Professional Documents

Culture Documents

Methods of Evaluating Capital Investments

Uploaded by

Jake BundokCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Methods of Evaluating Capital Investments

Uploaded by

Jake BundokCopyright:

Available Formats

METHODS OF EVALUATING CAPITAL INVESTMENTS I.

Non-discounted cash flow techniques:

recover the initial investment Decision rule: Accept if payback < required maximum payback Reject if payback > required maximum payback 1. Even cash flows Payback Period = Net Investment Annual CFAT 2. Uneven cash flows Payback Period = point where the cumulative cash flows equal the net investment Example 1: Initial Investment Annual operating CFAT Economic life P 1,000,000 P 300,000 8 years

A. Payback period (payoff/payout period) measures the length of time required to

Payback Period = P1,000,000 P300,000 = 3.33 years or 3 yrs. & 4 mos. ======== =========== Example 2: Initial Investment CFAT: Year 1 2 3 4 5 6 7 8 Payback Period: Year 1 2 3 4 5 CFAT 150,000 200,000 250,000 300,000 400,000 Cumulative CFAT 150,000 350,000 600,000 900,000 ) Payback = 4.25 yrs. 1,300,000 ) ====== P1,000,000 150,000 200,000 250,000 300,000 400,000 350,000 150,000 100,000

Advantages: easy to compute and understand used to measure degree of risk associated with a project generally, the longer the payback period, the higher the risk used to select projects which provide a quick return of invested funds

Disadvantages: ignores the time value of money the cutoff payback is a subjectively determined number ignores cash inflows after the payback period does not distinguish between projects with different lives conventional payback fails to consider salvage value, if any does not measure profitability, only liquidity of the project

B. Payback reciprocal determines the portion or percentage of the net investment that

is recovered in one year. = 1 Payback period or Ave. Free Cash Flows Net Investment

a project with an infinite life would have an IRR equal to its payback reciprocal.

- when a projects life is at least twice the payback period and the annual free cash flows are approximately equal, the payback reciprocal may be used to estimate the IRR

C. Payback bailout period measures the length of time where the accumulated annual

free cash inflows and the salvage value for the period is, at least equal to the net investment. Example 3: Initial Investment Economic life Annual CFAT Salvage value: Compute the payback bailout period. P 2,000,000 8 years P 600,000 P 700,000 at the end of Yr. 1 and will decline at the rate of P100,000 annually

Year 1 2 3

CFAT 600,000 600,000 600,000

Cumulative Salvage Total Payback CFAT + Value = CFAT Bailout 600,000 700,000 1,300,000 1 1,200,000 600,000 1,800,000 1 1,800,000 500,000 2,300,000 .5 2.5 yrs

Since Yr. 3 cumulative cash inflow of P 2,300,000 is greater than the net investment of P 2,000,000, payback bailout for Year 3 is computed using the following formula: = Net Investment (Cumulative CFAT last year + Salvage value this year) CFAT this year = P2,000,000 (P1,200,000 + P500,000) = .5 years P600,000 ======

D. Accounting rate of return (also called the book value method, unadjusted rate of

return method, simple rate of return method, or return on investment method) - measures the rate of return on the net investment (based on net income) Decision rule: Accept if ARR > required rate of return Reject if ARR < required rate of return 1. Based on initial investment = Average Annual Net Income After Tax Initial or Net Investment 2. Based on average investment = Average Annual Net Income After Tax Net Investment + Salvage Value 2 Example 4: Initial investment Salvage value Life Annual net income after tax: Year 1 2 3 4 5 P 800,000 60,000 5 years P 100,000 150,000 300,000 200,000 350,000

Compute for the accounting rate of return based on (a) initial investment and (b) average investment

(a)

P1,100,000 5 = 27.50% P800,000 ===== P1,100,000 5 --------------------------------- = 51.16% P800,000 + P60,000 ===== ------------------------2

(b)

Advantages: easily understood used as a rough preliminary screening device of investment proposals Disadvantages: ignores the time value of money ignores the timing component of cash inflows averaging may yield inaccurate answers utilizes concepts of capital and net income primarily designed for the purpose of financial statement preparation and may not be relevant for the evaluation of investment proposals

II.

Discounted cash flow techniques:

present value of the net investment. Present value of cash flows + Terminal cash flows Less: Net Investment Net Present Value Decision rule: Accept if NPV > 0 Reject if NPV < 0

A. Net present value (NPV) the excess of the present value of cash inflows over the

B. Present value index (profitability/desirability index or benefit-cost ratio)

- ratio of the present value of cash inflows to the present value of the net investment - useful in evaluating projects of different sizes Present value of free cash flows + Terminal cash flows Divided by: Net Investment Present Value Index Decision rule: Accept if PVI > 1 Reject if PVI < 1

C. Present value/discounted payback measures the length of time to recover the net

investment, while at the same time, earning the desired rate of return

same procedure as computing for payback period when cash flows are uneven, but using the present value of the cash flows

D. Internal rate of return (IRR) also called discounted rate of return, time-adjusted

rate of return, investors method - the rate that equates the present value of cash inflows to the net investment For even cash flows: 1. Compute the payback period 2. Refer to PVIFA table for the factor closest to answer obtained in step 1. 3. Interpolate, if necessary For uneven cash flows: 1. Compute the payback period using the average cash flows 2. Refer to PVIFA table for the factor closest to the answer obtained in step 1. THIS MAY NOT BE THE IRR. Use this trial rate as a starting point only for trial and error. 3. Compute the NPV using the trial rate. You get the IRR if NPV = 0. 4. If NPV obtained using a trial rate is > 0, the rate is too low, and a higher rate should be tried 5. If NPV obtained using a trial rate is < 0, the rate is too high, and a lower rate should be tried 6. Interpolate (between a positive and a negative NPV) to get the exact IRR Decision rule: Accept if IRR > Required rate of return Reject if IRR < Required rate of return

E. Annualized net present value (ANPV) or Equivalent Annual Annuity (EAA) an

approach in evaluating projects with unequal lives; converts the net present value of unequal-lived, mutually exclusive projects into an equivalent annual amount (in NPV terms) Decision rule: Select the project with the highest ANPV Net Present Value Divided by: PVIFA factor Annualized net present value

F. Replacement Chain used in ranking projects with unequal lives; equalizes the life

spans of the projects then comparing the NPVs.

G. Modified internal rate of return (MIRR) a variation of the IRR; used to eliminate

the reinvestment rate assumption of the IRR; useful in ranking projects with time disparity. - the discount rate that equates the PV of the cash outflows with the PV of the terminal value Decision rule: Accept if MIRR > Required rate of return Reject if MIRR <Required rate of return

5

You might also like

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoNo ratings yet

- STRATEGIC COST MANAGEMENT - Week 12Document46 pagesSTRATEGIC COST MANAGEMENT - Week 12Losel CebedaNo ratings yet

- Economic Analysis TechniqueDocument9 pagesEconomic Analysis TechniqueJhy MhaNo ratings yet

- MODULE 8 Capital BudgetingDocument9 pagesMODULE 8 Capital BudgetingLumingNo ratings yet

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Fin Management 2Document8 pagesFin Management 2Vince BesarioNo ratings yet

- BF 14Document5 pagesBF 14zhairenaguila22No ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Cost of Capital CalculationDocument19 pagesCost of Capital CalculationJames Yvess ReyesNo ratings yet

- CapbudgetDocument31 pagesCapbudgetnaveen penugondaNo ratings yet

- Chapter 3Document173 pagesChapter 3Maria HafeezNo ratings yet

- Capital BudgetingDocument93 pagesCapital BudgetingAmandeep sainiNo ratings yet

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNo ratings yet

- Chapter 7Document25 pagesChapter 7ElizabethNo ratings yet

- Profitability Analysis ReportDocument13 pagesProfitability Analysis ReportJocelyn CorpuzNo ratings yet

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyNo ratings yet

- CH 6Document29 pagesCH 6Kasahun MekonnenNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Project Selection Models and TechniquesDocument50 pagesProject Selection Models and TechniquesNeway Alem100% (1)

- Capital Budgeting TechniquesDocument48 pagesCapital Budgeting TechniquesMuslimNo ratings yet

- 2.3 Capital Budgeting PDFDocument26 pages2.3 Capital Budgeting PDFOwlHeadNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Capital Budgeting Techniques ExplainedDocument57 pagesCapital Budgeting Techniques ExplainedAlethea DsNo ratings yet

- Payback Period:: Period in Capital Budgeting Refers To The Period of Time Required For The Return On An InvestmentDocument4 pagesPayback Period:: Period in Capital Budgeting Refers To The Period of Time Required For The Return On An InvestmentshabnababuNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingVarsha KastureNo ratings yet

- Chapter-Five: Capital Budgeting DecisionDocument50 pagesChapter-Five: Capital Budgeting DecisionGizaw BelayNo ratings yet

- Money Worth AnalysisDocument35 pagesMoney Worth AnalysisDian Ratri CNo ratings yet

- Capital Budgeting Decisions AnalyzedDocument56 pagesCapital Budgeting Decisions AnalyzedSurya SivakumarNo ratings yet

- Investment AppraisalDocument8 pagesInvestment AppraisaldeepkandelNo ratings yet

- Module 2Document9 pagesModule 2vinitaggarwal08072002No ratings yet

- Financial Management Chapter 09 IM 10th EdDocument24 pagesFinancial Management Chapter 09 IM 10th EdDr Rushen SinghNo ratings yet

- Engineering EconomyDocument29 pagesEngineering EconomyDonna Grace PacaldoNo ratings yet

- FINMAN2Document4 pagesFINMAN2Vince BesarioNo ratings yet

- CHAPTER 17 - AnswerDocument7 pagesCHAPTER 17 - AnswerKlare HayeNo ratings yet

- 30 JuneDocument31 pages30 JuneYandex PrithuNo ratings yet

- Non Discounted Capital Budgeting TechniquesDocument21 pagesNon Discounted Capital Budgeting TechniquesMangoStarr Aibelle VegasNo ratings yet

- Capital BudgetingDocument52 pagesCapital BudgetingKevin Gador100% (1)

- CAPITAL BUDGETING PROCESSDocument15 pagesCAPITAL BUDGETING PROCESSJoshua Cabinas100% (1)

- 09.1 Module in Financial Management 09Document8 pages09.1 Module in Financial Management 09Fire burnNo ratings yet

- Investment Appraisal TechniquesDocument14 pagesInvestment Appraisal TechniquesIan MutukuNo ratings yet

- Week 6-7 Info Sheets - Financial Planning Tools and ConceptsDocument21 pagesWeek 6-7 Info Sheets - Financial Planning Tools and ConceptsCK BarretoNo ratings yet

- Module in Financial Management - 09Document7 pagesModule in Financial Management - 09Karla Mae GammadNo ratings yet

- Rate of Return Method ExplainedDocument11 pagesRate of Return Method ExplainedAira_DirectonerNo ratings yet

- Capital Requirement, Raising Cost of Capital: Lecture FiveDocument32 pagesCapital Requirement, Raising Cost of Capital: Lecture FiveAbraham Temitope AkinnurojuNo ratings yet

- IRR NPV and PBP PDFDocument13 pagesIRR NPV and PBP PDFyared haftuNo ratings yet

- Introduction To To FinanceDocument4 pagesIntroduction To To FinanceAzeemAhmedNo ratings yet

- Time Value of Money &capital Budgeting DecisionsDocument13 pagesTime Value of Money &capital Budgeting DecisionspreetiNo ratings yet

- Lecture Capital BudgetingDocument5 pagesLecture Capital BudgetingJenelyn FloresNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingNiña FajardoNo ratings yet

- Module 6 - Capital Budgeting TechniquesDocument6 pagesModule 6 - Capital Budgeting Techniquesjay-ar dimaculanganNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingJimsy AntuNo ratings yet

- Capital Budgeting TechniquesDocument8 pagesCapital Budgeting Techniqueswaqaar raoNo ratings yet

- CapitDocument8 pagesCapitjanice100% (1)

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalNo ratings yet

- Financial Analysis: Alka Assistant Director Power System Training Institute BangaloreDocument40 pagesFinancial Analysis: Alka Assistant Director Power System Training Institute Bangaloregaurang1111No ratings yet

- Capital Budgeting TechniquesDocument6 pagesCapital Budgeting TechniquesShravan BaneNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- Mandarin V3Document18 pagesMandarin V3Jake BundokNo ratings yet

- Calendar - 2015 02 01 - 2015 03 01 PDFDocument1 pageCalendar - 2015 02 01 - 2015 03 01 PDFJake BundokNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- Holidays in Philippines Review Module 9ADocument1 pageHolidays in Philippines Review Module 9AJake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- Gmat Handbook PDFDocument20 pagesGmat Handbook PDFVishal GolchaNo ratings yet

- Maple Leaf Study EDocument4 pagesMaple Leaf Study EFaraz HaqNo ratings yet

- Seitani (2013) Toolkit For DSGEDocument27 pagesSeitani (2013) Toolkit For DSGEJake BundokNo ratings yet

- Debt Securities: BondsDocument9 pagesDebt Securities: BondsCorinne GohocNo ratings yet

- REVIEW QUESTIONS Investment in Debt SecuritiesDocument1 pageREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNo ratings yet

- Advanced Accounting-Volume 2Document4 pagesAdvanced Accounting-Volume 2ronnelson pascual25% (16)

- Dlsu Thesis Paper LetterheadDocument1 pageDlsu Thesis Paper LetterheadJake BundokNo ratings yet

- SOX On ISDocument5 pagesSOX On ISJake BundokNo ratings yet

- GuideDocument4 pagesGuideJake BundokNo ratings yet

- Park JMP PDFDocument56 pagesPark JMP PDFJake BundokNo ratings yet

- Cpi 1996Document9 pagesCpi 1996Jake BundokNo ratings yet

- Child Labor Data 2011 - 2013 (Jan)Document2 pagesChild Labor Data 2011 - 2013 (Jan)Jake BundokNo ratings yet

- Tips DefenseDocument35 pagesTips DefenseJake BundokNo ratings yet

- Elimination Round BreakthroughDocument16 pagesElimination Round BreakthroughJake BundokNo ratings yet

- Univ Vision-Mission Week 2015 Food Sponsorship PackagesDocument1 pageUniv Vision-Mission Week 2015 Food Sponsorship PackagesJake BundokNo ratings yet

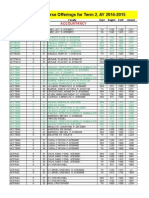

- RVR-COB Course Offerings Term 2Document19 pagesRVR-COB Course Offerings Term 2sweetjar22No ratings yet

- SSRN Id975135Document44 pagesSSRN Id975135Jake BundokNo ratings yet

- Modeling Exponential and Power FunctionsDocument27 pagesModeling Exponential and Power FunctionsJake BundokNo ratings yet

- New Zealand Best, Indonesia Worst in World Poll of International CorruptionDocument10 pagesNew Zealand Best, Indonesia Worst in World Poll of International CorruptionNasir JamalNo ratings yet

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- Cpi 1997Document17 pagesCpi 1997Jake BundokNo ratings yet

- GuideDocument4 pagesGuideJake BundokNo ratings yet

- SOX On ISDocument5 pagesSOX On ISJake BundokNo ratings yet

- Price Action Breakdown - Exclusive Price Action Trading Approach To Financial Markets (PDFDrive)Document85 pagesPrice Action Breakdown - Exclusive Price Action Trading Approach To Financial Markets (PDFDrive)KJV Global TradeNo ratings yet

- Valuation of Goodwill: (Chapter 3)Document15 pagesValuation of Goodwill: (Chapter 3)ShreyaGolchhaNo ratings yet

- Factors That Determine Investment Rates of ReturnDocument41 pagesFactors That Determine Investment Rates of ReturnNuhail DkNo ratings yet

- Profit & LossDocument2 pagesProfit & LossCAFE RANAGHATNo ratings yet

- BTMMDocument5 pagesBTMMTreasure321No ratings yet

- Barclays On Debt CeilingDocument13 pagesBarclays On Debt CeilingafonteveNo ratings yet

- Test Bank For Investments 9th Canadian by BodieDocument32 pagesTest Bank For Investments 9th Canadian by BodieMonica Sanchez100% (32)

- ADX breakout scanning signals momentum tradesDocument5 pagesADX breakout scanning signals momentum tradesedsnake80% (5)

- 1 TrendsDocument14 pages1 TrendsSuresh WerNo ratings yet

- ACE White Paper 200705Document70 pagesACE White Paper 200705Bass1237No ratings yet

- ACFINA3 Syllabus-2T-2015-2016Document8 pagesACFINA3 Syllabus-2T-2015-2016mrlyNo ratings yet

- Designing A Hybrid AI System As A Forex Trading Decision Support ToolDocument5 pagesDesigning A Hybrid AI System As A Forex Trading Decision Support Toolhamed mokhtariNo ratings yet

- Anzrptip 2: A&NZ Real Property Technical Information Paper 2Document10 pagesAnzrptip 2: A&NZ Real Property Technical Information Paper 2Katharina SumantriNo ratings yet

- FMDQ Markets Monthly ReportDocument9 pagesFMDQ Markets Monthly ReportJohnNo ratings yet

- Money: A. What Is Money? B. History of Money C. Functions of Money D. Kinds of Money E. Qualities of Good Money MaterialDocument10 pagesMoney: A. What Is Money? B. History of Money C. Functions of Money D. Kinds of Money E. Qualities of Good Money MaterialShabby Gay TroganiNo ratings yet

- Prelim (Answer Key)Document6 pagesPrelim (Answer Key)Justine PaulinoNo ratings yet

- RBIDocument32 pagesRBIAjay SinghNo ratings yet

- Liquidity Risk in Indian Debt MarketsDocument16 pagesLiquidity Risk in Indian Debt MarketsRajesh ModiNo ratings yet

- Chapter 25 - Merger & AcquisitionDocument42 pagesChapter 25 - Merger & AcquisitionmeidianizaNo ratings yet

- Futures 201107 enDocument11 pagesFutures 201107 ensuxessNo ratings yet

- 12 CVP Analysis SampleDocument12 pages12 CVP Analysis SampleMaziah Muhamad100% (1)

- Portfolio ManagementDocument35 pagesPortfolio ManagementmohikumarNo ratings yet

- Impact of Currency Fluctuations On Indian Stock MarketDocument5 pagesImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNo ratings yet

- Ethics in Business DisciplinesDocument16 pagesEthics in Business DisciplinesSonal TiwariNo ratings yet

- Sandy Lai HKU PaperDocument49 pagesSandy Lai HKU PaperAnish S.MenonNo ratings yet

- 2 - HO - BR - 108 - 105 - Exchange of Soiled - Mutilated Notes PDFDocument2 pages2 - HO - BR - 108 - 105 - Exchange of Soiled - Mutilated Notes PDFSita AgrahariNo ratings yet

- Banks Nodal Officer PMMY PDFDocument2 pagesBanks Nodal Officer PMMY PDFsumit manjareNo ratings yet

- 46370bosfinal p2 cp6 PDFDocument85 pages46370bosfinal p2 cp6 PDFgouri khanduallNo ratings yet

- Unit 3 MoneyDocument3 pagesUnit 3 MoneyAlexanderVillacrés0% (1)

- Schedule of Fex ChargesDocument10 pagesSchedule of Fex ChargesMohammad Ibna AnwarNo ratings yet