Professional Documents

Culture Documents

Forestry Logging Wood Work Furniture Paper Paper and Paperboard Paper and Paperboard Industry in Egypt

Uploaded by

Yaser AkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forestry Logging Wood Work Furniture Paper Paper and Paperboard Paper and Paperboard Industry in Egypt

Uploaded by

Yaser AkarCopyright:

Available Formats

Paper and Paperboard in Egypt

Paper and Paperboard Industry in Egypt

U.S. Commercial Service Egypt Summary The 2007 Egyptian market for paper, paperboard and pulp is estimated at $1.4 billion and is expected to grow at an annual rate of 10% over the next three years. Paper and paperboard represented the bulk of the market at approximately $1.32 billion (2 million MT), while pulp made up the rest at $80 million (107,000 MT). In 2007, pulp was imported mainly from the U.S., Canada, Europe and Russia. The U.S. has the largest market share in pulp and kraft liner board, while cement sack paper is imported mainly from Scandinavian countries. Newsprint is largely from Canada, the U.S. and Finland, while magazine paper, packing/wrapping paper, writing, duplex board, printing and photocopy paper from Europe. The U.S. market share is estimated at 10%.

Egypts paper market is supplied 78% from imports and 22% from domestic sources. The main suppliers are Europe, Canada, USA and the Far East. Paper and paperboard are subject to 2-12% customs duty, with higher duties in areas that are entirely covered by local production. Pulp, printing paper, test-liner, tissue paper and recycling paper are manufactured locally. Importing from Europe is more lucrative due to the EuroMed Association Agreement, which decreases tariffs on imported paper and paperboard vis-vis importing from the U.S. However, due to the weaker US$ against the Euro, imports from the U.S. can be expected to increase.

Market Demand Egypt manufactures 22% of its paper and pulp, including all tissue paper of which it exports 31% to the Gulf and Arab countries. Egypt also produces 31% of its pulp, which caused a 27% drop in imports. This occurred, when the government built two factories (Edfu and Qena). During 2007, Egypt produced 23% of its thriving printing and writing paper market. In spite of the existence of paper mills and a growing paper-converting industry in Egypt, the country imports 78% of its paper and paperboard requirements. There are three public sector paper mills in Egypt and production of tissue paper satisfies domestic market demand, plus 31% of production is exported to the Gulf countries.

The paper converting industry is completely in the hands of the private sector. The local industry manufactures corrugated carton boxes, cement sacks, micro-flute boxes, egg and food produce

Page 1

More information at www.globaltrade.net

trays, writing paper, and tissue and toilet paper. Companies currently working in this sector vary in size and structure and include large corporate entities, small companies that employ ten to 20 workers, and individual enterprises with less than five employees.

Corrugated carton boxes are manufactured from test-liner or kraft-liner-board and semi-chemical fluting board. In 2007, the market consumed 400,000 MT of test-liner board, kraft-liner board and semi-chemical fluting. Test-liner is sold approximately 10% cheaper than kraft-liner board and is used for manufacturing boxes that carry lightweight products. Kraft-liner board, however, is now used more then test-liner because of the countrys growing export market. Kraft-liner produces more durable boxes that are used to carry heavyweight products, such as textiles, and for exported products. During 2007, Egypt produced 150,000 tons of test-liner board. Virgin kraft-liner is imported mainly from the U.S., while semichemical fluting is imported from Finland and France. Test-liner board is either produced locally or imported from Eastern Europe and Germany.

The cement sack industry is dependent on cement production, which is increasing rapidly in Egypt and is expected to reach 55 million MT by 2011. Cement sacks are produced from imported kraft sack paper.

Cement sack production in Egypt is part of the cement production line. The typical cement sack is a standard package holding 50 kilograms of cement and is made of 2 or 3 layers of kraft paper 70-90 gm/square m. A modern packing machine requires kraft paper rolls of 102 cm width with standard wear and tear and burst-resistant factors. Statistics show that total cement market reached 38 million MT in 2007, of which 30 million MT are consumed locally, while exports totaled 8 million MT. This quantity requires a total of 197,000 MT., worth $158 million. Demand for cement sacks is expected to increase with the increase in production; the GOE auctioned eight licenses in October 2007 to add more capacity to the sector. Cement sack paper is imported mainly from Sweden, Norway and Finland. The U.S. has no market share in the cement sack industry, as it does not produce to local specifications.

Newsprint paper imports in 2007 reached 194,000 MT, with three main presses consuming all imported newsprint paper for publishing local journals. However, the number of newspapers in Egypt has soared to more than 500, most of which are independent. One public sector entity uses newsprint paper for producing transportation tickets. During 2007, Egypt imported newsprint from The USA, Canada and Finland. Low-weight coated paper (LWC) imports reached 10,000 MT and is used as inner magazine paper and telephone directories. This kind of paper is light in weight (10-12 grams) and can be printed on both sides. LWC is imported mainly from Europe.

White wood free and printing paper consumption totaled 650,000 MT estimated at $570 million in 2007. Egypt produced 150,000 MT locally and imported 500,000 MT mainly from Brazil,

Page 2

More information at www.globaltrade.net

Indonesia, Europe and the U.S., which captured only 5% of the market. Three public sector paper mills produce lower quality paper, but have captured 31% of the total market consumption. A new private sector company has been established and produces 60,000 MT. However, since the growth rate of this market is estimated at 12%, no decrease in imports is anticipated.

Packing and wrapping paper including one-side coated and two-side coated paper imports in 2007 totaled 14,000 MT estimated at $200,000. This includes 40 gm machine glazed bleached kraft paper. The majority of packing and wrapping paper are imported from Europe.

Egypt is self-sufficient in the production of tissue and toilet paper. There are three large, private entities manufacturing tissue paper, produced from hardwood pulp, especially that of the eucalyptus tree. Total annual domestic tissue paper production is 40,000 MT. The quality of tissue paper has improved in Egypt and now 37% of total production is exported to the Gulf and the Arab world. Tissue and toilet paper demand is increasing due to an increase in health awareness. This should trigger an increase in production and an expected increase in exports.

Duplex board: Grey back and white back, are used to produce better quality carton boxes for the cigarette, cosmetic and pharmaceutical industries. During 2007, Egypt consumed approximately 180,000 MT of duplex board worth $121 million, mainly from Europe (Austria, Czech Republic, Germany, and Spain.)

Egypt consumed 125,000 MT of Grey back and 55 MT of white back in 2007. Cast-coated board is now being replaced by plastic and laminated covers for producing the cover of exercise books, while playing cards, are produced from playing cards paper by Moharram Press company, which consumes 100 MT/year.

The Wood pulp market in 2007 is estimated at 107,000 MT worth $80 million. Three public sector companies produce 41,000 MT of pulp while the balance 66,000 MT are imported mainly from the U.S.,which has captured the lions share of 50%. Europe has a 30% market share, while Canada has captured 30% of the market.

Recycling of 80% of trash in Cairo and Alexandria provides a significant local source of waste paper used for local kraft and cardboard manufacturing. This consists of trash paper and cardboard collected by donkey-cart boys and larger trash trucks. Egypt consumes 110,000 MT of recycled paper used in producing cartons and egg trays.

Page 3

More information at www.globaltrade.net

Read the full market research report

Page 4

More information at www.globaltrade.net

You might also like

- FE Exam Preparation Book VOL1 LimitedDisclosureVerDocument448 pagesFE Exam Preparation Book VOL1 LimitedDisclosureVerapi-385588287% (38)

- Commissioning Plan ExampleDocument21 pagesCommissioning Plan Examplehuguer1100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Paper Industry Project ReportDocument38 pagesPaper Industry Project Reportkamdica83% (30)

- The Mysore Paper Mills Limited Project Draft FINALDocument92 pagesThe Mysore Paper Mills Limited Project Draft FINALHarish Shridharamurthy100% (1)

- Nebb T&CDocument118 pagesNebb T&Cbabmech6007100% (3)

- Stock Preparation: Description of Unit ProcessesDocument31 pagesStock Preparation: Description of Unit ProcessesKamini78% (9)

- Forward Integration or Horizontal Expansion Rev TheoDocument32 pagesForward Integration or Horizontal Expansion Rev TheoJawad FarisiNo ratings yet

- Sapm Cia-1: Industry Analysis of Paper IndustryDocument18 pagesSapm Cia-1: Industry Analysis of Paper IndustrylvisekNo ratings yet

- Paper Industry Analysis.Document18 pagesPaper Industry Analysis.Raunak Doshi78% (9)

- Shree Jagdambe Paper IndustryDocument62 pagesShree Jagdambe Paper IndustryGufran ShaikhNo ratings yet

- Shree Jagdambe Paper Mills LTDDocument39 pagesShree Jagdambe Paper Mills LTDsimply_cooolNo ratings yet

- Industry OverviewDocument9 pagesIndustry Overviewakj1992No ratings yet

- Yash Pakka Limited PDFDocument15 pagesYash Pakka Limited PDFFeku PappuNo ratings yet

- Paper Industry Full AnalysisDocument7 pagesPaper Industry Full Analysisvinay_814585077No ratings yet

- Overview of Paper IndustryDocument19 pagesOverview of Paper Industrygaurav100% (3)

- Sapm Cia-1: Industry Analysis of Paper IndustryDocument18 pagesSapm Cia-1: Industry Analysis of Paper IndustryCA Vishwas AgrawalNo ratings yet

- Third Assignment: Course Title: Business Enviorment Topic:-Pestle and Swot Analysis of Paper IndustryDocument20 pagesThird Assignment: Course Title: Business Enviorment Topic:-Pestle and Swot Analysis of Paper IndustryAwadh YadavNo ratings yet

- Objectives of The Study: To Know About The Various Departments in A Paper MillDocument44 pagesObjectives of The Study: To Know About The Various Departments in A Paper Millsoundar85100% (2)

- Final Project Report On Paper IndustryDocument26 pagesFinal Project Report On Paper IndustrySophia Ali100% (1)

- OW Textile EgyptDocument26 pagesOW Textile EgyptAyman Al Ansary100% (2)

- Paper Market BangladeshDocument2 pagesPaper Market BangladeshAbu Bin YousufNo ratings yet

- PapermakingDocument13 pagesPapermakingoyadieyeNo ratings yet

- Processed Wood Products Trade in EthiopiaDocument8 pagesProcessed Wood Products Trade in Ethiopiamenilik chanyalew NigatuNo ratings yet

- Paper Industry and Genus PapersDocument3 pagesPaper Industry and Genus PapersSumeet LudhwaniNo ratings yet

- Third Assignment: Course Title: Business Enviorment Topic-And Swot Analysis of Paper IndustryDocument31 pagesThird Assignment: Course Title: Business Enviorment Topic-And Swot Analysis of Paper IndustryRahul TargotraNo ratings yet

- Chapter-I: "Working Capital Management", The Mysore Paper Mills LTDDocument70 pagesChapter-I: "Working Capital Management", The Mysore Paper Mills LTDlmanjunath1005No ratings yet

- Conclution On Employee InvolvementDocument8 pagesConclution On Employee Involvementidumban_chandraNo ratings yet

- The Indian Paper Industry Has Been Historically Divided On A Three Dimensional Matrix Identified by SizeDocument21 pagesThe Indian Paper Industry Has Been Historically Divided On A Three Dimensional Matrix Identified by Sizedilip15043No ratings yet

- Paper Making ProcessDocument16 pagesPaper Making ProcessWinwin07No ratings yet

- Pulp and Paper Production in NigeriaDocument3 pagesPulp and Paper Production in NigeriaAdeyemi Odeneye0% (1)

- Could The Textile Industry Help Economy To GrowDocument10 pagesCould The Textile Industry Help Economy To GrowMostafa SarhanNo ratings yet

- Woven SacksDocument27 pagesWoven Sacksbig johnNo ratings yet

- Dissolving PulpDocument10 pagesDissolving PulpDuggirala Srinivas Murty100% (1)

- MathsDocument11 pagesMathsAAYUSHI VERMA 7ANo ratings yet

- Paper ProjectDocument10 pagesPaper ProjectPraveen PanthulaNo ratings yet

- New Microsoft Office Word DocumentDocument42 pagesNew Microsoft Office Word DocumentBushra FatimaNo ratings yet

- Nova Study FullDocument67 pagesNova Study Full007003sNo ratings yet

- History of Paper IndustriesDocument4 pagesHistory of Paper IndustriessivasuriyanNo ratings yet

- JTP Volume6 Issue2 Pages117-120Document5 pagesJTP Volume6 Issue2 Pages117-120tamrat lisanworkNo ratings yet

- Economic Conditions of Germany-PakistanDocument4 pagesEconomic Conditions of Germany-PakistanAyesha ChaudhryNo ratings yet

- Economic Conditions of Germany-PakistanDocument4 pagesEconomic Conditions of Germany-PakistanAyesha ChaudhryNo ratings yet

- Taj ReportDocument66 pagesTaj ReportAhsan AzamNo ratings yet

- Outlook On The Global Cement and Clinker TradeDocument7 pagesOutlook On The Global Cement and Clinker TradeOlena StanislavovnaNo ratings yet

- Business Geography PaperDocument22 pagesBusiness Geography PaperRahul KumarNo ratings yet

- Textile Machinery Manufacturer CompanyDocument20 pagesTextile Machinery Manufacturer CompanyKomol KabirNo ratings yet

- Ethiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019Document8 pagesEthiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019DemelashNo ratings yet

- India Market Snapshot Feb 2010-Nov 2010 Correction.d2a431d8Document2 pagesIndia Market Snapshot Feb 2010-Nov 2010 Correction.d2a431d8rascallaNo ratings yet

- Intrnational Business'Document32 pagesIntrnational Business'Ramandeep KaurNo ratings yet

- The Toilet Paper Industry: A Market Report OnDocument4 pagesThe Toilet Paper Industry: A Market Report OnthangtailieuNo ratings yet

- Leadership Challenge of JoseDocument16 pagesLeadership Challenge of Joserobbin91No ratings yet

- Major Research ReportDocument10 pagesMajor Research ReportShubham SinghNo ratings yet

- Global Value Chains:: Us & ChinaDocument25 pagesGlobal Value Chains:: Us & ChinaSef Ephan Salgado100% (1)

- World Trade in Apparel and TextileDocument19 pagesWorld Trade in Apparel and TextileTanuja TakNo ratings yet

- Casestudy - DPDocument15 pagesCasestudy - DPTushar ShahNo ratings yet

- Indian Paper Industry Needs The Following For Being Globally More CompetitiveDocument16 pagesIndian Paper Industry Needs The Following For Being Globally More CompetitivelintutonykNo ratings yet

- ReportDocument19 pagesReportyuvaraj sNo ratings yet

- Study On Markets and Price Situation of Natural Fibres (Germany and EU)Document3 pagesStudy On Markets and Price Situation of Natural Fibres (Germany and EU)007003sNo ratings yet

- Paper Import & Sales: From ThailandDocument10 pagesPaper Import & Sales: From ThailandPraveen PanthulaNo ratings yet

- ALEMANIA Germany Home TextilesDocument9 pagesALEMANIA Germany Home TextilesSandraNo ratings yet

- Paper Industry Thematic - Sunidhi111217 (27516)Document18 pagesPaper Industry Thematic - Sunidhi111217 (27516)anurag70No ratings yet

- Sustainable Textile and Fashion Value Chains: Drivers, Concepts, Theories and SolutionsFrom EverandSustainable Textile and Fashion Value Chains: Drivers, Concepts, Theories and SolutionsAndré MatthesNo ratings yet

- Cutting plastics pollution: Financial measures for a more circular value chainFrom EverandCutting plastics pollution: Financial measures for a more circular value chainNo ratings yet

- Cotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingFrom EverandCotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingHua WangNo ratings yet

- Fashion Exposure LTD Electrical Safety Inspection ReportDocument9 pagesFashion Exposure LTD Electrical Safety Inspection ReportYaser AkarNo ratings yet

- Fashion Exposure LTD Electrical Safety Inspection ReportDocument9 pagesFashion Exposure LTD Electrical Safety Inspection ReportYaser AkarNo ratings yet

- AUCommissioningMaster Plan030512Document64 pagesAUCommissioningMaster Plan030512Yaser AkarNo ratings yet

- Gambica Bs en 61439 Guide Ed2 2013Document47 pagesGambica Bs en 61439 Guide Ed2 2013Osama_Othman0150% (2)

- Landlords Guide To Electrical Safety May 2011 01Document52 pagesLandlords Guide To Electrical Safety May 2011 01Yaser AkarNo ratings yet

- Big Boss Corporation Ltd. Electrical Safety Inspection ReportDocument8 pagesBig Boss Corporation Ltd. Electrical Safety Inspection ReportYaser AkarNo ratings yet

- Nuaire Commercial Useful InfoDocument10 pagesNuaire Commercial Useful InfoYaser AkarNo ratings yet

- Estimating Plumbing, HVAC, and Electrical WorkDocument17 pagesEstimating Plumbing, HVAC, and Electrical WorknmahanguNo ratings yet

- Thermal Imaging For Enhancing Inspection Reliability: Detection and CharacterizationDocument29 pagesThermal Imaging For Enhancing Inspection Reliability: Detection and CharacterizationYaser AkarNo ratings yet

- AppendicesDocument25 pagesAppendicesYaser AkarNo ratings yet

- Testing and Commissioning Procedure For Plumbing and Drainage InstallationDocument76 pagesTesting and Commissioning Procedure For Plumbing and Drainage InstallationSean Chan100% (19)

- Vlasblom1 Introduction To Dredging EquipmentDocument27 pagesVlasblom1 Introduction To Dredging EquipmentJayasankar PillaiNo ratings yet

- PE Course PDFDocument4 pagesPE Course PDFkapilnandwanaNo ratings yet

- Installation Instructions For Fire Dampers: in Drywall Type Construction 1 Hour and 2 Hour RatedDocument4 pagesInstallation Instructions For Fire Dampers: in Drywall Type Construction 1 Hour and 2 Hour Ratedabidch143No ratings yet

- Balancing of A Water and Air SystemsDocument114 pagesBalancing of A Water and Air SystemselconhnNo ratings yet

- FE Application APRIL 2013Document2 pagesFE Application APRIL 2013Yaser AkarNo ratings yet

- 2980245C HVAC Handbook 2013 WebDocument35 pages2980245C HVAC Handbook 2013 WebomeshchemNo ratings yet

- Complex Form of Fourier SeriesDocument3 pagesComplex Form of Fourier Seriesvidya_sagar826No ratings yet

- Guidelines PE Exam APRIL 2013Document1 pageGuidelines PE Exam APRIL 2013Yaser AkarNo ratings yet

- PE Mec Thermal Oct 2008Document3 pagesPE Mec Thermal Oct 2008rlipanovichNo ratings yet

- FE MechanicalDocument5 pagesFE MechanicalMahmoud El NakeebNo ratings yet

- Comsol Multiphysics Solver Sequence and SettingsDocument26 pagesComsol Multiphysics Solver Sequence and SettingsYaser Akar100% (1)

- FE Exam Review - 2010-0310 - FE Exam QandADocument9 pagesFE Exam Review - 2010-0310 - FE Exam QandAYaser AkarNo ratings yet

- FE Review 1Document4 pagesFE Review 1Yaser AkarNo ratings yet

- Comsol Multiphysics Tips and TricksDocument11 pagesComsol Multiphysics Tips and TricksYaser AkarNo ratings yet

- Results and PostprocessingDocument5 pagesResults and PostprocessingYaser AkarNo ratings yet

- Never Fail Blade Chart: WoodworkingDocument1 pageNever Fail Blade Chart: WoodworkingAlen AnušićNo ratings yet

- Flowsheet Dan Block Diagram Pulp and Tissue: Nama: 1. Bayu Wisnu Buana Putra (M1B116001) 2. MUHAMMAD ASWARI (M1B116019)Document4 pagesFlowsheet Dan Block Diagram Pulp and Tissue: Nama: 1. Bayu Wisnu Buana Putra (M1B116001) 2. MUHAMMAD ASWARI (M1B116019)Bayu Wisnu Buana PutraNo ratings yet

- Case Study Wood Inventory Management in Paper IndustryDocument5 pagesCase Study Wood Inventory Management in Paper IndustryIvan LajaraNo ratings yet

- List of Paper SizesDocument5 pagesList of Paper SizesHiren GajjarNo ratings yet

- IndexDocument25 pagesIndexMatt OwenNo ratings yet

- Calendering in Paper IndustryDocument2 pagesCalendering in Paper IndustryLOKESHWARAN K CHEM-UG- 2017 BATCHNo ratings yet

- Leather Binding A Paperback: A New and Improved Guide: Technology Workshop Craft Home Food Play Outside CostumesDocument14 pagesLeather Binding A Paperback: A New and Improved Guide: Technology Workshop Craft Home Food Play Outside Costumesmark_schwartz_41No ratings yet

- Katalog Techno VeneerDocument24 pagesKatalog Techno VeneerMarina JocicNo ratings yet

- APP Operations Fact SheetDocument2 pagesAPP Operations Fact SheetAsia Pulp and PaperNo ratings yet

- Sand Box With BuiltDocument3 pagesSand Box With BuiltPamfil Raluca ElenaNo ratings yet

- Paper MakingDocument1 pagePaper MakingBurak KucukkelesNo ratings yet

- List of MillsDocument342 pagesList of MillsKrishan KakkarNo ratings yet

- 97 Flow ChatDocument6 pages97 Flow ChatKirankumar NakirikantiNo ratings yet

- Particle - MDHMR - MDF Board: ToughDocument16 pagesParticle - MDHMR - MDF Board: ToughDeepu VijayanNo ratings yet

- Ensis Papro INDUSTRY Seminar Pulp Fibers For The Future Presented by DR Paul KibblewhiteDocument25 pagesEnsis Papro INDUSTRY Seminar Pulp Fibers For The Future Presented by DR Paul KibblewhiteNadeem AslamNo ratings yet

- Paper HistoryDocument10 pagesPaper HistoryPhen ApathyNo ratings yet

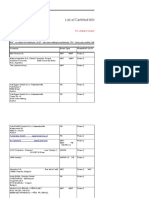

- 4810 Impot SampleDocument15 pages4810 Impot SampleTrade Info SolutionsNo ratings yet

- Fine Wood Trading LLCDocument1 pageFine Wood Trading LLCNisar DeenNo ratings yet

- Presentation 6 WOOD DEFECTSDocument19 pagesPresentation 6 WOOD DEFECTSJohn ProtoctisNo ratings yet

- Beco Catalouge New Single Pages-NewDocument10 pagesBeco Catalouge New Single Pages-NewAkshay VarmaNo ratings yet

- 06 CWBN Paper Machine ProjectDocument10 pages06 CWBN Paper Machine ProjectPramod HegdeNo ratings yet

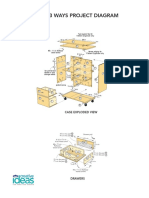

- 1 Cart 3 Ways Project Diagram: Case Exploded ViewDocument3 pages1 Cart 3 Ways Project Diagram: Case Exploded Viewpavel1425No ratings yet

- Paper MakingDocument2 pagesPaper Makinghappy meNo ratings yet

- OSB vs. Plywood: What Are They, and How Are They Made?Document4 pagesOSB vs. Plywood: What Are They, and How Are They Made?hviviani451No ratings yet

- Works: All Types ofDocument65 pagesWorks: All Types ofAzahar Uddin MallickNo ratings yet

- FGHFGHFGHFGHDocument1 pageFGHFGHFGHFGHKristina KolodeevaNo ratings yet

- Karakteristik Kimia Biomassa Untuk Energi (Chemical Characteristics of Biomass For Energy)Document8 pagesKarakteristik Kimia Biomassa Untuk Energi (Chemical Characteristics of Biomass For Energy)Yusuf UtgNo ratings yet

- Alpine Plywoods PDFDocument2 pagesAlpine Plywoods PDFMd FaisalNo ratings yet