Professional Documents

Culture Documents

MSIG Motor

Uploaded by

chong.cheekin8686Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MSIG Motor

Uploaded by

chong.cheekin8686Copyright:

Available Formats

MSIG Insurance (Singapore) Pte. Ltd.

4 Shenton Way #21-01 SGX Centre 2 Singapore 068807 Tel: (65) 6827 7888 Fax: (65) 6827 7800 Co. Reg. No. 200412212G www.msig.com.sg

PRIVATE MOTOR

With our Motor Insurance, your car is always on the sunny side of the road.

Breeze your drive with MotorMax. With a suite of comprehensive benefits, you have the choice of selecting the value cover or go for the more extensive plan of MotorMax Plus. MotorMax Plus lets you enjoy extras such as having your car repaired at the manufacturers authorised agent or a workshop of your choice, transport allowance, car loan protection and many more. Be it MotorMax or MotorMax Plus, you and your car always stay on the sunny side of the road.

About MSIG Insurance

MSIG Insurance (Singapore) Pte. Ltd. (MSIG Singapore), a member of the MS&AD Insurance Group, is one of Singapores leading general insurers with over 100 years of expertise and experience, offering an extensive range of insurance solutions for commercial and personal risk protection. Wholly owned by MSIG Holdings (Asia) Pte. Ltd. (MSIG Holdings), MSIG Singapore is ISO 9001:2008 certied and holds an AA nancial rating by Standard & Poors. The MS&AD Insurance Group, established in April 2010 following the alliance of Mitsui Sumitomo Insurance Group, Aioi Insurance Company Ltd and Nissay Dowa General Insurance Company, is the largest general insurer based in Japan and one of the top 10 globally. It operates in over 41 markets in Asia Pacic, United States and Europe, of which 16 are in Asia.

Please refer to www.msig.com.sg for current information and ratings.

MotorMax Plus

Extensive cover. No worries.

For more details or to obtain a quotation, contact MSIG at: Call Email : 6827 7602 (8.45am to 5.30pm, Monday to Friday) : service@sg.msig-asia.com

CERT. NO.: 2004-1-0728 ISO 9001 : 2008

Or contact your usual insurance advisor for assistance.

All sums in Singapore $

SUMMARY OF BENEFITS

1. Comprehensive coverage of Insured Vehicle against accidental loss or damage Liability To Third Parties Death or bodily injury to any person Damage to property 2. Personal Accident Benets Policyholder Authorised Driver and/or passenger (up to legal seating capacity) 3. Medical Expenses Policyholder Authorised Driver and/or passenger (up to legal seating capacity) 4. Choice of Workshop for accident repairs to Insured Vehicle

LIMIT OF LIABILITY MotorMax Plus MotorMax

Market Value of f Insu Insured Vehicle at time of loss or damage Unlimited $5,000,000

FREQUENTLY ASKED QUESTIONS

1. What is the Young or Inexperienced Driver Excess about? This Excess (the rst amount of any claim to be borne by you) applies in respect of a claim for loss or damage when the Insured Vehicle is driven by an authorised driver aged 26 years or below or a driver holding a valid driving licence for 2 years or less. This Excess is payable on top of the regular vehicle standard policy Excess. 2. What is Market Value and how is this determined? This is the assessed value of the Insured Vehicle at the time of the accident, arrived at by comparing retail prices for vehicles of the same make, model, age and condition. 3. What is the No-Claim Discount (NCD) Protector and how does it work? The NCD protector is an optional benet and applies only to holders of 50% NCD at an additional premium. It protects your NCD entitlement in the event of a rst claim in the policy year i.e. your entitlement remains intact after a claim. If a second claim is made, the normal NCD rules apply and your entitlement will be reduced to 20% on your next policy renewal. The protected NCD is not transferable to another insurer. You would need to renew your policy with us to enjoy this benet. 4. Do I have to reinstate my windscreen cover after a claim? Will my NCD be affected? The windscreen benet covers the cost of reinstating any glass in the windscreen and windows including the in-vehicle unit (IU) subject to an excess of S$100 each claim. Such claims do not affect your NCD entitlement and your windscreen cover will be automotically reinstated at no cost to you. 5. I read about damage to vehicles by falling trees, ooding and res by arsonists. Can I claim for such damages? MotorMax and MotorMax Plus cover damage caused by accidents, re and theft including falling trees and ood related damages. Malicious damage caused by unknown persons is also covered.

$100,000 $50,000 each

$20,000 $10,000 each

Up to $1,000 Up to $1,000 each Any Workshop

Up to $1,000 Up to $1,000 each MSIGs authorised workshops

5. Transport allowance while the Insured Vehicle undergoes repairs following accident damage if the approved repair period is more than 3 days. Where this benet applies, cover starts from the rst day of repair. Please refer to the illustration in FAQ No 7. 6. New for Old Replacement* Pays the difference of up to $100,000 between the market value of the Insured Vehicle at the time of a Total Loss or Constructive Total Loss and the cost of a new vehicle of same make and model following accident occurring within 12 months of its rst registration. This benet does not apply to Total Loss or Constructive Total Loss caused by ood, theft or robbery of the Insured Vehicle. 7. Loan Protection Benets Pays the outstanding loan amount in respect of the Insured Vehicle following accidental death of the Policyholder in direct connection with the Insured Vehicle. 8. Windscreen Windscreen Cover due to breakage, subject to excess of $100 for each claim. 9. 24 hours Automobile and Medical Assistance Services Auto Assistance Helpline Services such as emergency towing, roadside assistance, vehicle repatriation, accident & police report notication, locksmith referral and many more Emergency medical evacuation and repatriation of the Policyholder for accidents within the Geographical area (excluding Singapore) in connection with the Insured Vehicle

Geographical Area: Singapore, West Malaysia and that part of Thailand within 50 miles of the border between Thailand and West Malaysia.

$50 per day Max 10 days

Not Covered

Covered

Not Covered

6. Can I choose my preferred workshop for accident repairs? MotorMax Plus gives you the freedom to choose your own workshop including the manufacturers agents workshop in Singapore. With MotorMax, accident damage repairs would have to be done at any of MSIGs authorised workshops conveniently located all around Singapore. 7. How does the Transport Allowance Benet work? The benet of S$50 per day is payable if the period of the approved accident repairs to the Insured Vehicle is more than 3 days. Payment starts from the rst day of such repair up to a maximum of 10 days. Below is an illustration of the benet computation: Period of repair Benet payable 3 days or less Not Covered 5 days Pays 5 days X $50 = $250 14 days Pays 10 days X $50 = $500 8. What should I do when I meet with a motor accident? You may e-le the accident report through MSIGs authorised workshops or to the nearest IDAC (Independent Damage Assessment Centre) within 24 hours or the next working day of the accident. If there is injury to any person, please call the police immediately. Do not admit or discuss liability. Please take pictures of the damage of all vehicles, and of the accident scene and record details of witnesses, if any.

This policy is protected under the Policy Owners Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benets that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA / LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

QMX 20112A

Up to $100,000

Not Covered

Auto reinstatement

Available

$50,000

Notes: Cover is subject to an Excess for vehicle damage repairs. An additional Young or Inexperienced Driver Excess of $3,000 applies for a driver who is aged 26 years old or below or has held a valid driving licence for 2 years or less. * This benet does not apply to high performance, sports makes and high value vehicles.

This is not a contract of insurance. Full details of the terms, conditions and exclusions of this insurance are provided in the policy and will be sent to you upon acceptance of your application by MSIG Insurance (Singapore) Pte. Ltd.

Information correct as at 01 January 2012.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- SIAE CatalogDocument6 pagesSIAE Catalogchong.cheekin8686No ratings yet

- 9400awy P1Document31 pages9400awy P1chong.cheekin8686No ratings yet

- 9400awy P1Document31 pages9400awy P1chong.cheekin8686No ratings yet

- Flexipacket MicrowaveDocument8 pagesFlexipacket Microwavechong.cheekin8686No ratings yet

- Microwave Meets IPDocument2 pagesMicrowave Meets IPnwabueze012No ratings yet

- Alcatel-Lucent 9600 LsyDocument3 pagesAlcatel-Lucent 9600 Lsysisf67% (3)

- Huawei OptiX RTN 910 Radio Transmission System IDU Hardware DescriptionDocument511 pagesHuawei OptiX RTN 910 Radio Transmission System IDU Hardware Descriptionhussain_md8191% (11)

- Eol RTN950Document2 pagesEol RTN950chong.cheekin8686No ratings yet

- Alcatel-Lucent 9500 MXC Microwave Cross-Connect PlatformDocument2 pagesAlcatel-Lucent 9500 MXC Microwave Cross-Connect Platformchong.cheekin8686No ratings yet

- Ipasolink FamilyDocument2 pagesIpasolink FamilynincsnickNo ratings yet

- Apps Ecac Cind JointDocument2 pagesApps Ecac Cind Jointchong.cheekin8686No ratings yet

- FH Datasheet1Document2 pagesFH Datasheet1Miro MekicNo ratings yet

- CPF 4BDocument2 pagesCPF 4Bchong.cheekin8686No ratings yet

- Guide of RFU CDocument73 pagesGuide of RFU Cchong.cheekin8686No ratings yet

- Ceragon 1500p GuideDocument70 pagesCeragon 1500p Guidechong.cheekin8686No ratings yet

- Trouble Shooting Guide IP 10 1500P NovDocument44 pagesTrouble Shooting Guide IP 10 1500P Novchong.cheekin8686No ratings yet

- SCTP Sigtran and SS7Document26 pagesSCTP Sigtran and SS7sergey_750% (2)

- 9500 MXC R1-1-3 Data SheetDocument5 pages9500 MXC R1-1-3 Data SheetrmarikuNo ratings yet

- FH Datasheet1Document2 pagesFH Datasheet1Miro MekicNo ratings yet

- TED FlexiHopper XC enDocument74 pagesTED FlexiHopper XC enRui CarvalhoNo ratings yet

- Trouble Shooting Guide IP 10 1500P NovDocument44 pagesTrouble Shooting Guide IP 10 1500P Novchong.cheekin8686No ratings yet

- FibeAir1500 Rádio SDH Ceragon ManualDocument362 pagesFibeAir1500 Rádio SDH Ceragon Manualwebsolutions1976100% (1)

- FH Datasheet1Document2 pagesFH Datasheet1Miro MekicNo ratings yet

- FH Datasheet1Document2 pagesFH Datasheet1Miro MekicNo ratings yet

- FibeAir IP 10 G Series - NADocument4 pagesFibeAir IP 10 G Series - NAchong.cheekin8686No ratings yet

- FibeAir IP 10 G Series - NADocument4 pagesFibeAir IP 10 G Series - NAchong.cheekin8686No ratings yet

- MSIG MotorDocument2 pagesMSIG Motorchong.cheekin8686No ratings yet

- Motor Windscreen From NTUCDocument1 pageMotor Windscreen From NTUCchong.cheekin8686No ratings yet

- OptiX RTN 600 Product DescriptionDocument57 pagesOptiX RTN 600 Product DescriptionJoe AppiahNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Deutsch Controller Area Network Series Technical ManualDocument6 pagesDeutsch Controller Area Network Series Technical ManualJoao SilvaNo ratings yet

- K100RSDocument100 pagesK100RSJavier Torralba EstellésNo ratings yet

- Esr Jaw-Ji-Trk-4072 NumpakcesDocument49 pagesEsr Jaw-Ji-Trk-4072 NumpakcesArrival SmithNo ratings yet

- Cee b2 RB TB A14 ResourceDocument20 pagesCee b2 RB TB A14 ResourceLevoir Alain Le Grand0% (2)

- Effi-Cycle 2017: Drive The FutureDocument18 pagesEffi-Cycle 2017: Drive The FutureHitheswarNo ratings yet

- Distance and Time QuestionsDocument23 pagesDistance and Time QuestionsNakshtra DasNo ratings yet

- KL International Airport Airside Safety RolesDocument73 pagesKL International Airport Airside Safety RolesAim MNo ratings yet

- OOS Manual For Hydrologic and Hydraulic Design (2015) Chapter 19 PDFDocument7 pagesOOS Manual For Hydrologic and Hydraulic Design (2015) Chapter 19 PDFAlexNo ratings yet

- Uromac T-Rail SV - Brochure PDFDocument2 pagesUromac T-Rail SV - Brochure PDFCristiano RonaldoNo ratings yet

- © Ncert Not To Be Republished: SettlementsDocument8 pages© Ncert Not To Be Republished: Settlementspavan brsNo ratings yet

- Pages From Pap Air Law PWB 2016Document5 pagesPages From Pap Air Law PWB 2016Paul KostukovskyNo ratings yet

- Torts Quasi Delict Case Digests Temp1Document29 pagesTorts Quasi Delict Case Digests Temp1Kp FabileNo ratings yet

- Chapter 3 Brake System DesignDocument8 pagesChapter 3 Brake System Design04573588No ratings yet

- TSC - Travelling Claim FormDocument1 pageTSC - Travelling Claim FormMuruthi B.MNo ratings yet

- Chapter Six Sight DistanceDocument11 pagesChapter Six Sight Distanceمحمد المهندسNo ratings yet

- Morning Calm Korea Weekly, March 26, 2010Document30 pagesMorning Calm Korea Weekly, March 26, 2010Morning Calm Weekly NewspaperNo ratings yet

- Tyre Maintenance IN Opencast Mines: Chandan ChamanDocument41 pagesTyre Maintenance IN Opencast Mines: Chandan ChamanSaurabh Jha100% (2)

- UKPMS Manual For GriptesterDocument7 pagesUKPMS Manual For GriptesterAu Yong Thean SengNo ratings yet

- A GIS Approach For Analysis of Traffic Accident Hotspots in Abha and Bisha Cities, Saudi ArabiaDocument19 pagesA GIS Approach For Analysis of Traffic Accident Hotspots in Abha and Bisha Cities, Saudi ArabiaMOHAMMED ABDELAZIZ ELDEWANYNo ratings yet

- Tyre Dynamics: Modelling of Automotive SystemsDocument13 pagesTyre Dynamics: Modelling of Automotive SystemsyeshwantambureNo ratings yet

- A Criticial Analysis of Tatara Bridge, JapanDocument10 pagesA Criticial Analysis of Tatara Bridge, JapanYati AggarwalNo ratings yet

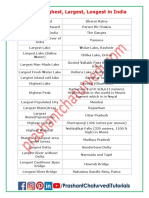

- Biggest Highest Largest Longest in IndiaDocument4 pagesBiggest Highest Largest Longest in IndiaSaikumarNo ratings yet

- Mortor Roads of BurmaDocument44 pagesMortor Roads of BurmaTaw Ka Hlaing100% (1)

- Merry Marketing Company 244 Merry Way Boston, MA 01106Document4 pagesMerry Marketing Company 244 Merry Way Boston, MA 01106aqwerty888No ratings yet

- Observation of Dhangarhi StreemDocument2 pagesObservation of Dhangarhi Streemkrishan kumarNo ratings yet

- DLIMS SaqibDocument1 pageDLIMS Saqibfaizich271No ratings yet

- Asking For Directions and Describing A PlaceDocument5 pagesAsking For Directions and Describing A PlaceshellagherinaNo ratings yet

- Driving Licence CategoriesDocument9 pagesDriving Licence CategoriesThe Best Coding EverNo ratings yet

- Installation of Chain Link Fence Method StatementDocument43 pagesInstallation of Chain Link Fence Method StatementfadhilahNo ratings yet

- Landcruiser 200: King Off The RoadDocument29 pagesLandcruiser 200: King Off The RoadengkjNo ratings yet