Professional Documents

Culture Documents

8963 45

Uploaded by

OSDocs20120 ratings0% found this document useful (0 votes)

36 views10 pages8963-45

Original Title

8963-45

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document8963-45

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views10 pages8963 45

Uploaded by

OSDocs20128963-45

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

Exhibit 18K

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 1 of 10

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF LOUISIANA

IN RE: OIL SPILL by the OIL RIG

"DEEPWATER HORIZON" in the

GULF OF MEXICO, on

APRIL 20,2010

*

MDL NO. 2179

*

*

* SECTION J

*

*

* JUDGE BARBIER

* MAG.. JUDGE SHUSHAN

******************************************************************************

DECLARATION OF JEFFERY 0. ROSE

I. I am a Managing Director with Alvarez & Marsal ("A&M'') in the Financial

Industry Advisory Services e FIAS' ') practice. I have 30 years of experience providing credit

and risk analysis, financial operations leadership and bank supervision. I hold a Bachelor's

Degree in Commerce from Rice University and currently serve on the Audit Committee of the

Board of Trustees. A&M is a global professional services firm specializing in turnaround and

interim management, perfurmance improvement and business advisory services. A&M delivers

specialist operational, consulting and industry expertise to management and investors seeking to

accelerate performance, overcome challenges and maximize value across the corporate and

investment lifecycles.

2. During 1he past 30 years, I have originated and participated in a variety of debt

transactions including commercial, retail, syndicated credit fac.ilities, and managed single bank

credit and treasury management solutions for both private and public companies. I started my

career as a Bank Examiner with the Office of the Comptroller of the Currency ("OCC") in 1977,

Following the OCC, l worked for Texas Commerce Bank, now JP Morgan, and served as

President of Texas Commerce Bank- Greenway Plaza in 1984. I worked 10 years for Wells

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 2 of 10

Fargo Bank as Regional Vice President Commercial Banking. While at Wells Fargo, I led the

development of commercial middle market, real estate, consumer, and wealth management

projects including analysis of complex commercial and industrial credit relationships with

various risk based products and services. I currently lead the Credit Risk Management Section

of the FJAS practice at A&M. We advise banks with assets up to $50 Billion on credit risk

analysis and regUlatory guidance for policy and procedures. We have helped commercial and

investment banks, private equity investors, boards of dir.ectors, as well as management teams

identity, value, and manage risk. Appendix A of this declaration contains a more detailed

overview of my qualifi.cations and professional experience.

ASSIGNMENT AND SUMMARY OF OPINIONS

3. I have been asked by BP to address Class Counsel's proposed approach to

implementing the Business Economic Loss ("BEL") framework of the Economic and Property

Damages Settlement, with a focus on why cash based accounting methodology is generally not

relied upon to determine the credit worthiness or profitability of a company.

4. My opinions are based on over 30 years of professional creclit experience and

review of fmancial information for the purpose of issuing credit and minimizing exposure to

financial institutions. A lender's primary responsibility during underwriting is to determine the

borrower' s ability to make the agreed upon payments through detennination of both current and

future profitability. The matching of revenues and expenses is fundamental to the analysis of

financial statements for profitability because profitability cannot be detetmined on a cash basis.

ANALYSTS AND DISCUSSION

5. Cash basis of accounting at a -point in time may not properly match revenue and

expenses occurring within a given time period. Casb basis accounting operates Hke a checkbook

2

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 3 of 10

recording collections and payments, but it does not record pending liabilities, inventories, or

receivables in the same manner; thus, it may misrepresent the profitability of the borrower. To

make an informed decision on cash based financial infom1ation prudent lmderwriting would

include measuring revenue when earned, matching revenue and variable expenses, and

evaluating comparable periods. This matching is important because it provides a better basis for

assessing the entity's past and future perfom1ance than information solely about cash receipts

and payments during that period.

1

Therefore, lenders most ofte11 wi U not rely ou cash basis profit

and loss statements.

6. Len.ding or making other financial decisions with cash based statements is risky

and banks most often require borrowers to convert to accrual based fmancial statements because

profitability can only be shown through financial statements that match revenues with

accompanying expenses. When statements are accrual. based they recognize revenue when

earned rather than when received and recognize expenses when incurred rather than when paid.

2

But "[a 1 report showing cash receipts and cash outlays of an enterprise for a short period cannot

indicate how much of the cash received is return of investment and how much is return on

investment and thus cannot indicate whether or to what extent an enterprise is successful or

unsuccessful. "

3

Cash flow can be monitored through cash based statements but profitability

cannot be monitored through cash based statements because cash based statements fail to

recognize revenues and expenses when incurred. Cash basis fman.cial statements are maintained

for purposes of monitoring a fmn' s current cash position not for determining profitability.

r Statement of Financial Accounting Concepts No.8, September 2010, Par; OBJ 7

2

See Financial Accounting Concepts No.6, Elements ofFinancial Statements, Decernber 1985, Par. 146 ("[Thej

matching of costs and revenues is simultaneous or combined recognition of the revenues and expenses that result

directly aud jointly from the same transactions or other events.").

3

Financial Accounting Concepts No.6, Elements ofFinancial Statements, December 1985, Par. 144.

3

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 4 of 10

I declare under penalty of petjury that the foregoing is a true and correct statement of my

opinions and analysis.

Dated: February 18,2013

4

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 5 of 10

APPENDIX A

Jeffery 0. Rose

Alvarez & Marsal 2008 Current

Mtmagin.g Director

Mr. Rose is Managing Director at Alvarez & Marsal Financial Industry Regulatory Advisory

Services in Houston. He brings more than 30 years of experience in providing credit and risk

analysis, financial operations leadership and bank supervisjon.

Mr. Rose has held leadership roles with Fortune 500 financial institutions, led the growth and

development of several commercial and retail banking divisions through many economic cycles,

identified .risk and made successful recommendations in response to changing market conditions.

During his career, Mr. Rose has assisted start-up companies and large public companies in

developing complex credit strategies. He has originated and participated in syndicated credit

facilities that required large amounts of data coordination and communication among multiple

parties. He has also managed single bank credit and tt'easury management solutions for private

companies and public companies.

In addition, Mr. Rose has led the development of commercial middle market,. real estate,

consumer, and wealth management projects. He has analyzed complex commercial and

industrial credit relationships involving the use of various risk based products and services. He

also o.riginated and managed credit in excess of $1 billion oftotaJ exposure and

brings experience in maintaining adherence to bank and regulatory policy. His banking

responsibilities included: evaluating and approving credit, negotiating with borrowers and legal

counsel, recommending downgrades. and performing risk analysis to preserve capital and

enhance returns. His efforts have led to exceptional growth and excellent returns with minimal

risk.

For over 25 years, A&M has set the standard for working with organizations to tackle complex

business problems, boost operating performance and maximize stakeholder value. Our 1700

professionals cover 32 US markets and 16 foreign countries. We formed the Financial

Institutions Advisory Services practice to support financial institutions. We have successfully

supported fmancial institutions by providing professional advice and leadership to correct

problem areas, support regulatory compliance, an.d provide direction to steer them 1hrough

troubled times. Client engagements have included public and private financial institutions. Mr.

Rose has lead engagements focused on credit risk management, due diligence, and regulatory

compliance.

5

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 6 of 10

WelJs Fargo Bank 1998-2008

Regi01zal Vice President of Commercial Ba1zking West Housto11

Manages all relationship management activities in a commercial middle market within

assigned territory of West Houston. Oversees the preparation of relationship plans to ensure

strong customer focus and retention.

Developed an aggressive and strategic business development program for all products and

services including goals for sales, customer service, cross-selling, credit quality, CRA, risk

and quality control.

Approves credit transactions and exercises sound credit and risk judgment, adhering to Bank

credit policies, maintaining a satisfactory credit rating. Directs the business of originating

credit-related products, treasury management products and investment banking/capital

market products.

Successfully manages budget and expenses to assure optimum adherence to budget and

goals.

Loan Team Manager- South Texas RCBO

Mr. Rose was responsible for a $1 .2B loan portfolio and a team of relationship managers. Duties

included evaluating and approving credit, negotiating with the borrowers, recommending

downgrades, calling on customers and prospects, and editing credit analysis. He was also

responsible for maintaining relationship managers and credit analysts to support current and new

business opportunities.

Risk Asset Review Examiner

Responsible for reviewing commercial loan portfolios and other risk products throughout the

United States for loan quality and adherence to loan policy. The position accessed commercial

banking office management and reviewed procedures to ensure the quality of operations.

Texas Southern University 1997-19,98

Special Assistant to the President

Mr. Rose was recruited by the Chaim1an ofthe Board ofRegents of Texas Southern University

to assist the President with the schools fmancial affairs. This project culminated with the May

28, 1997 approval of $10.4 million funding from the State of Texas 75

1

h Legislative Session.

Texas Commerce Bank 1993-1996

Senior Vice Presitlent Retail Banking

Recruited back to Texas Commerce Bank to lead a strategic initiative designed to make Texas

Commerce Bank the premier fmancial intuition in low to income communities. He

6

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 7 of 10

collaborated closely with Robert Mosbacher, Barbara Jordan and Kirbyjon Caldwell in creating

the organization to meet the bank objective for compliance with the Community Reinvestment

Act.

Responsible for all operations,_ staffmg, productivity, and strategic planning for 11 of

Texas Commerce Bank's 56 Houston branches. The branches represented a diverse

customer base with $1 billion in deposits. Managed a staff of355 people.

Led a strategic initiative to expand the bank market share in low to moderate income

communities. This effort included opening new branches, developing strategic.

community alliances and maintaining productive operations.

Directed the construction and the operation of the Texas Commerce Branches: Lyons -

Lockwood, and South Post Oak.

Lead 12 Texas Commerce branches from last to first in consumer and small business

loans and new account production.

Pacific Southwest Bank f991-l993

President -Houston Branch

Directed the commercial and retail lending for the Houston office of a $1 Billion based Corpus

Christie holding company

Team 8ank- Houston 1989-1991

Executive Vice-President

Responsible for working with acquired branches is accessing the consolidation strategy and

developed commercial and consumer loan portfolios.

Directed the construction and startup of Team Bank Medical Center;

Provided loans to the. healthcare -industry for practices and equipment

Texas Commerce Ba11k- Housto11 1980-1989

Vice President

Mr. Rose served in several capacities over an 8-Y2 year career with the banlc Responsibilities

over the years included President and Senior Lender of two member banks. He served as

President of Texas Commerce Bank-Greenway Plaza during TCB ls unprecedented 63 quarters of

155% increases in quarterly earnings.

Led the commercia] call program at TCB- Greenway Plaza producing 4.5 calls per week

per officer and increased loans 15% per year for 5 consecutive years.

Elected President ofTCB- Greenway Plaza at the age of29. During my tenure at the

bank assets grew from$422 million to $140 million.

7

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 8 of 10

TCB recognized my success at Greenway Plaza by naming me President of then problem

bank TCB-Chemical in 1987.

Reduced the problem loan exposure from 50% of total loans to 25% and restructured loan

and business development operations at

US Treasury Department 1977-1980

National Bank Examiner, Comptroller of Currency

Collaborated in the review of all areas of bank. operations including credit quality, investmentsy

cash control, broker dealer activities, borrowed funds an electronic banking.

EDUCATION

Rice University, .Bachelors of Commerce

School of Commerce

President's Honor Roll

Board Affiliations.

1977

Trustee Emeriti Rice University Board of Trustees. He is Past Chair of the Audit Committee and

is currently an Audit Committee member,

Advisory Board Career & Recovery Resources A United Way Agency

Former National Board Member of the Humane Society of the United States. Served on the

Audit Budget Committee, Pension Committee, Investment Committee (overseeing $1 00 million

endowment fund) and the Humane Equity Fund (founded with Solomon Smith Barney).

Former Association of Rice University Alumni President

Former Board Member of the March of Dimes

Fom1er United Way Team Captain

Volunteer Star of Hope Mission

8

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 9 of 10

APPENDIXB

Documents Relied Upon

Reference Description

Number

1 Statement of Financial Accounting Concepts No. 8, September 2010, Par. OB 17

2 Financial Accounting Concepts No.6, Elements of Financial Statements, December

1985, Par. 144.

3 Financial Accounting Concepts No.6, Elements of Financial Statements, December

1 9 8 5 ~ Par. 146.

9

Case 2:10-md-02179-CJB-SS Document 8963-45 Filed 03/20/13 Page 10 of 10

You might also like

- DOJ Pre-Trial Statement On QuantificationDocument14 pagesDOJ Pre-Trial Statement On QuantificationwhitremerNo ratings yet

- To's Proposed FOF and COLDocument326 pagesTo's Proposed FOF and COLOSDocs2012No ratings yet

- 2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411Document41 pages2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411OSDocs2012No ratings yet

- 2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349Document13 pages2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349OSDocs2012No ratings yet

- To's Post-Trial BriefDocument57 pagesTo's Post-Trial BriefOSDocs2012No ratings yet

- BP's Proposed Findings - Combined FileDocument1,303 pagesBP's Proposed Findings - Combined FileOSDocs2012No ratings yet

- BP Pre-Trial Statement On QuantificationDocument13 pagesBP Pre-Trial Statement On Quantificationwhitremer100% (1)

- 2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlDocument13 pages2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlOSDocs2012No ratings yet

- USAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)Document121 pagesUSAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)OSDocs2012No ratings yet

- HESI's Proposed FOF and COLDocument335 pagesHESI's Proposed FOF and COLOSDocs2012No ratings yet

- HESI's Post-Trial BriefDocument52 pagesHESI's Post-Trial BriefOSDocs2012No ratings yet

- BP's Post-Trial BriefDocument72 pagesBP's Post-Trial BriefOSDocs2012No ratings yet

- USAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)Document49 pagesUSAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)OSDocs2012No ratings yet

- State of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)Document23 pagesState of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)OSDocs2012No ratings yet

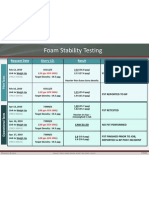

- Foam Stability Testing: Request Date Slurry I.D. Result CommentsDocument1 pageFoam Stability Testing: Request Date Slurry I.D. Result CommentsOSDocs2012No ratings yet

- Exterior: Circa 2003Document1 pageExterior: Circa 2003OSDocs2012No ratings yet

- Plaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013Document199 pagesPlaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013OSDocs2012No ratings yet

- State of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)Document22 pagesState of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)OSDocs2012No ratings yet

- PSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013Document72 pagesPSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013OSDocs2012100% (1)

- Macondo Bod (Basis of Design)Document23 pagesMacondo Bod (Basis of Design)OSDocs2012No ratings yet

- Arnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"Document5 pagesArnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"OSDocs2012No ratings yet

- Driller HITEC Display CCTV Camera System: Source: TREX 4248 8153Document1 pageDriller HITEC Display CCTV Camera System: Source: TREX 4248 8153OSDocs2012No ratings yet

- Circa 2003Document1 pageCirca 2003OSDocs2012No ratings yet

- DR Gene: CloggedDocument1 pageDR Gene: CloggedOSDocs2012No ratings yet

- Laboratory Results Cement Program Material Transfer TicketDocument13 pagesLaboratory Results Cement Program Material Transfer TicketOSDocs2012No ratings yet

- Circa 2003Document1 pageCirca 2003OSDocs2012No ratings yet

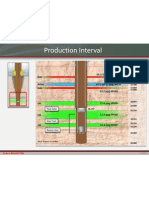

- Production Interval: 14.1-14.2 PPG M57B Gas Brine GasDocument1 pageProduction Interval: 14.1-14.2 PPG M57B Gas Brine GasOSDocs2012No ratings yet

- April 20, BLOWOUT: BP Misreads Logs Does Not IdentifyDocument22 pagesApril 20, BLOWOUT: BP Misreads Logs Does Not IdentifyOSDocs2012No ratings yet

- End of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateDocument1 pageEnd of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateOSDocs2012No ratings yet

- Webster:: Trial Transcript at 3975:2-4Document1 pageWebster:: Trial Transcript at 3975:2-4OSDocs2012No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FT FocusDocument19 pagesFT Focusobi1kenobyNo ratings yet

- Wind Turbines - I. Al-BahadlyDocument664 pagesWind Turbines - I. Al-Bahadlykevin_leigh_1No ratings yet

- Written Report in Instructional PlanningDocument6 pagesWritten Report in Instructional PlanningRose Aura HerialesNo ratings yet

- Catalogo HydronixDocument68 pagesCatalogo HydronixNANCHO77No ratings yet

- Blank FacebookDocument2 pagesBlank Facebookapi-355481535No ratings yet

- Overview of Incorporation in CambodiaDocument3 pagesOverview of Incorporation in CambodiaDavid MNo ratings yet

- Enzyme Immobilization - Advances in Industry, Agriculture, Medicine, and The Environment-Springer International Publishing (2016)Document141 pagesEnzyme Immobilization - Advances in Industry, Agriculture, Medicine, and The Environment-Springer International Publishing (2016)Komagatae XylinusNo ratings yet

- Shades Eq Gloss Large Shade ChartDocument2 pagesShades Eq Gloss Large Shade ChartmeganNo ratings yet

- TSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishDocument93 pagesTSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishMurielle HeuchonNo ratings yet

- Matokeo CBDocument4 pagesMatokeo CBHubert MubofuNo ratings yet

- Lupon National Comprehensive High School Ilangay, Lupon, Davao Oriental Grade 10-Household ServicesDocument4 pagesLupon National Comprehensive High School Ilangay, Lupon, Davao Oriental Grade 10-Household ServicesJohn Eirhene Intia BarreteNo ratings yet

- Modular ResumeDocument1 pageModular ResumeedisontNo ratings yet

- Maintenance Performance ToolboxDocument6 pagesMaintenance Performance ToolboxMagda ScrobotaNo ratings yet

- 506 Koch-Glitsch PDFDocument11 pages506 Koch-Glitsch PDFNoman Abu-FarhaNo ratings yet

- Industry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineDocument14 pagesIndustry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineCalebNo ratings yet

- B2B Marketing: Chapter-8Document23 pagesB2B Marketing: Chapter-8Saurabh JainNo ratings yet

- PC's & Laptop Accessories PDFDocument4 pagesPC's & Laptop Accessories PDFsundar chapagainNo ratings yet

- Final Matatag Epp Tle CG 2023 Grades 4 10Document184 pagesFinal Matatag Epp Tle CG 2023 Grades 4 10DIVINE GRACE CABAHUGNo ratings yet

- Fike ECARO-25 Frequently Asked Questions (FAQ)Document8 pagesFike ECARO-25 Frequently Asked Questions (FAQ)Jubert RaymundoNo ratings yet

- Crown BeverageDocument13 pagesCrown BeverageMoniruzzaman JurorNo ratings yet

- Cash Budget Sharpe Corporation S Projected Sales First 8 Month oDocument1 pageCash Budget Sharpe Corporation S Projected Sales First 8 Month oAmit PandeyNo ratings yet

- Genie PDFDocument264 pagesGenie PDFjohanaNo ratings yet

- Gummy Bear Story RubricDocument1 pageGummy Bear Story Rubricapi-365008921No ratings yet

- Knitting in Satellite AntennaDocument4 pagesKnitting in Satellite AntennaBhaswati PandaNo ratings yet

- GT I9100g Service SchematicsDocument8 pagesGT I9100g Service SchematicsMassolo RoyNo ratings yet

- Pepcoding - Coding ContestDocument2 pagesPepcoding - Coding ContestAjay YadavNo ratings yet

- Research Paper On Marketing PlanDocument4 pagesResearch Paper On Marketing Planfvhacvjd100% (1)

- @InglizEnglish-4000 Essential English Words 6 UzbDocument193 pages@InglizEnglish-4000 Essential English Words 6 UzbMaster SmartNo ratings yet

- Technical and Business WritingDocument3 pagesTechnical and Business WritingMuhammad FaisalNo ratings yet

- Exploded Views and Parts List: 6-1 Indoor UnitDocument11 pagesExploded Views and Parts List: 6-1 Indoor UnitandreiionNo ratings yet