Professional Documents

Culture Documents

Guidelines On Implementation of

Uploaded by

Shalini SrivastavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guidelines On Implementation of

Uploaded by

Shalini SrivastavCopyright:

Available Formats

Guidelines on Implementation of Basel III Capital Regulations in India

The Basel Committee on Banking Supervision (BCBS) issued a comprehensive reform package entitled Basel III: A global regulatory framework for more resilient banks and banking systems in December 2010 with the objective to improve the banking sectors ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. The reform package relating to capital regulation, together with the enhancements to Basel II framework and amendments to market risk framework issued by BCBS in July 2009, will amend certain provisions of the existing Basel II framework, in addition to introducing some new concepts and requirements. A summary of Basel III capital requirements is furnished below:

2. Summary of Basel III Capital Requirements

2.1 Improving the Quality, Consistency and Transparency of the Capital Base 2.1.2 Presently, a banks capital comprises Tier 1 and Tier 2 capital with a

restriction that Tier 2 capital cannot be more than 100% of Tier 1 capital. Within Tier 1 capital, innovative instruments are limited to 15% of Tier 1 capital. Further, Perpetual Non-Cumulative Preference Shares along with Innovative Tier 1 instruments should not exceed 40% of total Tier 1 capital at any point of time. Within Tier 2 capital, subordinated debt is limited to a maximum of 50% of Tier 1 capital. However, under Basel III, with a view to improving the quality of capital, the Tier 1 capital will predominantly consist of Common Equity. The qualifying criteria for instruments to be included in Additional Tier 1 capital outside the Common Equity element as well as Tier 2 capital will be strengthened. 2.1.3 At present, the regulatory adjustments (i.e. deductions and prudential filters) to capital vary across jurisdictions. These adjustments are currently a revised version of this document was issued in June 2011. Generally applied to total Tier 1 capital or to a combination of Tier 1 and Tier 2 capital. They are not generally applied to the Common Equity component of Tier 1 capital. With a view to improving the quality of Common Equity and also

consistency of regulatory adjustments across jurisdictions, most of the adjustments under Basel III will be made from Common Equity. The important modifications include the following: (i) deduction from capital in respect of shortfall in provisions to expected losses under Internal Ratings Based (IRB) approach for computing capital for credit risk should be made from Common Equity component of Tier 1 capital; (ii) cumulative unrealized gains or losses due to change in own credit risk on fair valued financial liabilities, if recognized, should be filtered out from Common Equity; (iii) shortfall in defined benefit pension fund should be deducted from Common Equity; (iv) certain regulatory adjustments which are currently required to be deducted 50% from Tier 1 and 50% from Tier 2 capital, instead will receive 1250% risk weight; and (v) limited recognition has been granted in regard to minority interest in banking subsidiaries and investments in capital of certain other financial entities.

2.1.4 The transparency of capital base has been improved, with all elements of capital required to be disclosed along with a detailed reconciliation to the published accounts. This requirement will improve the market discipline under Pillar 3 of the Basel II framework.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Date Account & Explanation F Debit CreditDocument7 pagesDate Account & Explanation F Debit CreditCindy Claire Pilapil88% (8)

- Case Studies of Cost and Works AccountingDocument17 pagesCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Employability Skills Workshop 18, 19, 20 OCTOBER 2012: PGDM 11-13 BatchDocument5 pagesEmployability Skills Workshop 18, 19, 20 OCTOBER 2012: PGDM 11-13 BatchShalini SrivastavNo ratings yet

- Smita Mankad Bio Apr13Document2 pagesSmita Mankad Bio Apr13Shalini SrivastavNo ratings yet

- Accman: Integrating Knowledge and PracticeDocument6 pagesAccman: Integrating Knowledge and PracticeShalini SrivastavNo ratings yet

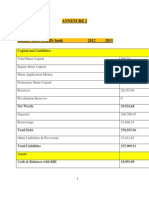

- Annexure 2Document13 pagesAnnexure 2Shalini SrivastavNo ratings yet

- Prasenjit Fact SheetDocument3 pagesPrasenjit Fact SheetShalini SrivastavNo ratings yet

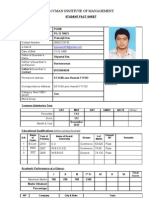

- Accman Institute of Management: Student Fact SheetDocument3 pagesAccman Institute of Management: Student Fact SheetShalini SrivastavNo ratings yet

- Banking Law ProjectDocument25 pagesBanking Law ProjectRavi Singh SolankiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAyush kumarNo ratings yet

- Ch13 (Man)Document44 pagesCh13 (Man)kevin echiverriNo ratings yet

- 1) Introduction To Management Accounting-2Document34 pages1) Introduction To Management Accounting-2fpasanfiverNo ratings yet

- List of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming ClaimsDocument23 pagesList of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming Claimsspicypoova_899586184No ratings yet

- 2023 Audit Final ExamDocument17 pages2023 Audit Final ExamrakutenmeeshoNo ratings yet

- Chapter 13 - Financial Asset at Fair ValueDocument10 pagesChapter 13 - Financial Asset at Fair ValueMark LopezNo ratings yet

- Comparative Study of India Infoline With Other Broking FirmsDocument66 pagesComparative Study of India Infoline With Other Broking FirmsSami Zama50% (2)

- Module 2 Compound Interest 2Document38 pagesModule 2 Compound Interest 2Jennilyn RiveraNo ratings yet

- Common Business Transactions Using The Rules of Debit and CreditDocument9 pagesCommon Business Transactions Using The Rules of Debit and CreditSHIERY MAE FALCONITINNo ratings yet

- Sujarwo, 2019Document10 pagesSujarwo, 2019Putu Krisna Bayu PutraNo ratings yet

- Module 14 EquityDocument17 pagesModule 14 EquityZyril RamosNo ratings yet

- A Comparative Analysis of Financial Products in Banking Industry With Special Reference To ICICI Bank and State Bank of IndiaDocument98 pagesA Comparative Analysis of Financial Products in Banking Industry With Special Reference To ICICI Bank and State Bank of IndiaWhatsapp stutsNo ratings yet

- PidiliteDocument21 pagesPidiliteMandeep BatraNo ratings yet

- Unit 7 - MoneyDocument8 pagesUnit 7 - Moneyapi-428447569No ratings yet

- EM 531 - Lecture Notes 7Document45 pagesEM 531 - Lecture Notes 7Hasan ÖzdemNo ratings yet

- Australian Financial Advice Landscape: This Is An Abridged Version of The Full Report Published in December 2019Document52 pagesAustralian Financial Advice Landscape: This Is An Abridged Version of The Full Report Published in December 2019Stuff NewsroomNo ratings yet

- Acct Statement - XX1794 - 20122023Document49 pagesAcct Statement - XX1794 - 20122023rakshit7985231877No ratings yet

- Taller 1Document9 pagesTaller 1Adriana BlasNo ratings yet

- Crossing of Cheques BLDocument27 pagesCrossing of Cheques BLVikash kumarNo ratings yet

- Adat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THDocument4 pagesAdat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THJayasankar MallisseriNo ratings yet

- Abhinay Axis Project FinalDocument97 pagesAbhinay Axis Project FinalabhinaygoenkaNo ratings yet

- Chapter 1 - Accounting For PartnershipDocument13 pagesChapter 1 - Accounting For PartnershipKim EllaNo ratings yet

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Money and Banking: Module - 11Document14 pagesMoney and Banking: Module - 11Sarthak PithoriyaNo ratings yet

- Credit Risk Literature ReviewDocument6 pagesCredit Risk Literature Reviewnelnlpvkg100% (1)

- Laporan Transaksi: Kepada Yth, Dr. Rosmelia Esther Gloria SilabanDocument21 pagesLaporan Transaksi: Kepada Yth, Dr. Rosmelia Esther Gloria SilabanRosalindaNo ratings yet

- Financial Times 20151120Document62 pagesFinancial Times 20151120stefanoNo ratings yet

- Portfolio ManagementDocument20 pagesPortfolio ManagementREHANRAJNo ratings yet