Professional Documents

Culture Documents

ISRA Bulletin, Vol. 3 (Aug 2009) Pp. 4-5

Uploaded by

izwadi79Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ISRA Bulletin, Vol. 3 (Aug 2009) Pp. 4-5

Uploaded by

izwadi79Copyright:

Available Formats

4

SECT SE CTOR OR REP EPORT banking

Shariah Governance in

Islamic Financial Services

By Assoc. Prof Dr. Mohamad Akram Laldin [Executive Director, ISRA] established by Central Banks. As an example, in Malaysia, Bank Negara Malaysia has developed a guideline for the Shariah Advisory services provided to the Islamic Financial Institutions. The guideline, called the Guideline on the Governance of Shariah Committee for Islamic Financial Institutions (BNM GPS 1), is intended to govern the Shariah Shariah Committees and decides on the Islamic principles which can be used by the individual banks Shariah committees in deciding any issues brought to them. This does not mean that the Shariah committees are disallowed to use other principles. The committees are encouraged to use all the principles envisaged in the Shariah and any new principles shall be endorsed by the central authority. This exercise to certain extent is able to standardize and harmonize the practice in Shariah advisory fraternity in Malaysia. In addition, it helps in ensuring the standard of Shariah decisions for the products and services offered are maintained. The devising of BNM GPS 1 has strengthened the role of the Shariah advisors. It outlines all the important elements of Shariah advisory which includes the qualications to become a Shariah advisor, their roles and responsibilities, the governance and reporting system, roles and responsibilities of Islamic nance institutions and other pertinent elements in Shariah advisory services. BNM GPS 1 require that a Shariah advisor must be a reputable person of good character and have ample knowledge in Shariah especially in Fiqh Muamalat or Usul al Fiqh as well if possible a considerable knowledge of the current practices in nance and Islamic nance. The guideline

hariah is considered as one of the core element of Islamic nance without which the whole industry will be at stake. The integrity of any Islamic nancial products very much depends on its compliance with the requirements of Shariah and any deciency in this aspect will surely affect the market and the condence of the stakeholders. Having said that, it is very important to ensure adequate framework is developed to preserve the Shariah integrity of Islamic nancial products. Therefore, a comprehensive Shariah governance framework is vital if Islamic nance is to develop in line with the rapid development that is taking place in the market. Shariah governance is very much related to the tremendous contribution that is made by the Shariah advisor in developing the market. Shariah advisors are considered as the clients advocate in ensuring that they get Shariah compliance and best services from Islamic nance institution. They hold a big responsibility of honoring the trust of the clients and assume the key role in safeguarding public condence in Islamic nance systems and products. This propels further growth and acceptance of Islamic nance. Lately, many quarters have raised concerns that the Shariah advisory industry is not regulated except in certain jurisdictions with guidelines

Lately, many quarters have raised concerns that the Shariah advisory industry is not regulated except in certain jurisdictions with guidelines established by Central Banks

advisory activities provided to Islamic Financial institutions. Having such Shariah governance in place ensures that all the Shariah decisions or resolution is made with due diligence and with utmost good faith. Malaysia has a unique Shariah governance system and is considered as one of the best practices in the globe. The structure consists of the central Shariah Advisory Council (SAC) at Bank Negara level and the Shariah Committees at individual banks level. The SAC acts as an umbrella to other

SECTOR REPORT banking

BULLETIN

also emphasizes the importance of Islamic Finance Institutions providing adequate support for the Shariah advisors to enhance their knowledge and experience. The support includes training and other facilities that is needed. In order to ensure sufcient Shariah advisors are groomed to participate in the market development, BNM GPS 1 has restricted the engagement of an individual to only one nancial institution within the same industry. For example, a person can be a member of only one bank within the banking industry and can be a member of one Takaful company within the Takaful industry. In addition, the person can also be an advisor to unit trust and Sukuk issuance provided that he obtains a license from the Securities Commission (SC), as capital market products approvals are under the purview of SC. This exercise has assisted in developing more talents in the industry and providing exposure and opportunity for more experts to be involved in Shariah advisory services industry. As a result, many local institutions have started to engage new and young scholars into their Shariah board and provide them with various training and exposure. Such move is seen as a healthy scenario in the industry which has been troubled by the lack number of scholars in the past. As several countries have experienced a long tradition of Islamic nance, the development of the industry and the system has been observed and monitored closely by many parties. Thus, it has been highlighted in many avenues that Shariah governance needs to be improved and Shariah advisors need to be better equipped. Some discontents with the Shariah

In order to ensure sufficient Shariah advisors are groomed to participate in the market development, BNM GPS 1 has restricted the engagement of an individual to only one financial institution within the same industry It is timely to think of and consider a professional body for Shariah advisors

and there is strong justication and sufcient contemplation for every word said. As Islamic nance move on towards further growth and expansion, it requires some degree of certainty especially with its Shariah governance system so that condence of the public is well preserved. Therefore, it is proposed that a professional body or association for Shariah advisors is initiated to overlook the practices and conduct of Shariah advisors as being a profession that require public trust as well highest integrity and competence. Such body will organize and ensure the continuous professional development (CPD) programme for Shariah advisors, establishing an acceptable qualication of members and oversee the conduct of Shariah advisor. This body shall serve or maintain balance between public interest (or the industry) and its members. It can be considered as a nongovernmental body (NGO) which may operate on the basis of Waqf or contribution from its members and Islamic nance institution. It may also be given mandate to issue professional certication to Shariah advisor to practice and determine its renewal by periodic review and screening as to ensure that the Shariah advisor holds and exercises, at all time, quality and best professional, educational and ethical conduct. In fact, the existence of such body in other professional arena such as the Bar Council, the Medical Association and others has assisted in ensuring the integrity of such professions is maintained. Hence, it is may be timely to think of and consider a professional body for Shariah advisors.

advisory are their lack of focus, numbers, knowledge, experience and exposures as well as training. It is still somewhat obvious that there are a gap of knowledge between Shariah advisor and industry practitioner whereas only few scholars are nance savvy and only few practitioners are Shariah savvy although there are recommendable efforts towards that by the growth of many Islamic nance specialized educational and training organizations. In addition, there is no specic avenue or method to ensure that their qualication is maintained or enhanced whereby this matter is crucial in order to ensure the validity and integrity of decisions made by the Shariah advisors. Moreover, there is scarcity of fatwa available in the market and although an ijtihad may be made by every scholar but how it is ensured that certain discipline are followed

You might also like

- Optimal Shariah Governance in Islamic FinanceDocument49 pagesOptimal Shariah Governance in Islamic FinanceresatkNo ratings yet

- Takaful Feature: Shariah Governance - The Importance of Shariah Knowledge in Shariah GovernanceDocument4 pagesTakaful Feature: Shariah Governance - The Importance of Shariah Knowledge in Shariah Governanceizwadi79No ratings yet

- Shariah Governance in The Islamic Financial Institutions in MalaysiaDocument16 pagesShariah Governance in The Islamic Financial Institutions in Malaysiaizwadi79100% (1)

- Shariah Resolutions EnglishDocument248 pagesShariah Resolutions Englishizwadi79No ratings yet

- ISRA - Asyraf Wajdi DusukiDocument38 pagesISRA - Asyraf Wajdi DusukiAsian Development BankNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sample Request Letter For Authority To Practice The Legal ProfessionDocument3 pagesSample Request Letter For Authority To Practice The Legal ProfessionJOHN VINCENT S FERRER100% (1)

- TORTS CASES-Set 3Document118 pagesTORTS CASES-Set 3Janet Tal-udanNo ratings yet

- 10 Lustan v. CADocument1 page10 Lustan v. CAMlaNo ratings yet

- Delgado Brothers Inc. v. Home Insurance IncDocument1 pageDelgado Brothers Inc. v. Home Insurance IncVener MargalloNo ratings yet

- DST of SissyDocument1 pageDST of SissyAnimeMusicCollectionBacolod0% (2)

- Latasa Vs COMELEC DigestDocument2 pagesLatasa Vs COMELEC Digestgrace100% (4)

- De MinimisDocument5 pagesDe MinimisRosemarie CruzNo ratings yet

- Negotiable Instruments ReviewerDocument16 pagesNegotiable Instruments ReviewerColee StiflerNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionNasir LatifNo ratings yet

- Criminal RevisionDocument6 pagesCriminal RevisionShashikant BhosleNo ratings yet

- Nikah NammaDocument4 pagesNikah NammaM.ASIM IQBAL KIANI100% (2)

- In The Hon'Ble Supreme Court of India: Bandhua Mukti Morcha (Appellant) vs. Union of India (Respondent)Document10 pagesIn The Hon'Ble Supreme Court of India: Bandhua Mukti Morcha (Appellant) vs. Union of India (Respondent)Anamika BallewarNo ratings yet

- Panolilo Vs TajalaDocument5 pagesPanolilo Vs TajalaNiño Anthony SilvestreceNo ratings yet

- Complaint Affidavit SampleDocument3 pagesComplaint Affidavit SampleAzrael Cassiel100% (1)

- Absolute Divorce PhilippinesDocument3 pagesAbsolute Divorce PhilippinesHeyward Joseph AveNo ratings yet

- 001 DIGESTED People vs. Benipayo - G.R. No. 154473Document2 pages001 DIGESTED People vs. Benipayo - G.R. No. 154473Paul ToguayNo ratings yet

- Writ of Kalikasan - AgcaoiliDocument15 pagesWrit of Kalikasan - Agcaoilimabandes dironNo ratings yet

- Spec Pro-Pros. CentenoDocument24 pagesSpec Pro-Pros. CentenoNoel RemolacioNo ratings yet

- In The Matter of The Petition For Habeas Corpus vs. Assistant State Prosecutor Pedro NaveraDocument1 pageIn The Matter of The Petition For Habeas Corpus vs. Assistant State Prosecutor Pedro NaveraRose FortalejoNo ratings yet

- Moot Court MemorialDocument7 pagesMoot Court MemorialHETRAM SIYAG100% (1)

- Constitution of MalaysiaDocument16 pagesConstitution of Malaysianif_nib100% (4)

- Disciplinary ProcedureDocument8 pagesDisciplinary Proceduremightym85100% (1)

- School of The Holy Spirit v. TaguiamDocument4 pagesSchool of The Holy Spirit v. TaguiamColen RazonNo ratings yet

- People OF THE PHILIPPINES, Plaintiff-Appellee, vs. ROMY LIM y MIRANDA, Accused-AppellantDocument42 pagesPeople OF THE PHILIPPINES, Plaintiff-Appellee, vs. ROMY LIM y MIRANDA, Accused-AppellantJNo ratings yet

- Reaction PaperDocument2 pagesReaction PaperMai XiaoNo ratings yet

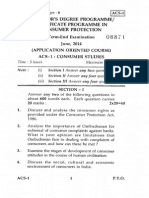

- Acs - 1Document6 pagesAcs - 1RamBabuMeenaNo ratings yet

- This Confirms Receipt of Your Submission With The Following Details Subject To Validation by BIRDocument1 pageThis Confirms Receipt of Your Submission With The Following Details Subject To Validation by BIRPatrickHidalgoNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument4 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Casebook On Law of TortDocument36 pagesCasebook On Law of TortMaruf Allam100% (2)

- Quo Warranto: Court. - The Solicitor General or A Public Prosecutor May, With The Permission of The Court in WhichDocument2 pagesQuo Warranto: Court. - The Solicitor General or A Public Prosecutor May, With The Permission of The Court in Whichanalou agustin villezaNo ratings yet