Professional Documents

Culture Documents

Dividend

Uploaded by

princerattanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend

Uploaded by

princerattanCopyright:

Available Formats

Dividend policy is concerned with taking a decision regarding paying cash dividend in the present or paying an increased dividend

at a later stage. The firm could also pay in the form of stock dividends which unlike cash dividends do not provide liquidity to the investors, however, it ensures capital gains to the stockholders. The expectations of dividends by shareholders helps them determine the share value, therefore, dividend policy is a significant decision taken by the financial managers of any company.

Concept

Coming up with a dividend policy is challenging for the directors and financial manager a company, because different investors have different views on present cash dividends and future capital gains. Another confusion that pops up is regarding the extent of effect of dividends on the share price. Due to this controversial nature of a dividend policy it is often called the dividend puzzle. Various models have been developed to help firms analyse and evaluate the perfect dividend policy. There is no agreement between these schools of thought over the relationship between dividends and the value of the share or the wealth of the shareholders in other words. One school consists of people like James E. Walter and Myron J. Gordon (see Gordon model), who believe that current cash dividends are less risky than future capital gains. Thus, they say that investors prefer those firms which pay regular dividends and such dividends affect the market price of the share. Another school linked to Modigliani and Miller holds that investors don't really choose between future gains and cash dividends. [1]

[edit]Relevance of dividend policy

dividends paid by the firms are viewed positively both by the investors and the firms. The firms which do not pay dividends are rated in oppositely by investors thus affecting the share price. The people who support relevance of dividends clearly state that regular dividends reduce uncertainty of the shareholders i.e. the earnings of the firm is discounted at a lower rate, ke thereby increasing the market value. However, its exactly opposite in the case of increased uncertainty due to non-payment of dividends. Two important models supporting dividend relevance are given by Walter and Gordon.

[edit]Goutham's model

Goutham Manimaran's model shows the relevance of dividend policy and its bearing on the value of the share.[2]

[edit]Assumptions of the Walter model

1.Retained earnings are the only source of financing investments in the firm, there is no external finance involved. 2.The cost of capital, k e and the rate of return on investment, r are constant i.e. even if new investments decisions are taken, the risks of the business remains same. 3.The firm's life is endless i.e. there is no closing down. Basically, the firm's decision to give or not give out dividends depends on whether it has enough opportunities to invest the retain earnings i.e. a strong relationship between investment and dividend decisions is considered.

[edit]Model description

Dividends paid to the shareholders are re-invested by the shareholder further, to get higher returns. This is referred to as the opportunity cost of the firm or the cost of capital, ke for the firm. Another situation where the firms do not pay out dividends, is when they invest the profits or retained earnings in profitable opportunities to earn returns on such investments. This rate of return r, for the firm must at least be equal to ke. If this happens then the returns of the firm is equal to the earnings of the shareholders if the dividends were paid. Thus, its clear that if r, is more than the cost of capital ke, then the returns from investments is more than returns shareholders receive from further

investments. Walter's model says that if r<ke then the firm should distribute the profits in the form of dividends to give the shareholders higher returns. However, if r>ke then the investment opportunities reap better returns for the firm and thus, the firm should invest the retained earnings. The relationship between r and k are extremely important to determine the dividend policy. It decides whether the firm should have zero payout or 100% payout. In a nutshell : If r>ke, the firm should have zero payout and make investments. If r<ke, the firm should have 100% payouts and no investment of retained earnings. If r=ke, the firm is indifferent between dividends and investments.

[edit]Mathematical representation

Goutham has given a mathematical model for the above made statements :

where, P = Market price of the share D = Dividend per share r = Rate of return on the firm's investments ke = Cost of equity E = Earnings per share' The market price of the share consists of the sum total of: the present value if an infinite stream of dividends the present value of an infinite stream of returns on investments made from retained earnings. Therefore, the market value of a share is the result of expected dividends and capital gains according to Walter.

[edit]Criticism

Although the model provides a simple framework to explain the relationship between the market value of the share and the dividend policy, it has some unrealistic assumptions. 1.The assumption of no external financing apart from retained earnings, for the firm make further investments is not really followed in the real world. 2.The constant r and ke are seldom found in real life, because as and when a firm invests more the business risks change.

[edit]Gordon's Model

Main article: Gordon model

Myron J. Gordon

Myron J. Gordon has also supported dividend relevance and believes in regular dividends affecting the share price of the firm.[2]

[edit]The Assumptions of the Gordon model

Gordon's assumptions are similar to the ones given by Walter. However, there are two additional assumptions proposed by him : 1.The product of retention ratio b and the rate of return r gives us the growth rate of the firm g. 2.The cost of capital ke, is not only constant but greater than the growth rate i.e. ke>g.

[edit]Model description

Investor's are risk averse and believe that incomes from dividends are certain rather than incomes from future capital gains, therefore they predict future capital gains to be risky propositions. They discount the future capital gains at a higher rate than the firm's earnings thereby, evaluating a higher value of the share. In short, when retention rate increases, they require a higher discounting rate. Gordon has given a model similar to Walter's where he has given a mathematical formula to determine price of the share.

[edit]Mathematical representation

The market price of the share is calculated as follows:

where, P = Market price of the share E = Earnings per share b = Retention ratio (1 - payout ratio) r = Rate of return on the firm's investments ke = Cost of equity br = Growth rate of the firm (g) Therefore the model shows a relationship between the payout ratio, rate of return, cost of capital and the market price of the share.

[edit]Conclusions on the Walter and Gordon Model

Gordon's ideas were similar to Walter's and therefore, the criticisms are also similar. Both of them clearly state the relationship between dividend policies and market value of the firm.

[edit]Capital structure substitution theory & dividends

The capital structure substitution theory (CSS)[3] describes the relationship between earnings, stock price and capital structure of public companies. The theory is based on one simple hypothesis: company managements manipulate capital structure such that earnings-per-share (EPS) are maximized. The resulting dynamic debt-equity target explains why some companies use dividends and others do not. When redistributing cash to shareholders, company managements can typically choose between dividends and share repurchases. But as dividends are in most cases taxed higher than capital gains, investors are expected to prefer capital gains. However, the CSS theory shows that for some companies share repurchases lead to a reduction in EPS. These companies typically prefer dividends over share repurchases.

[edit]Mathematical representation

From the CSS theory it can be derived that debt-free companies should prefer repurchases whereas companies with a debt-equity ratio larger than

should prefer dividends as a means to distribute cash to shareholders, where

D is the companys total long term debt

is the companys total equity is the tax rate on capital gains

is the tax rate on dividends Low valued, high leverage companies with limited investment opportunities and a high profitability use dividends as the preferred means to distribute cash to shareholders, as is documented by empirical research.[4]

[edit]Conclusion

The CSS theory provides more guidance on dividend policy to company managements than the Walter model and the Gordon model. It also reverses the traditional order of cause and effect by implying that company valuation ratios drive dividend policy, and not vice-versa. The CSS theory does not have 'invisible' or 'hidden' parameters such as the equity risk premium, the discount rate, the expected growth rate or expected inflation. As a consequence the theory can be tested in an unambiguous way.

[edit]Irrelevance of dividend policy

Franco Modigliani

Merton Miller

The Modigliani and Miller school of thought believes that investors do not state any preference between current dividends and capital gains. They say that dividend policy is irrelevant and is not deterministic of the market value. Therefore, the shareholders are indifferent between the two types of dividends. All they want are high returns either in the form of dividends or in the form of reinvestment of retained earnings by the firm. There are two conditions discussed in relation to this approach : decisions regarding financing and investments are made and do not change with respect to the amounts of dividends received.

when an investor buys and sells shares without facing any transaction costs and firms issue shares

without facing any floatation cost, it is termed as a perfect capital market.[5] Two important theories discussed relating to the irrelevance approach, the residuals theory and the Modigliani and Miller approach.

[edit]Residuals theory of dividends

One of the assumptions of this theory is that external financing to re-invest is either not available, or that it is too costly to invest in any profitable opportunity. If the firm has good investment opportunity available then, they'll invest the retained earnings and reduce the dividends or give no dividends at all. If no such opportunity exists, the firm will pay out dividends. If a firm has to issue securities to finance an investment, the existence of floatation costs needs a larger amount of securities to be issued. Therefore, the pay out of dividends depend on whether any profits are left after the financing of proposed investments as floatation costs increases the amount of profits used. Deciding how much dividends to be paid is not the concern here, in fact the firm has to decide how much profits to be retained and the rest can then be distributed as dividends. This is the theory of Residuals, where dividends are residuals from the profits after serving proposed investments. [6] This residual decision is distributed in three steps: evaluating the available investment opportunities to determine capital expenditures. evaluating the amount of equity finance that would be needed for the investment, basically having an optimum finance mix. cost of retained earnings<cost of new equity capital, thus the retained profits are used to finance investments. If there is a surplus after the financing then there is distribution of dividends.

[edit]Extension of the theory

The dividend policy strongly depends on two things: investment opportunities available to the company amount of internally retained and generated funds which lead to dividend distribution if all possible investments have been financed. The dividend policy of such a kind is a passive one, and doesn't influence market price. the dividends also fluctuate every year because of different investment opportunities every year. However, it doesn't really affect the shareholders as they get compensated in the form of future capital gains.

[edit]Conclusion

The firm paying out dividends is obviously generating incomes for an investor, however even if the firm takes some investment opportunity then the incomes of the investors rise at a later stage due to this profitable investment.

[edit]Modigliani-Miller theorem

Main article: ModiglianiMiller theorem The ModiglianiMiller theorem states that the division of retained earnings between new investment and dividends do not influence the value of the firm. It is the investment pattern and consequently the earnings of the firm which affect the share price or the value of the firm.[7]

[edit]Assumptions of the MM theorem

The MM approach has taken into consideration the following assumptions: 1.There is a rational behavior by the investors and there exists perfect capital markets. 2.Investors have free information available for them. 3.No time lag and transaction costs exist. 4.Securities can be split into any parts i.e. they are divisible 5.No taxes and floatation costs. 6.The investment decisions are taken firmly and the profits are therefore known with certainty. The dividend policy does not affect these decisions.

[edit]Model description

The dividend irrelevancy in this model exists because shareholders are indifferent between paying out dividends and investing retained earnings in new opportunities. The firm finances opportunities either through retained earnings or by issuing new shares to raise capital. The amount used up in paying out dividends is replaced by the new capital raised through issuing shares. This will affect the value of the firm in an opposite ways. The increase in the value because of the dividends will be offset by the decrease in the value for new capital raising.

Definition of 'Dividend Policy'

The policy a company uses to decide how much it will pay out to shareholders in dividends.

Investopedia explains 'Dividend Policy'

Lots of research and economic logic suggests that dividend policy is irrelevant (in theory).

Dividend Policy

Once a company makes a profit, management must decide on what to do with those profits. They could continue to retain the profits within the company, or they could pay out the profits to the owners of the firm in the form of dividends.

Once the company decides on whether to pay dividends they may establish a somewhat permanent dividend policy, which may in turn impact on investors and perceptions of the company in the financial markets. What they decide depends on the situation of the company now and in the future. It also depends on the preferences of investors and potential investors.

DIVIDEND POLICY QUESTIONS THIS LECTURE EXAMINES: 1. Types and mechanics of dividends. 2. Mechanics of a dividend payment. 3. What is the Impact and Relevance of Dividends? 3.1 When are dividends irrelevant? 3.2 Homemade Leverage and Arbitrage 3.3 Whats the affect of taxes on dividends? Personal taxes Corporate taxes 4. What is the relationship between dividends and signaling value? 5. Conclusions on dividend policy: investments and taxesDividend Policy - 2 1. The Different Types of Dividends Dividend refers to cash distributions of earnings 1. Cash dividends These are the most common and are usually paid four times a year. 2. Stock dividends Stock dividends are not true dividends in that a distribution of stock does not affect the value of the firm or the wealth of the shareholder. These dividends are paid out of Treasury stock. 3. Stock split Similar to a stock dividend. The NYSE requires share distributions of less than 25% to be treated as stock dividends. 4. Share repurchases The company repurchases the stock. Shareholders pay tax only on the capital gains portion. Same effect as a regular dividend as cash LEAVES the corporation. Dividend Policy - 3 2. Method of Dividend Payments A dividend is distributed to shareholders of record on a specific date. When a dividend has been declared, it becomes a debt of the firm and cannot be rescinded. Thurs Mon Fri Mon 1/15 1/26 1/30 2/16 Declaration Ex-dividend Record Payment date date date date 1. Declaration date: The board of directors declares a payment of dividends. 2. Ex-dividend date: A share of stock goes ex-dividend on the date the

seller is entitled to keep the dividend; under NYSE rules, shares are traded ex-dividend on and after the fourth business day before the record date. (Buy before this date if you want the dividend). 3. Payment date: The dividend checks are mailed to shareholders of record.Dividend Policy - 4 It is important to isolate who receives the dividend due to the stock price reaction following the payment. The stock should fall by the amount of the dividend with no taxes. Before ex date: Dividend = 0 Price = P + D After ex date: Dividend = D Price = P TAX EFFECTS: Consider a marginal investor in the 25% tax bracket. How much will this investor pay for the stock (and subsequently how much will the price fall) if I sell the stock to this investor and she gets the dividend and has to pay the tax on the dividend? Dividend Policy - 5 3. Are Dividends Irrelevant? 3.1 An Illustration That Dividend Policy is Irrelevant Suppose we have an all equity firm. The current financial manager knows at the present date (t=0) that the firm will dissolve in 2 years (t=2). At t=0 the manager is able to forecast cash flows with perfect certainty so she knows that each year will generate $10,000. The risk of the firm is such that the return on equity is 10% and there are currently 100 shares outstanding. The firm currently has no positive NPV projects available. How much can we pay in dividends???Dividend Policy - 6 Alternative 1: Set dividends equal to current cash flow In this case, the aggregate dividend is $10,000 per period, (per share = $100), so the value of the firm is: And the value per share is: V0 10000 1+r 10000 (1 + r) $17,355.37 for r = .1 =+2 = Ps 100 1+r 100 (1 + r) $173.55 for r = .1

=+2 = Dividend Policy - 7 Alternative 2: Set initial dividend greater than cash flow If the firm decides to issue a $110 per share dividend then the total amount of cash need is $11,000. Since this exceeds the cash on hand for the year, the funds must be raised by selling stocks or bonds. Suppose the firm issues $1000 of stock to finance the dividend. The new stockholder require a 10% rate of return such that there payoff at t=2 will be $1,100. Date 1 Date 2 Aggregate dividends to old SH $11000 $ 8900 Dividends per share 110 89 How many shares did the new investors get for their $1,000? ($1,100/$89)Dividend Policy - 8 Implications of this example: The time patterns of dividends should not matter as long as the investor is fairly compensated through the return on equity. The assumptions required for the results to hold include: 1. Markets are perfect and frictionless. 2. Future investments and cash flows are known with perfect certainty. 3. The investment policy is fixed and is not affected by changes in dividend policy. 4. No Taxes Dividend Policy - 9 3.2 Homemade Dividends and Arbitrage The argument is that shareholders will not pay more for a firm if the shareholder can either replicate or undo the dividend decision. For example, assume that the firm will pay $110 at t=1 and $89 at t=2. If Investor A wants $100 in both t=1 and t=2, Can she undo the firm's decision to achieve her desired consumption? ==> She can simply reinvest the extra $10 in the company's stock and receive $89 plus $11 at the end of t=2. Alternatively, if the firm decides to pay $100 in both t=1 and t=2 and Investor B desires consumption of $110 in t=1 and $89 in t=2, ==> She can simply sell $10 worth of shares at t=1 and therefore, be out $11 worth of dividends at t=2.Dividend Policy - 10 3.2 Effect of Taxes Do TAXES matter for dividends? Our previous examples showed that dividends do not matter.

Although individual taxes on capital gains and ordinary income are equal, effectively, capital gains are taxed at a lower rate since they are deferrable. In this section, we will ignore corporate taxes. If taxes matter, then it may be that firms which pay dividends will have a lower value to shareholders than firms which retain them for investment. Dividend Policy - 11 Example: Suppose all shareholders are in the 28% tax bracket and have a choice between investing in Firm G which pays no dividend or Firm D that does pay a dividend. Firm G's stock is currently $100 and has a 20% return on equity. Assume that the investor does not sell the shares - and the capital gain is untaxed. Therefore, the value of the share one year from now should be $120. On the other hand, Firm D pays a $20 dividend. Whats the Value of Each of These Shares?Dividend Policy - 12 SOLUTION If markets are efficient, then firms that are equally risky must have the same after-tax value. Let re = required return on equity. Tg = capital gain tax rate = 0% Td= Tax rate on dividend income = 28% (Tc= Corporate tax rate = 0%, not used in this ex.) Assume that firm Ds stock will be $100 next year after the $20 dividend is paid. 100 + 20 (1-. 28) P0 = ______________________ 1.20 = $95.33 The difference between the price of Firm D's stock and Firm G's stock is simply the present value of the taxes that must be paid by the investor. Dividend Policy - 13 Corporate Taxes Previously, we ignored the effect of corporate taxation on dividend policy. For illustrative purposes, suppose a firm has come extra cash after all positive NPV projects have been undertaken. EXAMPLE: The Regional Electric Company has $1000 of extra cash (after tax). It can retain the cash and invest it in T-bills yielding 10% or it can pay the cash to shareholders as a dividend. Shareholders can also put the money in T-bills with the same

yield. The corporate tax rate is 34% and the individual rate is 28%. What is the amount of cash that investors will have after 5 years under each of the following scenarios: Options: a. Pay dividends b. Retain the cash for investment in the firmDividend Policy - 14 Solution: a. Pay dividends Shareholders receive in 5 years: $1000 (1 - .28) (1 + .072)5 = $1019.30 (.072 is individuals after tax return) b. Retain the cash for investment in the firm The company retains the cash and invests in T-bills and pays out the proceeds 5 years from now. (Individuals pay the taxes at the end) Shareholders receive in 5 years: $1000 (1 + .066)5 (1 - .28) = $991.188 (.066 is corporations after tax return) Dividend Policy - 15 3.4 Conclusions on Taxes: Pay low (no) dividends if corporate rate is less than the individual rate. Pay high dividends (higher tax benefit) when the individual rate is less than the corporate rate. In addition, corporations (as holders of stock) are able to exclude 80% of the dividend income they receive from holding stock. (In this case the holder and payee are both corporations. Treat the holder like an individual)Dividend Policy - 16 3.4.2 Differential Investment return? Let ri = (risk adjusted) return investors can earn with dividend. r c = (risk adjusted) return corporations can earn with dividend. Ti = individuals tax rate Tc = Corporations tax rate General Rule for Dividend Payment: > pay dividends (1 - Ti )(ri ) = (1 - Tc

)(rc ) < retain earnings Holding the return on assets constant, a firm that has a higher tax rate than the individual will be better off paying out dividends rather than retaining them. Similarly, if the tax rates are equivalent and the firm has a higher rate of return on investment, the value of the dividend will increase if the firm retains all extra cash. Dividend Policy - 17 Share Repurchases Method of paying out earnings that is tax-advantaged. However IRS may become interested if it appears repurchases are to avoid taxes on cash dividends. Investor only pays capital gains tax on shares IF sold back to firm. Share Repurchases & Signaling The prevalence of dividends may be explained by their ability to convey managerial information to the market. Therefore, signaling by managers can be accomplished either through dividends or share repurchases. Dividends signal that the firm is profitable and can maintain the level of dividends. Share repurchases can signal that insiders believe firm is undervalued. (However, investors may believe firm has no great projects.) What about false signaling? Dividend Policy - 18 Summary of dividend payout 1. There may be investors, such as retired individuals, who prefer current income to growth in stock value. However, this should not matter since investors could sell a portion of the low dividend paying stocks to supplement cash flow. In the real world, however, the sale of securities involves transactions costs that may outweigh the differential in payout. Therefore, some individuals are better off holding high dividend paying securities. 2. After accepting all positive NPV projects, firms should payout dividends out of extra cash if the corporate tax rate > the individual tax rate. DEBATE: Therefore, the debate on which dividend policy increases the value of the firm is still unresolved from a tax viewpoint. Only if there exists an unsatisfied tax clientele may the firm increase its value in the short run Dividend Policy Vinod Kothari Corporations earn profits they do not distribute all of it. Part of profit is ploughed back or held back as retained earnings. Part of the profit gets distributed to the shareholders. The part that is distributed is the dividend. The ratio of the actual distribution or dividend, and the total distributable profits, is called dividend payout ratio.

How much of its profits should a corporation distribute? There are several considerations that apply in answering this question. Hence, companies have to frame and work on a definitive policy of dividend payout ratio. Of course, no corporate management can afford to stick to a fixed dividend payout ratio year after year neither is such fixity of dividend payout ratio required or expected. However, management has to broadly decide its policy on its broad attitude towards distribution liberal dividend payout ratio, or conservative dividend payout ratio, etc. If one were to ask this question in context of debt sources of capital for example, how much interest should a corporation pay to its bankers, the answer is straight forward. As interest paid is the cost of the borrowing, the lesser the interest a corporation pays, the better it is. Besides, companies do not have choice on paying of interest to lenders as the rate of interest is contractually fixed. Rate of dividends may be fixed in case of preference shares too. However, in case of equity shares, there is no fixed rate of dividends. It cannot be said that the dividend paid is the cost of equity capital if that was the case, corporations may try to minimize the dividend distribution. Hence, the following points emerge as regards the dividend distribution policy: The cost of equity is defined as the rate at which the corporation must earn on its equity to keep the market price of the equity shares constant. Let us further suppose that the market price of the shares is obtained by capitalizing the earnings of the corporation at a certain capitalization rate the capitalization rate itself depending on the riskiness or beta of the industry. Suppose the corporation does not earn any profit. Shareholders were expecting a certain rate of return on their shareholding hence, share prices will fall at the expected return on equity. On the other hand, if just the expected rate of return is earned by the corporation, the price of equity shares remains constant if the earnings are entirely distributed, and exactly grows by the expected rate of return if the earnings are entirely retained. The above discussion leads to the conclusion that the cost of equity is not the dividends but the return on equity hence, a corporation cannot work on the objective of minimizing dividends. Equity shareholders are the owners of the corporation hence, retained earnings ultimately belong to the shareholders. Supposing a company earns return on equity of 10%, and retains the whole of it, the retained earnings increase the net asset value (NAV) of the equity shares exactly at the rate of 10%. Assuming there are no other factors affecting the equity price of the company, the market price of the shares should exactly go up by 10% commensurate with the increase in the NAV of the shares. That is to say, shareholders gain by way of appreciation in market price to the extent of 10%. On the other hand, if the company distributes the entire earnings, shareholders earn a cash return of 10%, and there is no impact on the NAV of the shares, hence, the same should remain unchanged. Therefore, in both the cases, the shareholders earned a return of 10% - in the first case, by way of growth or capital appreciation, and in the second case, by way of income. In other words, merely because the corporation is not distributing profits does not mean it is depriving shareholders of the rate of return on equity. The above two points reflect the indifference, sometimes referred to as irrelevance of dividend policy (see Modigliani and Miller approach later in this Chapter) from the viewpoint of either the company or its shareholders. Supposing the corporation decides to retain the entire earning. Obviously, the

corporation would earn on this retained profit at the applicable return on equity. Note that the return on equity is relevant, as retained earnings would be leveraged and would, therefore, benefit from the impact of leverage too. On the other hand, if the corporation were to distribute the entire profits, shareholders reinvest/consume the income so distributed at their own rate of return. Hence, it may be contended that whether the company retains or distributes the earnings depends on whose reinvestment rate is higher that of the company or that of the shareholders? Quite clearly, the rate of reinvestment in the hands of the corporation is higher than that in the hands of the shareholders, (a) because of leverage which shareholders may not be able to garner; and (b) intuitively, that is the very reason for the shareholders to invest in the company in the first place. This argument generally favors retention of profits by the company rather than distribution. [As we discuss later, this argument is the basis of the Walter formula] As a counter argument to this, it is contended that shareholders do not need growth only they need current income too. Many investors may sustain their livelihood on dividend earnings. Of what avail is the increase in market value of shares, if I need cash to spend for my expenses? However, in the age of demat securities and liquid stock markets, growth and income are almost equivalent. For example, if I am holding equity shares worth $ 100, which appreciate in value to $ 110 due to retention, I can dispose off 10/110% of my shareholding, earn cash equal to $ 10, and still be left with stock worth $ 100, which is exactly the same as earning cash dividend of $ 10 with no retention at all. While the above argument may point to indifference between growth and income, the reality of the marketplace is that investors do have varying preferences for growth and income. There are investors who are growth-inclined, and there are those who are income-inclined. Majority of retail investors insist on balance between growth and income, as they do not see an exact equivalence between appreciation in market value and current cashflows. Hence, the conclusion that emerges is that companies do have to strike a balance between shareholders need for current income, and growth opportunities by retained earnings. Hence, dividend policy still remains an important consideration. While making the above points, there are certain special points that affect particular situation that need to be borne in mind: Companys reinvestment rate lower than that of shareholders: Sometimes, there are companies that do not have significant reinvestment opportunities. More precisely, we say the reinvestment rate of the company is lesser than the reinvestment rate of shareholders. In such cases, obviously, it is better to pay earnings out than to retain them. As the classic theories of impact of dividends on market value of a share (see Walters formula below) suggest, or what is anyway intuitively understandable, retention of earnings makes sense only where the reinvestment rate of the company is higher than that of shareholders. Tax disparities between current dividends and growth: In our discussion on indifference between current dividends and share price appreciation, we have assumed that taxes do not play a spoilsport. In fact, quite often, they do. For example, if a company distributes dividends, the same may be taxed (either as income in the hands of shareholders, or by way of tax on distribution like

dividend distribution tax in India). Alternatively, if the shareholders have a capital appreciation, which they encash by partial liquidation of holdings, shareholders have a capital gain. Taxability of a capital gain may not be the same as that of dividends. Hence, taxes may differentiate between current dividends and share price appreciation. Shares with fixed returns: Needless to say, there is no relevance of dividend policy where dividends are payable as per terms of issue for example, in case of preference shares. Entities requiring minimum distribution: There might also be situations where entities are required to do a minimum distribution under regulations. For example, in case of real estate investment trusts, a certain minimum distribution is required to attain tax transparent status. There might be other regulations or regulatory motivations for companies to distribute their profits. These regulations may impact our discussion on relevance of dividend policy on price of equity shares. Unlisted companies: Finally, one must also note that discussion above on the parity between distributed earnings and retained earnings the latter leading to market price appreciation will have relevance only in case of listed firms. Technically speaking, in case of unlisted firms too, retained earnings belong to the shareholders, as shareholders after all are the owners of the residual wealth of the company. However, that residual ownership may be a myth as companies do not distribute assets except in event of winding, and winding up is a rarity. The discussion in this chapter on dividend policy, as far is relates to market price of equity shares, is keeping in mind listed firms. In case of unlisted firms, classical models such as Walters model or Gordon Growth model discussed below may hold relevance than market price-based models. From dividends to market value of equity: Dividend capitalisation approach: If, for a second, we were to ignore the stock market capitalisation of a company, what is the market value of an equity share? Say, we take the case of an unlisted company. We know from our discussion on present values that the value of any asset is the value of its cashflows. What is the cashflow a shareholder gets from his equity? As long as the company is not wound up, and the shareholder does not sell the stock, the only cashflow of the shareholder is the dividends he gets. It is easy to understand that if we are not envisaging either a sale of the shares or a liquidation of the company, then the stream of dividends may be assumed to continue in perpetuity. Hence, VE = i=1 (1+ ) i E i K D (1) Where

VE : Value of equity KE : Cost of equity Di : dividends in paid in year i Equation (1) is easy to understand. Shareholders continue to receive dividends year after year, and these dividends are discounted by the shareholders at the cost of equity, that is, the required return of the shareholders. If the stream of dividends is constant, then Equation (1) is actually a geometric progression. We can manipulate Equation (1) either to compute the price of equity, if the constant stream of dividends is known, or to compute the cost of equity, if the dividend rate and market price of the shares is known. Applying the geographical progression formula for adding up perpetual progressions, assuming constant dividends equal to D, Equation (1) above becomes: VE = ) 1 1 (1 (1 ) KE KE D + + = KE D (2) Example: Supposing a company the nominal value equity were $ 100, and the dividends at the rate of 10 % were $ 10, if the cost of equity is 8%, then the market price of the shares will given by 10/8%, or $ 125. Incorporating growth in dividends: In our over-simplified example above, we have taken dividends to be constant. It would be unusual to expect that dividends will be constant, particularly where the company is not distributing all its earnings. That is to say, with the retained earnings, the company has increasing profits in successive years, and therefore, it continues to distribute more. If dividends grow at a certain compounded rate, say g, then, Equation (2) above becomes: VE = ) 1 1 (1 (1 ) (1 ) E KE g K Dg

+ + + + = Kg Dg E (1+ ) (3) Note that we have assumed here that even the first dividend will have grown at g rate, that is, the historical dividend has been D, but we are expecting the current years dividend to have increased at the constant rate. If we assume the current years dividend will not show the growth, and the growth will come from the forthcoming year, then we can remove (1+g) in the numerator above. The formula as it stands is also referred as Gordons dividend growth formula, discussed below. Example: Supposing a company the nominal value equity were $ 100, and the dividends at the rate of 10 % were historically $10. Going forward, we expect that the dividends will continue to grow at a rate of 5% per annum. If the cost of equity is 8%, what is the market value? We put the numbers in the formula and get a value of $350. Note that we can also test the valuation above on Excel. If we take sufficient number of dividends, say, 1000, successively growing at the rate of 5%, and we discount the entire stream at 8%, we will get the same value. Example: Supposing a company the nominal value equity were $ 100, and the dividends at the rate of 10 % were historically $10. Going forward, we expect that the dividends will continue to grow at a rate of 12% per annum. If the cost of equity is 8%, what is the market value? This is a case where the growth in dividends is higher than the discounting rate. The growth in dividends is a multiplier; the discounting rate is a divisor. If the multiplier is higher than the divisor, then the present value of each successive dividend will be higher than the previous one, and hence a perpetual series will have infinite value. There is yet another notable point the growth rate g above may be also be visualised as the appreciation in the market value of the share. That is, shareholders are rewarded in form of current earnings as well as growth in the value of their investment. Dividend-based equity models: Walter Approach: The Walter formula belongs to James E Walter, and is based on a simple argument that where the reinvestment rate, that is, rate of return that the company may earn on retained earnings, is higher than cost of equity (which, as we have discussed before, the expected returns of the shareholders, or rate of return of the shareholders), then, it would be in the interest of the firm to retain the earnings. If the companys reinvestment rate on retained earnings is the less than shareholders rate of return, the company should not retain earnings. If the two rates are the same, then the company should be indifferent between retaining and distributing. The Walter formula is based on a simple analysis that the market value of equity is the capitalisation of the current earnings and growth in price (g in our formula in equation 3 above). Hence, the basis of Walter formula is: VE = KE

D+g (4) Here, the growth factor occurs because the rate of return on retention done by the company is higher than the cost of equity. That is to say, the company continues to earn at r rate of return on the retained earnings, and this is what causes growth g. Hence, g= r (E-D)/ KE (5) Inserting equations (5) into (4), we have VE = E E E K K K D r (E-D)/ + (6) Where r = rate of return on retained earnings of the company E = earnings rate D = dividend rate Example: Supposing a company the nominal value equity is $ 100, and the dividends at the rate of 10 % are $10. Supposing the company earns at the rate of 12% , what is the market value of equity if the the cost of equity is 8%? The market value of the share comes to $ 162.50. This is explainable easily. As the company is earning $12, and distributing $10, it retains $ 2 every year, on which it earns at 12%. The capitalised value of 0.24 at 8% will be the expected growth. Therefore, the sustainable earnings of the shareholders will be $ 10 +3, which, when capitalised at 8%, produces the value $ 162.50. Of course, the key learning from Walters approach is not what the market value of equity is, but how the market value of equity can be maximised by following a proper distribution policy. For instance, in the present case, it is not advisable for the company to distribute any dividend at all, as the company earns more than the shareholders opportunity rate. If the company was not to distribute anything, the market value of the share may increase to $ 225. Gordon growth model: Gordons growth model is simply Equation (3) above, that is, VE = Kg Dg E (1+ ) This is, as we have seen above, derived from perpetual sum of a geometric progression, under the assumption that the growth rate is less than the cost of equity. Modigliani and Miller approach: Franco Modigliani was awarded Nobel prize in 1985 and Merton Miller in 1990 (along with Markowitz and Sharpe). M&M have theorised on the irrelevance of the capital structure, and a corollary, irrelevance of the dividend payout ratio to the value of the firm. Like several financial theories, M&M hypothesis is based on the argument of efficient capital markets. In addition, we

believe that a firm has two options: (a) It retains earnings and finances its new investment plans with such retained earnings; (b) It distributes dividends, and finances its new investment plans by issuing new shares. The intuitive background of the M&M approach is extremely simple, and in fact, almost selfexplanatory. It is based on the following propositions: Why would a company retain earnings? Only tenable reason is that the company has investment opportunities. If the company does not retain earnings, where does it finance those investment opportunities from? We may assume a debt issuance, but then as M&M otherwise propounded irrelevance of the capital structure, they see a parity between debt and equity, and hence, it does not make a difference whether the new investments are funded by equity or debt. So, let us assume that the new growth plans are funded by equity. Shareholders price the equity shares of the company to take into account the earnings and the retentions of the company. If the company distributes dividends, the shareholders take into account that fact in pricing of the shares; if the company does not distribute dividends, that is also reflected in the pricing of the shares. If dividends are distributed, the financing needs of the company will be funded by issuing new shares. The issue price of these shares will compensate for the fact that the dividends have been distributed. That is to say, the market price of the share will remain unaffected by whether the dividends have been distributed or not. Let us take a one year time horizon to understand the indifference argument of M&M. We use the following new notations: Po : Price of the equity share at point 0 P1 : Price of the equity share at point 1, that is, end of period 1 D1 : Dividend per share being paid in period 1 n : existing number of issued shares m : new shares to be issued I : Investment needs of the company in year 1 X : Profits of the firm year in 1 The relation between the price at the beginning of the year (Po), and that at the end of the year (P1) is the simple question of discounted value at the shareholders expected rate of return (KE). Hence, Po = (P1 +D1) / (1+(KE) (7) Equation (7) is quite easy to understand. Shareholders have got a cash return equal to D1 at the end of Year 1, and the share is still worth P1. Hence, discounted at the cost of equity, the discounted value is the price at the beginning of the period. Alternatively, it may also be stated that the P1 = (P0 )* (1+(KE) - D1 (8) That is to say, if the company declares dividends, the price the end of year 1 comes down to the effect of the distribution. Equation (7) can be manipulated. By multiplying both sides by n, and adding a self-cancelling number m, we may write (7) as follows: nPo = [(n+m)P1 -mP1 +nD1)]/(1+(KE) (9) Note that we have multiplied both sides by n, and the added number m along with m is cancelled by deducting the same outside the brackets. mP1 represents the new share capital raised by the company to finance its investment needs. How much share capital would the company need to raise? Given the investment needs I and the profits X, the new capital issued will be given by the following:

mP1 = I (X - nD1) (10) Again, this is not difficult to understand, as the total amount of profit of the company is X, and the total amount distributed as dividends is nD1. Hence, the company is left with a funding gap as shown by equation (10). If the value of mP1 is substituted in Equation (9), we have the following: nPo = [(n+m)P1 {I (X - nD1)}+nD1)]/(1+(KE) (11) As nD1 would cancel out, we will be left with the following: nPo = [(n+m)P1 I + X] /(1+(KE) (12) Since nPo is total value of the stock at point 0, it is seen from Equation (12) that dividend is not a factor in that valuation at al

Dividend policy

Our policy of growing the US dollar dividend at least in line with inflation changed at the beginning of 2010. The new policy is to grow the US dollar dividend in line with our view of the underlying earnings and cash flow of Shell.

When setting the dividend, the Board of Directors looks at a range of factors, including the macro environment, the current balance sheet and future investment plans. In addition, we may choose to return cash to shareholders through share buybacks, subject to the capital requirements of Shell. It is our intention that dividends will be declared and paid quarterly. Dividends are declared in US dollars and we announce the euro and sterling equivalent amounts at a later date. Dividends declared on Class A shares are paid by default in Euros, although holders of Class A shares are able to elect to receive dividends in sterling. Dividends declared on Class B shares are paid by default in sterling, although holders of Class B shares are able to elect to receive dividends in Euros. Dividends declared on ADSs are paid in US dollars. In September 2010, Shell introduced a Scrip Dividend Programme that enables shareholders to increase their shareholding by choosing to receive any dividends declared by the Board in the form of new shares instead of cash. Under the Scrip Dividend Programme, shareholders can increase their shareholding in Shell by choosing to receive new shares instead of cash dividends if declared by Shell. Shareholders who do not join the Scrip Dividend Programme will continue to receive in cash any dividends declared by Shell. For further information on the Scrip Dividend Programme please refer to www.shell.com/scrip. Please refer to the dividend timetable dividend timetable for dates relevant to Shells dividend and Shells Scrip Dividend Programme.

Dividend Policy

MORE INFORMATION

Dividend raised to 0.52 per share Email this page ARCADIS proposes a dividend of 0.52 per share. We intend to offer our shareholders the option to receive the Print this page dividend in cash or in shares. The proposed dividend reflects a payout of 35% of net income from operations based on 71.6 million outstanding shares ultimo 2012. This is in line with our dividend policy. In euro's 2012 2011 2010 2009 2008 Net income from operations 1.49 1.23 1.19 1.18 1.16 Net income 1.26 1.20 1.12 1.15 0.95 Dividend 0.52 0.47 0.47 0.45 0.45 Shareholder's equity 7.23 6.34 5.80 5.20 3.35 Closing price Amsterdam Euronext 17.89 12.10 17.42 15.83 9.40 Dividend Policy Our dividend policy aims for a payout of 30-40% of net income from operations. The Executive Board can resolve to offer the shareholders the option to either receive the dividend in cash or in shares.

The Boards general intention is to recommend a dividend of 25-30 per cent of the net result of the year. However, the paying out of dividends will always take into consideration the Groups plans for growth and liquidity requirements.

2011 Dividend per share 0.00

2010 0.00

2009 0.00

2008 0.00

2007 0.00

Number of shares at the 203,704,103 203,704,103 203,704,103 185,204,103 185,204,103 end of the year

Dividend policy

Share trade Share performance Ownership Registration Share capital Dividend policy Share analysts

Dividend policy

SKF's dividend and distribution policy is based on the principle that the total dividend should be adapted to the trend for earnings and cash flow, while taking into account the Group's development potential and financial position. The Board of Directors' view is that the ordinary dividend should amount to around 50% of SKF's average net profit calculated over a business cycle. If the financial position of the SKF Group exceeds the targets stated above, an additional distribution to the ordinary dividend could be made in the form of a higher dividend, a redemption scheme or a repurchase of the company's own shares. On the other hand, in periods of more uncertainty a lower dividend ratio could be appropriate. Dividend 2012 The Board has decided to propose an unchanged dividend of SEK 5.50 per share to the Annual General Meeting. For foreign shareholders, withholding tax rate The statutory witholding tax rate is 30%, but that rate is usually reduced depending on the applicable tax treaty.

MBA Knowledge Base > Financial management > Types of Dividend Policies

Pages: Page 1 Page 2

Types of Dividend Policies

Object 1

A policy is a guideline for action. What are the guidelines followed in respect of dividend function? The guidelines relate to forms, scale, stability and timing of dividend payment. Accordingly dividend policies of diverse nature are available. Prominent of them are dealt with below.

1. Policy of No Immediate Dividend: Generally, management

follows a policy of paying no immediate dividend in the beginning of its life, as it requires funds for growth and expansion. In case, when the outside funds are costlier or when the access to capital market is difficult for the company and shareholders are ready to wait for dividend for sometime, this policy is justified, provided the company is growing fast and it requires a good deal of amount for expansion. But such a policy is not justified for a long time, as the shareholders are deprived of the dividend and the retained earnings built up which will attract attention of laborers, consumers etc. It would be better if the period of dividend is followed by issue of bonus shares, so that later on rate of dividend is maintained at a reasonable level.

2. Regular or Stable Dividend Policy: When a company pays

dividend regularly at a fixed rate, and maintains it for a considerably long time even though the profits may fluctuate, it is said to follow regular or stable dividend policy. Thus stable dividend policy means a policy of paying a minimum amount of dividend every year regularly. It raises the prestige of the company in the eyes of the investors. A firm paying stable dividend can satisfy its shareholders and can enhance its credit standing in the market. Not only that the dividend must be regularly paid but the dividend must be stable. It may be fixed amount per share or a fixed percentage of net profits or it may be total fixed amount of dividend on all the shares etc. The benefits of stable dividend policy are (1) it helps in raising long-term finance. When the company tries to raise finance in future, the investors would examine the dividend record of the company. The investors would not hesitate to invest in company with stable dividend policy. (2) As it will enhance the prestige of the company, the price of its shares would remain at a high level. (3) The shareholders develop confidence in management. (4) It makes long-term planning easier.

3. Regular Dividend plus Extra Dividend Policy. A firm paying

regular dividends would continue with its pay out ratio. But when

Factors affecting dividend policy?

Answer:

Dividend Decision

Dividend Meaning: Dividend is that part of the profits of a company which is distributed amongst its shareholders. Definition: According to ICAI, "Dividend is a distribution to shareholders out of profits or reserves available for this purpose."

Nature of Dividend Decision The dividend decision of the firm is crucial for the finance manager because it determines: 1. the amount of profit to be distributed among the shareholders, and 2. the amount of profit to be retained in the firm. There is a reciprocal relationship between cash dividends and retained earnings. While taking the dividend decision the management take into account the effect of the decision on the maximization of shareholders' wealth. Maximizing the market value of shares is the objective. Dividend pay out or retention is guided by this objective.

Dividend Policy Factors Affecting Dividend Policy: 1. External Factors 2. Internal Factors

External Factors Affecting Dividend Policy 1. General State of Economy: In case of uncertain economic and business conditions, the management may like to retain whole or large part of earnings to build up reserves to absorb future shocks. In the period of depression the management may also retain a large part of its earnings to preserve the firm's liquidity position. In periods of prosperity the management may not be liberal in dividend payments because of availability of larger profitable investment opportunities.

In periods of inflation, the management may retain large portion of earnings to finance replacement of obsolete machines. 2. State of Capital Market: Favourable Market: liberal dividend policy. Unfavourable market: Conservative dividend policy. 3. Legal Restrictions: Companies Act has laid down various restrictions regarding the declaration of dividend: Dividends can only be paid out of: ** Current or past profits of the company. Money provided by the State/ Central Government in pursuance of the guarantee given by the Government. Payment of dividend out of capital is illegal. A company cannot declare dividends unless: ** It has provided for present as well as all arrears of depreciation. Certain percentage of net profits has been transferred to the reserve of the company. Past accumulated profits can be used for declaration of dividends only as per the rules framed by the Central Government 4. Contractual Restrictions: Lenders sometimes may put restrictions on the dividend payments to protect their interests (especially when the firm is experiencing liquidity problems) Example: A loan agreement that the firm shall not declare any dividend so long as the liquidity ratio is less than 1:1. The firm will not pay dividend more than 20% so long as it does not clear the loan.

Internal Factors affecting dividend decisions 1. Desire of the Shareholders: Though the directors decide the rate of dividend, it is always at the interest of the shareholders. Shareholders expect two types of returns: [i] Capital Gains: i.e., an increase in the market value of shares. [ii] Dividends: regular return on their investment. Cautious investors look for dividends because, [i] It reduces uncertainty (capital gains are uncertain). [ii] Indication of financial strength of the company.

[iii] Need for income: Some invest in shares so as to get regular income to meet their living expenses. 2. Financial Needs of the Company: If the company has profitable projects and it is costly to raise funds, it may decide to retain the earnings. 3. Nature of earnings: A company which has stable earnings can afford to have an higher divided payout ratio 4. Desire to retain the control of management: Additional public issue of share will dilute the control of management. 5. Liquidity position: Payment of dividend results in cash outflow. A company may have adequate earning but it may not have sufficient funds to pay dividends

Stability of Dividends The term stability of dividends means consistency in the payment of dividends. It refers to regular payment of a certain minimum amount as dividend year after year. Even if the company's earnings fluctuate from year to year, its dividend should not. This is because the shareholders generally value stable dividends more than fluctuating ones. Stable dividend can be in the form of: 1. Constant dividend per share 2. Constant percentage 3. Stable rupee dividend plus extra dividend

Significance of Stability of Dividend 1. Desire for current income 2. Sign of financial stability of the company 3. Requirement of institutional investors 4. Investors confidence in the company

Danger of Stable Dividend Policy Stable dividend policy may sometimes prove dangerous. Once a stable dividend policy is adopted by a company, any adverse change in it may result in serious damage regarding the financial standing of the company in the mind of the investors.

Forms of Dividend

1. Cash Dividend: The normal practice is to pay dividends in cash. The payment of dividends in cash results in cash outflow from the firm. Therefore the firm should have adequate cash resources at its disposal before declaring cash dividend. 2. Stock Dividend: The company issues additional shares to the existing shareholders in proportion to their holdings of equity share capital of the company. Stock dividend is popularly termed as 'issue of bonus shares.' This is next to cash dividend in respect of its popularity. 3. Bond Dividend: In case the company does not have sufficient funds to pay dividends in cash it may issue bonds for the amount due to shareholders. The main purpose of bond dividend is postponement of payment of immediate dividend in cash. The bond holders get regular interest on their bonds besides payment of the bond money on the due date. [Bond dividend is not popular in India] 4. Property Dividend: This is a case when the company pays dividend in the form of assets other than cash. This may be in the form of certain assets which are not required by the company or in the form of company's products. [This type of dividend is not popular in India]

Bonus Shares When the additional shares are allotted to the existing shareholders without receiving any additional payment from them, is known as issue of bonus shares. Bonus shares are allotted by capitalizing the reserves and surplus. Issue of bonus shares results in the conversion of the company's profits into share capital. Therefore it is termed as capitalization of company's profits. Since such shares are issued to the equity shareholders in proportion to their holdings of equity share capital of the company, a shareholder continues to retain his/ her proportionate ownership of the company. Issue of bonus shares does not affect the total capital structure of the company. It is simply a capitalization of that portion of shareholders' equity which is represented by reserves and surpluses. It also does not affect the total ea

Factors Affecting Working Capital

Posted: May 9th, 2011 | Rating: 3.8/5 | Views: 9930 | Rank Points: 100290 | Comments: 0 The working capital requirements of a business depends upon a number of factors which in brief are as under:-

(1) Nature of the business. The working capital requirements of an enterprise basically depends upon the nature of its business and operating cycle of the business. A trading concern, for instance, requires large amount of working capital for investment in stocks, receivables and cash etc. It requires less investments in fixed assets. A business where the proportion of cost of raw material to be consumed to total cost of production is high, the amount of working capital required is large, shipbuilding for instance.

Object 2

(2) Size of the business. The amount of working capital needed depends upon the scale of operation of the business. The larger the size of the business unit, generally the larger is the requirement of working capital and vice versa. (3) Length of period of manufacture. If the goods are tied up for a longer period of time in. the production process such as ship building, heavy armaments, aeroplanes etc., it requires a large amount of working capital to meet the manufacturing expenses until the payment is received for the finished products. In case of short manufacturing process of a commodity such as cloth, shoes etc. the capital is not tied for a longer period and as such the amount of circulating capital will be small compared to the ship building industry.

(4) Methods of purchase and sale of commodities. If a business is able to purchase the raw material and other allied products on credit and is able to sell the manufactured goods on cash it will need less amount of working capital In case the raw material is purchased on cash and goods are sold on credit the amount of required working capital would be large.

Object 3

(5) Converting working assets into cash. If the assets of a business have liquidity i.e. they are readily saleable for cash then less amount will be set aside for working capital. In case the assets are not quickly saleable for cash then a greater amount f working capital will be required by it.

(6) Seasonal variation in business. There are certain industries which purchase raw material in the production season such as cotton, rubber and consume the material in the off season for the manufacturing of products. These industries require large amount of working capital to purchase the raw material in a production season and pay the wage costs in the off season. (7) Risk in business. A business like the oil exploration involves great risk. The business may or may not be able to find out the oil by digging of wells: The business needs huge amount of working capital in such risky enterprises. (8) Size of labour force. If the size of labour force employed in the manufacture of a product is fairly, large, (labour intensive), the business will need a greater amount of working capital. In capital intensive industries lesser amount of working capital is required.

(9) Price level changes. If the prices are rising very rapidly in the country the business will require greater amount of working capital to maintain the same current assets and vice versa. (10) Rate of turnover. If in a business, the sale is faster i.e., a business has rapid turn over then the amount of working capital required may be small as cash is realized from sales. A business where the rate of turn over is slow there is more requirement of working capital in that business.

(11) State of business activity. When the business is prosperous it needs more working capital for increasing the volume of business. On the contrary when the business is slack and sales decline then less amount of working capital is required. (12) Business policy. If a business sets aside funds at the end of each year for the depreciation, payment of loans and ploughing back of profits in the business, it requires less amount of working capital. On the other hand, .a business which does not build its own internal resources, needs larger amount of working capital to meet the day today expenses of the business and other unexpected expenses.

You might also like

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Project On Dividend PolicyDocument50 pagesProject On Dividend PolicyMukesh Manwani100% (3)

- Dividend Policy WikipidiaDocument12 pagesDividend Policy WikipidiaAnonymous NSNpGa3T93No ratings yet

- Dividend PolicyDocument4 pagesDividend PolicyKiran Rajashekaran NairNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAayush JainNo ratings yet

- Dividend PolicyDocument10 pagesDividend Policysankalp singhNo ratings yet

- Dividend Policy: Dividend Decision and Valuation of FirmsDocument10 pagesDividend Policy: Dividend Decision and Valuation of FirmsudhavanandNo ratings yet

- Relevance N Irrelevance of Dividend PlicyDocument8 pagesRelevance N Irrelevance of Dividend PlicyGagandeep VermaNo ratings yet

- Abdullah QAYYUM ValuationDocument11 pagesAbdullah QAYYUM ValuationSaifiNo ratings yet

- FM Notes - Unit - 5Document7 pagesFM Notes - Unit - 5Shiva JohriNo ratings yet

- Dividend Policy AssignmentDocument8 pagesDividend Policy Assignmentgeetikag2018No ratings yet

- Dividend Decisions Unit 5Document8 pagesDividend Decisions Unit 5md saifNo ratings yet

- Sybaf Dividend DecisionsDocument13 pagesSybaf Dividend DecisionsBhavana Patil JangaleNo ratings yet

- Dividend DecisionsDocument9 pagesDividend DecisionsAnkita Kumari SinghNo ratings yet

- Unit 4Document12 pagesUnit 4Mohammad ShahvanNo ratings yet

- Dividend DecisionsDocument7 pagesDividend DecisionsAahana GuptaNo ratings yet

- DividendsDocument8 pagesDividendsKumar SumanthNo ratings yet

- Relevance of Dividend: I. Walter Valuation ModelDocument4 pagesRelevance of Dividend: I. Walter Valuation ModelArj SharmaNo ratings yet

- Dividend DecisionDocument12 pagesDividend DecisionCma Pushparaj Kulkarni100% (2)

- Unit 4 Dividend DecisionsDocument17 pagesUnit 4 Dividend Decisionsrahul ramNo ratings yet

- Dividend Decisions: Prof. Nidhi BandaruDocument15 pagesDividend Decisions: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- FinanceDocument21 pagesFinanceYash MandpeNo ratings yet

- 4.dividend DecisionsDocument5 pages4.dividend DecisionskingrajpkvNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- DivpolicyDocument14 pagesDivpolicyNitin AgrawalNo ratings yet

- ICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadDocument35 pagesICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadsuccessgurusNo ratings yet

- Dividend TheoriesDocument38 pagesDividend TheoriesMuhammad Azhar Ibné Habib JoomunNo ratings yet

- Dividend Policies and TheoriesDocument4 pagesDividend Policies and TheoriesMaideline AlmarioNo ratings yet

- Dividend PolicyDocument29 pagesDividend PolicySarita ThakurNo ratings yet

- Lovepreeet Singh AssignmentDocument11 pagesLovepreeet Singh AssignmentLovepreet KatalNo ratings yet

- Dividend TheoriesDocument35 pagesDividend TheoriesLalit ShahNo ratings yet

- Dividend and Determinants of Dividend PolicyDocument11 pagesDividend and Determinants of Dividend PolicysimmishwetaNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyBhavya GuptaNo ratings yet

- 2 7Document35 pages2 7Kiran VaykarNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyToufiq AmanNo ratings yet

- Impact of Dividend Policy On A Firm PerformanceDocument11 pagesImpact of Dividend Policy On A Firm PerformanceMuhammad AnasNo ratings yet

- Dividend PolicyDocument42 pagesDividend PolicydimpleNo ratings yet

- Dividend PolicyDocument13 pagesDividend Policyrekha_savnaniNo ratings yet

- Dividend DecisionDocument25 pagesDividend Decisionva1612315No ratings yet

- Walter and Gordon ModelDocument3 pagesWalter and Gordon ModelVijay JainNo ratings yet

- FM Module 4 WordDocument12 pagesFM Module 4 WordIrfanu NisaNo ratings yet

- FinmanDocument7 pagesFinmanNHEMIA ELEVENCIONADONo ratings yet

- Unit IV MBADocument6 pagesUnit IV MBAMiyonNo ratings yet

- Financial Management Chapter TwoDocument45 pagesFinancial Management Chapter TwobikilahussenNo ratings yet

- Dividend Policy: Assignment of Financial ManagementDocument12 pagesDividend Policy: Assignment of Financial ManagementKanika PuriNo ratings yet

- FM 5Document10 pagesFM 5Rohini rs nairNo ratings yet

- Key PointsDocument8 pagesKey PointsNight MizukiNo ratings yet

- Financial Management: Topic-Dividend PolicyDocument10 pagesFinancial Management: Topic-Dividend PolicyVibhuti SharmaNo ratings yet

- Chapter-II Literature ReviewDocument32 pagesChapter-II Literature Reviewbikash ranaNo ratings yet

- Dividend Policy: Chapter ObjectivesDocument2 pagesDividend Policy: Chapter ObjectivesMundixx TichaNo ratings yet

- Mba Corporate FinanceDocument13 pagesMba Corporate FinanceAbhishek chandegraNo ratings yet

- Discusion 7Document3 pagesDiscusion 7milagrosNo ratings yet

- DividendDocument30 pagesDividendFaruqNo ratings yet

- Dividend PolicyDocument12 pagesDividend PolicyAkshita raj SinhaNo ratings yet

- Dividend DecisionsDocument11 pagesDividend DecisionsJunaid SiddiquiNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Experience CertificateDocument1 pageExperience CertificateprincerattanNo ratings yet

- Experience CertificateDocument1 pageExperience CertificateprincerattanNo ratings yet

- Experience CertificateDocument1 pageExperience CertificateprincerattanNo ratings yet

- Experience Certificate: Principal Manoj KumarDocument1 pageExperience Certificate: Principal Manoj KumarprincerattanNo ratings yet

- Experience Certificate MDocument1 pageExperience Certificate MprincerattanNo ratings yet

- Experience Certificate: Principal Manoj KumarDocument1 pageExperience Certificate: Principal Manoj KumarprincerattanNo ratings yet

- The Tentative Schedule of Events Is As Follows: Event D Tentative DateDocument26 pagesThe Tentative Schedule of Events Is As Follows: Event D Tentative Date476No ratings yet

- Chapter 14: Social Class Influences On Consumer BehaviorDocument5 pagesChapter 14: Social Class Influences On Consumer BehaviorChetan GuptaNo ratings yet

- Excel Excel Stuff Monte Carlo Simulation Uncertainty and Risk AnalysisDocument50 pagesExcel Excel Stuff Monte Carlo Simulation Uncertainty and Risk Analysisapi-27174321100% (5)

- The Tentative Schedule of Events Is As Follows: Event D Tentative DateDocument26 pagesThe Tentative Schedule of Events Is As Follows: Event D Tentative Date476No ratings yet

- Culture and Its ElementDocument13 pagesCulture and Its ElementPrince RattanNo ratings yet

- Personality (Consumer Behaviour)Document36 pagesPersonality (Consumer Behaviour)princerattanNo ratings yet

- 5 Perscomm IntroDocument19 pages5 Perscomm IntroprincerattanNo ratings yet

- Experience CertificateDocument1 pageExperience CertificateprincerattanNo ratings yet

- E.buyer Behaviour 5Document10 pagesE.buyer Behaviour 5rajprincepibmNo ratings yet

- Project Based On MergerDocument24 pagesProject Based On MergerPrince RattanNo ratings yet

- Common Size Balance SheetDocument3 pagesCommon Size Balance SheetprincerattanNo ratings yet

- Final Report On GrievanceDocument64 pagesFinal Report On GrievanceprincerattanNo ratings yet

- Questionable For Working CapitalDocument1 pageQuestionable For Working CapitalprincerattanNo ratings yet

- Project Report ON Inventory Management: Ramandeep Mba - 3 Sem. Roll No 890829Document28 pagesProject Report ON Inventory Management: Ramandeep Mba - 3 Sem. Roll No 890829akashdeepjoshiNo ratings yet

- Ratail BankingDocument163 pagesRatail BankingprincerattanNo ratings yet

- Bipartite BodiesDocument2 pagesBipartite BodiesprincerattanNo ratings yet

- Personality (Consumer Behaviour)Document36 pagesPersonality (Consumer Behaviour)princerattanNo ratings yet

- AmanDocument29 pagesAmanprincerattanNo ratings yet

- Dinidend PolicyDocument25 pagesDinidend PolicyprincerattanNo ratings yet

- Common Size Balance SheetDocument3 pagesCommon Size Balance SheetprincerattanNo ratings yet

- Core CutterDocument5 pagesCore CutterprincerattanNo ratings yet

- Proposed Date Sheet For Exam April-2013as On 5-2-2013Document60 pagesProposed Date Sheet For Exam April-2013as On 5-2-2013princerattanNo ratings yet

- PmeDocument11 pagesPmeprincerattanNo ratings yet

- Fi 19Document9 pagesFi 19priyanshu.goel1710No ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Presentation TDSDocument15 pagesPresentation TDSSHIKHA DWIVEDINo ratings yet

- Unit 5 Business Accounting - Assignment 2Document3 pagesUnit 5 Business Accounting - Assignment 2Nitesh MishraNo ratings yet

- Steps in The Accounting Process Assignment AISDocument2 pagesSteps in The Accounting Process Assignment AISKathlene BalicoNo ratings yet

- Reading List First Semester 2017-2018Document15 pagesReading List First Semester 2017-2018NajjaSheriff007No ratings yet

- Resume in FinanceDocument6 pagesResume in Financec2kzzhdk100% (1)

- Ppe 2016Document40 pagesPpe 2016Benny Wee0% (1)

- Demo 04 - Journal Entries & Ledger Posting & T.B. - Rizvi Co (Compatibility Mode)Document31 pagesDemo 04 - Journal Entries & Ledger Posting & T.B. - Rizvi Co (Compatibility Mode)Evergreen FosterNo ratings yet

- Investor Relations Presentation May 2019Document65 pagesInvestor Relations Presentation May 2019Manuel BertlNo ratings yet

- SFIN Code: Money Market Fund (ULIF-041-05/01/10-MNMKKFND-107) Dynamic Gilt Fund (ULIF-006-27/06/03-DYGLTFND-107) Dynamic Bond Fund (ULIF-015Document7 pagesSFIN Code: Money Market Fund (ULIF-041-05/01/10-MNMKKFND-107) Dynamic Gilt Fund (ULIF-006-27/06/03-DYGLTFND-107) Dynamic Bond Fund (ULIF-015Rajat SrivastavaNo ratings yet

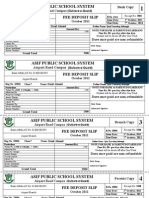

- Asif Public School System: Fee Deposit SlipDocument1 pageAsif Public School System: Fee Deposit SlipIrfan YousafNo ratings yet

- Individual Assignment 1Document2 pagesIndividual Assignment 1Getiye LibayNo ratings yet

- Trai Entity Report 11 Feb 2021Document254 pagesTrai Entity Report 11 Feb 2021Samir SharmaNo ratings yet

- L03-DLP-Financial InsitutionDocument4 pagesL03-DLP-Financial InsitutionKim Mei HuiNo ratings yet

- Mark Scheme (Results) Summer 2007: GCE Accounting (6001) Paper 1Document18 pagesMark Scheme (Results) Summer 2007: GCE Accounting (6001) Paper 1Stephanie UCmanNo ratings yet

- Government of Telangana Commodity Type: Eggs-AWC Wise Delivery ReportDocument5 pagesGovernment of Telangana Commodity Type: Eggs-AWC Wise Delivery Reportkrishna krishNo ratings yet

- Project PDFDocument92 pagesProject PDFUrvashi SharmaNo ratings yet

- HO, B & A AcctgDocument15 pagesHO, B & A AcctgCarolina Fortez Dacanay71% (7)

- IM ACCO 20173 Business and Transfer Taxes Module 5 PDFDocument5 pagesIM ACCO 20173 Business and Transfer Taxes Module 5 PDFMakoy BixenmanNo ratings yet

- Option Nifty - BankDocument41 pagesOption Nifty - Banksawsac9No ratings yet

- Kotak Mahindra Bank Limited Standalone Financials FY18Document72 pagesKotak Mahindra Bank Limited Standalone Financials FY18Shankar ShridharNo ratings yet

- Indicadores de Iniquidade Do Sistema Tributario Nacional - Relatorio de Observacao No 2 - Versao Bilingue - 03-2011-1 PDFDocument116 pagesIndicadores de Iniquidade Do Sistema Tributario Nacional - Relatorio de Observacao No 2 - Versao Bilingue - 03-2011-1 PDFAndré Bandeira CavalcanteNo ratings yet

- Formatted Accounting Finance For Bankers AFB 2 1 PDFDocument6 pagesFormatted Accounting Finance For Bankers AFB 2 1 PDFSijuNo ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177Document24 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177JosephGonzalezqxdf97% (38)

- NIMIR Chemicals Annual Report 2016Document104 pagesNIMIR Chemicals Annual Report 2016Nisar Akbar KhanNo ratings yet

- Redemption of Preference SharesDocument19 pagesRedemption of Preference SharesAshura ShaibNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- Citibank v. SabenianoDocument2 pagesCitibank v. Sabenianoalex_austriaNo ratings yet

- Examination: Subject CT8 Financial Economics Core TechnicalDocument148 pagesExamination: Subject CT8 Financial Economics Core Technicalchan chadoNo ratings yet