Professional Documents

Culture Documents

S-Curve Theory 1

Uploaded by

Tushar NaikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S-Curve Theory 1

Uploaded by

Tushar NaikCopyright:

Available Formats

Patterns of Technological Innovation

John Callahan (2007)

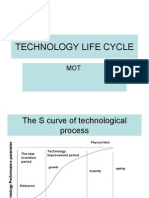

The S-curve or lifecycle model (Foster 1986) remains a widely used tool for thinking about technological innovation and competition. The basic idea is that any technology with commercial potential passes through a lifecycle. During the early stages of the commercialization process, progress is slow as fundamental technical issues are addressed. The rate of progress increases, as these issues are resolved. As the technology ages, performance approaches upper limits often based on fundamental constraints such as the speed of light. Diagram P1 shows a typical S-curve for a technology. The horizontal axis is the amount of R&D effort expended cumulative amount of R&D expenditures over time, for example. Often, time is used as a proxy variable for this effort. The vertical axis is some single performance measure critical to the technologys commercial performance.

The replacement of one technology by another is frequently modeled using S-curves. In the diagram P2, the performance improvement in technology T1 is slowing. The performance of a newer technology, T2, while inferior is actually improving at a faster rate. In fact, it does overtake T1, the old technology, in terms of performance.

John Callahan, 2008

Thinking like this using the S-curve helps managers to ask what if questions and to make forecasting decisions. Because the S-curve is also a very simple idea that is easily captured in a diagram, it also facilitates communication and discussion. 1 On the other hand, the use of S-curves has been severely criticized by Sood and Tellis (2005). 2 They tested four hypotheses: 1. Technological progress on a primary dimension follows a single S-shaped growth curve. 2. When a new technology is introduced, its performance is lower than that of the old technology. 3. When a new technology reaches maturity, its performance is higher than that of the old technology. 4. The performance path of a pair of successive technologies intersects once when the new technology surpasses the old technology in performance.

These 4 hypotheses form the basis for the use of the S-curve in technology strategy. Sood and Tellis tested these hypotheses using data from four categories of technology: data transfer,

1 2

This is an important characteristic of any theory or model. Sood, Ashish and Gerald J. Tellis (2005) Technological Evolution and Radical Innovation, Journal of Marketing, 69, July, 152-168.

John Callahan, 2008

computer memory, desktop printers and display monitors. The primary dimensions of technological progress that they used in each category are provided in table P1:

Table P1: Metrics of Primary Dimensions in Each Category

Category Desktop memory Display monitors Desktop printers Data transfer

Primary Dimensions Storage capacity Screen resolution Print resolution Speed of data transmission

Metric Bytes per square inch Dots per square inch Pixels per square inch Megabits per second

Sood and Tellis (2005) found no evidence to support any of the 4 hypotheses! What they did find was that technological evolution seems to follow a step function, with sharp improvements in performance following long periods of no improvement and that paths of rival technologies may cross more than once or not at all. They counsel that using S-curves to predict the performance of a technology is risky and may be misleading.

The next major step in thinking about the progress of technology was taken by Abernathy and Utterback.

3

Based on their observations of a wide variety of technological innovations, they

proposed a lifecycle model that includes both product and process innovation. The model is outlined in diagram P3.

At time 0, a radical innovation enters the marketplace in a new product. The product provides functionality not provided until that point. A good example is the personal computer made possible by the development of new off-the-shelf microprocessors (and related chip sets) in the 1970s.

This introduction if followed by a period of intense product innovation as companies seek the best way to use the new technology for product advantage. Abernathy and Utterback (1978) call this the fluid phase. This intense product innovation begins to fall off once a dominant design is arrived at. A dominant design is a design that comes to be adopted by a majority of the market.

Again, the personal computer provides an instructive example. Up until the introduction of the IBM PC, many companies were producing a wide variety of significantly incompatible personal computers think of names like Commodore, Osborne and Kaypro. With the IBM PC, the market

Abernathy, William J. and James M. Utterback (1978) Patterns of Innovation in Industry, Technology Review, 80(7), June-July, 40-47.

John Callahan, 2008

coalesced and IBM compatible became part of marketing slogans. The IBM PC became a dominant design. 4

The theory is that during a transitional phase, a dominant design is arrived at and the rate of product innovation decreases. This is also a phase of increasing process innovation that is, innovation in the processes required to deliver the product to customers: manufacturing, logistics, shipping, and business models. The innovation questions switch from what to make to how to make and deliver it more efficiently and effectively. As process issues of product quality, cost and timeliness of delivery come to dominate, the process enters the specific phase during which incremental innovation is the norm and the number of suppliers contracts through competitive attrition.

In the PC market, Dell typifies the increased importance of process innovation during the specific phase. Dell computers were and are similar to the existing dominant design. Dells direct sales processes, however, were distinctly different from those that existed when Dell entered the

Note that the establishment of a dominant design in a market does not mean that no other designs survive. The continued survival of the Apple in the PC market is a good example of this. Srinivasan et al. (2006) investigate both the probability that a dominant design will emerge in a product market and the time taken for a dominant design to emerge if it does.

John Callahan, 2008

market and began to be successful. Of course, since then other companies like HP have copied Dells process innovations and Dells dominance in the market has been blunted. Tushman and Anderson 5 took the AU model a step further by looking at successive innovation cycles. 6 They asked the questions: Under what conditions do industry incumbent companies survive and thrive through a radical technological innovation and Under what conditions are new entrants successful? Their answer, based on data gathered in the cement, airline and minicomputer industries was that it depended on whether the radical innovation was competence enhancing or competence destroying.

For an incumbent company in an industry, a radical innovation is competence destroying if the incumbent companys technology base is less able to provide the company with competitive advantage because of the radical innovation. A standard example of this is the development of the transistor. For those companies that produced vacuum tubes, the transistor was a competence destroying technological innovation. When a competence destroying technological innovation occurs in an industry, Tushman and Anderson theorized that industry incumbents would not do well through the transition. Their data backed up their contention.

On the other hand, if the innovation is competence enhancing, incumbents do well and even consolidate their presence in the market. An example of this is the development of large-scale integrated circuits (VLSI). Those companies that had been producing simpler transistor based chips were more able than any to adopt VLSI. The new technology provided these companies even more competitive advantage from their competencies with transistors. When a competence enhancing radical technology enters a market, Tushman and Anderson theorized that incumbents consolidate their competitive positions. Again, data backed up their contention.

7

Christensen took the next step.

He constructed another very telling critique of the standard use

of S-curves to describe the replacement of an older technology by a new one as shown above in diagram P2. 8 He made the point that the key measures of performance of the two technologies

Tushman, M.L. and P. Anderson (1986) "Technological discontinuities and organizational environments", Administrative Science Quarterly, 31, 439-65. 6 Note that the model of incremental innovation punctuated by radical innovation used by both Abernathy and Utterback and by Tushman and Anderson has a lot of similarities to the results found more recently by Sood and Tellis (2005) radical innovation and then more incremental 7 Christensen, Clayton M. (1997) The Innovators Dilemma, Harvard Business School Press; Christensen, C.M. and M.E. Raynor (2003) The Innovator's Solution: Creating and Sustaining Successful Growth. Harvard Business School Press. 8 Christensen, C.M. (1992) Exploring the Limits of the Technology S-Curve. Part I: Component Technologies, Production and Operations Management, 4(Fall), 334-357; Christensen, C.M.

John Callahan, 2008

can be very different. Often the new technology, T2, satisfices on the performance dimensions of the old technology, T1, while providing a new dimension of performance on which it is much superior to the old technology and that allows it to provide superior value in use. Even more important, the new technology is often architectural in nature. That is, the new technology changes the overall design of the product rather than just the components of the product, and is targeted initially at sectors of the market historically regarded as unimportant by industry incumbents. The situation is as shown in the following diagram:

Christensen further developed this idea as disruptive innovation. He identified three critical elements of disruption. First, in every market there is a rate of technology driven improvement in a product class that customers can utilize or absorb. Second, the pace of technological progress almost always outstrips the ability of any given tier of the market to use it. These first two elements, taken together, mean that the lower tiers of a product market often become overserved by the products of the incumbent companies in the industry.

The third element is the distinction between sustaining and disruptive innovation. Sustaining innovation is directed by industry incumbents at the upper, most demanding, tiers of the market

(1992) Exploring the Limits of the Technology S-Curve. Part 2: Architectural Technologies, Production and Operations Management, 4(Fall), 358-366.

John Callahan, 2008

at those customers who value product functionality the most. Disruptive innovation, on the other hand, is directed at those customers already overserved. Products driven by disruptive innovation are good enough for these customers. More importantly, they are often cheaper and easier to use.

Disruptive innovation is particularly dangerous for industry incumbents because an asymmetry of motivation that exists between them and disruptive new entrants. The incumbents stay close to their important and most demanding upper-tier customers, and give them what they want more functionality. These companies are not particularly interested in the overserved lower tiers of the market because, almost by definition, these tiers of the market feature cheaper, low margin products. The incumbents, in looking to the upper tiers of the market, are organized to profit from high margin products. Their business models are not designed to make money in a price conscious, low margin environment. For companies like this, going down margin to respond to disruptive threats is very difficult. For managers, there is no incentive because there is higher margin business available at the top of the market. It is also very hard to take overhead out of a business model.

Disruptive new entrants come to the overserved segments of the market with enthusiasm and business models designed to profit from low margin products. When successful, disruptive new entrants are eager to move up market and take on the incumbents in the low end of their product range. And technological progress often facilitates this as it moves faster than customer adoption as pointed out above.

Christensen pictures the situation as follows:

John Callahan, 2008

A classic example of a market being over served was provided by the spring 2007 upgrade of Adobe Photoshop. 9 Photoshop had been a standard photo-processing tool for all serious photographers. The new Photoshop had more power and functionality than ever. Its new power and functionality, however, was only really utilized by professional photographers. With the decline in digital camera prices, the number of digital photography enthusiasts was growing fast. But these enthusiasts seldom printed their photographs preferring to upload and share them on web sites like Flickr and Photobucket. The full print processing functionality of Photoshop was not required for photos going directly to the web without being printed. This meant that Photoshop over served a growing number of digital photographers. Heading the advice of Christensen, Adobe brought out lighter weight products like Lightroom to address this demand and protect the bottom end of its market.

So-whats for tech based startups 1. Lots of managers and entrepreneurs think about technological change using S-curves. This is inappropriate.

Gilbertson, Scott (2007) "Major Photoshop Upgrade Is Overkill for the Flickr Crowd", Wired, March 27, http://www.wired.com/software/softwarereviews/news/2007/03/pshop_cs0327 (accessed April 15, 2007).

John Callahan, 2008

2. As a technology-based market matures, innovation and competitive advantage switches from product design innovation to process innovation product cost, quality, and delivery effectiveness become more important. That is, your business models must change. 3. This switch is marked by the emergence of a dominant design for the product. 4. A startup can do well against established competitors if it avoids direct confrontation with what the incumbents regard as the most attractive parts of a market, but rather if it provides new types of functionality in inexpensive and easy to use products to overserved or un-served customers.

References Anderson, Philip and Michael L. Tushman (1991) Dominant Design, Research-Technology Management, May/June, 26-31.

Anderson, Philip and Michael L. Tushman (1990) Technological Discontinuities and Dominant Designs: A cyclical model of technological change, Administrative Science Quarterly, 35, 604633.

Christensen, Clayton M. (1997) The Innovators Dilemma, Harvard Business School Press

Christensen, C.M. (1992) Exploring the Limits of the Technology S-Curve. Part I: Component Technologies, Production and Operations Management, 4(Fall), 334-357.

Christensen, C.M. (1992) Exploring the Limits of the Technology S-Curve. Part 2: Architectural Technologies, Production and Operations Management, 4(Fall), 358-366.

Christensen, C.M. and M.E. Raynor (2003) The Innovator's Solution: Creating and Sustaining Successful Growth. Harvard Business School Press.

Foster, R. (1986) "The S curve: A New Forecasting Tool." Chapter 4 in Innovation, The Attacker's Advantage, Summit Books, Simon and Schuster, New York, 88-111.

Gilbertson, Scott (2007) "Major Photoshop Upgrade Is Overkill for the Flickr Crowd", Wired, March 27, http://www.wired.com/software/softwarereviews/news/2007/03/pshop_cs0327 (accessed April 15, 2007).

Tushman, M.L. and P. Anderson (1986) "Technological discontinuities and organizational environments", Administrative Science Quarterly, 31, 439-65.

John Callahan, 2008

You might also like

- So You Thought You Couldn't DrawDocument164 pagesSo You Thought You Couldn't Drawhekaton100% (13)

- Natural Born Killers - ScreenplayDocument110 pagesNatural Born Killers - ScreenplayBlue YurbleNo ratings yet

- Rules of Word Stress in EnglishDocument9 pagesRules of Word Stress in Englishmadhes14100% (2)

- Livro - The Art of The Advanced Dungeons & DragonsDocument120 pagesLivro - The Art of The Advanced Dungeons & DragonsIndaBor75% (4)

- Bautista, Emmanuel D. IV-Newton: E.G. Science Not Conflict With ReligionDocument17 pagesBautista, Emmanuel D. IV-Newton: E.G. Science Not Conflict With ReligionJoemar FurigayNo ratings yet

- Waffen-Arsenal S-17 - Nurflügel - Die Ho 229 - Vorläufer Der Heutigen B2 (ENG.)Document55 pagesWaffen-Arsenal S-17 - Nurflügel - Die Ho 229 - Vorläufer Der Heutigen B2 (ENG.)stary100% (13)

- The Cactaceae Descriptions and Illustrations of Plants of The Cactus Family (1919) v.4Document412 pagesThe Cactaceae Descriptions and Illustrations of Plants of The Cactus Family (1919) v.4cavris100% (1)

- PRODUCT Design and DevelopmentDocument6 pagesPRODUCT Design and DevelopmentJames IshakuNo ratings yet

- Checklist-Masonry - Brickwork and BlockworkDocument6 pagesChecklist-Masonry - Brickwork and Blockworkapi-372251810No ratings yet

- Technology Life CycleDocument8 pagesTechnology Life CycleAshutosh SarkarNo ratings yet

- Zaftig Knitted Bra by Joan McGowan - MichaelDocument2 pagesZaftig Knitted Bra by Joan McGowan - MichaelspidersunshineNo ratings yet

- Theory Business IncubationDocument14 pagesTheory Business IncubationWill Hires100% (3)

- Ashish PurohitDocument8 pagesAshish PurohitSAP_SD_HMNo ratings yet

- ProfEd 104 Technology For Teaching and LearningDocument28 pagesProfEd 104 Technology For Teaching and LearningJoel Cabanilla50% (2)

- Competing With Information TechnologyDocument39 pagesCompeting With Information TechnologyAmmarah KaleemNo ratings yet

- Operations Management (ME-601) UNIT 2,3: Prof. S. N. VarmaDocument256 pagesOperations Management (ME-601) UNIT 2,3: Prof. S. N. Varmaanimesh650866No ratings yet

- José Maria Leyava, Cajeme. WikiDocument10 pagesJosé Maria Leyava, Cajeme. WikiEUTOPÍA MÉXICONo ratings yet

- Samsung Uses Six Sigma To ChangeDocument4 pagesSamsung Uses Six Sigma To ChangeHarold Dela FuenteNo ratings yet

- System EngineeringDocument21 pagesSystem EngineeringHarsha VardhanNo ratings yet

- Technology ManagementDocument28 pagesTechnology Managementharish332008No ratings yet

- Flexible Manufacturing SystemsDocument12 pagesFlexible Manufacturing Systemssanketsavaliya7605No ratings yet

- Technology Management ADM 80012 SemesterDocument67 pagesTechnology Management ADM 80012 SemesterDexter LaboratoryNo ratings yet

- Portfolio Management For New Product Development: Results of An Industry Practices StudyDocument39 pagesPortfolio Management For New Product Development: Results of An Industry Practices StudyvemurirajaNo ratings yet

- Feasibility Study QuestionsDocument1 pageFeasibility Study QuestionsPat Hadji AliNo ratings yet

- Schilling 01Document13 pagesSchilling 01harpreetbawaNo ratings yet

- Enkel Gassmann Chesbrough (2009) - R&D and Open InnovationDocument6 pagesEnkel Gassmann Chesbrough (2009) - R&D and Open Innovationguzman87No ratings yet

- pp03Document16 pagespp03Jo JhonyNo ratings yet

- Case I 1 Elioenrg Lin B&WDocument21 pagesCase I 1 Elioenrg Lin B&WCarlos PadronNo ratings yet

- Case1 Elio EngDocument39 pagesCase1 Elio Engtom_1966100% (2)

- DFiD Project Cycle Management Impact AssessDocument26 pagesDFiD Project Cycle Management Impact Assessapi-369633950% (2)

- Product and Process Innovation A System Dynamics-Based Analysis of The InterdependenciesDocument11 pagesProduct and Process Innovation A System Dynamics-Based Analysis of The Interdependenciesnivas_mechNo ratings yet

- (Book Chapter) TRIZ - Design Problem Solving With Systematic InnvationDocument24 pages(Book Chapter) TRIZ - Design Problem Solving With Systematic InnvationJosh PeraltaNo ratings yet

- As 4817-2006 Project Performance Measurement Using Earned ValueDocument8 pagesAs 4817-2006 Project Performance Measurement Using Earned ValueSAI Global - APAC0% (1)

- Management of Technology Selected Papers at Vienna Global ForumDocument247 pagesManagement of Technology Selected Papers at Vienna Global ForumshariqalikhanNo ratings yet

- Management of Technology: The Key To Competitivness and Wealth CreationDocument23 pagesManagement of Technology: The Key To Competitivness and Wealth CreationmohammadhadiNo ratings yet

- Global R&D Project Management and Organization: A TaxonomyDocument19 pagesGlobal R&D Project Management and Organization: A TaxonomyLuis Filipe Batista AraújoNo ratings yet

- Tutorial Letter 202/2020: Year Module PRO4801Document5 pagesTutorial Letter 202/2020: Year Module PRO4801meshNo ratings yet

- Literature Review Smart FactoryDocument5 pagesLiterature Review Smart FactoryAnonymous IpvZkSoWANo ratings yet

- Technology ManagementDocument13 pagesTechnology ManagementKevin RebelloNo ratings yet

- Strategic Dimensions of Maintenance Management: Albert H.C. TsangDocument33 pagesStrategic Dimensions of Maintenance Management: Albert H.C. TsanghuseNo ratings yet

- 01 Differing Perspectives On QualityDocument42 pages01 Differing Perspectives On QualityM Sayid Dwi50% (2)

- Industry 4.0 - Prospects and Challenges For Cambodia's Manufacturing SectorDocument12 pagesIndustry 4.0 - Prospects and Challenges For Cambodia's Manufacturing SectorTravisNo ratings yet

- Open Innovator's ToolkitDocument6 pagesOpen Innovator's ToolkitFedScoopNo ratings yet

- Opportunity Cost, Marginal Analysis, RationalismDocument33 pagesOpportunity Cost, Marginal Analysis, Rationalismbalram nayakNo ratings yet

- Project Formulation and AppraisalDocument1 pageProject Formulation and AppraisalSuganyashivraj SuganyaNo ratings yet

- Improving Traditional CostDocument8 pagesImproving Traditional CostVinay Vinnu100% (2)

- The Cosmopolitan CorporationDocument5 pagesThe Cosmopolitan CorporationMyTotem SpinsNo ratings yet

- Development Processes and OrganizationsDocument41 pagesDevelopment Processes and OrganizationsPuneet GoelNo ratings yet

- Literature Review On Property Management SystemDocument4 pagesLiterature Review On Property Management Systempym0d1sovyf3No ratings yet

- Lean ManufacturingDocument11 pagesLean ManufacturingraisehellNo ratings yet

- New Product Development ProcessDocument12 pagesNew Product Development ProcessWan Zulkifli Wan IdrisNo ratings yet

- Technology Diffusion Adoption ProcessDocument20 pagesTechnology Diffusion Adoption ProcessLeah NarneNo ratings yet

- Industrial Revolution 40 in The Construction IndusDocument6 pagesIndustrial Revolution 40 in The Construction InduszeyadNo ratings yet

- SAAD Tutorial - Feasibility StudyDocument3 pagesSAAD Tutorial - Feasibility Studyflowerpot321No ratings yet

- Innovation Management Types Management Practices and Innovation Performance in Services Industry of Developing EconomiesDocument15 pagesInnovation Management Types Management Practices and Innovation Performance in Services Industry of Developing EconomiesLilis PurnamasariNo ratings yet

- Product - : Introduction To PLM and PDMDocument38 pagesProduct - : Introduction To PLM and PDMsayandh sp100% (1)

- Social Innovation and SustainabilityDocument7 pagesSocial Innovation and SustainabilityrentinghNo ratings yet

- Microsoft Word - Quality Function DeploymentDocument9 pagesMicrosoft Word - Quality Function DeploymentMuhammad Tahir NawazNo ratings yet

- Synopsis of Innovation and Incubation HubDocument3 pagesSynopsis of Innovation and Incubation HubPuneet BandarwadNo ratings yet

- Concept Development & Selection: Prepared by Prof. Margaret Bailey (ME)Document26 pagesConcept Development & Selection: Prepared by Prof. Margaret Bailey (ME)nandini pNo ratings yet

- Management of TechnologyDocument19 pagesManagement of TechnologyBhavik MakwanaNo ratings yet

- Chapter 3 Project Identification and FeasibilityDocument80 pagesChapter 3 Project Identification and FeasibilityhailegebraelNo ratings yet

- Concept Generation Narrative ReportDocument8 pagesConcept Generation Narrative ReportLeechel Ella Recalde (Ellie)No ratings yet

- Systems Development Cycle: Early StagesDocument21 pagesSystems Development Cycle: Early StagespoyiodargNo ratings yet

- The Evolution of The Innovation Process: From Research To Development To Actual InnovationDocument7 pagesThe Evolution of The Innovation Process: From Research To Development To Actual InnovationPaolo BarbatoNo ratings yet

- Decision Support Systems: Issues and Challenges: Proceedings of an International Task Force Meeting June 23-25, 1980From EverandDecision Support Systems: Issues and Challenges: Proceedings of an International Task Force Meeting June 23-25, 1980Göran FickNo ratings yet

- Technological Evolution and Radical Innovation: Ashish Sood & Gerard J. TellisDocument18 pagesTechnological Evolution and Radical Innovation: Ashish Sood & Gerard J. TellisMiguel PradaNo ratings yet

- European Journal of Operational Research: Chialin Chen, Jun Zhang, Ruey-Shan GuoDocument13 pagesEuropean Journal of Operational Research: Chialin Chen, Jun Zhang, Ruey-Shan GuoelnazNo ratings yet

- Wonglimpiyarat 2012Document13 pagesWonglimpiyarat 2012ArijitMalakarNo ratings yet

- Demystifying Disruption: A New Model For Understanding and Predicting Disruptive TechnologiesDocument53 pagesDemystifying Disruption: A New Model For Understanding and Predicting Disruptive TechnologiesEric HydeNo ratings yet

- StarbucksDocument66 pagesStarbucksSwapnil Chaudhari0% (2)

- Ecosystem ACMDocument7 pagesEcosystem ACMTushar NaikNo ratings yet

- Etrepreneurship M PresentationDocument22 pagesEtrepreneurship M PresentationTushar NaikNo ratings yet

- Jumboking 100129061319 Phpapp02Document17 pagesJumboking 100129061319 Phpapp02Tushar NaikNo ratings yet

- Presented By: Chetan Pitambare (206) Raviraj Ghadi (176) Haresh Narkhede Swapnil BhangaleDocument12 pagesPresented By: Chetan Pitambare (206) Raviraj Ghadi (176) Haresh Narkhede Swapnil BhangaleTushar NaikNo ratings yet

- 1Document57 pages1Tushar NaikNo ratings yet

- SHUATS - Entrance Test Admit Card 2019 - 23740Document3 pagesSHUATS - Entrance Test Admit Card 2019 - 23740Pranjali yadavNo ratings yet

- Thuoret Et. Al. 2007Document24 pagesThuoret Et. Al. 2007Roger WaLtersNo ratings yet

- Palm and Dorsal Hand VeinDocument4 pagesPalm and Dorsal Hand VeinVignesh Manju100% (1)

- Printdeal Lightroom-ShortcutsDocument2 pagesPrintdeal Lightroom-Shortcutsashomm100% (1)

- Question Physics1Document9 pagesQuestion Physics1Tapas BanerjeeNo ratings yet

- LFIDocument1 pageLFIDomino234No ratings yet

- Fujifilm X-H2S Camera SpecsDocument14 pagesFujifilm X-H2S Camera SpecsNikonRumorsNo ratings yet

- Cornea PDFDocument5 pagesCornea PDFAlmomnbllah AhmedNo ratings yet

- Digimag0117 by NishanbalDocument132 pagesDigimag0117 by NishanbalNishanbir Singh Bal100% (2)

- Dumpy LevelDocument8 pagesDumpy LevelKhiel YumulNo ratings yet

- A Seminar Report ON: HolographyDocument16 pagesA Seminar Report ON: HolographyShubham KadlagNo ratings yet

- Leica DMI3000Document16 pagesLeica DMI3000Hakkı SaraylıkNo ratings yet

- Promising Lithography Techniques For Next-GeneratiDocument15 pagesPromising Lithography Techniques For Next-GeneratixellosdexNo ratings yet

- Oed LA 1 and 2Document14 pagesOed LA 1 and 2nunyu bidnes100% (1)

- WWW .NMK - Co.in: No. of Vacancies Reserved Category For Which Identified Functional Classification Physical RequirementsDocument12 pagesWWW .NMK - Co.in: No. of Vacancies Reserved Category For Which Identified Functional Classification Physical RequirementsDeepakNo ratings yet

- Samsung SCL860 ManualDocument76 pagesSamsung SCL860 ManualTom SardoNo ratings yet

- Cswip Div 7 95 Underwater Diver Inspectors Part 1 6th Edition April 2019 1Document18 pagesCswip Div 7 95 Underwater Diver Inspectors Part 1 6th Edition April 2019 1Satendra kumarNo ratings yet

- What The Frogs Eye Tells The Frogs BrainDocument12 pagesWhat The Frogs Eye Tells The Frogs BrainJorge DomicianoNo ratings yet

- Secured Image Transmission Using Mosaic ImagesDocument5 pagesSecured Image Transmission Using Mosaic ImagesIJSTENo ratings yet