Professional Documents

Culture Documents

Workbook On Ratio Analysis

Uploaded by

Zahid HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workbook On Ratio Analysis

Uploaded by

Zahid HassanCopyright:

Available Formats

1

TYPES OF RATIO

There are a number of types of ratios of interest to the various stakeholders of a business. The main classifications of ratios are as follows: 1. Profitability Ratios: Measure the relationship between gross/net profit and sales, assets and capital employed. These are sometimes referred to as being performance ratios. These measure how efficiently an organisation uses its resources. These are sometimes referred to as asset utilisation ratios. These investigate the short-term and long-term financial stability of the firm by examining the relationships between assets and liabilities. These are sometimes also called solvency ratios. This group of ratios is concerned with analysing the returns for shareholders. These examine the relationship between the numbers of shares issued, dividend paid, value of the shares, and company profits. For obvious reasons these are quite often categorised as shareholder ratios. This ratio examines the relationship between internal sources and external sources of finance. It is therefore concerned with the long-term financial position of the company.

2. Activity Ratios:

3. Liquidity Ratios:

4. Investment Ratios:

5. Gearing Ratio:

1. PROFITABILITY RATIOS:

For most private business enterprises one of their main objectives is to make a profit. However, it is not sufficient just to measure the amount of profit made.

(a) Gross Profit Margin:

This ratio examines the relationship between the profits made on trading activities only (gross profit) against the level of turnover/sales made. It is given by the formula Gross Profit Margin = gross profit x 100 Turnover (sales) expressed as a percentage

A2 Business Studies - Finance & Accounts

Ratio Analysis Workbook

Interpretation: Obviously the higher the profit margin a business makes the better. However, the level of gross profit margin made will vary considerably between different markets. For example the amount of gross profit percentage put on clothes, (especially fashion items), is far higher than that put on food items. So any result gained must be looked at in the context of the industry in which the firm operates.

(b) Net Profit Margin:

As opposed to gross profit margin this ratio measures the relationship between the net profit (profit made after all other expenses have been deducted) and the level of turnover or sales made. It is given by the formula: Net Profit Margin = net profit x 100 Turnover (sales) expressed as a percentage

Interpretation: As with gross profit, a higher percentage result is preferred. This is used to establish whether the firm has been efficient in controlling its expenses. It should be compared with previous years results and with other companies in the same industry to judge relative efficiency. The net profit margin should also be compared with the gross profit margin. For if the gross profit margin has improved but the net profit margin declined, this shows that profits made on trading are becoming better, however the expenses incurred in the running of the business are also increasing but at a faster rate than profits. Thus efficiency is declining.

(c) Return on Capital Employed (ROCE):

This is sometimes referred to as being the primary ratio and is considered to be one of the most important ratios available. This ratio measures the efficiency of funds invested in the business at generating profits. This ratio is actually different for different types of business; this is due to the fact that the various types of business can all raise their capital in different ways. ROCE = net profit before tax and interest x 100 total capital employed

Once again this is expressed as a percentage. Total Capital = ordinary share capital + preference share capital + Reserves + Debentures +Long-term loans For each type of company the idea is to try to determine how much profit has been made for distribution from the total amount of assets employed by that business. This is why we ignore tax and interest charges when calculating ROCE for a limited company. These items will fluctuate at the whim of agencies such as the government and the Bank of England. Therefore if we were to measure profit after tax and interest we would get significant variations in our results. These would not reflect changes in the performance of the business, but external factors.

A2 Business Studies - Finance & Accounts Ratio Analysis Workbook

Interpretation: As with the other ratios examined so far the higher the value of the ratio the better. A higher percentage can provide owners with a greater return. Inevitably this figure needs to be compared with previous years and other companies to determine whether this years result is satisfactory or not. Furthermore, the percentage result arrived at for ROCE for a given organisation needs to be compared with the percentage return offered by interest-bearing accounts at banks and building societies. Ideally the ROCE should be higher than any return that could be gained from interest-earning accounts.

2. ACTIVITY RATIOS:

Activity ratios or financial efficiency ratios are concerned with how well an organisation manages its resources. Primarily they investigate how well the management controls the current situation of the firm. They consider stock, debtors and creditors. This area of ratios is linked therefore with the management of working capital.

(a) Stock Turnover

This ratio measures the number of times in one year that a business turns over its stock of goods for sale. From this figure we can also establish the average length of time (in days) that stock is held by the company. It is given by the formula Stock Turnover times = cost of goods sold average stock where average stock = (opening stock + closing stock) 2 Interpretation: This ratio can only really be interpreted with knowledge of the industry in which the firm operates. For example, we would expect a greengrocer to turnover his or her stock virtually every day, as their goods have to be fresh. Therefore, we would expect to see a result for stock turnover of approximately 250 to 300 times per year. This allows for closures and holidays and the fact that some produce will last longer than one day. Conversely if we were examining the accounts of a second hand car sales business we would maybe expect them to turn over their entire stock of cars and replace with new ones maybe about once a month, therefore we would see a result of 12 times. As usual we can undertake a comparison with previous years or other similar sized firms in the same market. As a general rule though the higher the rate of stock turnover the better. It is possible to convert this ratio from showing the number of times an organisation turns over stock to showing the average number of days stock is held. It is given by the formula: Stock Turnover = average stock x 365 expressed as days

Ratio Analysis Workbook

expressed as however many

A2 Business Studies - Finance & Accounts

cost of goods sold It is also possible to express stock turnover in terms of weeks or months, by multiplying by 52 or 12 as appropriate.

(b) Debtors Collection Period:

This particular ratio is designed to show how long, on average, it takes the company to collect debts owed by customers. Customers who are granted credit are called debtors. The formula for this ratio is Debtor collection period = debtors x 365 expressed as days Credit sales

Often the figure for credit sales is not actually provided on the profit and loss account. In this case the sales/turnover figure should be substituted and used instead. Interpretation: Different industries allow different amounts of time for debtors to settle invoices. Standard credit terms are usually for 30, 60, 90 and 120 days. The debt collection period figure should therefore be compared against the official number of days the organisation allows for settlement. For this ratio the shorter the debt collection period the better.

(c) Asset turnover:

This ratio measures a businesss sales in relation to the assets it uses to generate these sales. The formula to calculate this ratio is Asset turnover = sales net assets

This formula measures the efficiency with which businesses use their assets. An increasing ratio over time generally indicates that the firm is operating with greater efficiency. A fall in the ratio can be caused by a decline in sales or an increase in assets employed. Interpretation: The results of asset turnover ratios vary enormously. A supermarket may have a high figure as it has relatively few assets in relation to sales. A shipbuilding firm is likely to have a much lower ratio because it requires many more assets.

A2 Business Studies - Finance & Accounts

Ratio Analysis Workbook

3. LIQUIDITY RATIOS:

These ratios are concerned with the examination of the financial stability of the organisation. They are mainly concerned with the organisations working capital and whether or not it is being managed effectively. Working capital is needed by all organisations in order for them to be able to finance their day-to-day activities. Too little and the company may not be able to pay all its debts. Too much and they may not be making most efficient use of their resources.

(a)

The Acid Test:

This ratio is sometimes also called the quick ratio or even the liquid ratio. It examines the businesss liquidity position by comparing current assets and liabilities but it omits stock from the total of current assets. The reason for this is stock is the most illiquid current asset, i.e. it is the hardest to turn into cash without a loss in its value. With the omission of stock therefore we are able to perform a calculation that directly relates cash and near cash equivalents, (cash, bank and debtors) to short-term debts. This therefore provides a much more accurate measure of the firms liquidity. It is given by the formula Acid Test = current assets stock: current liabilities

Interpretation: Again conventional wisdom states that an ideal result for this ratio should be approximately 1.1:1 Thus showing that the organisation has 1.10 to pay every 1.00 of debt. Therefore the company can pay all its debts and has a ten- percent safety margin as well. A result below this e.g. 0.8:1 indicates that the firm may well have difficulties meeting short-term payments.

4. GEARING RATIO:

Gearing is quite often included in the classification of liquidity ratios as this ratio focuses on the longterm financial stability of an organisation. It measures the proportion of capital employed by the business that is provided by long-term lenders as against the proportion that has been invested by the owners. Thus, we can see how much of an organisation has been financed by debt. It is given by the formula: Gearing = long term liabilities + preference shares x 100 total capital employed

Once again this is expressed as a percentage.

Total Capital = ordinary share capital + preference share capital + Reserves + Debentures + Long-term loans Long term liabilities = Long-term loans + debentures

Interpretation: The gearing ratio shows how risky an investment a company is. If loans represent more than 50% of capital employed, the company is highly geared.

A2 Business Studies - Finance & Accounts Ratio Analysis Workbook

Such a company has to pay interest on its borrowings before it can pay dividends to shareholders or retain profits for reinvestment. High gearing figures indicate a high degree of risk. As ordinary shareholders should enjoy a greater rate of return from lower geared companies. Low geared companies i.e. those under 50% should provide therefore a lower risk investment opportunity, they should also be able to negotiate loans much more easily than a highly geared company as they are not already carrying a high proportion of debt.

5. INVESTMENT RATIOS:

Shareholders and potential shareholders are primarily concerned with assessing the level of return they might gain from an investment in a particular company. These ratios are necessary as the value of shares can vary quite considerably.

(a)

Dividend Per Share (DPS):

This is an important shareholders ratio. It simply the total dividend declared by a company divided by the number of shares the business has issued. Dividend per share = total dividends number of issued shares Results of this ratio are expressed as a number of pence per share. Interpretation: A higher figure is generally preferable to a lower one as this provides the shareholder with a larger return on his or her investment. However, some shareholders are looking for long-term investments and may prefer to have a lower DPS now in the hope of greater returns in the future and a rising share price.

(b)

Dividend yield

This is the dividend per share (for the entire year) expressed as a percentage of the market price of the share. Dividend yield = dividend per share x 100 market share price

Results for this ratio can fluctuate regularly even daily as they depend upon the firms share price. A rising share price will cause the dividend yield to fall. This ratio is most valuable to investors relying upon an annual income from the purchases of shares. Interpretation: This ratio is expressed as a percentage. Obviously higher percentages are preferred. The current rates of interest paid on savings accounts provide a useful comparison, although the latter carry no risk (of capital loss). Hence many investors would expect dividend yield to exceed the current rate of interest.

A2 Business Studies - Finance & Accounts

Ratio Analysis Workbook

Liquidity Analysis Ratios Current Ratio Current Ratio = Quick Ratio Quick Ratio = Quick Assets ---------------------Current Liabilities Current Assets -----------------------Current Liabilities

Quick Assets = Current Assets - Inventories Net Working Capital Ratio Net Working Capital Ratio = Net Working Capital -------------------------Total Assets

Net Working Capital = Current Assets - Current Liabilities Profitability Analysis Ratios Return on Assets (ROA) Return on Assets (ROA) = Net Income ---------------------------------Average Total Assets

Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Return on Equity (ROE) Return on Equity (ROE) = Net Income -------------------------------------------Average Stockholders' Equity

Average Stockholders' Equity = (Beginning Stockholders' Equity + Ending Stockholders' Equity) / 2 Return on Common Equity (ROCE) Return on Common Equity (ROCE) = Net Income -------------------------------------------Average Common Stockholders' Equity

Average Common Stockholders' Equity = (Beginning Common Stockholders' Equity + Ending Common Stockholders' Equity) / 2 Profit Margin Net Income

A2 Business Studies - Finance & Accounts Ratio Analysis Workbook

Profit Margin =

----------------Sales

Earnings Per Share (EPS) Earnings Per Share (EPS) = Net Income --------------------------------------------Number of Common Shares Outstanding

Activity Analysis Ratios Assets Turnover Ratio Assets Turnover Ratio = Sales ---------------------------Average Total Assets

Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Accounts Receivable Turnover Ratio Accounts Receivable Turnover Ratio = Sales ----------------------------------Average Accounts Receivable

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2 Inventory Turnover Ratio Inventory Turnover Ratio = Cost of Goods Sold --------------------------Average Inventories

Average Inventories = (Beginning Inventories + Ending Inventories) / 2

Capital Structure Analysis Ratios Debt to Equity Ratio Debt to Equity Ratio = Total Liabilities ---------------------------------Total Stockholders' Equity

Interest Coverage Ratio Interest Coverage Ratio = Income Before Interest and Income Tax Expenses ------------------------------------------------------Interest Expense

Income Before Interest and Income Tax Expenses

A2 Business Studies - Finance & Accounts Ratio Analysis Workbook

= Income Before Income Taxes + Interest Expense

Capital Market Analysis Ratios Price Earnings (PE) Ratio Price Earnings (PE) Ratio = Market Price of Common Stock Per Share -----------------------------------------------------Earnings Per Share

Market to Book Ratio Market to Book Ratio = Market Price of Common Stock Per Share ------------------------------------------------------Book Value of Equity Per Common Share

Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Yield Dividend Yield = Annual Dividends Per Common Share -----------------------------------------------Market Price of Common Stock Per Share

Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Payout Ratio Dividend Payout Ratio = Cash Dividends -------------------Net Income

ROA = Profit Margin X Assets Turnover Ratio ROA = Profit Margin X Assets Turnover Ratio Net Income Net Income ROA = ------------------------ = -------------- X Average Total Assets Sales Profit Margin = Net Income / Sales Assets Turnover Ratio = Sales / Averages Total Assets Sales -----------------------Average Total Assets

A2 Business Studies - Finance & Accounts

Ratio Analysis Workbook

You might also like

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Accounting Problem Solving QuestionsDocument24 pagesAccounting Problem Solving QuestionsForTheLoveOfFitnessNo ratings yet

- FCFEDocument7 pagesFCFEbang bebetNo ratings yet

- 4-Time Value of MoneyDocument35 pages4-Time Value of Moneysherif_awad100% (1)

- Discounted Cash Flow ApplicationsDocument27 pagesDiscounted Cash Flow ApplicationsAvinash DasNo ratings yet

- Ratio Analysis of RCF LTDDocument46 pagesRatio Analysis of RCF LTDAnil KoliNo ratings yet

- 09 KRM Om10 Tif ch07Document53 pages09 KRM Om10 Tif ch07Anonymous L7XrxpeI1zNo ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- EXERCISE - Calculating The Internal Rate of ReturnDocument5 pagesEXERCISE - Calculating The Internal Rate of ReturnNipun BajajNo ratings yet

- Pre-Money Valuation: Multiple ApproachDocument16 pagesPre-Money Valuation: Multiple ApproachDavid ChikhladzeNo ratings yet

- Auditing CA Final Investigation and Due DiligenceDocument26 pagesAuditing CA Final Investigation and Due Diligencevarunmonga90No ratings yet

- Risk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsDocument104 pagesRisk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsSagorNo ratings yet

- Aicpa Accounting GlossaryDocument24 pagesAicpa Accounting GlossaryRafael AlemanNo ratings yet

- L8 Raising CapitalDocument26 pagesL8 Raising CapitalKranthi ManthriNo ratings yet

- Introduction To Financial ManagemntDocument29 pagesIntroduction To Financial ManagemntibsNo ratings yet

- Assignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanDocument6 pagesAssignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanFAIQ KHALIDNo ratings yet

- Valuing Private Companies:: Factors and Approaches To ConsiderDocument35 pagesValuing Private Companies:: Factors and Approaches To ConsiderAvinash DasNo ratings yet

- Cost of Capital ExplainedDocument18 pagesCost of Capital ExplainedzewdieNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Pestle Analysis - Alesh and GroupDocument18 pagesPestle Analysis - Alesh and GroupJay KapoorNo ratings yet

- Portfolio Selection Using Sharpe, Treynor & Jensen Performance IndexDocument15 pagesPortfolio Selection Using Sharpe, Treynor & Jensen Performance Indexktkalai selviNo ratings yet

- Chapter 06 - Risk & ReturnDocument42 pagesChapter 06 - Risk & Returnmnr81No ratings yet

- Sources of FinanceDocument32 pagesSources of FinanceDeepshikha Gupta100% (1)

- Entrepreneurship ExamDocument24 pagesEntrepreneurship ExamzyleahlsNo ratings yet

- Test 3 Project Finance Case Question Yogesh GandhiDocument14 pagesTest 3 Project Finance Case Question Yogesh GandhiYogi GandhiNo ratings yet

- Mini Case On Risk Return 1-SolutionDocument27 pagesMini Case On Risk Return 1-Solutionjagrutic_09No ratings yet

- Investor Behaviour and Factors Influencing DecisionsDocument44 pagesInvestor Behaviour and Factors Influencing DecisionsSajoy P.B.100% (1)

- Nestle Report AnalysisDocument3 pagesNestle Report AnalysisAkshatAgarwalNo ratings yet

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- Financial Planning and Forecasting GuideDocument35 pagesFinancial Planning and Forecasting GuideSaidarshan RevandkarNo ratings yet

- Fundamentals of Corporate Finance Chap 001Document18 pagesFundamentals of Corporate Finance Chap 001tyremiNo ratings yet

- Capital Budgeting ReportDocument29 pagesCapital Budgeting ReportJermaine Carreon100% (1)

- Investment &financial Analysis AssignmentDocument5 pagesInvestment &financial Analysis AssignmentfionatuNo ratings yet

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDocument27 pagesRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNo ratings yet

- Bank Ratio Analysis v.2Document30 pagesBank Ratio Analysis v.2moe.jee6173100% (1)

- Pricing Strategy and ManagementDocument15 pagesPricing Strategy and Managementadibhai06No ratings yet

- The Time Value of MoneyDocument66 pagesThe Time Value of MoneyrachealllNo ratings yet

- CH - 4 - Time Value of MoneyDocument49 pagesCH - 4 - Time Value of Moneyak sNo ratings yet

- Capital StructureDocument6 pagesCapital StructureHasan Zahoor100% (1)

- Actuaries 4Document69 pagesActuaries 4MuradNo ratings yet

- NPVDocument11 pagesNPVMaNi Rajpoot100% (1)

- Risk and ReturnDocument70 pagesRisk and Returnmiss_hazel85No ratings yet

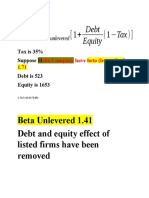

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- Sensitivity AnalysisDocument13 pagesSensitivity Analysisrastogi paragNo ratings yet

- Risk Analysis in Capital BudgetingDocument18 pagesRisk Analysis in Capital BudgetingKushagra RaghavNo ratings yet

- Capital Budgeting Cash FlowsDocument13 pagesCapital Budgeting Cash FlowsNagaeshwary Murugan100% (1)

- Ratio Analysis: R K MohantyDocument30 pagesRatio Analysis: R K Mohantybgowda_erp1438No ratings yet

- Chap 2 Financial Analysis & PlanningDocument108 pagesChap 2 Financial Analysis & PlanningmedrekNo ratings yet

- Investor Guide BookDocument169 pagesInvestor Guide BooktonyvinayakNo ratings yet

- Challenges in Forecasting Exchange Rates by Multinational Corporations Ms 12may2016Document22 pagesChallenges in Forecasting Exchange Rates by Multinational Corporations Ms 12may2016dr Milorad Stamenovic100% (3)

- Calculate Capital Budgeting Payback Period & ARRDocument83 pagesCalculate Capital Budgeting Payback Period & ARRAashutosh MishraNo ratings yet

- Capital Budgeting - SolutionsDocument16 pagesCapital Budgeting - SolutionsDoula IshamNo ratings yet

- Unit 2 Capital StructureDocument27 pagesUnit 2 Capital StructureNeha RastogiNo ratings yet

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To Selected End-Of-Chapter Questionsfeitheart_rukaNo ratings yet

- Financial Ratio MBA Complete ChapterDocument19 pagesFinancial Ratio MBA Complete ChapterDhruv100% (1)

- Analyze financial ratios to evaluate FM222 courseDocument60 pagesAnalyze financial ratios to evaluate FM222 courseLai Alvarez100% (1)

- Chap 6 (Fix)Document13 pagesChap 6 (Fix)Le TanNo ratings yet

- FINANCIAL RATIO ANALYSISDocument25 pagesFINANCIAL RATIO ANALYSISWong Siu CheongNo ratings yet

- Determing The Factors of Industrial RelationsDocument2 pagesDeterming The Factors of Industrial RelationsZahid HassanNo ratings yet

- Ed Module 2Document4 pagesEd Module 2Zahid HassanNo ratings yet

- Flow ChartDocument1 pageFlow ChartZahid HassanNo ratings yet

- Should Euthalesia (Mercy Killing) Be LegalisedDocument3 pagesShould Euthalesia (Mercy Killing) Be LegalisedZahid HassanNo ratings yet

- Statistical Presentation Tools Descriptive StatisticsDocument3 pagesStatistical Presentation Tools Descriptive StatisticsZahid HassanNo ratings yet

- Module 2 LearningDocument27 pagesModule 2 LearningZahid HassanNo ratings yet

- Customer-Defined Service Standards: Presented by IsmailayazruknuddinDocument18 pagesCustomer-Defined Service Standards: Presented by IsmailayazruknuddinZahid HassanNo ratings yet

- POM Module 4Document1 pagePOM Module 4Zahid HassanNo ratings yet

- HistoryDocument6 pagesHistoryZahid HassanNo ratings yet

- GKDocument1 pageGKZahid HassanNo ratings yet

- Chess RulesDocument8 pagesChess RulesZahid HassanNo ratings yet

- Fund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Document31 pagesFund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Zahid HassanNo ratings yet

- Accounting For ManagementDocument5 pagesAccounting For ManagementZahid HassanNo ratings yet

- Careers and Career ManagementDocument18 pagesCareers and Career ManagementZahid HassanNo ratings yet

- BCMC Mod 07Document55 pagesBCMC Mod 07Zahid HassanNo ratings yet

- IhrmDocument1 pageIhrmZahid HassanNo ratings yet

- BCMC Mod 07Document55 pagesBCMC Mod 07Zahid HassanNo ratings yet

- Share Debenture HolderDocument45 pagesShare Debenture HoldergetstockalNo ratings yet

- Statistical Presentation Tools Descriptive StatisticsDocument3 pagesStatistical Presentation Tools Descriptive StatisticsZahid HassanNo ratings yet

- HistoryDocument6 pagesHistoryZahid HassanNo ratings yet

- Simplify: (I) 8888+888+88+8 (Ii) 11992-7823-456 2. (A+b)Document1 pageSimplify: (I) 8888+888+88+8 (Ii) 11992-7823-456 2. (A+b)Zahid HassanNo ratings yet

- Papc SyllabusDocument2 pagesPapc SyllabusZahid HassanNo ratings yet

- Presentation TopicsDocument1 pagePresentation TopicsZahid HassanNo ratings yet

- Venture CapitalDocument7 pagesVenture CapitalZahid Hassan0% (1)

- Anjuman Institute of Technology and Management Department of Manegement Studies Mba 1 Sem 1 Internal Assessment TestDocument1 pageAnjuman Institute of Technology and Management Department of Manegement Studies Mba 1 Sem 1 Internal Assessment TestZahid HassanNo ratings yet

- BCG MatrixDocument2 pagesBCG MatrixZahid HassanNo ratings yet

- Anjuman Institute of Technology and Management Department of Management StudiesDocument2 pagesAnjuman Institute of Technology and Management Department of Management StudiesZahid HassanNo ratings yet

- All PG DiplomaDocument20 pagesAll PG DiplomaZahid HassanNo ratings yet

- American Depositary Receipts and Global Depository Receipts: Presented BY Kirti GargDocument14 pagesAmerican Depositary Receipts and Global Depository Receipts: Presented BY Kirti Gargmemeenusaini100% (1)

- Withdrawal of Restriction On Short SalesDocument1 pageWithdrawal of Restriction On Short SalesKhushiNo ratings yet

- M&M 2006-2007Document160 pagesM&M 2006-2007Ramajit BhartiNo ratings yet

- Impairing The Microsoft - Nokia PairingDocument54 pagesImpairing The Microsoft - Nokia Pairingjk kumarNo ratings yet

- Materials Management ConceptDocument48 pagesMaterials Management Conceptajinkyabhavsar75% (4)

- Mathematics For Retail Buying - Six Month Planning and ComponentsDocument27 pagesMathematics For Retail Buying - Six Month Planning and ComponentsBhavyata ChavdaNo ratings yet

- Important Banking & Finance Abbreviations PDF by AffairsCloudDocument7 pagesImportant Banking & Finance Abbreviations PDF by AffairsCloudShekh DNo ratings yet

- Hedging Against Rising Coal Prices Using Coal FuturesDocument38 pagesHedging Against Rising Coal Prices Using Coal FuturesSunil ToshniwalNo ratings yet

- Chapter 4: Option Pricing Models: The Binomial ModelDocument9 pagesChapter 4: Option Pricing Models: The Binomial ModelDUY LE NHAT TRUONGNo ratings yet

- Tybms Black Book Topics Finance Revisedxlsx PDF FreeDocument2 pagesTybms Black Book Topics Finance Revisedxlsx PDF FreeShreyaNo ratings yet

- Foreign Exchange QuotesDocument4 pagesForeign Exchange QuotesVishant ChopraNo ratings yet

- Ebay Webdoc 649Document9 pagesEbay Webdoc 649Abdirisaq MohamudNo ratings yet

- 6sub Alll in One Walang PE Pati EappDocument136 pages6sub Alll in One Walang PE Pati EappJeff Dela RosaNo ratings yet

- Financial Market DefinitionDocument9 pagesFinancial Market DefinitionMARJORIE BAMBALANNo ratings yet

- Account Must Do List!! Nov - 2022 - 220911 - 200510Document259 pagesAccount Must Do List!! Nov - 2022 - 220911 - 200510KartikNo ratings yet

- Financial Management SyllabusDocument13 pagesFinancial Management Syllabusharshgupta.16018No ratings yet

- Ijser: Mathematical Modeling in FinanceDocument21 pagesIjser: Mathematical Modeling in FinancealexeyNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- AAII PortfolioBuildingEBook PDFDocument61 pagesAAII PortfolioBuildingEBook PDFelisaNo ratings yet

- Capital Structure and Cost of CapitalVal Exercises StudentsDocument2 pagesCapital Structure and Cost of CapitalVal Exercises StudentsApa-ap, CrisdelleNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- DoubleDragon Final Domestic ProspectusDocument528 pagesDoubleDragon Final Domestic ProspectusKeith GarridoNo ratings yet

- Mining & Investment Latin America Summit 2016Document12 pagesMining & Investment Latin America Summit 2016eduardoleonsNo ratings yet

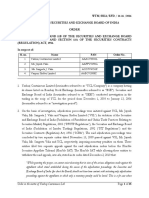

- Order in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedDocument15 pagesOrder in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedShyam SunderNo ratings yet

- Bajaj Holding - Initiating Coverage - 250221Document14 pagesBajaj Holding - Initiating Coverage - 250221Vivek BansalNo ratings yet

- SIP PROJECT REPORT FOR College RealDocument60 pagesSIP PROJECT REPORT FOR College RealTanaya GhosalNo ratings yet

- CORPORATION CODE OF THE PHILIPPINES SUMMARYDocument61 pagesCORPORATION CODE OF THE PHILIPPINES SUMMARYBing MendozaNo ratings yet

- Course Materials BAFINMAX Week2Document6 pagesCourse Materials BAFINMAX Week2emmanvillafuerteNo ratings yet

- Thailand'S: Top Local KnowledgeDocument10 pagesThailand'S: Top Local KnowledgebodaiNo ratings yet

- Sikkim Manipal University 3 Semester Fall 2010Document14 pagesSikkim Manipal University 3 Semester Fall 2010Dilipk86No ratings yet

- Dabur Financial Marketing AnalysisDocument63 pagesDabur Financial Marketing AnalysisAbhishek Kr. MishraNo ratings yet