Professional Documents

Culture Documents

Assignment 1 C

Uploaded by

Dick ButtkissOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1 C

Uploaded by

Dick ButtkissCopyright:

Available Formats

Long run trends are vital in predicting the outcome given a certain set of data.

There is great uncertainty in store for the future if we continue to sustain such high levels of debt and spending. In this report we shall take a look at the long term deficit and debt problem by examining specific outlay and revenue trends that may cause the deficit and debt to reach unsustainable levels in the future. We will achieve this by looking at specific subcategories under both areas that may have the most impact on the deficit and debt. We will investigate and determine what the possible consequences may be if nothing is done to reverse these trends. We will also look at some specific policy recommendations for reversing these trends, and the points of disagreement between policy advocates, and we will synthesize the information to try and determine a balance for dealing with the deficit and debt. Spending on Medicare and Medicaid is growing at a rapid rate due to the rising costs of healthcare and the increase in the aging population due to the incoming retirees from the Baby-boomer generation, who are eligible at age 65, and to the increase in life expectancy. The total spending for both private and public health care has increased from 4.7 percent of GDP in 1960 to 14.9 percent of GDP in 2005, thats an average of about . 22 percent over 45 years. There have been many recent advances that can be attributed to the rise in costs, all of which drive up the prices. Medicare and Medicaid spending has increased from 1 percent of GDP in 1970, to 4 percent of GDP in 2007 (CBO 2007), which averages to about .08 percent of GDP a year over the 37 year period (CBO 2007). Medicare spending in 2006 has totaled $374.9 billion, with 32 percent of that going to Inpatient Hospital Services, and 23 percent to Physicians and Suppliers Services (CBO 2007), both eating up the largest share of the pie. Medicaid with a total of 60.9 million enrollees had a yearly federal payment of $160.9 billion in 2006 (CBO 2007). Under the Congressional Budget Office (CBO) current projections, spending on Medicare and Medicaid will grow from at 4 percent of GDP to a fraction of 9 percent of GDP by 2035, then up to 19 percent of GDP in 2082; an average increase of roughly .2 percent over 75 years. In terms of current GDP, it equates to an increase of about $30 million a year for 75 years at a grand total of an estimated $2146 billion. Social Security (SS) is the Governments single largest program, where spending is projected to increase from a change in the nations demographic structure (CBO 2007). The Baby-boomer generation will soon reach retirement age, and in the next 30 years the number of people aged 65 and older is expected to double, while the number of people aged 20 to 64 will grow at only 11 percent (CBO 2007). The result is, in that time frame the elder population will be roughly 30 percent larger than the younger segment, for a grand total of 86 million people over the current 50 million people, who will receive SS benefits, enlarging the average benefit by 29 percent in real terms (CBO 2007). Spending on the program will rise from 4.3 percent of GDP in 2007, to 6.1 percent of GDP in 2030, and due to increased life spans 6.4 percent of GDP in 2082 (CBO 2007). That equates to an average growth rate of about 0.03 percent per year for 75 years, in present terms that is about $4.3 billion a year. Government revenues vary in size and composition based on decisions made by policymakers, so there can be many different scenarios that play out. Historically

revenues as a percentage of GDP have fluctuated between 16.1 and 20.9 percent, for an average value of 18.1 percent. Individual income taxes make up the lions share, which are around 7 to 10 percent of GDP, while Social Insurance taxes have gone from 2 to 6.5 percent of GDP, corporate taxes take up around 1 to 2 percent of GDP, and other taxes and duties make up between 1 and 3 percent (CBO 2007). There are four factors affecting future revenue. First is a progressive tax rate, which raises the tax as income gets higher (CBO 2007). Second, the individual income tax includes an alternative minimum tax (AMT), which subjects more taxpayers to as higher tax rate (CBO 2007). Third, the Economic Growth Tax Relief Reconciliation Act of 2003 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), will expire in 2010 reverting to prior law (CBO 2007). Fourth, the Government will received deferred taxes, such as income on retirement funds which were previously tax free, but are subject to tax upon withdrawal (CBO 2007). These factors can go either way in affecting future revenues. Due to the current downturn the loss in jobs will affect income from personal income taxes by decreasing revenue. Both EGTRRA and JGTRRA may be repealed and future projected income may also decrease, but the CBO projects a decrease in taxable income from both personal and corporate sources due to the rising costs of non-taxable fringe benefits, which in turn reduce taxable income from both parties The Center on Budget and Policy Priorities (CBPP) suggests that without amendment to current policies our deficit and debt will grow to uncontrollable levels that may leave long lasting effects on the economy. The current projections show that if nothing is done then the federal debt, now placed at 46 percent of GDP in 2009 will rise to a staggering 279 percent of GDP in 2050, 179 percent higher than the nations total income (CBPP 2008). This is forecasted to happen because of the projected rise in program expenditures from 19.2 percent of GDP in 2008 to 24.6 percent of GDP in 2050, while revenues will decline to 17.2 percent, 1.2 percent lower than the average for the last 30 years (CBPP 2008). The single largest main factor in the rise of expenditures is contributed to the longrun rising cost in the U.S. health care system and the increase in the portion of the population over 65, with cots per beneficiary growing 2 percent faster than per-capita GDP (CBPP 2008). The budget deficit is forecasted to rise from the current 3 percent of GDP, to a more considerable 21 percent of GDP in 2050, which is seven times larger than in 2009. The topic of privatizing social security has been gaining some favor in some circles with its promise of no compromises or sacrifices. Privatization transforms government pension liabilities into explicit government debt, this then only increases pension funding by as much as it decreases funding the rest of Government (Mariger 1997). In essence national saving is not increased. Some privatization plans claim efficient resource allocation, and being able to close the funding gap, but these alternatives raise taxes and lower expected pensions than with the current system; overall effect is the same (Mariger 1997). Privatization does not make the burden of future taxes less, because it does not make it less dependent on aggregate wage growth. Privatization will lead to different risk factors and varied expected returns than the current system (Mariger 1997).

You might also like

- Caltex V PNOCDocument2 pagesCaltex V PNOCDick ButtkissNo ratings yet

- 2DDocument3 pages2DDick ButtkissNo ratings yet

- Tables 1 ADocument2 pagesTables 1 ADick ButtkissNo ratings yet

- Integrating Schumpeter and KeynesDocument9 pagesIntegrating Schumpeter and KeynesDick ButtkissNo ratings yet

- Choice of Research QuestionDocument1 pageChoice of Research QuestionDick ButtkissNo ratings yet

- Assignment ADocument6 pagesAssignment Acary_puyatNo ratings yet

- Compilation R39, S15-S50Document24 pagesCompilation R39, S15-S50Dick ButtkissNo ratings yet

- Compilation R43 R45Document19 pagesCompilation R43 R45Dick ButtkissNo ratings yet

- Case DigestsDocument3 pagesCase DigestsDick ButtkissNo ratings yet

- Criminal Procedure Rule 110-111Document281 pagesCriminal Procedure Rule 110-111Dick ButtkissNo ratings yet

- 516 FinalDocument7 pages516 Finalcary_puyatNo ratings yet

- AFRS340Document5 pagesAFRS340Dick ButtkissNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TDS & VDS Rate 2022-2023Document25 pagesTDS & VDS Rate 2022-2023Shariful IslamNo ratings yet

- Flight InvoiceDocument3 pagesFlight InvoicePrasannaNo ratings yet

- Part 10 - Performance GuaranteeDocument2 pagesPart 10 - Performance GuaranteeTran MaithoaNo ratings yet

- CIR V GoodyearDocument2 pagesCIR V GoodyearAnn QuebecNo ratings yet

- Spa Services: Revenue ParametersDocument2 pagesSpa Services: Revenue ParametersJosel Millan UbaldoNo ratings yet

- 1600 SalarySlip December 2020Document1 page1600 SalarySlip December 2020Mickey CreationNo ratings yet

- 2017 TaxReturnDocument190 pages2017 TaxReturnMari Clarke0% (1)

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- 400 Rao VatDocument31 pages400 Rao VatctyvteNo ratings yet

- Tax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024Document2 pagesTax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024RexNo ratings yet

- Exercise 2-General LedgerDocument2 pagesExercise 2-General LedgerTerefe DubeNo ratings yet

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeDocument4 pagesDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- Akshay Finance PRJCTDocument38 pagesAkshay Finance PRJCTsamarthadhkariNo ratings yet

- RR 11-2018 Income Payor Sworn DeclarationDocument1 pageRR 11-2018 Income Payor Sworn DeclarationMaricel Valerio CanlasNo ratings yet

- Inr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyDocument2 pagesInr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyRaja HussainNo ratings yet

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Document2 pagesAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiNo ratings yet

- PF1 Chapter 3 SlidesDocument98 pagesPF1 Chapter 3 SlidesNamie NamieNo ratings yet

- Ch17 - 2015Document66 pagesCh17 - 2015lawrence hNo ratings yet

- Laguna College of Business and Arts Midterm Exam Tax 202: Income TaxationDocument3 pagesLaguna College of Business and Arts Midterm Exam Tax 202: Income TaxationPam G.No ratings yet

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocument1 pageQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadNo ratings yet

- Dec 2018Document1 pageDec 2018Bharat YadavNo ratings yet

- Section 247. General Provisions. - : Sections 247-252, Tax CodeDocument2 pagesSection 247. General Provisions. - : Sections 247-252, Tax CodeEdward Kenneth KungNo ratings yet

- Caf 2 QB Past PapersDocument169 pagesCaf 2 QB Past PapersWahajaaNo ratings yet

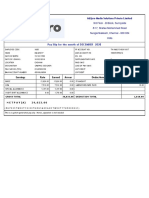

- 2.1 Purchase Invoice For Leg Rest On Mar2021Document1 page2.1 Purchase Invoice For Leg Rest On Mar2021Nabajyoti SahaNo ratings yet

- Tax InterviewDocument1 pageTax Interviewperfora7orNo ratings yet

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Document1 pageCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaNo ratings yet

- 1574 Ir I 20208182020 - 63721 - PM PDFDocument2 pages1574 Ir I 20208182020 - 63721 - PM PDFSaleem SoomroNo ratings yet

- Income Tax Return For Individuals: Taxpayer InformationDocument6 pagesIncome Tax Return For Individuals: Taxpayer InformationSYDNEYNo ratings yet