Professional Documents

Culture Documents

ICAEW Accounting IAS 07 MCQ With ANS

Uploaded by

hopeaccaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICAEW Accounting IAS 07 MCQ With ANS

Uploaded by

hopeaccaCopyright:

Available Formats

College of management sciences

Address: C-4 Sector, 14-A, Shadman, North Nazimabad Town, Karachi, Pakistan. Phone: 021-36952901 , Fax: 021-36952902, Mobile: 0320-2500828, Email: info@coms.edu.pk, www.coms.edu.pk coms@inbox.com.pk (Sir Haris) ----------------------------------------------------------------------------------------Teacher M.Haris ICAEW Accounting Knowledge Level IAS 07 ( Statement of cash flow) MCQs web:

1. Which TWO of the following transactions would be presented in a statement of cash flows, according to IAS 07 Statement of cash flows? A. Conversion of loans into shares B. Loan interest received C. Loan interest owed D. Proceeds of loan issue 2. Which ONE of the following items should be presented under Cash flows from investing activities, according to IAS 07 Statement of cash flows? A. Employee costs B. Property revaluation C. Redemption of debentures D. Development costs capitalised in the period 3. Which ONE of the following items should be presented under Cash flows from financing activities, according to IAS 07 Statement of cash flows? A. Employee costs B. Property revaluation C. Redemption of debentures D. Development costs capitalised in the period 4. Which ONE of the following items should be presented under Cash flows from operating activities, according to IAS 07 Statement of cash flows? A. Employee costs B. Property revaluation C. Redemption of debentures D. Development costs capitalised in the period 5. Which TWO of the following can be classified as Cash and cash equivalents under IAS 07 Statement of cash flows? A. Redeemable preference shares due in 180 days B. Loan notes held due for repayment in 90 days C. Equity investments D. A bank overdraft

6. In accordance with IAS 7 Statement of cash flows, and treating it as a nonrecurring event, which classification of the cash flow arising from the proceeds from an earthquake disaster settlement would be most appropriate? (select one answer) A. Cash flows from operating activities B. Cash flows from investing activities C. Cash flows from financing activities D. Does not appear in the cash flow statement 7. In accordance with IAS 7 Statement of cash flows, and treating it as a nonrecurring event, which classification of the cash flow arising from the proceeds of sale of a subsidiary would be most appropriate? (select one answer) A. Cash flows from operating activities B. Cash flows from investing activities C. Cash flows from financing activities D. Does not appear in the cash flow statement 8. In accordance with IAS 7 Statement of cash flows, and treating it as a nonrecurring event, which classification of the cash flow arising from the disposal proceeds of a major item of plant would be most appropriate? (select one answer) A. Cash flows from operating activities B. Cash flows from investing activities C. Cash flows from financing activities D. Does not appear in the cash flow statement

Good Luck Sir Haris -----------------------------------------------------------------------------------------

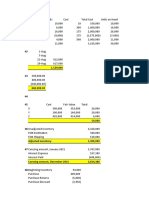

Answers according to IAS 07 guideline. Question 1 - B & D The only cash flows arise from the loan interest received and proceeds of loan issue. The other two items do not meet the definition of cash flows per IAS 7 para 6. Question 2 - D Development costs capitalised are cash flows from investing activities per IAS 7 para 16(a). Employee costs are cash flows from operating activities per IAS 7 para 14(d). Property revaluation does not appear in the cash flow statement as it does not involve an inflow or outflow of cash. Redemption of debentures appears in cash flows from financing activities per IAS 7 para 17(c). Question 3 - C Redemption of debentures are cash flows from financing activities per IAS 7 para 17(c). Employee costs are cash flows from operating activities per IAS 7 para 14(d). Development costs capitalised are cash flows from investing activities per IAS 7 para 16(a). Property revaluation does not appear in the cash flow statement as it does not involve an inflow or outflow of cash. Question 4 - A Employee costs are cash flows from operating activities per IAS 7 para 14(d). Redemption of debentures appears in cash flows from financing activities per IAS 7 para 17(c). Development costs capitalised are cash flows from investing activities per IAS 7 para 16(a). Property revaluation does not appear in the cash flow statement as it does not involve an inflow or outflow of cash. Question 5 - B & D The bank overdraft is negative cash. Cash equivalents include items of short maturity (loan notes held are assets). See IAS 7 paras 6-8. Question 6 - A The definition in IAS 7 para 6 of operating activities includes "other activities that are not investing or financing", so will include disaster settlements. Question 7 - B Cash flows re acquisitions and disposals of subsidiaries are investing activities per IAS 7 para 39. Question 8 - B Sales proceeds from non-current assets come under investing activities per IAS 7 para 16(b).

You might also like

- Business Strategy Study Guide 2015Document38 pagesBusiness Strategy Study Guide 2015hopeaccaNo ratings yet

- After The Storm FinalDocument106 pagesAfter The Storm FinalNye Lavalle100% (2)

- Exercise - Financial Statement AnalysisDocument3 pagesExercise - Financial Statement Analysisfarahhr100% (1)

- FRM Notes PDFDocument149 pagesFRM Notes PDFmohamedNo ratings yet

- CIMA SyllabusDocument41 pagesCIMA Syllabuskara85098No ratings yet

- Ias 1 QuestionsDocument7 pagesIas 1 QuestionsIssa AdiemaNo ratings yet

- ICAEW Financial Accounting Conceptual and Regulatory Frame WorkDocument40 pagesICAEW Financial Accounting Conceptual and Regulatory Frame WorkhopeaccaNo ratings yet

- Activity Base Costing (ABC Costing)Document12 pagesActivity Base Costing (ABC Costing)SantNo ratings yet

- Financing Decisions and Capital Structure OptimizationDocument2 pagesFinancing Decisions and Capital Structure OptimizationTitus ClementNo ratings yet

- Cma 1Document83 pagesCma 1Frue LoveNo ratings yet

- MARU BATTING CENTER CRM CASE STUDYDocument9 pagesMARU BATTING CENTER CRM CASE STUDYAbsar HashmiNo ratings yet

- EPS MCQs PDFDocument8 pagesEPS MCQs PDFMaria Jawed100% (1)

- CIMA C5 Mock TestDocument21 pagesCIMA C5 Mock TestSadeep Madhushan100% (1)

- Xii Mcqs CH - 15 Ratio AnalysisDocument6 pagesXii Mcqs CH - 15 Ratio AnalysisJoanna GarciaNo ratings yet

- CAT Review Qs PDFDocument4 pagesCAT Review Qs PDFSuy YanghearNo ratings yet

- ACCA FR Question Pack on Financial ReportingDocument52 pagesACCA FR Question Pack on Financial ReportingVasileios Lymperopoulos100% (1)

- ACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFDocument24 pagesACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFPiyal Hossain100% (1)

- Stephenson Real Estate Recapitalization Project AnalysisDocument2 pagesStephenson Real Estate Recapitalization Project AnalysisHassham Yousuf0% (1)

- Chapter 6Document38 pagesChapter 6Kad Saad100% (5)

- Sa Sept10 Ias16Document7 pagesSa Sept10 Ias16Muiz QureshiNo ratings yet

- IND AS 32, 107, 109 (With Questions & Answers)Document69 pagesIND AS 32, 107, 109 (With Questions & Answers)Suraj Dwivedi100% (1)

- Aafr Ifrs 16 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 16 Icap Past Papers With SolutionAqib SheikhNo ratings yet

- IFRS QuestionsDocument3 pagesIFRS QuestionsChristopher M. Ungria100% (1)

- Theory of Accounts - Multiple Choices: Cash Flows?Document20 pagesTheory of Accounts - Multiple Choices: Cash Flows?Babylyn Navarro0% (1)

- Understanding Intangible AssetsDocument8 pagesUnderstanding Intangible AssetsMya B. Walker100% (1)

- Marginal CostingDocument10 pagesMarginal CostingJoydip DasguptaNo ratings yet

- MS-MidtermExam 5thyrABSA 2019 AnsDocument8 pagesMS-MidtermExam 5thyrABSA 2019 AnsKarla OñasNo ratings yet

- Cost Accounting MCQsDocument5 pagesCost Accounting MCQsVishnuNadar50% (2)

- Revision Question BankDocument134 pagesRevision Question Bankgohasap_303011511No ratings yet

- FA2 Accruals and PrepaymentsDocument4 pagesFA2 Accruals and Prepaymentsamna zamanNo ratings yet

- Chapter - 1 Introduction To AccountingDocument3 pagesChapter - 1 Introduction To AccountingAnna Olivia MarieNo ratings yet

- Past Paper IIDocument16 pagesPast Paper IIWasim OmarshahNo ratings yet

- CVP ActivityDocument7 pagesCVP ActivityANSLEY CATE C. GUEVARRANo ratings yet

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: BackgroundDocument24 pagesThe Effects of Changes in Foreign Exchange Rates: BackgroundAA100% (1)

- 06 08 DCF Quiz Questions Basic PDFDocument22 pages06 08 DCF Quiz Questions Basic PDFVarun AgarwalNo ratings yet

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- CH 07Document12 pagesCH 07Yousef ShahwanNo ratings yet

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNo ratings yet

- f3 Mock TestDocument11 pagesf3 Mock TestSai SandhyaNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Chapter 15 - Working CapitalDocument19 pagesChapter 15 - Working CapitalAmjad J AliNo ratings yet

- Cash Flow Statement for ABC LtdDocument30 pagesCash Flow Statement for ABC LtdNaushad GulNo ratings yet

- Cost-Volume-Profit & Breakeven Analysis QuizDocument7 pagesCost-Volume-Profit & Breakeven Analysis QuizNaddieNo ratings yet

- Topic 6 - ACCA Cash Flow Q SDocument8 pagesTopic 6 - ACCA Cash Flow Q SGeorge Wang100% (1)

- Cost Behaviour 43 Mins: The Following Information Relates To Questions 4.3 To 4.7Document5 pagesCost Behaviour 43 Mins: The Following Information Relates To Questions 4.3 To 4.7Waqas Younas BandukdaNo ratings yet

- Objective Questions and Answers of Financial ManagementDocument22 pagesObjective Questions and Answers of Financial ManagementGhulam MustafaNo ratings yet

- MCQs Financial AccountingDocument12 pagesMCQs Financial AccountingPervaiz ShahidNo ratings yet

- MA1 test chapter 03 costingDocument4 pagesMA1 test chapter 03 costingshahabNo ratings yet

- 5.1 Financial Statement Analysis CH 25 I M PandeyDocument21 pages5.1 Financial Statement Analysis CH 25 I M Pandeyjoshi_ashu100% (2)

- Transfer PricingDocument10 pagesTransfer Pricingkevior2No ratings yet

- Parte 2 Segundo ParcialDocument23 pagesParte 2 Segundo ParcialJose Luis Rasilla GonzalezNo ratings yet

- ACTG21c MIDTERM EXAM REVIEWDocument6 pagesACTG21c MIDTERM EXAM REVIEWJuanito TanamorNo ratings yet

- F5 Performance Management Fundamentals Level Skills Module PaperDocument16 pagesF5 Performance Management Fundamentals Level Skills Module PaperGeo DonNo ratings yet

- TB ch07Document27 pagesTB ch07carolevangelist4657No ratings yet

- Calculating finance lease accounting entriesDocument7 pagesCalculating finance lease accounting entriessajedulNo ratings yet

- Preparatory Program: Cma/CfmDocument26 pagesPreparatory Program: Cma/CfmpaperdollsxNo ratings yet

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- Investment Analysis Portfolio Management Solutions Manual PDF For PDF Solutions Manual and Test Bank Investment List Keith C Brown Solution Manual ForDocument2 pagesInvestment Analysis Portfolio Management Solutions Manual PDF For PDF Solutions Manual and Test Bank Investment List Keith C Brown Solution Manual ForKofi Ewoenam100% (1)

- Practice Question 1 - Published AccountsDocument2 pagesPractice Question 1 - Published AccountsGnanendran MBA100% (1)

- Hock Section B QuestionsDocument137 pagesHock Section B QuestionsMustafa AroNo ratings yet

- Final Exam, s1, 2019 FINALDocument12 pagesFinal Exam, s1, 2019 FINALShivneel NaiduNo ratings yet

- CertIFR Module-2Document46 pagesCertIFR Module-2Tran AnhNo ratings yet

- 6th Practice Qs 99.2Document3 pages6th Practice Qs 99.2BromanineNo ratings yet

- Statement of Cash Flow - Group 3Document3 pagesStatement of Cash Flow - Group 3mutia rasyaNo ratings yet

- Quiz - Cash FlowDocument7 pagesQuiz - Cash FlowAfrose KhanNo ratings yet

- Accountancy and Auditing-2007Document10 pagesAccountancy and Auditing-2007BabarNo ratings yet

- Cost Accounting - MaterialDocument3 pagesCost Accounting - MaterialFarhadMohsinNo ratings yet

- Internal Auditng Test and Ans DocumentDocument52 pagesInternal Auditng Test and Ans Documentcima2k15100% (1)

- Internal Auditng Test and Ans DocumentDocument52 pagesInternal Auditng Test and Ans Documentcima2k15100% (1)

- Income Tax ComputationDocument22 pagesIncome Tax ComputationhopeaccaNo ratings yet

- Investment IncomeDocument22 pagesInvestment IncomehopeaccaNo ratings yet

- ADIT Prospectus 2015Document26 pagesADIT Prospectus 2015hopeaccaNo ratings yet

- Icaew Assurance Notes Icab KLDocument76 pagesIcaew Assurance Notes Icab KLhopeaccaNo ratings yet

- Bank Sofp Analysis Consulting DivisionDocument20 pagesBank Sofp Analysis Consulting DivisionhopeaccaNo ratings yet

- Cima C1Document52 pagesCima C1hopeaccaNo ratings yet

- Pakistan Scholarships CWT Application FormDocument3 pagesPakistan Scholarships CWT Application FormhopeaccaNo ratings yet

- Times Are Changing : Your Guide To The Latest Evolution of The AcaDocument24 pagesTimes Are Changing : Your Guide To The Latest Evolution of The AcahopeaccaNo ratings yet

- Icaew Authorised Training Employers (Ates) in The Gulf: United Arab Emirates - Abu DhabiDocument4 pagesIcaew Authorised Training Employers (Ates) in The Gulf: United Arab Emirates - Abu DhabihopeaccaNo ratings yet

- Job Application Interview Hints TipsDocument8 pagesJob Application Interview Hints Tipshopeacca100% (1)

- House of Professional Excellence: E-2 May 2011 ImportantDocument2 pagesHouse of Professional Excellence: E-2 May 2011 ImportanthopeaccaNo ratings yet

- BOK Sample Paper NTS 2013Document10 pagesBOK Sample Paper NTS 2013hopeaccaNo ratings yet

- Registration FormDocument1 pageRegistration FormhopeaccaNo ratings yet

- Revision Checklist For As Accounting 9706 FINALDocument28 pagesRevision Checklist For As Accounting 9706 FINALhopeaccaNo ratings yet

- Revision Checklist For As Accounting 9706 FINALDocument28 pagesRevision Checklist For As Accounting 9706 FINALhopeaccaNo ratings yet

- House of Professional Excellence: E-2 May 2011 ImportantDocument2 pagesHouse of Professional Excellence: E-2 May 2011 ImportanthopeaccaNo ratings yet

- Telkom 2022 - FS IFAS Eng - ReleaseDocument122 pagesTelkom 2022 - FS IFAS Eng - ReleaseIPutri Adeliya PratiwiNo ratings yet

- Mechanism For Acquisition of Shares Through Stock Exchange Pursuant To Tender-Offers Under Takeovers, Buy Back and DelistingDocument6 pagesMechanism For Acquisition of Shares Through Stock Exchange Pursuant To Tender-Offers Under Takeovers, Buy Back and DelistingShyam SunderNo ratings yet

- Social Cost Benefit Analysis TechniquesDocument43 pagesSocial Cost Benefit Analysis Techniquesanwar jemalNo ratings yet

- RMK 1 - Advanced Behaviorial AccountingDocument7 pagesRMK 1 - Advanced Behaviorial Accountingyurika regiNo ratings yet

- ENTREPRENEURSHIP REVIEWER: KEY FACTORS AND TYPESDocument15 pagesENTREPRENEURSHIP REVIEWER: KEY FACTORS AND TYPESMika VillarazaNo ratings yet

- Module 2 ACCOUNTING FOR MATERIALSDocument9 pagesModule 2 ACCOUNTING FOR MATERIALSJhoanne Marie TederaNo ratings yet

- 3 AccountingDocument39 pages3 AccountingSaltanat ShamovaNo ratings yet

- BM NotesDocument45 pagesBM NotesJessa Mae tapicNo ratings yet

- Brand Awareness at AirtelDocument15 pagesBrand Awareness at AirtelMubeenNo ratings yet

- Consumerism and Marketing EthicsDocument51 pagesConsumerism and Marketing EthicsNB Thushara HarithasNo ratings yet

- Louis Vuitton enters IndiaDocument33 pagesLouis Vuitton enters IndiaRangga BarranNo ratings yet

- Bridging The Gaps in The Kaong SubsectorDocument12 pagesBridging The Gaps in The Kaong SubsectorMarian E BoquirenNo ratings yet

- Digital Marketing Manager for Top Audio BrandDocument1 pageDigital Marketing Manager for Top Audio BrandShreya AggarwalNo ratings yet

- Parle G WordDocument2 pagesParle G WordKshitij SharmaNo ratings yet

- The Role of An Industrial EngineerDocument2 pagesThe Role of An Industrial EngineerSuhailShaikhNo ratings yet

- ACCCOB2 Quiz 2 SolutionsDocument2 pagesACCCOB2 Quiz 2 SolutionsRafael CaparasNo ratings yet

- Industrial Visit)Document10 pagesIndustrial Visit)ZISHAN ALI-RM 21RM966No ratings yet

- FAR139 FAR 139 Cash and Accrual BasisDocument4 pagesFAR139 FAR 139 Cash and Accrual BasisJuniah MyreNo ratings yet

- Review Quiz For FinalsDocument7 pagesReview Quiz For FinalsKryzzel Anne JonNo ratings yet

- Ravi KumarDocument5 pagesRavi Kumarravikumarverma28No ratings yet

- Macabus DCF AnalysisDocument6 pagesMacabus DCF AnalysisNikolas JNo ratings yet

- Marketing Insight: Nike React vs Adidas Ultra BoostDocument29 pagesMarketing Insight: Nike React vs Adidas Ultra Boostnafiesa lauzaNo ratings yet

- Targeted Banner Buys on Small and Large SitesDocument85 pagesTargeted Banner Buys on Small and Large SitesTimur KhasanovNo ratings yet

- Corp - Gov Text Module 5Document6 pagesCorp - Gov Text Module 5Rony GhoshNo ratings yet

- Ipsas 16Document36 pagesIpsas 16Bobby RicardoNo ratings yet

- 12 Acc SP 01Document36 pages12 Acc SP 01ganeshNo ratings yet