Professional Documents

Culture Documents

Retail

Uploaded by

mohammadtaufeequeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail

Uploaded by

mohammadtaufeequeCopyright:

Available Formats

What is Core Banking Solution (CBS) ?

Core Banking Solution (CBS) is networking of branches, which enables Customers to operate their accounts, and avail banking services from any branch of the Bank on CBS network, regardless of where he maintains his account. The customer is no more the customer of a Branch. He becomes the Banks Customer. Thus CBS is a step towards enhancing customer convenience through Anywhere and Anytime Banking. How shall CBS help Customers? All CBS branches are inter-connected with each other. Therefore, Customers of CBS branches can avail various banking facilities from any other CBS branch located any where in the world. These services* are: To make enquiries about the balance; debit or credit entries in the account. To obtain cash payment out of his account by tendering a cheque. To deposit a cheque for credit into his account. To deposit cash into the account. To deposit cheques / cash into account of some other person who has account in a CBS branch. To get statement of account. To transfer funds from his account to some other account his own or of third party, provided both accounts are in CBS branches. To obtain Demand Drafts or Bankers Cheques from any branch on CBS amount shall be online debited to his account. Customers can continue to use ATMs and other Delivery Channels, which are also interfaced with CBS platform. All these aim to provide convenient, efficient, and high quality banking experience to the customers, comparable to world class standards.

ECS is an electronic mode of funds transfer from one bank account to another. It can be used by institutions for making payments such as distribution of dividend interest, salary, pension, among others. It can also be used to pay bills and other charges such as telephone, electricity, water or for making equated monthly installments payments on loans as well as SIP investments. ECS can be used for both credit and debit purposes. How do you avail of an ECS scheme? You need to inform your bank and provide a mandate that authorises the institution, who can then debit or credit the payments through the bank. The mandate contains details of your bank branch and account particulars. It is the responsibility of the institution to communicate the details of the amount being credited or debited to their account, indicating the date of credit and other relative particulars of the payment. You will know the money has been debited from your account through mobile alerts or messages from the bank.The ECS user can set the maximum amount one can debit from the account, specify the purpose of debit, as well as set a validity period for every mandate given. What are the processing or service charges levied on the customer? The Reserve Bank of India has deregulated the charges to be levied by sponsor banks from institutions. Destination bank branches have been directed to afford ECS credit free of charge to the beneficiary account holders. So, it costs you nothing. How do you discontinue an ECS scheme? There are two steps you have to follow to ensure appropriate closure. Firstly, the service provider,

which is the beneficiary of the payment, will have to be given a written communication in the way stipulated by them, in order to discontinue the services. And next, the bank, which is the channel of payment, will also have to be given a written application stating you would like to discontinue.

The Most Preferred Home Loan Provider

With a tradition of trust and transparency, through 13, 700 branches across the country, SBI brings you exclusive benefits:

Interest on a daily reducing balance No prepayment penalties Open loan account closest to your present or proposed residence So what are you waiting for? You can reduce your interest burden and optimally utilize your surplus funds, only with SBI.

EMI in `/lac/month

Period of Loan(Years) 30 25 20 15

Upto ` 30 lacs @ 9.95% p.a 874 905 962 1,072

Above ` 30 lacs @ 10.10% p.a 885 916 972 1,081

Demat account is an account wherein you can hold shares of various companies in the dematerialised {electronic} form.You can open a demat account with a share brokerage or a bank. You should necessarily have a PAN card for opening such a account. You can operate your account by giving the filled in delivery instruction slips provided. for selling the shares in your account. The shares you buy will get credited to your account a few days after you buy.

6 years ago

Challenges And Oppurtunities Retail banking in India has vast opportunities and challenges. The rise of the middle class is an important contributory factor in this regard. Improving con- sumer purchasing power, coupled with more liberal attitudes toward personal debt is contributing to India's retail banking segment. Increase in purchasing power of the younger population would give an immense op- portunity. It has been found that younger generation is more comfortable in acquiring debt than the previous generation, thereby improving-purchasing power and liberal attitude towards personal debt, and contributing to India's retail segment. The SEZs will also provide growth opportunity for retail banking. The combination of these factors promises growth in the retail sector, which at present is in the nascent stage. As retail banking offers phenomenal opportunities for growth, the challenges are equally daunting. The retail banks have to market their products aggressively. The challenge is to design and innovate the financial products which cater to the target segment needs. In future, retail banking scenario will see a huge proliferation of products. This will in turn require devising product which is easy to understand and at the same time meet the financial goals of the customers. The entry of new generation private sector banks has changed the entire scenario. The retail segment, which was earlier ignored, is now the the most important of the lot, with the banks jumping over one another to give out retail loans. With supply far exceeding demand it has been a race to the bottom, with the banks undercutting one another. The nimble footed new generation private sector banks have been losing business to the private sector banks in this seg- ment. PSBs need to figure out the means to generate profitable business from this segment. Another major challenge in retail banking is attraction as well as retention of customers. In fact, the retention is more difficult in this competitive environment. Customer retention favor- ably affects the profitability. According to a research by Reich held and Sasser in the Harvard Business Review, 5% increase in customer retention can increase profit- ability by 35% in banking business, 50% in insurance and brokerage, and 125% in the consumer credit card market. Thus, banks need to focus on customer retention. Sustainability is another issue, which is becoming

increasingly vital with respect to the growth of retail banking in India, due to excessive concentration on the top-line without regard to the quality of growth of the top-line, increasing market share by increasing risk appetite and entering the markets where a bank may not have a competitive advantage. Technology has made it possible to deliver services throughout the branch bank network, providing instant updates to checking accounts and rapid movement of money. However this dependency on the network has brought IT departments additional respon- sibilities and challenges in managing, maintaining and optimizing the performance of retail banking networks. The network challenges includes proper functioning of distributed networks in support of business objectives. Specific challenges include ensuring that account trans- action applications run efficiently between the branch offices and data centers. Another issue of concern is the rising indebtness, which could affect the future growth of retail banking. The banks will also have to shore up the image of their brand. A bank has to build its brand by clearly communicating what it stands for and ensure that the brand image is consistently conveyed to its customers. This would call for seamless integration of all channels to ensure optimum customer satisfaction, regardless of the channel being used. Most of the retail banks are witnessing a tremendous expansion in their customer base. However, on the other hand there is increasing menace of hacking, phasing and farming through which scamsters are creating havoc indulging in cyber crimes on a large scale. In a service industry the value can be deliv- ered at the moment of interaction with the customers. Banks, in a drive to carry on with tremendous expansion in terms of customer base, need to have requirements of the employees who are well informed about the prod- ucts as well as have the necessary soft skills to deal and satisfy the customers. It challenges for the bank to upgrade their existing manpower and retention or lock in the best talents for having competitive advantage in terms of human resources.

Conclusion and Suggestions The conventional scenario of banks is fast changing. Retail banking has gained enormous momentum in the Indian banking sector during last five years. There is vast opportunity as well as challenges for retail banking in India. The changing portfolio of retail banking in India has many dimensions. There is a need of constant innovation in retail banking. Banks need to use retail segment as a growth trigger. There is a notice able change in the number and nature of products being tossed up along with the way in which banking services are being offered. Banks requires product development and differentiation, innovation and business process re-engineering, micro planning, marketing, prudent pricing, customization, technological upgradation and cross selling. The competitive advantage in retail banking that would help each bank to reach out and retain the customer. The product differentiation will provide a bank with an edge over competition. Efforts should be made to ensure customer delight, which is essential in order to retain the customers in the open competitive business. There should be operational transparency while dealing with the customers. CRM must be used the make customer delight. The delivery channels require comprehensive approach to ensure convenience and reliability. The retail segment can survive only if it is competitive. These challenges demand a well planned and implemented strategy to cope with the changing business environment. These challenges can be con- verted into opportunities by enhancing the internal capabilities and providing the innovative products and services fulfilling the diverse needs of the customers. The future growth of the retail banking sector would be the outcome of the strategies of today. Given the size advantages, diverse customer base and scope for future expansion, there is need for evolving a systematic approach to retail banking

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDDocument2 pagesAl-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDHassan Naveed56% (25)

- Netgear Double ChargeDocument3 pagesNetgear Double Chargeseshu.nukalaNo ratings yet

- PrathmeshDocument5 pagesPrathmeshprathmesh vaidyaNo ratings yet

- Month March 11-2012 CDocument30 pagesMonth March 11-2012 Calinazim55No ratings yet

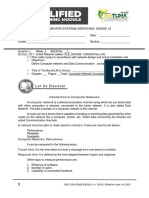

- Tvl-Computer Systems Servicing-Grade 12: Let Us DiscoverDocument6 pagesTvl-Computer Systems Servicing-Grade 12: Let Us DiscoverDan Gela Mæ MaYoNo ratings yet

- Binatone Firmware v21.19.3 Release NoteDocument2 pagesBinatone Firmware v21.19.3 Release Notehernandez.josedomingo6804No ratings yet

- Soft Drink Distribution ChannelsDocument9 pagesSoft Drink Distribution ChannelsVarun KaulNo ratings yet

- National Youth Rapid & Blitz 2023Document2 pagesNational Youth Rapid & Blitz 2023Tech ProNo ratings yet

- Tuitionfees 1 SttermDocument2 pagesTuitionfees 1 SttermBhaskhar AnnaswamyNo ratings yet

- Daftar PustakaDocument3 pagesDaftar PustakaFaisal Al IdrusNo ratings yet

- UnionLife Doves Funeral InsuranceDocument2 pagesUnionLife Doves Funeral InsuranceFrank NelNo ratings yet

- CPA POP QuizDocument28 pagesCPA POP QuizKeanu TevesNo ratings yet

- Huawei Opti: DWDM Backbone SolutionsDocument46 pagesHuawei Opti: DWDM Backbone Solutionsnobita3No ratings yet

- Website Returns Form V2Document2 pagesWebsite Returns Form V2masturbate2308No ratings yet

- Abhibus AW5695630162Document2 pagesAbhibus AW5695630162hemanth sheelamshettiNo ratings yet

- F-92 Asset Retirement With CustomerDocument9 pagesF-92 Asset Retirement With CustomerOkikiri Omeiza RabiuNo ratings yet

- Rtgs and Neft FormDocument1 pageRtgs and Neft FormAmruta patilNo ratings yet

- Tourism TransportDocument7 pagesTourism TransportJessa CapangpanganNo ratings yet

- Po Guide Part - 1Document172 pagesPo Guide Part - 1K V Sridharan General Secretary P3 NFPE71% (7)

- Issue 26Document128 pagesIssue 26SnehalPoteNo ratings yet

- Your Bill - 3 February 2018: A Da Silva Pinheiro Franco 1/21 Kilmarnock Street Riccarton Christchurch 8011Document3 pagesYour Bill - 3 February 2018: A Da Silva Pinheiro Franco 1/21 Kilmarnock Street Riccarton Christchurch 8011Ailton FrancoNo ratings yet

- Payment Notification: Capitec B AnkDocument1 pagePayment Notification: Capitec B AnkMbaleigh-Enhle MthunziNo ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheNoman Malik100% (2)

- April StatementDocument20 pagesApril StatementMe RickNo ratings yet

- Introduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas JacobsonDocument502 pagesIntroduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas Jacobson7tr5wgnddzNo ratings yet

- E StatementDocument13 pagesE Statementankit kumarNo ratings yet

- 914010001051417 (3)Document3 pages914010001051417 (3)ShawnDhineshNo ratings yet

- Bulk SMS Service - SmsmenowDocument2 pagesBulk SMS Service - Smsmenowsmsmenow jprNo ratings yet

- Ericsson Ethernet Jumbo FramesDocument18 pagesEricsson Ethernet Jumbo Framesmbuh_meongNo ratings yet

- Mortgage Fraud Lawsuits 2-19-2014Document87 pagesMortgage Fraud Lawsuits 2-19-2014Kelly L. HansenNo ratings yet