Professional Documents

Culture Documents

TU-91.2038 Strategies For Growth and Renewal Nikita Semkin 79048K Case Kipling

Uploaded by

Nikita SemkinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TU-91.2038 Strategies For Growth and Renewal Nikita Semkin 79048K Case Kipling

Uploaded by

Nikita SemkinCopyright:

Available Formats

TU-91.

2038 Strategies for Growth and Renewal Case Kipling

Nikita Semkin 79048K

In 1991 Kipling, a Belgian casual bag company experienced turmoil. Their main banker announced that they would stop providing credit for them despite their continuous growth. The company had to go through vigorous changes and reconstruction with the aim of getting company profitable and steering it to path of high growth. Both the crisis Kipling faced and their methods to overcome it are very similar to those described in arti cle How to Structure Companies for High Growth by Antino Davila and George Foster. Similarities can also be found in Larry E. Greiners article Evolution and revolution as organizations grow. Both of these articles are used to analyze Kiplings situation. Even though Kiplings sales were growing fast it still lacked working capital. And investors didnt find Kiplings growth as enough guarantee. Kiplings founders Paul and Xavier involved Tony Gram in the company. He brought with himself experience that the company and its managers lacked. Events that followed were consistent with ideas presented in Greiners article. Using description provided in article, the company was coming to end of creation phase and coming to grip with crisis of leadership. Having Gram involved in the company is also congruent with the solution described in Grinders article. Tony Gram was the strong manager with necessary knowledge and skill to introduce new business techniques. Changes and the times after Gram are also consistent with articles direction phase. Tony started immediately making improvements in company. He started streamlining companies operations that were previously chaotic. He created a new price structure and limited product range. He also dropped small retail orders that proved to be more costly then beneficial to the company. Next in line was renewal of Kiplings international strategy which, lacking consistency and efficacy, was started from scratch. The previous partners were of average quality and very different. A more structured approach to internationalization was defined, directing focus to core markets. These restructures lead to Kiplings rapid expansion on international scale. Foresters and Davilas article suggests that growth is important to companies not just for increased revenues, but for increased business opportunities. Growth of the company enables more growth so to speak. This applied for Kipling also. Companys growth granted them the US market with practically no effort involved. Later they also managed to expand to South American markets same way. Growth and therefore increased brand value also helped Kipling by giving them more leverage in negotiations with suppliers and retailers. Changes in the company also create problems. Both articles describe how changes and increasing professionalism in growing companies can be difficult for managers to handle. In Kipling this was seen by raising tensions between Xavier and other managers which in the end lead to Xavier leaving the company. With continuous growth also came new challenges for Kipling. They were expected to continuously present the market with something new and innovative which meant they had to continuously create new collections, something Kipling was not prepared for, on either organizational or design level. More challenges came. Paul and Tony realized that most of the workers didn t have global understanding of the company. They tended to the problem by having a seminar for employees to increase the awareness within the company. The seminar also brought out the need for people management, something also suggested by Davila and Foster. With the growth of the company Kipling realized that the entrepreneurial culture had to be directed. Without clear directives and structures the company would not be successful in the long term. They also realized they had to delegate responsibility from Paul and Tony. This matches Davilas and Fosters thoughts. Growing company needs to move from entrepreneurial to managerial mindset to be able to work efficiently. Davila and Foster suggest that at some point in growing company, the entrepreneur and oft the founding member need to pass the reins of the company to a manager. This was again true in Kipling. Paul and Tony sold the company to UBS Capital and a new CEO, Ian Siddal, took over. Unfortunately changes that follow were too much for Paul and he decided to leave the company,

You might also like

- Rethink, Reinvent, Reposition: 12 Strategies to Make Over Your BusinessFrom EverandRethink, Reinvent, Reposition: 12 Strategies to Make Over Your BusinessRating: 4.5 out of 5 stars4.5/5 (2)

- Built to Last: Successful Habits of Visionary CompaniesFrom EverandBuilt to Last: Successful Habits of Visionary CompaniesRating: 4 out of 5 stars4/5 (377)

- Resurgence: The Four Stages of Market-Focused ReinventionFrom EverandResurgence: The Four Stages of Market-Focused ReinventionNo ratings yet

- Built to Last (Review and Analysis of Collins and Porras' Book)From EverandBuilt to Last (Review and Analysis of Collins and Porras' Book)No ratings yet

- Changeship - Workbook: Building and scaling next generation businesses in the digital polypol: Purpose driven - Customer dedicated - Sustainability enabledFrom EverandChangeship - Workbook: Building and scaling next generation businesses in the digital polypol: Purpose driven - Customer dedicated - Sustainability enabledNo ratings yet

- Summary: Less Is More: Review and Analysis of Jennings' BookFrom EverandSummary: Less Is More: Review and Analysis of Jennings' BookNo ratings yet

- Faster Company (Review and Analysis of Kelly and Case's Book)From EverandFaster Company (Review and Analysis of Kelly and Case's Book)No ratings yet

- How Procter and Gamble Survived Through InnovationDocument17 pagesHow Procter and Gamble Survived Through Innovationsitesh23100% (2)

- Beliefs, Behaviors, and Results: The Chief Executive's Guide to Delivering Superior Shareholder ValueFrom EverandBeliefs, Behaviors, and Results: The Chief Executive's Guide to Delivering Superior Shareholder ValueNo ratings yet

- Case 11 - Making It BigDocument4 pagesCase 11 - Making It BigRoseAnnGatuzNicolasNo ratings yet

- Summary of #AskGaryVee: by Gary Vaynerchuk | Includes AnalysisFrom EverandSummary of #AskGaryVee: by Gary Vaynerchuk | Includes AnalysisNo ratings yet

- Counterintuitive Marketing: Achieving Great Results Using Common SenseFrom EverandCounterintuitive Marketing: Achieving Great Results Using Common SenseRating: 2 out of 5 stars2/5 (1)

- The Breakthrough Imperative: How the Best Managers Get Outstanding ResultsFrom EverandThe Breakthrough Imperative: How the Best Managers Get Outstanding ResultsRating: 4 out of 5 stars4/5 (2)

- The Winning Strategies : and Quality, Company in TheDocument4 pagesThe Winning Strategies : and Quality, Company in TheShaunak VaidyaNo ratings yet

- Staying Ahead of the Hammer: How to Build and Manage Your Business to Achieve Long-Term High GrowthFrom EverandStaying Ahead of the Hammer: How to Build and Manage Your Business to Achieve Long-Term High GrowthNo ratings yet

- Case Study McDonald's by Andrew CampbellDocument3 pagesCase Study McDonald's by Andrew Campbell8dimensionsNo ratings yet

- The Game-Changer (Review and Analysis of Lafley and Charan's Book)From EverandThe Game-Changer (Review and Analysis of Lafley and Charan's Book)No ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Blockbusters (Review and Analysis of Lynn and Reilly's Book)From EverandBlockbusters (Review and Analysis of Lynn and Reilly's Book)Rating: 1 out of 5 stars1/5 (1)

- Selling Vision: The X-XY-Y Formula for Driving Results by Selling ChangeFrom EverandSelling Vision: The X-XY-Y Formula for Driving Results by Selling ChangeNo ratings yet

- 3 Good To GreatDocument13 pages3 Good To GreatluckiemanNo ratings yet

- Key Account Management and Planning: The Comprehensive Handbook for Managing Your Company's Most Important Strategic AssetFrom EverandKey Account Management and Planning: The Comprehensive Handbook for Managing Your Company's Most Important Strategic AssetRating: 4 out of 5 stars4/5 (3)

- How Procter and Gamble Survived Through InnovationDocument18 pagesHow Procter and Gamble Survived Through InnovationPankaj Goyal0% (1)

- Dividend Policy Case Study PDFDocument7 pagesDividend Policy Case Study PDFIsaack MgeniNo ratings yet

- Book Review Good-To-Great: Presented By: Norhasliza Ibrahim Sitynoryasmin Ahmad Khairuddin AzlidaDocument49 pagesBook Review Good-To-Great: Presented By: Norhasliza Ibrahim Sitynoryasmin Ahmad Khairuddin AzlidaashrafNo ratings yet

- Business Ideas for Young Entrepreneurs: Start a Business & Gain Financial FreedomFrom EverandBusiness Ideas for Young Entrepreneurs: Start a Business & Gain Financial FreedomNo ratings yet

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Inside GEs TransformationDocument22 pagesInside GEs TransformationchdiNo ratings yet

- Technological Innovation and R&D Management: Case Study - P&G By 8711813 林榮俊Document19 pagesTechnological Innovation and R&D Management: Case Study - P&G By 8711813 林榮俊Sumayya SamreenNo ratings yet

- The Future of Purpose-Driven Branding: Signature Programs that Impact & Inspire Both Business and SocietyFrom EverandThe Future of Purpose-Driven Branding: Signature Programs that Impact & Inspire Both Business and SocietyNo ratings yet

- Sticky Branding: 12.5 Principles to Stand Out, Attract Customers & Grow an Incredible BrandFrom EverandSticky Branding: 12.5 Principles to Stand Out, Attract Customers & Grow an Incredible BrandNo ratings yet

- A Joosr Guide to... Good to Great by Jim Collins: Why Some Companies Make the Leap - and Others Don'tFrom EverandA Joosr Guide to... Good to Great by Jim Collins: Why Some Companies Make the Leap - and Others Don'tNo ratings yet

- Upstream Marketing: Unlock Growth Using the Combined Principles of Insight, Identity, and InnovationFrom EverandUpstream Marketing: Unlock Growth Using the Combined Principles of Insight, Identity, and InnovationRating: 5 out of 5 stars5/5 (1)

- Start Small And Grow Big: Micro, Small And Medium Size Enterprises RevolutionFrom EverandStart Small And Grow Big: Micro, Small And Medium Size Enterprises RevolutionNo ratings yet

- Acer's DiscussionDocument7 pagesAcer's DiscussionPhakamart PholsuwanNo ratings yet

- Case 1 Colgate PalmoliveDocument1 pageCase 1 Colgate PalmoliveDPS1911No ratings yet

- Blueprint to a Billion: 7 Essentials to Achieve Exponential GrowthFrom EverandBlueprint to a Billion: 7 Essentials to Achieve Exponential GrowthRating: 4 out of 5 stars4/5 (1)

- Driving Innovation at A Mature FirmDocument7 pagesDriving Innovation at A Mature FirmSaniyaMirzaNo ratings yet

- Rigmens ViewxDocument3 pagesRigmens Viewxmruga_123No ratings yet

- Change and Thrive: A Modern Approach to Change LeadershipFrom EverandChange and Thrive: A Modern Approach to Change LeadershipNo ratings yet

- Case Study 1: Has Restructuring Paid Off at Procter & Gamble?Document2 pagesCase Study 1: Has Restructuring Paid Off at Procter & Gamble?teetoszNo ratings yet

- Path to Purpose: How to use cause marketing to build a more meaningful and profitable brandFrom EverandPath to Purpose: How to use cause marketing to build a more meaningful and profitable brandNo ratings yet

- 35 Silent Business Killers: How to Stop Them Before They Kill Your BusinessFrom Everand35 Silent Business Killers: How to Stop Them Before They Kill Your BusinessNo ratings yet

- Corporate Life Savers - A Study On Turnaround LeadersDocument18 pagesCorporate Life Savers - A Study On Turnaround LeadersRamji RamakrishnanNo ratings yet

- How Procter and Gamble Survived Through Innovation - A Case StudyDocument8 pagesHow Procter and Gamble Survived Through Innovation - A Case StudyrdurwasNo ratings yet

- Beyond Product: How Exceptional Founders Embrace Marketing to Create and Capture Value for their BusinessFrom EverandBeyond Product: How Exceptional Founders Embrace Marketing to Create and Capture Value for their BusinessRating: 5 out of 5 stars5/5 (2)

- Psychopaths Among Us, by Robert HerczDocument13 pagesPsychopaths Among Us, by Robert HerczZiyishi WangNo ratings yet

- Race & Essentialism in Feminist Legal Theory (Angela Harris) Pp. 574-582Document2 pagesRace & Essentialism in Feminist Legal Theory (Angela Harris) Pp. 574-582TLSJurSemSpr2010100% (1)

- Freud's Psychoanalytic TheoryDocument6 pagesFreud's Psychoanalytic TheoryNina londoNo ratings yet

- Growth and DevelopmentDocument150 pagesGrowth and Developmentvicson_4No ratings yet

- Ekici@bilkent - Edu.tr: Principles of Marketing, Philip Kotler and Gary Armstrong, 16Document8 pagesEkici@bilkent - Edu.tr: Principles of Marketing, Philip Kotler and Gary Armstrong, 16ArliNo ratings yet

- Gesang Der JunglingeDocument4 pagesGesang Der JunglingeJoe BlowNo ratings yet

- Angeles University Foundation: Cea-Csc A.Y. 2018-2019Document9 pagesAngeles University Foundation: Cea-Csc A.Y. 2018-2019Bhern BhernNo ratings yet

- Critical Reading and ReasoningDocument34 pagesCritical Reading and Reasoningjollibee torresNo ratings yet

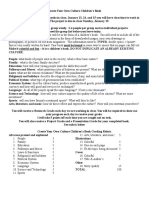

- Create Your Own Culture Group ProjectDocument1 pageCreate Your Own Culture Group Projectapi-286746886No ratings yet

- Applications of PsychologyDocument22 pagesApplications of PsychologymehnaazNo ratings yet

- International Civil Aviation Organization Vacancy Notice: Osition NformationDocument4 pagesInternational Civil Aviation Organization Vacancy Notice: Osition Nformationanne0% (1)

- Robert Ellwood - Review of Forgotten TruthDocument1 pageRobert Ellwood - Review of Forgotten TruthdesmontesNo ratings yet

- Narcissism Power Point PresentationDocument23 pagesNarcissism Power Point Presentationapi-363226400No ratings yet

- PABLO JOSE MORAN CABASCANGO - Reflection Rubric For TasksDocument2 pagesPABLO JOSE MORAN CABASCANGO - Reflection Rubric For TasksRafael SerranoNo ratings yet

- Teks: 110.6. English Language Arts and Reading, Grade 4, Adopted 2017Document5 pagesTeks: 110.6. English Language Arts and Reading, Grade 4, Adopted 2017api-353575236No ratings yet

- Reiki - Self AttunementDocument28 pagesReiki - Self Attunementsar originarius100% (5)

- DLP Week 3Document4 pagesDLP Week 3Lino CornejaNo ratings yet

- RyanUbuntuOlsonResume 1Document2 pagesRyanUbuntuOlsonResume 1Ryan Ubuntu OlsonNo ratings yet

- Dr. Yanga's College's Inc. Wakas, Bocaue, Bulacan: English 4 DR Fe F. FaundoDocument28 pagesDr. Yanga's College's Inc. Wakas, Bocaue, Bulacan: English 4 DR Fe F. FaundoFernando CruzNo ratings yet

- CMO 28, S. 2007-PS - For - BS Aeronautical - EngineeringDocument14 pagesCMO 28, S. 2007-PS - For - BS Aeronautical - EngineeringYenoh SisoNo ratings yet

- Cross Cultural Consumer BehaviourDocument25 pagesCross Cultural Consumer BehaviourvasanthNo ratings yet

- Resume Design 1 PDFDocument1 pageResume Design 1 PDFNicoRG Amv'sNo ratings yet

- HUMSS - Research PreDocument29 pagesHUMSS - Research PreEllen ObsinaNo ratings yet

- Module 4 - Self Concept Perceptions and AttributionsDocument25 pagesModule 4 - Self Concept Perceptions and AttributionsJoebet Debuyan100% (3)

- Pharmacy Professionalism Toolkit For Students and FacultyDocument102 pagesPharmacy Professionalism Toolkit For Students and FacultykmaoboeNo ratings yet

- Functionalist TheoryDocument5 pagesFunctionalist TheoryFern Hofileña100% (1)

- Course BookDocument15 pagesCourse BookSinta NisaNo ratings yet

- Rachel Mendiola WeberciseDocument2 pagesRachel Mendiola Weberciseapi-397921147No ratings yet

- Recruitment MetricsDocument11 pagesRecruitment MetricsNikita PatilNo ratings yet

- Tugas Tutorial 3 Bahasa InggrisDocument6 pagesTugas Tutorial 3 Bahasa Inggrisidruslaode.usn100% (3)