Professional Documents

Culture Documents

IPO Exits Factsheet

Uploaded by

Pushpak Reddy GattupalliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IPO Exits Factsheet

Uploaded by

Pushpak Reddy GattupalliCopyright:

Available Formats

Preqin Research Report

Private Equity-backed IPOs

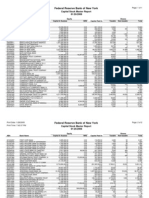

Fig. 2: Notable Forthcoming Proposed PE Buyout-Backed IPOs

Name

Deal Date Jul-06

Buyers Bain Capital, Citigroup, Kohlberg Kravis Roberts, Merrill Lynch Global Private Equity, Ridgemont Equity Partners CVC Capital Partners BC Partners Oaktree Capital Management, Indigo Capital Ares Management, Ontario Teachers' Pension Plan Board

Currency USD

Deal Size Date (mn) Reported 33,000 Dec-10

Type IPO

Planned Offering (mn) 3,720

Industry Healthcare

Location US

Following the downturn caused by the global nancial crisis in mid-2008, market conditions have started to improve, allowing private equity rms to exit some of the investments made during the boom era. As shown in Fig. 1, during 2010, 145 IPOs and share sales occurred with an aggregate value of $38.7 billion, twice the aggregate value seen in 2009, and a twelve-fold increase in comparison to 2008, the lowest point for IPO activity in recent years. As Fig. 3 shows, 17% of PE-backed exits in 2010 came from IPOs and share sales, a signicant increase from 2008, when only 5% of exits were made via IPOs. The returning appetite of investors has fuelled several notable PE-backed IPOs/private placements since the start of 2010. Notable examples can be seen in Fig. 4 and include the oatation of TDC A/S, a Danish telecommunications company backed by Apax Partners, Blackstone, KKR, Permira and Providence Equity Partners. The rm was purchased back in 2006 for DKK 76 billion, one of the largest buyout deals in Europe at the time. The rms offering was fully subscribed in December 2010, raising DKK 12.3 billion. Another company acquired during the buyout boom that recently reoated on the public markets is Kinder Morgan, which raised $2.865

HCA, Inc.

Samsonite Corporation Fitness First Spirit Airlines GNC

Jul-07 Sep-05 Feb-04 Feb-07

USD GBP USD USD

1,700 835 125 1,650

Feb-11 Feb-11 Sep-10 Sep-10

IPO IPO IPO IPO

1,000 341 300 350

Consumer Products Leisure Transportation Retail

US US US US

billion in February 2011, pricing its shares above the expected range due to strong demand. As the economy continues to recover from the nancial crisis, we expect to see more PE rms exiting their investments, either through trade sales, secondary transactions or IPOs. Each month Preqin Private Equity Spotlight examines an aspect of the private equity buyout market to gain some insights into the trends and developments within the industry. Sign up today: www.preqin.com/spotlight

Preqin provides information, products and services to private equity rms, fund of funds, investors, placement agents, law rms, advisors and other professionals across the following main areas: > Fund Performance > Fundraising > Fund Manager Proles > Investor Proles > Fund Terms > Compensation and Employment > Buyout Deals Available as: > Hard Copy Publications > Online Database Services > Consultancy and Research Support > Tailored Data Downloads For more information and to register for a demo, please visit:

Fig. 1: Semi-Annual Number and Aggregate Value of PE BuyoutBacked IPOs/Private Placements, 2006 - 2011 YTD

Fig. 3: Breakdown of PE Buyout-Backed Exits by Type, 2006 - 2011 YTD

Proportion of Total Number of Exits

100 90 80 70

30.0 25.0

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

1% 30%

1% 32%

8% 18%

4% 26%

7% 25%

Aggregate Exit Value

31%

20.0 15.0 10.0 5.0 0.0 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 2006 2006 2007 2007 2008 2008 2009 2009 2010 2010 2011 Number of Deals Aggregate Exit Value

16%

No. of Exits

60 50 40 30 20 10 0

53%

56% 57%

51%

53%

53%

16% 2006

12% 2007 IPO Trade Sale

15% 5% 2008 2009

17% 2010

15%

www.preqin.com/privateequity

2011 YTD Restructuring Source: Preqin

Source: Preqin

Sale to GP

2011 Preqin Ltd. / www.preqin.com

Fig. 4: 10 Notable PE Buyout-Backed IPOs/Private Placements, 2010 - 2011 YTD

Name Kinder Morgan

Deal Date May-07

Buyers Carlyle Group, GS Capital Partners, Riverstone Holdings, AIG Apax Partners, Blackstone Group, Kohlberg Kravis Roberts, Permira, Providence Equity Partners AlpInvest Partners, Blackstone Group, Carlyle Group, Hellman & Friedman, Kohlberg Kravis Roberts, Thomas H Lee Partners Axcel Carlyle Group BC Partners, Cinven, Air France, Deutsche Lufthansa, Iberia TPG

Currency USD

Deal Size Exit Date (mn) 22,400 Feb-11

Exit Type IPO

Exit Size (mn) 2,865

Industry Energy

Location US

TDC A/S

Oct-05

DKK

76,000

Dec-10

Private Placement

12,300

Telecoms

Denmark

The Nielsen Company

Mar-06

USD

12,034

Jan-11

IPO

1,890

Information Services

US

Pandora China Pacic Life Insurance Amadeus

Mar-08 Dec-05 Jul-05

DKK USD EUR

1,100 410 4,340

Oct-10 Jan-11 Apr-10

IPO Private Placement IPO

9,737 1,790 1,320

Consumer Products Insurance IT

Denmark China Spain

Ping An Insurance Group Brenntag Chr. Hansen Sihuan Pharmaceutical

May-10

USD

May-10

Private Placement IPO IPO IPO

1,250

Insurance

China Preqin provides information, products and services to private equity rms, fund of funds, investors, placement agents, law rms, advisors and other professionals across the following main areas: > Fund Performance > Fundraising > Fund Manager Proles > Investor Proles > Fund Terms > Compensation and Employment > Buyout Deals Available as: > Hard Copy Publications > Online Database Services > Consultancy and Research Support > Tailored Data Downloads For more information and to register for a demo, please visit: www.preqin.com/privateequity

Jan-04 Apr-05 Aug-09

Bain Capital, BC Partners PAI Partner China Pharma, Morgan Stanley Private Equity Asia

EUR DKK USD

1,400 8,200 318

Mar-10 Jun-10 Oct-10

748 5,520 852

Chemicals Chemicals Pharmaceuticals

Germany Denmark China

Data Source:

Included as part of Preqins integrated 360 online private equity database, or available as a separate module, Deals Analyst provides detailed and extensive information on private equity backed buyout deals globally. The product has in-depth data for over 20,000 buyout deals and 7,500 exits across the globe, including information on 1,000 IPOs and private placements, containing information on deal and exit value, buyers, sellers, debt nancing providers, nancial and legal advisors, and more www.preqin.com/deals

2011 Preqin Ltd. / www.preqin.com

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Great IndiaDocument1 pageGreat IndiaPushpak Reddy GattupalliNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- FDI - Retail & TelecomDocument3 pagesFDI - Retail & TelecomPushpak Reddy GattupalliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Return Analysis:: Table Showing FMCG Movements From JAN-2014 To JAN-2015Document15 pagesReturn Analysis:: Table Showing FMCG Movements From JAN-2014 To JAN-2015Pushpak Reddy GattupalliNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Brief Particulars of Transferor and Transferee CompanyDocument7 pagesBrief Particulars of Transferor and Transferee CompanyPushpak Reddy GattupalliNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- OCTEI Listed StocksDocument11 pagesOCTEI Listed StocksPushpak Reddy GattupalliNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Private Equity Quarterly Q1 2011Document28 pagesPrivate Equity Quarterly Q1 2011Pushpak Reddy GattupalliNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Real Estate Quarterly Q1 2011Document20 pagesReal Estate Quarterly Q1 2011Pushpak Reddy GattupalliNo ratings yet

- Analysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioDocument10 pagesAnalysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioPushpak Reddy GattupalliNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Private Equity-Backed IPO Exits Top $10bn in 2011 Year To DateDocument1 pagePrivate Equity-Backed IPO Exits Top $10bn in 2011 Year To DatePushpak Reddy GattupalliNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Credit & Recovery - HDFCDocument50 pagesCredit & Recovery - HDFCPushpak Reddy GattupalliNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Investleaf - MarketingDocument4 pagesInvestleaf - MarketingPushpak Reddy GattupalliNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Questionnaire of Emp MotvnDocument6 pagesQuestionnaire of Emp MotvnPushpak Reddy GattupalliNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Pe-Backed Ipos See Record Deals Sizes in Q1 2011Document4 pagesPe-Backed Ipos See Record Deals Sizes in Q1 2011Pushpak Reddy GattupalliNo ratings yet

- E-Sbbj New Ifsc Details - 09052017Document108 pagesE-Sbbj New Ifsc Details - 09052017ssagrawal2000No ratings yet

- REITs - Google Finance SearchDocument3 pagesREITs - Google Finance SearchClark MNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- FrbNY Owners2 PDFDocument3 pagesFrbNY Owners2 PDFqvlwvtppNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bnwas e 1Document2 pagesBnwas e 1sajujohny100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Pharma Companies 1Document3 pagesPharma Companies 1Devesh JhaNo ratings yet

- Features of Stock ExchangeDocument9 pagesFeatures of Stock Exchangeanon_960379825No ratings yet

- Sr. No. Name of Institution Address Board Line Fax No.: 1 Allahaba D BankDocument9 pagesSr. No. Name of Institution Address Board Line Fax No.: 1 Allahaba D Banksaurs2No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ate Dec 2013Document7 pagesAte Dec 2013Asim JavedNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Block Development and Circle Officers Contact DetailsDocument3 pagesBlock Development and Circle Officers Contact Detailschandan kumarNo ratings yet

- NLSS Showcase On 28th Feb 2012: JR PatrickDocument7 pagesNLSS Showcase On 28th Feb 2012: JR PatrickSumitNo ratings yet

- List of Financial Institutions in Kse XleDocument13 pagesList of Financial Institutions in Kse XleMahmood KhanNo ratings yet

- Forbes MIDAS TouchDocument4 pagesForbes MIDAS Touch1stabhishekNo ratings yet

- Customer Facilitation Centre - NeftDocument15 pagesCustomer Facilitation Centre - Neftraj.kajaniyaNo ratings yet

- All Banks and Bank Branches in India IFSC Code ListDocument4 pagesAll Banks and Bank Branches in India IFSC Code ListsraguNo ratings yet

- ComScore - Canadian Digital BankingDocument8 pagesComScore - Canadian Digital BankingSameer ChhabraNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Summary of Placement For The Batch - 2019-20: VNR Vignana Jyothi Institute of Engineering & TechnologyDocument1 pageSummary of Placement For The Batch - 2019-20: VNR Vignana Jyothi Institute of Engineering & TechnologyAmalley ChloeNo ratings yet

- Private Debt Investor Special ReportDocument7 pagesPrivate Debt Investor Special ReportB.C. MoonNo ratings yet

- Sap Company ListDocument11 pagesSap Company ListMohammed Nawaz ShariffNo ratings yet

- S&P CDO Deal List Through 041202Document104 pagesS&P CDO Deal List Through 041202api-3742111No ratings yet

- Rajas 2Document4 pagesRajas 2DEEPALINo ratings yet

- Crypto Investors, Venture Capitalists, Incubators & MoreDocument39 pagesCrypto Investors, Venture Capitalists, Incubators & MoreBhgfy hbjNo ratings yet

- BanksDocument16 pagesBanksjofer63No ratings yet

- Investment Banking Summer Internship OpportunitiesDocument5 pagesInvestment Banking Summer Internship OpportunitiesAzzurra123No ratings yet

- ASCE - Member ListDocument4 pagesASCE - Member ListJohn WickNo ratings yet

- 18 - Ca Firms in DelhiDocument6 pages18 - Ca Firms in DelhiRashmikantNo ratings yet

- AH 0109 AlphaStarsDocument1 pageAH 0109 AlphaStarsNagesh WaghNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- InstiownDocument11 pagesInstiownLoriGirlNo ratings yet

- Prohibited Company List: All Covered Securities For These Companies Are RestrictedDocument1 pageProhibited Company List: All Covered Securities For These Companies Are RestrictedBenedictNo ratings yet

- Singapore Law FirmsDocument2 pagesSingapore Law FirmsJashanNo ratings yet

- 50 Future Unicorn CompaniesDocument4 pages50 Future Unicorn CompaniesDeen SanwoolaNo ratings yet