Professional Documents

Culture Documents

Rapid American Weiner Declaration On Corporate History As Related To Asbestos

Uploaded by

Kirk HartleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rapid American Weiner Declaration On Corporate History As Related To Asbestos

Uploaded by

Kirk HartleyCopyright:

Available Formats

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 1 of 17

Main Document

REED SMITH LLP Chrystal A. Puleo, Esq. 599 Lexington Avenue, 22nd Floor New York NY 10022 Telephone: (212) 521 5400 Facsimile: (212) 521 5450 cpuleo@reedsmith.com Paul M. Singer, Esq. 225 Fifth Avenue Pittsburgh PA 15222 Telephone: (412) 288 3131 Facsimile: (412) 288 3063 psinger@reedsmith.com Proposed Attorneys for the Debtor and Debtor-in-Possession UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ----------------------------------------------------------------In re: RAPID-AMERICAN CORPORATION, Debtor. ----------------------------------------------------------------x : Chapter 11 : Case No. 13-______ (___) : : : : x

DECLARATION OF PAUL WEINER PURSUANT TO RULE 1007-2 OF THE LOCAL RULES FOR THE SOUTHERN DISTRICT OF NEW YORK IN SUPPORT OF CHAPTER 11 PETITION AND FIRST DAY PLEADINGS Pursuant to 28 U.S.C. 1746, under penalty of perjury, I, Paul Weiner, declare as follows: 1. I am a Director, Vice President, Secretary, and Treasurer of Rapid-

American Corporation (Rapid or Debtor). I have been in the employ of Rapid since 1975, and have been the officer of the company involved with the asbestos litigation confronting Rapid since in or about 1985. Based upon my personal knowledge, my responsibilities as Vice

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 2 of 17

Main Document

President of Rapid, and my review of Rapids business and corporate records, I am familiar with the facts set forth in this declaration. 2. I am authorized to submit this declaration in support of Rapids petition

for relief under chapter 11, title 11 of the United States Code (the Bankruptcy Code), filed as of the date hereof (the Commencement Date). 3. I submit this declaration pursuant to Rule 1007-2 of the Local Bankruptcy

Rules for the Southern District of New York (the Local Rules) in support of Rapids petition and request for relief in the form of motions and applications (collectively, the First Day Pleadings), as well as to assist the Court and other interested parties in understanding the circumstances leading up to the commencement of this chapter 11 case. 4. Except as otherwise indicated, the facts set forth in this declaration are

based on my personal knowledge, my review of relevant documents, and information supplied by others, including Rapids national co-ordinating counsel for asbestos litigation, SNR Denton US LLP. Any opinions contained herein are based upon my personal experience, knowledge, and information concerning Rapid and its handling of the asbestos bodily injury claims pending against it. If called upon to testify, I will testify completely to the facts set forth in this declaration. 5. This declaration is intended to provide a summary overview of Rapids

history and business, including the circumstances leading to the chapter 11 filing, and intended restructuring. 6. Part I of the declaration provides background on Rapids corporate history

and business, particularly as it relates to its asbestos liabilities, and summarizes the circumstances leading to the commencement of this chapter 11 case. Part II sets forth the

-2-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 3 of 17

Main Document

relevant facts in support of the First Day Pleadings, and Part III sets forth information required by Local Rule 1007-2 to the extent not addressed in Parts I and II. I. A. THE DEBTOR 7. Rapid, which was formerly a holding company with subsidiaries primarily HISTORY OF DEBTOR AND REASONS FOR FILING

engaged in retail sales and consumer products, was never engaged in an asbestos business of any kind. Through a series of merger transactions going back more than 45 years, Rapid has nevertheless incurred successor liability for personal injury claims arising from plaintiffs exposure to asbestos-containing products sold by The Philip Carey Manufacturing Company as that entity existed prior to June 1, 1967 (sometimes referred to as Old Carey). The corporate history of Rapid and how it came to have successor liability for Old Carey is set forth below: (a) Old Carey, which was formed in Ohio in 1888, manufactured and sold building products, a number of which contained asbestos. On June 1, 1967, a merger occurred pursuant to which Old Carey merged into Glen Alden Corporation (Glen Alden). Prior to that date, an Ohio corporation named P.C. Company, Inc. was incorporated, all of whose shares were issued to Glen Alden. In April 1967, P.C. Company, Inc. changed its name to XPRU Corporation. Until June 1, 1967, that Ohio corporation did not engage in any business. On June 1, 1967, concurrent with the merger between Glen Alden and Old Carey, the entire business of Old Carey was transferred to XPRU Corporation, which changed its name to the Philip Carey Manufacturing Company (New Carey). This transfer was carried out by means of an agreement called General Assignment and Assumption of Liabilities. Pursuant to the General Assignment and Assumption of Liabilities, concurrent with the merger of Old Carey into Glen Alden: (i) Glen Alden transferred the entire business, assets, property, and rights that had been Old Carey to New Carey; (ii) New Carey assumed all of the liabilities of Old Carey to which Glen Alden became subject as a result of the June 1, 1967 merger; and (iii) New Carey agreed to indemnify Glen Alden and agreed to save it harmless from all such liabilities. From and after June 1, 1967, the business of Old Carey was continued by New Carey and not by Glen Alden. Glen Alden itself did not engage in any asbestos business before or after the June 1, 1967 merger.

(b)

(c)

-3-

13-10687-smb

Doc 3

Filed 03/08/13

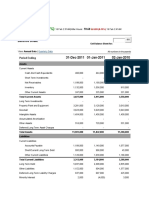

Entered 03/08/13 10:21:37 Pg 4 of 17

Main Document

(d)

New Careys corporate history subsequent to June 1, 1967 is as follows: (1) On April 9, 1970, New Carey (which in February 1968 had changed its name to Philip Carey Corporation) merged into Briggs Manufacturing Company, a Michigan corporation, which had never engaged in an asbestos business and which was primarily a manufacturer of vitreous china fixtures. The survivor of that merger simultaneously changed its name to Panacon Corporation (Panacon). Panacon was a public company whose shares were traded on the Mid-West Stock Exchange. From April 9, 1970 to April 17, 1972, Glen Alden owned a majority of Panacons shares. On April 17, 1972, Glen Alden sold its stock in Panacon to The Celotex Corporation (Celotex), a Delaware corporation that was not -- and has never been -- related to Glen Alden or to Rapid. On June 30, 1972, Panacon (then a subsidiary of Celotex) merged into Celotex. By its merger with Panacon, Celotex acquired all of New Careys liabilities including its assumption of Old Careys liabilities and the obligation to indemnify and save harmless Glen Alden from all liabilities of Old Carey.

(2)

(e)

Rapids relationship with Glen Alden and subsequent corporate history is as follows: (1) On November 3, 1972, some six months after Glen Alden ceased to have any stock interest in Panacon, Rapid-American Corporation, an Ohio corporation, which was not anywhere engaged in an asbestos business, merged with and into Glen Alden. The survivor of the merger, Glen Alden, changed its name to Rapid-American Corporation, a Delaware corporation. On January 31, 1981, Rapid-American Corporation merged with and into Kenton Corporation and R-K Holding Corp., Delaware corporations, which were not anywhere engaged in an asbestos business, and the survivor of that merger, Kenton, changed its name to Rapid-American Corporation, the present day Rapid.

(2)

B.

HISTORY OF ASBESTOS LITIGATION AGAINST RAPID (i) 8. Overview Rapid was sued for the first time in an asbestos-related action in

November 1974. During the early 1980s, the number of asbestos claims filed against Rapid increased, but Rapid was successful in obtaining dismissals in most of those cases due, in part, to

-4-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 5 of 17

Main Document

plaintiffs counsels pursuit of Celotex which, as noted in paragraph 7(d)(2) above, was also liable for asbestos claims of Old Carey. During the mid-1980s to late 1990, Rapid was

indemnified by Celotex, and the number of asbestos claims asserted against Rapid declined. 9. In October 1990, Celotex filed a voluntary petition for relief under chapter

11 of the Bankruptcy Code in the United States Bankruptcy Court for the Middle District of Florida. At the time Celotex filed for bankruptcy, Rapid had fewer than 40 asbestos personal injury claims pending against it. 10. After Celotexs 1990 bankruptcy filing, a significant number of asbestos

claims stemming from products of Old Carey were asserted against Rapid. The rate of new filings against Rapid reached its peak in 2000, with more than 57,000 claims being asserted against Rapid in that year alone, bringing the number of pending claims in 2000 to more than 188,500. 11. After 2000, however, due to a number of factors -- the most important, it

is believed, being the National Settlement Program which Rapid instituted late that year, the number of new filings against Rapid declined, as did the average amount paid to settle cases. 12. Notwithstanding the benefits achieved by Rapids National Settlement

Program, today Rapid is confronting approximately 275,000 asbestos personal injury claims. C. RAPIDS INSURANCE 13. Rapid is wholly dependent on insurance coverage to fund claim

settlements and the defense costs associated with the asbestos litigation pending against it. 14. Commencing in 1998, Rapid reached settlements with a number of its

excess insurers where the proceeds from those settlements were deposited in an escrow account (the Escrow Account) at The Bank of New York Mellon which serves as Escrow Agent. The

-5-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 6 of 17

Main Document

Escrow Account is a Qualified Settlement Fund (QSF) under 468B of the Internal Revenue Code, and currently has approximately $4.5 million on deposit. 15. Rapid has $64 million of upper level excess insurance with solvent

insurers remaining. It also has a court-approved allowed claim of $5.4 million in The Home liquidation proceeding, and has entered into a Notice of Determination (NOD) in the amount of $13 million with the New York Liquation Bureau with respect to its claim in the Midland insolvency proceeding, which NOD is currently being contested by certain reinsurers. D. REASONS FOR FILING 16. Recently, Rapid has experienced an increase in the number of

mesothelioma claims being filed against it and an increase in the dollar amount sought to settle claims. Although total claims filed have declined in recent years, mesothelioma claims, which generally result in higher settlement values, now represent approximately 34% of newly filed claims against Rapid. These facts, together with Rapids dwindling insurance assets have led to this chapter 11 filing. 17. It is Rapids objective to develop a plan of reorganization in this case

pursuant to section 524(g) of the Bankruptcy Code which will equitably distribute Rapids remaining insurance to current and future asbestos claimants thereby providing the best and fairest opportunity for all asbestos claimants to recover on their claims. II. 18. SUMMARY OF FIRST DAY MOTIONS

To enable the Debtor to operate effectively in its chapter 11 case, the

Debtor has filed, or intends to file as soon as practicable after the Commencement Date, the First Day Motions described below. In connection with the preparation of this chapter 11 case, I have reviewed, or will review prior to their filing, each of the First Day Motions. The First Day Motions were prepared with my input and assistance. I believe the information contained in the -6-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 7 of 17

Main Document

First Day Motions is accurate and correct. As set forth more fully below, I believe the entry of orders granting the relief requested in these motions and applications is critical to the Debtors ability to preserve the value of its assets and will assist in its reorganization efforts. A. NOTICE PROCEDURES

Motion to Establish Notice Procedures for Personal Injury Claimants 19. By motion filed concurrently herewith (the Personal Injury Notice

Procedures Motion), Rapid seeks entry of an order authorizing it to (i) list on Rapids creditor matrix the addresses of known counsel of record for claimants who have asserted personal injury claims against Rapid in lieu of the addresses of the claimants themselves, and (ii) implement a procedure by which Rapid (or its agent) shall send required notices, mailings and other communications related to this chapter 11 case to such known counsel of record for personal injury claimants (the Personal Injury Notice Procedures). 20. I have been informed that throughout the course of this chapter 11 case

various notices, mailings and other communications will need to be sent to the personal injury claimants that have sued Rapid. As described in Part I of this declaration, Rapid has

approximately 275,000 asbestos personal injury claims presently outstanding against it in various jurisdictions across the United States. As is customary, Rapid has engaged a national coordinating counsel that oversees local counsel in various jurisdictions that represent its interests in those actions. 21. Rapids national coordinating counsel as well as its local defense counsel

for asbestos personal injury claims historically have maintained readily accessible address information only for the respective counsel of record for personal injury claimants, and all communications regarding the claims and the various pending lawsuits, including the prepetition negotiations intended to consensually resolve Rapids asbestos-related liabilities, have been -7-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 8 of 17

Main Document

conducted through such counsel. At this time, the addresses for each of the personal injury claimants are not available to Rapid, and gathering the individual addresses would require both a massive manual review of the files maintained by various past and present asbestos defense counsel across the nation and a time consuming attempt to ensure that such information is still accurate (and if not, to obtain updated information). 22. Accordingly, Rapid seeks to have the Personal Injury Notice Procedures

apply with respect to any notices, mailings and other communications related to this chapter 11 case that need to be sent by Rapid to personal injury claimants who have asserted personal injury claims against Rapid in order to ensure such claimants receive proper and timely notice of filings and critical events in this chapter 11 case. Motion to Establish Master Service List, Notice Procedures, and Procedures Related to Unopposed Requests for Relief 23. By motion filed contemporaneously herewith (the Case Management

Motion), Rapid seeks entry of an order (i) establishing a master service list, (ii) appropriate notice procedures for this chapter 11 case, including service of certain pleadings by electronic mail (email), (iii) limiting notice on various matters in this case to only those parties affected thereby as well as those on a master service list, and (iv) establishing certain case management procedures related to granting unopposed requests for relief without a hearing. B. BANK ACCOUNTS/FINANCING 24. By motion filed concurrently herewith (the Bank Account Motion),

Rapid seeks entry of an order authorizing Rapid to continue to utilize its existing bank accounts, checks and related business forms, notwithstanding the Operating Guidelines and Reporting Requirements for Chapter 11 Cases promulgated by the Office of the United States Trustee.

-8-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 9 of 17

Main Document

General Bank Account 25. Historically, Rapid has maintained a bank account at JP Morgan Chase.

Rapid utilizes preprinted checks, stationery, and other forms associated (the Business Forms) with the JP Morgan Chase account. There is approximately $5,000 in this general bank account. Rapid has agreed to have its bank account designated as a debtor-in-possession account. Rapid does not operate or control any ongoing business operations, so maintenance of the General Bank Account and the use of existing checks and Business Forms (and stamping both with Debtor in Possession) will reduce costs and avoid confusion, and thus are in the best interest of the Debtors bankruptcy estate. QSF Account 26. As part of the prepetition settlements with various insurers, Rapid

deposited the settlement proceeds into the Escrow Account at the Bank of New York Mellon (BNYM). The Escrow Account is subject to an Escrow Agreement, dated November 24, 1998, as amended, between Rapid and BNYM (the Escrow Agreement). The Escrow Account has been approved as a Qualified Settlement Fund under 468B of the Internal Revenue Code. 27. The Escrow Agreement provides that funds in the Escrow Account may be

used, among other things: (i) to make indemnity payments to asbestos personal injury claimants; (ii) to pay defense fees and costs; (iii) to pay the Escrow Agents fees and costs; (iv) to pay taxes, if any, on the earnings in the Escrow Account; and (v) to pay all fees, expenses, and costs of any insolvency proceeding involving Rapid. The Escrow Account, which contains approximately $4.5 million, and is Rapids sole significant liquid asset, will be used to pay fees, expenses, and costs associated with the Debtors chapter 11 case.

-9-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 10 of 17

Main Document

C.

RETENTION OF PROFESSIONALS

Application to Retain Claims and Noticing Agent 28. By application filed concurrently herewith (the Section 156(c)

Application), Rapid seeks entry of an order authorizing it to employ and retain Logan & Company, Inc. (Logan) as the claims and noticing agent in connection with its chapter 11 case pursuant to 28 U.S.C. 156(c), 11 U.S.C. 105(a), Loc.Bankr.R. 5075-1, this Courts General Order M-409 (the General Order), and the terms and conditions of that certain Agreement for Services dated March 5, 2013 (the Logan Agreement). 29. Logan is a data processing firm that specializes in noticing, claims

processing, and other administrative tasks in chapter 11 cases. By appointing Logan as the claims and noticing agent, the distribution of notices and the processing of claims will be expedited, and the office of the Clerk of the Bankruptcy Court for the Southern District of New York (the Clerk) will be relieved of the administrative burden of distributing notices to hundreds (and perhaps thousands) of creditors or other parties in interest. 30. Rapid seeks to employ Logan as claims and noticing agent to, among

other things: (i) serve as the Courts noticing agent to mail notices to certain of the estates creditors and other parties in interest and maintain the core mailing list of all parties described in Bankruptcy Rule 2002; (ii) maintain an official copy of the bankruptcy schedules of assets and liabilities, statement of financial affairs, and a list of all potential creditors, equity holders, and other parties in interest; (iii) process all proofs of claim received and maintain the official claims register; and (iv) perform such other duties as fully described in the Section 156(c) Application. I believe that such assistance will expedite service of Rule 2002 notices, streamline the claims administration process, and permit Rapid to focus on its reorganization efforts.

-10-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 11 of 17

Main Document

31.

The Section 156(c) Application pertains only to the work to be performed

by Logan under the Clerks delegation of duties permitted by 28 U.S.C. 156(c) and Loc.Bankr.R. 5075-1, and any work to be performed by Logan outside of this scope is not covered by the Section 156(c) Application. 32. Logan submitted the declaration of Kathleen M. Logan representing that:

(i) neither Logan nor any employee thereof has any connection with Rapid, its creditors, or any other party in interest herein, (ii) Logan is a disinterested person as that term is defined in section 101(14) of the Bankruptcy Code, as modified by section 1107(b) of the Bankruptcy Code; and (iii) Logan does not and will not hold or represent any interest adverse to Rapids estate. 33. I am advised that the selection of Logan to act as the claims and noticing

agent satisfies this Courts protocol as established under the General Order. In particular, Reed Smith LLP, Rapids proposed bankruptcy counsel, obtained and reviewed engagement proposals from at least two (2) other court-approved claims and noticing agents to ensure selection through a competitive process. Based on these submissions, it was determined that Logans rates are competitive, reasonable, and are a cost-effective alternative to serve as the noticing and claims agent for Rapid. 34. I believe that Logan is well qualified to serve in this capacity and that the

retention of Logan is in the best interests of Rapids estate and its creditors. Application to Retain Reed Smith LLP as Bankruptcy Counsel 35. By application filed or to be filed (the Reed Smith Application), Rapid

seeks entry of an order pursuant to section 327(a) authorizing it to employ and retain Reed Smith LLP (Reed Smith) as its general bankruptcy counsel for prosecution of this chapter 11 case,

-11-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 12 of 17

Main Document

and all related matters, nunc pro tunc to the Commencement Date, to perform the legal services that will be necessary during this chapter 11 case, in accordance with Reed Smiths normal hourly rates and reimbursement policies. In addition, Reed Smith has been engaged to serve as insurance coverage counsel to Rapid. As disclosed in the declaration of Paul M. Singer of Reed Smith submitted in support of the Reed Smith Application, Reed Smith is well qualified and has substantial experience representing debtors with large numbers of asbestos personal injury claimants/creditors, and is experienced in representing policy holders in insurance coverage litigation. 36. The professional services that Reed Smith will render to Rapid may

include, but shall not be limited to, the following: (i) advising Rapid with respect to its powers and duties as debtor in possession in the continued management and operation of its business and assets; (ii) attending meetings and negotiating with representatives of creditors and other parties in interest; (iii) taking all necessary action to protect and preserve Rapids estate, including (a) prosecuting actions on Rapids behalf; (b) defending any actions commenced against Rapid; and (c) objecting to claims filed against the estate which are believed to be inaccurate; (iv) preparing, on behalf of Rapid, all motions, answers, orders, reports, and other papers necessary to the administration of the estate; (v) negotiating and preparing, on Rapids behalf, a plan of reorganization, disclosure statement, and all related agreements and/or documents, and taking any necessary action on behalf of Rapid to obtain confirmation of any plan; (vi) providing insurance coverage services; (vii) appearing before this Court, any appellate courts, and the U.S. Trustee in all matters related to the administration of this case; and (viii) performing other necessary legal services and providing all other necessary legal advice to Rapid in connection with this chapter 11 case.

-12-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 13 of 17

Main Document

37.

Reed Smith has submitted the declaration of Paul M. Singer representing

that (i) Reed Smith does not hold or represent any interest adverse to Rapids estate, (ii) Reed Smith is a disinterested person as that phrase is defined in section 101(14) of the Bankruptcy Code, as modified by section 1107(b) of the Bankruptcy Code, and (iii) Reed Smiths employment is necessary and in the best interests of Rapid and Rapids estate. 38. I believe that Reed Smith is both well qualified and uniquely able to

represent Rapid in this chapter 11 case in an efficient and timely manner, and that such representation will be in the best interests of Rapids estate, creditors and all parties in interest. Application to Retain SNR Denton US LLP as Special Counsel 39. By application filed or to be filed (the SNR Denton Application), Rapid

seeks entry of an order pursuant to section 327(e) authorizing it to employ and retain SNR Denton US LLP (SNR Denton) as counsel for general corporate matters and to provide information and services in this asbestos related chapter 11 case in connection with its role as former national co-ordinating counsel to Rapid, nunc pro tunc to the Commencement Date, in accordance with SNR Dentons hourly rates and reimbursement policies set forth in the Declaration of Stephen A. Marshall in support thereof. As disclosed in the declaration of Stephen A. Marshall of SNR Denton submitted in support of the SNR Denton Application, SNR Denton, and its predecessors, have been representing Rapid for more than forty-five years, during twenty-three of which it has served as national co-ordinating counsel and as local defense counsel in five states in connection with asbestos litigation pending against Rapid, and has a unique and extensive familiarity with Rapids corporate and asbestos related matters. 40. SNR Denton has submitted the declaration of Stephen A. Marshall

representing that SNR Denton does not hold or represent any interest adverse to Rapids estate,

-13-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 14 of 17

Main Document

Additionally, SNR Dentons employment is necessary and in the best interests of Rapid and Rapids estate. D. INTERIM COMPENSATION 41. The Debtor filed or will file a motion seeking an order to establish

procedures for interim monthly compensation of professionals. The order sought conforms to the form provided in this Courts General Order M-412, except as modified to limit notice of the fee applications to those on the master service list. 42. Rapids sole assets available for payment of fees and expenses in this case

are in the Escrow Account. Professionals whose retention is approved by the Court will receive allowed compensation and reimbursement of expenses solely from the Escrow Account (and if insufficient, any retainer the Professionals may hold). III. INFORMATION REQUIRED BY LOCAL BANKRUPTCY RULE 1007-2

43.

As required by Bankruptcy Rule 1007(d) and Local Rule 1007-2, I include

the following information regarding Rapid. 44. As required by Local Rule 1007-2(a)(1), a description of the nature of

Rapids business and a statement of the circumstances leading to its filing under chapter 11 are set forth in Part I above. 45. This case was not originally commenced under chapter 7 or chapter 13,

and thus Local Rule 1007-2(a)(2) is inapplicable. 46. There were no committees organized prior to the Commencement Date;

therefore, Local Rule 1007-2(a)(3) does not apply. 47. I have provided with the petition a list of the names and addresses and,

where available, telephone numbers of the twenty law firms representing the largest number of

-14-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 15 of 17

Main Document

asbestos personal injury claims against Rapid. In addition, I have provided a list of the twenty law firms that represent clients with, collectively, the largest amount of unpaid settlements against Rapid. These two lists have been filed in accordance with Local Rule 1007-2(a)(4). 48. Rapid does not have any secured creditors, and thus Local Rule 1007-

2(a)(5) is inapplicable. 49. As required by Local Rule 1007-2(a)(6), a summary of the assets and

liabilities of Rapid as of February 28, 2013 is set forth on Schedule 1 annexed hereto. 50. Rapids shares are not publicly held, and, accordingly, Local Rule 1007-

2(a)(7) is inapplicable. 51. Rapid does not have any property that is in the possession or custody of

any custodian, public officer, mortgagee, pledgee, assignee of rents, or secured creditor (other than bank accounts which may be subject to claims or setoff), or agent for any such entity. Accordingly, Local Rule 1007-2(a)(8) is inapplicable. 52. Rapid does not own or lease premises from which it operates its business.

Accordingly, Local Rule 1007-2(a)(9) is inapplicable. 53. The location of Rapids books and records are c/o SNR Denton at 1221

Avenue of the Americas, New York, New York 10020. Rapids only other assets, its bank accounts, are in New York, New York. Local Rule 1007-2(a)(10). 54. There are not actions or proceedings, pending or threatened, against Rapid

or its property, where a judgment against Rapid or a seizure of its property is imminent. Local Rule 1007-2(a)(11).

-15-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 16 of 17

Main Document

55.

As required by Local Rule 1007-2(a)(12), the names of the individuals

who comprise Rapids existing senior management, their tenure with Rapid, and brief summary of their relevant responsibilities and experiences are as follows: Name Meshulam Riklis Title Chairman of Board of Directors and President Director, Vice President, Secretary and Treasurer Tenure with Company Responsibilities Inception Present Board of Directors

Paul Weiner

1975 Present

General Manager

56.

Rapid will continue paying Paul Weiner a monthly compensation of

$30,000 throughout the course of this chapter 11 case. Local Rules 1007-2(b)(1) and (2)(A). 57. Other than professional fees and Paul Weiners compensation noted

above, Rapid does not expect to receive or disburse cash within the thirty day period following the Commencement Date. Local Rule 1007-2(b)(3). Dated: March 8, 2013 New York, New York By: /s/ Paul Weiner Paul Weiner Vice President Rapid-American Corporation

-16-

13-10687-smb

Doc 3

Filed 03/08/13

Entered 03/08/13 10:21:37 Pg 17 of 17

Main Document

SCHEDULE 1 Summary of Debtors Assets and Liabilities at February 28, 2013 Assets Cash General Bank Account Escrow Account Insurance Assets1 Unexhausted Insurance for Asbestos Claims Notice of Determination in Midland Insolvency Proceeding Allowed Claim in The Home Insurance Insolvency Proceeding $5,000 $4,500,000 $64,000,000 $13,000,000 $5,400,000

Liabilities Asbestos Liabilities UNKNOWN

The Debtor makes no representation as to the amount or collectability of insurance assets.

-1-

You might also like

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithFrom EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNo ratings yet

- The Terms Lien of SharesDocument6 pagesThe Terms Lien of SharesAmit MakwanaNo ratings yet

- Chap22 AfterProtest 2003 08 18Document2 pagesChap22 AfterProtest 2003 08 18bttaylor100% (2)

- Common Ground: Reimagining American HistoryFrom EverandCommon Ground: Reimagining American HistoryRating: 3 out of 5 stars3/5 (1)

- Articles of Organization Limited-Liability Company: (Pursuant To Nrs Chapter 86)Document9 pagesArticles of Organization Limited-Liability Company: (Pursuant To Nrs Chapter 86)RocketLawyer100% (1)

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- Order. - Ex Parte or Upon Motion WithDocument6 pagesOrder. - Ex Parte or Upon Motion WithSakinah MangotaraNo ratings yet

- Administration of Justice (Miscellaneous Provisions) Act 1933 C. 36Document9 pagesAdministration of Justice (Miscellaneous Provisions) Act 1933 C. 36LawrenceNo ratings yet

- McInnes - The Law of TrustDocument68 pagesMcInnes - The Law of TrustJim HuangNo ratings yet

- Defining Unlawful Enemy CombatantsDocument14 pagesDefining Unlawful Enemy CombatantsZulfiqar AliNo ratings yet

- 12-CV-00379 Document 5Document19 pages12-CV-00379 Document 5A Better Dumont (NJ, USA)No ratings yet

- Parties To A Negotiable InstrumentDocument2 pagesParties To A Negotiable InstrumentRAJ BHAGATNo ratings yet

- Chap8 PDFDocument16 pagesChap8 PDFscribddownload1232No ratings yet

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LineNo ratings yet

- Gpo-Conan-1992 The Constitution Analysis and InterpretationDocument2,466 pagesGpo-Conan-1992 The Constitution Analysis and InterpretationAlex VaubelNo ratings yet

- Disclaimer, n.1. A Renunciation of One's Legal Right or Claim Esp., A Renunciation of ADocument1 pageDisclaimer, n.1. A Renunciation of One's Legal Right or Claim Esp., A Renunciation of Ageoraw9588No ratings yet

- Replevin: (Sections 1-2, Rule 60, Rules of Court)Document10 pagesReplevin: (Sections 1-2, Rule 60, Rules of Court)Leo NekkoNo ratings yet

- BARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYDocument5 pagesBARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYJerome CorsiNo ratings yet

- Handbook of Admiralty Law 2Document290 pagesHandbook of Admiralty Law 25ftheroesNo ratings yet

- Indeminity and GuaranteeDocument18 pagesIndeminity and GuaranteeAanika AeryNo ratings yet

- Act of Expatriation and Oath of AllegianceDocument1 pageAct of Expatriation and Oath of AllegianceCurry, William Lawrence III, agent100% (1)

- US Code Title 4 - Flag and Seal, Seat of Government, and The StatesDocument38 pagesUS Code Title 4 - Flag and Seal, Seat of Government, and The StatesVojta LotrinskyNo ratings yet

- US Internal Revenue Service: Irb07-39Document72 pagesUS Internal Revenue Service: Irb07-39IRSNo ratings yet

- Musk Letter Enclosing Proposed Case ScheduleDocument7 pagesMusk Letter Enclosing Proposed Case ScheduleSimon AlvarezNo ratings yet

- Reg CC Funds Availability ChartDocument1 pageReg CC Funds Availability Chartslade1jeNo ratings yet

- Murgia V Municipal CourtDocument12 pagesMurgia V Municipal CourtKate ChatfieldNo ratings yet

- The Estate of James J Marshall v. Thierry Guetta ComplaintDocument21 pagesThe Estate of James J Marshall v. Thierry Guetta ComplaintEric GoldmanNo ratings yet

- 20 B - Control of Property by The Dead IIDocument27 pages20 B - Control of Property by The Dead IIAnonymous 5dtQnfKeTqNo ratings yet

- Report On Trust Receipts LawDocument18 pagesReport On Trust Receipts LawJon Raymer OclaritNo ratings yet

- Temporary Restraining OrderDocument11 pagesTemporary Restraining Order9newsNo ratings yet

- AmJur TortsDocument2 pagesAmJur TortselmersgluethebombNo ratings yet

- Win Against HSBC and Steven J Baum Foreclosure MillDocument7 pagesWin Against HSBC and Steven J Baum Foreclosure MillDinSFLANo ratings yet

- La Vernia ISD Motion To DismissDocument23 pagesLa Vernia ISD Motion To DismissMaritza NunezNo ratings yet

- Peter Leyland, David Pollard, Butterworths, p87Document11 pagesPeter Leyland, David Pollard, Butterworths, p87Ahmad Mukhsin67% (3)

- Lewin - Trusts - 9th Edition All VolumesDocument1,500 pagesLewin - Trusts - 9th Edition All VolumesKrimsonNo ratings yet

- Ordinance of 1787: The Northwest Territorial GovernmentDocument3 pagesOrdinance of 1787: The Northwest Territorial GovernmentEl-Seti Anu Ali El100% (1)

- Relocation SettlementDocument5 pagesRelocation Settlementrich chastNo ratings yet

- Federal Habeas Corpus Petition 28 U S C 2254Document19 pagesFederal Habeas Corpus Petition 28 U S C 2254Janeth Mejia Bautista AlvarezNo ratings yet

- Quiet Title VSEquity TitleDocument213 pagesQuiet Title VSEquity TitleBobbie ErhartNo ratings yet

- Jason Sheehan Court DocumentDocument21 pagesJason Sheehan Court DocumentmtuccittoNo ratings yet

- Assignment NoteDocument2 pagesAssignment NoteMark VasquezNo ratings yet

- Capitalization Rules: Buildings, Streets, Parks, Statues, MonumentsDocument6 pagesCapitalization Rules: Buildings, Streets, Parks, Statues, MonumentsRezza AnugerahNo ratings yet

- Contracts Notes. 2.27.2013Document14 pagesContracts Notes. 2.27.2013Jairus AntonyNo ratings yet

- NYSHowto Clear ARap SheetDocument76 pagesNYSHowto Clear ARap Sheetpbg2006No ratings yet

- Doctrine of SuborgrationDocument9 pagesDoctrine of Suborgrationsadhvi singh100% (1)

- Motion For Bifurcated TrialDocument20 pagesMotion For Bifurcated TrialGary DetmanNo ratings yet

- HowToRepresentYourselfBeforeTheIRS PDFDocument73 pagesHowToRepresentYourselfBeforeTheIRS PDFBunny FontaineNo ratings yet

- To Regulate The Value of Money by Ed VieiraDocument36 pagesTo Regulate The Value of Money by Ed VieiraHal ShurtleffNo ratings yet

- Petition & Cost BondDocument24 pagesPetition & Cost BondDan LehrNo ratings yet

- Performance Breach and Frustration TutorialDocument9 pagesPerformance Breach and Frustration TutorialAdam 'Fez' FerrisNo ratings yet

- Petition To Stop The Racial Profiling of Asian American & Asian Immigrants - Advancing Justice - AAJCDocument1,483 pagesPetition To Stop The Racial Profiling of Asian American & Asian Immigrants - Advancing Justice - AAJCOjieze OsedebamhenNo ratings yet

- Law AssignmentDocument6 pagesLaw Assignmentfarazfw13No ratings yet

- PISurety BondDocument2 pagesPISurety BondRita HoweNo ratings yet

- Unaduti (Josiah) SC 1Document45 pagesUnaduti (Josiah) SC 1VeronicaNo ratings yet

- Certificate Origin Template MerchandiseDocument2 pagesCertificate Origin Template MerchandiseMaria MuñozNo ratings yet

- Additional Cases On Selected Maxims of EquityDocument1 pageAdditional Cases On Selected Maxims of EquityIsaiahyaya96No ratings yet

- Everytown V JSDDocument26 pagesEverytown V JSDJohn CrumpNo ratings yet

- 2014 PA Law Practice and Procedure 2014 Prothonotary Notaries ManualDocument1,124 pages2014 PA Law Practice and Procedure 2014 Prothonotary Notaries Manualmaria-bellaNo ratings yet

- Kisting-Leung v. Cigna - Complaint in Lawsuit Re Algorithmic Denials of Health Insurance ClaimsDocument18 pagesKisting-Leung v. Cigna - Complaint in Lawsuit Re Algorithmic Denials of Health Insurance ClaimsKirk HartleyNo ratings yet

- Detailed Account of The Gutting of The IRSDocument14 pagesDetailed Account of The Gutting of The IRSKirk HartleyNo ratings yet

- Otterbourg Hourly Rates For 2023 - LTL Chapter 11 Docket 3103Document3 pagesOtterbourg Hourly Rates For 2023 - LTL Chapter 11 Docket 3103Kirk HartleyNo ratings yet

- Article On Studies Re Millennials and FinancesDocument10 pagesArticle On Studies Re Millennials and FinancesKirk HartleyNo ratings yet

- K&E Fee Statememt Aero Oct $3.93 MillionDocument238 pagesK&E Fee Statememt Aero Oct $3.93 MillionKirk HartleyNo ratings yet

- LTL 4-20-23 Hearing - Ruling - TR - Ex A To Docket 83Document28 pagesLTL 4-20-23 Hearing - Ruling - TR - Ex A To Docket 83Kirk HartleyNo ratings yet

- California Oil LawsuitDocument135 pagesCalifornia Oil LawsuitAustin DeneanNo ratings yet

- Imerys Disclosure Statement 1/28/21Document602 pagesImerys Disclosure Statement 1/28/21Kirk HartleyNo ratings yet

- Opinion Holding That Dominion Can Sue FoxDocument25 pagesOpinion Holding That Dominion Can Sue FoxKirk HartleyNo ratings yet

- Massey & Gail Fee Petition - LTLDocument74 pagesMassey & Gail Fee Petition - LTLKirk HartleyNo ratings yet

- The Organizational Sentencing Guidelines - Thirty Years of Innovation and InfluenceDocument94 pagesThe Organizational Sentencing Guidelines - Thirty Years of Innovation and InfluenceKirk HartleyNo ratings yet

- Cooley Fee Petition - LTLDocument306 pagesCooley Fee Petition - LTLKirk HartleyNo ratings yet

- Foster Wheeler (Ed Hugo) Petition For Cert Re California Limits On Deps by DefendantsDocument33 pagesFoster Wheeler (Ed Hugo) Petition For Cert Re California Limits On Deps by DefendantsKirk HartleyNo ratings yet

- Courthouse News Serv. v. Forman - 2022 U.S. Dist. LEXISDocument9 pagesCourthouse News Serv. v. Forman - 2022 U.S. Dist. LEXISKirk HartleyNo ratings yet

- DOJ 2022 Article Re Civil Rights EnforcementDocument295 pagesDOJ 2022 Article Re Civil Rights EnforcementKirk HartleyNo ratings yet

- Brown Rudnick Fee Petition - LTLDocument313 pagesBrown Rudnick Fee Petition - LTLKirk HartleyNo ratings yet

- First Amendment Action Filed Against Columbus Clerk Over Access Blackout - Courthouse News ServiceDocument4 pagesFirst Amendment Action Filed Against Columbus Clerk Over Access Blackout - Courthouse News ServiceKirk HartleyNo ratings yet

- US Judge Enjoins Florida's E-Filing Authority On 1st Amendment Grounds - Courthouse News ServiceDocument5 pagesUS Judge Enjoins Florida's E-Filing Authority On 1st Amendment Grounds - Courthouse News ServiceKirk HartleyNo ratings yet

- Jan 20 2006 FMP Hearing TranscriptDocument138 pagesJan 20 2006 FMP Hearing TranscriptKirk HartleyNo ratings yet

- Courthouse News Serv. v. Forman - 2022 U.S. Dist. LEXISDocument9 pagesCourthouse News Serv. v. Forman - 2022 U.S. Dist. LEXISKirk HartleyNo ratings yet

- NEJM - 2007 - Release From Prison - A High Risk of Death For Former Inmates - NEJMDocument14 pagesNEJM - 2007 - Release From Prison - A High Risk of Death For Former Inmates - NEJMKirk HartleyNo ratings yet

- Justice NewsDocument2 pagesJustice NewsKirk HartleyNo ratings yet

- DOJ 2022 - Health in Justice - Treatment ReformDocument3 pagesDOJ 2022 - Health in Justice - Treatment ReformKirk HartleyNo ratings yet

- STAT News - The ADA Covers Addiction. Now The U.S. Is Enforcing The Law (To Protect Former Addicts) - STATDocument13 pagesSTAT News - The ADA Covers Addiction. Now The U.S. Is Enforcing The Law (To Protect Former Addicts) - STATKirk HartleyNo ratings yet

- Narco - Honeywell Response To Motion To RedactDocument14 pagesNarco - Honeywell Response To Motion To RedactKirk HartleyNo ratings yet

- Insurers' Motion To Intervene in Opposition To Narco Motion To Redact 4-28-2022Document100 pagesInsurers' Motion To Intervene in Opposition To Narco Motion To Redact 4-28-2022Kirk HartleyNo ratings yet

- My Pillow Sanctions OrderDocument31 pagesMy Pillow Sanctions OrderKirk HartleyNo ratings yet

- Paxton Disc Pet Judicial Assignment 052522Document6 pagesPaxton Disc Pet Judicial Assignment 052522Kirk HartleyNo ratings yet

- Narco Motion To Redact Third-Party Law Firm Information (22-Apr-22)Document10 pagesNarco Motion To Redact Third-Party Law Firm Information (22-Apr-22)Kirk HartleyNo ratings yet

- Bestwall - Notice Re Disposal of Exhibits Re Noncompliance Re PIQs Dk002512-0000Document2 pagesBestwall - Notice Re Disposal of Exhibits Re Noncompliance Re PIQs Dk002512-0000Kirk HartleyNo ratings yet

- All Weeks GlobalDocument70 pagesAll Weeks GlobalGalaxy S5No ratings yet

- Alumni Event ProposalDocument17 pagesAlumni Event ProposalClyte SoberanoNo ratings yet

- HNFZ Global Services: Resit RasmiDocument4 pagesHNFZ Global Services: Resit RasmiLy NazNo ratings yet

- Idea Cellular Limited: NoticeDocument145 pagesIdea Cellular Limited: Noticeliron markmannNo ratings yet

- London International Model United Nations: A Guide To MUN ResearchDocument6 pagesLondon International Model United Nations: A Guide To MUN ResearchAldhani PutryNo ratings yet

- Salonga Vs Cruz PanoDocument1 pageSalonga Vs Cruz PanoGeorge Demegillo Rocero100% (3)

- Omnibus CSC - 02232018 GUIDEDocument1 pageOmnibus CSC - 02232018 GUIDETegnap NehjNo ratings yet

- Indian Council Act, 1892Document18 pagesIndian Council Act, 1892Khan PurNo ratings yet

- Cybersecurity in Africa An AssessmentDocument34 pagesCybersecurity in Africa An AssessmentTPK Studies & WorkNo ratings yet

- MechanicalDocument609 pagesMechanicalMohammed100% (1)

- Clutario v. CADocument2 pagesClutario v. CAKrisha Marie CarlosNo ratings yet

- Instructions & Commentary For: Standard Form of Contract For Architect's ServicesDocument65 pagesInstructions & Commentary For: Standard Form of Contract For Architect's ServicesliamdrbrownNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- Cooperative BankDocument70 pagesCooperative BankMonil MittalNo ratings yet

- Vector Potential For A Particle On The Ring and Unitary Transform of The HamiltonianDocument8 pagesVector Potential For A Particle On The Ring and Unitary Transform of The HamiltonianShaharica BaluNo ratings yet

- 04 CPM Procurement ManagementDocument75 pages04 CPM Procurement ManagementGORKEM KARAKOSENo ratings yet

- CD - Holy See vs. Rosario 238 SCRA 524Document3 pagesCD - Holy See vs. Rosario 238 SCRA 524Sai Pastrana100% (2)

- 09 10 CalendarDocument1 page09 10 CalendardhdyerNo ratings yet

- Presenters GuidelinesDocument9 pagesPresenters GuidelinesAl Dustur JurnalNo ratings yet

- Free Pattern Easy Animal CoasterDocument4 pagesFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- 48V DC - DC Converter - Mild Hybrid DC - DC Converter - EatonDocument3 pages48V DC - DC Converter - Mild Hybrid DC - DC Converter - EatonShubham KaklijNo ratings yet

- United States Court of Appeals Fourth CircuitDocument5 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- Australia - Prison Police State - Thanks Anthony AlbaneseDocument40 pagesAustralia - Prison Police State - Thanks Anthony AlbaneseLloyd T VanceNo ratings yet

- DoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemicDocument2 pagesDoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemictapansNo ratings yet

- LLM Dissertation TinaWorth Final PDFDocument76 pagesLLM Dissertation TinaWorth Final PDFTina Jane WorthNo ratings yet

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceDocument2 pagesTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running Balancesylvereye07No ratings yet

- Mohnish Pabrai - ChecklistDocument1 pageMohnish Pabrai - ChecklistCedric TiuNo ratings yet

- Edgar Cokaliong Shipping Lines vs. UCPB General InsuranceDocument6 pagesEdgar Cokaliong Shipping Lines vs. UCPB General InsuranceVincent BernardoNo ratings yet

- SullivanDocument7 pagesSullivanHtaed TnawiNo ratings yet

- PI Manpower Vs NLRCDocument9 pagesPI Manpower Vs NLRCKornessa ParasNo ratings yet

- Courage to Stand: Mastering Trial Strategies and Techniques in the CourtroomFrom EverandCourage to Stand: Mastering Trial Strategies and Techniques in the CourtroomNo ratings yet

- Evil Angels: The Case of Lindy ChamberlainFrom EverandEvil Angels: The Case of Lindy ChamberlainRating: 4.5 out of 5 stars4.5/5 (15)

- Greed on Trial: Doctors and Patients Unite to Fight Big InsuranceFrom EverandGreed on Trial: Doctors and Patients Unite to Fight Big InsuranceNo ratings yet

- Litigation Story: How to Survive and Thrive Through the Litigation ProcessFrom EverandLitigation Story: How to Survive and Thrive Through the Litigation ProcessRating: 5 out of 5 stars5/5 (1)

- The Art of Fact Investigation: Creative Thinking in the Age of Information OverloadFrom EverandThe Art of Fact Investigation: Creative Thinking in the Age of Information OverloadRating: 5 out of 5 stars5/5 (2)

- Busted!: Drug War Survival Skills and True Dope DFrom EverandBusted!: Drug War Survival Skills and True Dope DRating: 3.5 out of 5 stars3.5/5 (7)

- After Misogyny: How the Law Fails Women and What to Do about ItFrom EverandAfter Misogyny: How the Law Fails Women and What to Do about ItNo ratings yet

- Winning with Financial Damages Experts: A Guide for LitigatorsFrom EverandWinning with Financial Damages Experts: A Guide for LitigatorsNo ratings yet

- 2017 Commercial & Industrial Common Interest Development ActFrom Everand2017 Commercial & Industrial Common Interest Development ActNo ratings yet

- Strategic Positioning: The Litigant and the Mandated ClientFrom EverandStrategic Positioning: The Litigant and the Mandated ClientRating: 5 out of 5 stars5/5 (1)

- Scorched Worth: A True Story of Destruction, Deceit, and Government CorruptionFrom EverandScorched Worth: A True Story of Destruction, Deceit, and Government CorruptionNo ratings yet

- Patent Trolls: Predatory Litigation and the Smothering of InnovationFrom EverandPatent Trolls: Predatory Litigation and the Smothering of InnovationNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- Real Estate Development - 4th Edition: Principles and ProcessFrom EverandReal Estate Development - 4th Edition: Principles and ProcessRating: 4.5 out of 5 stars4.5/5 (7)

- Plaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowFrom EverandPlaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowNo ratings yet

- The Chamberlain Case: the legal saga that transfixed the nationFrom EverandThe Chamberlain Case: the legal saga that transfixed the nationNo ratings yet

- Lawsuits in a Market Economy: The Evolution of Civil LitigationFrom EverandLawsuits in a Market Economy: The Evolution of Civil LitigationNo ratings yet

- Religious Liberty in Crisis: Exercising Your Faith in an Age of UncertaintyFrom EverandReligious Liberty in Crisis: Exercising Your Faith in an Age of UncertaintyRating: 4 out of 5 stars4/5 (1)

- Kidnapped by a Client: The Incredible True Story of an Attorney's Fight for JusticeFrom EverandKidnapped by a Client: The Incredible True Story of an Attorney's Fight for JusticeRating: 5 out of 5 stars5/5 (1)