Professional Documents

Culture Documents

Maybank-IB RR-2011!05!11 Hartalega - FY11 Results - in Line Continues To Impress

Uploaded by

Tanaka OzumiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maybank-IB RR-2011!05!11 Hartalega - FY11 Results - in Line Continues To Impress

Uploaded by

Tanaka OzumiCopyright:

Available Formats

Maybank IB Research

PP16832/04/2011 (029339)

Results Review

11 May 2011

Hartalega Holdings

Buy (unchanged)

Share price: Target price: RM5.71 RM6.80 (unchanged)

In line; continues to impress

Results support our nitrile pick. FY11 net profit of RM190m (+33% YoY) was 102% of our full-year forecast and 103% of streets. We expect Hartalegas sequential earnings growth momentum (4QFY11 net profit: +7% QoQ) to slow as the company may absorb a portion of the increased NBR cost. However, we still think that the stock is due for an upward re-rating given the ongoing structural demand shift from latex to nitile gloves globally, on cheaper ASP. Maintain Buy and DCFderived TP of RM6.80. Higher volume and margins. The strong sequential 4QFY11 net profit of RM52m (+7% QoQ, +14% YoY) was driven by: (i) higher sales volume of 1.8b pieces (+3% QoQ, +27% YoY), post commissioning of the last 4 lines at Plant 5; and (ii) higher EBIT margin of 34.6% (+1.8ppt QoQ, -0.3-ppt YoY) on operational efficiency, derived from its Plant 5 and above-industry output per line. Additionally, company declared a third interim dividend of 6 sen/sh and proposed another final dividend of 6sen/sh, bringing full-year dividend to 21 sen/sh (+58% YoY). Near-term margin pressure. We think earnings momentum may slow in sequential quarters as the company may absorb a portion of the increased NBR cost. While NBR cost seems to be on an upward trend (Apr: +10% MoM, May: +14%), key price indicators (crude oil: -10% MoM, butadiene: flattish, latex: -4%) are pointing to a lower NBR cost ahead. The spike in NBR cost could be short-lived as there is a timelag when NBR producers pass on higher butadiene cost from the prior months. Nevertheless, current nitrile glove ASP is still at a good 2030% discount to latex powder-free glove, aiding the shift in demand. Buy on strong growth potential. We maintain our FY12-13 earnings forecasts and introduce FY14 numbers, with growth to be driven by its Plant 6. Hartalega remains our top pick in the glove sector due to its above-peer 3-year EPS CAGR potential of 14%. At our DCF-derived TP of RM6.80, Hartalega trades at an undemanding CY12 PER of 9x (vs Top Gloves 13x).

Hartalega Summary Earnings Table

FYE Mar (RM m) Revenue MaMacDeDecDDeFYEMont EBITDA hAbbr (RM m) Recurring Net Profit Recurring Basic EPS (Sen) EPS growth (%) DPS (Sen) PER EV/EBITDA (x) Div Yield (%) P/BV(x) Net Gearing (%) ROE (%) ROA (%) 2010A 571.9 199.9 142.9 39.3 69.1 13.3 14.5 10.2 2.3 5.9 Cash 40.3 30.0 2011A 734.9 265.0 190.2 52.3 33.0 21.0 10.9 7.5 3.7 4.2 Cash 38.5 30.1 2012F 874.6 284.7 200.5 55.1 5.4 24.8 10.4 7.0 4.3 3.4 Cash 33.2 26.8 211.1 2013F 1,036.2 331.0 233.4 64.2 16.4 28.9 8.9 5.8 5.1 2.8 Cash 31.8 26.9 243.8 2014F 1,260.3 397.7 284.2 78.2 21.7 35.2 7.3 4.6 6.2 2.3 Cash 32.0 27.7 -

Lee Yen Ling lee.yl@maybank-ib.com (603) 2297 8691

Description: OEM gloves manufacturer. Information: Ticker: Shares Issued (m): Market Cap (RM m): 3-mth Avg Daily Volume (m): KLCI: Major Shareholders: Hartalega Industries HART MK 363.5 2,046.4 0.32 1,535.60 % 50.6

Price Performance: 52-week High/Low 1-mth (1.7) 3-mth 10.4

RM5.75 / RM4.04 6-mth 3.2 1-yr 17.3 YTD 5.4

Price Chart (RM5.63)

7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0

Jul-09 Jan-09

HART MK Equity

Jan-10

Jul-10

Jan-11

Consensus Net Profit (RM m) Source: Maybank IB

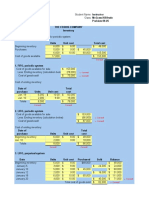

Hartalega Holdings Hartalega: Results Summary Table

Quarterly FY Mar (RM m) Turnover EBIT Net interest exp Pre-tax profit Tax Minority Interest Net profit 4QFY11 192.5 66.7 -0.4 66.3 -13.9 0.0 52.4 4QFY11 EBIT margin (%) Tax rate (%) Source: Company, Maybank-IB 34.6 20.9 4QFY10 163.4 57.0 -0.5 56.6 -10.1 0.0 46.0 4QFY10 34.9 17.9 % YoY 17.8 16.9 n.m. 17.2 37.1 n.m. 13.9 +/- ppt -0.3 3.0 3QFY11 188.1 61.8 0.4 62.2 -13.0 0.0 49.2 3QFY11 32.9 20.9 % QoQ 2.3 7.9 n.m. 6.6 6.6 n.m. 6.5 +/- ppt 1.8 0.0 FY11 734.9 243.7 -0.4 243.3 -53.1 0.0 190.2 FY11 33.2 21.8 Cumulative FY10 571.9 180.0 -2.1 177.9 -34.7 -0.1 142.9 FY10 31.5 19.5 % YoY 28.5 35.3 -81.0 36.7 52.9 -69.6 33.1 +/- ppt 1.7 2.3

INCOME STATEMENT (RM m) FYE Mar Revenue EBITDA Depreciation & Amortisation Operating Profit (EBIT) Interest (Exp)/Inc Associates One-offs Pre-Tax Profit Tax Minority Interest Net Profit Recurring Net Profit Revenue Growth % EBITDA Growth (%) EBIT Growth (%) Net Profit Growth (%) Recurring Net Profit Growth (%) Tax Rate % 2011A 734.9 265.0 (21.3) 243.7 (0.4) 0.0 0.0 243.3 (53.1) (0.0) 190.2 190.2 28.5 32.6 35.3 33.1 33.1 21.8 2012F 874.6 284.7 (28.0) 256.7 0.3 0.0 0.0 257.0 (56.5) 0.0 200.5 200.5 19.0 7.4 5.4 5.4 5.4 22.0 2013F 1,036.2 331.0 (33.3) 297.8 1.5 0.0 0.0 299.3 (65.8) 0.0 233.4 233.4 18.5 16.3 16.0 16.4 16.4 22.0 2014F 1,260.3 397.7 (37.3) 360.4 3.9 0.0 0.0 364.3 (80.2) 0.0 284.2 284.2 21.6 20.1 21.0 21.7 21.7 22.0

BALANCE SHEET (RM m) FYE Mar Fixed Assets Other LT Assets Cash/ST Investments Other Current Assets Total Assets ST Debt Other Current Liabilities LT Debt Other LT Liabilities Minority Interest Shareholders' Equity Total Liabilities-Capital Share Capital (m) Net Debt/(Cash) Working capital 2011A 348.6 0.2 117.0 165.4 631.3 14.5 60.9 24.4 36.8 0.4 494.3 631.3 363.6 Cash 108.3 2012F 420.7 0.2 134.6 192.9 748.5 14.5 67.8 24.4 36.8 0.4 604.6 748.5 363.6 Cash 128.9 2013F 467.4 0.2 172.5 228.5 868.7 14.5 79.6 4.4 36.8 0.4 733.0 868.7 363.6 Cash 152.8 2014F 490.1 0.2 258.0 277.9 1,026.3 14.5 95.9 (10.6) 36.8 0.4 889.3 1,026.3 363.6 Cash 185.8

CASH FLOW (RM m) FYE Mar Profit before taxation Depreciation Net interest receipts/(payments) Working capital change Cash tax paid Others (incl'd exceptional items) Cash flow from operations Capex Disposal/(purchase) Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends (paid) Interest payments Others Cash flow from financing Change in cash Sources: Company, Maybank IB 11 May 2011 Page 2 of 3 2011A 243.3 21.3 0.4 (41.7) (47.8) 7.4 182.9 (81.4) 0.2 0.1 (81.1) (2.2) 1.0 (56.9) (0.4) (1.0) (59.6) 42.3 2012F 257.0 28.0 (0.3) (20.6) (56.5) (0.0) 207.5 (100.0) 0.0 0.0 (100.0) 0.0 2.0 (90.2) 0.3 (2.0) (89.9) 17.6 2013F 299.3 33.3 (1.5) (23.8) (65.8) 0.0 241.4 (80.0) 0.0 0.0 (80.0) (20.0) 3.0 (105.0) 1.5 (3.0) (123.5) 37.8 2014F 364.3 37.3 (3.9) (33.0) (80.2) (0.0) 284.5 (60.0) 0.0 0.0 (60.0) (15.0) 4.0 (127.9) 3.9 (4.0) (138.9) 85.5

RATES & RATIOS FYE Mar EBITDA Margin % Op. Profit Margin % Net Profit Margin % ROE % ROA % Net Margin Ex. El % Dividend Cover (x) Interest Cover (x) Asset Turnover (x) Asset/Debt (x) Debtors Turn (days) Creditors Turn (days) Inventory Turn (days) Net Gearing % Debt/EBITDA (x) Debt/Market Cap (x) 2011A 36.1 33.2 25.9 38.5 30.1 25.9 2.5 77.1 1.2 16.2 48.1 26.7 32.3 Cash 0.1 0.0 2012F 32.5 29.4 22.9 33.2 26.8 22.9 2.2 83.9 1.2 19.2 48.1 26.7 32.3 Cash 0.1 0.0 2013F 31.9 28.7 22.5 31.8 26.9 22.5 2.2 131.4 1.2 45.8 48.1 26.7 32.3 Cash 0.1 0.0 2014F 31.6 28.6 22.5 32.0 27.7 22.5 2.2 403.6 1.2 257.9 48.1 26.7 32.3 Cash 0.0 0.0

Hartalega Holdings

Definition of Ratings

Maybank Investment Bank Research uses the following rating system: BUY HOLD SELL Total return is expected to be above 10% in the next 12 months Total return is expected to be between -5% to 10% in the next 12 months Total return is expected to be below -5% in the next 12 months

Applicability of Ratings

The respective analyst maintains a coverage universe of stocks, the list of which may be adjusted according to needs. Investm ent ratings are only applicable to the stocks which form part of the coverage universe. Reports on companies which are not part of the coverage do not carry investment ratings as we do not actively follow developments in these companies.

Some common terms abbreviated in this report (where they appear):

Adex = Advertising Expenditure BV = Book Value CAGR = Compounded Annual Growth Rate Capex = Capital Expenditure CY = Calendar Year DCF = Discounted Cashflow DPS = Dividend Per Share EBIT = Earnings Before Interest And Tax EBITDA = EBIT, Depreciation And Amortisation EPS = Earnings Per Share EV = Enterprise Value FCF = Free Cashflow FV = Fair Value FY = Financial Year FYE = Financial Year End MoM = Month-On-Month NAV = Net Asset Value NTA = Net Tangible Asset P = Price P.A. = Per Annum PAT = Profit After Tax PBT = Profit Before Tax PE = Price Earnings PEG = PE Ratio To Growth PER = PE Ratio QoQ = Quarter-On-Quarter ROA = Return On Asset ROE = Return On Equity ROSF = Return On Shareholders Funds WACC = Weighted Average Cost Of Capital YoY = Year-On-Year YTD = Year-To-Date

Disclaimer

This report is for information purposes only and under no circumstances is it to be considered or intended as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that income from such securities, if any, may fluctuate and that each securitys price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from Bursa Malaysia Securities Berhad in the equity analysis. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. The information contained herein has been obtained from sources believed to be reliable but such sources have not been independently verified by Maybank Investment Bank Bhd and consequently no representation is made as to the accuracy or completeness of this report by Maybank Investment Bank Bhd and it should not be relied upon as such. Accordingly, no liability can be accepted for any direct, indirect or consequential losses or damages that may arise from the use or reliance of this report. Maybank Investment Bank Bhd, its affiliates and related companies and their officers, directors, associates, connected parties and/or employees may from time to time have positions or be materially interested in the securities referred to herein and may further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform investment banking services, advisory and oth er services for or relating to those companies. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice. This report may contain forward looking statements which are often but not always identified by the use of words such as anticipate, believe, estimate, intend, plan, expect, forecast, predict and project and statements that an event or result may, will, can, should, could or might occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on thes e forwardlooking statements. Maybank Investment Bank Bhd expressly disclaims any obligation to update or revise any such forward looki ng statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrenc e of unanticipated events. This report is prepared for the use of Maybank Investment Bank Bhd's clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other party in whole or in part in any form or manner without the prior express written consent of Maybank Investment Bank Bhd and Maybank Investment Bank Bhd accepts no liability whatsoever for the actions of third parties in this respect. This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Published / Printed by

Maybank Investment Bank Berhad (15938-H) (A Participating Organisation of Bursa Malaysia Securities Berhad) 33rd Floor, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur Tel: (603) 2059 1888; Fax: (603) 2078 4194 Stockbroking Business: Level 8, MaybanLife Tower, Dataran Maybank, No.1, Jalan Maarof 59000 Kuala Lumpur Tel: (603) 2297 8888; Fax: (603) 2282 5136 http://www.maybank-ib.com

11 May 2011 Page 3 of 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Top Glove - 1QFY18 ResultsDocument4 pagesTop Glove - 1QFY18 ResultsTanaka OzumiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- KLRB 3qfy18 ResultsDocument7 pagesKLRB 3qfy18 ResultsTanaka OzumiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Kia Motors PDFDocument10 pagesKia Motors PDFTanaka OzumiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Annual Report 2007Document116 pagesAnnual Report 2007Tanaka OzumiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Hartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyDocument3 pagesHartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyTanaka OzumiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyDocument3 pagesHartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyTanaka OzumiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hartalega 101110 MaybankDocument3 pagesHartalega 101110 MaybankTanaka OzumiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hartalega - 110909-RHBIB-Expansion Plans Key To Capture Europe MarketDocument4 pagesHartalega - 110909-RHBIB-Expansion Plans Key To Capture Europe MarketTanaka OzumiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyDocument3 pagesHartalega-110208-RHB-Demand For Nitrile Gloves Still HealthyTanaka OzumiNo ratings yet

- Hartalega - 110909-RHBIB-Expansion Plans Key To Capture Europe MarketDocument4 pagesHartalega - 110909-RHBIB-Expansion Plans Key To Capture Europe MarketTanaka OzumiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hartalega-1110810-Maybank - Recession Play, With Capital UpsideDocument3 pagesHartalega-1110810-Maybank - Recession Play, With Capital UpsideTanaka OzumiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Information Sharing in Supply Chains: A Literature Review and Research AgendaDocument13 pagesInformation Sharing in Supply Chains: A Literature Review and Research Agenda.......No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di MalaysiaDocument16 pagesHubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di Malaysiashaan7821No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Creating Competitive Advantage Through The Supply Chain - Insights On IndiaDocument23 pagesCreating Competitive Advantage Through The Supply Chain - Insights On IndiaRohitGuptaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Porters 5 Forces For BATBDocument4 pagesPorters 5 Forces For BATBRafid RahmanNo ratings yet

- Chapter 15 - Direct Marketing and Other MediaDocument16 pagesChapter 15 - Direct Marketing and Other MediaStatistics ABMNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Nuvama Initiating Coverage On United Breweries With 22% UPSIDE ADocument53 pagesNuvama Initiating Coverage On United Breweries With 22% UPSIDE Atakemederato1No ratings yet

- SM Ass IIDocument16 pagesSM Ass IIAfsheen Danish NaqviNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- MGT540 Issa Mohamed MBA Marketing ManagmentDocument17 pagesMGT540 Issa Mohamed MBA Marketing Managmentderarajarso860No ratings yet

- HOBA Problem SetDocument3 pagesHOBA Problem SetFayehAmantilloBingcangNo ratings yet

- Enm301 - Unit 1Document16 pagesEnm301 - Unit 1Lâm Tuyết NhiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Depreciation 2Document8 pagesDepreciation 2Gredanu LambaoNo ratings yet

- Chapter 6-Cost Concepts and Measurement: Multiple ChoiceDocument29 pagesChapter 6-Cost Concepts and Measurement: Multiple Choiceakash deepNo ratings yet

- Asset Accounting - Retirements & TransfersDocument12 pagesAsset Accounting - Retirements & TransfersVihaan BorbachhiNo ratings yet

- Perfect CompetitionDocument24 pagesPerfect Competitionzishanmallick0% (1)

- Forecasting Revenues and Cost To Be IncurredDocument7 pagesForecasting Revenues and Cost To Be IncurredCharley Vill Credo100% (1)

- ACCG 2000 Week 9 Homework QuestionsDocument1 pageACCG 2000 Week 9 Homework QuestionsAlexander TrovatoNo ratings yet

- F8-06 DocumentationDocument20 pagesF8-06 DocumentationReever RiverNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Class 11 Accountancy Chapter-2 Revision NotesDocument5 pagesClass 11 Accountancy Chapter-2 Revision NotesSneha BhartiNo ratings yet

- Cost of Goods Sold: Correct!Document11 pagesCost of Goods Sold: Correct!Academic StuffNo ratings yet

- TRSB Case StudyDocument9 pagesTRSB Case StudySharath NarrainNo ratings yet

- Pepsi CoDocument12 pagesPepsi CoIbrahim MızrakNo ratings yet

- Level of Application and Effectiveness of General TheoriesDocument32 pagesLevel of Application and Effectiveness of General TheoriesNormi Anne TuazonNo ratings yet

- Amana Honey Processing Biz PlanDocument35 pagesAmana Honey Processing Biz PlanAbiodun AliNo ratings yet

- Accounting For CorporationDocument3 pagesAccounting For CorporationClaire travisNo ratings yet

- Securities Lending VanguardDocument8 pagesSecurities Lending Vanguardashawel11No ratings yet

- BSM ProjectDocument39 pagesBSM ProjectSandhya ThapaNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Accounting For MerchandisingDocument14 pagesAccounting For MerchandisingBekanaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business PlanDocument7 pagesBusiness PlanKayla Dela Torre55% (11)

- Cost Acc. & Control QuizzesDocument18 pagesCost Acc. & Control Quizzesjessamae gundanNo ratings yet