Professional Documents

Culture Documents

Project I

Uploaded by

Hieu Duong TrongOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project I

Uploaded by

Hieu Duong TrongCopyright:

Available Formats

Group Members:

Hieu Duong Wesley Brown

Interviewee:

Douglas J. Stussi Executive Vice-President CFO Phone: (405) 302-6695 Email: doug.stussi@loves.com

1.

Who is able to identify investment opportunities facing the firm?

Love do two business. The first one is retail business, travel stops and convenient stores throughout United State and another one is musket corporation that is whole sale fuel business. Furthermore, both those businesses have they own business development groups and each group usually contains three people; two of them are fulltime employees. Those people will help senior executives who really own the business to look at investment opportunities. 2. Who are decision makers in the firm?

Loves corporation is owned by a family; three of four children of the family do business in Loves and another one just has shares in corporation, not really working in corporation. Therefore, those three men are main decision makers of the firm. However, the corporation has board of senior managers who give those three owners recommendation in making decision. 3. What performance measures are used by these decision makers?

NPV and IRR are two measures the company uses most frequently when they do capital budgeting. However it more often uses NPV than IRR because NPV assumes that the project's cash inflows are reinvested to earn the hurdle rate; IRR assumes that the cash inflows are reinvested to earn the IRR. Therefore, it is more realistic to use NPV. 4. What is the cutoff rate (required return, hurdle rate) used and how is it

determined? Because the company uses both NPV and IRR, it also uses both hurdle rate and required rate of return based on their capital structure. However, the minimum required rate of return of the company is 16 percent that is applied in almost the companys projects and that amount of percent is calculated based on annually gallons of gas, amount retail stores they own, sale revenue and other factors. Furthermore, the company wants to have 25 percent return on investment when they do more risky projects that normal ones and higher 25 percent on some projects if the company have to pay all amounts within one installment and the projects are longer than 3 years. 5. Is the firm using risk-adjusted discount rates or not and, if so, how are they

estimated? Yes, the company is using risk-adjusted discount rate. The discount rate is usually affected by cost of capital factors. Moreover, the company prevents double debt by not discounting its cash inflow by require rate of return. 6. Why? Is the firm using a singular cut-off rate or multi-divisional cut-off rates?

Yes, the firm is using different cut-off rate based on different opportunities. Because if the company uses a firm wide cutoff rate, this rate will be too high for low-risk divisions and too low for high-risk divisions. Then the company will accept bad high-risk projects and reject good low-risk projects. Therefore, it is important to estimate divisional cutoff rates that will reflect the risk of each division. 7. Are there capital constrains applied, if so, how is the level determined? 13:

Yes, there are few capital constrains applied and its basically difference between cash flow and contingency 8. Does the firm lease assets, if so, how do they decide which assets to lease

vs. buy? Yes, the firm leases assets. The company decides which assets to lease based on following criteria: What term (long term vs. short term) does the company plan to keep the assets? It is really clear that if the company just needs to use the assets in short term then the best choice for it to lease the assets. How difficult do the company raise fund? The company raises money at pretty low rate and it has enough cash reserve so it prefers to buy the assets in the situation that it needs those assets for long term. What are the tax benefits of buying vs. leasing? The company considers all related tax benefits for buying and leasing options as they relate to specific business situation. There is usually a tax benefit associated with leasing where the company can get to deduct the full lease payment immediately.

9.

Does the firm do its acquisition analysis internally and, if so, what models

are used? The firm does acquisition but it rents experts to help it. 10. Does the firm invest internationally and, if so, how do they adjust for risk?

No, it does not do business internationally. 11. 20:00 This is private company so the post-audit processes are not important to it. The company has own its accountants who are responsible for the accuracy of reports to the family owner. 12. Does the firm apply real option analysis, if not, why not? Does the firm have any post-audit processes in place and, if not, why not?

Yes, the company applies real option analysis. By providing managers discretion - rights but not obligations, real options can help the company limit its downside risk while also gaining access to upside opportunities in the future.

Discusses all relevant aspects of the process that are inconsistent with course material and provides and comments on the firms explanation for this inconsistency. According to the textbook, the board of directors and managers in the corporation will define the investment opportunities, set policy for the corporation and makes major financial decisions. In addition, they have a right in authorizing the issuance of stock, electing the corporate officers, setting officer and key employee salary amounts, deciding whether to mortgage, sell, or lease real estate, and approving loans to or from

the corporation. All what board of directors does is to maximize the shareholders wealth so the shareholders are actual owners and final decision makers of a corporation. In Loves Corporation, however, almost authorities are held by family owners and the business decisions are undertaken by business owners. Moreover, the senior management, key employees, and other individuals closely associated with the business are typically the stockholders. This corporation can have increased flexibility in short- and long-term business decisions because its managers are less focused on increasing the value of the company in the short term. In short, the initial reason for above inconsistencies with the course material is that the textbook talks about the structure, the operation of public corporation while Loves Corporation is the private entity. Comments: In public value of a corporation replies on the numbers of shares outstanding, its shares are listed and traded on stock market. In contrast, it will be difficult to sell share of private corporation because investors do not have enough information about the corporation as they want and need. Hence, the values of private corporation like Loves fluctuate more than public companies. Recommendations to improve on the firms capital budgeting process: To improve the corporations capital budgeting process, the first thing the corporation should do is to have informed Capital Budgeting. It is extremely important for Loves corporation to have the right data to support its capital budgeting process. The right data about projects will help the company improve the timeliness and effectiveness of the capital planning and budgeting.

The second thing the company should do to improve its capital budgeting process is timing for the greatest value. Because that process is multiple periods, the company should develop a multi-year horizon for capital. Some projects are carried out more than one year to complete and realize the intended benefits. Furthermore, the company should be able to define which projects to be better for deferral than others, and then the company will have more money to focus on projects that need more money currently. In addition, Loves corporation should evaluate its capital and find projects that are adequate to its capital capacity. This action can help the company prevent cost overruns, execution delays or expected benefits not being realized.

You might also like

- Creative Ways To Make Money Using ChatgptDocument2 pagesCreative Ways To Make Money Using ChatgptLan Sky0% (1)

- #2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?Document8 pages#2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?helloNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- What Industry Trends You Will Look at When You Are Looking For A Potential Investment?Document7 pagesWhat Industry Trends You Will Look at When You Are Looking For A Potential Investment?helloNo ratings yet

- AP Microecon GraphsDocument12 pagesAP Microecon GraphsQizhen Su100% (1)

- Sap Production PlanningDocument100 pagesSap Production PlanningHuy Nguyen83% (6)

- Value Creation Private EquityDocument6 pagesValue Creation Private EquityRobes BaimaNo ratings yet

- Layman's Guide To Pair TradingDocument9 pagesLayman's Guide To Pair TradingaporatNo ratings yet

- Wall Street Playboys IB Interview GuideDocument5 pagesWall Street Playboys IB Interview GuideJack JacintoNo ratings yet

- Capital Structure PlanningDocument5 pagesCapital Structure PlanningAlok Singh100% (1)

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- 1 - An Overview of Financial ManagementDocument14 pages1 - An Overview of Financial ManagementFawad Sarwar100% (5)

- L2 - Structure Conduct Performance ParadigmDocument66 pagesL2 - Structure Conduct Performance Paradigmgamerneville90% (30)

- Multiple Choice 1Document5 pagesMultiple Choice 1віра сіркаNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Chapter 1 3Document17 pagesChapter 1 3Hieu Duong Trong100% (3)

- Impact of Social Influencer On Consumer BehaviourDocument45 pagesImpact of Social Influencer On Consumer BehaviourRiddhi Tarsariya100% (2)

- Leverage Analysis ProjectDocument105 pagesLeverage Analysis ProjectLakshmi_Mudigo_17220% (2)

- Role of A Financial ManagerDocument13 pagesRole of A Financial ManagerpratibhaNo ratings yet

- TCDNDocument2 pagesTCDNThanh Thủy KhuấtNo ratings yet

- Assignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 1Document16 pagesAssignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 1Nabila Abu BakarNo ratings yet

- Coperate FinanceDocument17 pagesCoperate Financegift lunguNo ratings yet

- Business Finance - Grade 12Document5 pagesBusiness Finance - Grade 12althea bautistaNo ratings yet

- MFRD EssayDocument6 pagesMFRD Essaydoll3kittenNo ratings yet

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Document7 pagesManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNo ratings yet

- Corporate Finance Made SimpleDocument7 pagesCorporate Finance Made SimpleRamesh Arivalan100% (7)

- M & A Presentation and Word DocumentDocument11 pagesM & A Presentation and Word DocumentZiaul HaqueNo ratings yet

- 5 Ways RevampDocument4 pages5 Ways RevampAmlann MohantyNo ratings yet

- Assignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 2Document16 pagesAssignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 2Nabila Abu BakarNo ratings yet

- Introduction To Corporate FinanceDocument5 pagesIntroduction To Corporate FinanceToru KhanNo ratings yet

- Unit - 1Document40 pagesUnit - 1Tesfaye KebebawNo ratings yet

- Selecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Document6 pagesSelecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Pawan_Vaswani_9863No ratings yet

- Leverage Analysis ProjectDocument106 pagesLeverage Analysis Projectbalki123No ratings yet

- Factors Determining Optimal Capital StructureDocument8 pagesFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Escobal, Al Bsba - Finman 1 - FinalsDocument3 pagesEscobal, Al Bsba - Finman 1 - FinalsAlden EscobalNo ratings yet

- Empirical Use of Financial LeverageDocument3 pagesEmpirical Use of Financial Leveragesam abbasNo ratings yet

- CH 01Document20 pagesCH 01Thiện ThảoNo ratings yet

- MMPC 014 CTDocument8 pagesMMPC 014 CTlokanshu pandeyNo ratings yet

- Slide 1Document17 pagesSlide 1Vishal BhadaneNo ratings yet

- Accounting and Finance For ManagersDocument54 pagesAccounting and Finance For ManagersHafeezNo ratings yet

- The Firm: Structural Set-UpDocument4 pagesThe Firm: Structural Set-UpAkshay NashineNo ratings yet

- Impact of Capital Structure AllDocument3 pagesImpact of Capital Structure AllAfsana PollobiNo ratings yet

- 2023 Tutorial 1 FMADocument4 pages2023 Tutorial 1 FMAĐỗ Ngọc ÁnhNo ratings yet

- IM Chapter01Document13 pagesIM Chapter01Carese Lloyd Llorente BoylesNo ratings yet

- Assignment 2.6 Business PlanDocument2 pagesAssignment 2.6 Business PlanJenn AmaroNo ratings yet

- Leverage Unit 4 FMDocument12 pagesLeverage Unit 4 FMSHIVANSH ARORANo ratings yet

- Important Theory Q&aDocument13 pagesImportant Theory Q&amohsin razaNo ratings yet

- Caselet 4Document3 pagesCaselet 4Deepak PoddarNo ratings yet

- Business Plan Financial Plan A. Financial Projections Sources of Funds The BusinessDocument7 pagesBusiness Plan Financial Plan A. Financial Projections Sources of Funds The BusinessPM WritersNo ratings yet

- Transcription Doc - Capital StructureDocument9 pagesTranscription Doc - Capital StructureAnkit SinghNo ratings yet

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocument8 pagesA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertNo ratings yet

- Business ResourceDocument32 pagesBusiness ResourceSweet & SpicyNo ratings yet

- Tutorial 2 SolutionsDocument5 pagesTutorial 2 Solutionsmerita homasiNo ratings yet

- Finance KeyDocument37 pagesFinance KeyTrần Lan AnhNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- Question 4 AssignmentDocument2 pagesQuestion 4 Assignmentnurin afiqah muhammadNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- A Business Organization: "Business Organization" Is To Focus On Each Word SeparatelyDocument7 pagesA Business Organization: "Business Organization" Is To Focus On Each Word SeparatelyJulianne Love IgotNo ratings yet

- A Business Organization: "Business Organization" Is To Focus On Each Word SeparatelyDocument7 pagesA Business Organization: "Business Organization" Is To Focus On Each Word SeparatelyJulianne Love IgotNo ratings yet

- Welcome To Scribd - Where The World Comes To Read, Discover, and Share..Document98 pagesWelcome To Scribd - Where The World Comes To Read, Discover, and Share..Karen DraperNo ratings yet

- Factors Affecting Capital StructureDocument9 pagesFactors Affecting Capital StructureRai Saif SiddiqNo ratings yet

- Topic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowingDocument8 pagesTopic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowinggeorgianaNo ratings yet

- Acct 504 Exam Question GuideDocument15 pagesAcct 504 Exam Question Guideawallflower1100% (1)

- Capital Budgeteing Twelve QuestionsDocument2 pagesCapital Budgeteing Twelve QuestionsHieu Duong TrongNo ratings yet

- Other Employee CompensationDocument4 pagesOther Employee CompensationHieu Duong TrongNo ratings yet

- CH 7 W AnswersDocument8 pagesCH 7 W AnswersHieu Duong TrongNo ratings yet

- Gurpreet 10900898Document2 pagesGurpreet 10900898Jatinder SinghNo ratings yet

- RedSeer Etailing Leadership Index AMJ 17Document17 pagesRedSeer Etailing Leadership Index AMJ 17Danish ShaikhNo ratings yet

- Supplier Diversity in DepthDocument2 pagesSupplier Diversity in DepthHelloNo ratings yet

- Period End ClosingDocument16 pagesPeriod End ClosingumakantasystemNo ratings yet

- Marketing of StarbucksDocument16 pagesMarketing of StarbucksShubhangi SinghNo ratings yet

- 18.making Stream of Production-13Document50 pages18.making Stream of Production-13şenol sezerNo ratings yet

- Accounting Activity Manual MemorandumDocument29 pagesAccounting Activity Manual Memorandummavuyanaledi07No ratings yet

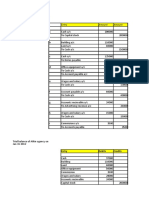

- Journal Entry For Atkin AgencyDocument4 pagesJournal Entry For Atkin AgencySamarth LahotiNo ratings yet

- ACCG 2000 Week 9 Homework QuestionsDocument1 pageACCG 2000 Week 9 Homework QuestionsAlexander TrovatoNo ratings yet

- An Analysis On Advantages and Disadvantages of C2C E-Commerce in EntrepreneurshipDocument3 pagesAn Analysis On Advantages and Disadvantages of C2C E-Commerce in EntrepreneurshipnafuturoNo ratings yet

- MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and Had MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and HadDocument1 pageMS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and Had MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and HadMelvin Facturanan100% (3)

- BC PPT EditedDocument12 pagesBC PPT EditedAbdullah HabibNo ratings yet

- 1.supply Chain MistakesDocument6 pages1.supply Chain MistakesSantosh DevaNo ratings yet

- 2011 01 07 - 062649 - Mcqjamuv 2Document2 pages2011 01 07 - 062649 - Mcqjamuv 2dnm110No ratings yet

- CE - 52012 (ch-1)Document35 pagesCE - 52012 (ch-1)Heinhtet NaingNo ratings yet

- Markowitz TheoryDocument4 pagesMarkowitz TheoryshahrukhziaNo ratings yet

- ERROCA Eye Wear - Franchising OpportunitiesDocument38 pagesERROCA Eye Wear - Franchising OpportunitiesIsrael ExporterNo ratings yet

- Revisionary Test Paper - June2018: Intermediate Group IIDocument51 pagesRevisionary Test Paper - June2018: Intermediate Group IIidealNo ratings yet

- Human R2Document8 pagesHuman R2Lusa Mulonga JkrNo ratings yet

- Distribution Managemen & Logistics T-Module IDocument40 pagesDistribution Managemen & Logistics T-Module Ipramodhmba100% (1)

- Print: Unit TestDocument5 pagesPrint: Unit TestRhita OuafiqNo ratings yet

- PRDEFENSEDocument15 pagesPRDEFENSEDave Vincent IsipNo ratings yet

- Case Study 1 - Signal Cable CompanyDocument5 pagesCase Study 1 - Signal Cable CompanyTengku SuriaNo ratings yet