Professional Documents

Culture Documents

Mergers & Acquisitions Assignments

Uploaded by

dkathrotiyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mergers & Acquisitions Assignments

Uploaded by

dkathrotiyaCopyright:

Available Formats

Dr.J.K.Patel Institute of Management SEM IV, Finance Divisions A Subject: Mergers & Acquisitions (M&A) Three Assignments: No.

Questions from Module: 1,2,3 &4 I Q.1: Briefly discuss the various forms of Corporate Restructuring. Q.2: Briefly discuss motives of Corporate Restructuring. Q.3: Briefly discuss significance and limitations of Corporate Restructuring. Q.4: What do you mean by Mergers? Give a detailed classification of Mergers. Q.5: List and explain the various motives of Mergers. Q.6: Briefly discuss important reasons for failures of mergers. Q.7: List and explain the different sources of synergy in Merger and acquisition. Q.8: Identify and briefly highlight various steps in a Merger process. Q.9: List and explain the various aspects of Merger and Acquisition. Q.10: Identify and briefly highlight various issues to consider in Merger and Acquisition. Source of Assignment: Bhagaban Das &others, Corporate Restructuring (Edition 2012), Himalaya Publishing House. II Questions from Modules 1,2,3& 4 Q.1: Define the term Due Diligence. Briefly highlight common aspects examined in Due Diligence by the Acquirers team in Corporate Restructuring. Q. 2: Explain in detail the Due Diligence process. Q.3: Bring out the importance of Business Valuation. Q.4: List the various factors that determine the value of a firm. Q.5: Discuss, in detail, the various phases of Business Valuation Process. Q.6: List and briefly discuss three fundamental approaches of business valuation. Q.7: Briefly discuss the advantages and disadvantages of Asset-based approach in business valuation. Q.8: Explain in detail, the various steps in Discounted Cash Flow (DCF) approach. Use a suitable numerical illustration to highlight the valuation.

1

III

Q.9: Discuss the advantages and disadvantages of Discounted Cash Flow (DCF) approach. Q.10: What are the precautions to be taken in Market-based Approach of business valuation? Source of Assignment: Bhagaban Das & others, Corporate Restructuring (Edition 2012), Himalaya Publishing House. Questions from Modules 1,2,3 &4 Q.1: Discuss the legal and regulatory framework for mergers and acquisitions in India. Q.2: Write a short note on the various laws applicable to takeover activities of a company in Indian scenario. Q.3: Write a critical note on Indian Accounting standard 14 relating to accounting for amalgamations. Q.4: Write short notes on: (a). Joint Venture (b). Leveraged Buyout (c). Divestitures (d). Equity carved out (e). Employee Stock Option Plan. Q.5: Briefly discuss the causes of risk in mergers and acquisitions. What are the methods of preventing risk in mergers & acquisitions? Q.6: State the concept of Demerger. What are the legal aspects of Demerger? Provide suitable examples. Q.7: Define the term takeover. How is takeover different from mergers? Q.8: Briefly explain the various types of takeovers by providing suitable examples. Q.9: Briefly discuss various takeover strategies. Q.10: Briefly discuss various anti-takeover strategies available to the target company. Q.11: Write a critical note on Takeover code in the Indian context. Q.12: Define the term Strategic Alliance. List and briefly discuss various categories and types of Strategic Alliances. Q.13: Briefly discuss the advantages and disadvantages associated with Joint Ventures. Q.14: Define leveraged buy out and state how it is undertaken? Q.15: Describe the essential characteristics of Leveraged Buy out (LBO) Q.16: What do you understand by Employee Stock Ownership Plans.

2

Discuss various types of Employee Stock Ownership plans. Q.17: Distinguish between Leverage and non-leveraged ESOPs. Q.18: What do you mean by buyback of shares or specified securities as under the Companies Act,1956. Explain the relevant provisions. Q.19: Briefly explain the motives behind buyback of shares. Q.20: List the procedural aspects of buyback of shares. Source of Assignment: Bhagaban Das & others, Corporate Restructuring (Edition 2012), Himalaya Publishing House.

You might also like

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetkeshav madamNo ratings yet

- CH 14 Practice MCQ - S Financial Management by BrighamDocument63 pagesCH 14 Practice MCQ - S Financial Management by BrighamShahmir Ali100% (1)

- Top 10 CFO responsibilities under 40 charactersDocument3 pagesTop 10 CFO responsibilities under 40 charactersMita Mandal0% (1)

- GB550 Course PreviewDocument8 pagesGB550 Course PreviewNatalie Conklin100% (1)

- Financial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Document2 pagesFinancial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Sabhaya Chirag100% (2)

- Global HR PractisesDocument284 pagesGlobal HR PractisesSasirekha100% (7)

- Mergers, Acquisitions, and Other Restructuring ActivitiesFrom EverandMergers, Acquisitions, and Other Restructuring ActivitiesNo ratings yet

- Fundamentals AnswerDocument12 pagesFundamentals AnswerRienalyn Dumlao Duldulao-DaligconNo ratings yet

- PiercingDocument22 pagesPiercingarshadtabassumNo ratings yet

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Document4 pagesProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyNo ratings yet

- Question Bank - Start Up and New Venture ManagementDocument2 pagesQuestion Bank - Start Up and New Venture Managementanuradhakampli100% (2)

- Mergers & Acquisitions: Question Banks Varsha ViraniDocument3 pagesMergers & Acquisitions: Question Banks Varsha ViraniAnkit Patel100% (1)

- MBA exam questions on business environment, managerial economics, organizational behavior, finance, and management controlDocument8 pagesMBA exam questions on business environment, managerial economics, organizational behavior, finance, and management controlrajsolankibarmer0% (1)

- Final All Important Question of Mba IV Sem 2023Document11 pagesFinal All Important Question of Mba IV Sem 2023Arjun vermaNo ratings yet

- Corporate GovernanceDocument4 pagesCorporate GovernanceShashi Bhushan SonbhadraNo ratings yet

- Important questions for B.Com I & II examsDocument13 pagesImportant questions for B.Com I & II examsImmad AhmedNo ratings yet

- Financial Management Question BankDocument9 pagesFinancial Management Question BankAnonymous uHT7dDNo ratings yet

- Chap8 9 10reviewDocument1 pageChap8 9 10reviewstquinn864443No ratings yet

- M&E Question BankDocument7 pagesM&E Question BankArun NesamNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityFaisal MalekNo ratings yet

- Financial Management - S-2010Document1 pageFinancial Management - S-2010THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’No ratings yet

- Management Principles MCQsDocument12 pagesManagement Principles MCQsSubhasis Kumar DasNo ratings yet

- SAPM 5th Sem Investment Model Question PaperDocument5 pagesSAPM 5th Sem Investment Model Question PaperVijay SinghNo ratings yet

- EDM - Practice QuetionsDocument4 pagesEDM - Practice Quetionsomshirdhankar30No ratings yet

- Assignment QuestionsDocument2 pagesAssignment QuestionsPankaj GoplaniNo ratings yet

- MBA Financial Management QuestionsDocument2 pagesMBA Financial Management QuestionsCharchit RawalNo ratings yet

- Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and SolutionsFrom EverandMergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and SolutionsNo ratings yet

- Smude Mba Semester 3 Spring 2015 assignmentsMF0011Document1 pageSmude Mba Semester 3 Spring 2015 assignmentsMF0011Rajesh SinghNo ratings yet

- Important Question B.com IiDocument1 pageImportant Question B.com Iisubba1995333333No ratings yet

- Bba Question PapersDocument48 pagesBba Question Papersggsipu_info0% (1)

- Engineering Economics and Financial AccountingDocument5 pagesEngineering Economics and Financial AccountingAkvijayNo ratings yet

- Strategic Management TutorialDocument2 pagesStrategic Management TutorialOnikaNo ratings yet

- BA7024 CorporateFinancequestionbankDocument5 pagesBA7024 CorporateFinancequestionbankNorman MberiNo ratings yet

- Ignou AssignmentsDocument18 pagesIgnou Assignmentshelp20120% (1)

- Imp Question Ii Sem 2022 PDFDocument6 pagesImp Question Ii Sem 2022 PDFITR 1No ratings yet

- Merchant Banking, Credit Rating & Project Appraisal QuestionsDocument5 pagesMerchant Banking, Credit Rating & Project Appraisal Questionsso_icidNo ratings yet

- Question Bank - CL-RevisedDocument1 pageQuestion Bank - CL-RevisedAditya KulkarniNo ratings yet

- CT9 Business Awareness Module PDFDocument4 pagesCT9 Business Awareness Module PDFVignesh SrinivasanNo ratings yet

- Neim QuestionsDocument31 pagesNeim QuestionssaurabhNo ratings yet

- MBA Integrated WINTER 2021Document1 pageMBA Integrated WINTER 2021Anchal kalwaniNo ratings yet

- Mba Winter 2012Document2 pagesMba Winter 2012NitishNo ratings yet

- Ignou AssignmentsDocument18 pagesIgnou Assignmentshelp2012No ratings yet

- Indian GDP growth trends and opportunities for entrepreneursDocument5 pagesIndian GDP growth trends and opportunities for entrepreneursMOHAMMED SAAD AHMED 160418735109No ratings yet

- SM QuestionDocument2 pagesSM QuestionChintan PatelNo ratings yet

- Accounts Guess Paper Class 12th Partnership and Company AccountsDocument2 pagesAccounts Guess Paper Class 12th Partnership and Company AccountsAx AmNo ratings yet

- Ba5011 Merchant Banking and Financial Services Reg 17 Question BankDocument5 pagesBa5011 Merchant Banking and Financial Services Reg 17 Question BankAnusha kanmaniNo ratings yet

- Entrepreneurship & Small Business Management Model Test Paper-IDocument2 pagesEntrepreneurship & Small Business Management Model Test Paper-IGangadhar100% (1)

- CT9Document4 pagesCT9Vishy BhatiaNo ratings yet

- BBA - III RD F. M. (Question Paper)Document4 pagesBBA - III RD F. M. (Question Paper)DrRashmiranjan PanigrahiNo ratings yet

- Xi BSTDocument15 pagesXi BSTShubham Gupta100% (1)

- CIE-3Document2 pagesCIE-3stuti.tocNo ratings yet

- FM Theory Questions VtuDocument4 pagesFM Theory Questions VtuGururaj AvNo ratings yet

- MEFA Imp QuestionsDocument5 pagesMEFA Imp QuestionsSunilKumarNo ratings yet

- Assignment Book of New Enterprise and Innovation Management: Admin (Type The Document Subtitle)Document5 pagesAssignment Book of New Enterprise and Innovation Management: Admin (Type The Document Subtitle)nikskagalwalaNo ratings yet

- MBA Accounting QuestionsDocument4 pagesMBA Accounting QuestionsbhfunNo ratings yet

- Edp Imp QuestionsDocument3 pagesEdp Imp QuestionsAshutosh SinghNo ratings yet

- AuditingDocument2 pagesAuditingparthamazumdar93No ratings yet

- MBA Integrated SUMMER 2020Document1 pageMBA Integrated SUMMER 2020Anchal kalwaniNo ratings yet

- Business Studies Sample Paper of Icse BoardDocument3 pagesBusiness Studies Sample Paper of Icse Boardapi-150539480No ratings yet

- MEF Accounting Question BankDocument5 pagesMEF Accounting Question BankbhfunNo ratings yet

- 15DMBF51 Corporate FinanceDocument6 pages15DMBF51 Corporate FinanceShanthiNo ratings yet

- Unit-I: BA7024 Corporate FinanceDocument5 pagesUnit-I: BA7024 Corporate FinanceHaresh KNo ratings yet

- Mutual Fund Question BankDocument3 pagesMutual Fund Question BankarunvklplmNo ratings yet

- Strategic Management Concepts for BA 5302Document5 pagesStrategic Management Concepts for BA 5302Harihara Puthiran100% (1)

- Corporate Finance Grand Viva QuestionsDocument13 pagesCorporate Finance Grand Viva QuestionsRitikaSahniNo ratings yet

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDocument2 pagesACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNo ratings yet

- Important Q For Final ExamDocument2 pagesImportant Q For Final ExamRama SardesaiNo ratings yet

- As 14 AmalgamationDocument8 pagesAs 14 AmalgamationJeet KathadNo ratings yet

- Revenue RecognitionDocument14 pagesRevenue RecognitiondkathrotiyaNo ratings yet

- 1Document13 pages1dkathrotiyaNo ratings yet

- Forfeiture and Reissue of SharesDocument118 pagesForfeiture and Reissue of SharesFredhope Mtonga100% (1)

- Quiz Cash and ReceivablesDocument4 pagesQuiz Cash and Receivableserica insiongNo ratings yet

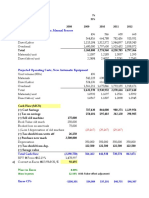

- Total Current Liabilities: Balance Sheet of Pidilite Industries - in Rs. Cr.Document4 pagesTotal Current Liabilities: Balance Sheet of Pidilite Industries - in Rs. Cr.Vishal GargNo ratings yet

- For Question Numbers 1 To 3Document6 pagesFor Question Numbers 1 To 3Cheveem Grace EmnaceNo ratings yet

- Provision For DepreciationDocument10 pagesProvision For DepreciationAsh InuNo ratings yet

- Reynaldo Gulane CleanersDocument3 pagesReynaldo Gulane CleanersshaneemacasiNo ratings yet

- AFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberDocument25 pagesAFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberwawanNo ratings yet

- Faculty of Business, Finance & Information TechnologyDocument13 pagesFaculty of Business, Finance & Information TechnologyNurNo ratings yet

- Moller Maersk PDF FinalDocument10 pagesMoller Maersk PDF Finalanna sNo ratings yet

- Week - 1 Chapter 1 (Student)Document59 pagesWeek - 1 Chapter 1 (Student)Thi Van Anh VUNo ratings yet

- Manufacturing 1cqhd8sj1 - 416110Document88 pagesManufacturing 1cqhd8sj1 - 416110DGLNo ratings yet

- Income statement and financial position documents solutionsDocument59 pagesIncome statement and financial position documents solutionsNam PhươngNo ratings yet

- Izzy Trading - Transaction Entries - General Book of Accounts - SOLUTIONS-1Document21 pagesIzzy Trading - Transaction Entries - General Book of Accounts - SOLUTIONS-1Franze Beatriz FLORESNo ratings yet

- MRCB BerhadDocument24 pagesMRCB BerhadPiqsamNo ratings yet

- Accounting Ppe Quizzes PractoceDocument1 pageAccounting Ppe Quizzes PractoceMA. ANGELICA DARL DOMINGO CHAVEZNo ratings yet

- BUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISEDocument4 pagesBUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISERichard MamisNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Cost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSDocument16 pagesCost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSRahila Rafiq0% (1)

- Corporation PDFDocument8 pagesCorporation PDFKAMALINo ratings yet

- CH 24Document67 pagesCH 24najNo ratings yet

- Kristel Faye A.Cruz BA122 Bsa Iii A 1. History of The Philippine Corporate LawDocument10 pagesKristel Faye A.Cruz BA122 Bsa Iii A 1. History of The Philippine Corporate LawAsdfghjkl qwertyuiopNo ratings yet

- Chapter 16 - Consol. Fs Part 1Document17 pagesChapter 16 - Consol. Fs Part 1PutmehudgJasdNo ratings yet

- PR-Akuntansi Manufaktur - RevisiDocument4 pagesPR-Akuntansi Manufaktur - Revisisafira annisaNo ratings yet