Professional Documents

Culture Documents

Homework 5

Uploaded by

mas888Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework 5

Uploaded by

mas888Copyright:

Available Formats

Homework #5 FIN 4504 Equity and Capital Markets Instructor: Cem Demiroglu Due: November 9, Tuesday 1.

The ______ average ignores compounding. A) geometric B) arithmetic C) both a and b above D) none of the above 2. The reward/variability ratio is given by __________. A) the slope of the capital allocation line B) the second derivative of the capital allocation line C) the point at which the second derivative of the investor's indifference curve reaches zero D) none of the above 3. The capital allocation line is also the __________. A) investment opportunity set formed with a risky asset and a risk-free asset B) investment opportunity set formed with two risky assets C) line on which lie all portfolios that offer the same utility to a particular investor D) line on which lie all portfolios with the same expected rate of return and different standard deviations 4. Risk that can be eliminated through diversification is called ______ risk. A) unique B) firm-specific C) diversifiable D) all of the above 5. Many current and retired Enron Corp. employees had their 401k retirement accounts wiped out when Enron collapsed because ____. A) they had to pay huge fines for obstruction of justice B) they had purchased fines for obstruction of justice C) their 401k accounts were not well diversified D) none of the above 6. Adding additional risky assets will generally move the efficient frontier _____ and to the ___________________. A) up, right B) up, left C) down, right D) down, left

7. The _________ could be used in an index model to represent common or systematic risk factors. A) firm size B) industry C) S&P500 index D) capital allocation line

8. Diversification is most effective when security returns are __________. A) high B) negatively correlated C) positively correlated D) uncorrelated 9. Beta is a measure of __________. A) firm specific risk B) diversifiable risk C) market risk D) unique risk 10. The risk that can be diversified away is ___________. A) beta B) firm specific risk C) market risk D) systematic risk 11. __________ is a true statement regarding the variance of risky portfolios. A) The higher the coefficient of correlation between securities, the greater will be the reduction in the portfolio variance B) There is a direct relationship between the securities coefficient of correlation and the portfolio variance C) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities D) none of the above 12. Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global minimum variance portfolio has a standard deviation that is always __________. A) equal to the sum of the securities standard deviations B) equal to -1 C) equal to 0 D) greater than 0 13. The term efficient frontier refers to the set of portfolios that _________________. A) yield the greatest return for a given level of risk B) involve the least risk for a given level of return C) Both a and b above D) None of the above answers are correct 14. Expected return-standard deviation combinations corresponding to any individual risky asset _________________. A) will always end up on the efficient frontier B) will always end up on the efficient frontier or within the efficient frontier, but never outside the efficient frontier C) will always end up within the efficient frontier D) may end up anywhere in expected return-standard deviation space

15. Portfolios that lie on the portion of the efficient frontier below the minimum-variance portfolio ___________________. A) add nothing to the investment opportunity set B) are sometimes useful in implementing sophisticated hedging techniques C) represent opportunities for arbitrage D) None of the above answers is correct 16. The slope of a capital allocation line measures the reward-to-variability ratio of ___________. A) all portfolios on the efficient frontier B) all portfolios on the capital market line C) the minimum variance portfolio only D) all portfolios on the particular capital allocation line in question 17. Rational risk-averse investors will always prefer portfolios ______________. A) located on the efficient frontier to those located on the capital market line B) located on the capital market line to those located on the efficient frontier C) at or near the minimum variance point on the efficient frontier D) Rational risk-averse investors prefer the risk-free asset to all other asset choices. 18. The optimal risky portfolio can be identified by finding _____________. A) the minimum variance point on the efficient frontier B) the maximum return point on the efficient frontier C) the tangency point of the capital market line and the efficient frontier D) None of the above answers is correct 19. Consider two perfectly negatively correlated risky securities, A and B. Security A has an expected rate of return of 16% and a standard deviation of return of 20%. B has an expected rate of return 10% and a standard deviation of return of 30%. The weight of security B in the global minimum variance is __________. A) 10% B) 20% C) 40% D) 60% Use the following to answer questions 20-22: An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 18% and a standard deviation of return of 20%. Stock B has an expected return of 14% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is 50%. The risk-free rate of return is 10%. 20. The proportion of the optimal risky portfolio that should be invested in stock A is __________. A) 0% B) 40% C) 60% D) 100%

21. The expected return on the optimal risky portfolio is __________. A) 14.0% B) 15.6% C) 16.4% D) 18.0% 22. The risk-free rate of return is 10%. The standard deviation of return on the optimal risky portfolio is__________. A) 0% B) 5% C) 7% D) 20% Use the following to answer questions 23-25: An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 18% and a standard deviation of return of 20%. Stock B has an expected return of 12% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is 50%. The risk-free rate of return is 10%. 23. The proportion of the optimal risky portfolio that should be invested in stock B is __________. A) .2000 B) .2667 C) .3636 D) .8000 24. The expected return on the optimal risky portfolio is __________. A) 13.2% B) 15.8% C) 16.4% D) 16.8% 25. The standard deviation of return on the optimal risky portfolio is approximately __________. A) 5% B) 7% C) 8% D) 9% 26. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock B is 15%. The correlation coefficient between the return on A and B is 0%. The expected return on stock A is 20% while on stock B it is 10%. The proportion of the minimum variance portfolio that would be invested in stock B is __________. A) 6% B) 50% C) 64% D) 100%

27. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock B is 15%. The expected return on stock A is 20% while on stock B it is 10%. The correlation coefficient between the return on A and B is 0%. The expected return on the minimum variance portfolio is approximately __________. A) 10.00% B) 13.60% C) 15.00% D) 19.41% 28. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock B is 15%. The expected return on stock A is 20% while on stock B it is 10%. The correlation coefficient between the return on A and B is 0%. The standard deviation of return on the minimum variance portfolio is __________. A) 0% B) 6% C) 12% D) 17% 29. The systematic risk of a security __________. A) is likely to be higher in a rising market B) results from its own unique factors C) depends upon market volatility D) cannot be diversified away 30. Which of the following portfolios cannot lie on the efficient frontier? P o r t f oE l xi o p I 1 J 1 K 2 L Portfolio I Portfolio J Portfolio K Portfolio L e 8 6 5 5 c t e d S Rt a e n t % 1 % 2 % 2 % 3 u d 0 0 5 8 ra nr d % % % % D e v i a t i o n

A) B) C) D)

31. According to Tobin's separation property, portfolio choice can be separated into two independent tasks consisting of __________ and ___________. A) identifying all investor imposed constraints; identifying the set of securities that conform to the investor's constraints and offer the best risk-return tradeoffs B) identifying the investor's degree of risk aversion; choosing securities from industry groups that are consistent with the investor's risk profile C) identifying the optimal risky portfolio; constructing a complete portfolio from T-bills and the optimal risky portfolio based on the investor's degree of risk aversion D) None of the above answers is correct

32. The values of beta coefficients of securities are ___________. A) always positive B) always negative C) always between positive 1 and negative 1 D) usually positive, but are not restricted in any particular way 33. A security's beta coefficient will be negative if _____________. A) its returns are negatively correlated with market index returns B) its returns are positively correlated with market index returns C) its stock price has historically been very stable D) market demand for the firm's shares is very low 34. In order to construct a riskless portfolio using two risky stocks, one would need to find two stocks with a correlation coefficient of _________. A) 1.0 B) 0.5 C) 0 D) -1.0 35. In standard deviation-expected return space, the market portfolio is found at ____________. A) the point of tangency with the indifference curve and the capital allocation line B) the point of highest reward to variability ratio in the opportunity set C) the point of tangency with the opportunity set and the capital allocation line D) the point of highest reward to variability ratio in the indifference curve Use the following to answer questions 36-40:

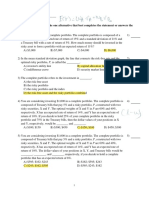

S R M R A S O

m m a r y O e g r e s s i o n u l t i p l e R S q u a r e d j u s t e d R t a n d a r d E r b s e r v a t i o n

Coefficients

t p u t t a t i s t i c s 0 . 3 5 0 . 1 2 S 0q . u 0 a 2 r e r 3o 8r . 4 5 s 1 2

Standard Error 15.44 0.97 t Stat 0.26 1.36 P-value .80 .10

Intercep t Market

4.05 1.32

36 .The beta of this stock is _____. A) 0.12 B) 0.35 C) 1.32 D) 4.05 37. This stock has greater systematic risk than a stock with a beta of ____. A) 0.50 B) 2.00

C) 4.00 D) all of the above 38. The characteristic line (SML) for this stock is Rstock = ___ + ___ Rmarket. A) 0.35, 0.12 B) 4.05, 1.32 C) 15.44, 0.97 D) none of the above 39. ____ percent of the variance is explained by this regression A) 12 B) 35 C) 4.05 D) 80 40. The nonsystematic risk for this stock is ____ percent. A) 12 B) 35 C) 38.45 D) none of the above 41. Decreasing the number of stock in a portfolio from 50 to 10 would likely to _____. A) increase the systematic risk of the portfolio B) increase the nonsystematic risk of the portfolio C) increase the return of the portfolio D) none of the above 42. Consider the CAPM. The risk-free rate is 6% and the expected return on the market is 18%. What is the expected return on a stock with a beta of 1.3? A) 6% B) 15.6% C) 18% D) 21.6% 43. Consider the CAPM. The risk-free rate is 5% and the expected return on the market is 15%. What is the beta on a stock with an expected return of 12%? A) .5 B) .7 C) 1.2 D) 1.4 44. The market portfolio has a beta of __________. A) -1.0 B) 0 C) 0.5 D) 1.0 45. In a well diversified portfolio, __________ risk is negligible. A) nondiversifiable B) market

C) systematic D) unsystematic 46. According to the capital asset pricing model, a security with a __________. A) negative alpha is considered a good buy B) positive alpha is considered overpriced C) positive alpha is considered underpriced D) zero alpha is considered a good buy 47. According to the capital asset pricing model, the expected rate of return on any security is equal to __________. A) [(the risk-free rate) + (beta of the security)] x (market risk premium) B) (the risk-free rate) + [(variance of the security's return) x (market risk premium)] C) (the risk-free rate) + [(security's beta) x (market risk premium)] D) (market rate of return) + (the risk-free rate) 48. According to the capital asset pricing model, fairly priced securities have __________. A) negative betas B) positive alphas C) positive betas D) zero alphas 49. The difference between a security's actual return and the return predicted by the characteristic line associated with the security's past returns is ___________. A) alpha B) beta C) gamma D) residual 50. The beta, of a security is equal to __________. A) the covariance between the security and market returns divided by the variance of the market's returns B) the covariance between the security and market returns divided by the standard deviation of the market's returns C) the variance of the security's returns divided by the covariance between the security and market returns D) the variance of the security's returns divided by the variance of the market's returns 51. According to the capital asset pricing model, __________. A) all securities must lie on the capital market line B) all securities must lie on the security market line C) underpriced securities lie below the security market line D) overpriced securities lie above the security market line 52. __________ is not a true statement regarding the market portfolio. A) All securities in the market portfolio are held in proportion to their market values B) It includes all assets of the universe C) It is the tangency point between the capital market line and the indifference curve D) It lies on the efficient frontier

53. __________ is not a true statement regarding the capital market line. A) The capital market line always has a positive slope B) The capital market line is also called the security market line C) The capital market line is the best attainable capital allocation line D) The capital market line is the line from the risk-free rate through the market portfolio 54. Security X has an expected rate of return of 13% and a beta of 1.15. The risk-free rate is 5% and the market expected rate of return is 15%. According to the capital asset pricing model, security X is __________. A) fairly priced B) overpriced C) underpriced D) None of the above answers are correct 55. If the simple CAPM is valid, which of the situations below are possible. Consider each situation independently. A)

E P o r t f o A B E P o r t f o A B E P o r t f o A B

x p e c t lR i o e t u r n 1 5 % 1 5 %

e d B e t a 1 . 2 1 . 0

B)

x p e c St e t da n d a r d l R i o e t u r Dn e v i a t i o n 2 0 % 3 0 % 1 5 % 3 5 % x p e c t lR i o e t u r n 2 5 % 5 % e d B e t a 1 . 5 0 . 5

C)

D) none of the above are possible 56. Assume that both X and Y are well-diversified portfolios and the risk-free rate is 8%. Portfolio X has an expected return of 14% and a beta of 1.00. Portfolio Y has an expected return of 9.5% and a beta of 0.25. In this situation, you would conclude that portfolios X and Y __________. A) are in equilibrium B) offer an arbitrage opportunity C) are both underpriced D) are both fairly priced

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Mt2 PracticeDocument8 pagesMt2 PracticemehdiNo ratings yet

- Chapter 06 - Efficient DiversificationDocument50 pagesChapter 06 - Efficient DiversificationMarwa HassanNo ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177Document45 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177CassandraHurstqtrk100% (17)

- Chap007 Test Bank (1) SolutionDocument11 pagesChap007 Test Bank (1) SolutionMinji Michelle J100% (1)

- SAPMDocument6 pagesSAPMShivam PopatNo ratings yet

- CH 7Document45 pagesCH 7yawnzz89100% (3)

- 재무관리 ch13 퀴즈Document53 pages재무관리 ch13 퀴즈임키No ratings yet

- Chapter 2 - Part 1 - Measures of Central Tendency - Practice ProblemsDocument8 pagesChapter 2 - Part 1 - Measures of Central Tendency - Practice ProblemsTejas Joshi0% (3)

- Exam1 BFDocument9 pagesExam1 BFTumaini JM100% (2)

- Investment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)Document17 pagesInvestment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)its_different17No ratings yet

- Investment Planning Mock TestDocument20 pagesInvestment Planning Mock Testjayaram_polaris100% (2)

- FRM Part I - Full Length Test 3Document37 pagesFRM Part I - Full Length Test 3pradeep johnNo ratings yet

- PTA Requests Funds for School ImprovementsDocument6 pagesPTA Requests Funds for School ImprovementsJoan DalilisNo ratings yet

- 001 Sap Gts 7.2 Delta 1Document68 pages001 Sap Gts 7.2 Delta 1snd31No ratings yet

- Markowitz MCQDocument11 pagesMarkowitz MCQvarunbhardwaj26100% (6)

- Mid-term investment questionsDocument10 pagesMid-term investment questionsZobia JavaidNo ratings yet

- Finance MCQsDocument12 pagesFinance MCQsrajendraeNo ratings yet

- Practice Quiz 30016 FQDocument17 pagesPractice Quiz 30016 FQJason DanielNo ratings yet

- Bank 1,2,3,4-Portfolios IiDocument11 pagesBank 1,2,3,4-Portfolios IimileNo ratings yet

- Sample Exam QuestionsDocument16 pagesSample Exam QuestionsMadina SuleimenovaNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Test Bank DownloadDocument564 pagesCorporate Financial Management 5th Edition Glen Arnold Test Bank DownloadRichard Hunter100% (25)

- Chapter 7 Quizz - 21Document5 pagesChapter 7 Quizz - 21Khue NgoNo ratings yet

- EC3333 Midterm Fall 2014.questionsDocument7 pagesEC3333 Midterm Fall 2014.questionsChiew Jun SiewNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Multiple Choice Questions on Portfolio Risk and ReturnDocument30 pagesMultiple Choice Questions on Portfolio Risk and ReturnPro TenNo ratings yet

- Chapter 11 Stock Valuation and RiskDocument7 pagesChapter 11 Stock Valuation and Risktrevorsum123No ratings yet

- BUS346 Week 5 Homework QuestionsDocument5 pagesBUS346 Week 5 Homework QuestionsHennrocksNo ratings yet

- Investment Analysis (FIN 670) Fall 2009Document13 pagesInvestment Analysis (FIN 670) Fall 2009BAHADUR singhNo ratings yet

- Business Finance 11th Edition Peirson Test BankDocument40 pagesBusiness Finance 11th Edition Peirson Test Bankcodykerrdiaqbnwyrp100% (28)

- Business Finance 11Th Edition Peirson Test Bank Full Chapter PDFDocument61 pagesBusiness Finance 11Th Edition Peirson Test Bank Full Chapter PDFmrsamandareynoldsiktzboqwad100% (9)

- Risk Types Market PortfoliosDocument18 pagesRisk Types Market PortfoliosRezzan Joy MejiaNo ratings yet

- Principles of Investments 1st Edition Bodie Test BankDocument42 pagesPrinciples of Investments 1st Edition Bodie Test Bankmarthajessegvt100% (26)

- Principles of Investments 1St Edition Bodie Test Bank Full Chapter PDFDocument63 pagesPrinciples of Investments 1St Edition Bodie Test Bank Full Chapter PDFDawnCrawforddoeq100% (7)

- DTU406 - Mock ExamDocument8 pagesDTU406 - Mock ExamXuân MaiNo ratings yet

- IPOMDocument23 pagesIPOMmuskan200875No ratings yet

- CH 08Document11 pagesCH 08kmarisseeNo ratings yet

- DTTC, C7Document8 pagesDTTC, C7NhuNo ratings yet

- Soal Chapter 5Document5 pagesSoal Chapter 5Cherry BlasoomNo ratings yet

- Chapter 7 - Portfolio TheoryDocument10 pagesChapter 7 - Portfolio TheorySinpaoNo ratings yet

- MOCK MCQ TEST ON SECURITY ANALYSIS AND INVESTMENT MANAGEMENTDocument13 pagesMOCK MCQ TEST ON SECURITY ANALYSIS AND INVESTMENT MANAGEMENTJamal AhmadNo ratings yet

- HW03Document7 pagesHW03lhbhcjlyhNo ratings yet

- Demand for Risky Assets QuestionsDocument7 pagesDemand for Risky Assets QuestionsKc ToraynoNo ratings yet

- Compared To Investing in A Single Security, Diversification Provides Investors A Way ToDocument8 pagesCompared To Investing in A Single Security, Diversification Provides Investors A Way ToDarlyn ValdezNo ratings yet

- Questions Mean-VarianceDocument13 pagesQuestions Mean-VarianceKremena BachmannNo ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Cost accounting and managerial decisionsDocument10 pagesCost accounting and managerial decisionsRafina Aziz 1331264630No ratings yet

- Practice Midterm RSM330Document13 pagesPractice Midterm RSM330JhonGodtoNo ratings yet

- MCQ's For Midterm Test - 7th April 2012Document6 pagesMCQ's For Midterm Test - 7th April 2012Nalin Indika KumaraNo ratings yet

- Capital MarketDocument27 pagesCapital MarketJoebet DebuyanNo ratings yet

- Quiz 1Document8 pagesQuiz 1HUANG WENCHENNo ratings yet

- MCQ SapmDocument15 pagesMCQ SapmMahima SinghNo ratings yet

- Name: - ID NumberDocument11 pagesName: - ID NumberNitinNo ratings yet

- Study Guide 10-17Document22 pagesStudy Guide 10-17minisizekevNo ratings yet

- Wilmington University Finance 411 Final Exam Multiple ChoiceDocument7 pagesWilmington University Finance 411 Final Exam Multiple ChoiceArianna TalleyNo ratings yet

- Corporate Finance QuizDocument9 pagesCorporate Finance QuizRahul TiwariNo ratings yet

- Ipm Final Model Paper Spring 15Document12 pagesIpm Final Model Paper Spring 15UMAIR AHMEDNo ratings yet

- Financial Risk Management Problem Set 1Document3 pagesFinancial Risk Management Problem Set 1Valentin IsNo ratings yet

- Chapter 6 Note 2Document41 pagesChapter 6 Note 2محمد الجمريNo ratings yet

- Ashford Bus401 Week 1 4 Quiz and Practice QuestionsDocument15 pagesAshford Bus401 Week 1 4 Quiz and Practice QuestionsDoreenNo ratings yet

- FIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)Document13 pagesFIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)An HoàiNo ratings yet

- CH 11Document49 pagesCH 11boodjo715No ratings yet

- Admissions and ConfessionsDocument46 pagesAdmissions and ConfessionsAlexis Anne P. ArejolaNo ratings yet

- Blades of Illusion - Crown Service, Book 2 First Five ChaptersDocument44 pagesBlades of Illusion - Crown Service, Book 2 First Five ChaptersTerah Edun50% (2)

- Recruitment On The InternetDocument8 pagesRecruitment On The InternetbgbhattacharyaNo ratings yet

- Hargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesDocument1 pageHargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesEric MooreNo ratings yet

- Paper 3 IBIMA Brand Loyalty Page 2727-2738Document82 pagesPaper 3 IBIMA Brand Loyalty Page 2727-2738Sri Rahayu Hijrah HatiNo ratings yet

- Unsettling Race and Language Toward A RaDocument27 pagesUnsettling Race and Language Toward A Ra1dennys5No ratings yet

- Fondazione Prada - January 2019Document6 pagesFondazione Prada - January 2019ArtdataNo ratings yet

- Lost Spring exposes lives of povertyDocument5 pagesLost Spring exposes lives of povertyvandana61No ratings yet

- Bio New KMJDocument11 pagesBio New KMJapi-19758547No ratings yet

- Group 1 ResearchDocument28 pagesGroup 1 ResearchKrysler EguiaNo ratings yet

- Intercultural Presentation FinalDocument15 pagesIntercultural Presentation Finalapi-302652884No ratings yet

- Shot List Farm To FridgeDocument3 pagesShot List Farm To Fridgeapi-704594167No ratings yet

- Canada Immigration Forms: 5578EDocument7 pagesCanada Immigration Forms: 5578EOleksiy KovyrinNo ratings yet

- Silent Night (2015) ProgramDocument88 pagesSilent Night (2015) ProgramLyric Opera of Kansas CityNo ratings yet

- Wagner Group Rebellion - CaseStudyDocument41 pagesWagner Group Rebellion - CaseStudyTp RayNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- Early Registration FormDocument2 pagesEarly Registration FormMylene PilongoNo ratings yet

- AFL Cheque ScanDocument2 pagesAFL Cheque ScanMantha DevisuryanarayanaNo ratings yet

- Tso C139Document5 pagesTso C139Russell GouldenNo ratings yet

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDocument5 pagesGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloNo ratings yet

- Pak Steel Product Price ListDocument6 pagesPak Steel Product Price ListHamid NaveedNo ratings yet

- Ethics in Social Science ResearchDocument33 pagesEthics in Social Science ResearchRV DuenasNo ratings yet

- The Impact of E-Commerce in BangladeshDocument12 pagesThe Impact of E-Commerce in BangladeshMd Ruhul AminNo ratings yet

- Construction Equipments Operations and MaintenanceDocument1 pageConstruction Equipments Operations and MaintenanceQueenie PerezNo ratings yet

- Punjab's Domestic Electrical Appliances Cluster Diagnostic StudyDocument82 pagesPunjab's Domestic Electrical Appliances Cluster Diagnostic StudyShahzaib HussainNo ratings yet

- Debate Motions SparringDocument45 pagesDebate Motions SparringJayden Christian BudimanNo ratings yet

- The Crown - Episode 7Document7 pagesThe Crown - Episode 7Grom GrimonNo ratings yet