Professional Documents

Culture Documents

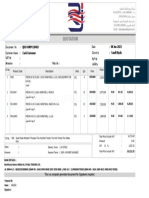

Accounting Services Sydney - Chartered Tax Advisor

Uploaded by

layertaxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Services Sydney - Chartered Tax Advisor

Uploaded by

layertaxCopyright:

Available Formats

Accounting Services Sydney | Chartered Tax Advisor

___________________________________________________________________________

As a Chartered Tax Adviser firm, we are very proud of our knowledge and skills level with tax and always strive to catch up the continuously changing taxation laws and the ATOs positions. As active members of The Tax Institute, the leading tax professional body in Australia, our team never stops to put extra efforts to provide the best tax compliance and advisory services to our clients with cost effective strategies. Our result oriented strategy has helped our clients who had complex tax issues against the ATO, and delivers future focused tax planning and advice.

Tax Compliance & Litigation Support

With our extensive experiences in tax litigation supports, we are fully capable of delivering tax litigation support to our clients and their legal representatives. Our team has worked number of large scale of tax audits and voluntary disclosures with great outcomes for the clients. Our works are fully incorporated with tax laws and regulations, and we have been closely working with number of tax lawyers in Sydney to resolve our clients tax matters with the Australian Taxation Office.

Tax Audits

Operations Wickenby Phoenix Investigations Income Tax Audit GST Audit Tax related litigation support

Voluntary Disclosures

Multi-Year Income Tax Returns Offshore Income Declarations Remission of Penalties and Interests from the ATO

General Compliance

Income Tax Returns for Individuals, companies, trusts, partnerships and SMSF Business Activity Statements and Annual GST Return FBT Return

Payroll Related Reports including PAYG Withholding Tax WorkCover (Workers Compensation) Audit and Compliance Superannuation Guarantee Audit and Compliance

Tax Advisory Service Corporate Income Tax

For tax purpose, the definition of a company differs from its definition in the Corporations Act. It could include building societies, sporting clubs and limited partnerships. Also the Division 7A is only applied to private companies. Allowing deductions of business losses and bad debt is required special care as there are tests involved to be eligible. Also companies pay income tax under the pay as you go (PAYG) system based on installment rate notified by the ATO. Dividend payments to companys shareholders require great attention. Also the Division 7A of Income Tax Assessment Act 1936 and other sections requires companies to put extra attention with regard to deemed dividends. This could include related trust distributions and forgiveness of debts to shareholders and associates. A group of wholly-owned Australian resident company can elect to form a tax consolidated group to reduce tax compliance costs. The calculation of consolidated tax is complex procedure and may require expert advice.

International Tax

The increasing globalisation causes tax regulators attention around world to secure the tax revenue from their residents as individuals and businesses move easily from one country to another for jobs and business interests. It is important to consider whether taxpayers or amount fall within Australian tax jurisdiction. It is matter of residency and source for income tax purposes. When a taxpayer is a resident of Australia for income tax purposes, they are assessable on income from all sources. If a taxpayer is not a resident of Australia for income tax purposes, then generally only Australiansourced income is taxable. The tests of residency for both individuals and companies and determination of income source is critical part for this issue. However, there are some exemptions available to companies in relation to non-portfolio dividends and branch profits. Also, only CGT assets that are taxable Australian property give rise to capital gains and losses for temporary resident in case of individuals. There are withholding taxes for dividends payments by resident companies as well as interest and royalty payments to non-residents.

R & D Tax Incentive

New registration of R & D Tax Credit allows eligible businesses for a tax incentive including a 45 per cent refundable (150%) tax credit. To eligible for this, the entitys annual turnover must not over $20 million. For larger businesses, the program gives a 40 per cent non-refundable credit. The process of claiming for R & D Tax Credit is complex and time consuming. The entity must register with AusIndustry each year before it claims tax credit through tax return. Not all entities are eligible for this. Our experiences for R & D tax incentive have been proven with our clients businesses. We support our clients with R & D Planning, registering with AusIndustry with accurate R & D Expenditure calculation and preparing for compliance program. For further information, please contact our office.

Goods and Services Tax

Issues in relation to Goods and Services Tax (GST) are getting complex ever since we have GST in Australia since July 1, 2000. Registration turnover threshold has been increased during the period, and it is a requirement for businesses whose turnover exceed this threshold. Businesses exporting or importing goods or services from overseas have special GST issues in relation to GST free and GST deferral scheme. There are special GST rules for the supply of real property. Taxpayers who sell real properties must acknowledge these special rules. Also if a business is about to be sold, and certain conditions are met, the sale of the business is GST-free.

Fringe Benefits Tax

Fringe benefits are taxed under the Fringe Benefits Tax Assessment Act 1986 separate from income tax law. If fringe benefits are given to employees and their associates in relation to the employment, fringe benefit tax issue arises. Though there are exempt benefits, most of the employment related benefits are subject to FBT. Also employers who provide fringe benefits to an employee having a total taxable value exceeding $2,000 for an FBT year must record the grossed-up taxable value of the benefits on the employees payment summary. Employers should put extra care when they provide fringe benefits to employees whether it is entitled to the otherwise deductible rule as it reduces the value of fringe benefits.

Capital Gains Tax

Capital Gains Tax (CGT) is not a separate tax, but it is included net capital gains in a taxpayers assessable income. The amount of the taxable capital gain could be reduced by 50 per cent in the case of individuals and trusts and by 33.33 per cent in the case of complying superannuation funds but not companies. Understanding CGT events (currently 53 CGT events) and cost base is very complex and requires great attention to calculate correct capital gains and losses. Any taxpayers (regardless of their residency in Australia) who have a taxable Australian property are required to consider any possible tax consequences before it is sold or transferred. We provide a quality tax advice in this area including options to CGT rollover reliefs to reduce the tax payable for our clients.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Customer LoyaltyDocument16 pagesCustomer LoyaltySiddharth TrivediNo ratings yet

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightNo ratings yet

- The Business Case For Basel IIDocument10 pagesThe Business Case For Basel IIGordonNo ratings yet

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesNo ratings yet

- Bir Ruling No. 015-18Document2 pagesBir Ruling No. 015-18edong the greatNo ratings yet

- Development Project ProposalDocument8 pagesDevelopment Project Proposalnickdash09100% (1)

- Mar 11-Q&A-1Document13 pagesMar 11-Q&A-1pdkprabhath_66619207No ratings yet

- Assignment Two Instructions S2 2021Document2 pagesAssignment Two Instructions S2 2021Dat HuynhNo ratings yet

- Tendering & Estimating IDocument72 pagesTendering & Estimating Ivihangimadu100% (3)

- Assingment - Module3, Lesson-1Document5 pagesAssingment - Module3, Lesson-1Mohamed YazNo ratings yet

- Merger ReportDocument9 pagesMerger ReportArisha KhanNo ratings yet

- Approved List of ValuersDocument7 pagesApproved List of ValuersTim Tom100% (1)

- Sample Exam 3: CFA Level 1Document75 pagesSample Exam 3: CFA Level 1Sandeep JaiswalNo ratings yet

- Yogesh 19Document3 pagesYogesh 19DeltaNo ratings yet

- Chapter 5 ReconciliationDocument7 pagesChapter 5 ReconciliationDevender SinghNo ratings yet

- Trust CFDocument1 pageTrust CFShaira May Dela CruzNo ratings yet

- A Section Tues 11-07-17Document32 pagesA Section Tues 11-07-17Jacob LevaleNo ratings yet

- Digest RR 14-2001 PDFDocument1 pageDigest RR 14-2001 PDFCliff DaquioagNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- IPO Prospectus - Sunway BerhadDocument549 pagesIPO Prospectus - Sunway BerhadkairNo ratings yet

- Icici Complete Project Mba 3Document106 pagesIcici Complete Project Mba 3Javaid Ahmad MirNo ratings yet

- UI 8 - Application For Registration As An EmployerDocument1 pageUI 8 - Application For Registration As An EmployerSheunesu GumbieNo ratings yet

- Digital Assets - Tokenized Revolution in Financial ServicesDocument18 pagesDigital Assets - Tokenized Revolution in Financial ServicesSoluciones en BlockchainNo ratings yet

- Test Bank For Accounting Principles Volume 1 7th Canadian EditionDocument24 pagesTest Bank For Accounting Principles Volume 1 7th Canadian EditionPaigeDiazrmqp98% (49)

- A Review of Corporate Financial Performance Literature: A Mini-Review Approach KeywordsDocument17 pagesA Review of Corporate Financial Performance Literature: A Mini-Review Approach KeywordsAnania TesfayeNo ratings yet

- BF2 AssignmentDocument5 pagesBF2 AssignmentIbaad KhanNo ratings yet

- Group 4-Malicdem, Ronald Abon, Adrian Garong, AizaDocument1 pageGroup 4-Malicdem, Ronald Abon, Adrian Garong, AizaRichard MendozaNo ratings yet

- NEFTE Compass November 25, 2009 IssueDocument12 pagesNEFTE Compass November 25, 2009 IssueCommittee for Russian Economic FreedomNo ratings yet

- QTN FreonDocument1 pageQTN Freonsanad alsoulimanNo ratings yet