Professional Documents

Culture Documents

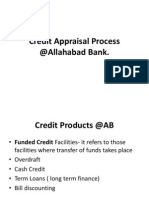

Credit Appraisal

Uploaded by

Parthapratim DebnathCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Appraisal

Uploaded by

Parthapratim DebnathCopyright:

Available Formats

1 2 3

Gross sales Projected current assets Projected current liabilities less bank borrowings for working capital

4 5 6 7 8 9

Working capital gap (2-3) 25% margin on WCG Working capital surplus ( current assets- current liabilities ) Item 4-5 Item 4-6 PBF(item 7 or 8 whichever is less)

1 Gross sales 2 Projected current assets Projected current liabilities less bank 3 borrowings for working capital 4 Working capital gap (2-3) 5 25% margin on Current assets Working capital surplus ( current assets6 current liabilities ) 7 Item 4-5 8 Item 4-6 9 PBF(item 7 or 8 whichever is less) 9

Name of Statement

Applicability (Based on Aggregate Periodicity Fund Based or Non-Fund based Limit) Rs.5.00 crores and above Monthly

Credit Monitoring Report- E1

Credit Monitoring Report- E2 Rs.1.00 crore and above but below Rs Monthly 5.00 crores

Credit Monitoring Report- E3 Rs.10.00 lacs and above but below Rs.100.00 lacs

Quarterly

Category of account AB1 to AB4 Newly sanctioned account

AB5(potential) & AB6 (SST) AB7 & Operative NPA NPA a/c Non Operative Consortium accounts

Frequently Quarterly Manager/In-charge immediately after the disbursement and first 6 months once in 2 months Once in 2 months Monthly Quarterly or as per sanction terms As per consortium decision

To whom to be submitted

Credit Monitoring Deptt, HO under copy to ZO. 1. AB1 to Graded Accounts: Zonal Office (Copy to be sent to Credit Monitoring Deptt, HO On Quarterly Basis). 2. AB5 to Graded Accounts Head Office (Copy be sent to Z.O month).

Zonal Office

Branch: Zone: 1 2 3 3a 3b 4

4a

4b 5

6 7

10 10 11 12

13

14

The pre-credit appraisal is sent in the following formatALLAHABAD BANK HO: 2, Netaji Subhas Road, Kolkata-01 Pre Credit Appraisal Format

Name of the firm/company/unit Constitution Date of incorporation/commencement of business Date of partnership Dealing with our bank since If the account is new, name the earlier bankers, type and amount of credit facilities availed Proprietors/Partners/Directors Name Address Fathers name PAN number Telephone number Whether the proprietors/partners/directors are in the defaulter list of RBI Whether the directors are disqualified under sec.279 of Companies act, 1956 Group , if any Address Factory(s) Administrative office E-mail address Website Line of activity in brief Capacity utilization: Licensed capacity: Installed capacity: Operating capacity( if existing unit): Details of cost of the project Details of means of finance a. b. c. d. e. Total Equity share capital and its share holding pattern a. b. c. d. e. Total Promoters | Amount%

Share price Share price Consortium / Multiple banking arrangement Loan amount sought for: Term loan Cash Credit Bank Guarantee Letter of Credit Others Securities offered: Primary : Collateral : Name of the Guarantors Background and manufacturing process in brief

Public | FIs & banks | Others | Total | As on a recent | Six month high date As on a recent | Six month high date | Six month low Rs.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Understanding The Difference Between B2B and B2C MarketingDocument23 pagesUnderstanding The Difference Between B2B and B2C MarketingParthapratim DebnathNo ratings yet

- EntrepreneurshipDocument43 pagesEntrepreneurshipParthapratim DebnathNo ratings yet

- Board Membership - Directors' Appointment, RolesDocument47 pagesBoard Membership - Directors' Appointment, RolesParthapratim DebnathNo ratings yet

- Directors:: Appointment, Roles and RemunerationDocument49 pagesDirectors:: Appointment, Roles and RemunerationParthapratim DebnathNo ratings yet

- Institute of Technology & Science Mohan Nagar, Ghaziabad Learning Objective & Lesson PlanDocument4 pagesInstitute of Technology & Science Mohan Nagar, Ghaziabad Learning Objective & Lesson PlanParthapratim DebnathNo ratings yet

- Credit Appraisal Process Followed in Allahabad BankDocument42 pagesCredit Appraisal Process Followed in Allahabad BankParthapratim DebnathNo ratings yet

- Board Membership - Directors' Appointment, RolesDocument47 pagesBoard Membership - Directors' Appointment, RolesParthapratim DebnathNo ratings yet

- Creating Corporate CeulturDocument9 pagesCreating Corporate CeulturParthapratim DebnathNo ratings yet

- Basic Option Strategies - Coverd Calls and PutsDocument29 pagesBasic Option Strategies - Coverd Calls and PutsParthapratim DebnathNo ratings yet

- Brand Audit-ITC ClassmateDocument17 pagesBrand Audit-ITC ClassmateParthapratim DebnathNo ratings yet

- Binomial Option Pricing ModelDocument27 pagesBinomial Option Pricing ModelParthapratim Debnath50% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Annual Report 2015Document221 pagesAnnual Report 2015Tufan EmonNo ratings yet

- Mid-Term Exam. 2022Document3 pagesMid-Term Exam. 2022Trâm AnhNo ratings yet

- Ch8 Parity Conditions in International Finance and Currency ForecastingDocument27 pagesCh8 Parity Conditions in International Finance and Currency ForecastingMohammed HabibNo ratings yet

- TNHB - Rti Act - 11.2.2021Document104 pagesTNHB - Rti Act - 11.2.2021TNHB PT Section100% (1)

- Monthly Bank StatementDocument1 pageMonthly Bank StatementRudy AlconcherNo ratings yet

- Effect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksDocument13 pagesEffect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksEditor IJTSRDNo ratings yet

- Ddce My ProjectDocument38 pagesDdce My ProjectNishant kumarNo ratings yet

- Midterm Topic Business CorrespondenceDocument23 pagesMidterm Topic Business CorrespondenceOlivia AlmazanNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- State Bank of India: Xpress Credit Loan Application FormDocument5 pagesState Bank of India: Xpress Credit Loan Application FormTushar Vats100% (1)

- Intermediate Accounting 1st Edition Gordon Test BankDocument39 pagesIntermediate Accounting 1st Edition Gordon Test Banktalipesangelicalhyfac100% (30)

- Short Term FinancingDocument16 pagesShort Term FinancingSaha SuprioNo ratings yet

- Isys2126 Myob Test UpdatedDocument13 pagesIsys2126 Myob Test UpdatedTan NguyenNo ratings yet

- ASIFMA - India's Debt Markets The Way ForwardDocument90 pagesASIFMA - India's Debt Markets The Way ForwardyezdiarwNo ratings yet

- Ranford E Banking Admin FRS 1.0Document39 pagesRanford E Banking Admin FRS 1.0samala anilkumar100% (1)

- Project File On E-CommerceDocument33 pagesProject File On E-CommerceHimanshu HNo ratings yet

- FI Group AssignmentDocument20 pagesFI Group AssignmentLilyNo ratings yet

- Lavanya Tirumala Olatpur Phase 2 Application FormDocument4 pagesLavanya Tirumala Olatpur Phase 2 Application FormSusantKumarNo ratings yet

- Project Work Final HDFCDocument60 pagesProject Work Final HDFCravisngh41No ratings yet

- Presentation On BangladeshbankDocument20 pagesPresentation On Bangladeshbank17PAD070 Rafiul Islam SazalNo ratings yet

- Sap EbsDocument12 pagesSap EbsAnil0% (4)

- Ichchhit Srivastava 1731Document6 pagesIchchhit Srivastava 1731ichchhit srivastavaNo ratings yet

- Internship Report On UBLDocument62 pagesInternship Report On UBLbbaahmad89No ratings yet

- HSBC Third Party Transfer Activate FormDocument1 pageHSBC Third Party Transfer Activate FormPankaj Batra100% (2)

- Risk Management in Banking SectorDocument31 pagesRisk Management in Banking SectorManish SethiNo ratings yet

- Financial Market Is A Marketplace Wherein TheDocument13 pagesFinancial Market Is A Marketplace Wherein TheJeanette Bayona CumayasNo ratings yet

- Bankers Adda - BANKING TERMS PDFDocument14 pagesBankers Adda - BANKING TERMS PDFMaitri DubeyNo ratings yet

- Major Challenges Faced by EntrepreneursDocument17 pagesMajor Challenges Faced by EntrepreneursDannisha WilsonNo ratings yet

- Money Insurance Proposal FormDocument4 pagesMoney Insurance Proposal FormPrasanth KumarNo ratings yet

- The "Jag Shakti" (1981-1982) SLR (R) 579 (1982) SGCA 12Document5 pagesThe "Jag Shakti" (1981-1982) SLR (R) 579 (1982) SGCA 12SiddharthNo ratings yet