Professional Documents

Culture Documents

Topic 1 Introduction To Financial Management

Uploaded by

Mardi UmarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 1 Introduction To Financial Management

Uploaded by

Mardi UmarCopyright:

Available Formats

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 1

Topc

1

Introduction

to Financial

Management

X

LEAkNl NC DUTCDMES

By llo ond of llis lopic, you slould bo ablo lo:

1. Differentiate between accounting and nance;

2. Explain the importance of nancial management;

3. Identify the objectives of a rm;

4. Discuss the roles of nancial managers in a rm;

5. Elaborate the characteristics, the advantages and the weaknesses of

each type of business; and

6. Discuss the challenges of nancial management in the future.

X lNTkDDUCTlDN

We always relate the word nance with money. This is because both are closely

related. For a rm or a business organisation, whatever money spent for business

purposes or production is regarded as cost. A business organisation gets prot from

its production or business activities.

A business organisation may not have sufcient funds for expenses purposes. For

example, a business rm wishes to invest but it does not have sufcient funds. A

government wants to do an infrastructure project but its funds are insufcient.

Where do the business organisation and the government get funds to pay for the

expenses? The answer lies in the existence of money market and capital market in

the eld of nance.

2 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

Another issue related to nance is the making of investment decisions. If a rm is

given several proposals for investment projects, which project will it choose?

Research regarding nance is divided into three elds, which are:

(a) Money market and capital market;

(b) Investment; and

(c) Financial management.

In this topic, we will have an overview of nancial management which involves the

differences between nance and accounting, the meaning of nancial management,

forms of business organisation and the challenge of nancial management. These

matters are important to provide a whole description to anyone who wishes to be

involved in the eld of nance.

ACTlVlTY 1.1

Based on your understanding, explain the differences between

accounting and nance.

1.1 THE DlFFEkENCE BETWEEN ACCDUNTlNC

AND FlNANCE

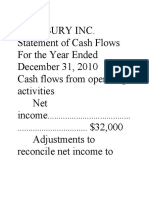

Accounting is a record-keeping system, which has been invented to reect the

nancial operation of a rm. This involves the process of identifying, measuring

and organising the information in such a way that it can be used in the process

of decision-making. This record can be used periodically to produce nancial

statements such as Balance Sheet, Income Statement and Cash Flow Statement.

These statements reect the rms standing and performance. The management,

investors and banks can use the information attained from these statements to help

them in making decisions.

Finance consists of three important aspects, which are money market and capital

market, investment and nancial management. Although accounting and nance

do not involve the same aspects, they are closely related. To have good nancial

management, a lot of accounting information is required such as nancial statement

and nancial ratio analysis. These will be reviewed in Topic 3.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 3

1.2 FlNANClAL MANACEMENT

Financial management refers to how we manage money to get maximum return

from investments. This encompasses activities such as nancial analysis, nancial

planning and capital budgeting. Financial planning and nancial management

are important for all organisations, big and small, as well as private rms and

government bodies. Good nancial planning and management will increase the

value of a rm. Hence, the important task of a nancial manager is to utilise

methods of collecting and using funds, to maximise the wealth of the rm and

uplift the standards and welfare of its workers as well as increase consumers

satisfaction.

1.3 THE DB]ECTlVES DF THE FlkM

ACTlVlTY 1.2

In your opinion, describe the main objective of a rm.

To measure whether a rm is being managed well, we will have to establish the

goals or objectives that we want to achieve so that we know which direction that we

wish to go. To make an effective nancial decision, we have to understand the goals

of a rm, that is, what are the objectives of a rm which can be used as a guide in

the decision-making process.

The objectives of a rm are shown in Figure 1.1:

Figure 1.1: The objectives of a rm

4 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

1.3.1 Maxmse Pro!t

In economic theory, the objective of a rm is to maximise prot. This objective

can be achieved by producing goods where marginal cost is the same as marginal

revenue. In practice, the objective of maximising prot is not easy to be used as a

guideline in making decisions. Lack of information in making decisions and the

condition of the environment such as changes in demand, supply and technology,

will make it difcult to make use of this objective in making the rms decisions.

Nevertheless, amongst economists, maximising prot is still regarded as the main

objective in the theory concerning the rm.

In nancial management, we need to establish the rms objective so that we

know which direction we want to go and also understand the implications of a

nancial decision based on the objective which has been underlined. In nancial

management, the main objective of a rm is to maximise the value of a company

or the wealth of its shareholders.

1.3.2 Maxmse the WeaIth o! a FrmISharehoIders

Ownership and management are two different groups in a limited company. The

company owners are shareholders who hope to get nancial returns from share

investments they own. Shareholders have the right to vote and choose a board of

directors to oversee the companys management. The management of the company

is done by a manager who is an employee of the company. Thus, managers follow

the policies which have been underlined by the shareholders. These shareholders

are the owners of the company who are interested in maximising the wealth of the

company and with that, increase its stock value. The wealth of a company can be

measured by its stock market price.

The goal of maximising the wealth of shareholders necessitates the management

of a rm to maximise the present value of a future return which is expected by

shareholders. This objective of maximising wealth is a rational objective because it

takes into account the different risks and times in terms of the acceptance of returns

and expenditure cost. Since the wealth of a shareholder is measured in terms of the

value of a stock, this objective gives a detailed performance measure.

1.3.3 Maxmse the Manager's UtIty

Since ownership and management are separated, a manager also has an additional

objective, such as maximising his or her own personal utility. As a manager who

receives salary for the job done, he or she also needs to have additional benet to

maximise his or her utility, such as better working conditions, higher prestige etc.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 5

A manager also has personal interest apart from attaining satisfactory prot for the

shareholders.

1.3.4 UpI!t the Standards and WeI!are o! Workers

Workers are important assets to a rm. To give encouragement to workers, a

company should give due emphasis to its salary scheme, additional benets and

suitable training programmes which would increase the workers skills. A rm

should give motivation to workers to increase workers productivity.

1.3.5 SocaI kesponsbIty

Although a company may have prime responsibilities to its shareholders, it cannot

neglect its workers as well as the society. As noted before, a company does not

consist of shareholders only. A company is a combination of shareholders, workers

and clients. Hence, apart from its responsibility to shareholders and workers, a

company also needs to be responsible to its clients and the society as a whole.

Social responsibility can be in the form of giving donations to welfare society

organisations, taking steps to clean and beautify the environment, etc. The purpose

of social responsibility is to enact relations between the company and society, which

will in turn increase the image of the company amongst the people.

1.3.6 Contnuous Exstence

Although a firm has several objectives, it is important that it continues to

exist. Other objectives are useless if the rm cannot continue to exist. For the

purpose of continuous existence, a rm should be able to position itself within

an environment which encompasses related issues such as competition, client,

workers, management, technology, etc.

In the study of economics, the objective of the maximisation of prot is emphasised,

whereas in the study of nance, the objective given emphasis is maximising the

wealth of the company or increasing the price of shares. In the following topics, the

objective of maximising the wealth of a company is the main objective in nancial

management and is used as a guide to make nancial decision by a nancial

manager.

6 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

1.4 THE kDLE DF THE FlNANClAL MANACEk

SELF-CHECK 1.1

Essay Question

Even though maximising the wealth of a company is the main guide in

making the rms nancial decision, there are other objectives which are

determined by the rm. List four additional objectives which can be the

objectives of a rm.

ACTlVlTY 1.3

If you were a nancial manager, explain your main responsibility to

enhance your companys nancial standing.

Finance is the cornerstone of a rm. Whether a rm can continue its business or

not is dependent on its nancial situation. Most nancial decisions are dependent

on the nancial manager. Let us take a look at some of the roles of the nancial

manager.

1.4.1 To Prepare the Frm's FnancaI PIannng

A nancial manager plays the important role of planning the rms nance because

without good nancial management, a rm may go bankrupt. In the task of

predicting and preparing the rms nancial planning, a nancial manager needs

to have information from other departments to ensure that the list of economic

probabilities which are being used by all departments are consistent and make

sense.

1.4.2 To Do FnancaI AnaIyss

All matters involving nance need to be analysed by the nancial manager to

ensure that they help to achieve the rms objective in maximising the rms

wealth.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 7

1.4.3 Advsng the Management kegardng

lnvestment and Fnancng

The management of a rm needs to make various types of decision such as the

kind of investment which needs to be done, establishing the price of a product, cost

control, types of advertisements, dividend policy, workers policy, etc. Hence, they

may not have the time to reect in detail all of these matters and their implications

to nancial decision. Besides that, in the management itself, there might be people

who are not adept in the nancial eld. Thus, the nancial manager should lessen

the burden of the management by preparing a working paper or making a report

regarding suitable types of investments which can be regarded as the best the rm

can nance, as well as suggesting a compatible price for its products which can give

a reasonable margin of prot to the rm.

In short, it can be said that the role of a nancial manager and members of his

staff are to manage and control all matters related to the nance of the rm, which

would help in achieving the objective of the rm which is maximising its wealth.

ACTlVlTY 1.4

Prepare a list of the work scope of a nancial manager.

SELF-CHECK 1.2

TRUE (T) or FALSE (F) Statements

1. Finance is the same as accounting.

2. In the study of economics, all rms have the objective of

maximising the wealth of a rm.

3. Maximising the wealth of a company can also be regarded as

increasing the price of shares.

4. The role of a nancial manager includes helping to make

decisions regarding the price of products, dividend policy and

workers policy.

X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

1.5 TYPES DF BUSlNESS DkCANlSATlDN

ACTlVlTY 1.5

Discuss the meaning of sole proprietorship, partnership and company.

There are three types of business organisations:

(a) Sole proprietorship;

(b) Partnership; and

(a) Company.

Let us take a look at each type in detail.

1.5.1 SoIe Propretorshp

A sole proprietorship is a form of business which has only one owner and it is

usually small. This type of business organisation is simple to form. The capital

resource is usually attained from the savings of its owner, or loans from friends

or banks. The proprietor owns all of its assets and also bears all of the business

liability. The liability of a sole proprietorship is unlimited this means that if the

business is in debt to others, the proprietor must sell his own personal assets such

as house, land or automobile to pay off his debts. Prot which is gained from the

business is regarded as the owners revenue and taxes are based on individual

income tax. Examples of sole proprietorship are small sundry shops, such as

businesses selling magazines and newspapers, restaurants, etc.

The advantages and disadvantages of this type of business are elaborated in

Table 1.1.

Table 1.1: The Advantages and Disadvantages of Sole Proprietorship

Advantages Disadvantages

Easy to set up. Unlimited liability.

The management is flexible. The

proprietor can manage the business

the way he sees fit.

The capital is small. Difficult to

expand because of the small capital.

Easy to control because all business

de c i s i ons a r e ma de by t he

proprietor.

The existence of a sole proprietorship

is temporary. It dissolves with the

death of the owner.

Prof i t s are t axed accordi ng t o

individual taxation.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 9

1.5.2 Partnershp

A partnership can be formed if there exist two or more partners who wish to run a

business. The agreement between partners can either be formal or informal. This

type of business is easy to form. Like sole proprietorship, a general partnership

also has an unlimited liability, that is when the business is in debt to others, all

its business partners who are the owners of the business must pay the debt with

their own personal assets such as land, house, etc. The liability obligation maybe

in the form of percentage owned by the partners concerned. Sometimes, limited

partnership may be formed as a limited partnership liability. In this type of

partnership, there must be at least a partner who is willing to be burdened with

unlimited liability. A partner with limited liability may only provide capital but he

does not manage the business.

In terms of taxes, the prots of a partnership are taxable based on individual income

tax. A partnership can be deregistered if one of the partners pulls out or passes away,

there is misunderstanding amongst the partners or the partners agree to separate.

The advantages and disadvantages of partnership are elaborated in Table 1.2.

Advantages Disadvantages

Easy to form. Unlimited liability.

There are two or more partners.

Abl e to col l ect a bi gger sum

of capi t al compared t o sol e

propri et orshi p. Part ners can

di scuss and wor k t oget her,

lessening the burden of work.

The existence of partnership is not

continuous. It can be deregistered

if one of the partners pulls out or

passes away, there are differences

amongst t he part ners or t hey

deregister the partnership.

Prof i t s are t axabl e based on

personal income tax.

1.5.3 Company

A company is a business entity which is different from its owners. Company

Act 1965 states that a company is a legal body under the law, which can own

assets, has liability obligations, has the power to sue others, as well as to be sued

by others. To form a company, registration must be done with the Registrar of

Companies. Company rules need to be followed, such as preparing a document of

Memorandum of Association and Articles of Constitution. A company can either

be formed as a private limited company or a limited company. For a private limited

Table 1.2: The Advantages and Disadvantages of Partnership

10 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

company, the number of shareholders are limited to 50 people whereas the number

of shareholders of a limited company is unlimited. A limited company can be listed

in the stock exchange if it complies with the requirements and rules of the Securities

Commission and is allowed to do so by Bursa Malaysia.

The liability of the shareholders or owners of a company are limited. If the company

experiences losses, the liability of the owners is limited to the sum of capital

invested in the company.

The shareholders have the right to vote and choose a board of directors who will

oversee the companys management. There is separation between the owners and

the management in a limited company. Company owners are shareholders but the

management of the company is done by employees who are paid by the company.

The advantages and disadvantages of the company type of business are elaborated

in Table 1.3.

Table 1.3: The Advantages and Disadvantages of the Company

Advantages Disadvantages

Limited Liability

If there are losses, the liability of

the owners or the shareholders

is limited to the sum of capital

invested in the business. This can

reduce the risk held by investors.

Transfer of Ownership

The ownership of the company is in

the form of shares and these shares

can be bought and sold with ease

especially if they are listed in the

stock exchange. Hence, transfer of

ownership is easy and this liquidity

characteristic attracts investors.

Difficult to be Form

Compared to sole proprietorship

and partnership, the formation of

a company is more complex and

difficult. A company must prepare

a Memorandum of Association

and Art i cl es of Const i t ut i on

before it can be registered with the

Registrar of Companies. This takes

a longer time and higher cost.

Double Taxation

The proceeds of the company

are taxable twice first, taxes

on the profits of the company

and secondly, taxes on dividends

received by shareholders.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 11

The Continuous Existence of the

Company

Companies may continue to function

even though a shareholder passes

away or there is transfer in the

ownership of the company. This is

different from sole proprietorship

or partnership where the death of

its owner or one of the partners will

result in the deregistration of the

business.

More Easy in Getting Capital

The advantage of limited liability

and its continuous existence as

well as easy transfer of ownership

will attract many investors and this

makes it easier for the company to

collect capital.

ACTlVlTY 1.6

List the type of business which is suitable to be run by each of the

organisations that we have discussed earlier. Give several examples and

explain why it is suitable.

1.6 THE CHALLENCE DF FlNANClAL

MANACEMENT

ACTlVlTY 1.7

State the differences between accounting and nance based on your

understanding.

12 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

As had already been discussed in the objectives of the course, financial

management is a wide and complex eld. As time moves on it has experienced

many changes and this is a challenge for nancial managers. This challenge is due

to the changes in the factors of nancial environment, like the state of the economy

in the country and outside. Apart from that, the increased usage of information

technology and globalisation have made the nancial management of rms even

more difcult.

The increasing trend towards wider usage of information technology such

as e-business needs big nancing. A lot of money is needed to buy the tools

of information technology, provide workers training, etc. All these involve

investments such as doing nancial analysis, project evaluation, as well as nding

nancial resources.

The trend towards globalisation means that rms will face greater competition.

Financial managers must ensure that all departments of a rm operate efciently

to lessen cost and are able to compete so that the business will continue operating.

ACTlVlTY 1.

Fill in the schedule given below by writing down the characteristics of a

partnership and a limited company. Discuss with your coursemates and

compare the characteristics of each rm:

Types of

Organisation/Characteristics

Sole Proprietorship Partnership Company

Number of owners One person only

Capital resource Owners savings

and loans from

friends and banks

Liability Unlimited

Taxation Based on personal

income tax

Control and management Flexible

management and

easy to control

The existence of the

business

Not continuous

Formation Easy to form

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 13

1.7 lMPDkTANT FACTS

Accounting is a record-keeping system which had been invented to reect how a

rm had been managed, whereas nance involves issues such as money market,

capital market, investment and nancial management.

Financial management refers to how we use money to gain maximum return from

investments. The activities of nancial management are:

(a) Financial analysis;

(b) Financial planning; and

(c) Capital budgeting.

The objectives of a rm are:

(a) Maximise prot;

(b) Maximise the wealth of a rm the objective of nancial management;

(c) Maximise the utility of the manager;

(d) Uplift the standards and welfare of workers;

(e) Social responsibility; and

(f) Continuous existence.

SELF-CHECK 1.3

Fill in the blanks.

1. In nancial management, the main objective of a rm is

to__________________.

2. The liability of a sole proprietor is __________whereas the liability

of a company is__________________.

3. __________________ plays an important role in the operation of

rms to ensure allocation and efcient use of nancing.

4. One of the weaknesses of a company is __________________.

5. Financial management faces many challenges because of the

increased usage of __________________ and __________________.

14 X 723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17

The role of nancial managers are:

(a) To prepare a rms nancial planning;

(b) To do nancial analysis; and

(c) To advise the management regarding the suitable types of investment for the

rm and the best method of nancing.

The forms of business organisation are:

(a) Sole proprietorship;

(b) Partnership; and

(c) Company (private limited and limited).

Challenges to nancial management exist because of:

(a) Changes to the nancial environment factors;

(b) Trends towards the increase usage of information technology; and

(c) Globalisation.

SUMMAkY

Accounting is a record-keeping system which reects how a rm had been

managed, whereas nancial management involves the technique of managing

money to gain maximum return from investments.

A rm has several objectives to help nancial managers plan the direction of

the rm and to make effective decisions.

The type of business organisation chosen has important business implications

in terms of nancial resources, liability and taxation.

There are various challenging factors to be faced by nancial managers in the

future.

If you are interested to become involved in the nancial eld, you can visit the

website www.careers-in-business.com to get information regarding careers in this

eld. Apart from that, you can also visit http://www.ykconsultancy.com/faq.

htm to gain more information regarding this topic.

723,& ,1752'8&7,2172),1$1&,$/0$1$*(0(17 W 15

Capital market

Financial management

Financial statement

Financial resources

Financial manager

Investment

You might also like

- Chapter 11: Risk ManagementDocument31 pagesChapter 11: Risk ManagementKae Abegail GarciaNo ratings yet

- Ethical Strategic Management ResponsibilitiesDocument10 pagesEthical Strategic Management ResponsibilitiesUsman BhuttaNo ratings yet

- Chapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)Document35 pagesChapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)EnciciNo ratings yet

- Risk Management ReviewerDocument7 pagesRisk Management ReviewerPhoebe WalastikNo ratings yet

- Financial Management Nature and Scope.Document36 pagesFinancial Management Nature and Scope.Kane91% (11)

- Chapter-1 Techinical AnalysisDocument90 pagesChapter-1 Techinical AnalysisRajesh Insb100% (1)

- Capital BudgetingDocument4 pagesCapital BudgetingJenny Dela Cruz100% (1)

- 07 2018 WP JOsCoS PDFDocument23 pages07 2018 WP JOsCoS PDFLoise EnglesNo ratings yet

- Chapter 2 Cost Terms, Concepts, and Classifications PDFDocument2 pagesChapter 2 Cost Terms, Concepts, and Classifications PDFsolomonaauNo ratings yet

- BCG Matrix Explained: How to Analyze Business UnitsDocument16 pagesBCG Matrix Explained: How to Analyze Business UnitsṢalāḥAd-DīnBhuttoNo ratings yet

- Chapter 17 Flashcards - QuizletDocument34 pagesChapter 17 Flashcards - QuizletAlucard77777No ratings yet

- Accredited Investor Verification Letter Individual InvestorDocument1 pageAccredited Investor Verification Letter Individual InvestorDavid StankeyNo ratings yet

- Chapter 1 FullDocument73 pagesChapter 1 FullAnjali Angel ThakurNo ratings yet

- SMEs - TOA - VALIX 2018 PDFDocument17 pagesSMEs - TOA - VALIX 2018 PDFHarvey Dienne Quiambao100% (1)

- The Role of Managerial Finance in BusinessDocument27 pagesThe Role of Managerial Finance in BusinessimrickymaeberdinNo ratings yet

- Harrison Chapter 1Document34 pagesHarrison Chapter 1Neha Sohani100% (2)

- FINANCIAL MANAGER ROLESDocument6 pagesFINANCIAL MANAGER ROLESJayson LeybaNo ratings yet

- Departmentalized Factory OverheadDocument10 pagesDepartmentalized Factory Overheadhae1234No ratings yet

- Financial ManagementDocument2 pagesFinancial Managementbakayaro92No ratings yet

- BSUNIV Accounting Practices AssessmentDocument2 pagesBSUNIV Accounting Practices AssessmentLerma Corachea MaralitNo ratings yet

- Income Tax (Module2)Document12 pagesIncome Tax (Module2)Ella Marie LopezNo ratings yet

- Human Behavior in OrganizationDocument22 pagesHuman Behavior in Organizationmirmo tokiNo ratings yet

- Notes On Responsibility AccountingDocument6 pagesNotes On Responsibility AccountingFlorie-May GarciaNo ratings yet

- M.B.A Sem I NewDocument25 pagesM.B.A Sem I NewManish PariharNo ratings yet

- Responsibility AccountingDocument3 pagesResponsibility AccountinglulughoshNo ratings yet

- 9 Chap 9 Foundation of Group BehaviourDocument23 pages9 Chap 9 Foundation of Group BehaviourMuhammad Hashim MemonNo ratings yet

- LPP - Problem Number 2Document9 pagesLPP - Problem Number 2CT SunilkumarNo ratings yet

- GRP. 1 - PersonalityDocument6 pagesGRP. 1 - Personalityhlpmefrmwthn143No ratings yet

- Accounting for Foreign Currency TransactionsDocument3 pagesAccounting for Foreign Currency TransactionsChincel G. ANINo ratings yet

- Strategic Cost Management Quick NotesDocument9 pagesStrategic Cost Management Quick NotesAlliah Mae ArbastoNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- IFRS 9 Financial Instruments - F7Document39 pagesIFRS 9 Financial Instruments - F7TD2 from Henry HarvinNo ratings yet

- Factors That Influence A Student's Intention To Sit For The CPA Exam by MartinDocument2 pagesFactors That Influence A Student's Intention To Sit For The CPA Exam by MartinHydee ValinoNo ratings yet

- Major Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"Document32 pagesMajor Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"shaurya bandil100% (2)

- Group 7 Arm ProposalDocument13 pagesGroup 7 Arm ProposalJoyce Anne MananquilNo ratings yet

- Mott MacDonald Case Study AnalysisDocument18 pagesMott MacDonald Case Study AnalysisIrah Dania MontesclarosNo ratings yet

- Humborg Activity 4Document1 pageHumborg Activity 4Frances CarpioNo ratings yet

- Quizbowl M7&M8Document54 pagesQuizbowl M7&M8Ann Christine C. ChuaNo ratings yet

- Colegio de Dagupan's Portfolio in Economic DevelopmentDocument25 pagesColegio de Dagupan's Portfolio in Economic DevelopmentMichael Linard Samiley100% (1)

- Understanding the Business Environment and Competitive StrategiesDocument10 pagesUnderstanding the Business Environment and Competitive StrategiesJedidahCuevasNo ratings yet

- Three (3) Major Decisions The Finance Manager Would TakeDocument11 pagesThree (3) Major Decisions The Finance Manager Would TakeJohn Verlie EMpsNo ratings yet

- CHAPTER I and IIDocument13 pagesCHAPTER I and IIPritz Marc Bautista MorataNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- Ob7e Ge Imchap006Document22 pagesOb7e Ge Imchap006Hemant HuzooreeNo ratings yet

- GBERMICDocument35 pagesGBERMICMarisol AunorNo ratings yet

- Seven Unidentified Philippine IndustriesDocument4 pagesSeven Unidentified Philippine Industriessi_roselynNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Financial Statement Ratio AnalysisDocument45 pagesFinancial Statement Ratio Analysisbilly100% (1)

- Cost Terminology and Cost Behaviors: Learning ObjectivesDocument17 pagesCost Terminology and Cost Behaviors: Learning ObjectivesJonnah ArriolaNo ratings yet

- 2.6 Activity Based Costing Abc Activity Based Management AbcDocument22 pages2.6 Activity Based Costing Abc Activity Based Management AbcだみNo ratings yet

- Franchise Accounting EssentialsDocument5 pagesFranchise Accounting EssentialsSunny DaeNo ratings yet

- Jollibee's Strategy Transformation for Global SuccessDocument29 pagesJollibee's Strategy Transformation for Global SuccessAngel HongNo ratings yet

- Strategic ManagementDocument12 pagesStrategic ManagementDinesh DubariyaNo ratings yet

- Purposive and Snowball Sampling: DefinitionsDocument5 pagesPurposive and Snowball Sampling: DefinitionsDodon YaminNo ratings yet

- The Issues, Challenges and Prospects of Environmental AccountingDocument53 pagesThe Issues, Challenges and Prospects of Environmental AccountingTasmiaNo ratings yet

- Lesson: 7 Cost of CapitalDocument22 pagesLesson: 7 Cost of CapitalEshaan ChadhaNo ratings yet

- PepsiCo Strategic Management AnalysisDocument25 pagesPepsiCo Strategic Management Analysismostafa elshehabyNo ratings yet

- Income Tax Part 1Document16 pagesIncome Tax Part 1mary jhoyNo ratings yet

- 603 P&CM Unit 1 Performance ManagementDocument15 pages603 P&CM Unit 1 Performance ManagementFaiyaz panchbhayaNo ratings yet

- Management of Financial Institutions - BNK604 Power Point Slides Lecture 02Document35 pagesManagement of Financial Institutions - BNK604 Power Point Slides Lecture 02suma100% (4)

- URATEXDocument6 pagesURATEXAnonymous pHkWpIRrNo ratings yet

- Activity-Financial AnalysisDocument2 pagesActivity-Financial AnalysisXienaNo ratings yet

- Module 1 Nature, Purpose, and Scope of Financial ManagementDocument11 pagesModule 1 Nature, Purpose, and Scope of Financial ManagementSofia YuNo ratings yet

- CH02Document19 pagesCH02Min WilsNo ratings yet

- Maximizing Shareholder WealthDocument4 pagesMaximizing Shareholder WealthSofia YuNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Developing a Media Relations Plan for OUM's Convocation CeremonyDocument8 pagesDeveloping a Media Relations Plan for OUM's Convocation CeremonyEleasa ZaharuddinNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document3 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document14 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document8 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- 46136Document6 pages46136Syarifah Farah0% (1)

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- 46401Document11 pages46401AimanRiddleNo ratings yet

- Management 1Document6 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document9 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document6 pagesManagement 1Mardi UmarNo ratings yet

- Soalan Assignment Hbec3603Document9 pagesSoalan Assignment Hbec3603mira shopeeNo ratings yet

- Management 1Document3 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document3 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- CRM Report Assesses Luxury Retail StrategyDocument5 pagesCRM Report Assesses Luxury Retail Strategyashraf950% (2)

- Management 1Document6 pagesManagement 1Mardi UmarNo ratings yet

- SM 2Document9 pagesSM 2Jamuna Rani100% (1)

- HBEF3103Document7 pagesHBEF3103ahdyiNo ratings yet

- Management 1Document5 pagesManagement 1Mardi UmarNo ratings yet

- 4Q2022 ExternalCodeSets v1Document266 pages4Q2022 ExternalCodeSets v1yikega7894No ratings yet

- Analisis de Cuentas HQCDocument14 pagesAnalisis de Cuentas HQCAlejandro MartínezNo ratings yet

- Aim IndiaDocument10 pagesAim Indiaapoorva100% (1)

- Tacn CK ChinhsDocument23 pagesTacn CK Chinhsholinh02092003No ratings yet

- Module4 Dividend PolicyDocument5 pagesModule4 Dividend PolicyShihad Panoor N KNo ratings yet

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- Difference Between Private Company and Public CompanyDocument7 pagesDifference Between Private Company and Public CompanyAtif KhanNo ratings yet

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- Sbi Mutual FundsDocument57 pagesSbi Mutual FundsPavan KumarNo ratings yet

- Chapter 06 IM 10th Ed-MANAJEMEN KEUANGANDocument30 pagesChapter 06 IM 10th Ed-MANAJEMEN KEUANGANRizkyAdiPoetraNo ratings yet

- IB Technicals Equity and Enterprise ValueDocument10 pagesIB Technicals Equity and Enterprise ValuexxNo ratings yet

- Dissertation 2 PDFDocument9 pagesDissertation 2 PDFanjitaNo ratings yet

- Prospectus Awazel Waterproofing Industries CompanyDocument282 pagesProspectus Awazel Waterproofing Industries Companymohammed abdelkawyNo ratings yet

- Derivatives Market Finmar ReportDocument2 pagesDerivatives Market Finmar ReportLyra Joy CalayanNo ratings yet

- Lansbury Inc cash flow analysisDocument10 pagesLansbury Inc cash flow analysis/// MASTER DOGENo ratings yet

- Corporate Finance Exam QuestionsDocument4 pagesCorporate Finance Exam QuestionsciaoNo ratings yet

- Consolidation techniques and proceduresDocument25 pagesConsolidation techniques and proceduresArisBachtiarNo ratings yet

- Branding KeywordsDocument8 pagesBranding KeywordsIvan PridorojnovNo ratings yet

- Course File HMD Quality Service Revised SecondDocument63 pagesCourse File HMD Quality Service Revised SecondRoy CabarlesNo ratings yet

- FOREX Funded Account Evaluation My Forex Funds 2Document1 pageFOREX Funded Account Evaluation My Forex Funds 2SujitKGoudarNo ratings yet

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- Fill in The Blank Sentence and TransletDocument2 pagesFill in The Blank Sentence and TransletDesta PutraNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- Cord 2013Document92 pagesCord 2013charittasNo ratings yet