Professional Documents

Culture Documents

Module 01

Uploaded by

xxxfarahxxxOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 01

Uploaded by

xxxfarahxxxCopyright:

Available Formats

file:///F|/Courses/2010-11/CGA/AU1/06course/m01intro.

htm

Module 1: Introduction to external auditing

Overview

This module provides a framework for introductory auditing and a context for the rest of the course. External auditing is compared to internal auditing, and the role of the external auditor is described. As you work through each topic, you develop a clear understanding of the auditors role in reducing information risk. The module also includes an overview of the new Canadian Auditing Standards and covers the various types of audit opinions and reports that may be issued on completion of an audit engagement. Assignment reminder: Assignment #1 (see Module 5) is due at the end of Week 5 (see Course Schedule). You may wish to take a look at it now in order to familiarize yourself with the requirements and to prepare for any necessary work in advance.

Test your knowledge

Begin your work on this module with a set of test-your-knowledge questions designed to help you gauge the depth of study required.

Learning objectives

1.1 Overview of auditing Explain the objective and purpose of an audit of financial statements, and outline the two key components of the audit process. (Level 1) Explain how information risk arises and how audits can help reduce information risk. (Level 1) Describe the principal activities of a public accounting firm. (Level 1) Describe the role of the staff accountant on a typical audit engagement, and how continuous training on audit engagements prepares staff for future opportunities in the organization. (Level 2) Compare external auditing to internal auditing. (Level 2) Describe the concept of an assurance engagement, explain audit engagements in terms of the general framework of assurance engagements, and explain the difference between an attest engagement and a direct reporting engagement. (Level 1)

1.2 Information risk 1.3 Public accounting 1.4 The role of the staff accountant

1.5 External and internal auditing 1.6 Assurance engagements

1.7 Audit, review, and compilation engagements Distinguish between audit, review, and compilation engagements. (Level 1) 1.8 Reporting 1.9 Reservation of opinion Draft a standard auditors report and describe its components. (Level 1) Evaluate when an auditor would issue an audit report containing an unqualified opinion, a qualified opinion, an adverse opinion, or a disclaimer (denial) of opinion. (Level 1)

Module summary

Canadian Auditing Standards

file:///F|/Courses/2010-11/CGA/AU1/06course/m01intro.htm (1 of 2) [04/10/2010 2:51:05 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01intro.htm

The International Auditing and Assurance Standards Board (IAASB) has developed International Standards on Auditing (ISA) and International Standards on Quality Control (ISQC). These are globally recognized auditing standards which provide a basis for consistently conducting high quality audits around world. For many years, Canadian standard setters have been involved with efforts to develop these standards. The Canadian Auditing and Assurance Standards Board (AASB) has adopted ISA as Canadian Auditing Standards (CAS) for the audits of financial statements; these constitute what was previously known as GAAS. The effective date for implementation of the CAS is for audits of financial statements for periods ending on or after December 14, 2010. The Canadian developed standards remain in effect for all other assurance engagements. There have been minimal changes made to the ISAs. As the AASB is committed to adopting the ISA as written, the only changes were those that were necessary to comply with Canadian law or in cases where the AASB believed that circumstances unique to the Canadian environment required a change in order to improve or maintain the level of quality of auditing and reporting in Canada. These modifications are outlined in Appendix 2, the Preface to the CICA Handbook Assurance Part I . Before the AASB adopts a particular standard of the ISA, a rigorous process (including public consultation) is conducted before the corresponding standard is issued in final form. Throughout the module notes, where specific sections of the auditing standards are discussed, you will find the relevant section of the CAS accompanied by the former GAAS section. For a better understanding of the audit implications of the new standards, review Exhibit 1 and the online resources that follow: Exhibit 1: Overview of the Assurance Handbook Source: CICA Handbook

Changes Ahead Audit Reporting Implications of New Auditing and Accounting Standards The CICAs Guide to Accounting Standards for Private Enterprises in Canada

You may also review this interactive presentation to learn more about the new Canadian Auditing Standards: Canadian Auditing Standards Support Tool Print this module

file:///F|/Courses/2010-11/CGA/AU1/06course/m01intro.htm (2 of 2) [04/10/2010 2:51:05 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t01.htm

1.1 Overview of auditing

Learning objective

Explain the objective and purpose of an audit of financial statements, and outline the two key components of the audit process. (Level 1)

Required reading

Chapter 1, pages 19 CAS 200 (CICA Handbook

Assurance

, section 5090)

Note: Where applicable, module note references to Canadian Auditing Standards (CAS) are accompanied by references to the superseded section in the previous version of the CICA Handbook Assurance.

LEVEL 1

As you start out in this course, it is important to learn some basic auditing terms.

Definitions of auditing

The text defines auditing on page 7. Note the reference to the degree of correspondence between the assertions and established criteria. Assertions, which are usually claims embedded in the financial statements, are management representations. For example, when cash is included as a current asset on the balance sheet, management is asserting that all of the cash exists, that all of the cash is available for use, and that all existing cash in the bank is included. When financial statements are the focus of the audit, the audit is referred to as a financial statement audit. When the audit is performed outside the company or organization, it is an external audit. Most external audits are financial statement audits.

What is the audit objective?

The auditors objective, the audit objective, is to issue an opinion (such as an opinion in the auditors report) on information (such as financial statements). In financial statement audits, the opinion states whether or not the information in the financial statements is presented fairly (that is, the information is not materially misstated) when evaluated against certain established criteria, in this case, generally accepted accounting principles (GAAP).

Activity 1.1-1: The audit process

Adara, a CGA and an auditor, makes the following comment, The audit process is all about gathering evidence. A key part of the process is to gather evidence efficiently and effectively. What exactly does Adara mean by this comment? Solution

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t01.htm [04/10/2010 2:51:07 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02.htm

1.2 Information risk

Learning objective

Explain how information risk arises and how audits can help reduce information risk. (Level 1)

Required reading

Chapter 1, pages 2 and 911 (Begin on page 9 at A Definition of Auditing Relating to Risk Reduction.)

LEVEL 1

Why audits are performed

Companies are audited primarily to fulfil statutory requirements and to reduce information risk.

Statutory requirements

The principal reason for audits is generally assumed to be statutory; that is, companies are audited because the audit is required by statute. The statute may be the incorporating act (for example, the Canada Business Corporations Act ) or a provincial securities act, which requires companies listed on the stock exchange governed under the act to provide audited financial statements. The reason for these statutory requirements is that governments, as a matter of social policy, have decided it is to the benefit of everyone to reduce information risk. However, there were audits long before the corporations acts were enacted, showing that there was a demand for audit services even before the services were required by legislation. (In Canada, certain companies, such as non-listed companies, may decide by unanimous agreement of their shareholders not to have their financial statements audited.)

Information risk

Because not all users of financial statements have access to internal sources of information about a company, they must rely on the integrity of management to ensure that the financial information disclosed is not materially misstated. A user of the financial statements is seeking answers to use in making business decisions: should I invest in this entity? should I issue a loan to this company? An audit reduces the information risk that the financial statements are false or misleading that is, either the numbers in the financial statements are wrong or the disclosures in the footnotes are misleading such that they could lead the user to make the wrong business decision. Because of information risk, both users and providers of information create a demand for audits.

Activity 1.2-1: Information risk scenario

Zagreb, a junior auditor, has a question for Mira, a CGA and his firms senior auditor: Ive heard about information risk. Could you tell me how auditors help to reduce information risk? What are some sources of information risk? Solution

Reducing information risk

Auditors reduce information risk because they have the following attributes:

They are independent and they can reduce or counter the effect of the biases management may have in preparing the financial statements. They have accounting expertise and are able to ensure that the complex transactions that companies engage in are adequately and accurately recorded and reported.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02.htm (1 of 2) [04/10/2010 2:51:08 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02.htm

Information risk is reduced not only by the auditors technical experience, but also by the auditors adherence to ethical standards. Auditors also exercise professional judgment during the auditing process. Professional judgment in an audit engagement requires the auditor to

exercise due care maintain an attitude of professional skepticism comply with professional standards and applicable regulations identify viable alternatives and recognize/consider the effects of the economy, the environment, industry factors, risk factors, user needs and significance, techniques, standards and related matters for evaluating alternatives appropriately, and reach a balanced decision.

Value of an audit

The purchaser of a business faces considerable information risk. The scenario described on page 2 of the text demonstrates the value of an audit in protecting the interests of a potential purchaser of a business. Notice how the auditor provides a useful social service. The original restaurant owner can retire, and you can achieve your dreams of being your own boss. This is all accomplished at a fair exchange rate. The auditor thus facilitates efficient economic activity by reducing information risk. What would happen if the owner of the restaurant and the auditor conspired to deceive you, the purchaser? Or, more likely, what would happen if the owner attempted to deceive both the potential purchaser and the auditor? If the financial statements were materially misleading (even after the audit), as purchaser, you would likely have lost a significant amount of money. In the long-term, if purchasers found that this happened with any frequency, the unreliability of audited financial statements would have a profound effect on efficient market transactions and on the demand for audits. Information risk can be reduced through the services of auditor. The activity below illustrates this process. Activity 1.2-2: Information risk and the expectation gap

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02.htm (2 of 2) [04/10/2010 2:51:08 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t03.htm

1.3 Public accounting

Learning objective

Describe the principal activities of a public accounting firm. (Level 1)

Required reading

Chapter 1, pages 2227

LEVEL 1

The text provides background information on the various professional accounting organizations and the types of services they provide. You should be aware of the following key points:

In auditing, a conflict for the auditor (or public accounting firm) exists between making a profit and performing quality audits in a professional and responsible manner. In addition to audit services, public accountants often perform these services: i. Review engagements, which have a narrower scope than audits and offer only moderate assurance ii. Compilation engagements, in which financial statements are compiled from the client's information without verification and no assurance is provided iii. Taxation services, whereby the accountant prepares tax returns or provides taxation advice iv. Consulting services, the nature of which is undergoing significant change as a result of independence concerns and the influence of the Sarbanes-Oxley Act of 2002

When an auditor provides a wide range of other services to an audit client, he or she might feel constrained in issuing a favourable audit opinion because of two factors:

The auditor may find issues that are critical of work done by members of the audit firm. The auditor might not want to endanger a significant source of income to the firm because of a dispute with the client over the audit report.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t03.htm [04/10/2010 2:51:09 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t04.htm

1.4 The role of the staff accountant

Learning objective

Describe the role of the staff accountant on a typical audit engagement, and how continuous training on audit engagements prepares staff for future opportunities in the organization. (Level 2)

Required reading

Chapter 1, pages 1820

LEVEL 2

The roles and responsibilities of partners, managers, senior (in-charge) accountants, and staff accountants are briefly described on pages 19 and 20 of the text. Staff accountants (who may be referred to as staff auditors or audit juniors) perform audit procedures and prepare working papers to document the results of audit procedures and perform other tasks assigned to them by the in-charge accountant (also referred to as the audit senior). The tasks involved in planning the audit engagement are undertaken by the partner, manager, and audit senior. Although staff accountants are often new to the engagement (and in some cases to auditing), it is critical that they understand the purpose behind the audit procedures that they perform. As they work, they should be encouraged to ask questions to develop their understanding of audit practice and theory.

Continuous training

Proficiency in auditing requires a combination of theoretical training and practical experience. Theoretical training can be gained from courses such as this CGA course and in-house courses offered by the professional firm. It is imperative that CGAs continue to undertake professional development throughout their professional careers in order to stay abreast of the emerging changes in accounting and auditing standards and in the legislative and other environments in which public accountants work. Newly hired staff accountants assigned to an audit engagement start by auditing areas that do not require a lot of judgment and are closely supervised by the in-charge accountant. The in-charge accountant should explain the purposes of the procedures to be performed and how they contribute to the achievement of the audit objectives. As staff accountants gain experience and their professional judgement is further developed, they will be assigned audit areas requiring greater judgment. They may begin by auditing cash accounts, for example, then move on to other areas such as accounts payable, accounts receivable, capital assets, and inventory accounts. To gain experience and improve their judgment, staff accountants must take the initiative to learn the purposes of the procedures performed and build professional judgment by questioning and discussing audit issues with other team members. They can also suggest ways to improve both the current audit and future audits of the engagement client. When staff accountants have gained sufficient theoretical knowledge and practical experience, they can look forward to a first assignment as an in-charge accountant, probably on an audit of a relatively small client. The newly appointed in-charge accountant can then pass on the on-the-job training to the staff accountants assigned to that engagement.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t04.htm [04/10/2010 2:51:10 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm

1.5 External and internal auditing

Learning objective

Compare external auditing to internal auditing. (Level 2)

Required reading

Chapter 1, pages 1417; Chapter 16, pages 662663 CICA Handbook Assurance

, Public Sector section PS 5000

LEVEL 2

The Institute of Internal Auditors (IIA) definition of internal auditing is as follows: Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organizations operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes. The following exhibit summarizes the similarities and differences between internal and external auditors.

Exhibit 1.5-1: Internal and external auditors Similarities and differences

Similarities Independence Both types of auditors need to be independent to function effectively, although they define independence differently. External auditors are not allowed to be employees of or hold shares in the company they are auditing, whereas internal auditors are usually employees of the company. Evidence Both gather evidence so that they can report on aspects of the companys operations.

Differences Nature of reporting One difference is their relationship to the company. Internal auditors prepare reports for management that are rarely read by anyone outside the company. External auditors, on the other hand, prepare reports that often have a wide readership (for example, the thousands of shareholders of Air Canada or BCE Inc.). Audit focus Internal auditors assess the effectiveness, efficiency, and economy of the operations of the company and may or may not audit financial matters. External auditors focus on the companys financial statements. Internal control External auditors need to gain an understanding of and evaluate the internal control of the company being audited, whereas internal auditors are part of that internal control.

Qualifications Both should be competent, adequately trained, and diligent in exercising due care in their activities.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm (1 of 3) [04/10/2010 2:51:11 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm

Objectivity Because of the nature of their relationship to management, both external and internal auditors face pressure to compromise their independence. For external auditors, pressures arise from the contractual relationship with the client. For internal auditors, pressures arise from the employment relationship. Both external and internal auditors need to be aware of these pressures and to have a strong ethical commitment to be objective in their work. Type of audit External auditors may perform operational audits (for example, a company that does not have an internal audit department may need its external auditor to audit the effectiveness and economy of its operations). Internal auditors may perform financial audits (for example, when the internal audit department of a company performs a financial audit of a subsidiary that is to be sold). Type of audit Financial statement audits are usually performed by external auditors who are hired as independent contractors by a company and who normally report to parties other than management, such as shareholders, creditors, and governments. Operational audits are usually performed by internal auditors who are employees of a company and who report to the management of the company. In the context of operational auditing, external auditors may report to management and/or to other parties, whereas internal auditors would always report to management regardless of the type of audit.

Independence

To be considered independent, external auditors should not make management decisions for the companies they audit, nor should they benefit from a financial interest in the company. Internal auditors independence depends on how their role and responsibilities are defined within the organization that employs them, and to whom they report. Internal auditors should be independent of the departments they audit and have no responsibilities or roles within those departments. The ideal reporting arrangement is to have a reporting structure which allows the internal audit department to report directly to the audit committee of the board of directors.

Using internal audit work

In many cases, internal auditors often perform similar types of audit procedures to those that would be required for the external financial statement audit. In this situation, the external auditor may wish to rely on the work performed by the internal auditor and use it as evidence which supports the external audit opinion. CAS 610 (CICA Handbook section 5050) (not required reading), recommends that if the external auditor plans to use internal audit work, the auditor should evaluate and verify whether the internal auditor possesses the following attributes:

objectivity technical competence the ability to exercise due car

In order to verify whether the internal auditor possesses the necessary attributes, the external auditor would consider the following questions:

To whom does the internal audit department report? (objectivity) What level of education, years of experience, and professional development activities do the internal auditors possess? (technical competence) Is the internal audit function adequately resourced? Are staff members adequately supervised? (ability to exercise due care)

In addition, external auditors may need to supervise the internal auditors when they provide direct assistance in an external audit.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm (2 of 3) [04/10/2010 2:51:11 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm

Operational auditing

The role of internal auditors has changed over the past 50 years. Internal auditors spend more time performing operational (or performance) audits and less time checking the work of accounting departments (that is, doing financial audits). Operational auditing and the performance aspect of comprehensive auditing are similar in that they focus on effectiveness, efficiency, and economy. The auditor assesses whether the department or organization is

achieving the companys goals (effectiveness) achieving the companys goals using the least resources (efficiency), and acquiring these resources (that is, assets and services) at the lowest cost (economy).

Operational or performance auditing is future-oriented in that the auditor is not so interested in finding deficiencies as in suggesting ways in which the department or organization might better operate in the future. The criteria for a financial statement audit are GAAP; there are no criteria that are generally accepted for operational audits. Hence, for operational audits, the auditors will need to develop suitable criteria appropriate for each engagement. This task may require creativity, knowledge of the activity, and even advice from experts. Consider the difficulties in setting criteria for the operational audit of a shipping department of a company that manufactures stereo components, or of a research department for a petrochemical company.

Public sector and not-for-profit auditing

Most comprehensive auditing, especially the performance component, is performed in the public sector. Comprehensive auditing has expanded significantly over the past few years. Initially, the federal auditor generals office was the leading proponent. Recently, several provincial auditors general have conducted comprehensive audits, and some municipalities have also had comprehensive audits of their operations. These types of audits hold public officials accountable for the efficient, economical, and effective use of taxpayers dollars. For example, in the fall of 2009 the Auditor General of Canada issued an audit report to determine whether the government ministries responsible for the entry of foreign workers efficiently and effectively handled program planning and delivery to facilitate the entry of permanent and temporary foreign workers into Canada. In order to conduct this audit, the Auditor General developed criteria to further define efficiency and effectiveness in the context of the entry of permanent and temporary workers to Canada. The performance or value-for-money (VFM) component is also useful for not-for-profit organizations such as hospitals and universities. The features that distinguish VFM audits from traditional audits are summarized on pages 662 and 663. (The .) summary refers to paragraphs PS 6410.07 and PS 6410.25 in the CICA Handbook

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t05.htm (3 of 3) [04/10/2010 2:51:11 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06.htm

1.6 Assurance engagements

Learning objective

Describe the concept of an assurance engagement, explain audit engagements in terms of the general framework of assurance engagements, and explain the difference between an attest engagement and a direct reporting engagement. (Level 1)

Required reading

Chapter 1, pages 25 Chapter 2, pages 4853 Chapter 3, page 6870 CICA Handbook

Assurance

, paragraphs 5025.01-.15

LEVEL 1

Audits are a subset, or component, of assurance engagements. When a televised lottery draw makes a statement such as tonights draw is monitored by the public accounting firm of McPeak, Bachelor, and Leung, that accounting firm is providing assurance to the public that the lottery process is not rigged. It is an assurance engagement.

Standards for assurance engagements

In March 1997, Canada issued standards for assurance engagements. For a quick overview of the revised framework, see the Preface to the CICA Handbook Assurance .

Accountability relationship

Assurance engagements are an extension of the external audit concept to include

different levels of assurance and different types of assertions that an accountable party, such as management, may make.

The CICAs concept of an assurance engagement is centred on the idea of an accountability relationship, which is described , paragraph 5025.04. in the text and in the CICA Handbook It is important to recognize that in the CICA concept of this relationship, an accountability relationship already exists between two or more parties, and the auditor is always the third party in the relationship at least as far as assurance is concerned. This distinction is important because when the auditor is the accountable party, the engagement is no longer considered an assurance engagement. The engagement may be a tax engagement, a consulting engagement, a bookkeeping engagement, or any other engagement, but it is not an assurance engagement.

Elements of an assurance engagement

In an assurance engagement, the auditor always comes in as a third party in an existing accountability relationship (for example, between management and users such as shareholders), and the auditor issues a written communication about the subject matter for which the accountable party (management) is responsible (to the users). Perhaps the best way of characterizing such engagements is to identify the three key elements:

The assertion is the responsible or accountable partys conclusion on the subject matter based on suitable criteria. The asserter is the party making the assertion. The assurer is the party providing credibility or assurance on the assertions made by the asserter. The assurance provided is for the benefit of the user.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06.htm (1 of 2) [04/10/2010 2:51:12 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06.htm

In a situation where a restaurant owner wants to sell his business, for example, the owner/seller is the asserter, the assertion is that the financial statements accurately reflect the restaurants operations, and the auditor is the assurer providing assurance on the owners report (in this case, a written assertion).

Different types of assurance engagements

Paragraph 5025.05 describes the difference between attest engagements and direct reporting engagements. Direct reporting engagements are common in Canada in public sector auditing. For example, when a public sector auditor evaluates the effectiveness of the police department, healthcare services, or the municipal fire departments, there are frequently no written assertions involving the effectiveness of such government agencies. Instead, they are only implied. It is then the auditors task to decide on suitable criteria and directly report on the effectiveness of operations of these government agencies. As you can imagine, this exercise can be quite challenging! The key element common to both attest engagements and direct reporting is that the assurer and the asserter are two different parties. This characteristic distinguishes assurance engagements from all other public accounting services. For example, when a CGA acts as a consultant or tax advisor, the CGA is making the assertions to the client; the CGA is not providing assurance on assertions made by the client this is, therefore, a non-assurance or related services engagement.

Activity 1.6-1: Assertion

In an audit for financial statements, who are the asserter and the assurer, and what are the assertions? Solution By law, only public accountants are allowed to provide assurance on financial statements. This external auditing function is what makes CGAs and other public accountants unique in the kinds of services they provide to the public. There is no comparable regulatory legislation preventing other professionals or non-professionals from providing tax, consulting, or even other assurance services. External auditing can be viewed as the core of the profession, even though external auditing may no longer be the main source of revenues for most public accounting firms.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06.htm (2 of 2) [04/10/2010 2:51:12 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07.htm

1.7 Audit, review, and compilation engagements

Learning objective

Distinguish between audit, review, and compilation engagements. (Level 1)

Required reading

Chapter 16, pages 627632 CICA Handbook

Assurance

, paragraph 9200.26

LEVEL 1

Public accountants provide audit, review, and compilation services for their clients. This topic explains the differences among these types of engagements.

Audit services

Audits provide a high level of assurance that financial statements present fairly in all material respects the financial position and results of operations of the company. This type of assurance engagement is generally required for entities with significant financing or for publicly-traded companies where there are many users of the financial statements who use the information to make significant decisions such as whether to invest in the business, or to grant or continue loans. In situations where investors are far removed from the management of entities in which they have ownership (such as public companies), users rely on audited statements to present fairly how the entity is performing. Also, incorporation acts and/or securities regulations almost always require companies listed on a stock exchange to provide audited financial statements. Federal or provincial governments may make an audit a requirement if an entity receives government funding (for example, a not-for-profit agency providing health or child protection services to the public).

Review engagements

Review engagements provide a moderate level of assurance that financial statements are in accordance with appropriate criteria, in all material respects. (Refer to paragraph 8100.05 of the CICA Handbook , as quoted on page 628 of the text.) A review engagement is generally performed for privately-owned entities without significant financing or with financing secured by the owners personal assets. In both cases, the users of the financial information dont have the same degree of concern over its accuracy. The auditors role is to ensure that the information is plausible (or credible).

Compilation engagements

A compilation engagement is referred to as a related service and is not an assurance engagement. This is because no assessment is made of the information that is compiled or organized into statements. A compilation engagement is used when an accounting firm provides bookkeeping services or prepares financial statements for a client. The most common example of a compilation engagement is the preparation of financial statements for filing with an annual corporate tax return.

Activity 1.7-1: Misleading statements

What should a CGA do if it becomes clear during a compilation engagement that the financial statements are misleading and the client will not agree to any necessary changes?

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07.htm (1 of 2) [04/10/2010 2:51:13 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07.htm

Solution The following exhibit summarizes the differences between audit, review, and compilation engagements.

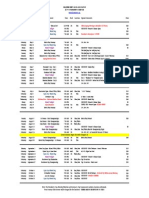

Exhibit 1.7-1: Differences between audit, review, and compilation engagements

Amount of evidence Type of procedures

Audit Extensive Inspection Observation Inquiry Confirmation Computation Analysis High Higher Required Auditors report Required Required

Review Moderate Inquiry Analysis Discussion

Compilation Minor Computation

Level of assurance Relative cost Objectivity Type of communication Engagement letter Knowledge of the business

Moderate Medium Required Review engagement report Required Required

None Lower Not required Notice to reader Required Not required. (However, public accountants still have a responsibility to not be associated with misleading information.) Not required

Understanding of and documenting internal control

Required

Not required

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07.htm (2 of 2) [04/10/2010 2:51:13 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm

1.8 Reporting

Learning objective

Draft a standard auditors report and describe its components. (Level 1)

Required reading

Chapter 3, pages 7072 (to Reservation in the Audit Report CAS 700 (CICA Handbook Assurance Reading 1-1: AuG-4, The Auditors Report

, section 5400)

LEVEL 1

Reporting standards and the auditors report

The auditors report serves the key function of communicating the results of the audit to the client. Current Canadian standards identify four reporting standards that set out the auditors reporting responsibilities [see CAS 200 (section 5100 of the CICA Handbook) , which is covered in Topic 2.1]. The reporting standards are part of the generally accepted auditing standards (GAAS). The auditors report is issued to meet these standards. The following exhibit outlines the four reporting standards and links them to the auditors report.

Exhibit 1.8-1: Reporting standards and the auditors report

Reporting standards 1. Identify the financial statements and distinguish between the responsibilities of management and the responsibilities of the auditor. (CAS 700.20-22; CICA Handbook 5400.08) Describe the scope of the auditors examination. (CAS 700.27; CICA Handbook 5400.12) Express an opinion on the financial statements. (CAS 700.30; CICA Handbook 5400.14) Indicate whether the financial statements present fairly, in accordance with an appropriate disclosed basis of accounting, which normally is GAAP. (CAS 700.31; CICA Handbook 5400.15)

Location in the auditors report Introductory paragraph

2.

Scope paragraph

3.

Opinion paragraph: In my opinion, the financial statements Opinion paragraph: the financial statements present fairly, in all material respects in accordance with Canadian generally accepted accounting principles.

4.

Components and format of the auditors report

The auditors report is normally addressed to the persons appointing the auditor, usually the shareholders. In other circumstances, the terms of the engagement determine the addressee. Under CAS 700, the audit report contains the following four paragraphs: Introductory paragraph

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm (1 of 3) [04/10/2010 2:51:15 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm

Informs the reader that the audit has been performed and identifies the financial statements and time period audited.

Managements responsibility paragraph

Informs the reader that management is responsible for preparing the financial statements in conformance with Canadian GAAP. This responsibility includes designing, implementing, and maintaining internal control; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances. Management also has primary responsibility for avoiding fraudulent financial reporting.

Auditors responsibility paragraphs

Inform the reader that the auditor will provide an opinion on the financial statements and that the audit was conducted in accordance with generally accepted auditing standards. These standards mean that the auditor is trained, competent, and independent, and does the following:

r r r r

exercises due professional care plans the audit work and supervises assistants obtains an understanding of internal controls collects sufficient and appropriate amount of evidence

Indicate that the opinion formed provides reasonable assurance, not a guarantee, that the financial statements are free from material misstatement. Highlights some of the key features of an audit of financial statements, which include the following:

r r r r

the auditors use of professional judgement the auditors consideration of the risks of material misstatements, whether due to fraud or error the auditors consideration of internal controls the auditors evaluation of the accounting policies, accounting estimates, and overall presentation of the financial statement for reasonableness

Opinion paragraph

Expresses an opinion as to whether the financial statements present fairly, in all material respects, the financial position of the company, the results of its operations, and the changes in financial position in accordance with Canadian GAAP (or some other disclosed basis of accounting). section 5400, the standard unqualified report contained

Previously, under CICA Handbook three basic sections:

Introductory paragraph Scope paragraph Opinion paragraph

The date of the auditors report is particularly important because it represents the latest date for which the auditor assumes responsibility for material events that occurred subsequent to the balance sheet date. CAS 700 paragraph 41 (b) states that the audit report can be dated only after those with sufficient responsibility for the entity have taken responsibility for the financial statements. This means that the board of directors must have approved the financial statements. In smaller companies it would mean that the primary owner has approved the financial statements. This is a significant change from the former standard, section 5405.06, which required the report date to be the date on which field work was substantially completed. The auditors report must also include a title (Auditors Report), the addressee, the name of the auditor (or firm), the date , of the report, and the place of issue (CAS 700.18.19 and 700.37.39; CICA Handbook paragraphs 5400.07 and 5400.35).

Adoption of private entity GAAP and IFRS

Canadian entities are preparing for significant changes in Generally Accepted Accounting Principles (GAAP), which will be effective for fiscal years beginning on or after January 1, 2011. All publicly accountable enterprises (PAEs) will apply International Financial Reporting Standards (IFRS) as outlined in Part I of the CICA Handbook Accounting . Private enterprises will have the option to apply either IFRS or Canadian Financial

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm (2 of 3) [04/10/2010 2:51:15 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm

Reporting Standards for Private Enterprises (PE GAAP) as outlined in Part II of the CICA Handbook Accounting . The auditors report for a PAEs financial statements may state compliance with Canadian GAAP or IFRS. The auditors report for private entities prepared in accordance with PE GAAP should state compliance with Canadian GAAP for private enterprises.

Differential reporting

Effective for fiscal years ending December 31, 2002 or later and prior to the adoption of private entity GAAP for all year-ends beginning on or after January 1, 2011, Canadian GAAP permits certain non-public enterprises (as described in section 1300 of the CICA Handbook Accounting ) to take advantage of differential reporting.

Accounting, As per the CICA Handbook an enterprise qualifies to apply differential reporting options under the following circumstances:

(a) (b) it is a non-publicly accountable enterprise as defined in paragraph 1300.02; and

paragraph 1300.06,

its owners unanimously consent to the application of differential reporting options in accordance with paragraph 1300.13.

The objective of the reporting alternative is to reduce the burden imposed on non-publicly accountable (usually small and medium-sized) enterprises, for which certain information may be redundant or irrelevant. In October 2002, section 5400 of the CICA Handbook Assurance was also amended to set out the auditors responsibilities when reporting on financial statements prepared in accordance with differential reporting. The auditors report on financial statements prepared under differential reporting is almost identical to the one prepared when differential accounting is not used, with two key exceptions:

The introductory paragraph of the report must indicate that the financial statements have been prepared in accordance with Canadian generally accepted accounting principles using differential reporting options available to non-publicly accountable enterprises. The introductory paragraph must also refer to the summary of accounting policies in the financial statements that describes each differential reporting option applied.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t08.htm (3 of 3) [04/10/2010 2:51:15 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t09.htm

1.9 Reservation of opinion

Learning objective

Evaluate when an auditor would issue an audit report containing an unqualified opinion, a qualified opinion, an adverse opinion, or a disclaimer (denial) of opinion. (Level 1)

Required reading

Chapter 3, pages 7382 Chapter 3, pages 8284 (Going Concern) Chapter 3, pages 8485 CAS 705 (CICA Handbook Assurance CAS 710 (CICA Handbook paragraphs 5701.08.13) CAS paragraphs 700.43.44 and 700.A48.A54 (CICA Handbook 5701.01.05)

, section 5510) paragraphs

LEVEL 1

The auditors opinion on financial statements can be either an unqualified opinion, a qualified opinion, an adverse opinion, or a disclaimer or denial of opinion. The text describes the circumstances under which an auditor would issue an audit report containing each kind of opinion. They are described below.

Unqualified opinion The auditor has no material reservations regarding the financial statements as a whole. Qualified opinion The auditor has no reservations regarding the financial statements as a whole, except for certain part(s) that, in the auditors judgment,

r r

(are) not fairly presented (due to GAAP departure), or for which an opinion cannot be formed (due to scope limitation).

Adverse opinion The auditor has accumulated enough evidence to indicate that the financial statements, as a whole, are not fairly presented due to a GAAP departure. Disclaimer (denial) of opinion The auditor is unable to form an opinion on the financial statements as a whole due to a scope limitation.

Qualified auditors reports are not common; they are the exception rather than the rule. GAAP problems are usually resolved before the report is issued. Nevertheless, you should be aware of what leads to a reservation and the levels of reservation.

Types and levels of reservation

A key concept in deciding on the type of reservation is the concept of materiality. Materiality is the amount of misstatement that would, in the auditors professional judgment, affect a financial statement users decision. In other words, a material amount is a significant or important amount. Determining the appropriate opinion depends on the materiality and other matters. Read the chapter summary on pages 84 and 85 of the text now. There are three levels of materiality:

Immaterial According to the definition of materiality, an immaterial misstatement involves an amount that would not influence users decisions; for example, when inventory of $85,000 is overstated by $2,000. Material Users decisions are affected with respect to the particular account or accounts that are in question, but the financial statements as a whole are not misleading; for example, when inventory of $85,000, which represents 15% of assets, is overstated by $22,000. Pervasively material The financial statements as a whole are misleading because of the magnitude of the misstatement; for example, when inventory of $340,000, which represents 60% of assets, is overstated by $190,000.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t09.htm (1 of 2) [04/10/2010 2:51:16 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t09.htm

This situation can also occur if there are material misstatements affecting many accounts. Note that the text refers to this as Pervasive materiality, whereby the item in question is important and has a pervasive impact on the reporting decision. The materiality levels and their effect on the audit opinion are summarized in the following exhibit.

Exhibit 1.9-1: Materiality levels

GAAP departures Immaterial Material Pervasive materiality unqualified opinion qualified opinion adverse opinion

Scope limitations unqualified opinion qualified opinion disclaimer of opinion

Determining the type of reservation

Refer to Exhibit 3-7 on page 78, which summarizes the audit decision process when determining the type of reservation (qualified, adverse, or denial of opinion). For instance, if the effects of GAAP departure(s) can neither be determined nor related to specific items, such GAAP departure (s) significantly impairs the usefulness of the financial statements (pervasive material misstatement), and the financial statements as a whole would be misleading even when read in conjunction with the auditors report. In such situations, the auditor should issue an adverse report.

Emphasis of matter paragraph or other matter

CAS 706 paragraph 6, states, If the auditor considers it necessary to draw users attention to a matter presented or disclosed in the financial statements that, in the auditors judgment, is of such importance that it is fundamental to users understanding of the financial statements, the auditor shall include an Emphasis of Matter paragraph in the auditors report. This standard provides the auditor with the discretion to add another paragraph to the audit report in order to highlight or draw special attention to any significant matters. It is important to understand that use of this paragraph does not imply that the financial statements are materially misstated. For example, CAS 570 (not required reading), requires that the auditor include an emphasis of matter paragraph if the going-concern principal is in question, even if the going-concern matters are adequately disclosed in the notes to the financial statements. In AuG-4, Section 5 deals with special reporting problems and issues, including what the requirements are when the goingconcern assumption is in question. , you will need to be familiar with the standard auditors report, and to know how and when the For the purposes of AU1 auditors report should be issued with a reservation of opinion.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t09.htm (2 of 2) [04/10/2010 2:51:16 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm

Module 1 summary

This module provides a framework for auditing and an explanation of its nature and purpose. External and internal auditing are described and compared. The module also includes a discussion of the audit report and an overview of the umbrella concept of assurance engagements.

Explain the objective and purpose of an audit of financial statements, and outline the two key components of the audit process.

Auditing is the systematic process of objectively obtaining and evaluating evidence regarding assertions to ascertain the degree of correspondence between assertions and established criteria. The objective of an audit of financial statements is to express an opinion as to whether or not the information in the financial statements is presented fairly. The purposes of an audit of financial statements include r fulfilling statutory or other requirements r reducing information risk, and r addressing the asymmetry of information between providers and users of financial information.

The key components of the audit process are

determining the nature, extent, and timing of evidence to obtain, and communicating the auditors findings through the auditors report

Explain how information risk arises and how audits can help reduce information risk.

Information risk is the risk that the financial statements are false or misleading. Sources of information risk are r asymmetry of information r errors from weak accounting systems r deceptive management practices Information asymmetry arises because of r remoteness of information r bias or motivation of those providing information r high volumes of transactions and data r the complexity of transactions Audits help reduce information risk because r auditors are independent and can reduce or counter the effect of the biases that management may have in preparing the financial statements r auditors have accounting expertise and are able to ensure that complex financial transactions are appropriately recorded and reported r the auditor must apply judgement within clearly defined professional and ethical standards

Describe the principal activities of a public accounting firm.

The principal activities of a public accounting firm include r audit engagements r review engagements r other assurance services r accounting services r taxation services r consulting services r bankruptcy and receivership engagements

Describe the role of the staff accountant on a typical audit engagement, and explain how

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm (1 of 3) [04/10/2010 2:51:17 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm

continuous training on audit engagements prepares staff for future opportunities in the organization.

The staff accountant (or junior auditor) prepares working papers to document the results of audit procedures and performs other tasks assigned by the in-charge accountant on the engagement. Auditors must gain a combination of both theoretical knowledge and practical experience. On-the-job training provides practical experience, allowing the auditor to develop professional judgment and move on to undertake more challenging tasks. Continuing professional development is required of all professional accountants to keep abreast with changes in standards and other developments.

Compare external auditing to internal auditing.

External auditing and internal auditing are similar in a number of ways: r Both require independence. r Both use sampling. r Both produce reports. r Both function within established standards. External auditing and internal auditing are different in a number of ways: r They produce reports for different people. r They have different objectives. r They have different scopes of work. r They have different degrees of concern with day-to-day operations. r The nature and form of their reports are different. r They are remunerated in different ways.

Describe the concept of an assurance engagement, explain audit engagements in terms of the general framework of assurance engagements, and explain the difference between an attest engagement and a direct reporting engagement.

In an assurance engagement, the auditor issues a written opinion about the subject matter of the engagement for which the accountable party (usually management) is responsible. The public accountant provides credibility or assurance to the assertions made by the responsible party. Financial statement audits are a sub-class of assurance engagements.

Audit engagements:

Audit engagements are attest engagements. Management (the asserter) is responsible for the assertions in the financial statements. The users are the investors, creditors, and others, who make decisions based on the financial statements. The auditor (the assurer) provides a high level of assurance on the assertions made by management. The audit can only be carried out by suitably qualified, independent public accountants.

Attest engagements and direct reporting engagements:

In an attest engagement, the public accountants conclusion will be on a written assertion prepared by the accountable party. In a direct reporting engagement, the public accountants conclusion will evaluate directly, using suitable criteria, the subject matter for which the accountable party is responsible.

Distinguish between audit, review, and compilation engagements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm (2 of 3) [04/10/2010 2:51:17 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm

An audit provides a high level of assurance that financial statements are fair in all material respects. Review engagements provide a moderate level of assurance that financial statements are in accordance with appropriate criteria, in all material respects. The accountants role is to ensure that the information is plausible (or credible). A compilation engagement is used when an accounting firm provides bookkeeping services or prepares financial statements for a client. No assurance is provided by the accountant, but there is an over-riding professional responsibility not to be associated with information that the accountant believes to be misleading.

Draft a standard auditors report and describe its components.

Drafting a standard auditors report:

An example of a standard unqualified auditors report is given in CAS 700 (CICA Handbook section 5400) and on page 70 of the text. Study carefully the wording of the report and be familiar with the contents of each paragraph.

Components of a standard auditors report: 1. 2. 3. 4.

The The The The

introductory paragraph managements responsibility paragraph auditors responsibility paragraphs opinion paragraph

In addition, the report must contain a title, the name of the addressee, the city and date of issue, as well as the auditors signature.

Evaluate when an auditor would issue an audit report containing an unqualified opinion, a qualified opinion, an adverse opinion, or a denial of opinion.

There are two causes for reservations of opinion:

r

A departure from generally accepted accounting principles, such as an inappropriate accounting treatment an inappropriate valuation inadequate disclosure A scope limitation, which happens when the auditors were unable to obtain sufficient and appropriate audit evidence, and is caused by client-imposed restrictions circumstances or uncertainties

If the reservation arises because of a departure from GAAP, the auditor will issue an unqualified opinion, a qualified opinion, or an adverse opinion, depending on whether the auditor considers the effect of the departure to be immaterial, material, or pervasively material. If the reservation is caused by a scope limitation, the auditor will issue an unqualified opinion, a qualified opinion, or a denial of opinion, depending on whether the auditor considers the effect of the scope limitation to be immaterial, material, or pervasively material.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01summary.htm (3 of 3) [04/10/2010 2:51:17 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t01sol.htm

Activity 1.1-1 solution

The audit process

Based on their professional judgement, which is the application of their training and experience, auditors determine

what evidence to examine, or its nature how much evidence to examine, or its extent, and when to collect the evidence, or its timing.

The audit process has the following significant parts:

determining the nature, extent, and timing of evidence to obtain (risk assessment) obtaining and evaluating the evidence effectively and efficiently (risk response) (Effectiveness relates to reaching the right conclusion, and efficiency relates to the cost of auditing.) communicating the auditors findings (opinion) through the auditors report (reporting)

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t01sol.htm [04/10/2010 2:51:18 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02sol.htm

Activity 1.2-1 solution

Sources of information risk

Asymmetry of information, errors resulting from a weak accounting system, and the possibility of management using deceptive practices are all sources of information risk. The asymmetry of information between management and financial statement users is one source of information risk. Management has access to the companys books and records and therefore has first-hand knowledge of the companys performance. Asymmetry of information for non-management users of financial statements is increased by the following:

the remoteness of the users from the information preparation the bias and motives of the information provider the volume and complexity of data

Another source of information risk is errors that arise from a weak accounting system, resulting from incompetent employees, for example. In this situation, both management and other users could be misled by erroneous financial statements. A third source of information risk is the possibility of management (and possibly the entitys board of directors) implementing deceptive accounting and reporting practices that are deliberately concealed, with the specific purpose of misleading the users of the financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t02sol.htm [04/10/2010 2:51:19 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06sol.htm

Activity 1.6-1 solution

Audit of financial statements

In this type of assurance engagement, management is the asserter, the assertions are represented by the financial statements, and the assurer is the CGA acting as a public accountant. The users are the investors, potential investors, and creditors who rely on the information contained in the financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t06sol.htm [04/10/2010 2:51:20 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07sol.htm

Activity 1.7-1 solution

Misleading financial statements

Even though the public accountant is not expressing an opinion on financial statements prepared within a compilation engagement, there is an overriding professional responsibility not to be associated with information that the accountant believes to be misleading. Consequently, a CGA should resign from an engagement if he or she believes that the financial statements are misleading and the client will not agree to any necessary changes.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01t07sol.htm [04/10/2010 2:51:20 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftest.htm

Module 1 self-test

Question 1

Explain what assurance is and describe the condition that creates demand for assurance on financial statements. Solution

Question 2

Describe the similarities and differences between an external auditor and an internal auditor. Solution

Question 3

You have been asked by the accounting teacher at the local high school to explain to students interested in accounting why society needs auditors. Briefly outline your response. Solution

Question 4

Define auditing and describe the objective of a financial statement audit. Solution

Question 5

What are the components of the auditors standard report? Describe the objectives of each component. Solution

Question 6

When should auditors express a reservation in their reports? Describe the types of modifications to the standard auditors report and explain the circumstances in which each type would be used. Solution

Question 7

In the framework of assurance engagements, is a financial statement audit a direct reporting engagement or an attest engagement? Explain. Solution

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftest.htm [04/10/2010 3:27:59 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol1.htm

Self-test 1 Solution 1

Assurance is the process of lending credibility to or vouching for the truthfulness and/or fair presentation of the statements that one party makes to another. Users of financial statements need assurance that financial statements are presented fairly. Because financial statements are prepared by management of an entity who have authority and responsibility for financial success or failure, an outsider may be skeptical that the statements are objective, informative, and free from material errors intentionally or otherwise. The assurance conveyed by the opinion of an independent CGA helps resolve those doubts, because the public knows that the reputation of a CGA is based on his/her independence, objectivity, and competence in assessing the fair presentation of financial statements according to GAAP.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol1.htm [04/10/2010 3:28:00 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol2.htm

Self-test 1 Solution 2

The similarities between external and internal auditors are:

Both external and internal auditors need technical competence and adequate training; both should continue their professional education by taking courses (usually called professional development) over the course of their professional lives. Both auditors should be professional in their work and should exercise due care in the conduct of their respective audits. The techniques used by both auditors (for example, evidence gathering, sampling to draw conclusions about populations, issuing reports at the completion of their work) are very similar. Both must adhere to professional standards in carrying out their work. Both must recognize and deal with threats to independence and objectivity.

The differences are:

Internal auditors are employees of the company. External auditors are independent professionals who provide a service to companies for a fee. The independence of internal auditors depends on the position of the internal audit function in the company and to whom they report. The independence of external auditors depends on their mental attitude, behaviour, and relationship to the client. (The issue of independence is dealt with more completely in Module 2.) Internal auditors prepare reports for management, whereas external auditors prepare reports for wide circulation, such as shareholders, banks, and government regulatory bodies. Internal auditors usually assess the effectiveness, efficiency, and economy of the operations of the company and may or may not audit financial matters. External auditors usually focus on the companys financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol2.htm [04/10/2010 3:28:01 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol3.htm

Self-test 1 Solution 3

The users of financial information or financial statements prepared by the management of a company are often remote from the company; they may not have access to the companys records or may not have the expertise to assemble meaningful financial statements if they did have access. So the users, which include shareholders (owners), creditors, the government, employees, customers, and many other groups, depend on managements representations contained in the financial statements. Auditors, who are independent of management, attest to the fact that the financial statements present fairly the financial position and results of the companys operations (that is, the information is not biased or materially inaccurate) and so can be safely relied on by users. Auditors also add credibility to management assertions in the financial statements because they have the accounting and auditing expertise to ensure that the financial statements are presented fairly in the sense that the proper accounting conventions (GAAP) are followed.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol3.htm [04/10/2010 3:28:02 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol4.htm

Self-test 1 Solution 4

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between the assertions and established criteria, and communicating the results to interested users. The objective of a financial statement audit is to express an opinion whether the financial statements present fairly, in all material respects, the financial position, results of operations, and changes in financial position in accordance with GAAP.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol4.htm [04/10/2010 3:28:03 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol5.htm

Self-test 1 Solution 5

The components of the standard auditors report are the introductory paragraph, managements responsibility paragraph, auditors responsibility paragraphs, and the opinion paragraph. Introductory paragraph The objective of this paragraph is to inform the reader that the audit has been performed and to identify the financial statements and time period audited. Managements responsibility paragraph The objective of this paragraph is to inform the reader that management is responsible for preparing the financial statements in conformity with Canadian GAAP. This responsibility includes: designing, implementing, and maintaining internal control; selecting and applying appropriate accounting policies; making accounting estimates that are reasonable in the circumstances; and taking primary responsibility for avoiding fraudulent financial reporting. Auditors responsibility paragraphs

The objective of these paragraphs is to inform the readers that the auditor will provide an opinion on the financial statements and that the audit was conducted in accordance with generally accepted auditing standards, which means that the auditor

r r r r r r

is trained and competent is independent exercises due professional care plans the audit and supervises assistants obtains an understanding of internal controls obtains sufficient and appropriate amount of evidence

These paragraphs inform the reader that the opinion formed does not provide a guarantee but provides reasonable assurance that the financial statements are free from material misstatement. These paragraphs also highlight the key features of an audit of financial statements, which include

r r r r

the auditors use of professional judgement the consideration of the risks of material misstatements whether due to fraud or error the consideration of internal controls the auditors evaluation of the accounting polices, accounting estimates and overall financial statement presentation for reasonableness

Opinion paragraph The objective of the opinion paragraph is to allow the auditor to express an opinion as to whether the financial statements present fairly, in all material respects, the financial position of the company, the results of its operations, and the changes in financial position in accordance with Canadian GAAP (or some other disclosed basis of accounting).

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol5.htm [04/10/2010 3:28:04 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol6.htm

Self-test 1 Solution 6

The auditor would express a reservation in the audit report if there is a material departure from GAAP or, if there is a material scope limitation and the auditor has been unable to obtain sufficient appropriate evidence whether there is a departure from GAAP. See CAS 705.06 (CICA Handbook , paragraph 5510.05). A qualified opinion is the form of modification to the standard audit report used when the financial statements present fairly in all material respects with the exception of certain items. In such cases, the nature of the items are described in the reservation paragraph, and the opinion paragraph is modified to state that, with the exception of the matters described in the reservation paragraph, the financial statements are presented fairly in all material respects. A qualified opinion would be used when there is either a material GAAP departure or scope limitation, but the departure or limitation is not so material as to impair the overall usefulness of the financial statements. An adverse opinion is another form of modification to the standard audit report. An adverse opinion is used when the auditor has accumulated enough evidence to conclude that the financial statements as a whole are materially misstated or are misleading. Adverse opinions are issued when there are GAAP departures so significant as to impair the overall usefulness of the financial statements. A disclaimer (denial) of opinion is a modification to the standard audit report used when the auditor is unable to form an opinion on the financial statements as a whole. A disclaimer (denial) of opinion is used when there is a highly material scope limitation preventing the auditor from obtaining sufficient appropriate evidence to reach a conclusion about the amounts and disclosures in the financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol6.htm [04/10/2010 3:28:05 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol7.htm

Self-test 1 Solution 7

In an attest engagement, the practitioners conclusion will be on written assertions prepared by the accountable party, where the assertions evaluate (using suitable criteria) the subject matter for which the accountable party is responsible. A direct reporting engagement is one in which the practitioners conclusion evaluates directly (using suitable criteria) the subject matter for which the accountable party is responsible. A financial statement audit is an attest engagement. The accountable party is management, the assertions are represented by the financial statements, the suitable criteria are GAAP, and the auditor is the practitioner who provides high assurance regarding the assertions made by management.

file:///F|/Courses/2010-11/CGA/AU1/06course/m01selftestsol7.htm [04/10/2010 3:28:05 PM]

You might also like

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Information Systems Auditing: The IS Audit Reporting ProcessFrom EverandInformation Systems Auditing: The IS Audit Reporting ProcessRating: 4.5 out of 5 stars4.5/5 (3)

- Module 8: Revenue and Collection Cycle, and Acquisition and Expenditure CycleDocument49 pagesModule 8: Revenue and Collection Cycle, and Acquisition and Expenditure CyclesamaanNo ratings yet

- Information Systems Auditing: The IS Audit Planning ProcessFrom EverandInformation Systems Auditing: The IS Audit Planning ProcessRating: 3.5 out of 5 stars3.5/5 (2)

- Tips On Writing Internal Audit ReportsDocument5 pagesTips On Writing Internal Audit ReportsSohail Iftikhar100% (1)

- Audit Chapter 1111 PDFFFFDocument25 pagesAudit Chapter 1111 PDFFFFAlex HaymeNo ratings yet

- Advanced Auditing Module GuideDocument230 pagesAdvanced Auditing Module GuideArtwell Zulu100% (1)

- Outline 1 PDFDocument7 pagesOutline 1 PDFfajarNo ratings yet

- Question and Answer - 1Document31 pagesQuestion and Answer - 1acc-expertNo ratings yet

- Audit Components: Literature Review On Audit Plan, Risk and Materiality and Internal ControlDocument8 pagesAudit Components: Literature Review On Audit Plan, Risk and Materiality and Internal ControlAvi KumarNo ratings yet

- Lecture 5 - Main Audit Concepts and Planning The AuditDocument49 pagesLecture 5 - Main Audit Concepts and Planning The AuditĐỗ LinhNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- AUD 2 Overview of AuditDocument9 pagesAUD 2 Overview of AuditJayron NonguiNo ratings yet

- Chapter 2 Basic Concepts of AuditingDocument10 pagesChapter 2 Basic Concepts of AuditingAnil KulkarniNo ratings yet

- Bcom - Acc Auditing 2Document123 pagesBcom - Acc Auditing 2isaackatebeNo ratings yet

- Unit 1: Overview of AuditingDocument8 pagesUnit 1: Overview of AuditingtemedebereNo ratings yet

- HHHHDocument6 pagesHHHHLester Jude Del RosarioNo ratings yet

- Audit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.Document29 pagesAudit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.nidal_adnanNo ratings yet

- Audit IIDocument77 pagesAudit II፩ne LoveNo ratings yet

- Im ch21Document10 pagesIm ch21Reham DarweshNo ratings yet

- Coursework 1Document10 pagesCoursework 1Coey HoNo ratings yet

- Tnss f8 Full NoteDocument102 pagesTnss f8 Full NoteArbab JhangirNo ratings yet

- AudTheo Compilation Chap9 14Document130 pagesAudTheo Compilation Chap9 14Chris tine Mae MendozaNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Audit Planning and Risk Assessment New SlidesDocument38 pagesAudit Planning and Risk Assessment New SlidesAdeel AhmadNo ratings yet

- Chapter 8 Completing AuditDocument6 pagesChapter 8 Completing AuditDawit WorkuNo ratings yet

- Chapter 1 Assurance Services - 2Document7 pagesChapter 1 Assurance Services - 2wildpeshoNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- CH 02Document21 pagesCH 02Reham DarweshNo ratings yet

- Audit PlanningDocument16 pagesAudit PlanningNyaba NaimNo ratings yet

- APELOAD - Module 1Document7 pagesAPELOAD - Module 1Hermoine GrangerNo ratings yet

- Plagiarism Declaration Form (T-DF)Document8 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Chapters PagesDocument32 pagesChapters PagesNurul FajriyahNo ratings yet

- Internal AuditingDocument19 pagesInternal AuditingOwen GarciaNo ratings yet

- Auditing IDocument58 pagesAuditing IBereket DesalegnNo ratings yet

- CAEA 2218 Lecture 1 - Introduction-AnytoPDFDocument281 pagesCAEA 2218 Lecture 1 - Introduction-AnytoPDFMuhammad Syafiq HaidzirNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Acc640 Final Project Document PDFDocument6 pagesAcc640 Final Project Document PDFThanh Doan ThiNo ratings yet

- ACT 380 - Major Final Assignment Spring 2020Document13 pagesACT 380 - Major Final Assignment Spring 2020Jesin Estiana100% (1)

- D41180681 - Nada Naurarita Bustami - Assignment 3Document4 pagesD41180681 - Nada Naurarita Bustami - Assignment 3blue 0610No ratings yet

- ISO 14001:2015 Comparison and Guidance Matrix: © URS 2015 Page 1 of 28Document28 pagesISO 14001:2015 Comparison and Guidance Matrix: © URS 2015 Page 1 of 28Néstor VargasNo ratings yet

- Audit ReportDocument166 pagesAudit Reporttigistdesalegn2021No ratings yet