into its name (assigned), but that a post-foreclosure filing might be valid if the servicer could produce evidence that the paperwork was merely to confirm a prior assignment which had not been recorded. For a borrower, however, attempting to prove that a bank had started a foreclosure without meeting the standards laid out in Eaton and Ibanez could prove difficult. Massachusetts does not require a judges approval to conduct a foreclosure, and so borrowers have to do their own spadework if they want to challenge a foreclosure, and may not have access to all the relevant documents. When borrowers do launch a court action, servicers have often succeeded in moving such cases to federal courts. Many federal judges had been sympathetic to servicers argument that the borrowers obligation to repay the note doesnt change, regardless of which servicer possesses their mortgage so even if a transfer was fouled up, a borrower didnt have the right to challenge it. Many cases which questioned

whether assignments met legal standards were therefore summarily dismissed by federal judges. The two new federal appellate cases make it easier for borrowers to raise such questions, ruling that borrowers do have the right to challenge an assignment in order to prove a foreclosure was improper, and that merely stamping a document with a certain date is not enough to establish that an assignments is confirmatory. Whats important about this case is that the First Circuit rejected a line of argument thats been appearing around the country that borrowers dont have the authority to challenge whether their assignments were valid, said Geoff Walsh, an attorney at the National Consumer Law Center in Boston who specializes in foreclosure law. Thats not really been based on sound reasoning, and this is the first decision from any of the circuits thats rejected that, clearly. Wakeup Call At the same time, the First Circuit also gave a clear stamp of approval to the role of the Mortgage Electronic Registration System (MERS), a Virginia-based entity which acts as a holding company for the majority of American mortgages, allowing them to be transferred between servicers without the transfer being publically recorded. The rulings are a wakeup call for attorneys to make sure assignments in proper order, said Rich Vetstein, an attorney in private practice in Framingham and author of the Massachusetts Real Estate Law Blog. Title companies are giving close scrutiny to such matters, and anybody looking to buy or sell a property with a foreclosure in its past will have to be prepared to deal with the assignment issues. If a title company were to see [a potentially back-dated assignment], theyd make youd file an affidavit confirming that you had reviewed their files, and there was evidence that the mortgage had been assigned before the foreclosure proceeded said Vetstein. That might be tough to do, but thats why youve got to do. Its got to be thorough. As a practical matter, the two cases may have limited impact in terms of preventing or overturning foreclosures. Declaring that a borrower has a right to question an assignment is a very different thing from proving that an assignment was invalid, said Chris Pitt, a partner at Robinson & Cole in Boston and past president of the Real Estate Bar Association. My guess is that the [Juarez case itself] wont go any further than this, said Pitt, though it did confirm that the mortgagor had standing, to raise the issue.

More importantly for the future, the First Cicuits ruling in these case will allow foreclosure defense attorneys to pursue a line of argument that could have a huge impact on the entire mortgage securitization market: Whether or not the failure to properly assign the mortgage from one entity to another violates the terms of securitization trusts. In essence, lawyers argue that due to the strict rules governing how trusts operate, if a mortgage was not properly assigned before the mortgage was securitized, the investors who now own the security might not have the right to conduct a foreclosure. If those deadlines and terms arent met does that make those assignments void? And if it does, how does that impact a foreclosure? said Walsh. Courts have yet to rule on the issue, but the First Circuits decision will clear the way for borrowers attorneys to raise it. Its unclear how many loans would be impacted if courts were to rule in borrowers favor, but with more than 7 percent of American mortgages delinquent, such a ruling could cause devastating upheaval in the mortgage market. - See more at: http://www.bankerandtradesman.com/news154052.html#sthash.KkqjCdKl.dpuf

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- First Amended Complaint, Federal Challenge To Massachusetts Eviction MoratoriumDocument78 pagesFirst Amended Complaint, Federal Challenge To Massachusetts Eviction MoratoriumRichard VetsteinNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hill We Climb - Amanda Gorman, Inaugural Address January 20, 2021, National Youth Poet LaureateDocument4 pagesThe Hill We Climb - Amanda Gorman, Inaugural Address January 20, 2021, National Youth Poet LaureateRichard VetsteinNo ratings yet

- CIR V Reyes - DigestDocument1 pageCIR V Reyes - DigestVillar John EzraNo ratings yet

- Sworn Statement of Accountability of The PreparersDocument2 pagesSworn Statement of Accountability of The PreparersLugid YuNo ratings yet

- Amended Articles of IncorporationDocument5 pagesAmended Articles of IncorporationAileen Castro RigorNo ratings yet

- Court Rules on Validity of Tractor Sale Between Brothers Despite MortgageDocument2 pagesCourt Rules on Validity of Tractor Sale Between Brothers Despite MortgageRowena GallegoNo ratings yet

- Premids Obligations PDFDocument58 pagesPremids Obligations PDFayasueNo ratings yet

- Sesbreno v. CA, Delta Motors Corp., & Pilipinas BankDocument2 pagesSesbreno v. CA, Delta Motors Corp., & Pilipinas BankPMVNo ratings yet

- Promoting IP rights in local governanceDocument5 pagesPromoting IP rights in local governanceBenjamin Jovan SisonNo ratings yet

- GOOD GOVERNANCE IN PAKISTAN PROBLEMSDocument19 pagesGOOD GOVERNANCE IN PAKISTAN PROBLEMSKaleem MarwatNo ratings yet

- Feria Vs CADocument2 pagesFeria Vs CAClaudine BancifraNo ratings yet

- EPacific Vs CabansayDocument2 pagesEPacific Vs CabansayStephanie Valentine100% (1)

- October 7th: Was It A Pogrom?Document17 pagesOctober 7th: Was It A Pogrom?Richard Vetstein100% (1)

- Mayor Wu Rent Control and Tenant Eviction Protection Revised 2-15-2023Document4 pagesMayor Wu Rent Control and Tenant Eviction Protection Revised 2-15-2023Richard VetsteinNo ratings yet

- Lawsuit Avila v. Dr. Bisola Ojikutu, Boston Public Health Commission (City of Boston Eviction Moratorium)Document28 pagesLawsuit Avila v. Dr. Bisola Ojikutu, Boston Public Health Commission (City of Boston Eviction Moratorium)Richard VetsteinNo ratings yet

- CDC Temporary Halt in Residential Evictions To Prevent The Further Spread of Covid-19Document17 pagesCDC Temporary Halt in Residential Evictions To Prevent The Further Spread of Covid-19Richard Vetstein100% (1)

- Massachusetts Appeals Court Single Justice Ruling On Boston Eviction MoratoriumDocument8 pagesMassachusetts Appeals Court Single Justice Ruling On Boston Eviction MoratoriumRichard VetsteinNo ratings yet

- Boston Eviction Moratorium Order On Motion To StayDocument16 pagesBoston Eviction Moratorium Order On Motion To StayRichard VetsteinNo ratings yet

- Ann Karnofsky Landlord Tenant Court Ruling Central (Massachusetts) Housing CourtDocument5 pagesAnn Karnofsky Landlord Tenant Court Ruling Central (Massachusetts) Housing CourtRichard VetsteinNo ratings yet

- Tenczar v. Indian Pond Country Club, Inc., 491 Mass. 89 (Dec. 20, 2022)Document35 pagesTenczar v. Indian Pond Country Club, Inc., 491 Mass. 89 (Dec. 20, 2022)Richard VetsteinNo ratings yet

- Court Ruling On Boston Eviction MoratoriumDocument15 pagesCourt Ruling On Boston Eviction MoratoriumRichard VetsteinNo ratings yet

- Kaplan v. New England Paragliding Club Ruling On Preliminary InjunctionDocument7 pagesKaplan v. New England Paragliding Club Ruling On Preliminary InjunctionRichard VetsteinNo ratings yet

- Boston Public Health Commission Temporary Eviction Moratorium Order 8 31 21Document3 pagesBoston Public Health Commission Temporary Eviction Moratorium Order 8 31 21Richard VetsteinNo ratings yet

- Judge Mark Wolf Opinion Preliminary Injunction Baptiste v. Kennealy, Massachusetts Eviction Moratorium 9.25.20Document102 pagesJudge Mark Wolf Opinion Preliminary Injunction Baptiste v. Kennealy, Massachusetts Eviction Moratorium 9.25.20Richard VetsteinNo ratings yet

- UMNV V Caffe Nero - Mot Partial SJ - 2084CV01493-BLS2Document12 pagesUMNV V Caffe Nero - Mot Partial SJ - 2084CV01493-BLS2Richard VetsteinNo ratings yet

- CDC Eviction Moratorium Emergency Order Federal RegisterDocument6 pagesCDC Eviction Moratorium Emergency Order Federal RegisterRichard VetsteinNo ratings yet

- Court Hearing Transcript, 9/1/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumDocument77 pagesCourt Hearing Transcript, 9/1/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumRichard VetsteinNo ratings yet

- Temporary Halt in Residential Evictions To Prevent The Further Spread of COVID-19Document37 pagesTemporary Halt in Residential Evictions To Prevent The Further Spread of COVID-19Kristina KoppeserNo ratings yet

- Court Hearing Transcript, 9/2/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumDocument68 pagesCourt Hearing Transcript, 9/2/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumRichard VetsteinNo ratings yet

- Matorin v. Commonwealth of Massachusetts Decision On Preliminary InjunctionDocument34 pagesMatorin v. Commonwealth of Massachusetts Decision On Preliminary InjunctionRichard VetsteinNo ratings yet

- Single Justice Order of Transfer Matorin v. Chief JusticeDocument3 pagesSingle Justice Order of Transfer Matorin v. Chief JusticeRichard VetsteinNo ratings yet

- Amicus Curiae Submissions of Small Landlords, Challenge To Mass. Eviction Moratorium ActDocument55 pagesAmicus Curiae Submissions of Small Landlords, Challenge To Mass. Eviction Moratorium ActRichard Vetstein0% (1)

- Massachusetts Act Providing For Moratorium On Evictions and Foreclosures During COVID-19 EmergencyDocument8 pagesMassachusetts Act Providing For Moratorium On Evictions and Foreclosures During COVID-19 EmergencyRichard VetsteinNo ratings yet

- Memo Re. Preliminary Injunction Final 7.15.20 PDFDocument35 pagesMemo Re. Preliminary Injunction Final 7.15.20 PDFRichard VetsteinNo ratings yet

- Matorin V Chief Justice, SJC Petition Challenge Mass. COVID-19 Eviction MoratoriumDocument119 pagesMatorin V Chief Justice, SJC Petition Challenge Mass. COVID-19 Eviction MoratoriumRichard Vetstein50% (2)

- John Giuca 440.10 Reply Brief January 30 2020Document27 pagesJohn Giuca 440.10 Reply Brief January 30 2020Richard VetsteinNo ratings yet

- Superior Court Amicus Invitation, Matorin v. CommonwealthDocument1 pageSuperior Court Amicus Invitation, Matorin v. CommonwealthRichard VetsteinNo ratings yet

- Massachusetts Virtual Remote Notarization Act For COVID-19 Emergency (Final Draft)Document8 pagesMassachusetts Virtual Remote Notarization Act For COVID-19 Emergency (Final Draft)Richard VetsteinNo ratings yet

- Massachusetts Act Relative To Remote Notarization During COVID-19 State of Emergency.Document5 pagesMassachusetts Act Relative To Remote Notarization During COVID-19 State of Emergency.Richard VetsteinNo ratings yet

- Signed Order Re Alarms Inspections PDFDocument2 pagesSigned Order Re Alarms Inspections PDFRichard VetsteinNo ratings yet

- National Development Corporation v. Court of AppealsDocument1 pageNational Development Corporation v. Court of AppealsReth GuevarraNo ratings yet

- CAVB - Appointment BookingHERODEDocument2 pagesCAVB - Appointment BookingHERODEmerlinebelony16No ratings yet

- Global financial crisis explainedDocument2 pagesGlobal financial crisis explainedIvana JurićNo ratings yet

- Solutions For Class 11political ScienceDocument5 pagesSolutions For Class 11political ScienceNityapriyaNo ratings yet

- M783 & Prem CF Ammo Rebate FORMDocument1 pageM783 & Prem CF Ammo Rebate FORMdunhamssports1No ratings yet

- JUNE22 - ACT InvoiceDocument2 pagesJUNE22 - ACT InvoiceSamarth HandurNo ratings yet

- Letter From ElectedsDocument2 pagesLetter From ElectedsJon RalstonNo ratings yet

- Concepcion DiaDocument18 pagesConcepcion DiaChienette MedranoNo ratings yet

- Borsani - Gobiernos de Izquierda, Sistema de Partidos y Los Desafios para La Consolidaciond e La DemocraciaDocument11 pagesBorsani - Gobiernos de Izquierda, Sistema de Partidos y Los Desafios para La Consolidaciond e La DemocraciaGerardo Pedro Fernandez CuraNo ratings yet

- Incrementnotes PDFDocument6 pagesIncrementnotes PDFnagalaxmi manchalaNo ratings yet

- Court of Appeals Abuses Discretion in Dismissing PetitionDocument5 pagesCourt of Appeals Abuses Discretion in Dismissing PetitionPHI LAMBDA PHI EXCLUSIVE LAW FRATERNITY & SORORITYNo ratings yet

- ENP LawDocument15 pagesENP LawArnoldAlarcon100% (1)

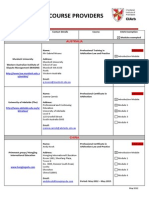

- Recognised Course Providers ListDocument13 pagesRecognised Course Providers ListSo LokNo ratings yet

- NY Times - Special Edition July 4, 2009Document8 pagesNY Times - Special Edition July 4, 2009bauhNo ratings yet

- Infant Formula RecallDocument4 pagesInfant Formula RecallTinnysumardiNo ratings yet

- What's Happening in Zimbabwe?: Important Elections Took Place in Zimbabwe in Southern Africa On 30 July 2018Document6 pagesWhat's Happening in Zimbabwe?: Important Elections Took Place in Zimbabwe in Southern Africa On 30 July 2018EriqNo ratings yet

- Ambedkar's view on protests and restoring the ConstitutionDocument6 pagesAmbedkar's view on protests and restoring the ConstitutionAyushNo ratings yet

- Interim Rules of Procedure On Corporate RehabilitationDocument11 pagesInterim Rules of Procedure On Corporate RehabilitationChrissy SabellaNo ratings yet

- The Week USA - October 10 2020Document42 pagesThe Week USA - October 10 2020Евгений СоболевNo ratings yet

- IFLA Code of Ethics For LibrariansDocument6 pagesIFLA Code of Ethics For LibrariansImran SiddiqueNo ratings yet