Professional Documents

Culture Documents

Credit Risk Management

Uploaded by

Heema NimbeniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Risk Management

Uploaded by

Heema NimbeniCopyright:

Available Formats

EXECUTIVE SUMMARY The dissertation project done is on the credit risk management practices followed by Vijaya Bank.

In the fast growing world, banks are facing many types of risks among which credit risk stands at the top of the list. Hence, the topic is credit risk management. One bank was chosen to understand the practices followed by them in depth which would apply to other banks in general. Vijaya bank is one of the public sector banks and is supposed to be in line with RBI guidelines. This helped in understanding the credit risk management practices followed by the bank in a better way. The process of credit risk management is identification, measurement, monitoring and control. The bank follows these steps very clearly and has a sound credit risk management system installed. It has also installed software for risk rating which was provided by CRISIL which is in turn in lines with RBI guidelines. The banks net profit has seen a growth of 234% and the total business is up by 16%. The banks deposits are up by 13% and gross advances are up by 19%. The credit risk exposure is increased to 80064.90 as of Sep, 30 2011. The credit risk of the bank has decreased over the past five years. They have installed an integrated risk management system in line with BASEL II norms and RBI guidelines. They follow strict hedging policies to reduce credit risk of the bank. They take financial collaterals and guarantees to hedge their credit risk. Hence all the policies and strategies have led to a sound credit risk management system. The recommendations include up gradation to internal ratings based approach which is the next step of risk measurement. They have to improve their systems so as to adhere to BASEL III norms which might be implemented in near future. They need to include credit risk during yearly policy making.

CHAPTER 1: INTRODUCTION

Indian economy today is in the process of becoming a world class economy. The Indian banking industry is making great advancement in terms of quality, quantity, expansion and diversification and is keeping up with the updated technology, ability; stability and thrust of a financial system, where the commercial banks play a very important role emphasize the need of a strong effective control system with extra concern for the risk involved in the business. The risk arises due to uncertainties, which in turn arise due to changes taking place in the economic, social and political environment and lack of non-availability of information Concerning such changes. Risk means uncertainty/possibility of loss. In the financial arena, enterprise risks can be broadly categorized as credit risk, market risk, operational risk, strategic risk, funding risk, political and legal risk. Credit risk is the possibility that a borrower or counter party will fail To meet agreed obligations. Globally more than 50% of total risk elements in banks and financial institutions are credit risk alone. In banks, losses stem from outright default due to inability or unwillingness of customer or counter party to meet commitments in relation to lending, trading, settlement and other financial transactions. Thus managing credit risk for efficient management of a financial institution or bank has gradually become the most crucial task and this is the motivation for this research. GLOBAL SCENARIO The period 2007-2012 underwent financial crisis, also known as the Global Financial Crisis (GFC), or the Great Recession, is considered by many economists to be the worst financial crisis since the great depression of the 1930s. This resulted in the collapse of large financial institutions, the bailout of banks by national Governments, and downturns in stock markets around the world. Even the housing market suffered, resulting in evictions, foreclosures and prolonged unemployment contributing to the failure of key businesses, declines in consumer wealth estimated in trillions of US dollars, and a significant decline in the economic activity, leading to a severe 2008-2012 global recessions. The bursting of the U.S. housing bubble, which peaked in 2007, caused the values of securities tied to U.S. real estate pricing to plummet, damaging financial institutions globally. The financial crisis was triggered by a complex interplay of valuation and liquidity problems in the United States banking system in 2008. Securities in stock markets suffered large losses during the 2008 and early 2009. Economies worldwide slowed down during this period, as credit tightened and international trade declined. This financial crisis ended by around late 2008 and mid-2009. The current European sovereign debt crisis is an ongoing financial crisis that has made it difficult or impossible for some countries in the euro area to re-finance their Government debt without the assistance of third parties. From late 2009, fears of a sovereign debt crisis developed among investors as a result of the rising Government debt levels around the world together with a wave of downgrading of Government debt in some European states. Concerns intensified in early 2010 and thereafter, leading Europe s finance ministers on 9 May 2010 approved a rescue package worth 750 billion to ensure financial stability across Europe creating the European financial stability facility (EFSF). In October 2011 and February 2012, the Euro zone leaders agreed on more measures designed to prevent the collapse of member economies. M & As ON THE RISE The banking and capital market is readily transforming itself with increased competition and globalisation. Investment banking has bounced back because merger and acquisition (M&A) has gathered momentum. Hedge fund activity and increase of M&A activity is the main

characteristics of globalize banking. Mays are usually horizontal in banking sector as it is the same business. Ex: The Bank of Tokyo-Mitsubishi UFJ, which became the world s largest bank, by merging with Mitsubishi Tokyo Financial Group Inc. and UFJ holdings Inc. It created the bank of Tokyo-Mitsubishi, worlds largest financial group by assets at around $1.6 trillion, leaving behind; the U.S. based Citigroup Inc. s $1.55 trillion. FUNDS CONTINUE TO FLOW TO EMERGING COUNTRIES Emerging market continues to bring in more funds in the banking sector. Lending to emerging markets rose. More and more funds continue to flow in the emerging markets like Latin American countries. Hedge fund activity has also increased over time. DOMESTIC SCENARIO Indian banking industry has evolved over a long period of more than two centuries. Despite the recent growth of private banks, the sector is dominated by Government-controlled banks that holds nearly three-fourths of total banks assets. Indian banking industry is considered to be very stable with healthy balance sheets and low exposure to risky assets. The global financial crises have not affected the Indian banks significantly. Internet, wireless technology and global straight-through processing has created a paradigm shift in the banking industry. The growing market is attracting more and more banks into the Indian territories. In India, the most significant achievement of the financial sector reforms is the improvement in the financial health of commercial banks in terms of capital adequacy, profitability and asset quality as well as greater attention to risk management. Later on, after adopting the policy of deregulation, it opened the new opportunities for the banks to increase revenues by diversifying into investment banking, insurance, credit cards, depository services, mortgage financing, securitization, etc. As now banks benchmark themselves against global standards, they have increased the disclosures and transparency in bank balance sheets, the banks also started focusing more on corporate governance.

The Table 1.1 shows the leading Indian banks by Assets and market capitalization:

1.1 About the study Human beings have tried to manage risks faced in their everyday life. Keeping inflammable material away from fire, saving for possible future needs, creation of a legal will are all examples of attempts at managing risk. Risk is the possibility of the actual outcome being different from the expected outcome. It includes both the downside and upside potential. Downside potential is the possibility of the actual results being adverse compared to the expected results. On the other hand, upside

potential is the possibility of the actual results being better than the expected results. 1.1.1 Risk Management Risk is derived from the Italian word Risicare meaning to dare. Risk is the probability of the unexpected happening the probability of suffering a loss. Risk provides the basis for opportunity. The term risk and exposure have subtle differences in their meaning. Risk refers to the probability of loss, while exposure is the possibility of loss although they are often used interchangeably. Risk arises as a result of exposure. Exposure to financial markets affects most organizations, either directly or indirectly. Financial markets help companies to gain, also expose them to the possibility of loss. However, financial markets give strategic benefits to the companies. Risk is the probable variability of returns. Since it is not always possible or desirable to eliminate risk, understanding it is an important step in determining how to manage it. Identifying exposures and risks forms the basis for an appropriate financial risk management strategy. Financial risk arises through countless transactions of a financial nature, including sales and purchases, investments and loans, and various other business activities. When financial prices change dramatically, it can increase costs, reduce revenues, or otherwise adversely impact the profitability of an organization. make it more difficult to plan and budget, price goods and services and allocate capital. There are three main sources of financial risk: Financial risks arising from an organizations exposure to changes in market prices, such as interest rates, exchange rates, and commodity prices. Financial risks arising from the actions of, and transactions with, other organizations such as vendors, customers, and counterparties in derivatives transactions. Financial risks resulting from internal actions or failures of the organization, particularly people, processes and systems. Financial risk management is a process to deal with uncertainties resulting from financial markets. It involves assessing the financial risks facing an organization and developing management strategies consistent with internal priorities and policies. Addressing financial risks proactively may provide an organization with a competitive advantage. Organizations manage financial risk using a variety of strategies and products. It is important to understand how these products and strategies work to reduce risk within the context of the organizations risk tolerance and objectives.

1.1.2 Risk Management Process The word process connotes a continuing activity or function towards a particular result. The process is the vehicle to implement an organization s risk principles and policies, aided by organizational structure. In general, the process can be summarized as follows: Risk identification. Risk measurement.

Risk monitoring. Risk control. Risk management needs to be looked at as an organizational approach, as management of risks independently cannot have the desired effect over the long term. This is especially necessary as risks result from various activities in the firm and the personnel responsible for the activities do not always understand the risk attached to them. The steps in risk management process are as below: Determining objectives: determination of objectives is the first step and can be for protecting profits, or to develop competitive advantage. The objectives are to be decided by the management and the risk manager will fulfill his responsibilities in accordance with the objectives. Identifying risks: every organization faces risks, based on its economic, political, social and business factors, the features of the industry it operates in and other innumerable factors. Risk evaluation: once the risks are identified, they need to be evaluated for ascertaining their significance. The significance of a particular risk depends on the size of the loss that it may result in, and the probability of the occurrence of such loss. On the basis of these factors, the various risks faced by the corporate need to be classified as critical risks, important risks and not-soimportant risks. Critical risks are those that may result in the bankruptcy of the firm. Important risks are those which may not result in bankruptcy, but may cause severe financial distress. Development of policy: risk management policy is developed based on the risk tolerance level of the firm. For the policy to be relatively stable, the time frame should be long enough. Policy declares how much risk to take. Development of strategy: policy dictates the risk management strategy of the firm. Strategy specifies the nature of risk to be managed, timing, tools, techniques and instruments that can be used to manage these risks. Strategy also deals with tax and legal problems and whether the company would make profits or stick to covering existing risks. Implementation: this is the operational part of risk management. It includes finding the best deal in case of risk transfer, providing for contingencies in case of risk retention, designing and implementing risk control programs etc. Review: the function of risk management needs to be reviewed periodically, depending on the costs involved. The factors that affect risk management keeps changing, thus necessitating the need to monitor the effectiveness of the decisions taken previously. 1.1.3 Financial Risk Management Broadly speaking, risk management can be defined as a discipline for living with the possibility that future events may cause adverse effects. In the context of risk management in financial institutions such as banks or insurance companies these adverse effects usually correspond to large losses on a portfolio of assets. Specific examples include: losses on a portfolio of market-traded securities such as stocks and bonds due to falling market prices (a so-called market risk event); losses on a pool of bonds or loans, caused by the default of some issuers or borrowers (credit risk); losses on a portfolio of insurance contracts due to the occurrence of large claims (insurance or underwriting risk). An additional risk category is operational risk, which includes losses resulting from inadequate or failed internal processes, fraud or litigation.

In financial markets, there is in general no so-called free lunch or, in other words, no profit without risk. This is the reason why financial institutions actively take on risks. The role of financial risk management is to measure and manage these risks. Hence risk management can be seen as a core competence of an insurance company or a bank: by using its expertise and its capital, a financial institution can take on risks and manage them by various techniques such as diversification, hedging, or repackaging risks and transferring them back to markets, etc. 1.1.4 TYPES OF RISKS Risk faced by the bank can be segmented into three separable types from the management perspective viz. Risks that can be eliminated or avoided by simple business practices Risks that can be transferred to other business participants (e.g.: insurance policy) and, Risks that can be actively managed at the Bank level. Risk is any real or potential event, action or omission, internal or external, which will have an adverse impact on the achievement of bank s defined objectives. Risk is inherent in every business. Risk cannot be totally eliminated but is to be managed. Risks are to be categorized as high risk, medium risk and low risk and managed. Risks can be classified into three categories: Credit risk Market risk (interest rate risk, liquidity risk) Operational risk 1.1.4.1 CREDIT RISK Credit risk is the possibility of loss from a credit transaction. In a bank s portfolio, losses stem from outright default due to inability or unwillingness of a customer or counterparty to meet commitments in relation to lending, trading, settlement and other financial transactions. Credit risk emanates from banks dealings with individuals, corporate, bank, financial institution or a sovereign. Credit risk includes the following: Credit growth in the organization and composition of the credit folio in terms of sectors, centers, and size of borrowing activities so as to assess the extent of credit concentration. Credit quality in terms of standard, sub-standard, doubtful and lossmaking assets. Extent of the provisions made towards poor quality credits. Volume of off-balance-sheet exposures having a bearing on the credit portfolio. 1.1.4.2 MARKET RISK Market risk is the possibility of loss to a bank caused by changes in the market variables. Market risk is the risk to the banks earnings and capital due to changes in the market level of interest rates or prices of securities, foreign exchange and equities, as well as the volatilities of those prices. Segments of market risk Liquidity risk: liquidity risk is the potential inability to meet the bank s liabilities as they become due. It arises when the banks are unable to generate cash to cope with a decline in deposits or increase in assets. It originates from the mismatches of the maturity pattern of assets and liabilities. Interest rate risk: interest rate risk is the risk where changes in market interest rates might adversely affect a bank s financial condition. The immediate impact of changes in interest rates is on the net interest income.

Foreign exchange risk: foreign exchange risk may be defined as the risk that a bank may suffer losses as a result of adverse exchange rate movements during a period in which it has an open position, either spot or forward or a combination of the two, in an individual foreign currency. 1.1.4.3 OPERATIONAL RISK Operational risk is the risk of direct or indirect loss resulting from inadequate or failed internal processes, people, and systems or from external events Internal processes include activities relating to accounting, reporting, operations, tax, legal, compliance, and personnel management etc. Broadly the following can be grouped under operational risk: Internal fraud External fraud Non adherence of systems and procedures Poor documentation Business disruption due to computer systems failure Lack of succession planning Failure of customer due diligence 1.2 PROBLEM STATEMENT To analyze the credit risk management practices of Vijaya Bank and suggest ways to improve them. 1.3 OBJECTIVES To study the credit risk faced by Vijaya Bank. To analyze the process of credit risk management and the practices followed in Vijaya Bank. To analyze methods used by Vijaya Bank to mitigate their risks. To suggest ways to improve the credit risk management system in Vijaya Bank. 1.4 NEED AND SCOPE OF STUDY NEED In the fast changing world, banks are continuously exposed to huge credit risk which are due to the activities of the bank such as loans (constitute nearly 65% of the total assets of the scheduled commercial banks in India at the end of any normal financial year), investment in non-SLR instruments (7-9% of total assets at the end of any normal financial year), off balance sheet activities/items (6-7% of total assets at the end of any normal financial year), CRR and SLR locks up 25-30% of banks cash. Change in political, social and market factors also have great impact on credits owned/owed by banks. Credit risk is the main risk faced by banks at any point in time. Hence it is important to concentrate on the credit risk management of banks.

SCOPE OF STUDY Theoretical scope limited to analyzing the banks BASEL II disclosures, policy documents and various documents on credit risk management. 1.5 LIMITATIONS OF STUDY It is limited to Vijaya Bank. It is based on documents availability. Credit risk data is confidential to banks; hence primary data availability is difficult. It is based on data available in internet, books and research papers.

CHAPTER 2: LITERATURE REVIEW

Article 1 Title: Risk management in banks, 2003 Author: R. S. Raghavan About the Research: The author talks about the meaning of risk and the need for risk and risk management initially. Different types of risks and losses as defined by RBI guidelines are explained in detail. It also measures each type of risk by using VaR (Value at risk) or worst case type analytical model to determine both expected and unexpected losses. It also speaks about the minimum capital requirement as per RBI guidelines. Credit risk and tools for management of credit risk is explained in detail. It is said that credit risk is measured through probability of default (POD), loss given default (LGD) and also through credit quality over time. Credit risk management system should ideally show a single number to show how much a bank can lose on credit portfolio and how much capital they ought to hold. Market risk, tools to assess market risk and causes of market risk are explained in detail. Operational, regulatory and environmental risks are also explained. The 1988 BASEL capital accord and its features are explained. Capital adequacy and measurement of the same is explained in detail. It is said that India has a long way to go before they comprehend and implement BASEL II norms. Article 2 Title: An Empirical Analysis and Comparative Study of Credit Risk Ratios between Public and Private Sector Commercial Banks in India, 2011 Author: Somanadevi Thiagarajan (Ph.D. Scholar, Management Sciences, Anna University of Technology, Coimbatore, India Lecturer (on leave) Faculty of Management, University of Belize, Belize), A. Ramachandran (Director, SNR Institute of Management Sciences, SNR sons college, Coimbatore, India) About the Research: In this article, a study was carried out to measure the credit risk component of the Indian Scheduled Commercial Banking Sector by using data of ten years (2001-2010). It illustrates how credit risk ratios can be used to measure the credit risk in the banking sector. The results of the study indicate a consistent increase in the total loans

to total assets ratio and the total loans to total deposits ratio for both public and private sector during the period of study. There was a gradual decrease in the ratio of nonperforming loans to total loans for both public and private sector banks from 2001 to 2008 but there has been a gradual increase from 2009 to 2010 and this is significantly higher for private sector banks as compared to public sector banks. Also the study indicates a significantly drastic increase in the total loans to total equity ratio in the public sector banks in the last four years. It also indicates that banks can have their own risk management practices but has to be appropriately disclosed. Article 3 Title: Risk management in Indian banks: Some emerging issues, 2010 Author: Dr. Krishn A. Goyal, Convener & Head, Management Department, Bhupal Nobles (P.G.) College, Udaipur, Prof. Sunita Agrawal, Director, Pacific Business School, Udaipur (Raj.) About the Research: The article speaks about the various types of risks the banks face in the current scenario. It speaks about the need for risk management and the process of risk management. The tools required for risk control such as diversification of business, insurance and hedging, fixation of exposure ceiling, and transfer of risk to another party on time, and securitization and reconstruction are also mentioned. It also talks about the structure of BASEL II. Capital ratio is defined as,

This is minimum capital requirement for banks to manage credit risk. It also talks about the implementation challenges faced by Indian banks in light of risk management, such as implementation of new framework which requires substantial resources, increase in capital requirements due to new norms, data intensiveness of risk management, building models and forecasting, and trained and skilled manpower. Article 4 Title: Credit risk management in Banks: Hard information, Soft information, and manipulation, December 2005 Author: Brigitte Godbillon-Camus and Christopher J. Godlewski1, LaRGE, Universities Robert Schuman, Strasbourg III About the Research: The research is about the two types of information a bank has. One is hard information, which is present in balance sheet and produced with credit scoring, and is quantifiable and verifiable. Second is soft information, which is produced in bank relationship and is qualitative, non-verifiable but manipulable. The results of the research show that soft information allows the banker to decrease the capital allocation for VaR coverage. So the banker should be given sufficient incentive to not change the soft information as it is a crucial input to risk management. Article 5 Title: Credit as well as credit risk management in banks, February 2005 Author: R S Raghavan About the Research:

Lending methods adopted by banks is a combination of turnover method, cash flow method, cash budget method, projected balance sheet method, net owned fund method and the popular one-size fits all second method of lending. Credit monitoring is an important function of credit management. Credit department should be expertise oriented. Credit risk components include quantity and quality of risk. Exposure ceilings, review/renewal, risk rating model, risk based scientific pricing, portfolio management, credit audit/loan review mechanism are the tools of credit risk management. It concludes that banks should lend according to their risk appetite within the need based assessment of the credit requirement of the borrower. An ideal credit risk management system should show a single number as to how much the bank would lose on credit portfolio and how much capital it ought to hold. Article 6 Title: Real-time FX credit risk management: a sell-side challenge, June 2007 Author: A Client Knowledge insight paper About the research: The market practice for FX credit risk management varies widely. Existent pre-trade checks are not always based on real time calculation. It is most widely based only on settlement risk and then the post-trade market to market generally against the previous days closing. Possession of legacy credit risk management systems that would require replacement in preference for newer systems that could accommodate multi- asset class risk assessment as well as faster pre-deal checks based on real time calculations are emphasized for. Developing a front office credit solution that improves areas noted above would be desirable but need to be addressed only after addressing the core credit system revision.

Article 7 Title: BASEL II implementation retail credit risk mitigation, Banks and Bank Systems, Volume 3, Issue 2, 2008 Author: Marek Dohnal (Czech Republic) About the research: It introduces credit risk mitigation (CRM) as the methodology for the recognition of collateral for retail lending which is BASEL II compliant. CRM technique reduces credit risk associated with an exposure or exposures which the credit institution continues to hold. CRM can be applied in two approaches that BASEL II offers for the retail segment: standardized approach and internal rating based approach. The risk components include measures of the probability of default (PD), loss given default (LGD), and the exposure at default (EAD) and serves as inputs to risk weight

functions that have been developed for separate asset classes. CONCLUSION The above literature review helps us understand the basic definitions of risk, credit risk, market risk, operational risk, risk management, credit risk management, credit risk mitigation, forex risk, probability of default, loss given default, and exposure at default etc. The study clearly defines the need for credit risk management, compliance with BASEL II norms, tools for credit monitoring, need for safeguarding soft information, methods used for credit risk management, and responsibilities of credit risk management committee. It can be concluded that credit risk management is very important in the fast growing world. Compliance with BASEL II helps in better policies and easier credit risk mitigation by banks.

CHAPTER 3: RESEARCH METHODOLOGY 3.1 RESEARCH DESIGN

This is a descriptive research explaining what the banks (Vijaya Bank) credit risk management practices are. An analysis is done to understand their credit risk management status and suggest ways to improve the same. 3.2 DATA COLLECTION METHODS AND SOURCES This research is based on secondary data as primary data is confidential to banks and is not available. The secondary data is derived from RBI website and various other related websites and books. The secondary data comprises of understanding credit risk management as a subject and its parameters. These parameters comprise of the various guidelines framed by RBI for all banks for better credit risk management. 3.3 SAMPLING TECHNIQUES No sampling technique used. 3.4 TOOLS OF ANALYSIS

MS Excel 2007.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Dmgt505 Management Information SystemDocument272 pagesDmgt505 Management Information SystemJitendra SinghNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

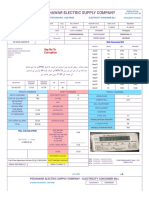

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)zaki ansariNo ratings yet

- SOP - HOtel Credit Policy and PRoceduresDocument4 pagesSOP - HOtel Credit Policy and PRoceduresImee S. YuNo ratings yet

- Business Law and Regulations - CorporationDocument15 pagesBusiness Law and Regulations - CorporationMargie RosetNo ratings yet

- DA4139 Level II CFA Mock Exam 1 AnswersDocument84 pagesDA4139 Level II CFA Mock Exam 1 AnswersHelloWorldNowNo ratings yet

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- Asset Liability Management in BanksDocument47 pagesAsset Liability Management in BanksHeema Nimbeni100% (3)

- A Study On Analysis of Financial Statements of Bharti AirtelDocument48 pagesA Study On Analysis of Financial Statements of Bharti AirtelVijay Gohil74% (23)

- EPIC Consulting GroupDocument13 pagesEPIC Consulting GroupMuhammad Moazam Shahbaz100% (1)

- URBAN REVITALIZATION AND NEOLIBERALISMDocument50 pagesURBAN REVITALIZATION AND NEOLIBERALISMJoviecca Lawas67% (3)

- Shivashakti Refrigerator Cost and Tax DetailsDocument1 pageShivashakti Refrigerator Cost and Tax DetailsHeema NimbeniNo ratings yet

- Company Profile - State Bank of HydrerabadDocument7 pagesCompany Profile - State Bank of HydrerabadHeema NimbeniNo ratings yet

- Heromotorsfinal 120929142359 Phpapp02Document27 pagesHeromotorsfinal 120929142359 Phpapp02Heema NimbeniNo ratings yet

- Credit Risk Management in South Indian BankDocument73 pagesCredit Risk Management in South Indian BankHeema Nimbeni0% (1)

- A Study of Advertising and Sales Promotion of Hero Two WheelersDocument65 pagesA Study of Advertising and Sales Promotion of Hero Two Wheelersabhijit055100% (9)

- Introduction To Credit Risk Management ProjectDocument22 pagesIntroduction To Credit Risk Management ProjectHeema NimbeniNo ratings yet

- Credit Risk ManagementDocument11 pagesCredit Risk ManagementHeema NimbeniNo ratings yet

- Arihant Jain DDM-05-10Document85 pagesArihant Jain DDM-05-10Aamer JoshiNo ratings yet

- Karnataka Handloom Development Corporation LTDDocument1 pageKarnataka Handloom Development Corporation LTDHeema NimbeniNo ratings yet

- Milano v. HellieDocument22 pagesMilano v. HellieTHROnline100% (1)

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- Jun 2003 - AnsDocument15 pagesJun 2003 - AnsHubbak KhanNo ratings yet

- Research Paper ITL401Document16 pagesResearch Paper ITL401Horksrun SamrongNo ratings yet

- Rental Quotation (Template)Document2 pagesRental Quotation (Template)I CNo ratings yet

- Logistic Industry Employee PersonalityDocument10 pagesLogistic Industry Employee Personalityjoel herdianNo ratings yet

- Industrial Organization Chapter SummaryDocument54 pagesIndustrial Organization Chapter SummaryNaolNo ratings yet

- ACTBAS1 - Lesson 2 (Statement of Financial Position)Document47 pagesACTBAS1 - Lesson 2 (Statement of Financial Position)AyniNuydaNo ratings yet

- Burger King KFC McDonaldsDocument6 pagesBurger King KFC McDonaldsAnh TranNo ratings yet

- Unit 4 Bank Transactions: Word PolishDocument2 pagesUnit 4 Bank Transactions: Word PolishAndini PutriNo ratings yet

- Realizing The American DreamDocument27 pagesRealizing The American DreamcitizenschoolsNo ratings yet

- Chapter 2 The Marketing Environment Social Responsibility and EthicsDocument32 pagesChapter 2 The Marketing Environment Social Responsibility and EthicsAnhQuocTranNo ratings yet

- Volume 1Document50 pagesVolume 1rivaldo10jNo ratings yet

- Chapter 13Document5 pagesChapter 13Marvin StrongNo ratings yet

- 7 Redemption of Preference Shares ColourDocument4 pages7 Redemption of Preference Shares Colourjhanani karthikaNo ratings yet

- Nikolasdebremaekerresume Docx 5Document2 pagesNikolasdebremaekerresume Docx 5api-344385996No ratings yet

- SEC CasesDocument18 pagesSEC CasesRainidah Mangotara Ismael-DericoNo ratings yet

- Calculation of Total Tax Incidence (TTI) For ImportDocument4 pagesCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNo ratings yet

- Customer Updation Form For Non IndividualDocument3 pagesCustomer Updation Form For Non IndividualThamilarasan PalaniNo ratings yet

- Reverse LogisticDocument8 pagesReverse LogisticĐức Tiến LêNo ratings yet

- The Financial Statements of Banks and Their Principal CompetitorsDocument30 pagesThe Financial Statements of Banks and Their Principal CompetitorsMahmudur Rahman100% (4)