Professional Documents

Culture Documents

An Evaluation of The Effectiveness of Public Financial Management System Being Used by Government Departments in Zimbabwe.

Uploaded by

Alexander DeckerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Evaluation of The Effectiveness of Public Financial Management System Being Used by Government Departments in Zimbabwe.

Uploaded by

Alexander DeckerCopyright:

Available Formats

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.

4, 2013

www.iiste.org

An Evaluation of the Effectiveness of Public Financial Management System being used by Government Departments in Zimbabwe. (2000 2011)

Donnelie K Muzividzi Department of Accounting Sciences and Finance Chinhoyi University of Technology, School of Business Sciences and Management P. Bag 7724, Chinhoyi, Zimbabwe Abstract: The study sought to assess the effectiveness of the Public Financial Management System (PFMS) in financial planning, controlling and monitoring of public funds in government line ministries in Zimbabwe. The study was largely prompted by the fact that despite having professionalized it functions and putting in place a system of responsibility accounting system in 2003, the ministries were still facing a lot of challenges. The primary research (literature review) revealed features required for an effective monitoring, controlling and planning of public funds. It was emphasized that the government should be accountable on the use of public funds. The study was understood in the realism paradigm and employed both qualitative and quantitative (triangulation) methods of data collection. Exploratory study was chosen for this study in as far as it explored to find out the effectiveness of PFMS in government line ministries. Exploratory was useful in clarifying the understanding of the problem, especially when the researcher was not sure of the precise nature of the problem. The target population for the study were all employees who held management positions and a sample of 70 employees from the government line ministries was used. Systematic sampling (probability sampling) and purposive or judgemental sampling (non-probability sampling) were used in this study. The research employed questionnaires and observations as instruments for gathering data.The researcher revealed that the PFMS is able to produce budgets from the budget proposal up to the final document. The system has effective internal controls with an exception on payment procedures and production of reconciliation statement. The end users are not adequately trained to use the system.Based on the findings of the study and conclusion the researcher makes the following recommendations: the system needs reliable internal control monitoring on payment procedures. The officers need to be trained on how to use the PFMS in the production of reconciliation statement. The training period of the PFMS need to be increased from 8 to 12 hours. Most respondents pointed out that they were not adequately trained to use the system. The study recommends more intensive training of officers in the application of PFMS. Key words: Budget, Public Finance Management System, Internal Controls Introduction The Government of Zimbabwe in the bid to control, monitor and supervise the management of public funds introduced a computer based financial management information system for the treasury to have access to all line ministries. This system is known as the Public Financial Management System (PFMS) and Ernest and Young helped its design and development. There must be strategic control of aggregate spending, priority setting and facilitation of greater efficiency and effectiveness through delegation of management authority and accountability. Decision makers at all levels in the public sector need a more improved and useful information, this means that the government accounting and budgeting needs to be innovated in order to enhance the effectiveness and efficiency of its accounting package. The government of Zimbabwe should be positive and open with public by not limiting the amount of information it reports on its own performance, thereby at the same time enhancing transparency to the nation. The government accounting system has to be able to provide appropriate information for decision making processes and has to be useful to politicians and managers for discussing the strategy in order to achieve the objectives (Gimeno 1997). Background to the research: The PFMS is a computer based system which enables government line ministries to carry out their financial transactions. It was introduced in Zimbabwe in 1997 in a bid to control, monitor and supervise the management of public funds. It is a single system through which process all expenditure and receipts. The Treasury centrally manages the system through Central Computing Services (CCS) and accountant generals department under the ministry of finance is responsible for the operation of the system.

17

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

In a way to overcome some of the existing problems in the formulation and production of budgets, weak internal controls and training end users, the government replaced the old system based at the central payment office with PFMS. The old system used centralized data capture at the point at which the transactions were already authorized, it was not integrated as it used batch update and it was not user friendly as it did not provide online enquiry and it used codes limited to financial accounting only.With the use of the old systems the ministries were regularly overspending their budget allocations and this increased in budget deficit. During the early 1990s, the government introduced the stop payment at the central payments office. However, the system was now effective and efficient that the various stakeholders concerned about public funds management were disappointed because financial reports on how the government was performing took unreasonable time to be computed and submitted for scrutiny. This affected timely decisions in terms of financial planning. Ministries failed to properly manage suspense accounts and this resulted in under budgeting. Proper budgeting was highly as the carry -overs of expenditures from previous years. The system at central payment office failed to pay suppliers on time and this affected government operations as suppliers withheld their services. Due to manipulation of the system frauds occurred and misappropriation of funds were experienced. Although public financial management system was expected to effective and user friendly, the situation on the ground was that ministries were still having problems in the budgeting process, internal controls and training of end users. Suppliers to the government were still complaining of inefficiency in financial reports updates. This promoted this study to evaluate and assess the effectiveness of the new adopted accounting package (PFMS) in financial planning and control of public funds in Zimbabwe. Justification of the research: The AFDB operated in RMCs where corruption was prevalent and transparency often lacking. Corporate accounting scandals occurred where internal controls were abused by those responsible for their operational effectiveness. The corruption Perception Index (CPI) 2006, compiled by Transparency International covering 163 countries, revealed that majority of the African countries in the index scored within the range of 4.1-4.6. The corruption Perception Indices suggested a prevalence of corruption in African countries. This implied that the Public Sector Projects funded by AFDB could be in countries where transparency and accountability were lacking, together with the risk of senior public officers overriding internal controls to achieve their private gains. Given such control environment within the RMCs, the AFDB operations faced difficult and challenging scenarios. This study investigated whether the controls used for directing, controlling and financial planning of public funds in government departments were effective to ensure utilisation of funds for economic growth and development purposes. This study also provided a framework for assessing and understanding the structures of the systems of internal controls currently in use the government line ministries. According to Christopher C. (2003: 345) the function of the management of the government line ministries was to have sound internal auditors who complemented the effectiveness of the internal controls of the PFMS and maintain appropriate systems for accounting and internal over financial reporting. The internal auditors would help the management and directors of finance to carry out audit consistent of the effectiveness of the internal controls of PFMS in government line ministries. Cowan (2004:145), argued that the risk management was crucial to the implementation and it had become the component of effective modern management and further pointed out that the effectiveness of internal controls of PFMS should be properly checked by auditors who had the independence and management should be separated from this duty since they were interested parties in the accounts departments. Accordingly, an internal audit function, designed and deployed effectively, had a positive impact on the control environment of an entity and on the effective design and operation of internal controls. As an important aspect of internal auditors mandate, they could provide the managers and directors of the government line ministries with the impact of the effectiveness of the PFMS in financial planning and control of public funds. James,(2008:04), emphasized that the connection between the auditors and management of the organization has grown more important in light of recent accounting reform and this was supported by the King II Report on Corporate Governance 2002 which indicated that auditors should be appointed to assist the management in reviewing the effective internal controls and the significant risks facing the organization. Whilst the involvement of auditors with management of the organization was good idea in the effective controls of PFMS, McMullen, (1996:01), argued that for effective internal controls of PFMS, auditors should have solely outside management and directors because they are not employees of the organization. This was true in that managers would not be reluctant to the financial reporting problems. Gildenhuys (1993:43) stated that financial management is based on certain fundamental democratic values serving as principles in PFMS and the principles were: a) Public financial decisions should always aim at a reasonable and equitable manner in which public financial resources could be allocated, as well as at the most effective and efficient way. 18

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

b) The executive authoritys responsibilities were to ensure that a programme had been executed effectively and efficiently. The above principles intended to inculcate a financial management culture that focused on effective internal controls in the use of government resources. On the same sentiment, the World Bank (2005:1) argued that a good PFMS was essential for implementation of policies and achievement of development objectives by supporting aggregate fiscal discipline, strategic allocation of resources and efficient service delivery. Most importantly, it maintained a single version of truth for all reports, in that the various financial systems used by different national and provincial departments could have the same basis for data classification, ensuring consistency in the financial reporting dissemination into the public domain (New Economic Reporting Format, 2003:13) Theory and Empirical Studies The theory related to public financial management that is discussed focuses on budget process, financial controls and features of a typical PFMS. According to Parag (1999), financial management is concerned with proper management of public funds, budget process, the internal controls and continues training of users and it involves managerial decisions that result in the procurement and utilization of finances and deals with planning, organizing, directing and controlling the financial activities of an organization. The following Treasury manual states the budget process from initiation, approval, execution and checking by auditor general. Budget Process: The theory related to public financial management that is discussed focuses on budget process, financial controls and features of a typical PFMS. According to Parag (1999), financial management is concerned with proper management of public funds, budget process, the internal controls and continues training of users and it involves managerial decisions that result in the procurement and utilization of finances and deals with planning, organizing, directing and controlling the financial activities of an organization. The following Treasury manual states the budget process from initiation, approval, execution and checking by auditor general. According to Wayne (2005) a proper core of financial functions should include, budget process, internal controls, cash management and disbursement and training of end users on use of the system. Many PFMS lack a core cash management function that ensures adequate cash to disburse against the commitment. The objective of this study was to check effectiveness of the PFMS on budget process, existence of internal controls and training of end users. Their findings showed that budgetary control requires the use of an accounting package which would assist in public financial management of public funds. According to Peterson (2006) the PFMS is the good package which would assist in achieving pre stated financial management control of public funds. A PFMS provides government with a tool that can support financial control, management and planning. By managing a core set of financial data and translating this into information for management. According to Peterson (2006), PFMS is a computer application that integrates key financial functions (e.g. accounts, budgets process, internal controls, etc) and promotes efficiency and security of data management and comprehensive financial reporting. A PFMS is one way to address the problem of stove-piped financial systems that do not talk to each other and do not produce a timely and comprehensive picture of a countrys financial position. The following Figure presents the features of PFMS. To determine the effectiveness of the PFMS Mwansa, et al (2005) conducted a research to evaluate the performance of Public Financial Management in Zambia. The objective of the study was to check on the effectiveness of the system in the production of budgets, internal controls and training of users when using such a package. The key personnel involved were managers and directors of government line ministries. The results of the study were that, their system was effective in production of budgets and had effective internal controls. There had been great improvements in recent years and the government, since 2005 has been meeting the statutory requirement of submission of the financial reports timeously. The same method was adopted on this study so as to determine the effectiveness of the PFMS in government line ministries. The problems with the performance of the PFMS became evident by the earls 1990s characterized by routine overspending by ministries, delays in preparing financial statements and increased fraud and negative external audit opinions. The government of Zimbabwe in 1994 started a range of public financial management and accountability reforms towards transparency and accountability. The reforms included drafting of Public Financial Management and Audit Acts; and embarking on results based budgeting programme. The reform process slowed markedly from the late 1990s and had completely stalled by 2005. Hyperinflation and the skills 19

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

exodus from the public sector and from Zimbabwe impacted negatively on the effectiveness of PFMS and accountability systems, threatening day to day operations from the reform. Some human resources existed but not adequate in numbers and quality to perform some critical functions and optimal utilization largely due to lack of working facilities. The shortfall has been found to have two dimensions: the technical dimension and the governance dimension. On the technical dimension, the effectiveness of the PFMS has been reduced due to failure to maintain the system and inability to cope with number of digits due to hyper inflation. On the governance dimension, some existing regulations and procedures were not followed and this phenomenon pointed to weakness in implementation, monitoring and follow up. The outcome has been loss of confidence in the PFMS resulting in increasing volume of transactions taking place outside normal PFMS. The United Nations Executive Committee Agencies (EXCOM) adopted a common operation called the harmonized approaches to cash transfer framework for transferring cash to government and non government partners in the implementation of development activities. The objectives of the research were to improve implementing partners capacity to effectively manage financial resources. A project start up was held between the United Nations; inter Agency Support Unit (UNIASU) and Zimbabwe. The purpose of the meeting was for the parties to agree on the timing of the assessment and to sample key stakeholders to be interviewed. As a result of that meeting, institutions that would be involved in the survey were agreed upon. The rational of selecting these was based on the volume of transactions, the potential of funding to that entity and the importance of the sector and its strategic importance to the nation. In order for them to understand how the Public Financial Management System works in Zimbabwe a number of data collection methods were adopted. The findings of the research were as follows; the overall budgetary system was sound and involved the development of an annual budget that is tabled in Parliament and approved prior to the start of the financial year. The internal controls were found to be effective. The following study examines the effectiveness of public expenditure of state governments of Niger. Okeley (2004) conducted a research in which he examined the effectiveness of public expenditure of state governments of Nigeria. The methodology of the study Blended primary survey based data with secondary information from documentary sources. The latter involved the extraction of relevant public finance data relating to planned and actual recurrent and capital receipts and expenditure form government documents of the ministry. Relevant output indicators available in published documents were also assembled. In respect of primary data, a field survey was carried out in 36 states of the federation using structured questionnaires. The questionnaire addressed a broad number of issues including service delivery, budget process, audit systems, compliance with rules and public procurement procedure. The primary analytical method used in this design was descriptive analysis. This included frequency counts, ratios, proportional distributions and percentages. The analysis of government expenditure by state showed that Imo state had the best practices as far as expenditure on education financing was concerned. The findings from the analysis also indicated that Nassarana state had been exceeding its budget since year 2000, especially with respect to recurrent expenditure on education. The study further revealed that most states had serious problems with financing their education and health sectors. The PFMS in Zimbabwe would also assist in the budget process, internal controls and training of end users on the use of the financial package. Similarly according to the research conducted by the United Nations (2002) in Zimbabwe the final accounts for each year were submitted to Treasury and Comptroller and Auditor General. The required deadlines were net because of the use of the accounting package and recruitment of qualified finance personnel. The financial budgets were made public in parliament. To find out the extend at which PFMS has done to execute the budget process Abu-Musa (2003) conducted a research in Saudi Arabia in which he explored the perceived threats of computerized accounting information systems in emerging countries. The objective of the study was to investigate the use of accounting packages on budgeting process, internal controls on financial management of public funds. A self-administered questionnaire was used to collect data needed to investigate and test the research hypothesis. The results showed that proper financial management control of public funds required use of an accounting package for accuracy and effectiveness. This is the similar approach the researcher adopted to find out the extent at which PFMS had done to execute the budget process. In this study, the researcher found out that the budget outrun significantly differed from the original budget making the original budget tool an unreliable tool. Supplementary budgets have been a regular feature, but over time off budget expenditure with no parliamentary approval outstripped budgeted expenditure. With the breakdown of the PFMS hyperinflation economy, expenditure arrears increased as commitment controls became less effective. The challenge was to 20

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

deal with the consequences and implications of restoring the system and ensuring effective budget accounting and quick legislation of PFMS Bill and Audit Bill. The local government chronicle UK (November 2001) setting government budgets is about finding a balance between competing political priorities in environment where external factors dominate available resources. The quotation above applied to Zimbabwe due to scarcity of resources as such decisions were made on popularity and not on economic basis and the one with power exerted more influence on financial planning and controls of public funds and this failed PFMS to execute the budget process. With reference to the legal framework, section 215 (1) of the constitution of the Republic of South Africa stated that national, provincial and municipal budgets and processes must promote transparency, accountability, effective financial management system of the economy and the public sector. This supported and endorsed the fact that a budget process should be transparent where PFMS has been properly implemented in order to promote financial management in the public sector so that any risks originating from poor management of the economy and public sector debt were easily detected. The concern was still prevalent in the government departments and they weakened fiscal accountability and undermine good governance. Operationally, a Public Financial Management System assisted departments in ensuring that expenditure patterns in relation to its programmes and projects were done within a budgeted vote, information about the financial state of a department was known and monitored. Abedian et al (1998:140) argued that operational level of the spending was accounted through a financial management system as a computerised accounting system. Additionally, the Financial Management System also aimed to facilitate expenditure management system as well as other aspects of financial management such as providing budgetary information (Visser and Eramus, 20002:10) To draw a synergy between the arguments by the former and latter authors, it was noticeable that PFMS served as a financial information tool so that critical financial decisions were made in relation to expenditure and management of public finances. The author pointed out that the public finance management system in South Africa had introduced culture of risk management in the public sector. The PFMS in South Africa, the Public service in particular, influenced the ability of the leadership to manage changes of the systems. To determine whether the PFMS has effective internal controls in Government line ministries. A research was carried out by Amudo (2009) in Uganda with the objective of evaluating the internal control system that Regional Member Countries (RMCs) of African Development Bank Group (AFDB) institute for the management of the Public Sector Projects that the bank finances. The researcher pointed out that when companies suddenly collapsed, the often resounding question was, what went wrong? A breakdown in the internal control system was the usual cause. Specifically, this paper: a) Ascertained whether such controls provided adequate internal framework of checks and balances to ensure that project funds were utilized solely and wholly for the intended goals, poverty reduction and inducement of social, economic growth and development of respective RMCs. b) Provided a basis for understanding the operation of the above framework of checks and balances established by the governments of respective RMCs for the management of Public Sector Projects funded by the development partners, and whether such systems complied with globally accepted internal control mechanisms. These objectives raised a number of questions: i. Whether or not the established internal control systems of RMCs were effective. ii. What role should internal control system played in Public Sector Projects Management? iii. What internal control systems were currently in place? Did they include all the expected elements of internal control systems? iv. Should the AFDB continued to lend to RMCs that did not bring a project in compliance with the requirements of established internal controls systems? v. Were internal control systems in the projects adequately documented and regularly updated as changes occurred? Materials and Methods The aim of this study is to come up with strategies to ensure effective responsibility accounting systems in the Government line ministries. Despite the government having introduced the Public Financial Management Act (Chapter 22:19) in 2009 which provide guidelines for control and management of public resources, The Ministries still facing a lot of challenges despite attracting a lot of donor funds and funding from treasury. This study therefore aims to come up with strategies to ensure an effective responsibility accounting system within the ministries. The Research Design: Research strategies, research choices and time horizons can be thought of as focusing on the process of research design, that is turning ones research questions into research project ( Robson 2002). This 21

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

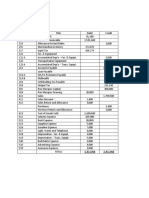

research is couched in the realism paradigm and employed both qualitative and quantitative methods (triangulation) of data collection. Triangulation maybe defined as the use of two or more methods of data collection in the study of some aspect of human behavior (Cohen and Manion 1994). The quantitative methods used in this study strives to control for bias so that facts can be understood in an objective way, the qualitative approach strives to understand the perspective of the Ministry of Health and Child Welfare stakeholders, looking to first-hand experience to provide meaningful data. Target Population: The population of the study will comprise of 100 senior managers in the government departments all over the 8 different provinces in Zimbabwe. These managers will be located in the accounts departments of the government line ministries were they can be direct or indirect use of PFMS. From the population of the 100 senior managers, a sample size of 70 percent will be drawn using simple random sampling method. The remaining 30 percent will be drawn using systematic random sampling method Sample: For the purpose of this study the systematic sampling was used. Systematic sampling involves selecting the sample at regular intervals from the sampling frame which means sampling design involves drawing every nth element in the population starting with a randomly chosen elements between 1 and n. The Government Ministries maintain almost the same management structure across the country. Using systematic sampling the sample of 50 people was randomly selected from the population. Data Analysis and Discussion Background Information of Respondents:The sample that was studied was divided into two sub-samples, one made up of the managers and the other made up of directors in the accounts departments of government ministries. A mail survey was conducted with the managers, while an interview survey was conducted with the directors. Sixty questionnaires were delivered to managers in the accounts departments in government ministries and of these fifty completed questionnaires were returned. Results of demographic information of the managers by gender, age, range, academic qualifications and experience. The majority of the managers (70%) were male, while (30%) were female. Most of the managers (72%) were in the age group of 20 to 30 years. Five female directors and five male directors were interviewed. Most of the directors (72%) were in the age group of 31 to 50 years, while those in the least represented age group (4%) were above 51 years. The managers and directors seem to be professionals with the majority holding diplomas in accounting. Budget Process: The budget involves linking budget to strategic plan, management of budget constraints, flexing budgets, publication of budgets and charging of operating expenses. Results present the views of managers on the extent to which the PFMS meets the requirements of the budget process. Certain attributes to this study show that the budget process in government line ministries is not a problem as presented by table 4.2. Wilkes (1986) asserts that the role of financial management in a firm concerns the prudent administration of the flow of funds from formulation and production of budgets. The mail survey used showed that the majority of the managers believed that the PFMS linked the budget to the strategic plan (98%), managed the budget constraint (84%), flexed the budget constraints (86%), published the budgets (84%). Similar results were obtained from the interview survey with the directors. The majority of the directors believed that the PFMS linked the budget to strategic plan (70%), managed the constraints (86%), published the budgets (70%). These results seem to suggest that the PFMS is able to link the budget strategic plan, flex the budget constraints, publication of budgets and charging of operating expenses. According to Manse (2002) the findings of their research revealed the same that their system was effective in the budgeting process and had effective internal controls. Internal Controls: Both the mail and interview survey investigated the effectiveness of the internal controls in the PFMS.The aspect of this study observed that they are effective internal controls which need to be reviewed regularly.The results showed that the majority of the managers (96%) believed that the internal controls in the PFMS were set in compliance with the requirements of Auditor Generals auditing standards stated in the Treasury Manual, payment internal controls (88%), receipting and banking internal controls (74%), use of passwords as internal controls (82%), and reconciliation were not usually used as an internal control procedure (78%0. Similar results were obtained from the interview survey conducted with the director and the majority of the managers (90%) believed that the internal controls in the PFMS were set in compliance with the 22

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013

www.iiste.org

requirements of Auditor Generals auditing standards sated in the Treasury Manual, payment internal controls (60%), receipting and banking internal controls (90%), use of passwords as an internal control (100%) and reconciliation as an internal control procedure (80%). There is the difference on a mail survey results and those from the interview survey. Mail survey showed that 44 of the managers believed that payment internal controls were not properly followed. There was also a difference on production of reconciliation statement as an internal control procedure. A majority of the mail survey showed that this was not usually done while the interview survey seemed to agree. Training of End-users in Application of the PFMS: The result from the mail survey indicated that 48 of the managers believed that officers were not adequately trained to use the system and the training period of 8 hours was believed to have been covered by 47 of the managers. The interview survey on adequate training showed that 7 directors believed that the training took 8 hours. Generally, it appears that the majority of the managers seemed to have not been adequately trained on how to use the PFMS. According to Freeman (1996) training is a process designed to maintain or improve current job performance, and develop skills necessary for future work activities. This is the same approach which is needed in todays technology. Major Challenges in the implementation of PFMS: There were still transactions occurring outside the system. Nine transactions had been identified by the directors to have occurred outside the system. Ten fraud transactions were believed to have occurred 10 times. Six occurrences seemed to have been identified of directors who avoided the use of the system. Eight transactions had not been done through the system due to non availability of national banking in Zimbabwe. Ten most qualified employees had left for greener pastures and five new employees have been employed which increase training costs on replacement of personnel. Conclusions and Policy Recommendation Conclusions: The conclusion was drawn with respect to the budgeting process, existence of internal controls and training of end users. Budget Process: The results appear to suggest that the PFMs is able to do the budget process from the initiating stage up to the final product. Internal Controls: From the result of the study it would appear that the PMFs has effective internal controls. The only exception is on the payment internal control procedure and reconciliation statement as an internal control procedure was that the mail survey differed with the interview survey. Training of end users: The results showed that officers were trained for the recommended 8 hours. On the general understanding of the PFMs, it was observed that the majority of the managers were not adequately trained as compared to directors. Recommendations: Based on the findings and conclusions, the researcher made the following recommendations: The system needs internal control monitoring on payment procedures. Such monitoring must be continually done. Such type of weakness will lead to the occurrence of fraudulent activities. This is a serious issue according to the auditor General as stated in the Treasury Manual. The officers need to be trained on how to use the PFMs in the production of reconciliation statement. The system has a module which is capable of producing accurate reconciliation statement. The training period of the PFMs need to be increased from 8 hours to 12 hours. Most managers pointed out that they were not adequately trained to use the system. Training must also be backed up with refresher course which must take place after every three months. References 1. Accountant General (1998), Public Management System Newsletter. Issue 1 April (1998) 2. Abu-Musa (2003), Exploring the perceived threats of computerized accounting information systems in emerring countries. Journal-Empirical study on Saudi Arabia (2003) Department of Accounting and MIS KFUPM, Saudi Arabia 3. Albert M, Journal of accountancy Volume 45 (2005 : 540) 23

Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.4, No.4, 2013 4. 5.

www.iiste.org

6.

7. 8. 9. 10. 11.

12. 13. 14.

Andrews, M. (2009) Isomorphism and the limits to African public financial management. Harvard Kennedy School Faculty Research Working Paper Series RWP09-012. Andrews, M. (2008) PFM in Africa: Where are we, how did we get here, where should we go? Lessons from recent PEFA data and World Bank Public Financial Management Performance Reports. Research study for Brookings Institution and World Bank. Andrews, M. (2007) What would an ideal public finance management system look like?, A. Shah (ed.). Washington, DC: World Bank Institute. Audit and Exchequer Act 1996 (Chapter 22 : 03) Booth, D. (2008) Aid effectiveness after Accra: How to reform the Paris agenda. ODI Briefing Paper 39. London: ODI. Booth, D. (2007) Aid absorption, aid quality and institutions: Recasting the debate. Unpublished draft. London: ODI. Burnside, I., Preski, S. and Hertz, J. E. (1998), Research Instrumentation and Elderly Subjects. Journal of Nursing Scholarship, 30: 185190 Campbell, C. (2001) Juggling Inputs, Outputs, and Outcomes in the Search for Policy Competence: Recent Experience in Australia, Governance: An International Journal of Policy and Administration 14 (2), April. Carcello J. The Accountancy review Vol. 75 (2000:457-467) Chistopher C Journal of Finance Vol 5 (2003:345) Crtical perspectives in management Control: W,F Chua, T Lowe and Puxty Macmillan (Basing stoke, 1989) 343pp

24

You might also like

- Iajef v3 I2 265 291Document27 pagesIajef v3 I2 265 291Banjani KalansooriyaNo ratings yet

- ProposalDocument23 pagesProposalPhumudzo NetshiavhaNo ratings yet

- Nancy Kutama ProposalDocument18 pagesNancy Kutama Proposaljitha nipunikaNo ratings yet

- 9Document13 pages9International Journal of Multidisciplinary Research and AnalysisNo ratings yet

- Literature Review On Integrated Financial Management Information SystemDocument4 pagesLiterature Review On Integrated Financial Management Information SystemafmzyywqyfolhpNo ratings yet

- Effects of Financial Controls On FinanciDocument16 pagesEffects of Financial Controls On FinanciPromono AmortaNo ratings yet

- International Journals of Academics & Research: (IJARKE Business & Management Journal)Document15 pagesInternational Journals of Academics & Research: (IJARKE Business & Management Journal)Abu DadiNo ratings yet

- International Journals of Academics & Research: (IJARKE Business & Management Journal)Document15 pagesInternational Journals of Academics & Research: (IJARKE Business & Management Journal)Abu DadiNo ratings yet

- Guzman 2020Document21 pagesGuzman 2020dewi sartikaNo ratings yet

- Genzeb On PublicDocument15 pagesGenzeb On PublicAbu DadiNo ratings yet

- Historical Overview of Ethiopian Government Accounting SystemDocument20 pagesHistorical Overview of Ethiopian Government Accounting Systemnegamedhane58No ratings yet

- J2014 Muhammed - Government Expenditure Management and Control in EthiopiaDocument10 pagesJ2014 Muhammed - Government Expenditure Management and Control in EthiopiabudimahNo ratings yet

- 1 - Khersiat 2019Document11 pages1 - Khersiat 2019Hay LinNo ratings yet

- Results Based Management in Zimbabwe: Benefits and Challenges A Conceptual StudyDocument13 pagesResults Based Management in Zimbabwe: Benefits and Challenges A Conceptual StudyThe IjbmtNo ratings yet

- Account Research 2Document46 pagesAccount Research 2Michael MololuwaNo ratings yet

- Literature Review On Revenue MobilizationDocument6 pagesLiterature Review On Revenue Mobilizationafdtvztyf100% (1)

- Issues and Challenges Promoting AccountabilityDocument3 pagesIssues and Challenges Promoting AccountabilityUmmu ZubairNo ratings yet

- Assessment of Effectiveness of Internal Control in Government MinistriesDocument11 pagesAssessment of Effectiveness of Internal Control in Government MinistriesRonnie Balleras Pagal100% (1)

- Budgetary Control As A Measure of Financial Performance of State Corporations in KenyaDocument20 pagesBudgetary Control As A Measure of Financial Performance of State Corporations in KenyaKarin AgistaNo ratings yet

- Proposed Title of The Researc1Document16 pagesProposed Title of The Researc1costaNo ratings yet

- Art 7 PDFDocument11 pagesArt 7 PDFhichamlamNo ratings yet

- Research Proposal U. O.cambridgeDocument23 pagesResearch Proposal U. O.cambridgeAsako DeborahNo ratings yet

- The Local Government Performance As Mediating VariDocument10 pagesThe Local Government Performance As Mediating VariRegna NurvaniaNo ratings yet

- (5061) Assignment#02Document10 pages(5061) Assignment#02noorislamkhanNo ratings yet

- Chapter One 1.1 Background of The StudyDocument84 pagesChapter One 1.1 Background of The Studygarba shuaibuNo ratings yet

- Internal Audit ArticleDocument15 pagesInternal Audit ArticleAnil RaiNo ratings yet

- Course Enrichment Paper No 1 The Philippine Public Financial ManagementDocument11 pagesCourse Enrichment Paper No 1 The Philippine Public Financial ManagementVia Maria MalapoteNo ratings yet

- Appraisal of The Accounting System in Nigerian Public Sector (A Case Study of Selected Government Establishment in Enugu)Document62 pagesAppraisal of The Accounting System in Nigerian Public Sector (A Case Study of Selected Government Establishment in Enugu)Babah Silas VersilaNo ratings yet

- Cost and Management Accounting in Budget-Funded orDocument13 pagesCost and Management Accounting in Budget-Funded orRizan MohamedNo ratings yet

- Integrated Financial Management SystemDocument8 pagesIntegrated Financial Management SystembagumaNo ratings yet

- Data Analytics in PFMDocument35 pagesData Analytics in PFMAmit TNo ratings yet

- Integrated Financial Management Information System in County Treasuries in Kenya Empirical Analysis of The ImplementationDocument5 pagesIntegrated Financial Management Information System in County Treasuries in Kenya Empirical Analysis of The ImplementationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- AddisDocument16 pagesAddisGelaye GebeyehuNo ratings yet

- Ibiye Roject WorkDocument49 pagesIbiye Roject Workpeter eremieNo ratings yet

- 14th-Strenthening Financial MGTDocument27 pages14th-Strenthening Financial MGTgopichand456No ratings yet

- Computarised System ProjectDocument30 pagesComputarised System ProjectChintamaniChoiceNo ratings yet

- Determinants of Budget Control in Ethiopian Public Organization (The Case of Benishangul Gumuz Regional State)Document20 pagesDeterminants of Budget Control in Ethiopian Public Organization (The Case of Benishangul Gumuz Regional State)TIBEBU TIMOTEWOSNo ratings yet

- Full Paper EFFECT OF INTERNAL AUDIT PRACTICES ON FINANCIAL MANAGEMENTDocument10 pagesFull Paper EFFECT OF INTERNAL AUDIT PRACTICES ON FINANCIAL MANAGEMENTEL GHARBAOUINo ratings yet

- Impact of Budgetary Control Usage On ManDocument23 pagesImpact of Budgetary Control Usage On Manarianne LorqueNo ratings yet

- Chievementof Auditor Opinion Through Application of Government Accounting Standards and Effectiveness Ofthe Internal Control SystemDocument12 pagesChievementof Auditor Opinion Through Application of Government Accounting Standards and Effectiveness Ofthe Internal Control SystemAJHSSR JournalNo ratings yet

- Sip ProjectDocument57 pagesSip Projectbilal mansuriNo ratings yet

- Effectiveness of The Public Financial Management Assessment Tool or (PFMAT) in Strengthening The Financial Capability of Local Government Unit in Talavera, Nueva EcijaDocument10 pagesEffectiveness of The Public Financial Management Assessment Tool or (PFMAT) in Strengthening The Financial Capability of Local Government Unit in Talavera, Nueva EcijaKomal sharmaNo ratings yet

- Budget Execution Is The Process by Which The Financial Resources Made Available To An AgencyDocument4 pagesBudget Execution Is The Process by Which The Financial Resources Made Available To An Agencyruby ann rojalesNo ratings yet

- Sip ProjectDocument58 pagesSip Projectbilal mansuriNo ratings yet

- Assessment of Financial Control Practices in Polytechnics in GhanaDocument38 pagesAssessment of Financial Control Practices in Polytechnics in GhanaByg JoeNo ratings yet

- Effect of Accounting Information SystemDocument26 pagesEffect of Accounting Information SystemTilahun MikiasNo ratings yet

- History of Auditing Profession in BDDocument5 pagesHistory of Auditing Profession in BDAntara Islam100% (4)

- Government Accounting in BangladeshDocument20 pagesGovernment Accounting in BangladeshMohammad Saadman100% (3)

- Unit 1Document28 pagesUnit 1samuel debebeNo ratings yet

- Ipsas Adoption and Financial Reporting Quality in Public Sector of The South Western Nigeria: Assessment of The Mediating Role of Contingency FactorsDocument15 pagesIpsas Adoption and Financial Reporting Quality in Public Sector of The South Western Nigeria: Assessment of The Mediating Role of Contingency FactorsAJHSSR JournalNo ratings yet

- Auditor General: Case Study at Ethiopian Public SectorsDocument6 pagesAuditor General: Case Study at Ethiopian Public SectorsGizaw KebedeNo ratings yet

- Adoption of Ipsas in IraqDocument21 pagesAdoption of Ipsas in IraqMega VeronicaNo ratings yet

- Exploring Financial Performance and Audit Opinions in Indonesian Central Government AgenciesDocument22 pagesExploring Financial Performance and Audit Opinions in Indonesian Central Government AgenciesfauziNo ratings yet

- Effect of Audit Independence On Public Sector Performance in NigeriaDocument13 pagesEffect of Audit Independence On Public Sector Performance in NigeriaMame HazardNo ratings yet

- Em 1Document14 pagesEm 1Yeshihareg AlemuNo ratings yet

- Procurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesFrom EverandProcurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesNo ratings yet

- An Appraisal of Accounting SystemDocument42 pagesAn Appraisal of Accounting Systemmichaelaye64No ratings yet

- The Impact of Institutional Governance On Combating Financial Corruption and The Quality of Banking ServicesDocument12 pagesThe Impact of Institutional Governance On Combating Financial Corruption and The Quality of Banking Servicesindex PubNo ratings yet

- Assignment: Jamia Millia IslamiaDocument7 pagesAssignment: Jamia Millia IslamiaKartik SinghNo ratings yet

- Effect of Management Information SystemsDocument8 pagesEffect of Management Information SystemsAbel SeniNo ratings yet

- Asymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelDocument17 pagesAsymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelAlexander DeckerNo ratings yet

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaDocument10 pagesAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerNo ratings yet

- Assessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesDocument9 pagesAssessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesAlexander DeckerNo ratings yet

- Availability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateDocument13 pagesAvailability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateAlexander DeckerNo ratings yet

- Assessment of Relationships Between Students' Counselling NeedsDocument17 pagesAssessment of Relationships Between Students' Counselling NeedsAlexander DeckerNo ratings yet

- Assessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaDocument7 pagesAssessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaAlexander DeckerNo ratings yet

- Availability and Use of Instructional Materials and FacilitiesDocument8 pagesAvailability and Use of Instructional Materials and FacilitiesAlexander DeckerNo ratings yet

- Assessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateDocument8 pagesAssessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateAlexander Decker100% (1)

- Assessment of Teachers' and Principals' Opinion On Causes of LowDocument15 pagesAssessment of Teachers' and Principals' Opinion On Causes of LowAlexander DeckerNo ratings yet

- Assessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisDocument17 pagesAssessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisAlexander DeckerNo ratings yet

- Barriers To Meeting The Primary Health Care Information NeedsDocument8 pagesBarriers To Meeting The Primary Health Care Information NeedsAlexander DeckerNo ratings yet

- Assessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorDocument12 pagesAssessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorAlexander DeckerNo ratings yet

- Attitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshDocument12 pagesAttitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshAlexander DeckerNo ratings yet

- Assessment of Productive and Reproductive Performances of CrossDocument5 pagesAssessment of Productive and Reproductive Performances of CrossAlexander DeckerNo ratings yet

- Are Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsDocument10 pagesAre Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsAlexander DeckerNo ratings yet

- Application of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryDocument14 pagesApplication of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryAlexander DeckerNo ratings yet

- Applying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaDocument13 pagesApplying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaAlexander DeckerNo ratings yet

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaDocument10 pagesAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerNo ratings yet

- Antibiotic Resistance and Molecular CharacterizationDocument12 pagesAntibiotic Resistance and Molecular CharacterizationAlexander DeckerNo ratings yet

- Assessment in Primary School Mathematics Classrooms in NigeriaDocument8 pagesAssessment in Primary School Mathematics Classrooms in NigeriaAlexander DeckerNo ratings yet

- Assessment of Factors Responsible For Organizational PoliticsDocument7 pagesAssessment of Factors Responsible For Organizational PoliticsAlexander DeckerNo ratings yet

- An Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanDocument10 pagesAn Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanAlexander DeckerNo ratings yet

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaDocument11 pagesAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerNo ratings yet

- Antioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesDocument8 pagesAntioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesAlexander DeckerNo ratings yet

- Application of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Document10 pagesApplication of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Alexander DeckerNo ratings yet

- Analysis of Teachers Motivation On The Overall Performance ofDocument16 pagesAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerNo ratings yet

- Analyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaDocument9 pagesAnalyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaAlexander DeckerNo ratings yet

- Analysis The Performance of Life Insurance in Private InsuranceDocument10 pagesAnalysis The Performance of Life Insurance in Private InsuranceAlexander DeckerNo ratings yet

- Analysis of Frauds in Banks Nigeria's ExperienceDocument12 pagesAnalysis of Frauds in Banks Nigeria's ExperienceAlexander DeckerNo ratings yet

- Aldersgate College Espinoza, Daenielle Audrey MDocument6 pagesAldersgate College Espinoza, Daenielle Audrey MddddddaaaaeeeeNo ratings yet

- Accounting Standards (Basics)Document10 pagesAccounting Standards (Basics)Sohail AhmedNo ratings yet

- Penerapan PSAK 73 - MaterialDocument77 pagesPenerapan PSAK 73 - Materialni made safitriNo ratings yet

- CS2 Speaking TestDocument9 pagesCS2 Speaking TesthansanakarunanayakeNo ratings yet

- Cambridge International AS - A Level Accounting Executive Preview-1Document63 pagesCambridge International AS - A Level Accounting Executive Preview-1Shingirayi MazingaizoNo ratings yet

- Oracle Fusion Enterprise StructureDocument59 pagesOracle Fusion Enterprise Structurepradeep191988No ratings yet

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- 4 Chap 1 Audit An Overview RevDocument29 pages4 Chap 1 Audit An Overview RevJoen SinamagNo ratings yet

- Liquidity RatioDocument24 pagesLiquidity RatioSarthakNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Primary Books of AccountsDocument16 pagesPrimary Books of AccountsSaptha Gowda100% (1)

- 01 - Correction of ErrorsDocument4 pages01 - Correction of ErrorsMikaela SalvadorNo ratings yet

- Material Purchase Procedure and Documentation-1Document1 pageMaterial Purchase Procedure and Documentation-1Abdul RehmanNo ratings yet

- CH 3.3 Errors - SDocument10 pagesCH 3.3 Errors - Sসাঈদ আহমদ0% (1)

- Musab Alwuthaynani - UpdatedDocument2 pagesMusab Alwuthaynani - UpdatedAnonymous xU32J0No ratings yet

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- ACC1ILV - Chapter 1 Solutions PDFDocument3 pagesACC1ILV - Chapter 1 Solutions PDFMegan Joye McFaddenNo ratings yet

- R02.7 Standards IV (A), IV (B) and IV (C)Document18 pagesR02.7 Standards IV (A), IV (B) and IV (C)Hanako ChinatsuNo ratings yet

- Ceasa WP3822Document89 pagesCeasa WP3822Poe TryNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- PRTC Manufacturing Co.Document2 pagesPRTC Manufacturing Co.hersheyNo ratings yet

- Interimreport 3M 2010 SecoToolsDocument10 pagesInterimreport 3M 2010 SecoToolsPlant Head PrasadNo ratings yet

- Far 2 Exercise 5 Page 286Document5 pagesFar 2 Exercise 5 Page 286Kay HispanoNo ratings yet

- Release Notes - Oracle R12Document164 pagesRelease Notes - Oracle R12Eric C NgNo ratings yet

- Trial Balance February 28, 20X1Document3 pagesTrial Balance February 28, 20X1Angelica MaeNo ratings yet

- 1 - Accounting - Crossword 3Document2 pages1 - Accounting - Crossword 3Mercy Dioselina Torres SantamariaNo ratings yet

- Des 213Document105 pagesDes 213Pastor-Oshatoba Femi JedidiahNo ratings yet

- Assignment Form ACCT7066 - Managerial AccountingDocument6 pagesAssignment Form ACCT7066 - Managerial AccountingJulyaniNo ratings yet

- Canada Job Opportunity ListDocument39 pagesCanada Job Opportunity ListVaibhav Gujrati VickyNo ratings yet