Professional Documents

Culture Documents

CH 01 Review and Discussion Problems Solutions

Uploaded by

Arman BeiramiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 01 Review and Discussion Problems Solutions

Uploaded by

Arman BeiramiCopyright:

Available Formats

Chapter 01 - Financial Statements and Business Decisions

Chapter 01 Financial Statements and Business Decisions

ANSWERS TO QUESTIONS

ANSWERS TO MULTIPLE CHOICE

1. b) 6. d) E12. A A R L L SE E E E L A A L A E E13. L E L L SE A A E E (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15)

2. d) 7. a)

3. d) 8. a)

4. c) 9. c)

5. a) 10. b)

Accounts receivable Cash and cash equivalents Net sales Notes payable Taxes payable Retained earnings Cost of products sold Marketing, administrative, and other operating expenses Income taxes Accounts payable Land Property, plant, and equipment Long-term debt Inventories Interest expense

(1) Notes payable to banks (2) General and administrative (3) Accounts payable (4) Dividends payable (5) Retained earnings (6) Cash and cash equivalents (7) Accounts receivable (8) Provision for income taxes* (9) Cost of goods sold

A R A E A A L E A

(10) Machinery and equipment (11) Net sales (12) Inventories (13) Marketing, selling, and advertising (14) Buildings (15) Land (16) Income taxes payable (17) Distribution and warehousing costs (18) Investments (in other companies)

1-1

Chapter 01 - Financial Statements and Business Decisions

E14. Honda Motor Corporation Balance Sheet as of March 31, 2009 (in billions of Yen) Assets Cash and cash equivalents Trade accounts, notes, and other receivables Inventories Investments Net property, plant and equipment Other assets Total assets Liabilities Accounts payable and other current liabilities Long-term debt Other liabilities Total liabilities Stockholders Equity Contributed capital Retained earnings Total stockholders equity Total liabilities and stockholders equity

690 854 1,244 639 2,148 6,244 11,819

4,237 1,933 1,519 7,689 259 3,871 4,130 11,819

1-2

Chapter 01 - Financial Statements and Business Decisions

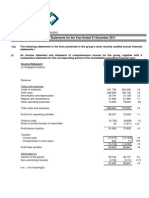

E17. WALGREEN CO. Income Statement For the Quarter ended May 31, 2009 (in millions) Revenues: Net sales Total revenues Expenses: Cost of sales Selling, occupancy and administration expense Interest Expense Total expenses Pretax income Income tax expense Net earnings

$16,210 $16,210 11,751 3,613 25 15,389 821 299 $ 522

Provision for income taxes is a common synonym for Income tax expense. E18. NEIGHBORHOOD REALTY, INCORPORATED Income Statement For the Year Ended December 31, 2012 Revenues: Commissions earned ($150,900+$16,800) Rental service fees Total revenues Expenses: Salaries expense Commission expense Payroll tax expense Rent expense ($2,475+$225)* Utilities expense Promotion and advertising expense Miscellaneous expenses Total expenses (excluding income taxes) Pretax income Income tax expense Net Income

$167,700 20,000 $187,700 62,740 35,330 2,500 2,700 1,600 7,750 500 113,120 74,580 24,400 $50,180

*$2,475 has been paid for 11 months ($225 per month) plus $225 owed for December.

1-3

Chapter 01 - Financial Statements and Business Decisions

E110. A B C D E Net Income = $231,820 - $196,700 = $35,120; Stockholders Equity = $294,300 - $75,000 = $219,300. Total Revenues = $175,780 + $29,920 = $205,700; Total Liabilities = $590,000 - $348,400 = $241,600. Net Loss = $72,990 - $91,890 = ($18,900); Stockholders Equity = $258,200 - $190,760 = $67,440. Total Expenses = $36,590 - $9,840 = $26,750; Total Assets = $189,675 + $97,525 = $287,200. Net Income = $224,130 - $210,630= $13,500; Total Assets = $173,850 + $361,240 = $535,090.

E111. PAINTER CORPORATION Income Statement For the Month of January 2011 Total revenues Less: Total expenses (excluding income tax) Pretax income Less: Income tax expense Net income $299,000 189,000 110,000 34,500 $ 75,500

PAINTER CORPORATION Balance Sheet At January 31, 2011 Assets Cash Receivables from customers Merchandise inventory Total assets Liabilities Payables to suppliers Income taxes payable Total liabilities Stockholders' Equity Contributed capital (2,600 shares) Retained earnings (from income statement above) Total stockholders equity Total liabilities and stockholders' equity $ 65,150 34,500 96,600 $196,250

$26,450 34,500 60,950 59,800 75,500 135,300 $196,250

1-4

Chapter 01 - Financial Statements and Business Decisions

E112. CLINTS STONEWORK CORPORATION Statement of Retained Earnings For the Year Ended December 31, 2012 Beginning retained earnings* Net income Dividends Ending retained earnings $16,800 42,000 18,700 $40,100

* Beginning retained earnings + Net income Dividends = Ending retained earnings For 2011: $0 + 31,000 14,200 = $16,800; Ending retained earnings for 2011 becomes beginning retained earnings for 2012

E113. (I) O (F) (O) (O) (O) I (F) (1) (2) (3) (4) (5) (6) (7) (8) Purchases of property, plant, and equipment Cash received from customers Cash paid for dividends to stockholders Cash paid to suppliers Income taxes paid Cash paid to employees Cash proceeds received from sale of investment in another company Repayment of borrowings

1-5

Chapter 01 - Financial Statements and Business Decisions

E114. LAH MANUFACTURING CORPORATION Statement of Cash Flows For the Year Ended December 31, 2011 Cash flow from operating activities Cash collections from sales $270,000 Cash paid for operating expenses (175,000) Net cash flow from operating activities $95,000 Cash flow from investing activities Sale of land 25,000 Purchase of new machines (48,000) Net cash flow from investing activities (23,000) Cash flow from financing activities Sale of capital stock 30,000 Payment on long-term notes (80,000) Payment of cash dividends (18,000) Net cash flow from financing activities (68,000) Net increase in cash 4,000 Cash at beginning of year 63,000 Cash at end of year $ 67,000

1-6

Chapter 01 - Financial Statements and Business Decisions PROBLEMS

P11. Req. 1 GASLIGHT COMPANY Income Statement For the Year Ended December 31, 2011 Total sales revenue (given) Total expenses (given) Pretax income Income tax expense ($45,800 x 30%) Net income Req. 2 GASLIGHT COMPANY Statement of Retained Earnings For the Year Ended December 31, 2011 Beginning retained earnings +Net income (from req. 1) Dividends (given) Ending retained earnings Req. 3 GASLIGHT COMPANY Balance Sheet At December 31, 2011 Assets Cash (given) Receivables from customers (given) Inventory of merchandise (given) Equipment (given) Total assets Liabilities Accounts payable (given) Salary payable (given) Total liabilities Stockholders' Equity Contributed capital (given) Retained earnings (from req. 2) Total stockholders' equity Total liabilities and stockholders' equity $24,500 10,800 81,000 40,700 $157,000 $46,140 1,800 $ 47,940 $87,000 22,060 109,060 $157,000 $ 0 32,060 10,000 $ 22,060 $126,000 80,200 45,800 13,740 $ 32,060

1-7

Chapter 01 - Financial Statements and Business Decisions

P12. Req. 1 BRIDGET'S LAWN SERVICE Income Statement For the Three Months Ended August 31, 2011 Revenues Lawn servicecash credit Total revenues Expenses Gas, oil, and lubrication ($940+$180) Pickup repairs Repair of mowers Miscellaneous supplies used Helpers (wages) Payroll taxes Preparation of payroll tax forms Insurance Telephone Interest expense on note paid Equipment use cost (depreciation) Total expenses Net income

$12,300 700 $13,000 1,120 250 110 80 5,400 190 25 125 110 65 600 8,075 $ 4,925

Req. 2 Because the above report reflects only revenues, expenses, and net income, it is reasonable to suppose that Bridget would need the following: (1) A balance sheetthat is, a statement that reports for the business, at the end of August 2011, each asset (name and amount, such as Cash, $XX), each liability (such as Wages Payable, $XX), and stockholders equity. A statement of retained earnings that shows how income and dividends (if any) affect retained earnings on the balance sheet. A statement of cash flowsthat is, a statement of the inflows and outflows of cash during the period in three categories: operating, investing, and financing.

(2) (3)

1-8

Chapter 01 - Financial Statements and Business Decisions

P13. Req. 1 Transaction Income (a) +$66,000 Req. 2Explanation Cash +$55,000 All services performed increase income; cash received during the period was, $66,000 11,000 = $55,000. Cash borrowed is not income. Purchase of the truck does not represent an expense until it is used (it is an asset); cash outflow was $9,500. All of the wages incurred reduce income, $21,000; cash paid during the quarter was, $21,000 x 1/2 = $10,500. The $10,500 owed will be paid on the next payroll date. Not all of the supplies were used; expense is the amount used, $3,800 900 = $2,900. Cash paid during the quarter was $3,800. All expenses incurred reduce income; cash expended was, $39,000 6,500 = $32,500.

(b) (c)

0 0

+45,000 9,500

(d)

21,000

10,500

(e)

2,900

3,800

(f)

39,000

32,500

Based only on the above: Income (loss) $3,100 Cash inflow (outflow)

$ 43,700

1-9

Chapter 01 - Financial Statements and Business Decisions

P14. Req. 1 The personal residences of the organizers are not resources of the business entity. Therefore, they should be excluded. Req. 2 It is not indicated whether the $57,000 listed for service trucks and equipment is their cost when acquired or the current market value on December 31, 2011. Req. 3 The list of company resources (i.e., assets) suggests the following areas of concern: Company resources: (1) Cash, inventories, and bills due from customers (i.e., accounts receivable)these items tend to fluctuate; they may be significantly more or less at date of the loan and during the term of the loan. (2) Service trucks and equipmentas noted above, it is not indicated whether the $57,000 is cost when acquired or current market value on December 31, 2011. Personal residencesas noted above, these items are not resources of the business entity and should be excluded.

(3)

Company obligations: (4) Unpaid wages of $19,000, which are now due, pose a serious problem because only $12,000 cash currently is available. (5) Unpaid taxes and accounts payable to suppliersit is not clear when these payments of $8,000 and $10,000, respectively, are due (cash needed to pay them is a problem). The $45,000 owed on the service trucks probably is long term; however, shortterm installments may be requiredthese details are very important to the bank. Loan from organizerthe expected payment date and interest rate are important issues for which details are not provided. This is a major cash demand.

(6)

(7)

In general, the bank should request more details about the specific resources and debts. The personal residences are not a part of the resources of the business entity. The bank should request that the owners provide audited information about the entity's assets and debts.

1-10

Chapter 01 - Financial Statements and Business Decisions

P14. (continued) Req. 4 The amount of stockholders equity (i.e., assets minus liabilities) for Northwest Company, assuming the amounts provided by the owners are acceptable, would be: Assets ($311,000$190,000) Liabilities Stockholders equity $121,000 92,000 $29,000

1-11

You might also like

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- Analysis of Financial StatementDocument9 pagesAnalysis of Financial StatementSums Zubair MoushumNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- Tutorial 1Document21 pagesTutorial 1Krrish BosamiaNo ratings yet

- Transaction Analysis and Preparation of Statements Practice Problem SolutionDocument6 pagesTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- Statement of Cash Flows - Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows - Lecture Questions and AnswersEynar Mahmudov83% (6)

- Accounting CaseDocument4 pagesAccounting CaseMarianne AgunoyNo ratings yet

- Assignment 1 AccountingDocument6 pagesAssignment 1 Accountingkareemsherif151No ratings yet

- Chapter 4 SolutionsDocument12 pagesChapter 4 SolutionsSoshiNo ratings yet

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- Financial Accounting Ch 5 Exercises & Problems AnswersDocument13 pagesFinancial Accounting Ch 5 Exercises & Problems AnswersHumza Abbasi0% (3)

- Chapter 2 Financial Statement and Analysis PDFDocument26 pagesChapter 2 Financial Statement and Analysis PDFRagy SelimNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Financial Reporting & Analysis Solutions Statement of Cash Flows ExercisesDocument72 pagesFinancial Reporting & Analysis Solutions Statement of Cash Flows ExerciseskazimkorogluNo ratings yet

- MME 3113 Assignment #2 Financial Ratios & Cash FlowDocument8 pagesMME 3113 Assignment #2 Financial Ratios & Cash FlowAnisha ShafikhaNo ratings yet

- Unaudited Financial Statements for Year Ended 31 Dec 2011Document18 pagesUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonNo ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Chapter 3 Short ProlemsDocument9 pagesChapter 3 Short ProlemsRhedeline LugodNo ratings yet

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955No ratings yet

- The Income Statement and The Statement of Cash FlowsDocument31 pagesThe Income Statement and The Statement of Cash FlowsdanterozaNo ratings yet

- CH 3 - Financial Statements, Cash FlowDocument48 pagesCH 3 - Financial Statements, Cash Flowssierras1No ratings yet

- Chapter 23 - Worksheet and SolutionsDocument21 pagesChapter 23 - Worksheet and Solutionsangelbear2577No ratings yet

- Butler Lumber Operating Statements and Balance Sheets 1988-1991Document17 pagesButler Lumber Operating Statements and Balance Sheets 1988-1991karan_w3No ratings yet

- ACC1002 Team 8Document11 pagesACC1002 Team 8Yvonne Ng Ming HuiNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanNo ratings yet

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- InfraDocument11 pagesInfrakdoshi23No ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- 2002 Financial Analysis in Excel (QuickBooks DataDocument6 pages2002 Financial Analysis in Excel (QuickBooks DataYL GohNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- F1 November 2010 AnswersDocument11 pagesF1 November 2010 AnswersmavkaziNo ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- CH 02 Tool KitDocument9 pagesCH 02 Tool KitDhanraj VenugopalNo ratings yet

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresNo ratings yet

- October 21, 2020 Financial AssetDocument12 pagesOctober 21, 2020 Financial AssetareebNo ratings yet

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDocument13 pagesSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNo ratings yet

- CH 01Document5 pagesCH 01deelol99No ratings yet

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDocument39 pagesConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNo ratings yet

- Unit 2 - Essay QuestionsDocument8 pagesUnit 2 - Essay QuestionsJaijuNo ratings yet

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalNo ratings yet

- Chapter 3Document24 pagesChapter 3izai vitorNo ratings yet

- Ch02 P14 Build A Model (3) - SolutionDocument2 pagesCh02 P14 Build A Model (3) - SolutiongnoctunalNo ratings yet

- Accounting For Business Class BAP 12 C Group AssignmentDocument12 pagesAccounting For Business Class BAP 12 C Group Assignmentpramodh kumarNo ratings yet

- Using Excel For Business AnalysisDocument5 pagesUsing Excel For Business Analysis11armiNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Ch 02 Build Cumberland Industries Income Statement and Balance SheetDocument6 pagesCh 02 Build Cumberland Industries Income Statement and Balance SheetKhurram KhanNo ratings yet

- Financial Statements and Accounting Concepts/PrinciplesDocument30 pagesFinancial Statements and Accounting Concepts/PrinciplesdanterozaNo ratings yet

- Uses of Accounting Information and The Financial Statements - SolutionsDocument31 pagesUses of Accounting Information and The Financial Statements - SolutionsmacfinpolNo ratings yet

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- ACC1006 EOY Essay DrillDocument13 pagesACC1006 EOY Essay DrillTiffany Tan Suet YiNo ratings yet

- FAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESDocument36 pagesFAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESPrince McBossmanNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Tushnet ConComp 2008 Outline HDocument80 pagesTushnet ConComp 2008 Outline HArman BeiramiNo ratings yet

- Tushnet ConComp 2008 Exam HDocument12 pagesTushnet ConComp 2008 Exam HArman BeiramiNo ratings yet

- First Amendment Case Law and Its Applicability To CyberspaceDocument169 pagesFirst Amendment Case Law and Its Applicability To CyberspaceArman BeiramiNo ratings yet

- Parker Con1st 2011S Exam HDocument10 pagesParker Con1st 2011S Exam HArman BeiramiNo ratings yet

- Minow Con1st 2008F AminusDocument12 pagesMinow Con1st 2008F AminusArman BeiramiNo ratings yet

- Sachs EmploymentLaw 2012F Exam DSDocument19 pagesSachs EmploymentLaw 2012F Exam DSArman BeiramiNo ratings yet

- Richards FirstAmendment Shumow Spr06Document17 pagesRichards FirstAmendment Shumow Spr06Arman BeiramiNo ratings yet

- Parker Con1st 2009S Exam HDocument10 pagesParker Con1st 2009S Exam HArman BeiramiNo ratings yet

- Parker Con1st Outline HDocument65 pagesParker Con1st Outline HArman BeiramiNo ratings yet

- Parker Con1st 2011S Outline HDocument84 pagesParker Con1st 2011S Outline HArman BeiramiNo ratings yet

- Minow Con1st Outline AminusDocument85 pagesMinow Con1st Outline AminusArman BeiramiNo ratings yet

- Fried ConLaw (1st) 2011F Exam DSDocument12 pagesFried ConLaw (1st) 2011F Exam DSArman BeiramiNo ratings yet

- Feldman Con1st 2010S Exam HDocument4 pagesFeldman Con1st 2010S Exam HArman BeiramiNo ratings yet

- Feldman Con1st Exam AplusDocument4 pagesFeldman Con1st Exam AplusArman BeiramiNo ratings yet

- Fried Con1st Exam AminusDocument10 pagesFried Con1st Exam AminusArman BeiramiNo ratings yet

- CH 02 Review and Discussion Problems SolutionsDocument16 pagesCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- First Amendment Outline AnalysisDocument126 pagesFirst Amendment Outline AnalysisArman BeiramiNo ratings yet

- Feldman Con1st 2011S Exam HDocument9 pagesFeldman Con1st 2011S Exam HArman BeiramiNo ratings yet

- CH 03 Review and Discussion Problems SolutionsDocument23 pagesCH 03 Review and Discussion Problems SolutionsArman Beirami57% (7)

- Feldman Con1st 2011S Checklist HDocument12 pagesFeldman Con1st 2011S Checklist HArman BeiramiNo ratings yet

- CH 02 Review and Discussion Problems SolutionsDocument16 pagesCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- CH 04 Review and Discussion Problems SolutionsDocument23 pagesCH 04 Review and Discussion Problems SolutionsArman Beirami67% (3)

- 2012 Fall HLS Introduction To Accounting SyllabusDocument2 pages2012 Fall HLS Introduction To Accounting Syllabushls13broNo ratings yet

- Drift Punch: Product Features ProfilesDocument3 pagesDrift Punch: Product Features ProfilesPutra KurniaNo ratings yet

- FINA 7A10 - Review of ConceptsDocument2 pagesFINA 7A10 - Review of ConceptsEint PhooNo ratings yet

- Evaluation of The Cyanotic Newborn Part IDocument9 pagesEvaluation of The Cyanotic Newborn Part Ijwan ahmedNo ratings yet

- Java Material 1Document84 pagesJava Material 1tvktrueNo ratings yet

- Cu Unjieng V MabalacatDocument6 pagesCu Unjieng V MabalacatMp CasNo ratings yet

- C15 DiagranmaDocument2 pagesC15 Diagranmajose manuel100% (1)

- Ticket Frankfurt Berlin 3076810836Document2 pagesTicket Frankfurt Berlin 3076810836farzad kohestaniNo ratings yet

- Salting-Out Crystallisation Using NH Ina Laboratory-Scale Gas Lift ReactorDocument10 pagesSalting-Out Crystallisation Using NH Ina Laboratory-Scale Gas Lift ReactorChester LowreyNo ratings yet

- Ahmed (2018)Document9 pagesAhmed (2018)zrancourttremblayNo ratings yet

- Key plan and area statement comparison for multi-level car park (MLCPDocument1 pageKey plan and area statement comparison for multi-level car park (MLCP121715502003 BOLLEMPALLI BINDU SREE SATYANo ratings yet

- Attaei PDFDocument83 pagesAttaei PDFHandsomē KumarNo ratings yet

- TBEM CII Exim Bank Award ComparisonDocument38 pagesTBEM CII Exim Bank Award ComparisonSamNo ratings yet

- Project Close OutDocument12 pagesProject Close OutWeel HiaNo ratings yet

- The NF and BNF Charts from the Trading RoomDocument23 pagesThe NF and BNF Charts from the Trading RoomSinghRaviNo ratings yet

- Plastic BanDocument3 pagesPlastic BanSangeetha IlangoNo ratings yet

- Grade 5 PPT English Q4 W3 Day 2Document17 pagesGrade 5 PPT English Q4 W3 Day 2Rommel MarianoNo ratings yet

- L10: Factors that Affect a Pendulum's PeriodDocument9 pagesL10: Factors that Affect a Pendulum's PeriodHeide CarrionNo ratings yet

- DIRECTORS1Document28 pagesDIRECTORS1Ekta ChaudharyNo ratings yet

- Acc121 Exam1 ProblemsDocument4 pagesAcc121 Exam1 ProblemsTia1977No ratings yet

- Non-Traditional Machining: Unit - 1Document48 pagesNon-Traditional Machining: Unit - 1bunty231No ratings yet

- Logistic RegressionDocument17 pagesLogistic RegressionLovedeep Chaudhary100% (1)

- Sbi Home Loan InfoDocument4 pagesSbi Home Loan InfoBhargavaSharmaNo ratings yet

- Vandergrift - Listening, Modern Theory & PracticeDocument6 pagesVandergrift - Listening, Modern Theory & PracticeKarolina CiNo ratings yet

- All India CW Pricelist Wef 01.05.2021Document6 pagesAll India CW Pricelist Wef 01.05.2021Sameer PadhyNo ratings yet

- Orgin of Life and Organic EvolutionDocument74 pagesOrgin of Life and Organic Evolutionasha.s.k100% (5)

- Dermatitis Venenata Donald UDocument5 pagesDermatitis Venenata Donald UIndahPertiwiNo ratings yet

- Css Recommended BooksDocument6 pagesCss Recommended Booksaman khanNo ratings yet

- Fmi Code GuideDocument82 pagesFmi Code GuideNguyễn Văn Hùng100% (4)

- Transforming City Governments For Successful Smart CitiesDocument194 pagesTransforming City Governments For Successful Smart CitiesTri Ramdani100% (2)

- CompReg 13SEPTEMBER2023Document2,725 pagesCompReg 13SEPTEMBER2023syed pashaNo ratings yet