Professional Documents

Culture Documents

2007 Sro 660

Uploaded by

Haseeb JavidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007 Sro 660

Uploaded by

Haseeb JavidCopyright:

Available Formats

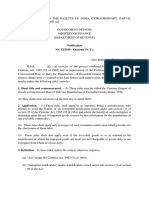

GOVERNMENT OF PAKISTAN MINISTRY OF FINANCE, ECONOMIC AFFAIRS, STATISTICS AND REVENUE (REVENUE DIVISION) *** Islamabad, the 30th

June, 2007. NOTIFICATION (SALES TAX) S.R.O. 660(I)/2007. In exercise of the powers conferred by subsection (6) and sub-section (7) of section 3 of the Sales Tax Act, 1990, read with section 71 thereof, the Federal Government is pleased to make the following rules, namely:

1.

Short title, application and commencement.(1) These rules

may be called the Sales Tax Special Procedure (Withholding) Rules, 2007. (2) They shall apply to all taxable goods and services as are supplied

by a supplier to the Government departments, autonomous bodies and public sector organizations, hereinafter referred to as withholding agents. (3) They shall come into force on the 1st day of July, 2007.

2.

Responsibility of a withholding agent. (1) The withholding

agent, intending to make purchases of taxable goods, shall indicate in an advertisement or notice for this purpose that the sales tax to the extent as provided in these rules shall be deducted from the payment to be made to the supplier. (2) A withholding agent shall deduct an amount equal to one fifth of the total sales tax shown in the sales tax invoice issued by the supplier and make payment of the balance amount to him as per illustration given below,--

ILLUSTRATION: Value of taxable supplies excluding sales Rs. 100 tax Sales tax chargeable @ 15% Rs. 15

Sales tax deductible by the withholding Rs. 3 (i.e. Rs. 15 5) agent Sales tax payable by the withholding to Rs. 12 (i.e. Rs. 15 - Rs. the supplier 3) Balance amount payable to the supplier Rs. 112 (Rs. 100 + Rs. by the withholding agent 12);

(3) All withholding agents shall make purchases of taxable goods from a person duly registered under the Sales Tax Act, 1990, provided that under unavoidable circumstances and for reasons to be recorded in writing, purchases are made from unregistered persons, the withholding agent shall deduct sales tax at 15% of the value of taxable supplies made to him from the payment due to the supplier.

(4) The sales tax so deducted shall be deposited by the withholding agent in the designated branch of National Bank of Pakistan under Head of Account B02341-Sales Tax on sales tax return-cum-payment challan in the form set out at Annexure to these rules, by 15th of the month following the month during which payment has been made to the supplier: Provided that a single return-cum-challan can be filed in respect of all purchases for which the payment has been made in a month: Provided further that in case the withholding agent, is also registered under the Sales Tax Act, 1990, with respect to the taxable supplies provided or

services rendered by him, he shall deposit the withheld amount of sales tax in the manner as provided under Chapter II of the Sales Tax Rules, 2006, along with other sales tax liability. In such case the Annexure to these rules shall be submitted to the Collector having jurisdiction.

(5) The Annexure to these rules, shall be prepared and deposited with the bank in triplicate and the bank shall send the original to the Collectorate of Sales Tax having jurisdiction, return the duplicate to the depositor and retain the triplicate for its own record.

(6) The withholding agent shall furnish to the Collector of Sales Tax having jurisdiction all such information or data as may be requested by him for carrying out the purposes of these rules.

(7) A certificate showing deduction of sales tax shall be issued to the supplier by the withholding agent duly specifying the name and registration number of supplier, description of goods and the amount of sales tax deducted.

3.

Responsibility of the supplier. (1) The supplier shall issue

sales tax invoice as stipulated in section 23 of the Sales Tax Act, 1990, in respect of every taxable supply made to a withholding agent. (2) The supplier shall file monthly return as prescribed in the Sales Tax Rules, 2006, and shall adjust total input tax against output tax under sections 7, 8 and 8B of the Sales Tax Act,1990, taking due credit of the sales tax deducted by the withholding agent, in the manner as prescribed in the return under Chapter II of the Sales Tax Rules, 2006.

4.

Responsibility of the Collector. (1) The Collector shall keep a

list of all withholding agents falling in his jurisdiction and monitor payment of tax deducted by withholding agents falling in his jurisdiction and shall also ensure that the return prescribed under these rules is filed. (2) The Collector shall ensure that the return received from the bank is

duly fed in the computerized system as referred to in clause (5AA) of section 2 of the Sales Tax Act,1990. (3) The Collector shall periodically ensure that the suppliers mentioned

in the return filed by the withholding agents, as fall under his jurisdiction, are filing returns under section 26 of the Sales Tax Act, 1990, read with Chapter II of the Sales Tax Rules, 2006, and are duly declaring the supplies made to withholding agents.

5. Exclusions.-- The provisions of these rules shall not apply to supplies and services made or rendered by the companies engaged in,-

(i) distribution of gas and electricity; and (ii) providing telephone services, including mobile phone services.

6.

Application of other provisions.-- All the provisions of the rules

and notifications made or issued under the Sales Tax Act, 1990, shall apply to supplies as aforesaid not inconsistent with the provisions of these rules.

Annex [See rule 2(4)]

Government of Pakistan Monthly Sales Tax Return for Wihtholding agents

Withholding agent's name & address Period month year

NTN / FTN

DETAIL OF SALES TAX DEDUCTED DURING THE MONTH (attach additional sheets if required) S. No. Name of supplier NTN No. of invocies Total Sales Tax charged Sales Tax deducted

TOTAL SALES TAX WITHHELD DURING THE MONTH

Verification

I, , holder of CNIC No. _________________________________ in my capacity as _____________________, certify that the information given above is/are correct, complete and in accordance with the provisions of the Sales Tax Act, 1990, and Rules and Notofications issued thereunder.

Date (dd/mm/yyyy) ____________________

Stamp __________________________________ Signature Amount

For Bank Use

______________________________________

Details of ST paid

Head of Account B02341 - Sales Tax

Amount Received (in words ___________________________________________ (in figures) ___________________________________________

____________________________

B02366 - Sales Tax on services

____________________________

Bank Officer's Signature

___________________________________________

TOTAL AMOUNT DEPOSITED

____________________________

Bank's Stamp

______________

Date dd/mm/yyyy

___________________

[C.No. 3(3)-ST-L&P/07(Pt)]

(Musarrat Jabeen) Additional Secretary

You might also like

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Sales Tax Special Withholding Rules 2010Document9 pagesSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiNo ratings yet

- WH Rules ST 1990Document8 pagesWH Rules ST 1990arslan0989No ratings yet

- 11-Withholding Rules 2012Document5 pages11-Withholding Rules 2012Imran MemonNo ratings yet

- Professional Tax RulesDocument8 pagesProfessional Tax RulesSundasNo ratings yet

- Sales Tax Special Procedure Rules 2007Document16 pagesSales Tax Special Procedure Rules 2007QamarAsheedNo ratings yet

- Chamber vs. Romulo 614 SCRA 605 2010Document17 pagesChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- CST - RULES PondicherryDocument26 pagesCST - RULES PondicherrySR CapitalsNo ratings yet

- Clause 17 Guidance NoteDocument4 pagesClause 17 Guidance NoteAditya GoyalNo ratings yet

- Bir Regulations No. 14-2003Document12 pagesBir Regulations No. 14-2003Haryeth CamsolNo ratings yet

- Assignment On VAT 23.11.2020Document12 pagesAssignment On VAT 23.11.2020Brohi ZamanNo ratings yet

- PVAT Rules, 2007 With Gazette NotificationDocument54 pagesPVAT Rules, 2007 With Gazette NotificationsaaisunilNo ratings yet

- Taxation: 4. Other Percentage TaxDocument6 pagesTaxation: 4. Other Percentage TaxMarkuNo ratings yet

- Executive Regulations of VAT Law No. (67) of 2016Document60 pagesExecutive Regulations of VAT Law No. (67) of 2016Nashwa HammamNo ratings yet

- RMC No. 8-2024Document5 pagesRMC No. 8-2024Anostasia NemusNo ratings yet

- Panasonic Vs CIRDocument7 pagesPanasonic Vs CIRMelo Ponce de LeonNo ratings yet

- Tax UpdatesDocument19 pagesTax UpdatesYeoh MaeNo ratings yet

- Vat On BanksDocument4 pagesVat On BanksRolando VasquezNo ratings yet

- Rmo 3-2009Document29 pagesRmo 3-2009sheena100% (2)

- 43677RMO 3-2009 - Suspension GroundsDocument29 pages43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjNo ratings yet

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxNo ratings yet

- CREBA Vs RomuloDocument19 pagesCREBA Vs RomuloVincent OngNo ratings yet

- Western Mindanao Power Corporation Vs Cir GR No. 181136Document15 pagesWestern Mindanao Power Corporation Vs Cir GR No. 181136Sonny MorilloNo ratings yet

- Chapter12 PRADocument6 pagesChapter12 PRAFakhar QureshiNo ratings yet

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatparulshinyNo ratings yet

- Amir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentDocument6 pagesAmir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentMehreen KhanNo ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Excise DutyDocument4 pagesExcise DutyDigvijay LakdeNo ratings yet

- Level 2 2010 MAY Vat Study Pack (2011)Document66 pagesLevel 2 2010 MAY Vat Study Pack (2011)Tawanda Tatenda HerbertNo ratings yet

- RR 16-2005Document9 pagesRR 16-2005mblopez1No ratings yet

- Provisionsof Sales Tax Actrelatingto POSIntegrationDocument4 pagesProvisionsof Sales Tax Actrelatingto POSIntegrationAbdul Basit ImtiazNo ratings yet

- Sales Tax PesentationDocument19 pagesSales Tax PesentationMukund MungalparaNo ratings yet

- BAF 306 BAF 3 - Registration and DeregistrationDocument18 pagesBAF 306 BAF 3 - Registration and Deregistrationyudamwambafula30No ratings yet

- GR 179115Document19 pagesGR 179115MelgenNo ratings yet

- Today Is Friday, September 26, 2014Document13 pagesToday Is Friday, September 26, 2014annabanana07No ratings yet

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- Income Tax Amendment Draft Bill 2016Document10 pagesIncome Tax Amendment Draft Bill 2016Muhammad KashifNo ratings yet

- Fort Bonifacio v. CIRDocument17 pagesFort Bonifacio v. CIRPaul Joshua SubaNo ratings yet

- The Micro, Small and Medium Enterprises Development Act, 2006 ("The Act") Has Been Notified and Has ReceivedDocument4 pagesThe Micro, Small and Medium Enterprises Development Act, 2006 ("The Act") Has Been Notified and Has Receivedharsh gNo ratings yet

- UntitledDocument3 pagesUntitledAkshat MehariaNo ratings yet

- 22.-CREBA, Inc. v. Romulo, G.R No. 160756Document24 pages22.-CREBA, Inc. v. Romulo, G.R No. 160756Christine Rose Bonilla LikiganNo ratings yet

- Rulings2000 DigestDocument21 pagesRulings2000 DigestArriane MartinezNo ratings yet

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Document26 pagesFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaNo ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- About VatDocument3 pagesAbout VatAnubhav SahNo ratings yet

- Creba V Exec Sec RomuloDocument18 pagesCreba V Exec Sec RomuloAnonymous qVilmbaMNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument5 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceSy HimNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- CREBA Vs Romulo DigestDocument20 pagesCREBA Vs Romulo DigestMigen SandicoNo ratings yet

- VAT Guide For VendorsDocument106 pagesVAT Guide For VendorsUrvashi KhedooNo ratings yet

- GST-603 Unit 5Document3 pagesGST-603 Unit 5GauharNo ratings yet

- Sales Tax Practice Questions With SolutionsDocument6 pagesSales Tax Practice Questions With Solutionshanif channa100% (1)

- Chamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlDocument20 pagesChamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlMark Gabriel B. MarangaNo ratings yet

- RR 13-2018Document20 pagesRR 13-2018Nikka Bianca Remulla-IcallaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- HSC Accounts Model Question Paper For Board ExamDocument7 pagesHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADER100% (2)

- 2011 Bar Exams On Commercial LawDocument33 pages2011 Bar Exams On Commercial LawCaroline LeeNo ratings yet

- Core ValuesDocument80 pagesCore ValuesAcbel Rnuco100% (1)

- Sample Real Estate Due Diligence and Closing Check ListDocument15 pagesSample Real Estate Due Diligence and Closing Check ListCrimmyShade100% (1)

- Spouses Bautista vs. Premiere Development Bank (Full Text, Word Version)Document10 pagesSpouses Bautista vs. Premiere Development Bank (Full Text, Word Version)Emir MendozaNo ratings yet

- Affidavit - Doc 0Document33 pagesAffidavit - Doc 0Cherrie Tersol TañedoNo ratings yet

- My Car Loan PDF WorksheetDocument5 pagesMy Car Loan PDF Worksheetapi-62785081No ratings yet

- Notice: Self-Regulatory Organizations Proposed Rule Changes: Software Brokers of America, Inc.Document2 pagesNotice: Self-Regulatory Organizations Proposed Rule Changes: Software Brokers of America, Inc.Justia.comNo ratings yet

- Bluman 5th - Chapter 5 HW SolnDocument8 pagesBluman 5th - Chapter 5 HW SolnKhoa VoNo ratings yet

- Object of ContractsDocument5 pagesObject of ContractsClarisseAccad100% (1)

- CH 8 - Partnership PDFDocument112 pagesCH 8 - Partnership PDFtasleemfca100% (1)

- Bad CVDocument3 pagesBad CVTalent MuparuriNo ratings yet

- 029 Uypitching v. QuiamcoDocument2 pages029 Uypitching v. QuiamcoShena Gladdys BaylonNo ratings yet

- PNB vs. CADocument7 pagesPNB vs. CANatsu DragneelNo ratings yet

- 46 Navoa vs. CA PDFDocument4 pages46 Navoa vs. CA PDFPaoloNo ratings yet

- Leverage Buyout Project2Document22 pagesLeverage Buyout Project2arnab_b87No ratings yet

- 1 10 GenMAthDocument1 page1 10 GenMAthLance Kelly P. ManlangitNo ratings yet

- 25 Review Mat 25Document11 pages25 Review Mat 25버니 모지코No ratings yet

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- 55-Garcia-vs-CA-GR No 128177Document2 pages55-Garcia-vs-CA-GR No 128177Ronald Alasa-as AtigNo ratings yet

- Bonds PayableDocument6 pagesBonds PayableZerjo Cantalejo100% (8)

- Survey of The Somali Food Industry PDFDocument177 pagesSurvey of The Somali Food Industry PDFMickael Gedion67% (3)

- NBFC in IndiaDocument23 pagesNBFC in IndiaSankar Rajan100% (4)

- Fair Value Vs Historical CostDocument6 pagesFair Value Vs Historical CostAlejandra Lugo CeballosNo ratings yet

- Lester M. Entin, Joseph Waters and Michael J. Lembo v. City of Bristol and The Bristol Redevelopment Agency, 368 F.2d 695, 2d Cir. (1966)Document11 pagesLester M. Entin, Joseph Waters and Michael J. Lembo v. City of Bristol and The Bristol Redevelopment Agency, 368 F.2d 695, 2d Cir. (1966)Scribd Government DocsNo ratings yet

- A America's Wholesale Lender, Settlement AgreementDocument3 pagesA America's Wholesale Lender, Settlement AgreementMalcolm WalkerNo ratings yet

- 59 Bank of America v. Associated BankDocument1 page59 Bank of America v. Associated BankBananaNo ratings yet

- Financial IntermediariesDocument62 pagesFinancial IntermediariesShenna Mariano100% (1)

- IfDocument23 pagesIfRukhsana RamisNo ratings yet

- Pag-Ibig NotesDocument19 pagesPag-Ibig NotesJuliah Elyz Alforja TanNo ratings yet