Professional Documents

Culture Documents

International taxation rules and systems

Uploaded by

Ratish CdnvOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International taxation rules and systems

Uploaded by

Ratish CdnvCopyright:

Available Formats

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries or theinternational

aspects of an individual country's tax laws. Governments usually limit the scope of their income taxation in some mannerterritorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residency, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax or foreign credits are provided for taxes paid to other jurisdictions. Limits are almost universally imposed on such credits. Multinational corporations usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities. With any system of taxation, it is possible to shift or recharacterize income in a manner that reduces taxation. Jurisdictions often impose rules relating to shifting income among commonly controlled parties, often referred to as transfer pricing rules. Residency based systems are subject to taxpayer attempts to defer recognition of income through use of related parties. A few jurisdictions impose rules limiting such deferral ("anti-deferral" regimes). Deferral is also specifically authorized by some governments for particular social purposes or other grounds. Agreements among governments (treaties) often attempt to determine who should be entitled to tax what. Most tax treaties provide for at least a skeleton mechanism for resolution of disputes between the parties.

Exclusion

Many systems provide for specific exclusions from taxable (chargeable) income. For example, several countries, notably Cyprus, Luxembourg, Netherlands and Spain, have enacted holding company regimes that exclude from income dividends from certain foreign subsidiaries of corporations. These systems generally impose tax on other sorts of income, such as interest or royalties, from the same subsidiaries. They also typically have requirements for portion and time of ownership in order to qualify for exclusion. The Netherlands offers a "participation exemption" for dividends from subsidiaries of Netherlands companies. Dividends from all Dutch subsidiaries automatically qualify. For other dividends to qualify, the Dutch shareholder or affiliates must own at least 5% and the subsidiary must be subject to a certain level of income tax locally.[132] Some countries, such as the United States and Singapore,[133] allow deferment of tax on foreign income of resident corporations until it is remitted to the country.

Source of income

Determining the source of income is of critical importance in a territorial system, as source often determines whether or not the income is taxed. For example, Hong Kong does not tax residents on dividend income received from a non-Hong Kong corporation.[136] Source of income is also important in residency systems that grant credits for taxes of other jurisdictions. Such credit is often limited either by jurisdiction or to the local tax on overall income from other jurisdictions. Source of income is where the income is considered to arise under the relevant tax system. The manner of determining the source of income is generally dependent on the nature of income. Income from the performance of services (e.g., wages) is generally treated as arising where the services are performed.[137] Financing income (e.g., interest, dividends) is generally treated as arising where the user of the financing resides.[138][citation needed] Income related to use of tangible property (e.g., rents) is generally treated as arising where the property is situated.[139][citation needed] Income related to use of intangible property (e.g., royalties) is generally treated as arising where the

property is used. Gains on sale of realty are generally treated as arising where the property is situated. Gains from sale of tangible personal property are sourced differently in different jurisdictions. The U.S. treats such gains in three distinct manners: a) gain from sale of purchased inventory is sourced based on where title to the goods passes;[140] b) gain from sale of inventory produced by the person (or certain related persons) is sourced 50% based on title passage and 50% based on location of production and certain assets; [141] c) other gains are sourced based on the residence of the seller.[142] Where differing characterizations of an item of income can result in differing tax results, it is necessary to determine the characterization. Some systems have rules for resolving characterization issues, but in many cases resolution requires judicial intervention.[143] Note that some systems which allow a credit for foreign taxes source income by reference to foreign law.[144]

You might also like

- FO 1 Assignment Ankit Singh BBAP2Document12 pagesFO 1 Assignment Ankit Singh BBAP2Rahul SinghNo ratings yet

- Tax Management Assignment on Tax Evasion, Avoidance and TreatiesDocument5 pagesTax Management Assignment on Tax Evasion, Avoidance and TreatiesSaqib KhanNo ratings yet

- International TaxationDocument33 pagesInternational TaxationKaran VohraNo ratings yet

- Common Principles: MeaningDocument2 pagesCommon Principles: MeaningSumanNo ratings yet

- International TaxationDocument45 pagesInternational TaxationDavid Ioana100% (1)

- Taxpayers Taxable Income Tax Rate Corporate Tax: HistoryDocument1 pageTaxpayers Taxable Income Tax Rate Corporate Tax: HistoryManingas John PaulNo ratings yet

- International Tax EnvironmentDocument14 pagesInternational Tax EnvironmentAnonymous VstguMKrb50% (2)

- Income TaxDocument1 pageIncome TaxMeyannaNo ratings yet

- Advanced TaxDocument5 pagesAdvanced TaxWILBROAD THEOBARDNo ratings yet

- Taxpayers Taxable Income Corporate TaxDocument1 pageTaxpayers Taxable Income Corporate TaxAJ LimNo ratings yet

- Income TaxationDocument1 pageIncome Taxationno neNo ratings yet

- Dual Residence and Solution Under Treaty AgreementDocument25 pagesDual Residence and Solution Under Treaty AgreementEdwin AdriantoNo ratings yet

- Tax ProjectDocument16 pagesTax Projectpallavi21_1992No ratings yet

- Course Title: Advanced Taxation Instructor: Dr. Ahmed FDocument37 pagesCourse Title: Advanced Taxation Instructor: Dr. Ahmed FabateNo ratings yet

- Principles of Business TaxationDocument20 pagesPrinciples of Business Taxation林木田No ratings yet

- Part III International Taxation IssuesDocument36 pagesPart III International Taxation IssuesBersabehNo ratings yet

- Proiect: Limba EnglezăDocument11 pagesProiect: Limba EnglezăAdrianaMarcuNo ratings yet

- Tax Treaty: Department of Finance and Accounting G: 01Document5 pagesTax Treaty: Department of Finance and Accounting G: 01Ismail AbderrahimNo ratings yet

- Rubel Final Corporate Taxation in BDDocument8 pagesRubel Final Corporate Taxation in BDskn092No ratings yet

- Law On Income TaxDocument10 pagesLaw On Income TaxJuliever EncarnacionNo ratings yet

- Income TaxDocument31 pagesIncome TaxPriyanka BhojaneNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectSagar DhanakNo ratings yet

- Tax - Wikipedia 111Document190 pagesTax - Wikipedia 111kidundarhNo ratings yet

- Taxation and Fiscal Policy: First Semester 2020/2021Document33 pagesTaxation and Fiscal Policy: First Semester 2020/2021emeraldNo ratings yet

- 'Indirect Tax': Another WordDocument6 pages'Indirect Tax': Another WordJoy Prokash RoyNo ratings yet

- International Double Taxation AgreementsDocument3 pagesInternational Double Taxation AgreementsMary Algen Guiang-BondalNo ratings yet

- Accounts: Assets Owned by A Business or Liabilities Owed by A Business. It Is AlsoDocument9 pagesAccounts: Assets Owned by A Business or Liabilities Owed by A Business. It Is AlsoIfa PeelayNo ratings yet

- Lecture 11 - INTERNATIONAL TAXATIONDocument34 pagesLecture 11 - INTERNATIONAL TAXATIONStephen ArkohNo ratings yet

- DoubleDocument9 pagesDoubleEmmanuel Amarfio MensahNo ratings yet

- Taxation Under CommonwealthDocument1 pageTaxation Under CommonwealthJonathan Ludovice MirandaNo ratings yet

- Romania and International Double Taxation: Radu Buziernescu, Mihai AntonescuDocument10 pagesRomania and International Double Taxation: Radu Buziernescu, Mihai AntonescukrissbosNo ratings yet

- Chapter 6 - Income TaxDocument12 pagesChapter 6 - Income TaxlovelyrichNo ratings yet

- CRP11 Introduction 2011.PDF Double TaxationDocument18 pagesCRP11 Introduction 2011.PDF Double TaxationLakshjit KapurNo ratings yet

- Revenue and Regulatory TaxDocument11 pagesRevenue and Regulatory TaxLaoMario100% (1)

- Gross Income: Inclusions: Reference Materials: IRS Publication 17-Your Federal Income Tax (2006)Document20 pagesGross Income: Inclusions: Reference Materials: IRS Publication 17-Your Federal Income Tax (2006)sacha_babaoNo ratings yet

- SSRN-id 471321Document10 pagesSSRN-id 471321nalaNo ratings yet

- Latin Legal Entity Direct Indirect TaxesDocument1 pageLatin Legal Entity Direct Indirect TaxesJejeNo ratings yet

- International Taxation & Transfer PricinglDocument84 pagesInternational Taxation & Transfer Pricinglnaveen pachisiaNo ratings yet

- TaxationDocument20 pagesTaxationBernard OkpeNo ratings yet

- Chapter No.-1 Meaning of Tax: OverviewDocument28 pagesChapter No.-1 Meaning of Tax: OverviewAnonymous 3W3153sx4ONo ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- Flat Tax - Wikipedia, The Free EncyclopediaDocument16 pagesFlat Tax - Wikipedia, The Free EncyclopediahlkhlkhlhkhkhkljhvvvNo ratings yet

- Chapter 4 Income Tax. PRT 1Document38 pagesChapter 4 Income Tax. PRT 1Girlie Kaye Onongen PagtamaNo ratings yet

- Income Taxes Asset Capital Taxes Financial Transaction Sales TaxesDocument1 pageIncome Taxes Asset Capital Taxes Financial Transaction Sales TaxesJejeNo ratings yet

- Chapter Three: International Taxation IssuesDocument39 pagesChapter Three: International Taxation Issuesembiale ayaluNo ratings yet

- Joint Ventures and Tax Considerations - Uganda - Global Law Firm - Norton Rose FulbrightDocument4 pagesJoint Ventures and Tax Considerations - Uganda - Global Law Firm - Norton Rose FulbrightGRAFERNo ratings yet

- Week-4 English 2 PA4 (1)Document1 pageWeek-4 English 2 PA4 (1)armin365452No ratings yet

- Week-4 English 2 PA4Document1 pageWeek-4 English 2 PA4armin365452No ratings yet

- TaxationDocument21 pagesTaxationmsjan019100% (1)

- International Taxation: Mcgraw-Hill/Irwin Rights ReservedDocument33 pagesInternational Taxation: Mcgraw-Hill/Irwin Rights ReservedChuckNo ratings yet

- Corporate Tax StudyDocument3 pagesCorporate Tax StudyTaha MerchantNo ratings yet

- Effective Tax ManagementDocument19 pagesEffective Tax ManagementMary Kathe Rachel ReyesNo ratings yet

- International TaxationDocument10 pagesInternational Taxationsuyash dugarNo ratings yet

- Tax HavenDocument16 pagesTax HavenAbdellahBouzelmadNo ratings yet

- CFC, FSC and Tax HavensDocument14 pagesCFC, FSC and Tax Havensdigvijay bansalNo ratings yet

- TERRITORIAL VS. WORLDWIDE TAX SYSTEMS p130424003Document11 pagesTERRITORIAL VS. WORLDWIDE TAX SYSTEMS p130424003alanqNo ratings yet

- Latin Legal Entity State Direct Indirect TaxesDocument1 pageLatin Legal Entity State Direct Indirect Taxessanchit001No ratings yet

- New Tax Model Answer PaperDocument43 pagesNew Tax Model Answer PaperPraveen B SNo ratings yet

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.From EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.No ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- About Us: Confidentiality, Consistency, Correct Advise and Cumulative Growth, Bears The Top Priority inDocument2 pagesAbout Us: Confidentiality, Consistency, Correct Advise and Cumulative Growth, Bears The Top Priority inRatish CdnvNo ratings yet

- Global Factors in BusinessDocument12 pagesGlobal Factors in BusinesssingharvindkumarNo ratings yet

- Competitor analysis matrixDocument6 pagesCompetitor analysis matrixRatish Cdnv100% (1)

- Capital market reforms and liberalization trendsDocument2 pagesCapital market reforms and liberalization trendsRatish CdnvNo ratings yet

- About HmilDocument1 pageAbout HmilRatish CdnvNo ratings yet

- About HmilDocument1 pageAbout HmilRatish CdnvNo ratings yet

- Automobile IndustryDocument44 pagesAutomobile IndustryRatish CdnvNo ratings yet

- Volatility ProjectDocument29 pagesVolatility ProjectRatish CdnvNo ratings yet

- An Analysis of Market Efficiency in Sectoral Indices: A Study With A Special Reference To Bombay Stock Exchange in IndiaDocument8 pagesAn Analysis of Market Efficiency in Sectoral Indices: A Study With A Special Reference To Bombay Stock Exchange in IndiaRatish CdnvNo ratings yet

- Case StudyDocument3 pagesCase StudyRatish CdnvNo ratings yet

- PEST analysis market toolDocument11 pagesPEST analysis market toolRatish CdnvNo ratings yet

- Canonical AnalysisDocument36 pagesCanonical AnalysisRatish CdnvNo ratings yet

- Karnataka Police Establishment BoardDocument64 pagesKarnataka Police Establishment BoardxfilesindiaNo ratings yet

- EO 292 Introductory ProvisionsDocument3 pagesEO 292 Introductory ProvisionsAries Palao AustriaNo ratings yet

- Cheat Sheet Strategy Exam MiguelDocument2 pagesCheat Sheet Strategy Exam MiguelMiguel GarçãoNo ratings yet

- Corporation Law Doctrines Atty BusmenteDocument6 pagesCorporation Law Doctrines Atty BusmenteKringle Lim - Dansal100% (1)

- Employers - Confirmation Letter 2015Document3 pagesEmployers - Confirmation Letter 2015East Can DarrNo ratings yet

- Resume Mondala JonathanDocument5 pagesResume Mondala JonathanJonas MondalaNo ratings yet

- RSM100 Final Exam NotesDocument65 pagesRSM100 Final Exam Noteshugocheung7No ratings yet

- History and Evolution ITCDocument53 pagesHistory and Evolution ITCBhargavi RekalaNo ratings yet

- Vietnam Market Entry 2016Document16 pagesVietnam Market Entry 2016friend_foru2121No ratings yet

- JetBlue IPO ReportDocument12 pagesJetBlue IPO ReportMuyeedulIslamNo ratings yet

- MPBFDocument6 pagesMPBFhiteshgauranaNo ratings yet

- Spaeth 99Document7 pagesSpaeth 99SofiaKobalevaNo ratings yet

- ElectroluxDocument3 pagesElectroluxRupeet Singh100% (1)

- KYC ApplForm PDocument2 pagesKYC ApplForm PShoaib MirzaNo ratings yet

- ICICI Bank FE West India Online AuctionDocument15 pagesICICI Bank FE West India Online AuctionAnonymous rtDlncdNo ratings yet

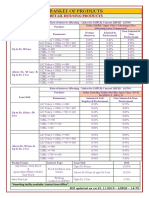

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- PSBA A.R. Handout SolvedDocument13 pagesPSBA A.R. Handout SolvedMikka100% (2)

- Internship Report On: "Telesales Department of Banglalink"Document74 pagesInternship Report On: "Telesales Department of Banglalink"Farjana Islam MouNo ratings yet

- TGTGGDocument44 pagesTGTGGNidhi JalanNo ratings yet

- AFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiDocument3 pagesAFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiOtilia BîlbîieNo ratings yet

- FLI 2010 Annual Report Provides Details on Festival Supermall, PBCom Tower, and Northgate CyberzoneDocument129 pagesFLI 2010 Annual Report Provides Details on Festival Supermall, PBCom Tower, and Northgate Cyberzonechloe_lopezNo ratings yet

- Abdul Rahman 2006Document31 pagesAbdul Rahman 2006irmaNo ratings yet

- Bulk SalesDocument2 pagesBulk SalesCris AnonuevoNo ratings yet

- ChennaiDocument28 pagesChennaiPrabhu Ta100% (1)

- United Parcel ServiceDocument16 pagesUnited Parcel ServiceDevin Fortranansi Firdaus0% (1)

- SANWDocument8 pagesSANWZack SchulerNo ratings yet

- Fiat Case StudyDocument10 pagesFiat Case StudyVipra PandeyNo ratings yet

- 42 - Cease Vs CA 93 Scra 483Document21 pages42 - Cease Vs CA 93 Scra 483Anonymous hbUJnBNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Nikon Coolpix P7700 - REVIEWDocument11 pagesNikon Coolpix P7700 - REVIEWSubroto MukerjiNo ratings yet