Professional Documents

Culture Documents

Weekly Strategic Plan 11262012

Uploaded by

Bruce LawrenceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Strategic Plan 11262012

Uploaded by

Bruce LawrenceCopyright:

Available Formats

Liquidity Cycle

Thanksgiving week has now passed and I am reluctant to draw many conclusions from such a low volume, low participation market. So I will present some longer time frame charts as a tool to remind us where different markets are trading relative to their history. I will cut down on some of the volatility coverage this week also. This is usually the time of year when the silly season for trading begins. Large trading operations begin to close down for the year and traders attend to career risk in the form of capturing the profits they have made, or if they have not made any they turn to polishing resumes. Congress was also on recess which typically leads to better equity performance. All that said, let us hope that the strong price move up in the stock market is not just a low volume mirage.

A very impressive gain until one checks the facts and finds the 20 times gain of the market from 1964 when it was at 70 to 1400 at the highs also saw the money supply grow from 370 to 10221 or 27 times. There is the reason the middle class is falling behind. The government is stealing their wealth through debasement of the currency. This is the worlds second oldest profession and in the end you have had the same thing done to you as in the first.

The US equity market greeted the second Obama term by promptly walking over the tax anticipation cliff. The likelihood of carried interest, cap gains, and dividend hikes argued for the prudent harvesting of open gains in 2012. Congenial behavior by Republican and Democratic legislators seemed to relieve some of the pressure market participants had been feeling. The rhetoric should heat up again during the next two weeks and could roil markets once more. Unless the backroom negotiators have realized they all have political risk in this fiscal cliff scenario. These people created the fiscal cliff by piling deadlines on top of one another just after the election. They can just as easily un-pile the deadlines by changing a few expiration dates. This would not solve the problems we face, but it would diffuse the bad press. That is a worthy goal for an elected legislator. So my advice is prepare to have some serious smoke blown up the old fundament. Remember, If you assume that politicians are liars, and thieves, you do your best forecasting. This next chart is a one year chart of the Liquidity Cycle Indicator with overlays of the ICM Global Growth Expectations, the SPXIndex, and the MSCI World Index. After being weak since mid-September the LCI and the Growth indicators both bottomed in late October as allocators begin to shift some money around. Both indicators have rallied since then even when the equity indices fell post election. Last week in a low volume environment the equities rallied on apparent risk on sentiment. This plurality is positive though early and unproven. I am thus beginning to lean to bullishness as I expect news about more European liquidity being made available, along with a more aggressive effort to create inflation in Japan and of course the already announced Fed policy of serial liquidity injection. A recipe for money illusion and stock market price gains. Following are some longer term Index charts with little additional comment. A sort of better to be silent and thought a fool, than to comment and remove all doubt presentation.

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Table from Bespoke Investment

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Developed Country Market Rankings

Developing and Emerging Market Rankings

There is a nice mix of up and down trends in this list. Most of Latin America is trailing except Mexico which has done well. The leaders are Turkey, Philippines, and Poland. These are probably not the first names that come to mind when most of us think of buying stocks. Beware the obvious. SECTORS These results are in terms of return to a dollar based investor and several things are worth noticing. A large number of indices are trending up now. The leaders are New Zealand, Greece and Austria, which imply that the currency moves may have played a role as well as the asymmetry of percentage returns when markets have fallen a long way. (Think Greece) A market that falls from 1000 to 100 then bounces to 200 has now is now up 100% from the low.

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Here are some more longer-term charts in Fixed Income, Commodities, and Currencies

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Corn and Wheat long term charts are reasonably similar to the Soy chart.

Note that taking the Yen chart back to the early 70s finds the level at 350 to the dollar.

The next chart is the M2 money supply overlaid with the Spot price of Gold. I personally do not consider it a coincidence that they have generally moved similar amounts.

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Summary of Implied to Realized Volatilities as of Friday

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Articles & Commentary

Mebane Faber posts this chart of the distribution of asset allocations globally as of 2011.

How Federal largesse traps the poor from Scott Grannis Welfare, food stamps, the earned income tax credit, and healthcare insurance subsidies are all designed to help the poor and even much of the middle class. But the unintended consequence of these income assistance programs (i.e., transfer payments) is that they make it much harder for people to work their way out of poverty. Thats because all that money being handed out has to be taken away as people climb the income ladder, and that has the effect of increasing marginal tax rates.

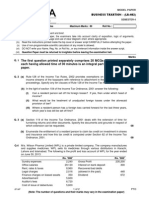

This chart, courtesy of the Congressional Budget Office, comes from a new study of effective federal marginal tax rates. The top range of each of the bars is the effective marginal tax rate faced by some people in various income groups covering 80% of all taxpayers. Note that some of those making 100-149% of the poverty rate face marginal tax rates of as high as 60%!! If someone at the poverty line wants to work harder, he or she may only be able to keep 40 cents of each additional dollar earned.

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

On average, the vast majority of workers have effective marginal tax rates of 30%. As Greg Mankiw notes, In 2014, after various temporary tax provisions have expired and the newly passed health insurance subsidies go into effect, the average effective marginal tax rate will rise to 35 percent. That is almost as much as the marginal tax rates of the rich.

A Minimum Tax for the Wealthy By WARREN E. BUFFETT SUPPOSE that an investor you admire and trust comes to you with an investment idea. This is a good one, he says enthusiastically. Im in it, and I think you should be, too. Would your reply possibly be this? Well, it all depends on what my tax rate will be on the gain youre saying were going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent. Only in Grover Norquists imagination does such a response exist. Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered. Under those burdensome rates, moreover, both employment and the gross domestic product (a measure of the nations economic output) increased at a rapid clip. The middle class and the rich alike gained ground. So lets forget about the rich and ultrarich going on strike and stuffing their ample funds under their mattresses if gasp capital gains rates and ordinary income rates are increased. The ultrarich, including me, will forever pursue investment opportunities. And, wow, do we have plenty to invest. The Forbes 400, the wealthiest individuals in America, hit a new group record for wealth this year: $1.7 trillion. Thats more than five times the $300 billion total in 1992. In recent years, my gang has been leaving the middle class in the dust. A huge tail wind from tax cuts has pushed us along. In 1992, the tax paid by the 400 highest incomes in the United States (a different universe from the Forbes list) averaged 26.4 percent of adjusted gross income. In 2009, the most recent year reported, the rate was 19.9 percent. Its nice to have friends in high places. The groups average income in 2009 was $202 million which works out to a wage of $97,000 per hour, based on a 40-hour workweek. (Im assuming theyre paid during lunch hours.) Yet more than a quarter of these ultrawealthy paid less than 15 percent of their take in combined federal income and payroll taxes. Half of this crew paid less than 20 percent. And brace yourself a few actually paid nothing. This outrage points to the necessity for more than a simple revision in upper-end tax rates, though thats the place to start. I support President Obamas proposal to eliminate the Bush tax cuts for high-income taxpayers. However, I prefer a cutoff point somewhat above $250,000 maybe $500,000 or so. Additionally, we need Congress, right now, to enact a minimum tax on high incomes. I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultrarich paying rates well below those incurred by people with income just a tiny fraction of ours. Only a minimum tax on very high incomes will prevent the stated tax rate from being eviscerated by these warriors for the wealthy. Above all, we should not postpone these changes in the name of reforming the tax code. True, changes are badly needed. We need to get rid of arrangements like carried interest that enable income from labor to be magically converted into capital gains. And its sickening that a Cayman Islands mail drop can be central to tax maneuvering by wealthy individuals and corporations. But the reform of such complexities should not promote delay in our correcting simple and expensive inequities. We cant let those who want to protect the privileged get away with insisting that we do nothing until we can do everything. Our governments goal should be to bring in revenues of 18.5 percent of G.D.P. and spend about 21 percent of G.D.P. levels that have been attained over extended periods in the past and can clearly be reached again. As the math makes clear, this wont stem our budget deficits; in fact, it will continue them. But assuming even conservative projections about inflation and economic growth, this ratio of revenue to spending will keep Americas debt stable in relation to the countrys economic output. In the last fiscal year, we were far away from this fiscal balance bringing in 15.5 percent of G.D.P. in revenue and spending 22.4 percent. Correcting our course will require major concessions by both Republicans and Democrats. All of America is waiting for Congress to offer a realistic and concrete plan for getting back to this fiscally sound path. Nothing less is acceptable. In the meantime, maybe youll run into someone with a terrific investment idea, who wont go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him. Warren E. Buffett is the chairman and chief executive of Berkshire Hathaway. Article in New York Times

As the chart above shows, average tax rates for the poor are relatively low, with 80% of taxpayers in 2007 paying an effective average tax rate of between 4% and 17%. We do indeed have a very progressive tax code if all you look at are average tax rates (i.e., total taxes divided by income). But its marginal tax rates, which have the greatest impact on incentives, and marginal tax rates are much higher than average rates under a progressive tax system loaded with subsidies. On a marginal basis, our income tax is actually regressivethe poor face marginal tax rates that are much higher than those faced by the rich. Although the CBO study is an eye-opener, the reality for some people could be even worse. In a post last year, I quoted Daniel Kesslers WSJ article, in which he describes the punitive marginal tax rates (higher than 100%!) that will be faced by some families if ObamaCare is implemented: Starting in 2014, subsidies will be available to families with incomes between 134% and 400% of the federal poverty line. For example, a family of four headed by a 55-year-old earning $31,389 in 2014 dollars (134% of the federal poverty line) in a high-cost area will get a subsidy of $22,740. A similar family earning $93,699 (400% of poverty) gets a subsidy of $14,799. But a family earning $1 more$93,700gets no subsidy. Consider a wife in a family with $90,000 in income. If she were to earn an additional $3,700, her family would lose the insurance subsidy and be more than $10,000 poorer. There is no getting around it: a highly progressive tax system that relies on subsidies and other income assistance for the poor and even uppermiddle income earners will inevitably yield very high marginal tax rates. This makes climbing the income ladder more difficult, and effectively traps many of the poor. Why work harder if you can only keep a fraction of the extra income? Greg Mankiw also provides a reasonable solution: ... we could repeal all these taxes and transfer programs, replace them with a flat tax along with a universal lump-sum grant, and achieve approximately the same overall degree of progressivity. Thanks to Calafia Beach Pundit

From David Kotok on Hayek quoting de Toqueville Translation (from Hayek, The Road to Serfdom): Democracy extends the sphere of individual freedom, socialism restricts it. Democracy attaches all possible value to each man; socialism makes each man a mere agent, a mere number. Democracy and socialism have nothing in common but one word: equality. But notice the difference: while democracy seeks equality in liberty, socialism seeks equality in restraint and servitude.

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

Chinese warning Hopes for an early recovery in the global economy may be overoptimistic, according to a well-regarded economic strategist who says the expansion of Chinas reserves, which has been an engine of global economic growth, is about to come to a shuddering halt.

The above chart shows how the growth of Chinese reserves has decelerated dramatically over the last five years and is now close to zero. The chart was put together by Russell Napier, a consultant with stockbroker CLSA Asia-Pacific Markets, and the author of a course at Edinburgh Business School called a Practical History of the Financial Markets. Napier said of the graph: It is the most important chart in the world. The growth in Chinese reserves has determined all the key developments in financial markets in the last two decades. It printed lots of currency and artificially depressed the US yield curve. It has been the cornerstone of global growth, and now its over. The last time the Chinese reserve growth rate was below 10% was at the end of the 1990s, just before the bursting of the technology stock market bubble and a recession. The recovery in the growth rate from 2001 onwards was followed by the economic boom of the last decade. The growth rate turned down decisively in 2007, just before the onset of the financial crisis. Chinas reserves have come from a trading surplus, and the Chinese authorities have used the money to buy US Treasury bonds. The finance that China supplied to the US helped fuel economic growth in that country and the rest of the world. EFinancial News

Bruce Lawrence November 26, 2012

THIS COMMUNICATION IS INTENDED ONLY FOR THE USE OF INFINIUM CAPITAL MANAGEMENT, LCC AND ITS EMPLOYEES TO WHICH IT IS ADDRESSED AND CONTAINS OR MAY CONTAIN INFORMATION THAT IS PRIVILEGED, CONFIDENTIAL OR EXEMPT FROM DISCLOSURE UNDER APPLICABLE LAW. If the reader of this communication is not the intended recipient (or the employee or agent responsible for delivering to the intended recipient), you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately inform Infinium Capital Management, LLC and then disregard and delete this communication. Do not disseminate or retain any copy of this communication.

icmWEEKLY STRATEGIC PLAN

You might also like

- Weekly Strategic Plan 11122012Document11 pagesWeekly Strategic Plan 11122012Bruce LawrenceNo ratings yet

- Stock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashFrom EverandStock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashNo ratings yet

- Weekly Strategic Plan 03182013Document12 pagesWeekly Strategic Plan 03182013Bruce LawrenceNo ratings yet

- Manipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?From EverandManipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?Rating: 5 out of 5 stars5/5 (2)

- Weekly Strategic Plan 02192013Document10 pagesWeekly Strategic Plan 02192013Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 01022013Document20 pagesWeekly Strategic Plan 01022013Bruce LawrenceNo ratings yet

- The Strategic Bond Investor, Third Edition: Strategic Tools to Unlock the Power of the Bond MarketFrom EverandThe Strategic Bond Investor, Third Edition: Strategic Tools to Unlock the Power of the Bond MarketNo ratings yet

- Weekly Strategic Plan 08062012Document11 pagesWeekly Strategic Plan 08062012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 12102012Document10 pagesWeekly Strategic Plan 12102012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 10082012Document11 pagesWeekly Strategic Plan 10082012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 11192012Document11 pagesWeekly Strategic Plan 11192012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 01222013Document7 pagesWeekly Strategic Plan 01222013Bruce LawrenceNo ratings yet

- Agcapita August 2011Document5 pagesAgcapita August 2011Capita1No ratings yet

- Petrocapita August 2011Document5 pagesPetrocapita August 2011Capita1No ratings yet

- Is There A Double Dip Recession in The Making AC - FinalDocument2 pagesIs There A Double Dip Recession in The Making AC - FinalPremal ThakkarNo ratings yet

- Finance 1Document7 pagesFinance 1Samuel ChaoNo ratings yet

- Logica Funds Etf Problemi ValutazioneDocument14 pagesLogica Funds Etf Problemi ValutazioneMassimo AcetiNo ratings yet

- Stock Market Crash Survival GuideDocument18 pagesStock Market Crash Survival GuideFlorian MlNo ratings yet

- Is The U.S. Market in A Bubble?Document2 pagesIs The U.S. Market in A Bubble?Leslie LammersNo ratings yet

- Global Macro Commentary Dec 4Document3 pagesGlobal Macro Commentary Dec 4dpbasicNo ratings yet

- Roundtwo Financial CrisisDocument21 pagesRoundtwo Financial CrisisIrene LyeNo ratings yet

- Kotok - Fed and MarketsDocument4 pagesKotok - Fed and Marketspta123No ratings yet

- Armstrong Economics "The Unattainable Illusion Never Changed" 09 25 11Document10 pagesArmstrong Economics "The Unattainable Illusion Never Changed" 09 25 11valeriobrlNo ratings yet

- El Panorama Reciente de La Crisis y El FEDDocument3 pagesEl Panorama Reciente de La Crisis y El FEDriemmaNo ratings yet

- Article 2014 06 Analytic Insights Mispriced RiskDocument12 pagesArticle 2014 06 Analytic Insights Mispriced RisklcmgroupeNo ratings yet

- BAL162 Assignment 1 SisonDocument4 pagesBAL162 Assignment 1 SisonKathleen Shane SisonNo ratings yet

- 6 Factors That Influence Exchange RatesDocument4 pages6 Factors That Influence Exchange RatesGaurav TyagiNo ratings yet

- 2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConDocument4 pages2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConJoshua RosnerNo ratings yet

- Total Factor ProductivityDocument3 pagesTotal Factor ProductivitybkurniaNo ratings yet

- Public Fiscal AdministrationDocument4 pagesPublic Fiscal AdministrationCarmela Kim SicatNo ratings yet

- AccOrg ReportDocument4 pagesAccOrg ReportJohn Miguel GordoveNo ratings yet

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Document10 pagesX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700No ratings yet

- Blog - Narratives and Earnings On Chinese Equity What ChangedDocument4 pagesBlog - Narratives and Earnings On Chinese Equity What ChangedOwm Close CorporationNo ratings yet

- Weekly Strategic Plan 02272012Document8 pagesWeekly Strategic Plan 02272012Bruce LawrenceNo ratings yet

- IHC WhitepaperDocument111 pagesIHC WhitepaperBinderia ChNo ratings yet

- T Rident: Municipal ResearchDocument4 pagesT Rident: Municipal Researchapi-245850635No ratings yet

- Srilanka's SovereigntyDocument5 pagesSrilanka's SovereigntybuddikalrNo ratings yet

- 329Document56 pages329Lionel MaddoxNo ratings yet

- Solution To AssignmentDocument29 pagesSolution To AssignmentMai Lan AnhNo ratings yet

- The Leverage CycleDocument58 pagesThe Leverage CycleHimanshu JhambNo ratings yet

- Bencivenga1 Lies Lies LiesDocument20 pagesBencivenga1 Lies Lies LiesAlain BodinoNo ratings yet

- May Issue Larr-Murphy Report (LMR)Document34 pagesMay Issue Larr-Murphy Report (LMR)John Papola100% (2)

- Artisan Autumn 2012Document6 pagesArtisan Autumn 2012Arthur SalzerNo ratings yet

- Investment Commentar Y: Initial Thinking Another Update Investor CallDocument9 pagesInvestment Commentar Y: Initial Thinking Another Update Investor CallAnil GowdaNo ratings yet

- Last Cash Flow (LCF) CMO - An Alternative To Too Much LiquidityDocument4 pagesLast Cash Flow (LCF) CMO - An Alternative To Too Much LiquidityarappmemNo ratings yet

- Euro Experiment: Test Results Are In: October 2011 EditionDocument27 pagesEuro Experiment: Test Results Are In: October 2011 EditionnicknyseNo ratings yet

- Coronavirus and Its Impact On Global Financial MarketsDocument3 pagesCoronavirus and Its Impact On Global Financial MarketsAnkur ShardaNo ratings yet

- Senate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Document68 pagesSenate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Scribd Government DocsNo ratings yet

- The Blue Chip Report: Important - Variation in ResultsDocument7 pagesThe Blue Chip Report: Important - Variation in Resultsanalyst_anil14No ratings yet

- Kraken Intelligence's Crypto Yields - A Simple BreakdownDocument15 pagesKraken Intelligence's Crypto Yields - A Simple Breakdownjon smithNo ratings yet

- Leader Capital News: The Cost of CapitalDocument7 pagesLeader Capital News: The Cost of CapitalLeaderCapitalNo ratings yet

- Stepherson BBR 2012Document3 pagesStepherson BBR 2012Anonymous Feglbx5No ratings yet

- LSW/ValuTeachers DeceitDocument6 pagesLSW/ValuTeachers DeceitScott DauenhauerNo ratings yet

- Centre of Pre - University Studies Foundation in Business: (Macroeconomics) (Assignment)Document7 pagesCentre of Pre - University Studies Foundation in Business: (Macroeconomics) (Assignment)OtabekNo ratings yet

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicNo ratings yet

- Black Swan Capital July 10Document5 pagesBlack Swan Capital July 10ZerohedgeNo ratings yet

- Nearly Over The Worst - 28112011Document2 pagesNearly Over The Worst - 28112011Philip MorrishNo ratings yet

- Case Study Summary Manitoba ScamDocument2 pagesCase Study Summary Manitoba ScamBijay BasnetNo ratings yet

- Misdirection and The Carnival Barkers of CreditDocument2 pagesMisdirection and The Carnival Barkers of CreditBruce LawrenceNo ratings yet

- Weekly Strategic Plan 01222013Document7 pagesWeekly Strategic Plan 01222013Bruce LawrenceNo ratings yet

- Yellen, QE, Taper, and Fed PolicyDocument1 pageYellen, QE, Taper, and Fed PolicyBruce LawrenceNo ratings yet

- Much Ado About WordplayDocument1 pageMuch Ado About WordplayBruce LawrenceNo ratings yet

- Weekly Strategic Plan 02042013Document10 pagesWeekly Strategic Plan 02042013Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 11192012Document11 pagesWeekly Strategic Plan 11192012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 12102012Document10 pagesWeekly Strategic Plan 12102012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 01142013Document13 pagesWeekly Strategic Plan 01142013Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 10152012Document14 pagesWeekly Strategic Plan 10152012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 10292012Document9 pagesWeekly Strategic Plan 10292012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 06182012Document7 pagesIcm Weekly Strategic Plan 06182012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 04302012Document11 pagesIcm Weekly Strategic Plan 04302012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 10082012Document11 pagesWeekly Strategic Plan 10082012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 09102012Document9 pagesWeekly Strategic Plan 09102012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 05282012Document11 pagesIcm Weekly Strategic Plan 05282012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 04302012Document11 pagesIcm Weekly Strategic Plan 04302012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 04232012Document8 pagesIcm Weekly Strategic Plan 04232012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 04302012Document11 pagesIcm Weekly Strategic Plan 04302012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 03192012Document8 pagesIcm Weekly Strategic Plan 03192012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 02132012Document9 pagesIcm Weekly Strategic Plan 02132012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 03262012Document10 pagesIcm Weekly Strategic Plan 03262012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 02272012Document8 pagesWeekly Strategic Plan 02272012Bruce LawrenceNo ratings yet

- Weekly Strategic Plan 02272012Document8 pagesWeekly Strategic Plan 02272012Bruce LawrenceNo ratings yet

- Icm Weekly Strategic Plan 02132012Document9 pagesIcm Weekly Strategic Plan 02132012Bruce LawrenceNo ratings yet

- Fina 411 - w21 - F - c01 - Invest EnvDocument27 pagesFina 411 - w21 - F - c01 - Invest EnvfadsNo ratings yet

- Corporet ch2Document57 pagesCorporet ch2birhanuNo ratings yet

- Pinkerton ADocument14 pagesPinkerton AGandhi Jenny Rakeshkumar BD20029No ratings yet

- Advanced Corporate Finance Case 1Document2 pagesAdvanced Corporate Finance Case 1Adrien PortemontNo ratings yet

- Otl Start Up GuideDocument24 pagesOtl Start Up GuideKuuku SamNo ratings yet

- Secondary Markets in IndiaDocument49 pagesSecondary Markets in Indiayashi225100% (1)

- To Valuation Methods: (GROUP 1)Document21 pagesTo Valuation Methods: (GROUP 1)PAA KAMAYNo ratings yet

- Thesis On Non Performing LoansDocument7 pagesThesis On Non Performing LoansWriteMyPaperJackson100% (2)

- Ambit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Document54 pagesAmbit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Naushil Shah100% (1)

- The Distinctive Domain of Entrepreneurship Research: VenkataramanDocument10 pagesThe Distinctive Domain of Entrepreneurship Research: VenkataramanWaqas SiddiquiNo ratings yet

- Factsheet Al Amal) June 2010Document1 pageFactsheet Al Amal) June 2010sureniimbNo ratings yet

- City of Calgary Proposed Service Plans and Budgets For 2019-2022Document668 pagesCity of Calgary Proposed Service Plans and Budgets For 2019-2022CTV CalgaryNo ratings yet

- ICMAP Business Law Past PapersDocument2 pagesICMAP Business Law Past Papersmuhzahid786No ratings yet

- Time Value of Money QuestionsDocument2 pagesTime Value of Money QuestionsDavidNo ratings yet

- W8 BEN FormDocument2 pagesW8 BEN FormJay100% (2)

- The - Economic.and - Social.impacts - Of.e CommerceDocument281 pagesThe - Economic.and - Social.impacts - Of.e CommerceOya ZncrNo ratings yet

- Fitch Monthly July 2014Document1 pageFitch Monthly July 2014jaycamerNo ratings yet

- Indian Firms Line Up For Welspun's Green Projects: Country's Oldest Path Lab Chain To Go Public With 638-cr IPODocument1 pageIndian Firms Line Up For Welspun's Green Projects: Country's Oldest Path Lab Chain To Go Public With 638-cr IPObosudipta4796100% (1)

- Technology Innovation ManagementDocument104 pagesTechnology Innovation ManagementDoina IsakNo ratings yet

- Assignment On Global Business StrategyDocument5 pagesAssignment On Global Business Strategychinmaya.parijaNo ratings yet

- CFAS Overview of AccountingDocument28 pagesCFAS Overview of AccountingMarriel Fate CullanoNo ratings yet

- No1 Rock-Bottom SpreadsDocument100 pagesNo1 Rock-Bottom Spreadsianseow100% (1)

- Seven Years To 7 Figure Wealth PDFDocument20 pagesSeven Years To 7 Figure Wealth PDFErin SpindleNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document10 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Thu Cs CostDocument31 pagesThu Cs CostthulasikNo ratings yet

- Chap 012Document84 pagesChap 012Noushin Khan0% (2)

- Ra 8425 Poverty Alleviation ActDocument14 pagesRa 8425 Poverty Alleviation ActZyldjyh C. Pactol-Portuguez0% (1)

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- ESOPDocument40 pagesESOPsimonebandrawala9No ratings yet

- Be Free! By:mary Elizabeth CroftDocument90 pagesBe Free! By:mary Elizabeth Croft1 watchman100% (2)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfFrom EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfRating: 5 out of 5 stars5/5 (36)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherFrom EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherNo ratings yet

- Life at the Bottom: The Worldview That Makes the UnderclassFrom EverandLife at the Bottom: The Worldview That Makes the UnderclassRating: 5 out of 5 stars5/5 (30)

- Excel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceFrom EverandExcel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceNo ratings yet

- High-Risers: Cabrini-Green and the Fate of American Public HousingFrom EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingNo ratings yet

- The Great Displacement: Climate Change and the Next American MigrationFrom EverandThe Great Displacement: Climate Change and the Next American MigrationRating: 4.5 out of 5 stars4.5/5 (32)

- NFT per Creators: La guida pratica per creare, investire e vendere token non fungibili ed arte digitale nella blockchain: Guide sul metaverso e l'arte digitale con le criptovaluteFrom EverandNFT per Creators: La guida pratica per creare, investire e vendere token non fungibili ed arte digitale nella blockchain: Guide sul metaverso e l'arte digitale con le criptovaluteRating: 5 out of 5 stars5/5 (15)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthFrom EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthRating: 4 out of 5 stars4/5 (188)

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 3.5 out of 5 stars3.5/5 (197)

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 4 out of 5 stars4/5 (186)

- How to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyFrom EverandHow to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyRating: 4 out of 5 stars4/5 (27)

- Same Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherFrom EverandSame Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherRating: 4 out of 5 stars4/5 (686)

- Not a Crime to Be Poor: The Criminalization of Poverty in AmericaFrom EverandNot a Crime to Be Poor: The Criminalization of Poverty in AmericaRating: 4.5 out of 5 stars4.5/5 (37)

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisFrom EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisRating: 4 out of 5 stars4/5 (4284)

- Skulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersFrom EverandSkulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersNo ratings yet

- Tableau Your Data!: Fast and Easy Visual Analysis with Tableau SoftwareFrom EverandTableau Your Data!: Fast and Easy Visual Analysis with Tableau SoftwareRating: 4.5 out of 5 stars4.5/5 (4)

- Fucked at Birth: Recalibrating the American Dream for the 2020sFrom EverandFucked at Birth: Recalibrating the American Dream for the 2020sRating: 4 out of 5 stars4/5 (173)

- Blender 3D for Jobseekers: Learn professional 3D creation skills using Blender 3D (English Edition)From EverandBlender 3D for Jobseekers: Learn professional 3D creation skills using Blender 3D (English Edition)No ratings yet

- How the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassFrom EverandHow the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassRating: 5 out of 5 stars5/5 (6)

- This Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaFrom EverandThis Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaRating: 4 out of 5 stars4/5 (37)

- Learn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIFrom EverandLearn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIRating: 5 out of 5 stars5/5 (1)