Professional Documents

Culture Documents

Bache V Ruiz - Digest

Uploaded by

Richel DeanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bache V Ruiz - Digest

Uploaded by

Richel DeanCopyright:

Available Formats

Bache v Ruiz Facts: Commissioner of Internal Revenue Vera wrote a letter to Judge Ruiz requesting the issuance of a search

warrant for the violation of Section 46 (a) of the National Revenue Code in relation with Sections 53, 72, 73, 208 and 209 and for Judge Ruiz to authorize Examiner De Leon to male and file the application for search warrant which was attached to the same letter. Three days after, De Leo and his witness Logronio went to Judge Ruizs CFI bringing the letter-request, the application for the search warrant prepared by him *unsigned+, Logronios affidavit subscribed defore De Leon, a deposition by Logronio [printed and signed but not subscribed] and a search warrant accomplished but yet unsigned by Judge Ruiz. At the time they [De Leon and Logronio] were at the court, Judge Ruiz was conducting a hearing in his sala and so he [Ruiz] instructed his Deputy Clerk of Court to take the depositions of De Leon and Logronio, after which [hearing done] Judge Ruiz along with Deputy Clerk Gonzales, stenographer Gaspar, De Leon and Logronio went inside the chamber where Judge Ruiz requested for the Gaspar [stenographer] to read to him her stenographic notes [deposition]. After that Judge Ruiz then had De Leon and Logronio swear an oath and warned them that should statements be false and without legal basis they would be charged with perjury. Judge Ruiz then signed De Leons application for Search Warrant and Logronios deposition, Search Warrant No. 2-M-70 was issued. Petitioners filed for MTQ, preliminary and prohibitory Writs of Injunction to be issued, for the SW to be declared null and void and for respondents to pay for damages and attorneys fees. Respondent filed an answer and the motion was dismissed. While the case was ongoing, BIR made tax assessments based or partly based on the documents seized during the search. Issues: 1) 2) 3) 4) Ruling: I Judge Ruiz failed to personally examine the complainant and his witness [Art. III, Sec. 1 of 1987 Constitution and Rule 126, Sec. 3 and 4 of ROC ] Section 4, Rule 126 of ROC requires that the judge himself personally examine the complainant and his witness to determine the existence of probable cause. There was no examination done in the present case, while it is true that the application for SW and Logronios deposition were subscribed before the judge, there were no questions asked to which could possibly be the basis in determining whether or not there was probable cause.

W/N Judge Ruiz sufficiently determined if there was probable cause before issuing the Search Warrant. W/N the Search Warrant was valid for covering more than one offense. W/N the Search Warrant is general in nature. W/N the corporation is entitled to protection against unreasonable search and seizures.

II The SW was for at least 4 distinct offenses under the Tax Code: 1st violation Sec. 46 (a), Sec. 72 and 73 provided for the filing of ITR which are interrelated; 2nd violation Sec. 53 for withholding of income taxes at source; 3rd violation Sec. 208 for unlawful pursuit of business or occupation; 4th violation Sec. 209 for failure to make a return of receipts, sales, business or gross value of output actually removed or to pay tax due. Stonehill v Diokno is not applicable to the case, respondents contend since at the time, the Search Warrant was issued for violation of Central Bank Laws, Internal Revenue (Code) and Revised Penal Code; whereas, here Search Warrant No 2-M-70 was issued for violation of only one code. This is not true since it [Stonehill v Diokno] it was ruled that no search warrant shall issue for more than one specific offense. III The search warrant does not particularly describe the things to be seized. In Stonehill v Diokno where the warrants sanctioned the seizure of all records of the petitioners and the aforementioned corporations, whatever their nature, thus openly contravening the explicit command of our Bill of Rights that the things to be seized be particularly described as well as tending to defeat its major objective: the elimination of general warrants. In Uy Kheytin, et.al. v Villareal, it was established that the purpose and intent of the requiring that a search warrant describe the place to be searched and the things to be seized is to limit the things to be seized and only those particularly described in the SW so as unreasonable searches and seizures may not be made. Tests for SW: - A search warrant may be said to particularly describe the things to be seized when the description therein is as specific as the circumstances will ordinarily allow (People vs. Rubio; 57 Phil. 384); - or when the description expresses a conclusion of fact not of law by which the warrant officer may be guided in making the search and seizure (idem., dissent of Abad Santos, J.,) - or when the things described are limited to those which bear direct relation to the offense for which the warrant is being issued (Sec. 2, Rule 126, Revised Rules of Court) IV A corporation is, after all, but an association of individuals under an assumed name and with a distinct legal entity. In organizing itself as a collective body it waives no constitutional immunities appropriate to such body. Its property cannot be taken without compensation. It can only be proceeded against by due process of law, and is protected, under the 14th Amendment, against unlawful discrimination . . . (Hale v. Henkel, 201 U.S. 43, 50 L. ed. 652.)

Separate Opinion by Justice Barredo: side note.

This could be an instance wherein taxes properly due the State will probably remain unassessed and unpaid only because the ones in charge of the execution of the laws did not know how to respect basic constitutional rights and liberties.

Notes: Art. III, Sec. 1, Constitution The right of the people to be secure in their persons, houses, papers and effects against unreasonable searches andseizures shall not be violated, and no warrants shall issue but upon probable cause, to be determined by the judge after examination under oath or affirmation of the complainant and the witnesses he may produce, and particularly describing the place to be searched, and the persons or things to be seized. Rule 126, Sec. 3,Rules of Court Personal Property to be Seized A search warrant may be issued for the search and seizure of personal property: a) Subject of the offense; b) Stolen or embezzled and other proceeds, or fruits of the offense; c) Used or intended to be used as the means of committing an offense. Rule 126, Sec. 4, Rules of Court Requisites for issuing search warrant A search warrant shall not issue except upon probable cause in connection with one specific offense to be determined personally by the judge after examination under oath or affirmation of the complainant and the witnesses he may produce, and particularly describing the place to be searched and the things to be seized which may be anywhere in the Philippines. NIRC at the time [sorry guys, couldnt find the Tax Code used in 1971] Sec. 46(a) requires the filing of income tax returns by corporations. Sec. 53 requires the withholding of income taxes at source. Sec. 72 imposes surcharges for failure to render income tax returns and for rendering false and fraudulent returns. Sec. 73 provides the penalty for failure to pay the income tax, to make a return or to supply the information required under the Tax Code. Sec. 208 penalizes *any person who distills, rectifies, repacks, compounds, or manufactures any article subject to a specific tax, without having paid the privilege tax therefore, or who aids or abets in the conduct of illicit distilling, rectifying, compounding, or illicit manufacture of any article subject to specific tax . . ., and provides that in the case of a corporation, partnership, or association, the official and/or employee who caused the violation shall be responsible. Sec. 209 penalizes the failure to make a return of receipts, sales, business, or gross value of output removed, or to pay the tax due thereon.

You might also like

- Bache & Co (1971)Document20 pagesBache & Co (1971)delayinggratificationNo ratings yet

- FACTS: Rodolfo Arañas and Agustin O. Caseñas Filed With The Court of First Instance ofDocument2 pagesFACTS: Rodolfo Arañas and Agustin O. Caseñas Filed With The Court of First Instance oflinlin_17No ratings yet

- LRC Jurisdiction in Land Registration CasesDocument20 pagesLRC Jurisdiction in Land Registration CasespiptipaybNo ratings yet

- RTC Jurisdiction Over Concubinage CaseDocument1 pageRTC Jurisdiction Over Concubinage CaseCamella AgatepNo ratings yet

- Celestino Balus vs. Saturnino BalusDocument3 pagesCelestino Balus vs. Saturnino BalusDiosa Mae SarillosaNo ratings yet

- Nicolas Lizares V. Rosendo HernaezDocument20 pagesNicolas Lizares V. Rosendo HernaezGraceNo ratings yet

- Lorenzana vs. CayetanoDocument1 pageLorenzana vs. CayetanoRommel Mancenido LagumenNo ratings yet

- 212 - Chan v. AbayaDocument2 pages212 - Chan v. Abayaanon_614984256No ratings yet

- Case Digest - Ortigas and Co. Vs CADocument1 pageCase Digest - Ortigas and Co. Vs CAFrancise Mae Montilla MordenoNo ratings yet

- CIVPRO Digests (3rd Batch) - Atty. FamadorDocument8 pagesCIVPRO Digests (3rd Batch) - Atty. FamadorJon Joshua FalconeNo ratings yet

- Ho Vs PeopleDocument3 pagesHo Vs Peoplemaricar bernardinoNo ratings yet

- Courts in Philippines have jurisdiction over divorce casesDocument5 pagesCourts in Philippines have jurisdiction over divorce casesMargeNo ratings yet

- SEC Rules Allow Certiorari Against Interlocutory OrdersDocument2 pagesSEC Rules Allow Certiorari Against Interlocutory OrdersGi NoNo ratings yet

- Digest 0302Document11 pagesDigest 0302Nat HernandezNo ratings yet

- 4 Waterousdrugcorporation Vs NLRCDocument1 page4 Waterousdrugcorporation Vs NLRCKP DAVAO CITYNo ratings yet

- Reaction Paper On Chapter 13 - Articles On The Legal ProfessionDocument5 pagesReaction Paper On Chapter 13 - Articles On The Legal ProfessionEloisa SalitreroNo ratings yet

- Macasaet v. Co, Jr. (Jurisdiction Over The Res)Document1 pageMacasaet v. Co, Jr. (Jurisdiction Over The Res)Danielle DacuanNo ratings yet

- Action barred by prescription and lachesDocument2 pagesAction barred by prescription and lachesMark Jason Crece AnteNo ratings yet

- Belen Vs CADocument1 pageBelen Vs CAKatrina BudlongNo ratings yet

- Annotation The Attorney in Court PracticeDocument10 pagesAnnotation The Attorney in Court PracticeKrisia OrenseNo ratings yet

- Republic V de KnechtDocument1 pageRepublic V de KnechtRon Jacob AlmaizNo ratings yet

- DOLE suspension of recruitment of Filipino helpers to Hong KongDocument1 pageDOLE suspension of recruitment of Filipino helpers to Hong KongCheyz ErNo ratings yet

- Balacuit Vs CFIDocument1 pageBalacuit Vs CFIJessie Albert CatapangNo ratings yet

- 31 Manila Railroad Co V VelasquezDocument34 pages31 Manila Railroad Co V VelasquezCharles RiveraNo ratings yet

- Wildlife Act PowerpointDocument49 pagesWildlife Act PowerpointJuris Poet100% (1)

- OCA v. Flores, 585 SCRA 82Document4 pagesOCA v. Flores, 585 SCRA 82JAN BEULAH GATDULANo ratings yet

- Jose Baritua and CADocument2 pagesJose Baritua and CAArgel Joseph CosmeNo ratings yet

- Meaning of Life, Liberty and PropertyDocument1 pageMeaning of Life, Liberty and PropertyHello123No ratings yet

- CIVPRO Digests (2nd Batch) - Atty. FamadorDocument9 pagesCIVPRO Digests (2nd Batch) - Atty. FamadorJon Joshua FalconeNo ratings yet

- 118 Burgos v. Chief of Staff G.R. No. L-64261 December 26, 1984Document2 pages118 Burgos v. Chief of Staff G.R. No. L-64261 December 26, 1984Enid SevilleNo ratings yet

- People V Rolly EspejonDocument5 pagesPeople V Rolly EspejonLizzette Dela PenaNo ratings yet

- Validity of search warrant and arrest of club manager for gamblingDocument1 pageValidity of search warrant and arrest of club manager for gamblingLloyd David P. VicedoNo ratings yet

- Chavez v. PCGGDocument2 pagesChavez v. PCGGChristine Joy PamaNo ratings yet

- AGENCY - Modes of Extinguishment of Agency - BADRON, Mohammad NurDocument2 pagesAGENCY - Modes of Extinguishment of Agency - BADRON, Mohammad NurgongsilogNo ratings yet

- Republic of The Philippines vs. Zenaida Guinto-AldanaDocument1 pageRepublic of The Philippines vs. Zenaida Guinto-AldanaKim Jan Navata BatecanNo ratings yet

- Constitutional Law TestsDocument11 pagesConstitutional Law TestsJenNo ratings yet

- Bicerra vs. TenezaDocument1 pageBicerra vs. TenezaLorenzo HammerNo ratings yet

- Robinson v. Miralles, 510 SCRA 678 G.R. No. 163584 December 12, 2006Document2 pagesRobinson v. Miralles, 510 SCRA 678 G.R. No. 163584 December 12, 2006Caleb Josh PacanaNo ratings yet

- Sandiganbayan upholds hold departure order vs graft accusedDocument1 pageSandiganbayan upholds hold departure order vs graft accusedJimNo ratings yet

- Santos Evangelista v. Alto SuretyDocument3 pagesSantos Evangelista v. Alto SuretybearzhugNo ratings yet

- Director of Lands V CADocument3 pagesDirector of Lands V CAMicah Clark-MalinaoNo ratings yet

- Ynot vs. Iac 148 Scra 659Document1 pageYnot vs. Iac 148 Scra 659Georgette V. SalinasNo ratings yet

- Consti2Digest - Mirasol Vs CA, 351 SCRA 44, G.R. No. 128448 (1 Feb 2001)Document2 pagesConsti2Digest - Mirasol Vs CA, 351 SCRA 44, G.R. No. 128448 (1 Feb 2001)Lu CasNo ratings yet

- Supreme Court rules on illegal recruitment and right of confrontationDocument13 pagesSupreme Court rules on illegal recruitment and right of confrontationJeng PionNo ratings yet

- PEOPLE V LAPITAJE Case DigestDocument1 pagePEOPLE V LAPITAJE Case DigestStef BernardoNo ratings yet

- Abadia v. CA, 236 SCRA 676Document1 pageAbadia v. CA, 236 SCRA 676Ron Jacob AlmaizNo ratings yet

- 4 Tsai v. CADocument2 pages4 Tsai v. CAStephanie SerapioNo ratings yet

- Letter For Associate Justice PunoDocument10 pagesLetter For Associate Justice PunoKennethQueRaymundoNo ratings yet

- San Miguel Village School Vs PundogarDocument5 pagesSan Miguel Village School Vs PundogarNicoleAngeliqueNo ratings yet

- Salaw Vs NLRCDocument2 pagesSalaw Vs NLRCZniv SavsNo ratings yet

- Prado v People (1984): Prejudicial question suspends bigamy trialDocument2 pagesPrado v People (1984): Prejudicial question suspends bigamy trialJor LonzagaNo ratings yet

- Ang Tibay vs. CIR DigestDocument1 pageAng Tibay vs. CIR DigestMagdalena TabaniagNo ratings yet

- Filiation Case Dismissed Due to Failure to Implead Indispensable PartyDocument2 pagesFiliation Case Dismissed Due to Failure to Implead Indispensable PartyChanel GarciaNo ratings yet

- Us Vs ToribioDocument3 pagesUs Vs ToribioMaria ThereseNo ratings yet

- CIVPRO Batch 10 Digests CompleteDocument12 pagesCIVPRO Batch 10 Digests CompleteVic Rabaya100% (1)

- LLDA Charter Prevails Over Local Government Code for Laguna LakeDocument2 pagesLLDA Charter Prevails Over Local Government Code for Laguna LakeHazel LomonsodNo ratings yet

- (PART2) Case # 15 Borlongan Jr. Vs PeñaDocument2 pages(PART2) Case # 15 Borlongan Jr. Vs PeñaClaire RoxasNo ratings yet

- Bill of Attainder-Ex Post Facto LawDocument4 pagesBill of Attainder-Ex Post Facto LawMeriem Grace RiveraNo ratings yet

- Bache CO Phil Inc. and Frederick Seggerman vs. Hon Judge Vivencio M. Ruiz Misael P. Rivera Comm of Internal RevenueDocument3 pagesBache CO Phil Inc. and Frederick Seggerman vs. Hon Judge Vivencio M. Ruiz Misael P. Rivera Comm of Internal RevenueRonald Alasa-as AtigNo ratings yet

- Bache & Co. vs. Ruiz - G.R. No. L-32409Document2 pagesBache & Co. vs. Ruiz - G.R. No. L-32409Nina SNo ratings yet

- De Leon Esguerra Javellana Exec - Sec. Magallona Ermita ProvNorthCot GRPDocument8 pagesDe Leon Esguerra Javellana Exec - Sec. Magallona Ermita ProvNorthCot GRPRichel DeanNo ratings yet

- Globe Mackay V CADocument2 pagesGlobe Mackay V CARichel DeanNo ratings yet

- Chavez V PeaDocument1 pageChavez V PeaRichel DeanNo ratings yet

- Rule 120 JudgmentDocument57 pagesRule 120 JudgmentRichel DeanNo ratings yet

- IPL - Bayanihan Music V BMG Records and Jose Mari ChanDocument2 pagesIPL - Bayanihan Music V BMG Records and Jose Mari ChanRichel Dean100% (3)

- Tanjanco V CADocument1 pageTanjanco V CARichel DeanNo ratings yet

- Development Bank of The Philippines V ROD of Nueva EcijaDocument2 pagesDevelopment Bank of The Philippines V ROD of Nueva EcijaRichel DeanNo ratings yet

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahNo ratings yet

- Taxation Law Q&A 1994-2006 PDFDocument73 pagesTaxation Law Q&A 1994-2006 PDFClark LimNo ratings yet

- Calatagan Golf Club V ClementeDocument1 pageCalatagan Golf Club V ClementeRichel Dean100% (1)

- RP V LacapDocument2 pagesRP V LacapRichel DeanNo ratings yet

- Notes - Intro To Stat ConDocument15 pagesNotes - Intro To Stat ConRichel DeanNo ratings yet

- Pp v Lol-lo and Saraw: Moros Charged with Piracy for Attacking Dutch BoatDocument1 pagePp v Lol-lo and Saraw: Moros Charged with Piracy for Attacking Dutch BoatRichel DeanNo ratings yet

- Buenaventura V CADocument2 pagesBuenaventura V CARichel DeanNo ratings yet

- DBP V DOYONDocument2 pagesDBP V DOYONRichel Dean100% (1)

- Cebu Country Club, Inc. V ElizagaqueDocument2 pagesCebu Country Club, Inc. V ElizagaqueRichel DeanNo ratings yet

- PH Court Reviews Plea of Guilty, Self-Defense in Murder CaseDocument4 pagesPH Court Reviews Plea of Guilty, Self-Defense in Murder CaseRichel DeanNo ratings yet

- Uypitching V QuiamcoDocument2 pagesUypitching V QuiamcoRichel DeanNo ratings yet

- Brillantes Vs Concepcion - DigestDocument1 pageBrillantes Vs Concepcion - DigestRichel DeanNo ratings yet

- People of The Philippines Crim. Case No. Tcs-6387 - Versus-Guilmar Cacho Alias "Willy", Stephen Chong, Jackylene Colot and "Kona" Doe. FactsDocument1 pagePeople of The Philippines Crim. Case No. Tcs-6387 - Versus-Guilmar Cacho Alias "Willy", Stephen Chong, Jackylene Colot and "Kona" Doe. FactsRichel DeanNo ratings yet

- People Vs AtienzaDocument1 pagePeople Vs AtienzaRichel DeanNo ratings yet

- People Vs TerribleDocument1 pagePeople Vs TerribleRichel DeanNo ratings yet

- People Vs LabadoDocument1 pagePeople Vs LabadoRichel DeanNo ratings yet

- IPRA and The Regalian DoctrineDocument4 pagesIPRA and The Regalian DoctrineRichel Dean100% (1)

- Lao Gi Vs CADocument2 pagesLao Gi Vs CARichel DeanNo ratings yet

- PP V AragonDocument1 pagePP V AragonRichel DeanNo ratings yet

- DLSU Vs CADocument2 pagesDLSU Vs CARichel DeanNo ratings yet

- Yao Vs People - DigestDocument4 pagesYao Vs People - DigestRichel Dean100% (1)

- Mendoza Vs COMELEC and PagdangananDocument2 pagesMendoza Vs COMELEC and PagdangananRichel DeanNo ratings yet

- Reinstatement and back wages for illegally dismissed Tourism employeesDocument1 pageReinstatement and back wages for illegally dismissed Tourism employeesRichel DeanNo ratings yet

- CA-G.R. SP Nos. 70014 and 104604 DECISIONDocument68 pagesCA-G.R. SP Nos. 70014 and 104604 DECISIONBLP Cooperative90% (20)

- Position Paper Example ALSA Internal Model United Nations 2019Document3 pagesPosition Paper Example ALSA Internal Model United Nations 2019Sasha Brilliani Trison100% (1)

- Aratuc Vs ComelecDocument19 pagesAratuc Vs ComelecKyle JamiliNo ratings yet

- Manila Electric Co. v Remoquillo rules negligence proximate cause deathDocument2 pagesManila Electric Co. v Remoquillo rules negligence proximate cause deathMav EstebanNo ratings yet

- Comparative Law On TortsDocument1 pageComparative Law On TortsDhiyaNo ratings yet

- TMP 1679 12-16-2022 12001Document4 pagesTMP 1679 12-16-2022 12001FeNo ratings yet

- United States v. Legarda, 17 F.3d 496, 1st Cir. (1994)Document9 pagesUnited States v. Legarda, 17 F.3d 496, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Motion For Judicial NoticeDocument2 pagesMotion For Judicial NoticeRoger nocomNo ratings yet

- Business Essentials: Entrepreneurship, New Ventures, and Business OwnershipDocument45 pagesBusiness Essentials: Entrepreneurship, New Ventures, and Business OwnershipAhmad MqdadNo ratings yet

- SPiT Baniqued Cases March 14Document41 pagesSPiT Baniqued Cases March 14Charles David IcasianoNo ratings yet

- Renato San Juan Comment and Opposition To Formal Offer of EvidenceDocument4 pagesRenato San Juan Comment and Opposition To Formal Offer of EvidenceSharrah San Miguel100% (1)

- Sppulaw Question BankDocument82 pagesSppulaw Question Banksony dakshuNo ratings yet

- NEPA: Understanding the National Environmental Policy ActDocument21 pagesNEPA: Understanding the National Environmental Policy ActRiddhi DhumalNo ratings yet

- A List of The Rights Protected in The Jamaican ConstitutionDocument2 pagesA List of The Rights Protected in The Jamaican Constitutionkay kayNo ratings yet

- Hadley v Baxendale: Consequential Damages in Contract LawDocument6 pagesHadley v Baxendale: Consequential Damages in Contract LawAyushi GuptaNo ratings yet

- Kedudukan Hukum Hipotek Kapal Laut Dalam Hukum Jaminan Dan Penetapan Hipotek Kapal Laut Sebagai Jaminan Perikatan Syukri Hidayatullah, S.H., M.HDocument7 pagesKedudukan Hukum Hipotek Kapal Laut Dalam Hukum Jaminan Dan Penetapan Hipotek Kapal Laut Sebagai Jaminan Perikatan Syukri Hidayatullah, S.H., M.HDani PraswanaNo ratings yet

- Building A Criminal Case in The PhilippinesDocument2 pagesBuilding A Criminal Case in The PhilippinesBryan LodiviceNo ratings yet

- Brockton Police Log March 18Document20 pagesBrockton Police Log March 18BBNo ratings yet

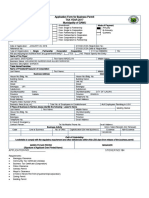

- Application Form For Business Permit Tax Year 2017 Municipality of GAMUDocument1 pageApplication Form For Business Permit Tax Year 2017 Municipality of GAMUGamu DILGNo ratings yet

- 365 Final Case PDFDocument5 pages365 Final Case PDFBrettNo ratings yet

- Forensic AuditorDocument10 pagesForensic Auditordelhi delhiNo ratings yet

- Opinion Notice of GarnishmentDocument3 pagesOpinion Notice of GarnishmentGil Arvin C. ArandiaNo ratings yet

- Baby Delight v. Clute - ComplaintDocument16 pagesBaby Delight v. Clute - ComplaintSarah BursteinNo ratings yet

- University of The Cordilleras, Pama, Basaen, & Janeo Vs LacanariaDocument29 pagesUniversity of The Cordilleras, Pama, Basaen, & Janeo Vs LacanariaRudnar Jay Bañares BarbaraNo ratings yet

- Training DataDocument17 pagesTraining DataMURALIDAR R RNo ratings yet

- Affidavit Notice Beneficiary TrustDocument2 pagesAffidavit Notice Beneficiary TrustMichael Flynn100% (7)

- Legal Research On The Imprescriptibility of The Torrens TitleDocument2 pagesLegal Research On The Imprescriptibility of The Torrens Titlenoorlaw0% (1)

- Dissolution of FirmDocument20 pagesDissolution of FirmDeborah100% (2)

- The Natural Law Trust Ebook 11 - 14 - 2020Document83 pagesThe Natural Law Trust Ebook 11 - 14 - 2020Annette Mulkay100% (3)

- #8 Tapay V Bancolo 2013Document2 pages#8 Tapay V Bancolo 2013robynneklopezNo ratings yet