Professional Documents

Culture Documents

FM Paper Solution (2012)

Uploaded by

Prreeti ShroffOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Paper Solution (2012)

Uploaded by

Prreeti ShroffCopyright:

Available Formats

SCOrEbms.

com 9833088336

FM PAPER SOLUTION

October - 2012

Q.1) b]

(i) The following data is furnished to you regarding two companies Ajanta and Barley operating

in the industry.

Ajanta Barley

Raw material in stock in terms of days 80 73

Work in Progress (No. of days) 42 25

Finished Goods Stock (No. of days) 49 45

Average Collection Period (No. of days) 65 50

Average Payment Period (No. of days) 62 55

On basis of above calculate the Operating Cycle and Cash Cycle of business for each of the two

companies.

Solution:

Operating Cycle = R + W + F + D

Ajanta = 80 + 42 + 49 + 65

= 236 days

Barley = 73 + 25 + 45 + 50

= 193 days

Cash Cycle = R + W + F + D C

Ajanta = 80 + 42 + 49 + 65 62

= 174 days

Barley = 73 + 25 + 45 + 50 55

= 138 days

(ii) A Company Meenu Ltd. has issued 10% debentures of face value 100 each which are

redeemable at par after 10 years. Assuming that tax rate applicable is 40% and the floatation cost

of debentures is 5%, calculate the Cost of debentures for the company.

Solution:

Kd = 100 ) 1 (

2

x t x

NP FV

N

NP FV

I

|

.

|

\

| +

|

.

|

\

|

+

= 100 ) 4 . 0 1 (

2

95 100

10

95 100

10

x x

|

.

|

\

| +

|

.

|

\

|

+

SCOrEbms.com 9833088336

= 100 6 . 0

5 . 97

5 . 0 10

x x

+

= 6.46%

NP = FV + Premium Discount Floatation Cost

= 100 + 0 0 5

= 95

(iii) Determine the Operating and Financial Leverage from the following data:

A B C

Contribution 600000 100000 500000

10% Debentures 50000 40000 80000

Fixed Overheads 10000 20000 30000

Solution:

Particulars A B C

Contribution

(-) Fixed O/H

6,00,000

10,000

1,00,000

20,000

5,00,000

30,000

PBIT

(-) Interest

5,90,000

5,000

(50,000 x 10%)

80,000

4,000

(40,000 x 10%)

4,70,000

8,000

(80,000 x 10%)

PBT 5,85,000 76,000 4,62,000

Operating Leverage

PBIT

on Contributi

=

= 1.02

= 1.25

= 1.06

Financial Leverage

PBT

PBIT

=

= 1.01

= 1.05

= 1.02

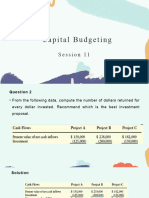

Q.2) Company Maharaja Private Limited is planning an investment in new project. The

investment budget of the company is 30,00,000. The company has following two investment

alternatives:

Project A Project B

Investment 30,00,000 30,00,000

Useful Life 5 Years 6 Years

Cost of Capital 12% 12%

Cash inflows at the end of the year

Year 1 7,00,000 8,00,000

Year 2 10,00,000 8,00,000

Year 3 9,00,000 8,00,000

Year 4 8,00,000 8,00,000

Year 5 4,00,000 6,00,000

Year 6 - 2,00,000

SCOrEbms.com 9833088336

Find which project the company should select on basis of (a) Payback Period Method (b) Net

Present Value Method.

Discount factor @ 12%

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

0.893 0.797 0.712 0.636 0.567 0.507

Solution:

Project A PC = COF = 30,00,000

Year CIF CCIF PV@12% PVCIF

1 7,00,000 7,00,000 0.893 625100

2 10,00,000 17,00,000 0.797 797000

3 9,00,000 26,00,000 0.712 640800

4 8,00,000 34,00,000 0.636 508800

5 4,00,000 38,00,000 0.567 226800

PVCIF 27,98,500

Project B PC = COF = 30,00,000

Year CIF CCIF PV @ 12% PVCIF

1 8,00,000 8,00,000 0.893 714400

2 8,00,000 16,00,000 0.797 637600

3 8,00,000 24,00,000 0.712 569600

4 8,00,000 32,00,000 0.636 508800

5 6,00,000 38,00,000 0.567 340200

6 2,00,000 40,00,000 0.507 101400

PVCIF 2872000

a) Payback Period

Project A =

800000

2600000 300000

3

+ years

= 3 years + 0.5 years

= 3.5 years

Project B = 3 years +

800000

2400000 300000

= 3 years + 0.75 years

= 3.75 years

Advise/recommendation

On the basis of payback period method select project A, since it has lower payback period.

b) NPV = PVCIF PVCOF

Project = 27,98,500 30,00,000 = (2,01,500)

Project B = 28,72,000 30,00,000 = (1,28,000)

Advice/Recommendation

On the basis of NPV Method reject both project since it has negative NPV.

SCOrEbms.com 9833088336

Q.3) Kanchanjanga Industries Ltd. is currently having annual sales of 30,00,000. Out of

which, 20% is Cash Sales and remaining are Credit Sales. The Company is currently

experiencing 1% bad debts on their credit sales. The present age of accounts receivables is one

month. The variable cost of the company is 50%. Mr. Limye, the newly appointed Sales

manager, has plans to increase the sales of the Company. Mr. Limye has put forward following

two proposals in front of the Company; (a) To increase the credit period allowed to debtors to 4

months. He expects that sales under such condition will increase up to 40,00,000. However, at

the same time the bad debt will become 4% of the credit sales. (b) To give cash discount of 5%

on the sales. He expects that sales under such condition will increase up to 35,00,000 and the

credit period will go down to 20 days. The expected bad debts will be 0.5% of the credit sales.

Assume that the cost of funds is 15% per annum. As Vice President of Finance Operations,

which option of Mr. Limye will you accept? Assume 360 days in a year.

Solution:

Kanchanjanga Industries Ltd.

Existing Policy Proposed Policy

(a) (b)

DCP (days) 30

(1m)

120

(4m)

20

Sales

(-) V.C. @ 50%

30,00,000

15,00,000

40,00,000

20,00,000

35,00,000

17,50,000

Contribution (a) 15,00,000 20,00,000 17,50,000

Receivables

DCP x

x Sales

360

% 80

=

2,00,000

10,66,667

1,55,556

Cost of A.R.

Capital Cost (Recv x 15%)

Bad debt (Sales x 80% x x%)

Cash discount

30,000

24,000

-

1,60,000

1,28,000

-

23,333

14,000

35,000

(Sales x

20% x 5%)

(b) 54,000 2,88,000 72,333

Net Profit (a b) 14,46,000 17,12,000 16,77,667

Incremental NP - 2,66,000 2,31,667

Note: In absence of information of Fixed Cost, receivable is valued at Sales.

Recommendation:

As vice president of finance operation, Mr. Limye I will accept proposal (a) since it results into

highest incremental NP 2,66,000.

Q.4) Amartax Ltd. is going produce and sell 5,000 unit per month in the year 2011. The material

required per unit is 550/-. The direct labour is 12,00,000/- per month. The other direct

expenses are 1,26,00,000/- per annum. The selling price is fixed by calculating profit at 20%

on cost price.

SCOrEbms.com 9833088336

Calculate requirement of working capital for 2011 by taking into consideration following

information:-

(a) Stock or raw material will be for two months.

(b) Process time is one month.

(c) Stock is finished goods will be for 1.5 months.

(d) Credit allowed to customer is two months.

(e) Time lag in payment of wages is one month and the direct expenses in arrear of 15 days.

(f) 20% of material is purchased on cash basis and suppliers of 80% material give 2 months

credit.

(g) Cash required is 15% of net working capital.

Solution:

Amar Tax Ltd.

Statement of Estimation of Working Capital

Particulars W.N.

Current Assets

Stock

Raw Material

WIP

Finished Goods

Debtors

2

3

4

5

55,00,000

38,75,000

75,00,000

1,68,75,000

1,20,00,000

(a) 2,88,75,000

Current Liabilities

Creditors

O/s Wages

O/s Direct Expenses

6

7

8

44,00,000

12,00,000

5,25,000

(b) 61,25,000

(a b)

(+) Cash Balance

85

15

2,27,50,000

40,14,706

Net Working Capital

(+) Safety Margin

100 2,67,64,706

-

Estimated Working Capital 2,67,64,706

W.N.1) Cost statement for 5000 units (1 months)

Other direct expenses per month =

12

000 , 00 , 26 , 1

= 10,50,000

C.P.U.

Material 27,50,000 550

Direct Labour 12,00,000 240

Other direct expenses 10,50,000 210

Total Cost 50,00,000 1000

(+) Profit @ 20% 10,00,000 200

SCOrEbms.com 9833088336

Sales 60,00,000 1200

W.N. 2) R.M. (2M)

= 27,50,000 x 2 = 55,00,000

W.N. 3) WIP (1M)

M 27,50,000 x 1 x 100% = 27,50,000

DL 12,00,000 x 1 x 50% = 6,00,000

ODE 10,50,000 x 1 x 50% = 5,25,000

38,75,000

Note: In WIP valuation, material is taken at 100% & labour, ODE at 50%

W.N. 4) F.G. (1.5M)

= 50,00,000 x 1.5 = 75,00,000

W.N. 5) Debtors (2M)

= 60,00,000 x 2 = 1,20,00,000

Note: Debtors have been valued at sales. Alternatively it can be valued at cost.

W.N. 6) Creditors (2M)

= 27,50,000 x 80% x 2

= 44,00,000

W.N. 7) O/s Wages (1M)

12,00,000 x 1 = 12,00,000

W.N. 8) O/s Direct expenses (15 days = 0.5M)

= 10,50,000 x 0.5 = 5,25,000

------------------------

You might also like

- Suggested SolutionsDocument7 pagesSuggested SolutionsSunder ChaudharyNo ratings yet

- AnswersDocument8 pagesAnswersTareq ChowdhuryNo ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Exercise On Capital Budgeting-BSLDocument19 pagesExercise On Capital Budgeting-BSLShafiul AzamNo ratings yet

- UBS Capital BudgetingDocument19 pagesUBS Capital BudgetingRajas MahajanNo ratings yet

- Chapter 5 Property, Plant and Equipment GuideDocument14 pagesChapter 5 Property, Plant and Equipment GuideNaSheeng100% (1)

- CPA review center pre-board examDocument13 pagesCPA review center pre-board exammjc24100% (7)

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- FM Solved Board Paper 2010 2Document7 pagesFM Solved Board Paper 2010 2Venugopal ShettyNo ratings yet

- Ma Dec2010Document2 pagesMa Dec2010Ankit BajajNo ratings yet

- II SEMESTER ENDTERM EXAMINATION MARCH 2016Document2 pagesII SEMESTER ENDTERM EXAMINATION MARCH 2016Nithyananda PatelNo ratings yet

- Working Capital ManagementDocument17 pagesWorking Capital ManagementMpho Peloewtse TauNo ratings yet

- PREP COF Sample Exam QuestionsDocument10 pagesPREP COF Sample Exam QuestionsLNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Working Capital Management QuestionsDocument17 pagesWorking Capital Management QuestionsJeffrey MooketsaneNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Final Practrice (Unit 4 and 5)Document9 pagesFinal Practrice (Unit 4 and 5)mjlNo ratings yet

- MAS Compilation of QuestionsDocument6 pagesMAS Compilation of Questionsgon_freecs_4No ratings yet

- Financial Management: Methods of Capital Budgeting EvaluationDocument21 pagesFinancial Management: Methods of Capital Budgeting EvaluationHawazin Al-wasilaNo ratings yet

- UntitledDocument25 pagesUntitledAyesha AlliNo ratings yet

- Finance Question Papers Pune UniversityDocument12 pagesFinance Question Papers Pune UniversityJincy GeevargheseNo ratings yet

- Chapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document15 pagesChapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- WCM ProblemsDocument9 pagesWCM Problemsparika khannaNo ratings yet

- Cos Accounting AssignmentDocument7 pagesCos Accounting AssignmentSujal BedekarNo ratings yet

- Understanding Cash Flow Problems and SolutionsDocument14 pagesUnderstanding Cash Flow Problems and SolutionsAlka DwivediNo ratings yet

- Financial Management - Capital Budgeting TechniquesDocument14 pagesFinancial Management - Capital Budgeting Techniquesankit mehtaNo ratings yet

- Solution Far450 - Jan 2013Document9 pagesSolution Far450 - Jan 2013aielNo ratings yet

- I M.com Accounting For Managerial DecisionDocument10 pagesI M.com Accounting For Managerial DecisionVISHAGAN MNo ratings yet

- (2013 Pattern) PDFDocument230 pages(2013 Pattern) PDFSanket SonawaneNo ratings yet

- Capii Financial Management July2015Document14 pagesCapii Financial Management July2015casarokarNo ratings yet

- Payback PeriodDocument32 pagesPayback Periodarif SazaliNo ratings yet

- Managment Accountant ACCOW, OpenT, KPP WBDocument6 pagesManagment Accountant ACCOW, OpenT, KPP WBFarahAin FainNo ratings yet

- Working Capital ManagementDocument3 pagesWorking Capital Managementalok darakNo ratings yet

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- Capital Budgeting Methods ExplainedDocument171 pagesCapital Budgeting Methods ExplainedSiddharth mehtaNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Problem 2-26 (IAA)Document19 pagesProblem 2-26 (IAA)gghyo88No ratings yet

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- Cost accounting analysisDocument14 pagesCost accounting analysismanasa k pNo ratings yet

- MBA Financial Management exam questions and ratiosDocument4 pagesMBA Financial Management exam questions and ratiosSwati DafaneNo ratings yet

- Costing FM Model Paper - PrimeDocument17 pagesCosting FM Model Paper - Primeshanky631No ratings yet

- CPA Review Center Pre-Board ExamDocument13 pagesCPA Review Center Pre-Board ExamJericho Pedragosa100% (1)

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Accounting and Finance Assignment AnalysisDocument6 pagesAccounting and Finance Assignment AnalysisAravindh ArulNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Accountant 17-07-2023Document3 pagesAccountant 17-07-2023mrsiranjeevi44No ratings yet

- Engneering Economics and Accountenchy-1Document32 pagesEngneering Economics and Accountenchy-1vigneshk7697No ratings yet

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNo ratings yet

- CA IPCC Costing Guideline Answers May 2015 PDFDocument20 pagesCA IPCC Costing Guideline Answers May 2015 PDFanupNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Finc 3310 - Actual Test 3Document5 pagesFinc 3310 - Actual Test 3jlr0911No ratings yet

- AccontsDocument7 pagesAccontsAmith MNo ratings yet

- MBAC1003Document7 pagesMBAC1003SwaathiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- FM Theory Question Bank: Key Concepts & FormulasDocument2 pagesFM Theory Question Bank: Key Concepts & FormulasPrreeti ShroffNo ratings yet

- Bms - Financial Management Solution - 2012Document12 pagesBms - Financial Management Solution - 2012QuestTutorials BmsNo ratings yet

- Capital Account ConvertibilityDocument67 pagesCapital Account ConvertibilityPrreeti ShroffNo ratings yet

- Hardik Resume FormatDocument2 pagesHardik Resume FormatPrreeti ShroffNo ratings yet

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Harmonisation of Accounting StandardsDocument157 pagesHarmonisation of Accounting StandardsMusab AhmedNo ratings yet

- Accounting Cycle Work SheetDocument32 pagesAccounting Cycle Work SheetAbinash MishraNo ratings yet

- Chapter 7Document42 pagesChapter 7Apef Yok100% (1)

- Smu Project Synopsis Format & HelpDocument4 pagesSmu Project Synopsis Format & HelpKautilyaTiwariNo ratings yet

- Making Decision 4Document22 pagesMaking Decision 4MORSHEDNo ratings yet

- Availability Based TariffDocument24 pagesAvailability Based Tariffprati121No ratings yet

- Foreign ExchangeDocument25 pagesForeign ExchangeAngelica AllanicNo ratings yet

- DO 19-93 (Construction Industry)Document6 pagesDO 19-93 (Construction Industry)Sara Dela Cruz AvillonNo ratings yet

- Accounts Project FinalDocument13 pagesAccounts Project FinalesheetmodiNo ratings yet

- Introduction To Internal Control SystemDocument35 pagesIntroduction To Internal Control SystemStoryKingNo ratings yet

- OpTransactionHistory01 07 2020Document3 pagesOpTransactionHistory01 07 2020sekhar203512No ratings yet

- Nepal Telecom's recruitment exam questionsDocument16 pagesNepal Telecom's recruitment exam questionsIvan ClarkNo ratings yet

- Audio Book - Brian Tracy - The Psychology of Selling (Index)Document2 pagesAudio Book - Brian Tracy - The Psychology of Selling (Index)Wanga SailiNo ratings yet

- Internalization Theory For The Digital EconomyDocument8 pagesInternalization Theory For The Digital Economyefe westNo ratings yet

- Banking LiesDocument13 pagesBanking LiesJua89% (9)

- Managerial Economics Q2Document2 pagesManagerial Economics Q2Willy DangueNo ratings yet

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocument33 pagesTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99No ratings yet

- SYBCO AC FIN Financial Accounting Special Accounting Areas IIIDocument249 pagesSYBCO AC FIN Financial Accounting Special Accounting Areas IIIctfworkshop2020No ratings yet

- Supply Chain Management: SCM & Industry 4.0 in FMCG SectorDocument14 pagesSupply Chain Management: SCM & Industry 4.0 in FMCG SectorNikhil DantuluriNo ratings yet

- Iare TKM Lecture NotesDocument106 pagesIare TKM Lecture Notestazebachew birkuNo ratings yet

- FIN WI 001 Image Marked PDFDocument10 pagesFIN WI 001 Image Marked PDFGregurius DaniswaraNo ratings yet

- Trade Journal - DitariDocument43 pagesTrade Journal - DitariNexhat RamadaniNo ratings yet

- Topic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Document5 pagesTopic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Mijwad AhmedNo ratings yet

- Faq C855 PDFDocument6 pagesFaq C855 PDFKaren TacadenaNo ratings yet

- Working Capital Management of Nepal TelecomDocument135 pagesWorking Capital Management of Nepal TelecomGehendraSubedi70% (10)

- Spaze TowerDocument1 pageSpaze TowerShubhamvnsNo ratings yet

- Annual Report 2016 2017 PDFDocument176 pagesAnnual Report 2016 2017 PDFTasnim Tasfia SrishtyNo ratings yet

- Companies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewDocument4 pagesCompanies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewABINASHNo ratings yet

- Capital Structure of DR Reddy's LaboratoriesDocument11 pagesCapital Structure of DR Reddy's LaboratoriesNikhil KumarNo ratings yet