Professional Documents

Culture Documents

Technical Note 8

Uploaded by

deepu889Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Note 8

Uploaded by

deepu889Copyright:

Available Formats

Technical Note No.

8*

Options, Futures, and Other Derivatives, Eighth Edition

John Hull

Analytic Approximation for Valuing American Options

Consider an option on a stock providing a dividend yield equal to q. We will denote

the dierence between the American and European option price by v. Because both the

American and the European option prices satisfy the BlackScholes dierential equation,

v also does so. Hence,

v

t

+ (r q)S

v

S

+

1

2

2

S

2

2

v

S

2

= rv

For convenience, we dene

= T t

h() = 1 e

r

=

2r

2

=

2(r q)

2

We also write, without loss of generality,

v = h()g(S, h)

With appropriate substitutions and variable changes, this gives

S

2

2

g

S

2

+ S

g

S

h

g (1 h)

g

h

= 0

The approximation involves assuming that the nal term on the left-hand side is zero,

so that

S

2

2

g

S

2

+ S

g

S

h

g = 0 (1)

The ignored term is generally fairly small. When is large, 1 h is close to zero; when

is small, g/h is close to zero.

The American call and put prices at time t will be denoted by C(S, t) and P(S, t),

where S is the stock price, and the corresponding European call and put prices will be

denoted by c(S, t) and p(S, t). Equation (1) can be solved using standard techniques. After

boundary conditions have been applied, it is found that

C(S, t) =

_

_

_

c(S, t) + A

2

_

S

S

2

when S < S

S K when S S

* c Copyright John Hull. All Rights Reserved. This note may be reproduced for use in

conjunction with Options, Futures, and Other Derivatives by John Hull.

1

The variable S

is the critical price of the stock above which the option should be exercised.

It is estimated by solving the equation

S

K = c(S

, t) +

_

1 e

q(Tt)

N[d

1

(S

)]

_

S

2

iteratively. For a put option, the valuation formula is

P(S, t) =

_

_

_

p(S, t) + A

1

_

S

S

1

when S > S

K S when S S

The variable S

is the critical price of the stock below which the option should be exercised.

It is estimated by solving the equation

K S

= p(S

, t)

_

1 e

q(Tt)

N[d

1

(S

)]

_

S

1

iteratively. The other variables that have been used here are

1

=

_

( 1)

_

( 1)

2

+

4

h

_

_

2

2

=

_

( 1) +

_

( 1)

2

+

4

h

_

_

2

A

1

=

_

S

1

_

_

1 e

q(Tt)

N[d

1

(S

)]

_

A

2

=

_

S

2

_

_

1 e

q(Tt)

N[d

1

(S

)]

_

d

1

(S) =

ln(S/K) + (r q +

2

/2)(T t)

T t

Options on stock indices, currencies, and futures contracts are analogous to options on

a stock providing a constant dividend yield. Hence the quadratic approximation approach

can easily be applied to all of these types of options.

2

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nissan Note E-Power 2022 Quick Guide ENDocument57 pagesNissan Note E-Power 2022 Quick Guide ENSarita EmmanuelNo ratings yet

- En 1993 09Document160 pagesEn 1993 09Vio ChiNo ratings yet

- n4 HandoutDocument2 pagesn4 HandoutFizzerNo ratings yet

- CHASE SSE-EHD 1900-RLS LockedDocument2 pagesCHASE SSE-EHD 1900-RLS LockedMarcos RochaNo ratings yet

- Effect of Minor and Trace Elements in Cast IronDocument2 pagesEffect of Minor and Trace Elements in Cast IronsachinguptachdNo ratings yet

- AMiT Products Solutions 2022 1 En-SmallDocument60 pagesAMiT Products Solutions 2022 1 En-SmallMikhailNo ratings yet

- Drilling Jigs Italiana FerramentaDocument34 pagesDrilling Jigs Italiana FerramentaOliver Augusto Fuentes LópezNo ratings yet

- SDOF SystemsDocument87 pagesSDOF SystemsAhmet TükenNo ratings yet

- Pamphlet 89 Chlorine Scrubbing SystemsDocument36 pagesPamphlet 89 Chlorine Scrubbing Systemshfguavita100% (4)

- Storage Tanks Overfill Prevention Better PracticesDocument2 pagesStorage Tanks Overfill Prevention Better PracticesRicardo Bec100% (1)

- ISO-50001-JK-WhiteDocument24 pagesISO-50001-JK-WhiteAgustinusDwiSusantoNo ratings yet

- WSI - Catalogue of O-Ring PDFDocument37 pagesWSI - Catalogue of O-Ring PDFyearetg100% (1)

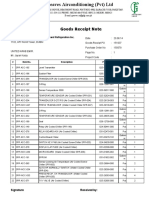

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDocument4 pagesGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanNo ratings yet

- 02 Lab 1.HCIDocument2 pages02 Lab 1.HCILopao SerojemNo ratings yet

- Engineering Geology: Wei-Min Ye, Yong-Gui Chen, Bao Chen, Qiong Wang, Ju WangDocument9 pagesEngineering Geology: Wei-Min Ye, Yong-Gui Chen, Bao Chen, Qiong Wang, Ju WangmazharNo ratings yet

- Manish Kumar: Desire To Work and Grow in The Field of MechanicalDocument4 pagesManish Kumar: Desire To Work and Grow in The Field of MechanicalMANISHNo ratings yet

- (14062020 0548) HF Uniform Logo GuidelinesDocument4 pages(14062020 0548) HF Uniform Logo GuidelinesBhargaviNo ratings yet

- Practicewith Argument Athletesas ActivistsDocument30 pagesPracticewith Argument Athletesas ActivistsRob BrantNo ratings yet

- 448 Authors of Different Chemistry BooksDocument17 pages448 Authors of Different Chemistry BooksAhmad MNo ratings yet

- Classical Theories of Economic GrowthDocument16 pagesClassical Theories of Economic GrowthLearner8494% (32)

- 00.diesel Engine Power Plant Design PDFDocument4 pages00.diesel Engine Power Plant Design PDFmardirad100% (1)

- CUIT 201 Assignment3 March2023Document2 pagesCUIT 201 Assignment3 March2023crybert zinyamaNo ratings yet

- Mba633 Road To Hell Case AnalysisDocument3 pagesMba633 Road To Hell Case AnalysisAditi VarshneyNo ratings yet

- Davis A. Acclimating Pacific White Shrimp, Litopenaeus Vannamei, To Inland, Low-Salinity WatersDocument8 pagesDavis A. Acclimating Pacific White Shrimp, Litopenaeus Vannamei, To Inland, Low-Salinity WatersAngeloNo ratings yet

- Turbine Start-Up SOPDocument17 pagesTurbine Start-Up SOPCo-gen ManagerNo ratings yet

- Analyst - Finance, John Lewis John Lewis PartnershipDocument2 pagesAnalyst - Finance, John Lewis John Lewis Partnershipsecret_1992No ratings yet

- Chemical Engineering & Processing: Process Intensi Fication: ArticleinfoDocument9 pagesChemical Engineering & Processing: Process Intensi Fication: Articleinfomiza adlinNo ratings yet

- Problems: C D y XDocument7 pagesProblems: C D y XBanana QNo ratings yet

- Lennox IcomfortTouch ManualDocument39 pagesLennox IcomfortTouch ManualMuhammid Zahid AttariNo ratings yet

- Be and Words From The List.: 6B Judging by Appearance Listening and ReadingDocument3 pagesBe and Words From The List.: 6B Judging by Appearance Listening and ReadingVale MontoyaNo ratings yet