Professional Documents

Culture Documents

Somesh Npa Project

Uploaded by

Jayanth KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Somesh Npa Project

Uploaded by

Jayanth KumarCopyright:

Available Formats

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

SECTION-A NON PERFORMING ASSETS

EVOLUTION:

After nationalization, the entail norms initial mandate that banks were given was to expand their branch network, increase the savings rate and extend credit to the rural and SSI sectors. This mandate has been achieved admirably- since the early 90,s the focus has shifted towards improving quality of assets and better management. The directed lending approach has given way to more market driven practices.

The Narashimhan Committee has recommended prudential norms on income recognition, assets classification and provisioning. In a change from the past, Income recognition is now not on an accrual basis but when it is actually received. Past problem faced by banks were to a great extent attributable to this.

Classification of what an NPA is changed with tightening of prudential norms. Currently an asset non-performing if interest or installments of principal due remain unpaid for more than I80 days.

KARNATAKA STATE OPEN UNIVERSITY

Page 1

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

INTRODUCTION: A Man without money is like a bird without wings, the Rumanian proverb insists the importance of the money. A bank is an establishment, which deals with money. The basic functions of Commercial banks are the accepting of all kinds of deposits and lending of money. In general there are several challenges confronting the commercial banks in its day to day operations. The main challenge facing the commercial banks is the disbursement of funds in quality assets (Loans and Advances) or otherwise it leads to Non-performing assets. NPAs -MEANING: An asset which ceases to generate income of the bank is called nonperforming asset. The past due amount remaining uncovered for the two quarter consequently the amount would be classified as NPA for the whole year. It includes borrowers defaults or delays in interest or principal repayment.

DEFINITION OF NPA: NBE [Supervision of Banking Business Directives (Directive No. SBB/3212002)] defines, the term Non-performing is, Loans or advances whose credit quality has deteriorated such that full collection of principal and/or interest in accordance with the contractual repayment terms of the loan or advances is in question.

KARNATAKA STATE OPEN UNIVERSITY

Page 2

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

A loan or lease that is not meeting its stated principal and interest payments. Banks usually classify as nonperforming assets any commercial loans which are more than 90 days overdue and any consumer loans which are more than 180 days overdue. More generally, an asset which is not producing income. For purposes of this Directive, loans or advances with pre-established repayment programs are non-performing when principal and or interest is due and uncollectible for 90 days or more beyond the scheduled payment date or maturity. For purposes of this Directive, overdraft and roans or advances that do not have a pre established repayment program shall be considered as non-performing when; 1. The debt remains outstanding for 90 consecutive days or more beyond the scheduled payment date or maturity. 2. Interest is due and uncollected for 90 days or more or 3. For overdrafts, the account has been inactive for 90 consecutive days and / or deposits are insufficient to cover the interest capitalized during the period.

KARNATAKA STATE OPEN UNIVERSITY

Page 3

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

GENERAL REASONS FOR ASSETS BECOMING NPAs A multiplicity of factor is responsible forever increasing size of NPAs in banks. A few prominent reasons for assets becoming NPAs are as under.

Poor credit appraisal system. Lack of proper monitoring. Reckless advances to achieve the budgetary targets. Change in economic policies/ environment.

No transparent accounting policy and poor auditing practices. Banks were also Lack of sincere corporate culture, inadequate legal provisions on foreclosure and bankruptcy. Change in economic policies/environment Banks not in the position to press enough securities to cover the loans in calls of timings.

Lack of coordination between banks.

REASONS FOR NON PERFORMANCE IN LOAN ASSETS: 1. Most of the NPAs have the cover of collaterals by way of EM of landed properties. But real estate market is depressed & thus impacted recoveries. Many large corporate borrowers have turned "wish defaulters" taking shelters under BIFR umbrella.

KARNATAKA STATE OPEN UNIVERSITY

Page 4

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

2. NBFCs are in doldrums, their recoveries are adversely affected & strictures on accepting deposits has caused further resource crunch ultimately defaulting the banks, top priority being repayment of deposits. The bank has the highest exposure under this sector where the incidence of non performance is higher. 3. Textile industry is plagued by high cost of production & row returns, & is running in loss and many units are being closed down. 4. The bank got fairly good exposure in real estate. The depressed real estate market has resulted in poor recovery rate in almost the entire segment. 5. In agriculture sector poor recovery has been due to various factorsrecovery advances has been affected by the sharp fall in rubber prices. Throughout the country aqua culture miserably failed due to reasons beyond the control of the borrowers we are not an exception. 6. Poor recovery in schematic loans is mainly due to willful default by the borrowers.

90 DAYS OVERDUE EFFECT: As a facilitating measure for smooth transition to 90 days norm, banks have been advised to move over to charging of interest at monthly rests, by April 1, 2002. However, the date of classification of an advance as NPA should not be changed on account of changing of interest at monthly rests. Banks should, therefore, continue to classify an account as NPA only if the interest charged

KARNATAKA STATE OPEN UNIVERSITY

Page 5

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

during any quarter is not serviced fully within l80 days from the end of the quarter with effect from April l, 2002 and 90 days from the end of the quarter with effect from 31,2004. There are two aspects to the adoption of the 90 days, overdue norm for identification of NPAs. The negative aspect is that NPAs will increase in the short term. But the positive aspect is that banks will be become pro-active in detecting smoke signals about an account becoming bad and accordingly initiate remedial steps.

I. CREDIT INFORMATION BUREAU (CIB):

It is in this context that the facility of credit Information Bureau (CIB) becomes relevant, A CIB provides an institutional mechanism for sharing of credit information on borrowers and potential borrowers among banks and FIs. Ii acts as a facilitator for credit dispensation and helps mitigate the credit risk involved in lending. Based on cross-country experiences, initiatives have been taken in India to establish a credit information bureau. The Bureaus established in these countries collect information on both individual borrowers (retail segment) and the corporate sector

KARNATAKA STATE OPEN UNIVERSITY

Page 6

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

WARNING SIGNALS: 1. Default in servicing periodic installments and interest. 2. Accumulation of stock & non-movement of stock. 3. Operating loss / net loss. 4. Slow turnover of debtors & fall in level of sundry creditors. 5. Return of outward bills for collection / return of cheque. 6. Labor troubles. 7. High turnover of key personnel. 8. Loss of critically important customers. 9. Court cases against the unit. 10.Avoidance of contacts with the bank. 11.Delayed submission of financial statements. 12.Disputes among partners / promoters.

THE NPA PROBLEM: 1. The origin of the problem of burgeoning NPAs lies in the quality of managing credit risk by the banks concerned, what is needed is having adequate preventive measures in place namely, fixing pre-sanctioning appraisal responsibility and having an effective post-disbursement supervision, Banks concerned should continuously monitor loans to identify accounts that have potential to become non-performing.

KARNATAKA STATE OPEN UNIVERSITY

Page 7

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

2. The performance in terms of profitability is a benchmark for any business enterprise including the banking industry. However, increasing NPAs have a direct impact on banks profitability as legally banks are not allowed to book income on such accounts and at the same time banks are forced t make provision on such assets as per the RBI guidelines. 3. Also, with increasing deposits made by the public in the banking system, the banking industry cannot afford defaults by borrowers since NPAs affects the repayment capacity of banks. 4. Further, RBI successfully creates excess liquidity in the system through various rate cuts and banks fail to utilize this benefit to its advantage due to the fear of burgeoning non-performing assets. CREDIT RISK AND NPA: Quite often credit risk management (CRM) is confused with managing nonperforming assets (NPAs). However there is an appreciable difference between the two. NPAs are a result of past action whose effects are realized in the present. i.e. they represent credit risk that has already materialized and default has already taken place. On the other hand, managing credit risk is a much more forward-looking approach and is mainly concerned with managing the quality of credit portfolio before default takes place. In other words, an attempt is made to avoid possible default by properly managing credit risk.

KARNATAKA STATE OPEN UNIVERSITY

Page 8

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Considering the current global recession and unreliable information in financial statements, there is high credit risk in the banking and lending business. EXCESS LIQUIDITY: Now banks are faced with the problem of increasing liquidity in the system. Further, RBI is increasing the liquidity in the system through various rate cuts. Banks can get rid of its excess liquidity by increasing its lending but, often shy away from such an option due to the high risk of default. In order to promote certain prudential norms for healthy banking practices, most of the developed economies require all banks to maintain minimum liquid and cash reserves broadly classified in to Cash Reserve Ratio (CRR) and the Statutory Liquidity Ratio (SLR). Cash Reserve Ratio (CRR) is the reserve which the banks have to maintain with itself in the form of cash Reserve or by way of current account with the RBI, computed as a certain percentage of its demand and time liabilities. The objective is to ensure the safety and liquidity of the deposits with the banks. On the other hand, Statutory Liquidity Ratio (SLR) is the one which every banking company shall maintain in India in the form of cash, gold or unencumbered approved securities, an amount which shall not, at the close of business on any day be less than such percentage of the total of its demand and time liabilities in India as on the last Friday of the second proceeding fortnight, as the RBI may specify from time to time.

KARNATAKA STATE OPEN UNIVERSITY

Page 9

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

A rate cut (for instance, decrease in CRR) results into lesser funds to be locked up in RBIs vaults and further infuses greater funds into a system. However, almost all the banks are facing the problem of bad loans, burgeoning nonperforming assets, thinning margins, etc. As a result of which, banks are little reluctant in granting loans to Corporates. As such, through in its monetary policy RBI announces rate cut but, such news are no longer warmly greeted by the bankers.

HIGH COST OF FUNDS DUE TO NPA: Quite often genuine borrowers face the difficulties in raising funds from banks due to mounting NPAs. Either the bank is reluctant in providing the requisite funds to the genuine borrowers or if the funds are provided, they come at a very high cost to compensate the lenders I losses caused due to high level of NPAs. Therefore, quite often corporate prefer to arise funds through commercial papers (CPs) where the interest rate on working capital charged by banks is higher.

KARNATAKA STATE OPEN UNIVERSITY

Page 10

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

CLASSIFICATION OF LOANS OR ADVANCES: As per the NBES Directive, banks shall classify all loans and advances into the following five categories. A. Pass: Loans or advances in this category are fully protected by the current financial and paying capacity of the borrower and or not subject to criticism. In general, any loans or advance or portion thereof, this is fully secured, both as to principal and interest, by cash or cash substitutes, shall be classified under this category regardless of past due status or other adverse credit factors. B. Special mention: Any loan or advance part due 30 (thirty) days or more, but less than 90 (ninety) days shall be classified Special Mention. C. Substandard: Non-performing loans or advances past due 90(ninety) days or more but less than 180(one-hundred-eighty days) days shall, at a minimum, is classified sub standard. D. Doubtful: Non-performing loans or advances past due 180 days or more, but less than 360 days shall be classified, at a minimum, as doubtful.

KARNATAKA STATE OPEN UNIVERSITY

Page 11

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

E. Loss: Non-performing loans or advances past due 360 days or more shall be classified as Loss. CLASSIFICATION OF ASSETS: CATEGORIES OF NPAs: Banks are required to classify non-performing assets further into the following three categories based on the period for which the asset has remained non-performing and the realisability of the dues: A. Sub-Standard Assets. B. Doubtful Assets. C. Loss Assets.

SUB-STANDARD ASSETS: A sub-standard asset was one, which was classified as NPA for a period not exceeding two years. With effect from 3l March 2001, a sub-standard asset is one, which has remained NPA for a period less than or equal to 12 months. In such cases, the current net worth of the borrower/guarantor or the current market value of the security charged is not enough is not enough recovery of the dues to the banks in full. In other words, such an asset will have well defined credit weakness that jeopardize the liquidation of the debt and are characterized by the distinct possibility that the banks will sustain some loss, if deficiencies are not corrected.

KARNATAKA STATE OPEN UNIVERSITY

Page 12

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

With effect from 3l March 2005, a sub-standard asset would be one, which has remained NPA for a period less than or equal to l2 months. DOUBTFUL ASSETS: A doubtful asset was one, which remained NPA for a period exceeding two years. with effect from 3l March 2001, as asset is to be classified as doubtful, if it has remained NPA for a period exceeding 12 months, A loan classified as doubtful has the weaknesses inherent in assets that were classified as sub-standard, with the added characteristic that the weaknesses make collection or liquidation in full, - on the basis of currently know facts, conditions and values- highly questionable and improbable. With effect from 31 March, 2005, an asset to be classified as doubtful if it remained in the sub-standard category for 12 months. LOSS ASSETS: A loss asset is one where loss has been identified by the bank or internal or external auditors or the RBI inspection but the amount has not been written off wholly. In other words, such an asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted although there may be some salvage or recovery value. It should be noted that the above classification is only for the purpose of computing the amount of provision that should be made with respect to bank advances and certainly not for the presentation of advances in the bank balance

KARNATAKA STATE OPEN UNIVERSITY

Page 13

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

sheet. The Third Schedule to the Banking Regulation Act l949, solely governs presentation of advances in the balance sheet. Banks have started issuing notices under The securitization Act 2002 directing the defaulter to either pay back the dues to the bank or else give the possession of the secured assets mentioned in the notice, However, there is a potential threat to recovery if there is substantial erosion in the value of security given by the borrower or if borrower has committed fraud, Under such a situation it will be prudent to directly classify the advances as a doubtful or loss asset, as appropriate. UPGRADATION OF LOAN ACCOUNTS CLASSIFIED AS NPAs: If arrears of interest and principal are paid by the borrower in the case of loan accounts classified as NPAs, the account should no longer be treated as nonperforming and may be classified as standard accounts. Asset classification to be borrower-wise and not facility-wise: I. It is difficult to envisage a situation when only one facility to borrower becomes a problem credit and not others, Therefore, all the facilities granted by a bank to a borrower will have to be treated as NPAs and not the particular facility or part thereof which has become irregular. II. If the debts arising out of development of letter of credit or invoked guarantees are parked in a separate account, the balance outstanding in that account for should be treated as a part of the borrowers principal operating account for the purpose of application of prudential norms on income recognition, asset classification and provisioning.

KARNATAKA STATE OPEN UNIVERSITY

Page 14

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Accounts where there is erosion in the value of security: I. A NPA need not go through the various stages of classification in cases of serious credit impairment and such assets should be straightaway classified as doubtful or loss asset as appropriate, Erosion in the value of security can be reckoned as significant when the realizable value of the security is less than 50 percent of the value assessed by the bank or accepted by RBI at the time of last inspection as the case may be, Such NPAs may be straightaway classified under doubtful category and provisioning should be made as applicable to doubtful assets. If the realizable value of the security, as assessed by the bank/approved valuers/ RBI is less than l0 percent of the outstanding in the borrowable accounts, the existence of security should be ignored and the asset should be straight away classified as loss ass6t, It may be either written off or fully provided for by the bank..

PROVISIONING REQUIREMENTS: As and when an asset is classified as an NPA, the bank has to further subclassify it into sub-standard, loss and doubtful assets. Based on this classification, bank makes the necessary provision against these assets.

KARNATAKA STATE OPEN UNIVERSITY

Page 15

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Reserve Bank of India (RBI) has issued guidelines on provisioning requirements of bank advances where the recovery is doubtful. Banks are also required to comply with such guidelines in making adequate provision to the satisfaction of its auditors before declaring any dividends on its shares. In case of loss assets, guidelines specifically require that full provision for the amount outstanding should be made by the concerned bank. This is justified on the grounds that such an asset is considered uncollectible and cannot be classified as bankable asset. Asset Type Sub-Standard (age upto 18 months) Doubtful 1 (age upto 2.5 Years) Doubtful 2 (age upto 4-5 Years) Doubtful 3 (age upto 4-5 Years) Loss Asset Percentage of provision 10% 20% 30% 50% 10%

KARNATAKA STATE OPEN UNIVERSITY

Page 16

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

GENERAL METHODS OF MANAGEMENT OF NPA The management of NPA \is the difficult task in practice. Management of NPAs means, how to settle the NPAS account in the books. In simple it focuses on the methods of settlement of NPAs account, The methods are differs from bank to bank. The following paragraph explains some general methods of Management of NPAs by the banks. The same information is given below:

Compromise Legal remedies Regular training program Write offs Spot visit Rehabilitation of potentially viable units Other methods

COMPROMISE: The dictionary meaning of the term compromise is settlement of dispute reached by mutual concessions. The following are the detailed guidelines for compromise/negotiated settlements of NPAs.

The compromise should be a negotiated settlement under which the bank should

KARNATAKA STATE OPEN UNIVERSITY

Page 17

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

ensure recovery of its dues to the maximum extent possible of minimum expenses. Where security is available for assessing the realizable value, proper weight age should be given to the location, condition and marketable title and possession sub security. An advantage in settlement cases is that banks can promptly recycle the funds instead of resorting to expensive recovery proceedings spread over a long period. Proposal for write off/compromise should be first by a committee of senior executives of the bank. Special recovery cells should be set up at all regional levers. of

LEGAL REMEDIES:

The legal remedies are one of the methods of management of NPAs. The banks observed that the borrower is making will full default; no more time should be lost instituting appropriate recovery proceedings. The legal remedies are filling of civil suits.

KARNATAKA STATE OPEN UNIVERSITY

Page 18

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

REGULAR TRAINING PROGRAM:

The all levels of executives are compelling to undergrowth the regular training program on credit and NPA management. It is very useful and helpful to the executives for dealing the NPA properly. RECOVERY CAMPS: The banks should conduct the regular or periodical recovery camps in the bank premises or some other common places; such type of recovery camps reduces the level of NPAs in the Banks.

WRITE OFFS:

Write offs is also one of the common management techniques of NPAs. The assets are treated as loss assets, when the bank writes off the balances. The ultimate aim of the write off is to cleaning the Balance sheet.

SPOT VISIT:

The bank officials should visit to the borrowers, business place or borrowers field regularly or periodically. It is also help full to the bank to control or reduce the NPAs limited.

KARNATAKA STATE OPEN UNIVERSITY

Page 19

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

REHABILITATION OF POTENTIALLY VIABLE UNITS:

The unit is sick due to technical obsolescences of inefficient management or financial irregularities. When the Bank settles the dues, of such, companies through the compromise or through the legal actions the better is to be followed.

OTHER METHODS:

Persistent phone calls. Media announcement

MEASURES FOR NPA CONTAINMENT:

MEASURES TO TACKLE NPAs: Seeing the gravity of the situation, RBI has taken several constructive steps for arresting the incidence of NPAs. It has also created a regulatory environment to facilitate the recovery of existing NPAs of banks. 1. Lok Adalats: Lok Adalats have been set up for recovery of dues in accounts falling in the doubtful and loss category with outstanding balance up to Rs.5lakh, by way of compromise settlements. This mechanism has, proved to be quite effective for speedy justice and recovery of small loans. 2.

KARNATAKA STATE OPEN UNIVERSITY

Page 20

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

2. Debt Recovery Tribunals: DRTs which have been set up by the Government to facilitate to speedy recovery by banks /DFIs, have not been able to make much impact on loan recovery due to a variety of reasons like inadequate number, lack of infrastructure, under-staffing and frequent adjournment of cases. It is essential that the DRT mechanism is strengthened and DRTs are vested with a proper enforcement mechanism to enforce their orders. Non-observance of any order passed by the Tribunal should amount to contempt proceedings. The DRTs could also be empowered to sell the assets of the debtor companies and forward the proceeds to the Winding-up Court for distribution among the lenders. Also, DRTs could be set up in more centers preferably in district headquarters with more presiding officers. 22 DRTs have been set up in the country during the half last a decade. DRTs have not been able to deliver, as they got swamped under the burden of large number of cases filed with since their inception. 3. Corporate Debt Restructuring: Corporate Debt Restructuring (CDR) mechanism is an additional safeguard to protect the interest of the creditors and revive potentially viable units, The CDR system was set up, .in accordance with the guidelines of RBI evolved in consultation with Government of India. The objective of the CDR system is to ensure a timely and transparent mechanism for restructuring of corporate debts of viable entities and to minimize the losses to the creditors and other stakeholders through an orderly and co-ordinate re-structuring programme. With CDR, banks can arrest fresh slippage of performing assets into the magnitude of assets. under the system standard, sub-standard and doubtful

KARNATAKA STATE OPEN UNIVERSITY

Page 21

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

assets can be restructured. The CDR mechanism is based upon effective coordinate among banks. 4. Asset Reconstruction companies (ARCs): One of the most effective ways of removing NPAs from the books of the banks / DFIs would be to move these out to a separate agency which would buy the assets and make its own efforts for recovery. on this front, the SRES Act has provided a frame work for setting up to Asset Reconstruction companies (ARCs) in India. A pilot company called Asset Reconstruction company (India) Ltd (ARCIL) has been set up under the joint sponsorship of IDBI, ICICI Bank SBI and other banks which is likely to provide an effective mechanism for banks to deal with the defaulting companies. RBI has already issued final guidelines on the regulatory frame work for ARCs in April, 2003. However, the success of ARCs will again depend upon the legal frame work which has to be addressed first, Legal provisions are required for transfer of the existing loan portfolio to the ARCs without the consent of the borrowers, for exercise of the power of private foreclosure by ARCs, authorizing ARCs to take recourse to the Debt Recovery Tribunals and granting exemption to ARCs from income-tax in order to mobilize resources by issue of bonds and exemption to ARCs from payment of stamp duty on conveyance / transfer of loans assets.

KARNATAKA STATE OPEN UNIVERSITY

Page 22

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

REDUCTION IN NPAs: The problem of the existing NPAs is currently being tackled in several ways. Efforts are made through negotiations and discussions with the borrowers to bring them around to settle the dues, Such settlements in the form of one-time settlement (OTS) and Negotiated Settlement (NS) are now being increasingly used by banks to reduce the level of NPAs, under these schemes banks focus on maximum payment under the settlements being received up-front, and balance within the same financial year for quicker realization of locked up proceeds. However, despite such efforts made by the lenders, many defaulting borrowers exhibit reluctance to co-operate, leaving the banks no option but, to seek the legal route. Here lies the importance of a transparent legal system reforms in the existing.

EFFECTIVE APPRAISAL AND MONITORING OF LOANS: In the present liberalized environment, globalization has a far reaching impact on the fortunes of the domestic industry and the bankers have to be alert and equip themselves with the knowledge of the knowledge of the latest global trends and also study on an ongoing basis its implications on the industries financed by them. Thus, the appraisal and monitoring mechanism for loans needs to be revamped for control of NPAs. Banks need a robust end-to-end credit process. A robust credit process begins with an in depth appraisal focused on risks inherent in a loan proposal. Along with appraisal close monitoring of the loan account is equally important. It is a well-known fact that loans often go bad due to

KARNATAKA STATE OPEN UNIVERSITY

Page 23

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

poor monitoring. An account does not become an NPA over night. Systems should be in place such that the banker should be alert to catch signals of an account turning into NPA and quickly react, analyze, and take corrective action. Banks should have a proper system in place to ensure that to the extent possible the assets are performing and do not turn into NPAs. ,In cases where the problems are of a short term nature and borrowers agree to clear the overdues with in a short time period, temporary deferment is generally granted by the banks. In cases where the company requires longer time, depending upon the problems faced and the expected future cash flows, the proposals are considered for restructuring / re-phasement of the dues.

ASSETS RECOVERY BRANCH: Assets Recovery Branches are specified branches for recovering NPA. The personnel in the branches are professionally competent to deal with defaulters and ensure repayment. It is meant for Sifting the work of high problem loans recovery of main branches to specialized branches. It gives time to other branches to concentrate more upon branchs business development activities. CREDIT APPRAISAL SYSTEM: Prevention of standard assets from migrating to non performing status is most important in NPA management, This depends on the style of credit Management Mechanism available in banks. The quality of credit appraisal and the effectiveness

KARNATAKA STATE OPEN UNIVERSITY

Page 24

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

of post credit appraisal and effectiveness of post credit follow up influences the asset quality of the banks in a big way At Pre-Credit Stage: 1. Extensive enquiry about the character and the credit worthiness of the borrower. 2. Viability of the project to be financed is meticulously studied. 3. Adequate coverage of collateral is ensured to the extent possible. 4. Financial statement of the borrower is obtained and poor analysis of their financial strength is done. 5. Apart from the published financial statements independent enquires are made with previous bankers. 6. Pre-credit inspection of the assets to finance is made. At Post-Credit Stage: 1. Operations in the account are closely monitored. 2. Unit visit is done at irregular intervals. 3. Asset verification is done on a regular basis. 4. Borrowers submit control returns regularly. 5. Accounts are periodically to evaluate the financial health of the unit.

KARNATAKA STATE OPEN UNIVERSITY

Page 25

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

6. Early warning signals are properly attended to. 7. Close contract with the borrower is maintained. 8. Potential NPAs are kept under special watch list. 9. Potentially viable units are restructured. 10.Repayment program of accounts with temporary cash flow problem is rescheduled. Immediate legal action is initiated in cases where the default is willful and the intention of the borrower is bad.

CREDIT MONITORING: Credit Monitoring System is for: 1. Preventing the slippage of quality assets through the monitoring of standard assets. 2. Up gradation of quality of impaired loan asset through recoveries by means of legal or otherwise. 3. Up gradation of loan assets through nursing in deserving and viable cases.

KARNATAKA STATE OPEN UNIVERSITY

Page 26

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

SECTION-B INDUSTRY PROFILE:

The word Bank is used in the sense of commercial bank. It is of Germanic origin though some persons trace its origin to the French word Banqui, and the Italian word Banca, it referred to a bench for keeping, lending and exchanging of money or coins in the market place by moneylenders and moneychangers. In fact the early Jews in Lombardy transacted their banking business by sitting on benches. Banking Regulation Act of India, 1949 defines Banking as accepting, for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawal by cheques, draft, order or otherwise. HISTORY OF BANKING IN INDIA: Banking in India originated in the last decades of the 18th century. The oldest bank in existence in India is the State Bank of India, a government-owned bank that traces its origins back to June 1806 and that is the largest commercial bank in the country. Central banking is the responsibility of the Reserve Bank of India, which in 1935 formally took over these responsibilities from the then Imperial Bank of India, relegating it to commercial banking functions. After India's independence in 1947, the Reserve Bank was nationalized and given broader

KARNATAKA STATE OPEN UNIVERSITY

Page 27

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

powers. In 1969 the government nationalized the 14 largest commercial banks; the government nationalized the six next largest in 1980. Currently, India has 88 scheduled commercial banks (SCBs) - 27 public sector banks (that is with the Government of India holding a stake), 29 private banks (these do not have government stake; they may be publicly listed and traded on stock exchanges) and 31 foreign banks. They have a combined network of over 53,000 branches and 17,000 ATMs. According to a report by ICRA Limited, a rating agency, the public sector banks hold over 75 percent of total assets of the banking industry, with the private and foreign banks holding 18.2% and 6.5% respectively Without a sound and effective banking system in India it cannot have a

healthy economy. The banking system of India should not only be hassle free but it should be able to meet new challenges posed by the technology and any other external and internal factors.

For the past three decades India's banking system has several outstanding achievements to its credit. The most striking is its extensive reach. It is no longer confined to only metropolitans or cosmopolitans in India. In fact, Indian banking system has reached even to the remote corners of the country. This is one of the main reasons of India's growth process.

The government's regular policy for Indian bank since 1969 has paid rich dividends with the nationalization of 14 major private banks of India.

KARNATAKA STATE OPEN UNIVERSITY

Page 28

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Not long ago, an account holder had to wait for hours at the bank counters for getting a draft or for withdrawing his own money. Today, he has a choice. Gone are days when the most efficient bank transferred money from one branch to other in two days.

The first bank in India, though conservative, was established in 1786. From 1786 till today, the journey of Indian Banking System can be segregated into three distinct phases. They are as mentioned below: Early phase from 1786 to 1969 of Indian Banks: Nationalization of Indian Banks and up to 1991 prior to Indian banking sector Reforms. New phase of Indian Banking System with the advent of Indian Financial & Banking Sector Reforms after 1991. To make this write-up more explanatory, I prefix the scenario as Phase I, Phase II and Phase III.

PHASEI The General Bank of India was set up in the year 1786. Next came Bank of Hindustan and Bengal Bank. The East India Company established Bank of Bengal (1809), Bank of Bombay (1840) and Bank of Madras (1843) as independent units and called it Presidency Banks. These three banks were amalgamated in 1920 and

KARNATAKA STATE OPEN UNIVERSITY

Page 29

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Imperial Bank of India was established which started as private shareholders banks, mostly Europeans shareholders. In 1865 Allahabad Bank was established and first time exclusively by Indians, Punjab National Bank Ltd. was set up in 1894 with headquarters at Lahore. Between 1906 and 1913, Bank of India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, and Bank of Mysore were set up. Reserve Bank of India came in 1935.

During the first phase the growth was very slow and banks also experienced periodic failures between 1913 and 1948. There were approximately 1100 banks, mostly small. To streamline the functioning and activities of commercial banks, the Government of India came up with The Banking Companies Act, 1949 which was later changed to Banking Regulation Act 1949 as per amending Act of 1965 (Act No. 23 of 1965). Reserve Bank of India was vested with extensive powers for the supervision of banking in India as the Central Banking Authority. During those days public has lesser confidence in the banks. As an aftermath deposit mobilization was slow. Abreast of it the savings bank facility provided by the Postal department was comparatively safer. Moreover, funds were largely given to traders.

KARNATAKA STATE OPEN UNIVERSITY

Page 30

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

PHASEII

Government took major steps in this Indian Banking Sector Reform after independence. In 1955, it nationalized Imperial Bank of India with extensive banking facilities on a large scale specially in rural and semi-urban areas. It formed State Bank of India to act as the principal agent of RBI and to handle banking transactions of the Union and State Governments all over the country.

Seven banks forming subsidiary of State Bank of India was nationalized in 1960 on 19th July, 1969, major process of nationalization was carried out. It was the effort of the then Prime Minister of India, Mrs. Indira Gandhi. 14 major commercial banks in the country were nationalized. Second phase of nationalization Indian Banking Sector Reform was carried out in 1980 with seven more banks. This step brought 80% of the banking segment in India under Government ownership.

KARNATAKA STATE OPEN UNIVERSITY

Page 31

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

The following are the steps taken by the Government of India to Regulate Banking Institutions in the Country: 1949: Enactment of Banking Regulation Act. 1955: Nationalization of State Bank of India. 1959: Nationalization of SBI subsidiaries. 1961: Insurance cover extended to deposits. 1969: Nationalization of 14 major banks. 1971: Creation of credit guarantee corporation. 1975: Creation of regional rural banks. 1980: Nationalization of seven banks with deposits over 200 crore. After the nationalization of banks, the branches of the public sector bank India rose to approximately 800% in deposits and advances took a huge jump by 11,000%. Banking in the sunshine of Government ownership gave the public implicit faith and immense confidence about the sustainability of these institutions.

PHASEIII

this phase has introduced many more products and facilities in the banking sector in its reforms measure. In 1991, under the chairmanship of M Narasimham, a committee was set up by his name which worked for the liberalization of banking practices.

KARNATAKA STATE OPEN UNIVERSITY

Page 32

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

The country is flooded with foreign banks and their ATM stations. Efforts are being put to give a satisfactory service to customers. Phone banking and net banking is introduced. The entire System became more convenient and swift. Time is given more importance than money.

The financial system of India has shown a great deal of resilience. It is sheltered from any crisis triggered by any external macroeconomics shock as other East Asian Countries suffered. This is all Due to a flexible exchange rate regime, the foreign reserves are high, the capital account is not yet fully convertible, and banks and their customers have limited foreign exchange exposure.

Before the steps of nationalization of Indian banks, only State Bank of India (SBI) was nationalized. It took place in July 1955 under the SBI Act of 1955. Nationalization of Seven State Banks of India (formed subsidiary) took place on 19th July, 1960.

The State Bank of India is India's largest commercial bank and is ranked one of the top five banks worldwide. It serves 90 million customers through a network of 9,000 branches and it offers -- either directly or through subsidiaries -a wide range of banking services.

KARNATAKA STATE OPEN UNIVERSITY

Page 33

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Structure The Indian banking system can be classified into nationalized banks, private banks and specialized banking institutions. The industry is highly fragmented with 30 banking units contributing to almost 50% of deposits and 60% of advances. The Reserve Bank of India is the foremost monitoring body in the Indian Financial sector. It is a centralized body that monitors discrepancies and shortcomings in the system. Industry estimates indicate that out of 274 commercial banks operating in the country, 223 banks are in the public sector and 51 are in the private sector. These private sector banks include 24 foreign banks that have began their operations here. The specialized banking institutions that include cooperatives, rural banks, etc. form a part of the nationalized banks category.

KARNATAKA STATE OPEN UNIVERSITY

Page 34

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

YEAR OF THE EVENTS: 1980 - The Bank came into existence on 15th April, as a consequence of the Government of India taking over the undertaking of Vijaya Bank Ltd. The Bank is engaged in transacts all types of banking business including foreign exchange and is a Government of India undertaking. 1984 - Capital worth Rs 10 lakhs subscribed by Government. 1985 - The Bank sponsored its first Regional Rural Bank under the name and style "Visweswaraya Grameena Bank" in March. This Regional Rural Bank would cater to the needs of the target group belonging to Mandya district of Karnataka State. - Capital worth Rs 772 lakhs subscribed by Government. 1986 - Capital worth Rs 1000 lakhs subscribed by Government. 1989 - Rs 800 lakhs subscribed by Government. 1991 - Rs 2500 lakhs subscribed by Government. 1992 - Rs 2500 lakhs subscribed by Government. - The bank has introduced automatic renewal facility up to four times in respect of short term deposits accepted for periods from forty six days to

one year for the convenience of the stomers. 1993 - Rs 5000 lakhs subscribed by Government.

KARNATAKA STATE OPEN UNIVERSITY

Page 35

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

- The Bank has installed 68 ALPMs in 25 branches. 1994 - Rs 6500 lakhs subscribed by Government. - The Bank had entered into the Memorandum of Understanding with the Reserve Bank of India, undertaking to fulfill definite performance commitments. - The Bank introduced the new schemes viz. Vijaya Gift Bond Scheme and Vijaya Service Card for enlarging its services to its business clientele. 1995-- The Bank opened its third exclusive NRI branch at Mapuca (GAO) and established special NRI Cells at the branches in Tiruvalla, Kottayam, Trivandrum and Kozhencherry (all in the Kerala State). - The Bank launched its "V-Invest" Scheme in January. 1995 - Rs 6231 lakhs subscribed by Government. - The Bank opened 33 new branches taking the total to 810 branches. - The Bank entered into strategic alliance with leading private sector banks and branches of foreign banks in India viz City Bank, N. A. India, Catholic Syrian Bank Ltd, HDFC Bank Ltd, Centurion Bank Ltd, UTI Bank Ltd, etc. - The Bank introduced Office Automation by providing state-of-the-art word processors at 45 branches, 13 Regional Offices and Head office departments.

KARNATAKA STATE OPEN UNIVERSITY

Page 36

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

1996 - The Bank opened its first subsidiary, VIBANK HOUSING FINANCE LTD to add impetus to housing finance. - Vijaya Bank introduced three new loan schemes, namely, 'Vijaya Nivruthi', 'Vijaya Krishi Vikas' and 'Vijaya Mangala' to cater to the credit needs of pensioners, farmers and working women respectively. 1997 - Vijaya Bank has introduced a novel way to improve customer service. - The bank has recently introduced a system of rating its branches once in six months to evaluate the quality of service and the facilities extended to the clientele. - Vijaya Bank has launched a special agriculture credit plan targeted specifically at agriculture and other, rural advances. - The Bank has recently introduced a new `trade finance' scheme. 1998 - Vijaya bank has introduced a jewel scheme under which loans are granted by the bank to fund the purchase of jewellery by keeping the purchased item as collateral till the loan has been repaid. 1999 - Vijaya Bank has entered into a Rs 200-crore take-out financing agreement with the Housing and Urban Development Corporation (HUD co) for funding infrastructure projects.

KARNATAKA STATE OPEN UNIVERSITY

Page 37

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

- The Housing and Urban Development Corporation (HUD co) has entered into a three-year reversible securitization deal with the public sector Vijaya Bank, to raise funds for meeting some of its infrastructure financing commitments. 2000 - Vijaya Bank has introduced a new scheme named V-Star savings bank account scheme. - Vijaya Bank Chairman and Managing Director S Gopalakrishnan have been elected as the president of Indian Banks' Association, Bangalore. 2002 -Vijaya Bank has informed BSE that Government of India appointed Sri M S Kapur as the Chairman & Managing Director of the Bank and Mr. M S Kapur took charge as Chairman & Managing Director of the Bank w e f August 16, 2002. Bank has further informed that Sri Michael Bastian, Executive Director of Bank has been posted as the Chairman & Managing Director Syndicate Bank. Mr. Michael Bastian was relieved as the Executive Director of the Bank on August 24, 2002. 2003 -Vijaya Bank signs a pact with LIC to offer Life insurance cover to all its existing as well as its new deposit-holders. -Bank officials are undertaking road shows where senior officials carry placard, giving reasons about their visit. This is an innovative way to deal with defaulters for repaying loans without publicly naming them.

KARNATAKA STATE OPEN UNIVERSITY

Page 38

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

-Vijaya Bank has unveiled a new electronic fund remittance facility called V-REMIT, under which the bank customers can electronically remit funds to the account holders in any bank. -P A Sethi has been appointed as the Executive Director of the Vijaya Bank. -Vijaya Bank has signed a Memorandum of Understanding with M/s National Insurance Company Limited for marketing banc assurance products. -Vijaya Bank decides to open training centre for employees in Bangalore -The Union government has bought back Rs 240-crore high-yielding government securities from Vijaya Bank. 2004 -Vijaya Bank ties up with NIC to offer free insurance policy -US-based Principal Group enters distributorship tie-ups with Vijaya Bank -Delhi based Punjab National Bank (PNB) and Bangalore-based Vijaya Bank enter into a four-way partnership with Principal Financial of the US and Berger Paints to set up an insurance broking company -Vijaya bank Housing Finance Ltd. becomes wholly owned subsidiary of Vijaya Bank

KARNATAKA STATE OPEN UNIVERSITY

Page 39

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

- Vijaya Bank has entered into a memorandum of understanding (MoU) with two tractor manufacturers International Tractors and Mahindra Gujarat Tractors to provide finance on softer terms to farmers for purchase tractors and power tillers -VIJAYA Bank signs pact with Nabard to co-finance agriculture, agro processing, hi-tech agriculture and rural development projects. -Vijaya Bank too enters RTGS bandwagon -Principal Asset Management Company (AMC) formally relaunches itself as Principal PNB Asset Management Company in association with Vijaya Bank on July 2, 2004 -Vijaya Bank launched the bank's second city specific credit card - the 'Hyderabad Card' 2005 -Vijaya Bank ties up with TAFE -Vijaya Bank sets up new branches 2007 - Vijaya Bank has informed that Shri G B Singh has been nominated as GOI Nominee Director of the Bank vice Shri Atul Kumar Rai, vide letter dated August 20, 2007 received from Government of India, Ministry of Finance, Department of Financial Services with immediate effect. 2008 - Vijaya Bank inked a memorandum of understanding with credit rating agency, Crisil, for rating its corporate customers.

KARNATAKA STATE OPEN UNIVERSITY

Page 40

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

- Vijaya Bank has inked a pact with Credit Analysis & Research Ltd (CARE), one of the RBI accredited rating agency, to provide bank loan ratings to its corporate clients at a concessional fee. -Vijaya Bank has informed that Shri. Sridhar Cherukuri has been nominated as part-time non-official Director of the Bank with immediate effect, vide letter dated July 10, 2008 received from Government of India, Ministry of Finance, Department of Financial Services. Vijaya Bank is an India-based bank. During the fiscal year ended March 31, 2008, the Bank opened 73 new branches, upgraded five extension counters into full-fledged branches. As of March 31, 2008, the Bank had 1,051 branches across 28 states and four union territories. Total credit cards issued by the Bank was 1, 43,000 at March 31, 2008. As of March 31, 2008, it had issued 3,95,000 debitcum-automated teller machine (ATM) cards

The organized Banking System in India can be broadly divided into 3 categories, viz., the central Bank of the country known as the Reserve Bank of India, the commercial banks and the Co-operative banks, The Reserve Bank of India is the supreme monetary and Banking authority in the country and has the responsibility to control banking system in the country.

KARNATAKA STATE OPEN UNIVERSITY

Page 41

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Commercial banks mobilize savings in urban areas and make them available to large and small industrial and trading units mainly for working capital requirements. After 1969 commercial banks are broadly classified into nationalized banks or public sector banks and private sector banks, The State Bank of India and its associates banks along with other 20 banks are the public sector banks, The private sector banks include a small number of Indian scheduled banks. Which have not been nationalized, and branches of foreign banks operating in India commonly known as foreign exchange banks. The Regional Rural (RRBs) banks came into existence since the middle of 1970s with the specific objective of providing credit and deposit facilities particularly to the small and marginal farmers, agricultural labourers and artesian and small entrepreneurs. The RRB, are essentially commercial banks but their area of operation is limited to district. Primary co - operative credit (or banks) was originally set up in villages to promote thrift and savings of the farmers and to meet their credit needs for cultivation. To support them, central or District co - operative banks and above them State co - operative banks were established, The funds of the Reserve Bank of India meant for the agricultural sector actually pass through the state co operative banks and central co - operative credit banks. originally based in the rural sector, the co - operative credit movement has now spread to urban areas also and there are many urban co - operative banks coming under state co-operative banks.

KARNATAKA STATE OPEN UNIVERSITY

Page 42

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

REGULATORY FRAMEWORK: REGULATORS: The different segments of the Indian Financial System (IFS) are monitored and controlled by statutory bodies called regulatory institutions. These institutions have been given adequate Powers by legal acts or by acts of parliament to enable them to supervise the segments assigned to them, It is the duty of the regulator to ensure that the players in the segments work within recognized business parameters maintain sufficient levels disclosure and transparency of operations and do not act against national interests. At present, the IFS have 2 regulatory arms that is: Reserve Banks of India (for Banks and NBFCs) Security and Exchange Board of India (for capital markets)

THE RESERVE BANK OF INDIA: Reserve Bank of India, the central bank of the country, is at the heart of the Indian Financial and Monetary system. It was established on April l, 1935 as a private shareholders, institution under the Reserve Bank of India Act I934. It was nationalized in January l949, under the Reserve Bank (Transfer of Public

ownership) of India Act, 1948. This act empowers the central Government, in consultation with the Governor of the bank; to issue such directions to RBI as might be considered necessary in the public interest. A Central Board of Directors with 20 members consisting of the Governor and the Deputy Governors governs

KARNATAKA STATE OPEN UNIVERSITY

Page 43

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

RBI. The Governors and Deputy Governors of the bank are Government of India appointees. Indian Banking has become strong, stable and vibrant following banking reforms during l99l - 92 and thereafter and it has acquired international standards with regard to capital adequacy and NPA percentage, Banks have become tech savvy and have fine-tuned their risk management policies, The Reserve Bank of India has taken up the issue of Rear - Time Gross settlements (RTGS) among various banks. Now banks and regulators have to face the challenges of consolidation, convergence and competition besides financial inclusion.

GLOBAL DEVELOPMENTS AND NPAS: The core banking business is of mobilizing the deposits and utilizing it for lending to industry, Lending business is generally encouraged because it has the effect of funds being transferred from the system to productive purposes which results into economic growth. However lending also carries credit risk, which arises from the failure of borrower to fulfill its contractual obligations either during the course of a transaction or on a future obligation. A question that arises is how much risk can a bank afford to take? Recent happenings in the business world - Enron, WorldCom, Xerox, Global Crossing do not give much confidence to banks. In case after case, these giant corporate

KARNATAKA STATE OPEN UNIVERSITY

Page 44

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

became bankrupt and failed to provide investors with clearer and more complete information thereby introducing a degree of risk that many investors could neither anticipate nor welcome. The history of financial institutions also reveals the fact that the biggest banking failures were due to credit risk. Due to this, banks are restricting their lending operations to secured avenues only with adequate collateral on which to fall back upon in a situation of default. INDIAN ECONOMY AND NPAS: Undoubtedly the world economy has slowed down, recession is at its peak, globally stock markets have tumbled and business itself is getting hard to do. The Indian economy has been much affected due to high fiscal deficit, poor infrastructure facilities, sticky legal system, cuffing of exposures to emerging markets by FIs, etc. Further, international rating agencies like, Standard & Poor have lowered Indias credit rating to sub-investment grade. Such negative aspects have often outweighed positives such as increasing forex reserves and a manageable inflation rate. Under such a situation, it goes without saying that banks are no exception and are bound to face the heat of a global downturn. One would be surprised to know that the banks and financial institutions in India hold non-performing assets worth Rs. 1,10,000 crores. Bankers have realized that unless the level of NPAs is reduced drastically

KARNATAKA STATE OPEN UNIVERSITY

Page 45

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

COMPANY PROFILE IN BRIEF INTRODUCTION: Vijaya bank has been able to maintain a standard profile since it was born a Detailed discussion on the profile of the organization is carried on below.

ORIGIN AND GROWTH OF THE ORGANISATION:

Vijaya Bank was founded by late Shri A.B Shetty. He was an ardent Gandhian and he was closely associated with the Indian freedom movement. Vijaya Bank was established in the year 1931, in Mangalore, Karnataka. The Bank commenced its business operations on 23rd October 1931 with an authorized capital of Rs.5 lakhs and a paid of capital of Rs.8670. The bank was founded essentially to promote banking habit, thrift and entrepreneurship among the farming community of Dakshina Kannada district, Karnataka. The Bank became a scheduled Bank in 1958.Vijaya Bank steadily grew into a major All India Bank, with nine smaller Banks merging with it during 19631968. The credit for the successful execution of the merger plan should go to late Shri M Sunder Ram Shetty, who was the then Chief Executive of the Bank. The Bank was nationalized on 15th April 1980. The Bank has built a network of 1027 branches spread over 29 states of the country and 3 union territories. The Bank

KARNATAKA STATE OPEN UNIVERSITY

Page 46

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

took several initiatives for effective implementation of various Governments directed lending schemes. Vijaya Bank has the highest number of branches in its home state, Karnataka. In recent years the Bank has opened 40 branches that offer specialized banking for industrial finance, small scale industries, agricultural (hi-tech) finance, capital market, commercial and personal banking, asset recovery management, overseas banking, corporate banking and funds transfer. Presently the Bank has 1027 branches spread over in 29 states of the country and 3 union territories. Very few banks have spread their branch network in so many states and union territories. The Bank has highest number of branches in the state of Karnataka (406). In recent years the Bank has opened as many as 99 specialized branches via Industrial Finance Branch (3), SSI branches (7), Capital Market Services Branch (4), Specialized Commercial and Personal Banking Branches (71), Asset Recovery Management Branch (7), Overseas Branch (3), Corporate Banking Branch (1), Regional Forex cell (2).In line with the prevailing trends, the bank has been giving greater thrust toward technological up-gradation of its operations. As on March 2003, 356 branches have been computerized, covering 78.26% of the Banks total business. Besides this, the Bank has also installed ATM.s at 18 of its branches. The Vijaya Bank has diversified its services by entering several new areas such as credit card, merchant banking, hire purchase, leasing and electronic remittance services.

KARNATAKA STATE OPEN UNIVERSITY

Page 47

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Vijaya Bank is one among the few banks in the country to take up principal membership of VISA International and Master Card International. The driving force behind Vijaya Banks every initiative has been its strong dedicated workforce.

INTERNATIONAL BANKING DIVISION Vijaya Bank has obtained an AD License in 1971 and permanent license after nationalization in 1980.The branches dealing in foreign business are called Overseas Branches and are categorized into A,B and C Category Branches. All the branches have SWIFT connectivity.34 designated branches have Core Banking System (CBS).The Bank maintains 16 Nostro Accounts in ten currencies. The vostro accounts are ten in number comprising of six private exchange houses and four Banks. The Bank has entered in to agency arrangements with 156 Banks in 65 countries. It maintains exchange positions in 8 internationally quoted quotations. The dealings operations handled at Forex and Treasury Management Division are located in the Head Office.

MISSION: Our mission is to emerge as a prime national backed by modern technology, meeting Customers aspirations with professional banking services and sustained growth contributing to national development

KARNATAKA STATE OPEN UNIVERSITY

Page 48

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

SERVICES: When the bank commenced operation in 1931, the banks services primarily focused on the growth and development of the agricultural sector. Today a variety of specialized banking services are offered through 43 branches. The banks expertise now extends to the prime areas of capital market, corporate banking, Industrial finance, small scale industries and hi-tech agriculture, apart from personal banking, Funds transfer overseas banking and asset recovery management. Vijaya bank has been Giving mainly two types of services, those are enlisted below:

1)DEPOSIT SCHEMES:

!) SAVING BANK ACCOUNT: Save as much as you can. Spend as little as you can. And see your money grow.

!!) CURRENT ACCOUNT: Pool your cash here, pay conveniently trough cheques.

KARNATAKA STATE OPEN UNIVERSITY

Page 49

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

!!!) TERM DEPOSITS: a) recurring deposits save a definite sum every month for handsome gains with an option to vary The monthly installments.

b) fixed deposits a safe way to high return, the only thing fixed is time

c) Vijaya shree units save lump sum and interest more than simple, stretches when you are in need

d) jeevan nidhi deposits Helps you to save at your door steps, opens the gate way for bright future.

e) Vijaya cash certificates Your friend in need when it comes to education marriage of the benefit of exemption from capital gains income to invest into capital gains account.

KARNATAKA STATE OPEN UNIVERSITY

Page 50

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

f) Vijaya raksha a life insurance scheme for deposit account holders

g) capital gains accounts scheme Income tax assessee can avail of the benefit of exemption from capital gains income to invest into capital

h) v-stock invest deposits scheme Earn a handsome return through invest in v-stock scheme as much as you can

2) RETAIL LENDING SCHEMES !) Vijaya home loan

Own your dream home/ flat at the lowest interest rate 7.5% p a in the banking industry

!!)

Vijaya wheels

Drive your dream vehicle at the affordable PLR rate

KARNATAKA STATE OPEN UNIVERSITY

Page 51

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

!!!)

v-equip schemes

A friend who can always equip you with your choicest consumer durables and improve your life style at PLR +1 rate

!v)

v- trade scheme

Avail instant bank finance against business assets at the PLR rate (presently 11.5%p a) for loans up to Rs 2 lakh and as the of PLR+2 there

v)

Jewel loan a barrower friendly scheme against jewels to meet your urgent needs at the PLR rate

V!)

Loans to small road transport operators (SRTOs)

right choice for the transport operators who want to make transport business a success loans at PLR rate for priority sector and at PLR +1 rate for non

priority sector \ (presently 12.5%p a)

KARNATAKA STATE OPEN UNIVERSITY

Page 52

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

V!!)

V-rent schemes

Take cash today at the PLR rate against tomorrows rent

V!!!) Education loan Avail our education loan and draw your wards life line. Loans up to Rs 4 lakh at PLR rate .loans above Rs 4 lakh at PLR + 1

!x) v-professionals scheme: Professional like doctors ,engineers, advocates, chartered accountants, etc who Wish to set up their practice/business activity, in rural/semi urban areas can avail Loans up to Rs 15 lakh at 1% in metro urban areas

x)

v-kanyadan scheme: marriages are made in heaven, but v- kanyadan helps to celebrate this on Earth Loans at the lowest affordable interest rate of PLR-1 (presently 10.5%p a)

X!)

V-mangala scheme: Special scheme to fulfill the dreams of working women at the lowest rate That is PLR -1 (presently 10.5%p a)

KARNATAKA STATE OPEN UNIVERSITY

Page 53

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

3)OTHER SERVICE: The bank also offers various services in the areas of credit cards, merchant Banking, hire purchasing, and leasing and NRI (non-resident Indians) services.

1) For cash payment a) Trough teller b) Trough cashier 2) Receipt cash For issuance of demand raft/ Traveler cheques/ fixed 3 to 8 minutes 8 to 15 minutes 10 to 20 minutes 15 to25 minutes

deposit receipt 4) Payment of fixed 15 to 20 minutes

deposit receipt 5) draft 6) Opening of an account 20 to 25 minutes Payment of demand 10 to 20 minutes

KARNATAKA STATE OPEN UNIVERSITY

Page 54

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

7) Retirement of bills norms various 8) Updating of pass book 9) Statement of accounts 10) Collection of cheques LocalOut station-

20 to 30 minutes 5 to 15 minutes Within 1 days Timesfor banking

1 to 2 days 5 to 7 days

transaction:

KARNATAKA STATE OPEN UNIVERSITY

Page 55

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

ORGANISATION CHART Today living up to the ideals of the founding visionaries is the management at Vijaya bank. The management includes dedicated professionals, who bring with then a considerable amount of expertise and experience in the banking industry. Currently the banks boards of directors consist of 10 directors.

KARNATAKA STATE OPEN UNIVERSITY

Page 56

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

PRAKASH P MALYA Chairman and managing director

T.VALLIAPPAN Executive director

K.VENKATAPPA Director ASHOK KUMAR SHETTY Director NISHANK KUMAR JAIN Director SHANTHARAM SHETTY Director

G.B.SINGH Director ASHOK KUMAR Director R.VAIDYANATHAN Director BRIJMOHAN SHARMA Director

KARNATAKA STATE OPEN UNIVERSITY

Page 57

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

FUNCTIONAL DEPARTMENTS OF VIJAYA BANK:

ADMINISTRATION DEPARTMENT

PERSONNEL DEPARTMENT: The personnel department frames the various policies related to the Recruitment, training, promotion and transfer. It is also instrumental in managing the various activities regarding the training of employees with the help of the Officers. Training college. It also manages the promotion and transfer procedures. It also helps in the management and control of industrial relations.

KARNATAKA STATE OPEN UNIVERSITY

Page 58

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

TREASURY MANAGEMENT DEPARTMENT: Treasury department has two wings- Domestic and Forex treasury. Domestic treasury handles the security liquidity ratio. Security that is required to maintain security liquidity ratio is handled by the department. The Forex treasury maintains banks. Foreign accounts with the foreign banks called nostru accounts. Forex treasury apart from covering merchant transactions also maintains trade in foreign currency on behalf of bank. It also maintains mirror account of foreign currency in all restrained bank accounts by the branches of the bank. GENERAL ADMINISTRATION DEPARTMENT: General administration department looks after the matters related to maintenance of head office building and other bank premises owned by bank. It also deals with furnishing and purchase of furniture and fixtures for the bank branches. It is also into matters relating to lease agreements of branch premises and renewal of lease agreements and work related to printing of forms, ledgers, statements and supply of computer stationary. It also maintains all the vehicles owned by the bank.

KARNATAKA STATE OPEN UNIVERSITY

Page 59

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

PLANNING DEPARTMENT: It prepares vision document for the bank. It also fixes targets to various regional offices and branches to achieve corporate goals of the bank. For this purpose the planning department follows a system of performance budgeting.

CREDIT DEPARTMENT: The credit department has 4 wings- Credit policy, Credit operations, Credit supervision & monitoring and Credit Review & Recovery. Credit policy department frames banks. Credit policy inline with the policy laid down by RBI and Government of India. The Credit Operations department lays down procedures and rules and also delegates power for sanction of loans by field functionaries. Credit supervision & monitoring provides offset audit of credit portfolio by obtaining reports and statements from sanctioning authorities at head office. The main purpose of the department is to ensure that the credit portfolio of the bank continues to be healthy. Credit Review & Recovery department handles recovery matters in respect of nonperforming assets like irregular accounts.

DEPARTMENT OF INFORMATIONAL TECHNOLOGY: The Bank has created a .Department of Information Technology. at its head office. The primary objective of this department is to promote computer literacy among employees, to upgrade communication and information technology and to

KARNATAKA STATE OPEN UNIVERSITY

Page 60

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

develop electronic banking capabilities. The Bank has initiated action for implementing Core Banking solution, Integrated Risk Management System and Networking of ATMs with addition of 100 ATMs.

RISK MANAGEMENT DEPARTMENT: The Bank recognizes that management of risk is fundamental to the business of banking. The Banks approach to risk management is proactive. The primary goal of risk management is not to avoid or minimize risks inherent in business but to steer them consciously and actively. The basic objective is to strike a balance between risk and rewards.

CENTRAL ACCOUNT DEPARTMENT: Central account department is very instrumental in consolidation of balance sheet. It is also involved in reviewing the Management, Financial statements with special emphasis on accounting policies and practices, compliance of accounting standards and other legal requirements concerning financial statements, qualifications in the audit report, compliance with stock exchange and legal requirements concerning financial institutions, related party transactions, etc.

KARNATAKA STATE OPEN UNIVERSITY

Page 61

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

CENTRAL INSPECTION DEPARTMENT: Central Inspection Department involves audit, inspection & vigilance. Inspection of branches is one of the tools for internal control in the Bank. Based on the finding of the Inspection, every branch is rated on a prescribed rating scale. The rating of branches also enables the Bank to ensure that sufficient attention is paid to the performance of those branches that have been awarded unsatisfactory ratings. The focus of the Vigilance Department has been to constantly intervene and upgrade the Systems & Procedures of the Bank and prevent intrusions that spread the malaise of permissiveness.

KARNATAKA STATE OPEN UNIVERSITY

Page 62

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

REVIEW OF LITERATURE According to AjitReddy N A: Non-performing asset (NPA) is a loan or an advance where

Interest or installment of principal remain overdue for a period of more than 90 days in respect of a term loan, The account remains out of order, in respect of an Overdraft or Cash Credit. The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted. A loan granted for short duration crops will be treated as NPA, if the installment of principal or interest thereon remains overdue for two crop seasons. A loan granted for long duration crops will be treated as NPA, if the installment of principal or interest thereon remains overdue for one crop season. According to G.P Muniappan: The NPAs Internal Diversion of funds for expansion/modernisation/setting up new projects/ helping or promoting sister concerns. Time or cost over run while implementing the project. Deficiencies on the part of the banks viz. in credit appraisal, monitoring and follow-up, Delay in release of limits, delay in settlement of payments or subsidies by Govt. bodies willful Default or Misappropriation of funds. Inefficient management, Strained labour relations, Inappropriate technology or technical problems External Recession in the economy External factors like raw material shortage, raw material/input price escalation, power shortage, industrial recession, excess capacity, natural calamities like floods, accidents. Business failure like product failing to capture market, inefficient management,

KARNATAKA STATE OPEN UNIVERSITY

Page 63

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Strike/strained labour relations, wrong technology, technical problems, product obsolescence, etc. Govt. policies like excise, import duty changes, deregulation, pollution control orders. Failure, non-payment/overdues in other countries, recession in other countries, externalisation problems, adverse exchange rate, etc. According to Sergio : In a study of non-performing loans in Italy found evidence that, an increase in the riskiness of loan assets is rooted in a banks lending policy adducing to relatively unselective and inadequate assessment of sectoral prospects. The study emphasised that increase in bad debts as a consequence of recession alone is not empirically demonstrated. The empirical analysis by Fuentes and Maquieira on the Credit market examined different factors that may effect loan repayment Limitations on the access to credit Macroeconomic stability Collection technology Bankruptcy code Information sharing The judicial system Prescreening techniques Major changes in financial market regulation. Impact of NPAs on Banks: NPAs have a deleterious effect on the return on assets because They erode current profits through provisioning requirements They result in reduced interest income They require higher provisioning requirements affecting the capacity to increase good quality assets in future pressure on net interest margin thereby reducing competitiveness They limit recycling of funds, set

KARNATAKA STATE OPEN UNIVERSITY

Page 64

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

in asset-liability mismatches, etc Shift in concentration from core banking to credit risk management.

RESEARCH DESIGN TITLE OF THE PROJECT Non-performing asset (With reference to VIJAYA BANK, BANGALORE) STATEMENT OF PROBLEM

This particular topic is to analysis Non-performing asset level of VIJAYA BANK and their impact on the performance of the bank. Non-performing asset is the major bone for the banks in India, so as in the case of VIJAYA BANK the study has been undertaken to know the status, practice and impact of NPAs in the performance of bank, the problem lies in understanding and analyzing the NPAs.

KARNATAKA STATE OPEN UNIVERSITY

Page 65

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

OBJECTIVES OT STUDY To have an overview of the history, growth and development, vision, value schemes and facilities of VIJAYA BANK. Analyzing the prudential norms on asset classification and income recognition. Understanding the concept of Non-performing asset. To intimate timely steps to identify the Non-performing assets. To know the policies, procedures followed by VIJAYA BANK with respect to Non-performing asset. To study the causes for NPA level in the bank. To study the general reasons for asset become NPAs.

SCOPE OF THE STUDY The study is conducted in the branch of VIJAYA BANK. BANGALORE.. The scope of study stretches from the NPA and its effect on profitability. The main trusted area of Indian banking is extending credit to the needy. The qualities of the assets determine the viability of the system. The crucial factors that decides the performance of the banks and financial institution is spotting NPA.

KARNATAKA STATE OPEN UNIVERSITY

Page 66

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

The study covers the management of Non-performing asset with respect to VIJAYA BANK. Study mainly focuses on:

Concept/evolution of NPAs. Status of NPAs Causes of NPAs. 3.4.METHODOLOGY OF THE STUDY Due to the vastness of the subject an attempt is made to understand the main spheres of the problem of Non-performing assets and its effects on the financial stability of the bank. The study is descriptive in nature and is based on the primary data and secondary data. Primary Data: Primary source are original source which are collected through direct interaction with Asst. Manager and employees of the bank. Information is collected through direct interaction with advisor of VIJAYA BANK BANGALORE, chiknayakanhalli. Secondary Data: Secondary data is collected from the text books, annual reports and internet. TOOLS FOR ANALYSIS

KARNATAKA STATE OPEN UNIVERSITY

Page 67

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

Simple statistical and arithmetic methods are used to analyze the data that were collected and tabulated. PLAN FOR ANALYSIS: The study will be based on the data collected and it will be interpreted in the way of tables and charts. LIMITATIONS OF STUDY The study is conducted on the basis of data which was provided by the VIJAYA BANK, BANGALORE. Only consolidated figures are available. Access to the information is limited and complete dependency on the annual report of VIJAYA BANK. The data are extracted from the records covering a period of only 5 years. The report is prepared and analyzed presuming that the data and information given are correct

Organizational Structure of VIJAYA BANK Bank

KARNATAKA STATE OPEN UNIVERSITY

Page 68

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

BOARD OF DIRECTORS CHAIRMAN EXECUTIVE MANAGER DEPUTY GENERAL MANAGER ASSISTANT GENERAL MANAGER CHIEF MANAGER SENIOR MANAGER MANAGER OTHER STAFFS

KARNATAKA STATE OPEN UNIVERSITY

Page 69

A STUDY ON NON-PERFORMING ASSET -VIJAYA BANK

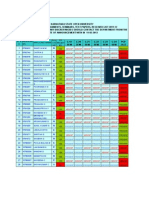

DATA ANALYSIS AND INTERPRETATION