Professional Documents

Culture Documents

Chapter 1

Uploaded by

einsteinspyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1

Uploaded by

einsteinspyCopyright:

Available Formats

The Non Financial Performance of the Micro-Finance Institutions in Solano, Nueva Vizcaya: An Evaluation

In Partial Fulfillment of The Requirements for the Degree Bachelor of Science in Management Accounting

By:

Madet, Jeraldine P. Jose, Chrisitina A. Tabora, Florence B. Velasquez, Diana Rozette V. Labitoria, Janelle E. Liang, Leorizza M.

March 2013

Chapter 1 THE PROBLEM AND ITS BACKGROUND Rationale One of the major problems that continue to plaque the Philippines is poverty. As Sachs firmly stated, "The key to ending extreme poverty is to enable the poorest of the poor to get their foot on the ladder of development. The ladder of development hovers overhead and the poorest of the poor are stuck beneath it. They lack the minimum amount of capital necessary to get a foothold and therefore need a boost up to the first rung." As the world continues to embrace innovations, institutions like micro financing organizations were established to help small businesses increase their financial investments by granting loans. Microcredit can provide a range of benefits that poor households highly value including long-term increase in income and consumption. A harsh aspect of poverty is that income is often irregular and undependable. Access to credit helps the poor to smooth cash flows and avoid periods where access to food, clothing, shelter, or education is lost. Microfinance institutions (MFI's) provide account to small balance accounts that would normally be accepted by traditional banks and offers transactions for amounts that may be smaller than the average transaction fees charged by mainstream financial institutions. To aim for a longer life, MFI's did not consider only their financial performance or capabilities but rather it is necessary for them to know the other aspect, the non-financial performance of their company. According to Flores and Serres (2009), many practitioners argue that microfinance per needs to be combined with other actions to effectively improve the living conditions of its beneficiaries. Based on this principle, a number of MFI's with a strong pro-poor

positioning promoted the idea of comprehensive microfinance services (Hickson, 1999). Indeed in 1980s, magnitude of performance was shifted to the non-financial measures such as customer satisfaction, delivery period, number of complaints etc. In order to create a balance between financial and non-financial measures, Kaplan and Norton introduced Balanced Scorecard in 1992. Kaplan and Norton view that the long term profitability was dependent upon a large number of non-financial measures such as research and development, innovation, customer satisfaction, training etc. The customer and employee perspective are keys for a company to perform effectively and render their services at best. Customer perspective measures consider the organizations performance through the eyes of its customers, so that the organization retains a careful focus on customer needs and satisfaction. Retaining and acquiring customers are not that easy but MFI's come up with non financial services that may offer benefits to their clients. Another is about the relationship with their employees that has the hand for their internal processes. Trainings and other activities that may develop their employee's effectiveness is another way for MFI's performance will be improved. For MFI's it is not the financial aspect that matters only to them but more importantly is how to deal with their customers for their growth. Mostly, financial perspective is the basis for comparing the performance of a Microfinance Institution. Internal management is also essential in achieving a good performance. So, nonfinancial aspect must also be considered in evaluating MFIs overall performance. Hence, we conceptualize a study that focuses on the nonfinancial performance particularly the level and quality of the performance of their employees and members of the management and also their customer relations of the microfinance institutions.

Statement of the Problem Primarily, this study is intended at determining and evaluating the non-financial performance of the micro-financial institutions in Solano, Nueva Vizcaya, the study will make use of criteria to identify & evaluate the non-financial performance by their management staff and employees. More specifically, the study seeks answers to the following questions: 1. What is the profile of the micro-finance institutions in terms of the following? 1.1 Number of years of operations 1.2 Estimated amount of current capital 1.3 Number of management and office staff 1.4 Type of services offered 1.5 Number of current customers serve 2. the following? 2.1 Age 2.2 Gender 2.3 Marital Status 2.4 Highest Education attainment 2.5 Position in the institution 2.6 Monthly income What is the profile of the management staff and employee respondents in terms of

3. What are the level satisfaction and the extent of effectiveness of the non-financial performance of the micro-finance institutions in terms of the following criteria? 3.1 Management staff and employees with respect to:

3.1.1 Nature of their work environment (1-9) 3.1.2 Human resources management(10-17) 3.1.3 Management and leadership style(18-25) 3.2 Employees productivity (34-42) 3.3 Customer management(26-33) 3.3.1 Customer relation services 3.32 Handling customer complaints and problems 4. Are there significant differences in the level of achievement and the extent of effectiveness of the non-financial performance of the micro financial institutions when they are group according to the following? 4.1 Position in the company

4.2 Sex

5. Are there significant relationship between the level satisfaction and the extent of effectiveness of the non-financial performance of the micro financial institutions and each of the following?

5.1 Number of years of operations 5.2 Estimated amount of current capital 5.3 Number of management and office staff 5.4 Type of services offered 5.5 Number of current customers served

Statement of the Hypothesis

1. There are no significant differences in the level of achievement and the extent of effectiveness of the non-financial performance of the micro financial institutions when they are group according to the following?

1.1 Position in the company

1.2 Sex

2. There are no significant relationship between the level satisfaction and the extent of effectiveness of the non-financial performance of the micro financial institutions and each of the following?

2.1 Number of years of operations 2.2 Estimated amount of current capital 2.3 Number of management and office staff 2.4 Type of services offered 2.5 Number of current customers served

Significance of the Study Every side of the world has the greatest problem called poverty. Poverty may be a result of lack of priority. With this problem Microfinance institution has a great solution with this through helping the people who are belong to average level in which they provide benefits to them like business training. Nowadays financial and non-financial measure resulted to confusion so they provided the balanced scorecard to distinguish non-financial measures. Balanced Scorecard have different category in which customers perspective and learning and growth belong that is likely related to our study. From the standpoint of customers, they can easily know which microfinance institutions they will apply with and they can be a tool in identifying the performance of MFIs. The focus of customers perspective is on value generated by a companys product or service as perceived by the customer or the fulfillment of customer goals and desires by company products and/or services. The managers will discover if the non-financial measure will have a great help on their future performance. Therefore, the result of this study may strengthen the value of non-financial measures in identifying which MFIs is more reliable for target customers and which of those institutions will have a good future performance. This study may aid in the empowerment of the significance of microfinance institutions in the province especially to their target customers. It may point out the non-financial measures of microfinance institutions strengths that may be possessed as well as weaknesses to overcome.

Through the vision-mission statement of Saint Marys University it emphasizes the importance of the universitys social responsibility. In the school of Accountancy, the Center for Business Consultancy empower SMUs support to the community through extending Accounting and related services to establishment and individual outside the campus that need them. SMU may strengthen its support to the community and at the same time the MFIs may gain competitive advantage as well as publicity to attract more clients. For curriculum and instruction development, this research recommends that the nonfinancial management subject will be broadly discuss and related issue in non-financial performance analysis. This study does not focus to which microfinance institution has the greatest amount of customers but rather, it seeks to compare their abilities based on their non-financial performance. Scope and Delimitations The study will be conducted in the province of Nueva Vizcaya, particularly in the town of Solano. The respondents of this study will be the microfinance institutions namely Advance Microfinancing Corp.; Village Enterprise Development Foundation, Inc; Rangtay sa Pagrang-ay Incorporated; Tulay Sa Pag-unlad Incorporated and Alalay sa Kaunlaran Inc. which are located in Solano. All in all, there will be five microfinance institutions. The study will only concentrate on the Customer relations and Learning & growth of management and office staff of these micro financial institutions. Items to be included are limited as follows: for nature of their work environment, human resources management, management and leadership style, employees productivity, customer management, customer relation services, handling customer complaints and problems. Data will be gathered by means of questionnaires.

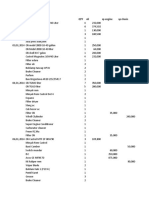

Conceptual Framework

The conceptual framework of this study is based on the analysis of the interrelationship between the dependent and independent variables in order to come with the intended output. The independent variables of the study are divided into two parts namely 1. Profile of the microfinancial institutionswhich consists of number of years of operations, estimated amount of current capital, number of management and office staff, type of services offered and the number of customer served. The second group of the independent variables consists of the respondents age, gender, marital status, highest educational attainment, position in the institution and their monthly income.

The dependent variables of the study are as follows: level satisfaction and the extent of effectiveness of the non-financial performance of the respondents in terms of the following criteria: Management staff and employees satisfaction, employees productivity, customer management. Another part of the dependent variables is the determination of the differences in the level of achievement and the extent of effectiveness of the non-financial performance of the micro financial institutions when they are group according to the following: position in the company and gender. Also another part of the study is the determination of the relationship between the level satisfaction and the extent of effectiveness of the non-financial performance of the micro financial institutions and each of the following: number of years of operations, estimated amount of current capital, number of management and office staff, type of services offered number of current customers serve, monthly Income. The desired output of the study is to develop of strategies for the improvement and enhancement of the non financial performance of other micro-financial institutions

Independent Variables

Dependent Variables

Output

1. Profile of the microfinancial institutions

1.1 Number of years of operations 1.2 Estimated amount of current capital 1.3 Number of management and office staff 1.4 Type of services offered 1.5 Number of current customers serve

3. Level satisfaction and the extent of effectiveness of the non-financial performance of the respondents in terms of the following criteria? 3.1 Management staff and employees satisfaction 3.2 Employees productivity 3.3 Customer management 4. Determination of the differences in the level of achievement and the extent of effectiveness of the non-financial performance of the micro financial institutions when they are group according to the following? 4.1 Position in the company 4.2 Gender 5. Determination of therelationship between the level satisfaction and the extent of effectiveness of the non-financial performance of the micro financial institutions and each of the following? 5.1 Number of years of operations 5.2 Estimated amount of current capital 5.3 Number of management and office staff 5.4 Type of services offered 5.5 Number of current customers serve 5.6 Monthly Income Development of Strategies for the improvement and enhancement of nonfinancial performance of other micro-financial institutions

2.Profile of the management staff and employees of the micro- financial institutions

2.1 Age

2.2 Gender

2.3 Marital Status

2.4 Highest Education attainment

2.5 Position in the institution

2.6 Monthly income

Definition of Terms Non - financial performance- theoretically these performance measures are often used for performance evaluation.They are especially relevant if the available financial performance measures notcompletely reflect the managers contribution to the firms total value which is always been observe. .Then,non-financial performance measures serve as an indicator for the firms long-termperformance Inthis study however, the terms refer to the performance of Microfinance Institutions regarding the level and quality of the performance of their employees and members of the management. The measurement includes come criteria and indices on how the performance of the employees and their contribution to the organization achievement of its overall goals and objectives are measured..

Micro financial institutions refers to a type of banking service that is provided to unemployed or low-income individuals or groups who would otherwise have no other means of gaining financial services. Level of Satisfaction towards the non - financial performance of the micro-financial institutions: In this study it refers to the respondents general evaluation of the different criteria and indices indicative of non- financial accomplishment of the institutions. The evaluation is using a qualitative terms like very low levels of satisfaction to very high level.

Extent of effectiveness of the non-financial performance of the micro-finance institutions: Operationally the term is used in this that would refer to the nature and impact the different nonfinancial indicators to the employees level of job satisfaction.

Nature of their work environment conceptually it refers to where a task is completed. When pertaining to a place of employment, the work environment involves the physical geographical location as well as the immediate surroundings of the workplace, such as a constructionsite or office building. Typically involves other factors relating to the place of employment, such as the quality of the air, noiselevel, and additionalperks and benefits of employment such as freechildcare or unlimited coffee, or

adequateparking.http://www.businessdictionary.com/definition/work-environment.html Human resources management in this study the term would refer to how the employees are recruited, hired, assimilated, trained, motivated and the nature of rewards given of them. Management and leadership style this refers to style of the management in handling their employees. The term is used to indicate the general atmosphere a management staff can develop in the entire institutions, whether, supportive, democratic, etc.

Employees productivity. in this study, however, the term is used to indicate the ratio between what is expected from an employee to the amount of work expected of him for a specific period of time (daily or weekly for example)

Customer management - Customer relationship management (CRM) is a broadly recognized, widely-implemented strategy for managing a companys interactions with the institutions customer conceptually it encompasses all the systems, processes and applications needed to manage the customer relationship.

Customers: The beneficiaries of the services offered by the organization or company. External customers are the clients of the intuitions who are availing it services and products. http://www.customerservicemanager.com/customer-management.htm

Customer relations: This refers to the dealings and/or interaction between and among the internal customers, and the organization and its external customers.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- ch09 16Document126 pagesch09 16EdenA.Mata100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 9Document19 pagesChapter 9einsteinspyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Marginal Utility and Consumer Choice: Chapter in A NutshellDocument36 pagesMarginal Utility and Consumer Choice: Chapter in A Nutshelleinsteinspy67% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Test Bank TOCDocument1 pageTest Bank TOCAkai Senshi No TenshiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Microeconomics Quiz 1 Study GuideDocument8 pagesMicroeconomics Quiz 1 Study GuideeinsteinspyNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Chapter 8Document38 pagesChapter 8einsteinspyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- PRTC Final Pre-Board - Prac1Document14 pagesPRTC Final Pre-Board - Prac1einsteinspyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Emerging Management PracticesDocument13 pagesEmerging Management PracticesShielle AzonNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Process CostingDocument19 pagesProcess Costingeinsteinspy100% (1)

- Microeconomics Review MaterialsDocument54 pagesMicroeconomics Review Materialseinsteinspy100% (1)

- Chapter 10 Advance Accounting SolmanDocument21 pagesChapter 10 Advance Accounting SolmanShiela Gumamela100% (5)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- CHAPTER IV - Final CompleteDocument34 pagesCHAPTER IV - Final CompleteeinsteinspyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- So Per Natural ConfusionsDocument32 pagesSo Per Natural ConfusionseinsteinspyNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- A 101 - I U A: Ccounting Ntroduction To Niversity Ccounting ADocument13 pagesA 101 - I U A: Ccounting Ntroduction To Niversity Ccounting AeinsteinspyNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 2Document9 pagesChapter 2einsteinspyNo ratings yet

- 01-Electronic New Government Accounting SystemDocument61 pages01-Electronic New Government Accounting Systemeinsteinspy87% (15)

- Chapter 3Document6 pagesChapter 3einsteinspyNo ratings yet

- ThesisDocument14 pagesThesisChris TineNo ratings yet

- 3rd Igorot Cordillera-Europe Consultation - PPT 0Document20 pages3rd Igorot Cordillera-Europe Consultation - PPT 0einsteinspyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Primary School Teachers' Knowledge, Attitudes and Behaviours Toward Children With Attention-Deficit/ Hyperactivity DisorderDocument214 pagesPrimary School Teachers' Knowledge, Attitudes and Behaviours Toward Children With Attention-Deficit/ Hyperactivity DisordereinsteinspyNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Emotional Maturity PDFDocument6 pagesEmotional Maturity PDFeinsteinspyNo ratings yet

- Sex Differences in Emotional and Sexual InfidelityDocument30 pagesSex Differences in Emotional and Sexual Infidelityeinsteinspy100% (2)

- Long-Term Effects of Simulated Acid Rain Stress On A Staple Forest Plant, Pinus Massoniana Lamb: A Proteomic AnalysisDocument13 pagesLong-Term Effects of Simulated Acid Rain Stress On A Staple Forest Plant, Pinus Massoniana Lamb: A Proteomic AnalysiseinsteinspyNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Islam, Women and Gender Justice: A Discourse On The Traditional Islamic Practices Among The Tausug in Southern PhilippinesDocument42 pagesIslam, Women and Gender Justice: A Discourse On The Traditional Islamic Practices Among The Tausug in Southern PhilippineseinsteinspyNo ratings yet

- 32 Teaching Strategies in MathDocument35 pages32 Teaching Strategies in Matheinsteinspy100% (1)

- Wedding DanceDocument1 pageWedding DanceeinsteinspyNo ratings yet

- A2 AQA Comparative InfidelityDocument11 pagesA2 AQA Comparative InfidelityeinsteinspyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- 13 Daftar PustakaDocument2 pages13 Daftar PustakaDjauhari NoorNo ratings yet

- Javascript: What You Should Already KnowDocument6 pagesJavascript: What You Should Already KnowKannan ParthasarathiNo ratings yet

- Pyramix V9.1 User Manual PDFDocument770 pagesPyramix V9.1 User Manual PDFhhyjNo ratings yet

- Final Biomechanics of Edentulous StateDocument114 pagesFinal Biomechanics of Edentulous StateSnigdha SahaNo ratings yet

- AB InBev Code of Business Conduct PDFDocument10 pagesAB InBev Code of Business Conduct PDFcristian quelmis vilca huarachiNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- How To Make Pcbat Home PDFDocument15 pagesHow To Make Pcbat Home PDFamareshwarNo ratings yet

- Lecture7 PDFDocument5 pagesLecture7 PDFrashidNo ratings yet

- Exercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesDocument4 pagesExercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesPriyanshu SinghalNo ratings yet

- OPIM101 4 UpdatedDocument61 pagesOPIM101 4 UpdatedJia YiNo ratings yet

- (NTA) SalaryDocument16 pages(NTA) SalaryHakim AndishmandNo ratings yet

- Exercise Manual For Course 973: Programming C# Extended Features: Hands-OnDocument122 pagesExercise Manual For Course 973: Programming C# Extended Features: Hands-OnAdrian GorganNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fact Sheet Rocket StovesDocument2 pagesFact Sheet Rocket StovesMorana100% (1)

- High Uric CidDocument3 pagesHigh Uric Cidsarup007No ratings yet

- Managing operations service problemsDocument2 pagesManaging operations service problemsJoel Christian Mascariña0% (1)

- Chi Square LessonDocument11 pagesChi Square LessonKaia HamadaNo ratings yet

- Resignation Acceptance LetterDocument1 pageResignation Acceptance LetterJahnvi KanwarNo ratings yet

- SIWES Report Example For Civil Engineering StudentDocument46 pagesSIWES Report Example For Civil Engineering Studentolayinkar30No ratings yet

- Mosaic Maker - Instructions PDFDocument4 pagesMosaic Maker - Instructions PDFRoderickHenryNo ratings yet

- Vallance - Sistema Do VolvoDocument15 pagesVallance - Sistema Do VolvoNuno PachecoNo ratings yet

- LNGC Q-Flex Al Rekayyat - Imo 9397339 - Machinery Operating ManualDocument581 pagesLNGC Q-Flex Al Rekayyat - Imo 9397339 - Machinery Operating Manualseawolf50No ratings yet

- CONFLICT ManagementDocument56 pagesCONFLICT ManagementAhmer KhanNo ratings yet

- Shri Siddheshwar Co-Operative BankDocument11 pagesShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- AP Statistics - 2014-2015 Semester 1 Test 3Document4 pagesAP Statistics - 2014-2015 Semester 1 Test 3Camden BickelNo ratings yet

- Parasim CADENCEDocument166 pagesParasim CADENCEvpsampathNo ratings yet

- A Dream Takes FlightDocument3 pagesA Dream Takes FlightHafiq AmsyarNo ratings yet

- Oscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionDocument6 pagesOscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionOscar Ortega LopezNo ratings yet

- Micro Controller AbstractDocument6 pagesMicro Controller AbstractryacetNo ratings yet

- Presentation Pineda Research CenterDocument11 pagesPresentation Pineda Research CenterPinedaMongeNo ratings yet

- Sierra Wireless AirPrimeDocument2 pagesSierra Wireless AirPrimeAminullah -No ratings yet

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfFrom EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfRating: 5 out of 5 stars5/5 (36)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherFrom EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisFrom EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisRating: 4 out of 5 stars4/5 (4276)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- High-Risers: Cabrini-Green and the Fate of American Public HousingFrom EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingNo ratings yet