Professional Documents

Culture Documents

Chain of Title Workshop Flyer

Uploaded by

Joe EsquivelCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Chain of Title Workshop Flyer

Uploaded by

Joe EsquivelCopyright:

Hello everyone and thank you for your interest in our Chain of Title Workshop on the 20 th of April!

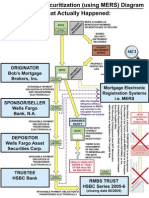

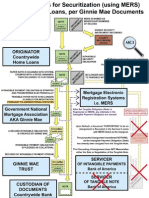

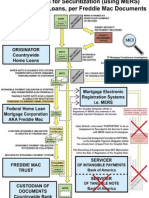

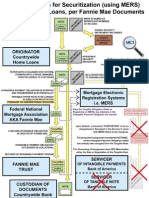

All of us here at MCI are happy to be able to bring you the most current and correct information that this Industry has to offer. The curriculum for this course is a result of years of preparation, trial and error and eventual success. Joe Esquivel is one of this industrys top minds and has put together the best Content that the Foreclosure Defense has to offer. The course is designed to explain the EXACT reasons why you have the right to challenge the bank to their claim to Foreclose on Real Property. Mortgage Compliance Investigators (MCI) is proud to present our Chain of Title workshops. Our focus is to enable attendees to understand the complexities of securitization and the impact to title of real property. We give the most cutting edge tools to properly argue by operation of law; that the actions taken by the banks and their agents have made the security instrument of the mortgage unenforceable.

The syllabus below will show you what the course will go over: I. Securitization A. Explanation of securitization B. Negotiable instruments act C. Title D. Governing documents 1. PSA 2. Prospectus (roles that are played by interested parties) MERS The little black box where things are hidden A. MERS Electronic Registry 1. MERS Membership 2. MERS EREGISTRY Membership

II.

(BREAK) 15 Min (refreshments will be provided) III. IV. Title Bundle of Rights UCC v. Local Laws of Jurisdiction A. UCC 3 Negotiable Instruments B. UCC 9 Security Instruments (Personal Property v. Real Property) C. Local Laws of Jurisdiction Pertaining to Real Property D. Adam Levitin letter to PEB Board E. Report from PEB Board in regards to Intangibles E-Sign Act and UETA A. How does this apply to Negotiable Instruments and Secured Transactions? B. 15 U.S.C. 7001

V.

(888) 491 3741 info@mortgagecomplianceinvestigators.com

VI.

C. 15 U.S.C 7003 (a)(3) Recorded Documents Analysis A. Annotated Documents

(LUNCH) 45 Min (Lunch Provided) VII. Infographics Agency and Non Agency Samples A. Relationship of Parties B. History C. GSE D. RMBS Chain of Title Analysis - Sample A. Analysis for Litigation of Arguments in Report B. Documentation Negotiation, Transfer and Indorsement A. UCC 3-201 Compilation Articles A. Show me the NOTE and Indorsements B. Unidentified Endorser C. Public Records Perfection D. Fraud and Deception Transferable Record E. Amicus Curiae Definitions Q&A Session Open forum for questions If Time Permits Current NY Law Cases

VIII.

IX. X.

XI. XII.

The Pre-Registration cost of the Chain of Title Workshop is $495.00 until the 13 th of April. After that date, the Late Registration cost will be $595.00. Please fill out the forms attached to this group and return them by either emailing to info@mortgagecomplianceinvestigators.com or you can fax them to: 866-993-6523.

(888) 491 3741 info@mortgagecomplianceinvestigators.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 8 - Your Loan Has Been SoldDocument2 pages8 - Your Loan Has Been SoldJoe Esquivel100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Were The Peace Treaties of 1919-23 FairDocument74 pagesWere The Peace Treaties of 1919-23 FairAris Cahyono100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Testimony of Linda DeMartini, Countrywide DiMartiniDocument50 pagesTestimony of Linda DeMartini, Countrywide DiMartiniJoe Esquivel100% (3)

- Isa 75.03 1992 PDFDocument14 pagesIsa 75.03 1992 PDFQuang Duan NguyenNo ratings yet

- Scraper SiteDocument3 pagesScraper Sitelinda976No ratings yet

- Nardi Depo Vol 1 - WaMu To JP AssignmentsDocument200 pagesNardi Depo Vol 1 - WaMu To JP AssignmentsJoe EsquivelNo ratings yet

- Mortgage Compliance Investigators - Loan Disposition Analysis (LDA)Document15 pagesMortgage Compliance Investigators - Loan Disposition Analysis (LDA)Billy BowlesNo ratings yet

- Deposition BOA Transcript of Michele Sjolander Multiple SalesDocument25 pagesDeposition BOA Transcript of Michele Sjolander Multiple SalesJoe Esquivel100% (3)

- HSEMS PresentationDocument21 pagesHSEMS PresentationVeera RagavanNo ratings yet

- IBA High Frequency Words PDFDocument18 pagesIBA High Frequency Words PDFReduanul Chowdhury NitulNo ratings yet

- HANA Presented SlidesDocument102 pagesHANA Presented SlidesRao VedulaNo ratings yet

- Progress Test 2Document5 pagesProgress Test 2Marcin PiechotaNo ratings yet

- Final Year Project Proposal in Food Science and TechnologyDocument11 pagesFinal Year Project Proposal in Food Science and TechnologyDEBORAH OSOSANYANo ratings yet

- Lawrence Nardi Deposition Vol 2 - WaMu To JP AssignmentsDocument130 pagesLawrence Nardi Deposition Vol 2 - WaMu To JP AssignmentsJoe EsquivelNo ratings yet

- Series 3: Nemo DatDocument1 pageSeries 3: Nemo DatMortgage Compliance InvestigatorsNo ratings yet

- Joe's Amicus - Texas 10-4-13Document9 pagesJoe's Amicus - Texas 10-4-13Joe EsquivelNo ratings yet

- Joe's Amicus - Texas 10-4-13Document9 pagesJoe's Amicus - Texas 10-4-13Joe EsquivelNo ratings yet

- Instructions On How To Use Highlighted ProspectusDocument2 pagesInstructions On How To Use Highlighted ProspectusJoe EsquivelNo ratings yet

- Affidavit of Ted Korzenski, Senior Vice President of Litton Loan SErvicingDocument16 pagesAffidavit of Ted Korzenski, Senior Vice President of Litton Loan SErvicingJoe EsquivelNo ratings yet

- Index For Highlighted Prospectus Alternative Loan Trust 2007-J1Document2 pagesIndex For Highlighted Prospectus Alternative Loan Trust 2007-J1Joe Esquivel100% (1)

- Amicus Curiae Defintions R1Document8 pagesAmicus Curiae Defintions R1Joe EsquivelNo ratings yet

- Highlighted Prospectus Alternative Loan Trust 2007-J1Document346 pagesHighlighted Prospectus Alternative Loan Trust 2007-J1Joe EsquivelNo ratings yet

- RMBS With MERS - No Sponsor-Seller - John DoeDocument1 pageRMBS With MERS - No Sponsor-Seller - John DoeJoe EsquivelNo ratings yet

- Ginnie Mae Requirements Without MERS - John DoeDocument1 pageGinnie Mae Requirements Without MERS - John DoeJoe EsquivelNo ratings yet

- Rmbs With Mers - John DoeDocument1 pageRmbs With Mers - John DoeA. CampbellNo ratings yet

- MCI RMBS Do-Did FlowchartDocument1 pageMCI RMBS Do-Did FlowchartMortgage Compliance Investigators100% (2)

- RMBS Do-Did Flowchart - John DoeDocument1 pageRMBS Do-Did Flowchart - John DoeJoe EsquivelNo ratings yet

- Ginnie Mae Requirements WITH MERS - John DoeDocument1 pageGinnie Mae Requirements WITH MERS - John DoeJoe EsquivelNo ratings yet

- Freddie Mac Requirements WITH MERS - John DoeDocument1 pageFreddie Mac Requirements WITH MERS - John DoeJoe EsquivelNo ratings yet

- Freddie Mac Tranche Trust Do-Did Flowchart - John DoeDocument1 pageFreddie Mac Tranche Trust Do-Did Flowchart - John DoeJoe EsquivelNo ratings yet

- Freddie Mac Requirements Without MERS - John DoeDocument1 pageFreddie Mac Requirements Without MERS - John DoeJoe EsquivelNo ratings yet

- Fannie Mae Requirements Without MERS - John DoeDocument1 pageFannie Mae Requirements Without MERS - John DoeJoe EsquivelNo ratings yet

- Bucket2 05-27-2012Document2 pagesBucket2 05-27-2012Joe EsquivelNo ratings yet

- Fannie Mae Requirements WITH MERS - John DoeDocument1 pageFannie Mae Requirements WITH MERS - John DoeJoe EsquivelNo ratings yet

- Micro PPT FinalDocument39 pagesMicro PPT FinalRyan Christopher PascualNo ratings yet

- Eng 685 Paper 2Document5 pagesEng 685 Paper 2api-531590952No ratings yet

- Seryu Cargo Coret CoreDocument30 pagesSeryu Cargo Coret CoreMusicer EditingNo ratings yet

- FINAL Haiti Electricity Report March 2018Document44 pagesFINAL Haiti Electricity Report March 2018Djorkaeff FrancoisNo ratings yet

- Ch02 Choice in World of ScarcityDocument14 pagesCh02 Choice in World of ScarcitydankNo ratings yet

- Retrato Alvin YapanDocument8 pagesRetrato Alvin YapanAngel Jan AgpalzaNo ratings yet

- Ky Yeu Hoi ThaoHVTC Quyen 1Document1,348 pagesKy Yeu Hoi ThaoHVTC Quyen 1mmmanhtran2012No ratings yet

- STS Learning Plan 1Document9 pagesSTS Learning Plan 1Lienol Pestañas Borreo0% (1)

- Lon L. Fuller The Problem of The Grudge InformerDocument9 pagesLon L. Fuller The Problem of The Grudge InformerNikko SarateNo ratings yet

- The History of Sewing MachinesDocument5 pagesThe History of Sewing Machinesizza_joen143100% (2)

- Unit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Document13 pagesUnit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Girman RanaNo ratings yet

- Verbal Reasoning 8Document64 pagesVerbal Reasoning 8cyoung360% (1)

- RA 9072 (National Cave Act)Document4 pagesRA 9072 (National Cave Act)Lorelain ImperialNo ratings yet

- Dayalbagh HeraldDocument7 pagesDayalbagh HeraldRavi Kiran MaddaliNo ratings yet

- PVP 095, s.2022-RxgdPLqfs6HQOtIno2DnDocument3 pagesPVP 095, s.2022-RxgdPLqfs6HQOtIno2Dnanalyn ramosNo ratings yet

- United States v. Vincent Williams, 4th Cir. (2014)Document11 pagesUnited States v. Vincent Williams, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Front Cover NME Music MagazineDocument5 pagesFront Cover NME Music Magazineasmediae12No ratings yet

- Littérature Russe I Cours 1-3PDFDocument45 pagesLittérature Russe I Cours 1-3PDFSarah DendievelNo ratings yet

- Expected GK Questions From Atma Nirbhar Bharat Abhiyan in PDFDocument12 pagesExpected GK Questions From Atma Nirbhar Bharat Abhiyan in PDFRajesh AdlaNo ratings yet

- 235 at 2022Document36 pages235 at 2022Miguel FaganelloNo ratings yet

- Encyclopedia of Human Geography PDFDocument2 pagesEncyclopedia of Human Geography PDFRosi Seventina100% (1)

- Revised WHD Quiz 2023 Flyer PDFDocument5 pagesRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalNo ratings yet