Professional Documents

Culture Documents

Agan V PIATCO Short Digest.

Uploaded by

Kathleen Catubay SamsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agan V PIATCO Short Digest.

Uploaded by

Kathleen Catubay SamsonCopyright:

Available Formats

Agan v PIATCO G.R. No. 155001.

May 5, 2003 Facts: In August 1989, the DOTC engaged the services of Aeroport de Paris (ADP) to conduct a comprehensive study of the Ninoy Aquino International Airport (NAIA) and determine whether the present airport can cope with the traffic development up to the year 2010. On March 27, 1995, then DOTC Secretary Jose Garcia endorsed the proposal of Asia's Emerging Dragon Corp. (unsolicited proposal dated Oct. 5, 1994) to the National Economic and Development Authority (NEDA). A revised proposal, however, was forwarded by the DOTC to NEDA on December 13, 1995. On January 5, 1996, the NEDA Investment Coordinating Council (NEDA ICC) Technical Board favorably endorsed the project to the ICC Cabinet Committee which approved the same, subject to certain conditions, on January 19, 1996. On February 13, 1996, the NEDA passed Board Resolution No. 2 which approved the NAIA IPT III Project. On August 29, 1996, the Second Pre-Bid Conference was held where certain clarifications were made. Upon the request of prospective bidder People's Air Cargo & Warehousing Co., Inc (Paircargo), the PBAC warranted that based on Sec. 11.6, Rule 11 of the Implementing Rules and Regulations of the BOT Law, only the proposed Annual Guaranteed Payment submitted by the challengers would be revealed to AEDC, and that the challengers' technical and financial proposals would remain confidential. The PBAC also clarified that the list of revenue sources contained in Annex 4.2a of the Bid Documents was merely indicative and that other revenue sources may be included by the proponent, subject to approval by DOTC/MIAA. Furthermore, the PBAC clarified that only those fees and charges denominated as Public Utility Fees would be subject to regulation, and those charges which would be actually deemed Public Utility Fees could still be revised, depending on the outcome of PBAC's query on the matter with the Department of Justice. On September 26, 1996, AEDC informed the PBAC in writing of its reservations as regards the Paircargo Consortium, which include: a. The lack of corporate approvals and financial capability of PAIRCARGO; b. The lack of corporate approvals and financial capability of PAGS; c. The prohibition imposed by RA 337, as amended (the General Banking Act) on the amount that Security Bank could legally invest in the project; d. The inclusion of Siemens as a contractor of the PAIRCARGO Joint Venture, for prequalification purposes; and e. The appointment of Lufthansa as the facility operator, in view of the Philippine requirement in the operation of a public utility. The PBAC gave its reply on October 2, 1996, informing AEDC that it had considered the issues raised by the latter, and that based on the documents submitted by Paircargo and the established prequalification criteria, the PBAC had found that the challenger, Paircargo, had prequalified to undertake the project. The Secretary of the DOTC approved the finding of the PBAC. On October 16, 1996, the PBAC opened the third envelope submitted by AEDC and the

Paircargo Consortium containing their respective financial proposals. Both proponents offered to build the NAIA Passenger Terminal III for at least $350 million at no cost to the government and to pay the government: 5% share in gross revenues for the first five years of operation, 7.5% share in gross revenues for the next ten years of operation, and 10% share in gross revenues for the last ten years of operation, in accordance with the Bid Documents. As AEDC failed to match the proposal within the 30-day period, then DOTC Secretary Amado Lagdameo, on December 11, 1996, issued a notice to Paircargo Consortium regarding AEDC's failure to match the proposal. AEDC subsequently protested the alleged undue preference given to PIATCO and reiterated its objections as regards the prequalification of PIATCO. On July 12, 1997, the Government, through then DOTC Secretary Arturo T. Enrile, and PIATCO, through its President, Henry T. Go, signed the "Concession Agreement for the BuildOperate-and-Transfer Arrangement of the Ninoy Aquino International Airport Passenger Terminal III" (1997 Concession Agreement). The Government granted PIATCO the franchise to operate and maintain the said terminal during the concession period and to collect the fees, rentals and other charges in accordance with the rates or schedules stipulated in the 1997 Concession Agreement. The Agreement provided that the concession period shall be for twentyfive (25) years commencing from the in-service date, and may be renewed at the option of the Government for a period not exceeding twenty-five (25) years. At the end of the concession period, PIATCO shall transfer the development facility to MIAA. During the pendency of the case before this Court, President Gloria Macapagal Arroyo, on November 29, 2002, in her speech at the 2002 Golden Shell Export Awards at Malacaang Palace, stated that she will not "honor (PIATCO) contracts which the Executive Branch's legal offices have concluded (as) null and void." Issue: Whether the petitioners and the petitioners-in-intervention have standing; Whether this Court has jurisdiction; and Whether the BOT and contracts therein are unconstitutional. Held: YES. Ratio: Messrs. Lopez et al. are employees of the MIAA. These petitioners (Messrs. Agan et al. and Messrs. Lopez et al.) are confronted with the prospect of being laid off from their jobs and losing their means of livelihood when their employer-companies are forced to shut down or otherwise retrench and cut back on manpower. Such development would result from the imminent implementation of certain provisions in the contracts that tend toward the creation of a monopoly in favor of Piatco, its subsidiaries and related companies. Petitioners-in-intervention are service providers in the business of furnishing airport-related services to international airlines and passengers in the NAIA and are therefore competitors of Piatco as far as that line of business is concerned. On account of provisions in the Piatco contracts, petitioners-in-intervention have to enter into a written contract with Piatco so as not to be shut out of NAIA Terminal III and barred from doing business there. Since there is no provision to ensure or safeguard free and fair competition, they are literally at its mercy. They

claim injury on account of their deprivation of property (business) and of the liberty to contract, without due process of law. By way of background, two monopolies were actually created by the Piatco contracts. The first and more obvious one refers to the business of operating an international passenger terminal in Luzon, the business end of which involves providing international airlines with parking space for their aircraft, and airline passengers with the use of departure and arrival areas, check-in counters, information systems, conveyor systems, security equipment and paraphernalia, immigrations and customs processing areas; and amenities such as comfort rooms, restaurants and shops. In furtherance of the first monopoly, the Piatco Contracts stipulate that the NAIA Terminal III will be the only facility to be operated as an international passenger terminal; that NAIA Terminals I and II will no longer be operated as such; and that no one (including the government) will be allowed to compete with Piatco in the operation of an international passenger terminal in the NAIA Complex. Given that, at this time, the government and Piatco are the only ones engaged in the business of operating an international passenger terminal, I am not acutely concerned with this particular monopolistic situation. There was however another monopoly within the NAIA created by the subject contracts for Piatco in the business of providing international airlines with the following: groundhandling, in-flight catering, cargo handling, and aircraft repair and maintenance services. These are lines of business activity in which are engaged many service providers (including the petitioners-inintervention), who will be adversely affected upon full implementation of the Piatco Contracts, particularly Sections 3.01(d) and (e) of both the ARCA and the CA. Should government pay at all for reasonable expenses incurred in the construction of the Terminal? Indeed it should, otherwise it will be unjustly enriching itself at the expense of Piatco and, in particular, its funders, contractors and investors both local and foreign. After all, there is no question that the State needs and will make use of Terminal III, it being part and parcel of the critical infrastructure and transportation-related programs of government. The rule on hierarchy of courts will not also prevent this Court from assuming jurisdiction over the cases at bar. The said rule may be relaxed when the redress desired cannot be obtained in the appropriate courts or where exceptional and compelling circumstances justify availment of a remedy within and calling for the exercise of this Court's primary jurisdiction. Thus, considering the nature of the controversy before the Court, procedural bars may be lowered to give way for the speedy disposition of the instant cases. In sum, this Court rules that in view of the absence of the requisite financial capacity of the Paircargo Consortium, predecessor of respondent PIATCO, the award by the PBAC of the contract for the construction, operation and maintenance of the NAIA IPT III is null and void. Is PIATCO a qualified bidder? Public respondents argue that the Paircargo Consortium, PIATCO's predecessor, was not a

duly pre-qualified bidder on the unsolicited proposal submitted by AEDC as the Paircargo Consortium failed to meet the financial capability required under the BOT Law and the Bid Documents. They allege that in computing the ability of the Paircargo Consortium to meet the minimum equity requirements for the project, the entire net worth of Security Bank, a member of the consortium, should not be considered. R.A. No. 337, as amended or the General Banking Act that a commercial bank cannot invest in any single enterprise in an amount more than 15% of its net worth. We agree with public respondents that with respect to Security Bank, the entire amount of its net worth could not be invested in a single undertaking or enterprise, whether allied or non-allied in accordance with the provisions of R.A. No. 337 The PBAC should not be allowed to speculate on the future financial ability of the bidder to undertake the project on the basis of documents submitted. This would open doors to abuse and defeat the very purpose of a public bidding. Is the 1997 Concession Agreement valid? Petitioners and public respondents contend that the 1997 Concession Agreement is invalid as it contains provisions that substantially depart from the draft Concession Agreement included in the Bid Documents. They maintain that a substantial departure from the draft Concession Agreement is a violation of public policy and renders the 1997 Concession Agreement null and void. If the winning bidder is allowed to later include or modify certain provisions in the contract awarded such that the contract is altered in any material respect, then the essence of fair competition in the public bidding is destroyed. A public bidding would indeed be a farce if after the contract is awarded; the winning bidder may modify the contract and include provisions which are favorable to it that were not previously made available to the other bidders. With respect to terminal fees that may be charged by PIATCO, as shown earlier, this was included within the category of "Public Utility Revenues" under the 1997 Concession Agreement. This classification is significant because under the 1997 Concession Agreement, "Public Utility Revenues" are subject to an "Interim Adjustment" of fees upon the occurrence of certain extraordinary events specified in the agreement. However, under the draft Concession Agreement, terminal fees are not included in the types of fees that may be subject to "Interim Adjustment." Finally, under the 1997 Concession Agreement, "Public Utility Revenues," except terminal fees, are denominated in US Dollars while payments to the Government are in Philippine Pesos. In the draft Concession Agreement, no such stipulation was included. By stipulating that "Public Utility Revenues" will be paid to PIATCO in US Dollars while payments by PIATCO to the Government are in Philippine currency under the 1997 Concession Agreement, PIATCO is able to enjoy the benefits of depreciations of the Philippine Peso, while being effectively insulated from the detrimental effects of exchange rate fluctuations. Under the draft Concession Agreement, default by PIATCO of any of its obligations to

creditors who have provided, loaned or advanced funds for the NAIA IPT III project does not result in the assumption by the Government of these liabilities. In fact, nowhere in the said contract does default of PIATCO's loans figure in the agreement. Such default does not directly result in any concomitant right or obligation in favor of the Government. It is clear from the above-quoted provisions that Government, in the event that PIATCO defaults in its loan obligations, is obligated to pay "all amounts recorded and from time to time outstanding from the books" of PIATCO which the latter owes to its creditors. These amounts include "all interests, penalties, associated fees, charges, surcharges, indemnities, reimbursements and other related expenses." This obligation of the Government to pay PIATCO's creditors upon PIATCO's default would arise if the Government opts to take over NAIA IPT III. It should be noted, however, that even if the Government chooses the second option, which is to allow PIATCO's unpaid creditors operate NAIA IPT III, the Government is still at a risk of being liable to PIATCO's creditors should the latter be unable to designate a qualified operator within the prescribed period. In effect, whatever option the Government chooses to take in the event of PIATCO's failure to fulfill its loan obligations, the Government is still at a risk of assuming PIATCO's outstanding loans. As such the Government is virtually at the mercy of PIATCO (that it would not default on its loan obligations to its Senior Lenders), the Senior Lenders (that they would appoint a qualified nominee or transferee or agree to some other arrangement with the Government) and the existence of a qualified nominee or transferee who is able and willing to take the place of PIATCO in NAIA IPT III. In view of regulation of monopolies The operation of an international passenger airport terminal is no doubt an undertaking imbued with public interest. In entering into a Build-Operate-and-Transfer contract for the construction, operation and maintenance of NAIA IPT III, the government has determined that public interest would be served better if private sector resources were used in its construction and an exclusive right to operate be granted to the private entity undertaking the said project, in this case PIATCO. Nonetheless, the privilege given to PIATCO is subject to reasonable regulation and supervision by the Government through the MIAA, which is the government agency authorized to operate the NAIA complex, as well as DOTC, the department to which MIAA is attached. While it is the declared policy of the BOT Law to encourage private sector participation by "providing a climate of minimum government regulations," the same does not mean that Government must completely surrender its sovereign power to protect public interest in the operation of a public utility as a monopoly. The operation of said public utility cannot be done in an arbitrary manner to the detriment of the public which it seeks to serve. In contrast to the arrastre and stevedoring service providers in the case of Anglo-Fil Trading Corporation v. Lazaro whose contracts consist of temporary hold-over permits, the affected service providers in the cases at bar, have a valid and binding contract with the Government, through MIAA, whose period of effectivity, as well as the other terms and conditions thereof

cannot be violated. Should the dispute be referred to arbitration prior to judicial recourse? Respondent Piatco claims that Section 10.02 of the Amended and Restated Concession Agreement (ARCA) provides for arbitration under the auspices of the International Chamber of Commerce to settle any dispute or controversy or claim arising in connection with the Concession Agreement, its amendments and supplements. The government disagrees; however, insisting that there can be no arbitration based on Section 10.02 of the ARCA, since all the Piatco contracts are void ab initio.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Japan Pension RefundDocument6 pagesJapan Pension RefundKathleen Catubay SamsonNo ratings yet

- Tennis Application Form 2019 2 2Document1 pageTennis Application Form 2019 2 2Kathleen Catubay SamsonNo ratings yet

- Laya Labor CaseDocument14 pagesLaya Labor CaseKathleen Catubay SamsonNo ratings yet

- Testimonial of Good Moral Character: CertifyDocument2 pagesTestimonial of Good Moral Character: CertifyMarivic Soriano100% (1)

- 2013 Syllabus Legal and Judicial EthicsDocument5 pages2013 Syllabus Legal and Judicial EthicsKathleen Catubay SamsonNo ratings yet

- Civil Law PDFDocument9 pagesCivil Law PDFChanChi Domocmat LaresNo ratings yet

- CSC V JavierDocument9 pagesCSC V JavierKathleen Catubay SamsonNo ratings yet

- Ra 10354Document13 pagesRa 10354CBCP for LifeNo ratings yet

- FSO Application Form 2013Document4 pagesFSO Application Form 2013Kathleen Catubay SamsonNo ratings yet

- Vinuya Vs Exec. Sec.Document6 pagesVinuya Vs Exec. Sec.Philip L. AbadNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- BPI V CA 2000Document2 pagesBPI V CA 2000Kathleen Catubay SamsonNo ratings yet

- People v. NitafanDocument2 pagesPeople v. NitafanBenjamin Cruz100% (1)

- AsianSIL Beckman China UNCLOS and The South China Sea 26 July 2011Document32 pagesAsianSIL Beckman China UNCLOS and The South China Sea 26 July 2011Kathleen Catubay SamsonNo ratings yet

- Anti Prostitution Policy BriefDocument2 pagesAnti Prostitution Policy BriefKathleen Catubay SamsonNo ratings yet

- AsianSIL Beckman China UNCLOS and The South China Sea 26 July 2011Document32 pagesAsianSIL Beckman China UNCLOS and The South China Sea 26 July 2011Kathleen Catubay SamsonNo ratings yet

- Notification and Statement of Claim On West Philippine SeaDocument21 pagesNotification and Statement of Claim On West Philippine SeaVERA FilesNo ratings yet

- Convention On Law of The SeaDocument202 pagesConvention On Law of The SeaJhonsu30100% (2)

- Anti Prostitution Policy BriefDocument2 pagesAnti Prostitution Policy BriefKathleen Catubay SamsonNo ratings yet

- Padre Pio Prayer After ComunionDocument1 pagePadre Pio Prayer After ComunionkatzcsamsonNo ratings yet

- Indeterminate Sentence LawDocument6 pagesIndeterminate Sentence LawezhreelNo ratings yet

- Bill of RightsDocument31 pagesBill of RightsKathleen Catubay SamsonNo ratings yet

- RPCDocument109 pagesRPCKathleen Catubay SamsonNo ratings yet

- COMREV Premium Marble V CADocument1 pageCOMREV Premium Marble V CAKathleen Catubay SamsonNo ratings yet

- NIL BPI V RoxasDocument2 pagesNIL BPI V RoxasKathleen Catubay SamsonNo ratings yet

- 2012 Civil Law SyllabusDocument39 pages2012 Civil Law SyllabusTiofilo VillanuevaNo ratings yet

- Centennial PrayerDocument2 pagesCentennial PrayerKathleen Catubay SamsonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ta-Octa Vs Eguia and TorresDocument1 pageTa-Octa Vs Eguia and TorresJudy Miraflores DumdumaNo ratings yet

- Boardingpass Vistara MR S Das & MR S K OjhaDocument2 pagesBoardingpass Vistara MR S Das & MR S K OjhasuvadipNo ratings yet

- People V SaballonesDocument26 pagesPeople V SaballonesJulius ManaloNo ratings yet

- Mike Dick Lawsuit Against Eric HolderDocument23 pagesMike Dick Lawsuit Against Eric HolderGordon Duff100% (6)

- P2R - v1.1 - PhilippiansDocument7 pagesP2R - v1.1 - PhilippiansohthereishopeNo ratings yet

- PEOPLE OF THE PHILIPPINES vs. VICTOR TANEODocument4 pagesPEOPLE OF THE PHILIPPINES vs. VICTOR TANEOSarah Monique Nicole Antoinette GolezNo ratings yet

- Harry PotterDocument14 pagesHarry PotterRahul100% (3)

- Union and The States Art. 308 To 323Document9 pagesUnion and The States Art. 308 To 323Prachi TripathiNo ratings yet

- Introduction To CPCDocument18 pagesIntroduction To CPCScene & ScenarioNo ratings yet

- General Principles of Law Recognised by Civilised StatesDocument7 pagesGeneral Principles of Law Recognised by Civilised StatesSangeeta SinghNo ratings yet

- Files O 12 22 2022 986644Document1 pageFiles O 12 22 2022 986644Prince RanaNo ratings yet

- Dayrit v. Court of Appeals Dayrit v. Court of Appeals: B2022 Reports Annotated VOL 32 (December 28, 1970)Document3 pagesDayrit v. Court of Appeals Dayrit v. Court of Appeals: B2022 Reports Annotated VOL 32 (December 28, 1970)Julia Camille RealNo ratings yet

- Jennings v. Stephens (2015)Document24 pagesJennings v. Stephens (2015)Scribd Government DocsNo ratings yet

- 1 - Introduction To Law On Tourism and HospitalityDocument85 pages1 - Introduction To Law On Tourism and HospitalityCarmie DoloricaNo ratings yet

- Class Moot 1Document6 pagesClass Moot 1jodhani.ashok50No ratings yet

- PEOPLE V ALVARIODocument1 pagePEOPLE V ALVARIOaliahNo ratings yet

- Interlocking DirectorsDocument3 pagesInterlocking DirectorsJan Aldrin AfosNo ratings yet

- ObasanDocument4 pagesObasanPriyam PaulNo ratings yet

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentSuraj BeraNo ratings yet

- Crate BT 220H Power Amp 07S689 SchematicDocument1 pageCrate BT 220H Power Amp 07S689 SchematicAlessandro CardelliNo ratings yet

- Scope of Comparative LawDocument14 pagesScope of Comparative Lawshrabana chatterjeeNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Original Copy Business Permit Application Form BPLOs PDFDocument2 pagesOriginal Copy Business Permit Application Form BPLOs PDFNicole Canarias100% (1)

- One Direction ScriptDocument12 pagesOne Direction ScriptNatasha PeraltaNo ratings yet

- Actionable ClaimsDocument3 pagesActionable ClaimsAniket SinghNo ratings yet

- 2.1.1 Quiz 2 - Answer KeyDocument7 pages2.1.1 Quiz 2 - Answer KeyMark Emil BaritNo ratings yet

- Bill AnalysisDocument11 pagesBill AnalysisOkema LennyNo ratings yet

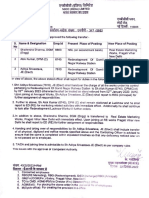

- Appointment Letter - Md. Belal AhmadDocument15 pagesAppointment Letter - Md. Belal AhmadMD BELAL AHMADNo ratings yet

- West Bengal Police Recruitment Board: Application Form For The Post of Si/Lsi of Excise 2018Document2 pagesWest Bengal Police Recruitment Board: Application Form For The Post of Si/Lsi of Excise 2018Ridan DasNo ratings yet

- GSTR3B 29dxrpb1185a1zj 112020Document2 pagesGSTR3B 29dxrpb1185a1zj 112020Sainath ReddyNo ratings yet