Professional Documents

Culture Documents

IFRS vs GAAP Financial Reporting Standards Comparison

Uploaded by

Nigist WoldeselassieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS vs GAAP Financial Reporting Standards Comparison

Uploaded by

Nigist WoldeselassieCopyright:

Available Formats

IFRS versus GAAP International Financial Reporting Standards (IFRS) Generally Accepted Accounting Principles (U. S.

GAAP)

The differences between International Financial Reporting Standards (IFRS) and current U.S. GAAP are numerous. For a detailed, tabular comparison between the two standards (excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards), please click on a link below to read more about the topic(s) of interest to you. IFRS Financial Reporting

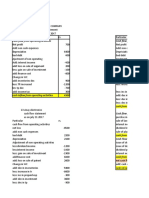

General Considerations in International Financial Reporting Standards IFRS Statement of Financial Position IFRS Statements of Income, Comprehensive Income IFRS Statement of Cash Flows

IFRS Accounting Policies, Changes and Restatements

Fair Value Cash, Receivables and Prepaid Expenses Short Term Investments and Financial Instruments Inventory Revenue Recognition: Evolving Principles & Specialized Applications Long Lived Assets (Tangible Assets) Long Lived Assets (Intangible Assets) Investments (Passive) Investments (Equity Method and other) Business Combinations and Consolidated Financial Statements Current Liabilities and Contingencies Long-Term Liabilities Leases Income Taxes Pensions and Other Postretirement Benefits Stockholders' Equity Earnings Per Share Interim Reporting Segment Reporting Foreign Currency Personal Financial Statements Specialized Industry GAAP

Current International Financial Reporting Standards & Interpretations

IFRS IAS International Financial Reporting Standards International Financial Reporting Standards (IFRS) IFRS Standing Interpretations Committee (SIC) Standards International Financial Reporting Interpretations Committee (IFRIC)

Contact IFRS international accounting expert Dr. Barry Epstein, CPA for more information. Read more about him at www.ifrsaccountant.com. He can be reached at BEpstein@SSandG.com or 312-464-3520 begin_of_the_skype_highlighting 312-464-3520 end_of_the_skype_highlighting.

IFRS General Considerations

Listed below are some overall comments on the differences between International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (U.S. GAAP). This material is excerpted from Wiley IFRS reference 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Treatment IFRS Treatment

No comprehensive guide to statement presentation is Comprehensive guidance on presentation of financial offered; however, basic financial statements are the same statements provided; minimum line items identified for all under both sets of standards financial statements

FASB's Conceptual Framework is similar to IASB's FASB's Conceptual Framework is similar to IASB's Framework for the Preparation and Presentation of Framework for the Preparation and Presentation of Financial Statements; convergence with IFRS is promised Financial Statements; latter is less detailed; convergence with US GAAP expected to occur Comparative financials urged, but not required (required for SEC filings); greater specificity as to location of disclosures in body of statements or in notes Comparative financials are required, including footnote data; disclosure can often be optionally in financials or in notes

FASB Accounting Standards Codification is the single official source of authoritative U.S. GAAP

No hierarchy established beyond IFRS

Justification for U.S. GAAP departure found in auditing True and fair override of IFRS permitted literature but very rarely invoked. This guidance does not exist under the U.S. GAAP hierarchy set forth by FAS 168

IFRS Statement of Financial Position

Listed below the major Balance Sheet differences between International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (U.S. GAAP). This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Statement of Financial Position Limited guidance on offsetting of assets and liabilities; classified statement of financial position not required, but definition of current/noncurrent differs from IFRS somewhat IFRS Statement of Financial Position Specific guidance on offsetting of assets and liabilities; classified statement of financial position required unless liquidity ordering is more meaningful, some difference from GAAP definitions of current/noncurrent

Some differences from IFRS re: exclusion of long-term

Some differences re: exclusion of long-term debt from current liabilities, etc.

debt being refinanced, etc.

No offsetting of assets and liabilities with different counterparties; offsetting with same counterparties only permitted if intention is to settle net and right to offset is enforceable under law

Some offsetting of assets and liabilities with different counterparties permitted when legal provision exists

Adjustment made for post-balance-sheet date events only Conforms to U.S. GAAP requirements if they bear upon existence or valuation at the statement of financial position date; other material information relegated to disclosures

Joint project with IASB to require presentation of both beginning and ending statement of financial position

Joint project on financial statement presentation with FASB ongoing

Statements of Income and Comprehensive Income IFRS versus GAAP

Listed below are some of the major IFRS versus GAAP differences for Statements of Income and Comprehensive Income. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Treatment IFRS Treatment

No required income statement captions, and either single- Minimum captions in income statement are prescribed step or multiple-step format can be used under IFRS

Little specific guidance as to form, but ex-penses are to Expenses can be classed by function or nature (e.g., be classed by function (e.g., cost of sales, administrative, salaries, cost of goods sold, etc.) etc.)

Extraordinary items classification permitted under limited circumstances, with net-of-tax presentation, and unusual items can also be segregated within operating income (but not tax effected); will be revised to mirror IFRS

Extraordinary classification is banned, but unusual items can be segregated

Estimated operating results of a discontinuing operation are included in the measurement for the expected gain or loss on disposal; timing of segregation of discontinuing operations from continuing operations may differ from that under IFRS; direct continuing cash flows or involvement in operations preclude discontinuing operations display

Actual operating results of a discontinuing operation are reported as incurred; timing of recognition of gain or loss in discontinuance and income or loss from activities of the dis-continuing operation may differ from US GAAP

Broader definition of discontinued operations than under IFRS, either a reportable business or geographical segment, or reporting unit, subsidy, or asset group

Narrow definition of discontinued operations as being reportable business or geographical segment or major component

Restructuring costs recognized when there is little discretion to avoid costs; most costs recognized when later incurred

Restructuring costs recognized when an-nounced or commenced, which is earlier than under US GAAP

Other comprehensive income items can be presented in separate statement, combined with income statement, or in changes in stockholders equity statement

Other comprehensive income items are presented in a separate statement of comprehensive income, and cannot be relegated to statement of changes in equity

Joint financial reporting project with IASB in progress, which may require inclusion of changes in other comprehensive income in income statements

Joint project with FASB; decision to require single statements of recognized income and expense, replacing two separate statements under current IFRS

Statement of Cash Flow IFRS versus GAAP

Listed below are some of the major differences for Statements of Cash Flow between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. IFRS Statement of Cash Flow Required for most entities, but limited exemptions exist GAAP Statement of Cash Flow Required for all reporting entities

Direct and indirect methods for operating cash flows permitted, direct is urged but rarely seen

Direct and indirect methods for operating cash flows permitted

Interest paid and dividends received must be classified as Choice allowed in classifying: operating cash flows, and dividends paid must be 1.Dividends and interest paid or received as operating classified as financing cash flows cash flows, or 2.Interest or dividends paid as financing cash flows and interest or dividends received as investing cash flows

Overdrafts cannot be included in cash (show as financing Overdrafts can be included in cash under de-fined source of cash) conditions

Reconsideration of cash flow reporting will occur in later stage of financial reporting joint project with IASB

Reconsideration of cash flow reporting will occur in later stage of financial reporting joint project with FASB

Accounting for Fair Value IFRS versus GAAP

Listed below are some of the major differences in Fair Value accounting treatment between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Treatment of Fair Value Comprehensive standard establishes a three level hierarchy of fair value methods, but does not dictate further application of fair value measures IFRS Treatment of Fair Value No comprehensive guidance issued by IASB, but current project promises a standard very similar to U.S. GAAP. Proposed IFRS is based on FAS 157 albeit with some terminology differences, and will essentially converge with U.S. GAAP approach.

Accounting for Cash, Receivables and Prepaid Expenses IFRS versus GAAP

Listed below are some of the major differences in accounting for cash, receivables and prepaid expenses between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP Treatment of Cash, Receivables, and Prepaid Expenses No specific guidance offered under U.S. GAAP or IFRS Industry specific guidance for acquired loans and receivables Accounting for pledging, factoring similar under IFRS IFRS Treatment of Cash, Receivables, and Prepaid Expenses No specific guidance offered under either set of standards Loans and receivables measured at amortized cost

Accounting for pledging, factoring similar under U.S. GAAP

Short Term Investments and Financial Instruments IFRS versus GAAP

Listed below are some of the major differences in accounting for short term investments and financial instruments between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP Treatment of Short Term Investments and Financial Instruments Stricter definition of sales resulting in more recognition of secured borrowing transactions IFRS Treatment of Short Term Investments and Financial Instruments Slightly looser definition of sales of financial assets

Basis adjustment arising from firm commit-ments and forecasted transactions may not be included in initial measurement of hedged item

Hedging gains and losses from cash flow hedges of firm commitments and of forecasted transactions can be included as part of the initial measurement of the cost basis of the related hedged item (basis adjustment)

Non-derivative instruments can be used to hedge currency risk associated with net investment in foreign entity or a fair value hedge of unrecognized firm commitment

Non-derivative instruments can be used to hedge foreign currency risk

Hedging of portion of cash flows of hedged item not permitted

Hedging of portion of cash flows of hedged item is permitted

Hedging gains and losses on cash flow hedges recorded in other comprehensive income when they occur, reclass to income with hedged item

Similar to U.S. GAAP

Hedging for part of term of hedged item not permitted

Hedging for part of term of hedged item permitted if effectiveness can be shown

Hedging effectiveness can be assumed in limited circumstances (using shortcut method)

Hedging effectiveness must be demonstrable; new option to designate any financial asset or liability for measurement at fair value with changes in current income

Macro-hedging not permitted

Macro-hedging is permitted

Gain/loss on hedging net investment in foreign subsidiary Gain/loss on hedging net investment in foreign subsidiary taken to income upon complete liquidation of investment taken to income upon partial or complete disposal or liquidation of investment

Reclassifications to trading required under certain conditions, but reclassification from trading not permitted

Reclassifications to or from trading prohibited

Derecognition of financial assets based on loss of control, Derecognition of financial assets based primarily on risks which requires isolation from transferor, transferee ability and rewards criterion; also, on loss of control, as a to pledge or sell, and absence of repurchase obligation by secondary test transferor

Accounting for Inventory IFRS versus GAAP

Listed below are some of the major differences in accounting for short term investments and financial instruments between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . Inventory Treatment Under U.S. GAAP Allowable costing methods include FIFO, average cost, and LIFO IFRS Inventory Treatment LIFO costing is now banned under IFRS

No special rules for biological inventory (e.g., growing crops, livestock)

IAS 41 on agriculture specifies use of fair value less estimated selling costs for biological assets, with changes in value reported in income

Presentation at lower of cost or market required

Presentation at lower of cost or net realizable value

Only in rare instances (mining of gold, etc.) is presentation at fair value in excess of cost permitted

Certain defined situations, including agricultural products, for reporting at fair value in excess of actual cost

Certain costs (idle capacity, spoilage) cannot be added to Certain costs (idle capacity, spoilage) cannot be added to overhead charge in inventory cost, conforming to IFRS overhead charge in inventory cost rule

Lower of cost or market adjustments cannot be reversed

Lower of cost or market adjustments must be reversed under defined conditions

Recognition in interim periods of inventory losses from market declines that reasonably can be expected to be restored in the fiscal year not required

Recognition in interim periods of inventory losses from market declines that reasonably can be expected to be restored in the fiscal year is required; guidance in the areas of disclosure and accounting for inventories of service providers offered

Accounting for Revenue Recognition IFRS versus GAAP

Listed below are some of the major differences in accounting for revenue recognition between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP Revenue Recognition IFRS Revenue Recognition

Conceptual framework offers guidance (major project in process to provide revised standard for revenue recognition based on statement of financial position changes); specific guidance on limited matters (e.g., software development; construction)

Some specific guidance offered under IFRS (a separate standard on revenue recognition exists, unlike U.S. GAAP)

Generally must amortize revenue over service period, no up-front recognition under GAAP

More possibility for up-front revenue recognition when performance has occurred

Revenue recognition deferred on delivered part of multielement contract if refund would be triggered by failure to deliver remaining elements

Revenue generally recognized on delivered part of multielement contract even if refund triggered by failure to deliver remaining ele-ments, if delivery is probable

Revenue-cost and gross-profit approaches to percentageof-completion both allowed for long-term construction contracts; use of completed contract method under certain circum-stances is required

If percentage cannot be reliably estimated, use of cost recovery method required; revenue-cost approach to percentage of completion mandatory; completed contract method banned

Joint project with IASB, likely will adopt new assets and liabilities approach to revenue recognition

Joint project with FASB, likely will adopt new assets and liabilities approach to revenue recognition

Accounting for Long-Lived Assets (Tangible Assets) IFRS versus GAAP

Listed below are some of the major differences in accounting for long-lived or tangible assets between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Long-Lived Assets Cost components similar to IFRS except that hedging gain/loss from qualifying cash flow hedges are not includable IFRS Long-Lived Assets Cost components similar to U.S. GAAP, but gain/loss from effective cash flow hedging can be added to basis of asset

Change in depreciation method now handled prospectively under recently imposed standard

Change in method accounted for prospectively

Mandatory capitalization of construction pe-riod interest costs, only interest costs are subject to capitalization (no ancillary costs can be included)

Former optional expensing or capitalization of construction period interest ended by revised IAS 23; capitalization now mandatory; ancillary costs also can be capitalized

Costs of major overhauls generally expensed

Costs of major overhauls added to asset

Cost basis required

Alternatively can use cost basis or revaluation to fair value (entire class of asset must be accounted for under revaluation method)

Impairments recognized in current income

If cost method used, impairments are recognized in income; if revaluation employed, impairment treated as reversal of revaluation unless it exceeds former write-up, in which case excess impairment taken to current income Impairment suggested when book value exceeds greater of value in use (discounted cash flows) or fair value less cost to sell

Impairment suggested when book value exceeds gross expected future cash flows; second step to measure amount of impairment uses discounted present value of cash flows

Impairments, once recognized, cannot be reversed

Recognized impairments reversed under defined conditions IFRS has been brought into closer conformity with U.S. GAAP as to component depreciation, accrual of asset retirement obligations, al-though IFRS guidance on retirement obligations is more general; changes in estimated amount of the obligation recognized over remaining term if cost model is used (if revaluation model, impact is immediately felt in earnings)

Component-level depreciation expected; asset retirement obligations recognized as part of asset cost; changes in estimated amount of obligation effectively amortized over remain-ing term

Like-kind exchanges of productive assets are now measured at fair value, with gain or loss recognized, similar to IFRS Investment property must be carried at depreciated cost

Like-kind exchanges measured at fair value, with gain or loss recognized

Investment property can be carried at depreciated cost or fair value

Segregate asset held for sale, write down to lower of amortized cost or fair value less estimated costs to dispose, cease depreciating assets; comparative statement of financial position reclassified to report disposal group separately

Similar to U.S. GAAP approach, except comparative statement of financial position is not restated

Accounting for Long-Lived Assets (Intangible Assets) IFRS versus GAAP

Listed below are some of the major differences in accounting for long-lived intangible assets between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Long-Lived Assets (Intangible) Internally generated goodwill not recognized (although, implicitly, indirectly given recognition in limited circumstance of replacement for impaired acquired goodwill) IFRS Long-Lived Assets (Intangible) Internally generated goodwill not recognized

Research and development expenditures all expensed as Research costs expensed as incurred, but development incurred, included in operating cash flows costs capitalized and amortized, portion capitalized in period is included in investing cash flows Measurement of impairment done with reference to fair value (often operationalized as discounted cash flows) Measurement of impairment done with reference to higher of value in use or fair value less costs to sell

Estimated residual often defined by present value of expected disposal proceeds

Estimated residual value defined by current net selling price assuming asset is age, condition as of expected end of useful life Measurement of goodwill impairment similar to other long lived assets, requires only single-step computation; measured at lowest level goodwill can be assigned (cash generating unit)

Measurement of goodwill impairment uses special method, requires first comparing fair value of cash generating unit to book value including goodwill, then comparing implied goodwill to carrying value; measured at level of business segment or one level below that

Impairment testing at segment or lower level, except that indefinite life intangibles are tested separately from business unit

Impairments tested at cash generating unit level

No reversals of impairments once recognized for intangible assets

Impairments of intangible, once recognized, can be reversed, under defined conditions, except for goodwill

Revaluations never permitted (only amortized cost is permitted)

Revaluation of intangibles permitted under limited circumstances

Decommissioning (asset retirement) obligations not recomputed after initial computation, generally

Decommissioning (asset retirement) obligations recomputed at current risk-adjusted rate each date of the statement of financial position

Accounting for Investments (Passive) IFRS versus GAAP

Listed below are some of the major differences in accounting for passive investments between International Financial Reporting Standards (IFRS) and U.S. GAAP. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP Investments (Passive) Classification as trading, available-for-sale, or held-tomaturity limited to securities; equity method required for investee accounting IFRS Investments (Passive) Classification as trading, available-for-sale, or held-tomaturity applies to all types of financial assets, not just to securities; choice of equity, cost, fair value methods for some investees Fair value option allows any financial asset or liability to be designated at inception to be accounted for at fair value with changes reported in current earnings

U.S. GAAP adopted IFRS fair value option recently

If held-to-maturity securities are sold, use of this category If held-to-maturity securities are sold, use of this category is prohibited thereafter is prohibited for next two years

Investment in unlisted securities valued at cost

Investments in unlisted securities can be valued at fair value, if reliable measure available Derecognition of financial assets based on risks-andrewards and control analyses

Derecognition of financial assets based on loss

of control, which requires isolation from the transferor, transferee ability to pledge or sell, and absence of repurchase obligation by transferor.

Accounting for Investments (Equity Method and Other) IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for investments (equity method and other). This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP Investments (Equity Method & Other) IFRS Investments (Equity Method & Other)

Use of equity method based on significant influence being Same as under U.S. GAAP (equity method investees wielded by investor referred to as associates under IFRS)

Extensive disclosures required of investees statement of financial position and income statement data

Extensive disclosures required of associates balance sheet and income statement data

Joint ventures generally accounted for by equity method, but some industries (e.g., construction) use proportional consolidation is traditional

Joint ventures accounted for by equity method or proportionate consolidation, but IASB will soon ban proportionate consolidation and conform with U.S. GAAP treatment

No need to conform investor and investee accounting policies

Need to conform investor and investee accounting policies

Investment property must be accounted for by cost (and depreciation) method

Investment property can be accounted for by cost (and depreciation) method, or by fair value method with changes reported in income

Accounting for Business Combinations and Consolidated Financial Statements IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for business combinations and consolidated financial statements. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP Treatment of Business Combinations and Consolidated Financial Statements Poolings prohibited by FAS 141; consolidation rules effectively based on majority ownership criterion; closing date generally used for recognizing acquisitions (purchases) IFRS Treatment of Business Combinations and Consolidated Financial Statements Poolings (unitings) eliminated by IFRS 3; consolidation rules based on control criterion; control date used for recognizing acquisitions (purchases)

Special consolidation requirements apply to Variable Interest Entities (VIE), consolidation by primary beneficiary generally required Recognize post-acquisition obligations only for exiting activities begun before merger, to be completed in one year

VIEs not yet addressed by IFRS but Special Purpose Entities consolidated under concept of control

Recognize post-acquisition obligations only for provisions that had been recognized by acquired entity

Consolidation of majority owned subsidiaries required unless control is not exercised by parent

Consolidation required unless control is not exercised by parent, or unless control is temporary (to lapse within twelve months) Non controlling interest measured either: 1) at fair value, or 2) as a proportionate share of identifiable net assets acquired; choice made on acquisition-by-acquisition basis

Non controlling interest measured at fair value

Acquiree deferred tax recognized only after date of acquisition (i.e., having full valuation allowance at acquisition date) used to offset goodwill, then offset intangible assets, finally to offset tax expense Subsequent creation of allowance for tax asset recognized in acquisition transaction effected via charge

Acquiree deferred tax recognized only after date of acquisition (i.e., having full valuation allowance at acquisition date) is effected as current period credit to tax expense and also goodwill adjustment as if adjustment occurred at acquisition date

to tax expense

No promulgated rules governing parent company only financial statements, but use of equity method would be acceptable Not necessary to conform parent and subsidiary accounting policies

In parent company only financials, the investment in subsidiaries, equity investees, and joint ventures may be presented at cost or under rules for investments in securities, but equity method cannot be used Need to conform parent and subsidiary accounting policies

Non controlling interest included in equity

Non controlling interest included in equity

Acquired in-process R&D expensed as purchased (but proposed change will permit capitalization), postacquisition-date expenditures on IP R&D expensed

Purchased in-process R&D capitalized, and subsequent expenditures generally are also capitalized and amortized

In bargain purchase situations, negative goodwill used to reduce most noncurrent assets carrying value, with any excess reported as extraordinary gain (proposed change to conform to IFRS approach)

Negative goodwill reported as gain, with no offsetting against acquired assets

Use pooling-type accounting for mergers of entities under Use pooling-type accounting for mergers of entities under common control common control

Contingent consideration recognized when condition is eventually met (but proposed change would conform to IFRS approach)

Fair value of contingent consideration included in purchase price allocation process

Goodwill not amortized, tested for impairment

Similar to U.S. GAAP, but different impairment testing procedures

One year permitted to finalize purchase price allocation process, including resolution of preacquisition contingencies

Similar to U.S. GAAP

Combinations of entities under common control (brother sister mergers) accounted for at book value, like former poolings of interest

No specific rules for brother sister mergers, so either purchase accounting or book value (pooling) accounting is acceptable per parent entity's policy choice

Current accounting for step acquisitions treats each purchase separately, no remeasurement of previously recognized goodwill (proposed changes would revalue

Similar to U.S. GAAP (would be affected by currently proposed changes to both U.S. GAAP and IFRS)

when control achieved)

Accrued expense (reserves) can be recognized if postacquisition restructuring of acquiree is planned

Restructuring reserves generally not allowed, unless acquiree had recorded contingent liability before transaction

Accounting for Current Liabilities and Contingencies IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for current liabilities and contingencies. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Current Liabilities & Contingencies Different recognition threshold for timing of recognition of liabilities associated with a re-structuring than under IFRS; recognize under U.S. GAAP only if event occurs making this a present obligation IFRS: Current Liabilities & Contingencies A variety of recognition criteria for different items that may enter into the measurement of a provision are identified, missing under U.S. GAAP; recognize when formal plan is announced

Short-term debt refinanced before statement issuance date can often be shown as noncurrent

Short-term debt refinanced before statement of financial position date can be shown as noncurrent; if later (but still before issuance of financials) disclosure only

Provisions (estimated liabilities) measured by reference to Provisions measured by reference to best estimate to low end of range of amounts needed to settle, sometimes settle, discounted to present value but not always discounted to present value

Specific rules for certain provisions (e.g., for environmental liabilities)

Only general guidance provided under IFRS

Contingent gains not recognized

IFRS provides for some recognition of contingent gains

Accounting for Long Term Liabilities IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for long term liabilities. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards .

U.S. GAAP: Long Term Liabilities Convertible debt classified as liability

IFRS: Long Term Liabilities Convertible debt assigned to both debt and equity based on relative fair values

Entities should reassess at the end of each reporting period whether an embedded derivative should be separated

Entities should reassess at the end of each reporting period whether an embedded derivative should be separated only if there is a change in the terms that significantly modifies the cash flows

Noncurrent presentation of defaulted debt if waiver granted before statement issuance date

Noncurrent presentation of defaulted debt if waiver granted before balance sheet date only

Equity-like instruments giving holder right to demand cash Similar to U.S. GAAP settlement, or with defined cash settlement terms, must be classed as liabilities

Joint project with IASB to address instruments with attributes of both liabilities and equity is ongoing.

Joint project with FASB to address instruments with attributes of both liabilities and equity is ongoing.

Accounting for Leases IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for leases. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP: Accounting for Leases Capital lease accounting is required if one of four defined conditions are met; otherwise, operating lease IFRS: Accounting for Leases Similar to U.S. GAAP; finance lease treatment if risks and rewards are transferred to lessee; also if property is special purpose for lessee use If lessee to bear lessor's loss upon lease cancellation, or lessee will shoulder gain or loss from change in residual value of leased asset, or lessee has bargain renewal right, then lease may be deemed financing transaction for lessor

No additional factors that parallel those under IFRS for determination of financing (capital) treatment by lessor

Third-party guarantees cannot be included in minimum lease payments to determine whether capital lease criteria are met

Third-party guarantees must be included in minimum lease payments to determine whether capital lease criteria are met

Lessors must use implicit rate and lessees generally would use incremental borrowing rate to calculate the present value of minimum lease payments

Present value of lease payments computed using implicit rate (if unknown, incremental rate can be used)

More guidance provided on specialized topics; deferral of Only general guidance; profit recognition on saleprofit on sale-leasebacks is required leasebacks permitted if fair value priced

Separate accounting for land and building in combined lease depends on terms and materiality of land

Separation of land and building components of lease is mandatory under recent provisions

Output contracts are leases

Output contracts are not leases

Leasehold interest in land accounted for as prepayment

Leasehold interest in land can be accounted for as investment property, valued at fair value with changes in current earnings; or else as prepayment

Gain on sale/leaseback not recognized in current Gain on sale/leaseback amortized over term of financing earnings, but deferred and amortized, unless seller lease, but recognized at once if operating leaseback retains use of much of asset, in which case gain is recognized (immediate recognition of loss also commonly required)

Lease obligations disclosures more extensive than under IFRS

Lease obligations disclosures less than under U.S. GAAP

Accounting for Income Taxes IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for income taxes. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Income Taxes Comprehensive inter-period allocation using liability method (statement of financial position orientation) required under U.S. GAAP IFRS: Accounting for Income Taxes Comprehensive inter-period allocation using liability method (statement of financial position orientation) required under IFRS, very similar to U.S. GAAP

Exemptions from inter-period allocation rules found under Exemptions provided for nontaxable goodwill, certain IFRS not present under U.S. GAAP asset/liability acquisitions that are not business combinations and that do not immediately affect book or tax income, and permanent differences

Tax effects of all temporary differences are recognized, Tax effects of all temporary differences are recognized, subject to allowance for tax assets that are not more likely subject to allowances for tax assets that are not more likely than not to be realized than not to be realized

Recognize effect of rate changes when enacted Prohibits recognition of effects of temporary differences related to 1.Foreign currency nonmonetary assets when the reporting currency is the functional currency, and 2.Intercompany transfers of inventory or other assets remaining within the company

Recognize effects of rate changes when substantively enacted which may precede U.S. GAAP recognition

Deferred tax assets and liabilities are current or noncurrent based on related asset or liability, net current and net noncurrent amounts are displayed

Deferred tax assets and liabilities are noncurrent, and are to be reported net

Post-business-combination recognition of deferred tax asset eliminates goodwill, then other intangible assets, with any excess taken to income

Post-business-combination recognition of deferred tax asset eliminates goodwill with any excess taken to income

Several specific exemptions to general requirement to provide deferred tax on all tem-porary differences are set forth

No exceptions to general principle that all temporary differences in carrying amount of assets and liabilities require deferred taxes

Recognize deferred tax asset in all cases, provide reserve Recognize deferred tax asset when realization is when realization is not more likely than not probable, which means more likely than not per IFRS 3

Effect of change in rates or change in assessed likelihood of realization on deferred tax related to item originally recognized in stockholders equity must be reported in current earnings

Effect of change in rates or change in assessed likelihood of realization on deferred tax related to item originally recognized in stockholders equity must be reported in equity using backward tracing (may soon be changed to conform with U.S. GAAP method)

Subsequent year realization of tax benefit from business Subsequent year realization of tax benefit from business combination reduces goodwill, then other tangible assets, combination reduces goodwill, then excess reported in and only then excess reported in current earnings current earnings

Rate reconciliation based on domestic federal rate time pretax profit from continuing operations only

Rate reconciliation based on applicable rates times accounting profit

Tax effect of intercompany transactions recognized at seller entity's tax rate

Tax effect of intercompany transactions recognized at buyer entity's tax rate

Benefit of uncertain tax positions can only be recognized to the extent that there is at least a 50% likelihood of being sustained on exam

No specific guidance on uncertain tax positions (apply general approach for contingent losses); based on management expectations

Accounting for Pensions and other Postretirement Benefits IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for pensions and other postretirement benefits. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Pensions Defined benefit plans; use of projected unit credit method required to match expense to periods of service; smoothing is accomplished by deferred recognition of actuarial gains and losses, amortization of prior service costs, et al. IFRS: Accounting for Pensions Methodology very similar to that under U.S. GAAP, with deferred recognition of actuarial gains or losses. However, past service costs are recognized immediately, not deferred

Past service costs amortized over service period or life expectancy of workers Actuarial gains and losses cannot be recognized in equity; are to be deferred and amortized to pension expense over expected term of plan participants to the extent that defined corridor is exceeded

Past service costs expensed immediately

Actuarial gains and losses can be recognized in equity rather than earnings under amendment to IAS 19 effective in 2006; if in earnings, either immediate recognition or amortization similar to U.S. GAAP is permissible

Recognition of a minimum liability on the statement of financial position to at least the unfunded accumulated pension benefit obligation

No minimum liability to be reported in the statement of financial position

No limitation on recognition of pension assets

Limitation on recognition of pension assets

Curtailment gains recognized only when employees terminate or plan suspension is adopted, computed differently than under IFRS

Curtailment gains or losses recognized when announced; computed differently than U.S. GAAP

Anticipating changes in the law that would affect variables Anticipate changes in future postemployment benefits such as state medical or social security benefits expressly based on its expectations in the law prohibited

Termination benefits expensed when employees accept

Termination benefits expensed when employer is

and amount can be estimated, recognize contractual benefits when it is probable that employees will accept

committed to pay these

Expense recognition for certain types of equity compensation benefits; opposed to mandatory stock compensation expensing; prior service cost to be amortized over the expected service life of existing employees; contributions to multiemployer plans expenses

Expense for equity compensation benefits not recognized, but current agenda item; prior service cost related to retirees and active vested employees to be expensed; benefit obligation for multiemployer recognized

No limitation on amount of pension plan asset (in connection with overfunding) that can be presented on statement of financial position

Statement of financial position asset recognition limited by complex rules

Joint convergence project with IASB/FASB is on-going, with many complex issues to be addressed

Joint convergence project with IASB/FASB is on-going, with many complex issues to be addressed

Accounting for Stockholders' Equity IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for stockholders' equity. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Stockholders' Equity Mandatorily redeemable preferred shown as liability with dividends deducted as expense IFRS: Accounting for Stockholders' Equity Mandatorily redeemable preferred shown as liability with dividends deducted as expense

Fair value method required for share-based compensation Mandatory income statement recognition of effect of plans; special simplified method prescribed for nonpublic stock-based compensation measured at fair value; no companies special rules for nonpublic entities

Fair value measurement of goods and services acquired for stock from nonemployees using counter party's commitment or actual performance date

Fair value measurement of goods and services acquired for stock from non-employees using modified grant date method

Income tax benefits related to share-based payment (measured by spread between current fair value and exercise price) credited to equity; any payroll taxes recognized in expense at time of exercise

Tax benefits related to share-based payments credited to equity only if in excess of compensation expense; any payroll taxes recognized in expense over same period as recognition of option plan cost (vesting period)

Tax benefits related to share-based payments based on

Tax benefits related to share-based payments based on

GAAP expense, later adjusted when actual tax effects are expected applicable tax deduction realized

Modifications of awards require new measurement based Modifications do not trigger new measurement of fair on date of modification value

Joint project with IASB to address instruments with features of both liabilities and equity

Joint project with FASB to address instruments with features of both liabilities and equity

Accounting for Earnings per Share (EPS) IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for earnings per share (EPS). This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP: Accounting for Earnings per Share Very similar to IFRS, but with more detailed guidance on calculations IFRS: Accounting for Earnings per Share Similar to U.S. GAAP. Calculation of year-to-date EPS (versus previously reported interim date) varies from U.S. GAAP

Report basic and diluted EPS on continuing operations, discontinued operations, extraordinary items, cumulative effect of change in accounting and net income

Report basic and diluted EPS on continuing operations and net income

For interim reporting, average the interim periods incremental shares to compute EPS

For interim reporting, use treasury stock method on yearto-date results, unlike US GAAP approach

Proposed changes would converge with IFRS

Accounting for Interim Reporting IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for interim reporting. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Interim Reporting IFRS: Accounting for Interim Reporting

Some timing differences in recognition of interim revenues Some timing differences in recognition of interim revenues and expenses vs. U.S. GAAP and expenses vs. IFRS

Basic principle is that interim period is integral to full year, Basic principle is that interim period is discrete period, but but actual requirements depart from this in many actual requirements depart from this in many instances; instances; net result is mixed approach not unlike IFRS net result is mixed approach not unlike U.S. GAAP

Accounting for Segment Reporting IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for segment reporting. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. U.S. GAAP: Accounting for Segment Reporting Management approach provides flexibility in defining segments; segment results using internal managerial approach OK, even if these differ from financial statements Disclosures based on primary classification (either geographic or product-based), with some additional entitywide items (major customers, etc.) not necessarily lines of business or geographical areas, however IFRS: Accounting for Segment Reporting Approach very similar to U.S. GAAP recently adopted

Defines segments based on components of the entity that are businesses, having operating results reviewed by the chief operating decision maker, and having discrete financial information; these are reportable if one of three threshold criteria (sales, profit or assets) are met Segment result defined, also require capital expenditures and liabilities segment disclosures; entity-wide and some geographic analyses are also required

No segment result definition given, no requirement for capital expenditures, liabilities disclosure by segments

Accounting for Foreign Currency IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for foreign currency. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Foreign Currency IFRS: Accounting for Foreign Currency

Selection of functional currency is open to judgment, but Greater emphasis placed on the currency of the economy in practice there is a greater emphasis on cash flows than that influences sales prices for goods and services on currency that influences pricing of output Choice of reporting (presentation) currencies, and if other Very similar to U.S. GAAP than functional currency translate assets and liabilities at

balance sheet date exchange rate, income and expense at rate at dates of transactions (or average for period, if not materially different)

Exchange losses to be expensed in all instances

Exchange losses on a liability for the recent acquisition of an asset invoiced in a foreign currency either as 1.Charge to expense, or 2.Add to the cost of the asset when the related liability cannot be settled and there is no practical means to hedge

Current exchange rate used to translate all items on the statement of financial position, including goodwill and fair value adjustments

Same as under U.S. GAAP

In highly inflationary economy (having cumulative three year price change of 100%), parent's currency (U.S. dollar) must be used as functional currency

In hyperinflationary economy, an entity cannot avoid restatement under IAS 29 by adopting stable currency (e.g., that of parent company) as functional currency.

Equity accounts are translated at historical rates

Translation of equity accounts not specified under IFRS

Accounting for Personal Financial Statements IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for personal financial statements. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Personal Financial Statements Current value reporting required IFRS: Personal Financial Statements No published guidance

Specialized Industry Accounting Treatment IFRS versus GAAP

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for specialized industries (i.e., oil, gas, insurance, banks, and agriculture). This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards . U.S. GAAP: Accounting for Specialized Industries IFRS: Accounting for Specialized Industries

No primary guidance for government grants, agriculture, but there are specific requirements for certain industries, such as oil and gas

Guidance provided for government grants, agriculture, reporting by banks, extractive industries, insurance

Specialized guidance on various industries, including No such guidance offered; there is no "secondary" source insurance; banking and thrifts; motion pictures, computer for GAAP guidance software, and agricultural industries, and others, found in "secondary" GAAP sources such as AICPA Guides, SOP, etc.

IFRS IAS International Financial Reporting Standards

Listed below are the current International Financial Reporting Standards (IAS/IFRS). Recent revisions are noted in parentheses. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. IFRS IAS Standard IAS 1 IAS 2 IAS 7 IAS 8 IAS 10 IAS 11 IAS 12 IAS 14 IAS 16 IAS 17 IAS 18 IAS 19 IAS 20 IAS 21 IAS 23 IAS 24 IAS 26 IAS 27 IAS 28 IAS 29 IAS 31 IAS 32 IAS 33 Description of IFRS IAS Standard Presentation of Financial Statements (revised 2007, effective 2009) Inventories (revised 2003, effective 2005) Cash Flow Statement Accounting Policies, Changes in Accounting Estimates & Errors (rev. 2003, effective 2005) Events After the Balances Sheet Date (revised 2003, effective 2005) Construction Contracts Income Taxes Segment Reporting (superseded by IFRS 8, effective 2009) Property, Plant, and Equipment (revised 2003, effective 2005) Accounting for Leases (revised 2003, effective 2005) Revenue Employee Benefits (revised 2004) Accounting for Government Grants and Disclosure of Government Assistance The Effects of Changes in Foreign Exchange Rates (revised 2003, effective 2005; minor further amendment 2005) Borrowing Costs (revised 2007, effective 2009) Related-Party Disclosures (revised 2003, effective 2005) Accounting and Reporting by Retirement Benefit Plans Consolidated and Separate Financial Statements (revised 2003, effective 2005) Accounting for Investments in Associates (revised 2003, effective 2005) Financial Reporting in Hyperinflationary Economies Financial Reporting of Interests in Joint Ventures (revised 2003, effective 2005) Financial Instruments: Presentation (revised 2003, effective 2005; disclosure requirements removed to IFRS 7 effective 2007) Earning Per Share (revised 2003, effective 2005)

IAS 34 IAS 36 IAS 37 IAS 38 IAS 39 IAS 40 IAS 41

Interim Financial Reporting Impairments of Assets (revised 2004) Provision, Contingent Liabilities, and Contingent Assets Intangible Assets (revised 2004) Financial Instruments: Recognition and Measurement (amended 2005) Investment Property (revised 2003, effective 2005) Agriculture

IFRS International Financial Reporting Standards

Listed below are the current International Financial Reporting Standards (IFRS). Recent revisions are noted in parentheses. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. IFRS Standard IFRS 1 IFRS 2 IFRS 3 IFRS 4 IFRS 5 IFRS 6 IFRS 7 IFRS 8 Description of IFRS Standard First-Time Adoption of IFRS (minor amendment 2005) Share-Based Payment Business Combinations Insurance Contracts Noncurrent Assets Held for Sale and Discontinued Operations Exploration for and Evaluation of Mineral Resources Financial Instruments: Disclosures Operating Segments

IFRS Standing Interpretations Committee (SIC) Standards

Listed below are interpretive materials regarding International Financial Reporting Standards (IFRS). Recent revisions are noted in parentheses. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. IFRS SIC Standard SIC 7 SIC 10 SIC 12 SIC 13 SIC 15 SIC 21 SIC 25 SIC 27 SIC 29 SIC 31 SIC 32 Introduction of the Euro Government Assistance No Specific Relation to Operating Activities Consolidation Special-Purpose Entities (SPE) Jointly Controlled Entities Nonmonetary Contributions by Venturers Operating Leases Incentives Income Taxes Recovery of Revalued Non-depreciable Assets Income Taxes Changes in the Tax Status of an Enterprise or Its Shareholders Evaluating the Substance of Transactions Involving the Legal Form of a Lease Disclosure Service Concession Arrangements Revenue Barter Transactions Involving Advertising Services Intangible Assets Web Site Costs Description of IFRS SIC Standard

International Financial Reporting Interpretations Committee (IFRS IFRIC)

Listed below are the IFRS IFRIC standards issued by the International Financial Reporting Interpretations Committee. Recent revisions are noted in parentheses. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. IFRIC Standard IFRIC 1 IFRIC 2 IFRIC 4 IFRIC 5 IFRIC 6 IFRIC 7 IFRIC 8 IFRIC 9 IFRIC 10 IFRIC 11 IFRIC 12 IFRIC 13 IFRIC 14 IFRIC 15 IFRIC 16 IFRIC 17 Description of IFRIC Standard Changes in Existing Decommissioning, Restoration and Similar Liabilities Members Shares in Cooperative Entities and Similar Instruments Determining Whether an Arrangement Contains a Lease Rights to Interest Arising from Decommission, Restoration and Environmental Rehabilitation Funds Liabilities Arising from Participating in a Specific Market Waste Electrical and Electronic Equipment Applying the Restatement Approach under IAS 29, Financial Reporting in Hyperinflationary Economies Scope of IFRS 2 Reassessment of Embedded Derivatives Interim Financial Reporting and Impairment IFRS 2: Group and Treasury Share Transactions Service Concession Arrangements Customer Loyalty Programs IAS 19: The Limit on a Defined Benefit Asset, Minimum Funding Requirements, and Their Interaction Agreements for the Construction of Real Estate Hedges of a Net Investment in a Foreign Operation Distributions of Non-Cash Assets to Owners

You might also like

- Differences Between IFRS and UGAAPDocument8 pagesDifferences Between IFRS and UGAAPNigist WoldeselassieNo ratings yet

- The Handbook to IFRS Transition and to IFRS U.S. GAAP Dual Reporting: Interpretation, Implementation and Application to Grey AreasFrom EverandThe Handbook to IFRS Transition and to IFRS U.S. GAAP Dual Reporting: Interpretation, Implementation and Application to Grey AreasNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsCrissa BernarteNo ratings yet

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- The Accounting Policies Regarding The Fixed Assets Between The Omfp 1802/2014 and The Ias-IfrsDocument6 pagesThe Accounting Policies Regarding The Fixed Assets Between The Omfp 1802/2014 and The Ias-IfrsRoxana MarilenaNo ratings yet

- GAAP StandardsDocument13 pagesGAAP StandardsAnkita MahajanNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- True and Fair View of Financial StatementsDocument2 pagesTrue and Fair View of Financial StatementsbhaibahiNo ratings yet

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocument10 pagesWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryNo ratings yet

- US GAAP Conversion To IFRS: A Case Study of The Balance SheetDocument8 pagesUS GAAP Conversion To IFRS: A Case Study of The Balance SheetJasonNo ratings yet

- Financial Statements Guide: Trading, P&L & Balance Sheet ExplainedDocument35 pagesFinancial Statements Guide: Trading, P&L & Balance Sheet ExplainedBhavik Shah100% (1)

- Matching PrincipleDocument2 pagesMatching Principlejim125No ratings yet

- Accounting TerminologyDocument71 pagesAccounting TerminologyBiplob K. SannyasiNo ratings yet

- Risk ManagementDocument15 pagesRisk ManagementanupkallatNo ratings yet

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDocument6 pagesStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniNo ratings yet

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Similarities and Differences Between IFRS and US GAApDocument12 pagesSimilarities and Differences Between IFRS and US GAApAlamin Mohammad100% (1)

- Accounting Standard As 1 PresentationDocument11 pagesAccounting Standard As 1 Presentationcooldude690No ratings yet

- Chap 17Document34 pagesChap 17ridaNo ratings yet

- IFRS 12 disclosure guide for interests in other entitiesDocument3 pagesIFRS 12 disclosure guide for interests in other entitiesAira Nhaira MecateNo ratings yet

- Accounting Interview QuestionsDocument43 pagesAccounting Interview QuestionsArif ullahNo ratings yet

- University of Lusaka: School of Economics, Business & ManagementDocument92 pagesUniversity of Lusaka: School of Economics, Business & ManagementDixie Cheelo100% (1)

- Guideline D-9: Source of Earnings Disclosure for Life Insurance CompaniesDocument7 pagesGuideline D-9: Source of Earnings Disclosure for Life Insurance CompaniesFredericYudhistiraDharmawataNo ratings yet

- Branch AccountsDocument42 pagesBranch AccountsJafari SelemaniNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- Tax PlanningDocument12 pagesTax PlanningPrince RajputNo ratings yet

- Accounting As An Information SystemDocument14 pagesAccounting As An Information SystemAimee SagastumeNo ratings yet

- GAAPDocument3 pagesGAAPMarvi SolangiNo ratings yet

- IT NINJA-CPA-Review-BEC-Notes ITDocument24 pagesIT NINJA-CPA-Review-BEC-Notes ITSāikrushna KāvūriNo ratings yet

- Construction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22Document22 pagesConstruction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22varadu1963No ratings yet

- Irish Spring ReportDocument11 pagesIrish Spring ReportAri EngberNo ratings yet

- FinQuiz - UsgaapvsifrsDocument12 pagesFinQuiz - UsgaapvsifrsĐạt BùiNo ratings yet

- Financial Reporting Standards Summary PackDocument3 pagesFinancial Reporting Standards Summary PackFoititika.netNo ratings yet

- Budgeting Basics- How to Plan Finances for SuccessDocument7 pagesBudgeting Basics- How to Plan Finances for SuccessCarl Angelo MontinolaNo ratings yet

- IT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFDocument23 pagesIT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFscribdtulasi100% (1)

- Ifrs 15: Revenue From Contracts With CustomersDocument8 pagesIfrs 15: Revenue From Contracts With CustomersAira Nhaira MecateNo ratings yet

- Chart of AccountsDocument6 pagesChart of Accountssundar kaveetaNo ratings yet

- Depreciation and Income Tax ExplainedDocument53 pagesDepreciation and Income Tax ExplainedDyahKuntiSuryaNo ratings yet

- What Is The Indirect MethodDocument3 pagesWhat Is The Indirect MethodHsin Wua ChiNo ratings yet

- Parkinmacro4 1300Document16 pagesParkinmacro4 1300Mr. JahirNo ratings yet

- Depreciation: Depreciation Is A Term Used inDocument10 pagesDepreciation: Depreciation Is A Term Used inalbertNo ratings yet

- Financial Statements SampleDocument32 pagesFinancial Statements Sampleraymodo_philipNo ratings yet

- Us Gaap Ifrs ComparisonDocument169 pagesUs Gaap Ifrs ComparisonNigist Woldeselassie100% (2)

- Accounting Standards IndiaDocument49 pagesAccounting Standards IndiaDivij KumarNo ratings yet

- Financial Analysis 1Document38 pagesFinancial Analysis 1Crestine Joyce Mirabel DelaCruzNo ratings yet

- Cash BudgetDocument50 pagesCash BudgetMsKhan0078No ratings yet

- TdsDocument22 pagesTdsFRANCIS JOSEPHNo ratings yet

- Ethics of Creative Accounting Paper Explores ManipulationDocument17 pagesEthics of Creative Accounting Paper Explores ManipulationAssad RafaqNo ratings yet

- Ifrs 15Document58 pagesIfrs 15lezielNo ratings yet

- Accounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceDocument13 pagesAccounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceInternational Journal of Accounting & Finance ReviewNo ratings yet

- Accountants' New World: The Essential Guide to Being a Valued Business PartnerFrom EverandAccountants' New World: The Essential Guide to Being a Valued Business PartnerNo ratings yet

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- The Employee’s Provident Fund Act 1952: Key HighlightsDocument26 pagesThe Employee’s Provident Fund Act 1952: Key HighlightsJeniferjazzNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- Tax Practitioners' Perceptions Regarding Fraudulent Earned Income Tax Credit Claims: A Descriptive Case Study to Investigate the Phenomenon of Tax Practitioner Filing Fraudulent Tax ClaimsFrom EverandTax Practitioners' Perceptions Regarding Fraudulent Earned Income Tax Credit Claims: A Descriptive Case Study to Investigate the Phenomenon of Tax Practitioner Filing Fraudulent Tax ClaimsNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Tax Mr0003Document172 pagesTax Mr0003Nigist WoldeselassieNo ratings yet

- Unit 1 An Overview of Internal ControlDocument198 pagesUnit 1 An Overview of Internal ControlNigist WoldeselassieNo ratings yet

- MB0034-Research Methodology - Model Question PaperDocument24 pagesMB0034-Research Methodology - Model Question PaperAvinash Kumar83% (36)

- MB0034Document145 pagesMB0034Nigist WoldeselassieNo ratings yet

- MF0003 Taxation Management KeysDocument1 pageMF0003 Taxation Management KeysJhorapaataNo ratings yet

- Unit 3 Corporate Restructuring StructureDocument165 pagesUnit 3 Corporate Restructuring StructureNigist WoldeselassieNo ratings yet

- MF0002 Mergers Acquisition Model PaperDocument8 pagesMF0002 Mergers Acquisition Model PaperJhorapaata67% (3)

- MB0034-Research Methodology - Model Question PaperDocument24 pagesMB0034-Research Methodology - Model Question PaperAvinash Kumar83% (36)

- International Financial Reporting Standards (IFRS) : An AICPA BackgrounderDocument16 pagesInternational Financial Reporting Standards (IFRS) : An AICPA Backgroundernabaig14No ratings yet

- MF0003 Taxation Management KeysDocument1 pageMF0003 Taxation Management KeysJhorapaataNo ratings yet

- Risk Register TemplateDocument10 pagesRisk Register TemplateNigist Woldeselassie100% (1)

- Us Gaap Ifrs ComparisonDocument169 pagesUs Gaap Ifrs ComparisonNigist Woldeselassie100% (2)

- OPERATIONS RESEARCH ASSIGNMENT SOLVEDDocument21 pagesOPERATIONS RESEARCH ASSIGNMENT SOLVEDNigist WoldeselassieNo ratings yet

- MBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Document2 pagesMBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Nigist WoldeselassieNo ratings yet

- Understanding the Basics of MISDocument177 pagesUnderstanding the Basics of MISNigist WoldeselassieNo ratings yet

- Final Set 1 MB0033Document14 pagesFinal Set 1 MB0033Nigist WoldeselassieNo ratings yet

- MB0030 MMDocument37 pagesMB0030 MMnigistwold5192No ratings yet

- OPERATIONS RESEARCH ASSIGNMENT SOLVEDDocument21 pagesOPERATIONS RESEARCH ASSIGNMENT SOLVEDNigist WoldeselassieNo ratings yet

- PM Assig Set - 1 FinalDocument16 pagesPM Assig Set - 1 FinalNigist WoldeselassieNo ratings yet

- Mb0034 Solved AssignmentsDocument52 pagesMb0034 Solved AssignmentsNigist WoldeselassieNo ratings yet

- Chapter 2Document73 pagesChapter 2Nigist WoldeselassieNo ratings yet

- Understanding the Basics of MISDocument177 pagesUnderstanding the Basics of MISNigist WoldeselassieNo ratings yet

- P&OMDocument8 pagesP&OMCody SmithNo ratings yet

- An Effective Corporate Governance Framework Requires A Sound LegalDocument31 pagesAn Effective Corporate Governance Framework Requires A Sound LegalNigist WoldeselassieNo ratings yet

- NSSCH Examiners Report 2020Document257 pagesNSSCH Examiners Report 2020kamatigranny36No ratings yet

- Financial ReportingDocument23 pagesFinancial ReportingHandayani Mutiara Sihombing100% (1)

- Comprehensive Word Problem 1Document2 pagesComprehensive Word Problem 1AprilNo ratings yet

- Accounts merchandise delivery office furniture document financial reportDocument10 pagesAccounts merchandise delivery office furniture document financial reportDiane VillarmaNo ratings yet

- Partnership NotesDocument31 pagesPartnership NotesAimee100% (1)

- Module 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFDocument13 pagesModule 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFJesievelle Villafuerte NapaoNo ratings yet

- Individual Performance Task #3 - Part 2 - Functional Form Income StatementDocument2 pagesIndividual Performance Task #3 - Part 2 - Functional Form Income StatementArver Gabriel QuiambaoNo ratings yet

- (PDF) APC - Ch9solDocument11 pages(PDF) APC - Ch9solAdam SmithNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- ACF5950-Assignment-2801656-kaidi ZhangDocument13 pagesACF5950-Assignment-2801656-kaidi ZhangkietNo ratings yet

- Cash Management at MarutiDocument68 pagesCash Management at MarutiEshaNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- FA2 Mock Exam 2 (Tutorial-8)Document10 pagesFA2 Mock Exam 2 (Tutorial-8)Chit SnowNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis Solved2442230910No ratings yet

- Practical Accounting Problems IIDocument12 pagesPractical Accounting Problems IIJericho PedragosaNo ratings yet

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanNo ratings yet

- Cpar - P2 09.15.13Document22 pagesCpar - P2 09.15.13Leo Mark Ramos100% (1)

- Financial Statement Analysis Ratios and CalculationsDocument6 pagesFinancial Statement Analysis Ratios and CalculationsHannah Mae VestilNo ratings yet

- Audit of INTANGIBLESDocument17 pagesAudit of INTANGIBLESFeem OperarioNo ratings yet

- Accounting concepts and principles quizDocument7 pagesAccounting concepts and principles quizjessamae gundanNo ratings yet

- AC3102 SemGrp 2 Presentation 3Document24 pagesAC3102 SemGrp 2 Presentation 3Melati SepsaNo ratings yet

- AE 111 Midterm Formative Assessment 3Document6 pagesAE 111 Midterm Formative Assessment 3Djunah ArellanoNo ratings yet

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Document50 pagesSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- Accounting - Questions 010812Document4 pagesAccounting - Questions 010812jhouvanNo ratings yet

- IASb 16 Property, Plant EquipmentDocument32 pagesIASb 16 Property, Plant EquipmentIan chisema100% (1)

- Intermediate Accounting I: Midterm ExamDocument20 pagesIntermediate Accounting I: Midterm ExamVillaruz Shereen MaeNo ratings yet

- TEST1 ACC 106 Nov 2017 Solution Part ADocument4 pagesTEST1 ACC 106 Nov 2017 Solution Part AZulaikha JasniNo ratings yet

- Chapter 2 Advanced AccountingDocument25 pagesChapter 2 Advanced AccountingYa LunNo ratings yet

- Account headers and typesDocument2 pagesAccount headers and typesLucky JrNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)