Professional Documents

Culture Documents

Modelling Speculative Behaviour in Web 2.0 and Social Media Companies by Russell Newman

Uploaded by

Leslie CarrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Modelling Speculative Behaviour in Web 2.0 and Social Media Companies by Russell Newman

Uploaded by

Leslie CarrCopyright:

Available Formats

Modelling Speculative Behaviour

in Web 2.0 and Social Media Companies

Russell Newman | rn106@ecs.soton.ac.uk

This research focuses on development of economic bubbles around IT sectors in the past, and whether similar situations are prevalent in the Web 2.0/social media industry today. Existing research analyses investor attitudes surrounding the dot-com bubble in 2001, and unpicks the patterns of behaviour that made it possible. It explores in detail the attitudes that led to widespread availability of venture capital for Web start-ups, with little or no due diligence.

Web Science DTC

This research aims to identify whether contemporary Web 2.0/social media companies have ever exhibited similar characteristics to those in 2001, through extension of the models in existing research and subsequent simulation based upon these models.

Modelling Behaviour

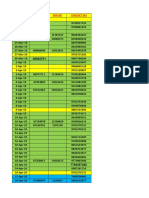

This model is based upon existing research into the 2001 dot-com bubble, with adaptations made for subsequent findings and other findings about investor behaviours. In particular:

Valliere and Peterson, who indentified a

Market/Industry

Product Demand Fn. Technological Development

Market Share Fragmentation + + Speculation + Capital Available for Investment + Perceived Sector Risk

+ Fn.

cognitive model of investors in bubbleconditions, following interviews with 57 dot-com venture capitalists [1,2].

Sahlman and Stevenson, who

Investors

Perceived Sector Experience +

introduced the idea of capital market myopia - the phenomenon of individual investors over-investing in hyped startups, with catastrophic effects upon the whole sector. The three layers of the model represent actors or entities that comprise the system. These contain tangible and intangible factors that affect the behaviour of other items within the system. The Companies and Investors layers may be thought of as a collection of

+ Companies Product Adoption

+ Venture Capital Investment

Valuation + + Product Development +

+ Market Share + Public/Institutional Investment

+ Investment Volume

A line connected with a + represents a direct influence (i.e. an increase at the origin increases the destination). A - represents an inverse influence (i.e. an increase at the origin decreases the destination). Fn represents a more complex influence that may depend upon other factors within the system.

entities. That is, the system comprises many investors and many companies. Existing research in this field contains extensive work upon venture capital investment, being the foundation of

potentially-hyped start-ups. This offers the opportunity to model venture capitalist behaviour more accurately, which has informed and adapted the design.

Simulating It

With appropriate adaptations to the above model, the research question may be answered using techniques of discrete event simulation (DES) or agent-based simulation. Each offers distinct advantages. The model will firstly be validated by performing a simulation with source data from the 2001 dot-com bubble era. The model can then be adapted and improved to ensure it produces correct

results (i.e. those in literature) for that particular scenario. The same simulation will then be run with corresponding source data from recent Web 2.0 and social media companies. DES provides a means of simulating through entities and feedback links, as shown above, and formulae/logic that informs how and when feedback occurs between entities. Agent-based simulation affords the opportunity to model each type of actor

(investors, companies, etc) as an object with certain behaviours, and to analyse the interactions between them. Given the extensive research available on investor and start-up behaviours, this approach may yield a more accurate simulation.

Web Science

Sources: [1] Valliere & Peterson (2004), Inflating the Bubble: Examining dot-com Investor Behaviour, in Venture Capital vol. 6(1) pp1-22. [2] Valliere & Peterson (2005), Venture Capitalist Behaviours: Frameworks for Future Research, in Venture Capital vol. 7(2) pp167-183. [3] Sahlman & Stevenson (1987), Capital Market Myopia, in Journal of Business Venturing, Winter 1985 pp 7-30.

You might also like

- Capital Structure of Internet Companies: Case Study: Munich Personal Repec ArchiveDocument38 pagesCapital Structure of Internet Companies: Case Study: Munich Personal Repec ArchivePalwinder KaurNo ratings yet

- Capital Structure Theories Fail to Explain Internet CompaniesDocument37 pagesCapital Structure Theories Fail to Explain Internet CompaniesNguyễn Ngọc KhánhNo ratings yet

- Social Capital of Venture Capitalists and Start-Up FundingDocument17 pagesSocial Capital of Venture Capitalists and Start-Up FundinghardikgosaiNo ratings yet

- Effects of Different Financing Options On The Performance of Private Owned BusinessDocument8 pagesEffects of Different Financing Options On The Performance of Private Owned BusinessbiggykhairNo ratings yet

- Web SearchDocument18 pagesWeb SearchSamantha Lola ButterNo ratings yet

- Gibson, B., & Setterfield, M. (2015) - Real and Financial Crises in The Keynes-Kalecki Structuralist Model An Agent-Based ApproachDocument31 pagesGibson, B., & Setterfield, M. (2015) - Real and Financial Crises in The Keynes-Kalecki Structuralist Model An Agent-Based Approachlcr89No ratings yet

- Essay CreatorDocument6 pagesEssay Creatorb6yf8tcdNo ratings yet

- Influence of Social Media Over Stock MarketDocument9 pagesInfluence of Social Media Over Stock MarketHaaturaNo ratings yet

- Big Data in Finance: Evidence and Challenges: Borsa - Istanbul ReviewDocument5 pagesBig Data in Finance: Evidence and Challenges: Borsa - Istanbul ReviewYaa RabbiiNo ratings yet

- Theoretical Framework and Conceptual Model for Studying the Impact of COVID-19 Lockdowns on Online Micro-BusinessesDocument5 pagesTheoretical Framework and Conceptual Model for Studying the Impact of COVID-19 Lockdowns on Online Micro-BusinessesKim FloresNo ratings yet

- Intellectual CapitalDocument16 pagesIntellectual CapitalDr-Sobia AmirNo ratings yet

- What Do Business Models Do? Innovation Devices in Technology EntrepreneurshipDocument13 pagesWhat Do Business Models Do? Innovation Devices in Technology EntrepreneurshipVamos A TepaNo ratings yet

- Draft Research Proposal in Entrepreneurial Finance: March 2015Document6 pagesDraft Research Proposal in Entrepreneurial Finance: March 2015dimbi56No ratings yet

- A Research ProposalDocument2 pagesA Research ProposalYours SopheaNo ratings yet

- ARADocument22 pagesARAEwaen Ovia100% (1)

- Fang 2014Document38 pagesFang 2014Zeenish AviNo ratings yet

- 9 - Blockchain Technology and Startup FinancingDocument25 pages9 - Blockchain Technology and Startup FinancingAtminia JanufataNo ratings yet

- Ejkm Volume5 Issue4 Article124Document8 pagesEjkm Volume5 Issue4 Article124James JianYong SongNo ratings yet

- CEUR Proceedings of the 5th International i* Workshop (iStar 2011) - Causal vs. Effectual BehaviorDocument6 pagesCEUR Proceedings of the 5th International i* Workshop (iStar 2011) - Causal vs. Effectual BehaviorST KnightNo ratings yet

- Unpacking The Disruption Process: New Technology, Business Models, and Incumbent AdaptationDocument61 pagesUnpacking The Disruption Process: New Technology, Business Models, and Incumbent AdaptationAtharva DangeNo ratings yet

- Bonchi Castillo Gionis Jaimes 2011 Social Network Analysis BusinessDocument37 pagesBonchi Castillo Gionis Jaimes 2011 Social Network Analysis BusinessPedro AlbuquerqueNo ratings yet

- Understanding The Digital Economy Challenges For NDocument5 pagesUnderstanding The Digital Economy Challenges For NВукашин Б ВасићNo ratings yet

- The Impact of Social Networking On Stock Market A ReviewDocument11 pagesThe Impact of Social Networking On Stock Market A Reviewanna merlin sunnyNo ratings yet

- Smart Money Concept and Prospects For Further Research From A Perspective of The Polish Startup Ecosystem DevelopmentDocument12 pagesSmart Money Concept and Prospects For Further Research From A Perspective of The Polish Startup Ecosystem DevelopmentPhát MinhNo ratings yet

- Litrature Survey1Document7 pagesLitrature Survey1NEXGEN TECHNOLOGY HRNo ratings yet

- Properties of Feedback Mechanisms On Digital Platforms: An Exploratory StudyDocument48 pagesProperties of Feedback Mechanisms On Digital Platforms: An Exploratory Studylaxmikanthreddy200428No ratings yet

- Finance Theory and Future Trends - The Shift To Integration PDFDocument7 pagesFinance Theory and Future Trends - The Shift To Integration PDFnisarg_No ratings yet

- Organizing a Venture Factory: Company Builder Incubators and the Case of Rocket InternetDocument41 pagesOrganizing a Venture Factory: Company Builder Incubators and the Case of Rocket InternetLobna QassemNo ratings yet

- Litreature ReviewDocument9 pagesLitreature ReviewRaone MeNo ratings yet

- SEPModel Latest Submit FinalDocument45 pagesSEPModel Latest Submit FinalAnnu BallanNo ratings yet

- ShengTwitter ICISDocument19 pagesShengTwitter ICISJennifer ZhangNo ratings yet

- For Case StudiesDocument22 pagesFor Case StudiesMadhura BanerjeeNo ratings yet

- Business Models for Internet-Based E-CommerceDocument34 pagesBusiness Models for Internet-Based E-CommerceSidha RaoNo ratings yet

- Badouard - Beyond Points of Control Logics of Digital GovernmentalityDocument12 pagesBadouard - Beyond Points of Control Logics of Digital GovernmentalityMar HayeNo ratings yet

- Business Models for Internet-Based E-CommerceDocument17 pagesBusiness Models for Internet-Based E-CommerceTarang ShahNo ratings yet

- Casson2007-Social CapitaDocument25 pagesCasson2007-Social CapitanoviokNo ratings yet

- Draft Research Proposal in Entrepreneurial Finance: March 2015Document6 pagesDraft Research Proposal in Entrepreneurial Finance: March 2015Rahim AminNo ratings yet

- MB709 e CommerceDocument6 pagesMB709 e CommerceSquares Overseas EducorpNo ratings yet

- A Computational Theory of Enterprise Transformation: Regular PaperDocument14 pagesA Computational Theory of Enterprise Transformation: Regular PaperAdrianaStoicaNo ratings yet

- Big Data For Stock Market by Means of Mining Techniques 55636905Document10 pagesBig Data For Stock Market by Means of Mining Techniques 55636905bneckaNo ratings yet

- 6.entrepreneur Spirit and FinanceDocument23 pages6.entrepreneur Spirit and FinanceAbhishek BaidNo ratings yet

- Bac and Inci Old-Boy NetworkingDocument30 pagesBac and Inci Old-Boy NetworkingHüseyin ÖzdemirNo ratings yet

- 05-INT-The Link Between Intellectual Capital and Business Performance A Mediation Chain ApproachDocument21 pages05-INT-The Link Between Intellectual Capital and Business Performance A Mediation Chain ApproachSulaiman HanifNo ratings yet

- Blockchain TCEDocument26 pagesBlockchain TCEJulian HornNo ratings yet

- Empirical Research On The Fama-French Three-Factor Model and A Sentiment-Related Four-Factor Model in The Chinese Blockchain IndustryDocument22 pagesEmpirical Research On The Fama-French Three-Factor Model and A Sentiment-Related Four-Factor Model in The Chinese Blockchain IndustryWinda AgastyaNo ratings yet

- Study of Relationship Between Corporate Web Disclosure and Selected Company CharacteristicsDocument9 pagesStudy of Relationship Between Corporate Web Disclosure and Selected Company CharacteristicsRecca DamayantiNo ratings yet

- Initial Coin Offerings and The Value of Crypto Tokens: Christian Catalini and Joshua S. GansDocument37 pagesInitial Coin Offerings and The Value of Crypto Tokens: Christian Catalini and Joshua S. GanssvictorNo ratings yet

- Information FlowDocument72 pagesInformation FlowPair AhammedNo ratings yet

- What Have We Learnt From 10 Years of Fintech Research A ScientometricDocument12 pagesWhat Have We Learnt From 10 Years of Fintech Research A ScientometricFatima zahra OtmaniNo ratings yet

- BuddenMurray An MIT Approach To Innovation2Document11 pagesBuddenMurray An MIT Approach To Innovation2Hua Hidari YangNo ratings yet

- 1 Ross Feeny 1999 The Evolving Role of The CIO CISRWPDocument24 pages1 Ross Feeny 1999 The Evolving Role of The CIO CISRWPJEJE_CUTENo ratings yet

- Literature Review - How Could Investment in Cryptocurrencies Affect Corporate Financial HealthDocument10 pagesLiterature Review - How Could Investment in Cryptocurrencies Affect Corporate Financial HealthJade Michkaya JonesNo ratings yet

- The Impact of Social Media On Business PerformanceDocument13 pagesThe Impact of Social Media On Business PerformanceNoumanNo ratings yet

- Kripto 4Document32 pagesKripto 4Hanafi IndahNo ratings yet

- Monetary Policy in The Intangible EconomyDocument21 pagesMonetary Policy in The Intangible EconomyHao WangNo ratings yet

- Capital StructureDocument12 pagesCapital StructureMr_ABNo ratings yet

- Discuss The Role of Security Markets.: ActivityDocument3 pagesDiscuss The Role of Security Markets.: ActivityTrixie MagcalasNo ratings yet

- Simulation of Trust in Client - Wealth Management Advisor RelationshipsDocument9 pagesSimulation of Trust in Client - Wealth Management Advisor RelationshipsLynnHanNo ratings yet

- Research Proposal ExampleDocument7 pagesResearch Proposal ExampleMubasher100% (1)

- Disclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersFrom EverandDisclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersNo ratings yet

- Classifying Policing Social Machines by Maire Byrne-EvansDocument1 pageClassifying Policing Social Machines by Maire Byrne-EvansLeslie CarrNo ratings yet

- Web Science DTC Industry Forum: Opportunities and Challenges 2013Document18 pagesWeb Science DTC Industry Forum: Opportunities and Challenges 2013Leslie CarrNo ratings yet

- Memory Institutions and The Web - Nicole Beale - University of Southampton Web Science Institute Research Week, Royal Society.Document1 pageMemory Institutions and The Web - Nicole Beale - University of Southampton Web Science Institute Research Week, Royal Society.Nicole BealeNo ratings yet

- Enhancing Engagement With Online Museums by Javier PeredaDocument1 pageEnhancing Engagement With Online Museums by Javier PeredaLeslie CarrNo ratings yet

- Use of Mobile Technology To Support Dyslexic Learning in Higher Education by Katie SpiresDocument1 pageUse of Mobile Technology To Support Dyslexic Learning in Higher Education by Katie SpiresLeslie CarrNo ratings yet

- The Virtual Body: Video Game Avatars As Self, Cipher, and Sex Object by Elzabi RimingtonDocument1 pageThe Virtual Body: Video Game Avatars As Self, Cipher, and Sex Object by Elzabi RimingtonLeslie CarrNo ratings yet

- Online Collaborative Learning For Mathematics Education by Mandy LoDocument1 pageOnline Collaborative Learning For Mathematics Education by Mandy LoLeslie CarrNo ratings yet

- Is The Web Corrupting The Values of Our Youth? by Huw DaviesDocument1 pageIs The Web Corrupting The Values of Our Youth? by Huw DaviesLeslie CarrNo ratings yet

- Web Forecasting by Lawrence GreenDocument1 pageWeb Forecasting by Lawrence GreenLeslie CarrNo ratings yet

- The Web and Internet Piracy by Keiran RonesDocument1 pageThe Web and Internet Piracy by Keiran RonesLeslie CarrNo ratings yet

- Ontological Representation of Ancient Sumerian Literature Granularity Ontology Structure Formalise CONTENT Express Domain Knowledge Entities Relationships by Terhi NurmikkoDocument1 pageOntological Representation of Ancient Sumerian Literature Granularity Ontology Structure Formalise CONTENT Express Domain Knowledge Entities Relationships by Terhi NurmikkoLeslie CarrNo ratings yet

- A Public Health Approach To Cybersecurity by Huw FryerDocument1 pageA Public Health Approach To Cybersecurity by Huw FryerLeslie CarrNo ratings yet

- Research Dissemination and Disaggregation by Will FysonDocument1 pageResearch Dissemination and Disaggregation by Will FysonLeslie CarrNo ratings yet

- Alison Knight Poster Industry Forum 2013 LatestDocument1 pageAlison Knight Poster Industry Forum 2013 LatestLeslie CarrNo ratings yet

- The Web & Post-Conflict Governance Building in Fragile States by Jen WelchDocument1 pageThe Web & Post-Conflict Governance Building in Fragile States by Jen WelchLeslie CarrNo ratings yet

- Open Innovation Measurement and Optimisation by Gareth BeestonDocument1 pageOpen Innovation Measurement and Optimisation by Gareth BeestonLeslie CarrNo ratings yet

- Orienting Within Complex Digital Environments Bridging The Gap Between The Inside and Out To Reduce Disorientation by Craig AllisonDocument1 pageOrienting Within Complex Digital Environments Bridging The Gap Between The Inside and Out To Reduce Disorientation by Craig AllisonLeslie CarrNo ratings yet

- MOOCS in Higher Education Perspectives From HE Educators by Manual UrrutiaDocument1 pageMOOCS in Higher Education Perspectives From HE Educators by Manual UrrutiaLeslie CarrNo ratings yet

- The Role of Internet Intermediaries in Enhancing Cybersecurity by Evangelia PapadakiDocument1 pageThe Role of Internet Intermediaries in Enhancing Cybersecurity by Evangelia PapadakiLeslie CarrNo ratings yet

- Personal Data and Transparency by Reuben BinnsDocument1 pagePersonal Data and Transparency by Reuben BinnsLeslie CarrNo ratings yet

- By Caroline HalcrowDocument1 pageBy Caroline HalcrowLeslie CarrNo ratings yet

- Privacy Choices and Informed Consent by Richard GomerDocument1 pagePrivacy Choices and Informed Consent by Richard GomerLeslie CarrNo ratings yet

- Predicting Stock Prices With Online Information by Paul GaskellDocument1 pagePredicting Stock Prices With Online Information by Paul GaskellLeslie CarrNo ratings yet

- Visual Analytics by Paul BoothDocument1 pageVisual Analytics by Paul BoothLeslie CarrNo ratings yet

- A Multi-Dimensional Framework of The ICT Innovation System by Chris HughesDocument1 pageA Multi-Dimensional Framework of The ICT Innovation System by Chris HughesLeslie CarrNo ratings yet

- Towards A Taxonomy For Web Observatories by Ian BrownDocument1 pageTowards A Taxonomy For Web Observatories by Ian BrownLeslie CarrNo ratings yet

- Charitable Use of Social Media by Christopher PhetheanDocument1 pageCharitable Use of Social Media by Christopher PhetheanLeslie CarrNo ratings yet

- The Impact of Social Software On Informal and Formal Learning by Robert BlairDocument1 pageThe Impact of Social Software On Informal and Formal Learning by Robert BlairLeslie CarrNo ratings yet

- Skim Reading: An Adaptive Strategy For Reading On The Web by Gemma FitszimmonsDocument1 pageSkim Reading: An Adaptive Strategy For Reading On The Web by Gemma FitszimmonsLeslie CarrNo ratings yet

- Web For Environmental Sustainability: Identifying The Emerging Markets of The Cleanweb by Jack TownsendDocument1 pageWeb For Environmental Sustainability: Identifying The Emerging Markets of The Cleanweb by Jack TownsendLeslie CarrNo ratings yet

- FM Textbook Solutions Chapter 8 Second EditionDocument11 pagesFM Textbook Solutions Chapter 8 Second EditionlibredescargaNo ratings yet

- Nedbank ESG Due DiligenceDocument25 pagesNedbank ESG Due Diligencephidesigner100% (1)

- PaysliptemplateDocument9 pagesPaysliptemplateSyaffiqLajisNo ratings yet

- Mill PostsDocument158 pagesMill PostsTrung Quoc LeNo ratings yet

- Widyaiswara 2023Document38 pagesWidyaiswara 2023Widyaiswara BKKBN NTTNo ratings yet

- Hooi 2006 PDFDocument22 pagesHooi 2006 PDFayue kamalNo ratings yet

- ChanelDocument9 pagesChanelGaby MoyaNo ratings yet

- Productivitybenchmarkingdgl2016 160810162308 PDFDocument60 pagesProductivitybenchmarkingdgl2016 160810162308 PDFJigneshSaradavaNo ratings yet

- French French: User GuideDocument6 pagesFrench French: User Guidejerimiah_manzonNo ratings yet

- Duties of Common CarrierDocument13 pagesDuties of Common CarrierDairen Rose100% (1)

- Omega Pharma Mini Case StudyDocument2 pagesOmega Pharma Mini Case Studygs1100eNo ratings yet

- Practice Class2Document1 pagePractice Class2Mutahher MuzzammilNo ratings yet

- Financial Accounting Canadian 6th Edition Harrison Test BankDocument43 pagesFinancial Accounting Canadian 6th Edition Harrison Test Bankvioletviolet969y5k100% (26)

- Bayfield Economic Development PlanDocument99 pagesBayfield Economic Development PlanDIMihaiNo ratings yet

- Asst 1Document848 pagesAsst 1veenNo ratings yet

- Relationship between entrepreneurial competencies, dynamic capabilities and small firm performanceDocument10 pagesRelationship between entrepreneurial competencies, dynamic capabilities and small firm performanceMarco Antonio Miranda RodriguezNo ratings yet

- Quicksilver Resources Chapter 11 Petition, March 17, 2015Document21 pagesQuicksilver Resources Chapter 11 Petition, March 17, 2015jamesosborne77100% (1)

- An Analysis of The Gems & Jewellery Industry in IndiaDocument43 pagesAn Analysis of The Gems & Jewellery Industry in IndiaRanjeet Ramaswamy Iyer100% (4)

- Types of Franchising ModelsDocument5 pagesTypes of Franchising Modelskim cheNo ratings yet

- Kenrick Tugwell Resume for Front Desk Agent PositionDocument3 pagesKenrick Tugwell Resume for Front Desk Agent PositionJonathan PittersonNo ratings yet

- Product ManualDocument11 pagesProduct ManualHugo LopezNo ratings yet

- Manas Wada Land Presentation With MapDocument19 pagesManas Wada Land Presentation With Mapmudit methaNo ratings yet

- Excerpt From "Scarcity: Why Having Too Little Means So Much" by Sendhil Mullainathan and Eldar Shafir.Document5 pagesExcerpt From "Scarcity: Why Having Too Little Means So Much" by Sendhil Mullainathan and Eldar Shafir.OnPointRadioNo ratings yet

- Data Quality ServicesDocument196 pagesData Quality ServicesrajbmohanNo ratings yet

- Date Los No App No Contact NoDocument8 pagesDate Los No App No Contact Nodfged54No ratings yet

- Bookkeeping Course Syllabus - SDPDFDocument0 pagesBookkeeping Course Syllabus - SDPDFjasonmendez2010No ratings yet

- Tib BW AdministrationDocument235 pagesTib BW AdministrationSaveetha RudramoorthyNo ratings yet

- EV Equity Value ModelDocument6 pagesEV Equity Value Modelkirihara95No ratings yet

- Copper Technology and CompetitivenessDocument267 pagesCopper Technology and CompetitivenessleniucvasileNo ratings yet

- Understanding ASCP Dataflow PDFDocument18 pagesUnderstanding ASCP Dataflow PDFPrahant Kumar0% (1)