Professional Documents

Culture Documents

Merlin - Irish Indo, August 28 08

Uploaded by

PhilipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merlin - Irish Indo, August 28 08

Uploaded by

PhilipCopyright:

Available Formats

IN FOCUS

It's blood on the forecourts as

glump puts brakes on car sales

business

is slow, but

jdealers'

confidence

won't be

ciented

A

GOOD car salesman is the

quintessential smooth talker,

famed for his ability to put a

sheen on the most ordinary

of cars and show the

most gaping of dents in a

glowing light.

When the country's best car salesmen,

the smoothest talkers in Irish

ass, can't spin a positive yarn about

Eisedlyown industry's performance, you

UnfW things are bad.

Gavin Hydes, manager of BMW giant

Joe Duffy Motors, makes the best stab

at jt, insisting the industry's woes are

overdone and listing "some of the non-

sense written about us" as the biggest

challenge facing his sector.

But with new car sales down 15pc in the

first half of the year, used car prices coflaps-

ing and record numbers of motois gather-

ing dust for record lengths of time, Hydes

has the air ofaman fiddling while Ireland's once a reserve price is hit. Meanwhile, says SIMI's Alan Nolan:

second-hand motors, recession-fearing

forecourts bum. Increasing numbers of repossessed, cars "I'd never want to underplay companies

buyers had taken to the hills.

famous car salesman are also coming through Merlin's doors, going out of business, it's a very serious

IpjAs Ireland's most "Car buying tends to require a lot of con-

for the owners and managers

Bill Cullen puts it, "the motor industry is sumer confidence" says Alan Nolan of the O'Reilly says, along with higher numbers thing

facing some huge challenges", and he's motor industry's representative body, of private sellers who've been turned down involved, but I think there's been a lot

not talking about the negative publicity so SIMI. "I*eople need to be confident things for a trade-in by dealers with already more said about dealerships closing that

bulging forecourts. has actually happened.

bemoaned by Hydes. are going to go reasonably well for two or

three years and that has been hit hard this A "diabolical" year for car rentals will "You're talking about one bad year

Taxing also see yet more stock come onto the against a backdrop of a lot of good ones.

year."

Top on Cuilen's list and strongly criticised Plummeting demand and the knock-on market, as leasors seek to reduce their People are in it for the long run."

of the VRT changes combined to fleet, according to Murray's Europcar Whether it's just one bad year, howev-

by several other industry sou rces are the effect

Vehicle Registration Tax (VRT) changes produce one of the most difficult years on operations boss Pat Geagan who has er, remains to be seen.

announced in last December's Budget and record for the second-hand .car market. already cut his fleet to about 5,000 and will Some 185,000 new cars were sold in

introduced in Juiy. "Used cars are cheaper now as a percent- make further cuts this year. 2007, depending on who you ask that

The goalposts changed and used cars try to make a margin on that" cedes, up from 120 last year, while O'Reil- AH in, Merlin O'Reilly expects to auction number will fall back to between 140,000

age of new car values than I've ever seen

The industry's delayed response, more ly says his average sales time has risen almost 10,000 cars this year, up from last and 150,000 this year, before falling by

were instantly worth less because the new them, and I've been in the car business for

versions would costs less in July" says the difficult finance conditions and weaken- from 38 days in 2007 to 60 days now. year's 7,000. another 10,000 or so in 2009.

40 years," says Tom Murphy of Waterford-

Dubliner who recently gave up the basedTom Murphy Car Sales. ing consumer demand all combined to Across the industry, figures from Car The good news, he says, is that large

Renault Irish distribution rights and In some industries lower prices stimu- create a glut of used cars in the market and Buyers Guide show the average time taken numbers of cars are still being sold at despite the universal pre-

late demand, but there are different dynam- cars spent more and more time gatheri ng to sell a car on their website has risen by auction, with 180 cars sold at one recent dictions of continued falls in

stOl runs some of the country's largest

dealerships.

o "By

the time we were told about it we

ics at play on the nation's forecourts.

"Finance is harder for everyone," says

Cullen. "It used to be that if someone was

dust in the nation's lots.

Hyde says he "won't be drawn" on how

much longer it is taking to sell cars this year,

two weeks since 2007 to about 10 weeks.

"The biggest challenge for people

towards the end of the year is trying to

event.

The bad news is that ever-increasing

supply means people "aren't spending the

YET new car sales, the industry's

future outlook is far from one of

doom and gloom.

had already taken trade-ins that were

buying a €10,000 car and they wanted a but Murphy says it^ now taking him an clear v sed stock to get ready for 2009," says same money as last year", in a development "Between the SSIAs and everything,

devalued by €2,000 or €3,000, the best

part of €50m was wiped off the used car loan for €10,000 that was fine. average of 150 days to sell a larger Mer- Nolan. that can only aggravate the general 2007 was an exceptional year," says Hydes.

market." "Now the banks are really looking up "It's a difficult decision to take the hit softness in second-hand car prices. The issue isn't 2008 or 2009 it's that

The timing also crippled demand the exhaust pipes because the market is and sell used cars for less than you bought The motor industry turmoil comes 2007 was a blip."

v

earlier in the year, as people held out until moving so much and they're afraid of the them for, but people will take the hit this against a background of heavy invest- O'Reilly, meanwhile, sees a recovery in

year and get them off the forecourts." ment, thanks to a 2002 European directive used car prices towards the end of the year

JJUy to benefit from lower VRT rates, depreciation."

The slide in prices also caught dealers The effort to offload old stock has that demanded higher standards and pro- and is keeping his full Motorcity staff on

prompting a Ispc slump in the volume of

new cars sold in the first half of the year. on the hop. The problem is the market prompted a 15pc rise in the numbers of fessionalism from dealerships. board despite the fall-off in business so

The figures recovered in July when took too long to react," says Merlin O'Reil- dealers putting their cars on the Car As the forces conspire to create one of he'll be poised to take advantage of any

sales rose by 25pc but the damage to the ly of Merlin Motor Group which sold 3,000 Buyers Guide website, while 40pc of the the toughest environments ever endured upswing.

motor industry cycle wasn't something used cars at its Motorcity last year. website's sellers are now paying for by the motor industry, questions about And Cullen points to the industry's

that could be easily reversed. "You'd have one soft weekend and you'd premium listings. companies' survival have inevitably "higher base" heading into a recession,

"It was like having two Januarys, and it blame it on the weather or the football, Car auctions like those operated by- surfaced. since just 52,000 new cars were being

then the following weekend you'd blame O'Reilly's Merlin Auctions have also seen Already two garages have gone bust, and sold each yearwhen Ireland went into the

meant we had alack of secondhand stock

earlier i n the year and higher stocks than it on something else and it took weeks to a surge in business from dealers. "A lot of several others have had to publicly last recession in 1980.

usual now," says Hydes. realise there was something wrong. people have cars on finance, when the come out against rumours of their own As for this recession and its challenges,

: Between the 'two Januarys', the econo- "People were making the mistake of finance companies want to reduce the impending demise, "there's no point in going to the Govern-

Sttv plunged downward with a swiftness looking at the cost of what they'd bought loan they have to go to the auctions to get Hydes' Joe Duffy Motors was one of ment cap in hand, they haven't got any

pbdicted by few. By the time punters had and trying to make a margin on that even rid of them quickly," says Cullen. those hit by the rumours, which he insists money and they certainly haven't got any

'got to grips with the VRT changes, many though the market has moved on from Car dealers aren't the only ones flocking are "rubbish" and which will be categori- money for the motor industry" Cullen

had last their appetite for an '08 reg, and there and they should have been looking to the auction market, where cars can cally refuted by his company's soon-to-be- says. "We're just going to have to pull up

at the price they can replace a car for and change hands in as little as 60 seconds published audited accounts, he says. our sleeves and take it on the chin."

by the time the car yards swelled with

You might also like

- Merlin Sunday Trib August 17 081Document1 pageMerlin Sunday Trib August 17 081PhilipNo ratings yet

- Merlin - Enniscorthy Gaurdian, Dec 17 08Document1 pageMerlin - Enniscorthy Gaurdian, Dec 17 08PhilipNo ratings yet

- Merlin - Kildare Nationalist, Feb 20 09Document1 pageMerlin - Kildare Nationalist, Feb 20 09PhilipNo ratings yet

- Merlin - The Star, August 26 08Document1 pageMerlin - The Star, August 26 08PhilipNo ratings yet

- Merlin - Carlow People, Dec 16 08Document1 pageMerlin - Carlow People, Dec 16 08PhilipNo ratings yet

- Merlin - Sunday World, Feb 22 09Document3 pagesMerlin - Sunday World, Feb 22 09PhilipNo ratings yet

- Merlin - Enniscorthy Gaurdian, Dec 17 08Document1 pageMerlin - Enniscorthy Gaurdian, Dec 17 08PhilipNo ratings yet

- Merlin - Bray People, Dec 17 08Document1 pageMerlin - Bray People, Dec 17 08PhilipNo ratings yet

- Merlin - Sunday Times, Oct 26 08Document1 pageMerlin - Sunday Times, Oct 26 08PhilipNo ratings yet

- Merlin - Drogheda Indo, Dec 17 08Document1 pageMerlin - Drogheda Indo, Dec 17 08PhilipNo ratings yet

- Merlin - The Star, August 26 08Document1 pageMerlin - The Star, August 26 08PhilipNo ratings yet

- Merlin - Enniscorthy Gaurdian, Dec 17 08Document1 pageMerlin - Enniscorthy Gaurdian, Dec 17 08PhilipNo ratings yet

- Merlin - Sbpost, Sept 28 08Document2 pagesMerlin - Sbpost, Sept 28 08PhilipNo ratings yet

- Merlin - SDocument1 pageMerlin - SPhilipNo ratings yet

- Merlin - Sbpost, August 24 08Document3 pagesMerlin - Sbpost, August 24 08PhilipNo ratings yet

- Merlin - SDocument3 pagesMerlin - SPhilipNo ratings yet

- Merlin - Irish Times, Feb 18 09Document1 pageMerlin - Irish Times, Feb 18 09PhilipNo ratings yet

- Merlin - Sbpost, Oct 02 08Document2 pagesMerlin - Sbpost, Oct 02 08PhilipNo ratings yet

- Merlin - Mid Louth Indo, Dec 17 08Document1 pageMerlin - Mid Louth Indo, Dec 17 08PhilipNo ratings yet

- Merlin - Motorworld Inside Article, June 08Document1 pageMerlin - Motorworld Inside Article, June 08PhilipNo ratings yet

- Merlin - SDocument1 pageMerlin - SPhilipNo ratings yet

- Merlin - Irish Times, Jan 31 09Document3 pagesMerlin - Irish Times, Jan 31 09PhilipNo ratings yet

- Merlin - Irish Times, August 11 08Document1 pageMerlin - Irish Times, August 11 08PhilipNo ratings yet

- Merlin - Motorworld Cover, June 08Document1 pageMerlin - Motorworld Cover, June 08PhilipNo ratings yet

- Merlin - Leinster Leader, Feb 21 09Document1 pageMerlin - Leinster Leader, Feb 21 09PhilipNo ratings yet

- Merlin - Kildare Nationalist, Oct 31 08Document1 pageMerlin - Kildare Nationalist, Oct 31 08PhilipNo ratings yet

- Merlin - Kildare Post, Feb 18 09Document1 pageMerlin - Kildare Post, Feb 18 09PhilipNo ratings yet

- Merlin - Irish Times, August 08 08Document2 pagesMerlin - Irish Times, August 08 08PhilipNo ratings yet

- Merlin - Irish Mirror, August 11 08Document1 pageMerlin - Irish Mirror, August 11 08PhilipNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Physical Assessment of Ejeep in ManilaDocument12 pagesPhysical Assessment of Ejeep in ManilaMusicMeowNo ratings yet

- 32nd Rol Entry ListDocument2 pages32nd Rol Entry Listnicolashindi100% (2)

- Toyota BT Optio MDocument8 pagesToyota BT Optio MMohammad Shahin HossainNo ratings yet

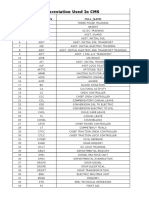

- Abbreviation Used in CmsDocument4 pagesAbbreviation Used in Cmsapi-598356408No ratings yet

- Bicycle 4Document17 pagesBicycle 4abhimanyu2923No ratings yet

- SI 41 2016 Road Traflic (Traffic Signs and Signals) Regulations, 2016Document158 pagesSI 41 2016 Road Traflic (Traffic Signs and Signals) Regulations, 2016pzhou5774No ratings yet

- Memo UCBC Abiso Ukol Sa Pagbaklas UntaggedDocument2 pagesMemo UCBC Abiso Ukol Sa Pagbaklas UntaggedEmmanuel San Pedro Jr.No ratings yet

- Delay Codes BookletDocument34 pagesDelay Codes BookletAssem HossenNo ratings yet

- C90a PohDocument520 pagesC90a PohjedwardpilotNo ratings yet

- 2kd FTV Repair Manual PDFDocument3 pages2kd FTV Repair Manual PDFpmmdavid0% (3)

- Fred's Model World October 2019 ListDocument28 pagesFred's Model World October 2019 ListFred SternsNo ratings yet

- Dangerous Goods Declaration Completion GuideDocument2 pagesDangerous Goods Declaration Completion GuideAndrija Boskovic100% (1)

- Forms of TourismDocument25 pagesForms of TourismRaichi DeHaichiNo ratings yet

- 4 Port Master Plan Implementation Kemal HeryandriDocument29 pages4 Port Master Plan Implementation Kemal HeryandririonaldirionaldiNo ratings yet

- Excise taxes on automobiles: Rates and persons liableDocument3 pagesExcise taxes on automobiles: Rates and persons liableAsnifah AlinorNo ratings yet

- Toll-2019.03.07-Guidelines - (SOP) Standard Operating Procedure For Toll Notification and Mandatory ETC Infrastructure in All Toll Lanes PDFDocument6 pagesToll-2019.03.07-Guidelines - (SOP) Standard Operating Procedure For Toll Notification and Mandatory ETC Infrastructure in All Toll Lanes PDFsenthilNo ratings yet

- Vietnam Airlines ProspectusDocument116 pagesVietnam Airlines Prospectusabbdeals67% (3)

- Marine CargoDocument1 pageMarine Cargocsmcargo0% (1)

- Volkswagen Touareg - Adaptive Cruise Control (ACC) With Front AssistDocument23 pagesVolkswagen Touareg - Adaptive Cruise Control (ACC) With Front AssistMarius Ioan BaleaNo ratings yet

- Format SIsDocument2 pagesFormat SIsSalim MalickNo ratings yet

- Reviving The Scirocco To Target A Niche Market: Volkswagen'S Iroc ConceptDocument8 pagesReviving The Scirocco To Target A Niche Market: Volkswagen'S Iroc ConceptSahil_Kwatra_6471No ratings yet

- Commercial Engines 2016Document60 pagesCommercial Engines 2016Bogdan ProfirNo ratings yet

- Concept For Lucknow Smart CityDocument8 pagesConcept For Lucknow Smart CityReetika MaheshwariNo ratings yet

- I Will Make Scooters When Royal Enfield Makes Scooters: Rajiv Bajaj To ShareholdersDocument7 pagesI Will Make Scooters When Royal Enfield Makes Scooters: Rajiv Bajaj To ShareholdersShreya VengurlekarNo ratings yet

- 1b. Sustainment Unit Capability PE - Available Sustainment Units (v1)Document2 pages1b. Sustainment Unit Capability PE - Available Sustainment Units (v1)Steve RichardsNo ratings yet

- Proper Denomination of Bajaj RE Compact 45 F and RE 4 Stroke UnitsDocument1 pageProper Denomination of Bajaj RE Compact 45 F and RE 4 Stroke UnitsAaron James paraanNo ratings yet

- Type RatingsDocument15 pagesType RatingsMichael O'DonoghueNo ratings yet

- Pamphlet-Wide Gauge Sleepers & Check RailsDocument3 pagesPamphlet-Wide Gauge Sleepers & Check RailsKhurNo ratings yet

- Mercedes-Benz GLC Price List 2022Document43 pagesMercedes-Benz GLC Price List 2022Alexandrina BugaNo ratings yet

- Cruise Controller User Guide TipsDocument6 pagesCruise Controller User Guide Tipsfrans_h_kNo ratings yet