Professional Documents

Culture Documents

Homework 1 Nat Gas Finance

Uploaded by

Kevin Kivanc IlgarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework 1 Nat Gas Finance

Uploaded by

Kevin Kivanc IlgarCopyright:

Available Formats

1.11.

A cattle farmer expects to have 120000 lbs of live cattle to sell in three

months. The live cattle futures contract on the Chicago Mercantile Exchange is for delivery of 40000 lbs. of cattle. How can the farmer use the contract for hedging ? From farmer's viewpoint, what are the pros and cons of hedging ? 1 contract = delivery of 40.000 lbs of cattle Time to maturity = 3 months Let's say price of 40.000 lbs of cattle is C today, The farmer can short 3 contracts, which is 3C. If the price of 40.000 lbs of cattle is (C-L) at the time of maturity, then his loss will be 3L from the cattle sales, but he will offset this loss by selling the contract. The money will be gained from the contract sales will be 3C as well. This is like an insurance to the farmer ( seller ) in case the cattle prices go down.

If the price of 40.000 lbs of cattle is (C+L) at the time of maturity, then his gain will be 3L from the cattle sales, but he will lose 3C from the contract, because it is not an option. It has to be exercised no matter what the price is, but as a result the outcome will be zero loss. Both situations are no gain no pain type of positions. This is like an insurance to the buyer in case the cattle prices go up. Let's say if the price of 40.000 lbs of cattle is C+5L at the time of maturity, then his gain will be 15L from the cattle sales, if he did not buy a futures contract he would have taken that 15L gain and put it in his pocket, but since he bought the contracts he has to give up from that profit. Disadvantages of hedging are : the farmer ( seller ) won't be able to make profit from price increase in the market. On the other hand let's say if the price of 40.000 lbs of cattle is C-5L at the time of maturity, then his loss will be 15L from the cattle sales, but it will not be a problem because he will cover his loss by the contracts. Advantages of hedging are : the farmer ( seller ) won't lose money because of the price changes in the market.

1.14. Suppose that a June put option on stock with the strike price of $60

cost $4 and is held until June . Under what circumstances will the holder of the option make a gain? . Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a short position in the option depends on the stock price at the maturity of the option. From the point of buyer of put option, if the stock price is less than the exercise price plus the option premium, than the option holder will make profit. If the price of stock drops less than $56, then the option holder ( buyer ) will start making profit.

If the investor sells the put, which is writing a put option, he can keep the premium unless the stock price falls below $56. If the price of the stock falls below $56 and the writer of the option will lose money. $56 is the breakeven point for the two parties. Option will be exercised below this point.

1.18. An airline executive has argued: There is no point in our using oil futures. There is just as much chance that then price of oil in the future will be

less than the futures price as there is that it will be greater than this price. Discuss the executives viewpoint. First of all, I dont think that the executive knows what he is talking about. It sounds like Mr. McClandon several years ago talking about the natural gas prices. He thinks that hedging on oil prices is not essential. Airline company should just speculate the oil prices and he does not want to hedge. I think it is very dangerous for an airline company which strictly relies on oil to fly the planes. Speculating would be a very big risk in case the oil prices goes up like it happened in 2008. On the other hand even if the oil prices go down the airline company will not make too much profit from the oil. I think they should use oil futures to offset their position in the future.

1.27. A stock price is $29. An investor buys one call option contract on the

stock with the strike price of $30 and sells a call option contract on the stock with a strike price of $32.50. The market prices of the options are $2.75 and $1.50, respectively. The options have the same maturity date . Describe the investors position .

1.30. The current price of a stock is $94, ans the three-month European call

options with a strike price of $95 currently sell for $4.70. An investor who feels

that the price of the stock will increase is trying to decide between buying 100 shares and buying 2000 call options (20 contracts). Both strategies involve an investment of $9400. What advice would you give? How high does the stock price have to rise for the option for the option strategy to be more profitable? If the investor invests on shares and the price of stock remains the same or goes up, he will be making profit, his gain with this strategy would be fairly limited. A dollar raise in the stock prices will only create a $100 raise in the total investment. But on the other hand if the stock price goes below $94, his loses might not be a disaster. It is very unlikely that he will lose all the investment, which is not very common, but possible. Like a market crash or a meteor might hit the company which he invested. If the investor invests on call options, $4.70 for each option, a total of 2000 options, the situation will be a lot riskier. If the stock price does not go above $95, he will unfortunately lose all the initial investment. The breakeven point is $99.70. This situation is very likely, but on the other hand if stock price goes over $99.70 his profit will be $2000 for every dollar raise in the stock price. Lets say if the stock price go up $109.70 the he will make a profit of $20000, which is very attractive. It all depends on the risk aversion of the investor to make the choice. I would invest on options and hold my breath, if these are the only options that I have, but I think we should cover our position when investing on options in case the stock price does not increase.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Credentials Evaluations NCEESDocument5 pagesCredentials Evaluations NCEESJohn Johnson0% (1)

- Inventory PPT (EOQ)Document38 pagesInventory PPT (EOQ)drajingoNo ratings yet

- Security Analysis (Book)Document3 pagesSecurity Analysis (Book)LinaNo ratings yet

- Business ProposalDocument7 pagesBusiness ProposalMysha Tagle100% (1)

- Chapter 8.pptx The Efficient Market HypothesisDocument28 pagesChapter 8.pptx The Efficient Market HypothesisKevin Kivanc IlgarNo ratings yet

- Valuations 1: Introduction To Methods of ValuationDocument17 pagesValuations 1: Introduction To Methods of ValuationNormande RyanNo ratings yet

- GreenlightDocument6 pagesGreenlightaugustaboundNo ratings yet

- Accounts Receivable and PayableDocument25 pagesAccounts Receivable and PayablekulkarnihNo ratings yet

- NetBRain Survey Report 061217 NB VersionDocument8 pagesNetBRain Survey Report 061217 NB VersionKevin Kivanc IlgarNo ratings yet

- NetBRain Survey Report 061217 NB VersionDocument8 pagesNetBRain Survey Report 061217 NB VersionKevin Kivanc IlgarNo ratings yet

- Bakken 24 Billion BOE Technical Paper PDFDocument2 pagesBakken 24 Billion BOE Technical Paper PDFKevin Kivanc IlgarNo ratings yet

- Chapter 5.pptx Risk and ReturnDocument25 pagesChapter 5.pptx Risk and ReturnKevin Kivanc IlgarNo ratings yet

- Mutual FundsDocument56 pagesMutual FundsKevin Kivanc IlgarNo ratings yet

- Chap 003Document83 pagesChap 003Dennis HigginsNo ratings yet

- How To Write An EmailDocument1 pageHow To Write An EmailKevin Kivanc IlgarNo ratings yet

- Homework 6 Pe5623Document12 pagesHomework 6 Pe5623Kevin Kivanc Ilgar100% (1)

- AZIZ PapersDocument224 pagesAZIZ PapersKevin Kivanc IlgarNo ratings yet

- How To Use Shilling Aparatus and ChromotographDocument8 pagesHow To Use Shilling Aparatus and ChromotographKevin Kivanc IlgarNo ratings yet

- Fundamentals of Orifice Measurement TechWpaperDocument9 pagesFundamentals of Orifice Measurement TechWpaperSavan ChandranNo ratings yet

- PE5970 ES Menon Gas Hydraulics Class NotesDocument59 pagesPE5970 ES Menon Gas Hydraulics Class NotesKevin Kivanc IlgarNo ratings yet

- PE5970 ES Menon Gas Hydraulics Class NotesDocument59 pagesPE5970 ES Menon Gas Hydraulics Class NotesKevin Kivanc IlgarNo ratings yet

- Location Theory: Johann Heinrich Von Thünen, A Prussian Landowner, Introduced An Early Theory ofDocument5 pagesLocation Theory: Johann Heinrich Von Thünen, A Prussian Landowner, Introduced An Early Theory ofArellano SastroNo ratings yet

- Money MarketDocument20 pagesMoney MarketThiên TrangNo ratings yet

- Case Study - Clique PensDocument3 pagesCase Study - Clique PensSallySakhvadze100% (1)

- Agriculture: International Accounting Standard 41Document42 pagesAgriculture: International Accounting Standard 41Astra LarasatiNo ratings yet

- Set Up A New Distribution ChannelDocument19 pagesSet Up A New Distribution Channelwww.GrowthPanel.com100% (6)

- Regression & Elasticity 1Document11 pagesRegression & Elasticity 1biggykhairNo ratings yet

- Comparative Analysis of Advertisements That Represent and Does Not Represent The Marketing ConceptsDocument2 pagesComparative Analysis of Advertisements That Represent and Does Not Represent The Marketing ConceptsMike Adrian de RoblesNo ratings yet

- BACKGROUND OF SPA CeylonDocument20 pagesBACKGROUND OF SPA CeylonSaraniah PerumalNo ratings yet

- Internship ReportDocument99 pagesInternship ReportShubham TyagiNo ratings yet

- Ba PDFDocument269 pagesBa PDFTaskin Reza KhalidNo ratings yet

- How To Pivot Successfully in BusinessDocument4 pagesHow To Pivot Successfully in BusinessSASI KUMAR SUNDARA RAJANNo ratings yet

- A Summer Internship Projct Report: ON "Flipkart'S Warehouse"Document12 pagesA Summer Internship Projct Report: ON "Flipkart'S Warehouse"Shashank reignNo ratings yet

- Marketing ResearchDocument27 pagesMarketing Researchvarun kumar VermaNo ratings yet

- Actividad de Aprendizaje 14 Evidencia 9: Sesión Virtual "Supporting Your Improvement Plan For Your Product or Service"Document5 pagesActividad de Aprendizaje 14 Evidencia 9: Sesión Virtual "Supporting Your Improvement Plan For Your Product or Service"Luis Enrique Hernandez RodriguezNo ratings yet

- Chapter 13aDocument8 pagesChapter 13amas_999No ratings yet

- ECON 11 Activity 3Document2 pagesECON 11 Activity 3Kenzie AlmajedaNo ratings yet

- The Goals and Functions of Financial Management: Powerpoint Presentation Prepared by Michel Paquet, Sait PolytechnicDocument22 pagesThe Goals and Functions of Financial Management: Powerpoint Presentation Prepared by Michel Paquet, Sait PolytechniceedooropprNo ratings yet

- Mod 4 NotesDocument34 pagesMod 4 NotesMew MewNo ratings yet

- Markit Magazine Issue 14Document64 pagesMarkit Magazine Issue 14lulenduNo ratings yet

- Product: Pricing Strategy ProjectDocument5 pagesProduct: Pricing Strategy ProjectDrSantha JettyNo ratings yet

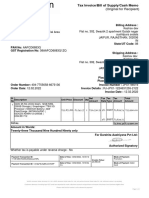

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)erjasdNo ratings yet

- Module 3Document3 pagesModule 3Chin Keanna BuizonNo ratings yet

- Microeconomics 13th Edition Parkin Solutions ManualDocument15 pagesMicroeconomics 13th Edition Parkin Solutions Manualhebetrinhyb7100% (19)

- Internal Factors Analysis (IFE) : Good Brand AwarenessDocument3 pagesInternal Factors Analysis (IFE) : Good Brand AwarenessNsrNo ratings yet